Gluten Free Beverage Market Report

Published Date: 31 January 2026 | Report Code: gluten-free-beverage

Gluten Free Beverage Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the gluten-free beverage market, highlighting market trends, sizes, and growth projections from 2023 to 2033, along with insights into regional dynamics and leading industry players.

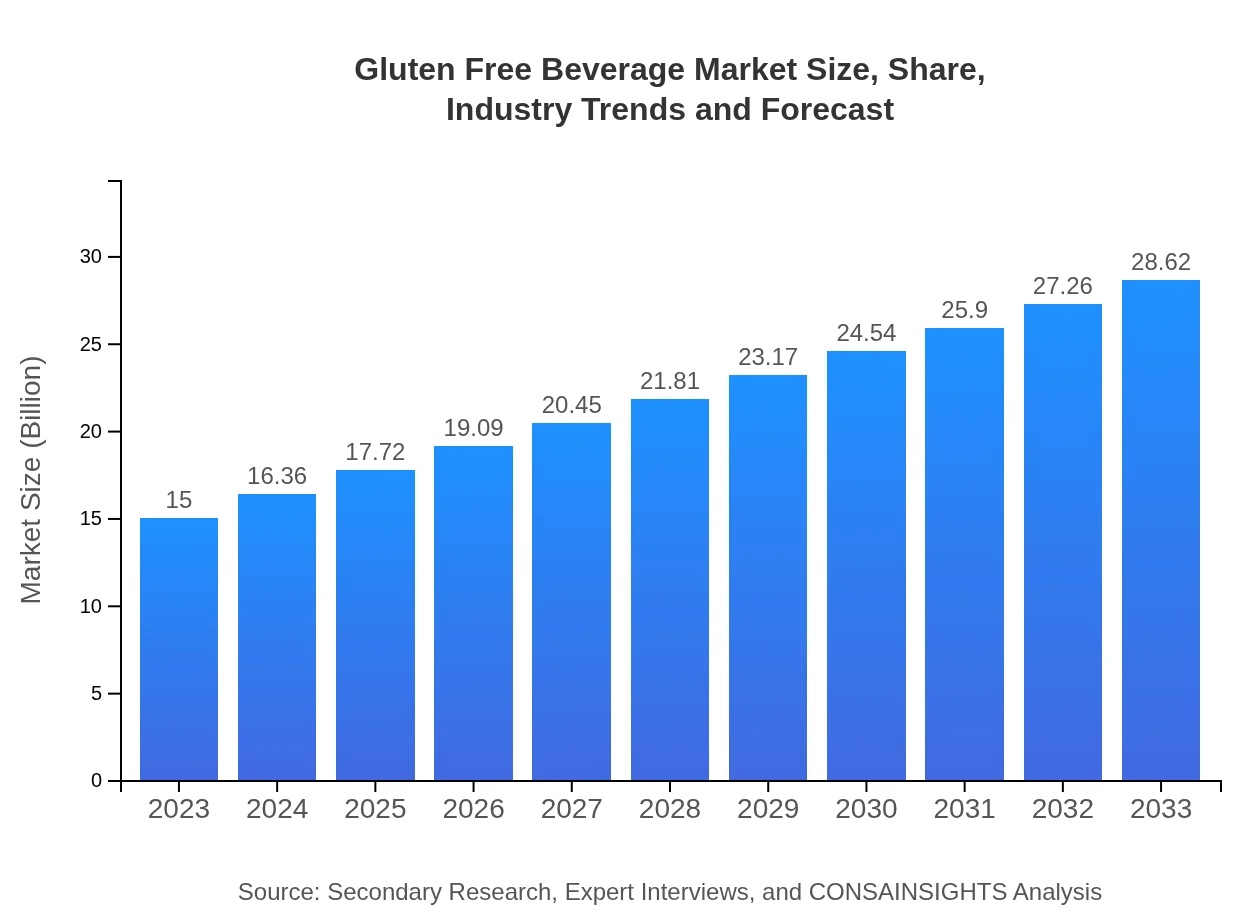

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $28.62 Billion |

| Top Companies | Coca-Cola , PepsiCo, Nestlé, Dr Pepper Snapple Group, Anheuser-Busch InBev |

| Last Modified Date | 31 January 2026 |

Gluten Free Beverage Market Overview

Customize Gluten Free Beverage Market Report market research report

- ✔ Get in-depth analysis of Gluten Free Beverage market size, growth, and forecasts.

- ✔ Understand Gluten Free Beverage's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gluten Free Beverage

What is the Market Size & CAGR of Gluten Free Beverage market in 2023?

Gluten Free Beverage Industry Analysis

Gluten Free Beverage Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gluten Free Beverage Market Analysis Report by Region

Europe Gluten Free Beverage Market Report:

The European gluten-free beverage market is estimated to grow from $4.96 billion in 2023 to $9.46 billion by 2033. Factors such as rising gluten sensitivity reports and increasing availability of gluten-free options in supermarkets are fueling this market.Asia Pacific Gluten Free Beverage Market Report:

The Asia-Pacific gluten-free beverage market in 2023 is valued at $2.83 billion and is expected to grow to $5.41 billion by 2033. This growth is driven by increasing health awareness and changing dietary habits, with countries like Australia and Japan leading the demand for gluten-free products.North America Gluten Free Beverage Market Report:

North America, leading the gluten-free beverage market, is projected to grow from $5.20 billion in 2023 to $9.92 billion by 2033. High consumer awareness, robust distribution networks, and a growing health-conscious population are key growth drivers in this region.South America Gluten Free Beverage Market Report:

In South America, the gluten-free beverage market is projected to expand from $0.42 billion in 2023 to $0.81 billion by 2033. The rise in gluten-free consumers and local innovation contribute significantly to this growth, particularly in Brazil and Argentina.Middle East & Africa Gluten Free Beverage Market Report:

The Middle East and Africa's gluten-free beverage market, worth $1.58 billion in 2023, is set to reach $3.02 billion by 2033. Growing expatriate populations and increasing interest in healthy lifestyles are spearheading market expansion in this region.Tell us your focus area and get a customized research report.

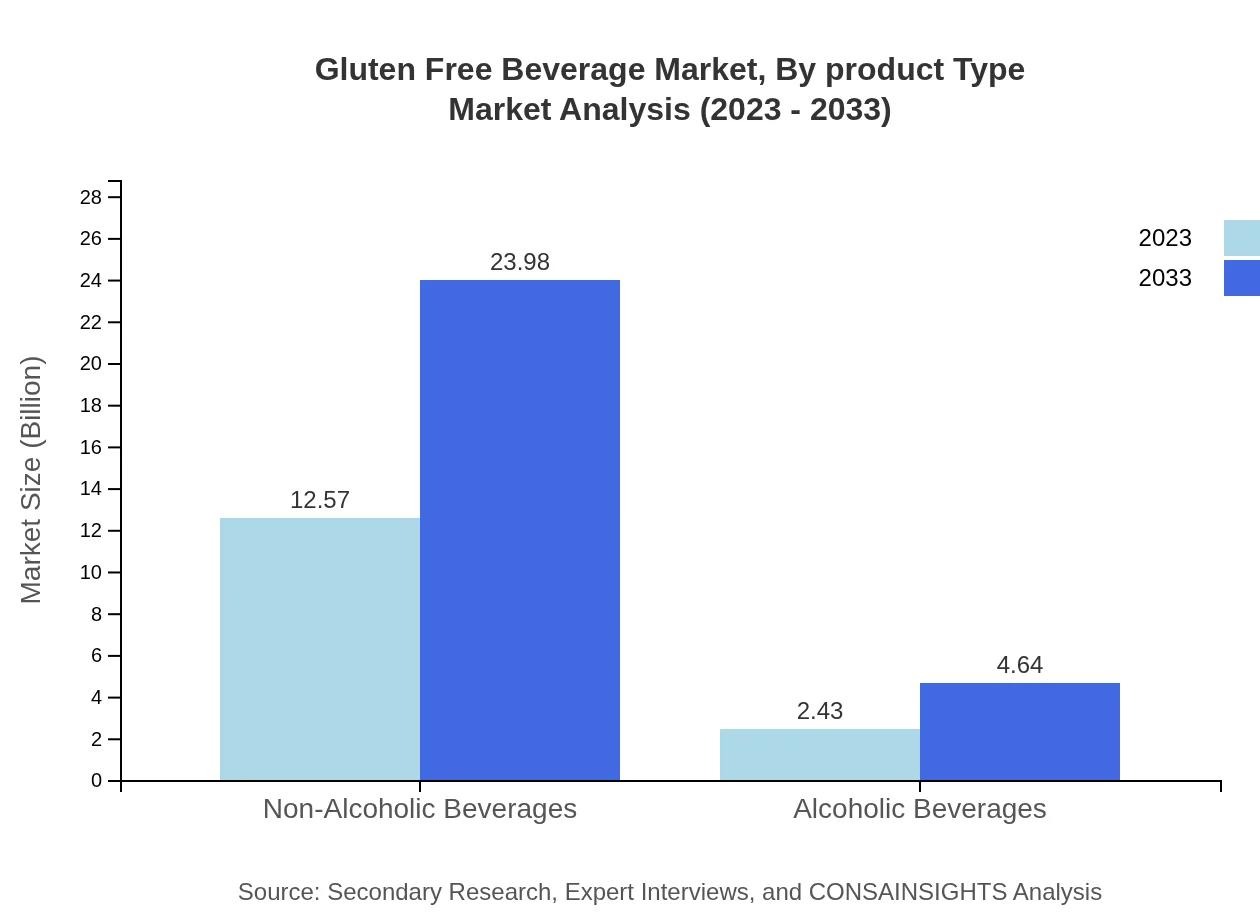

Gluten Free Beverage Market Analysis By Product Type

The gluten-free beverage market by product type is dominated by non-alcoholic beverages, which make up a significant share due to the increasing demand for refreshing and health-oriented drinks. Non-alcoholic options such as juices, sparkling waters, and teas are leading the growth, while gluten-free alcoholic beverages are also gaining traction among niche consumer groups.

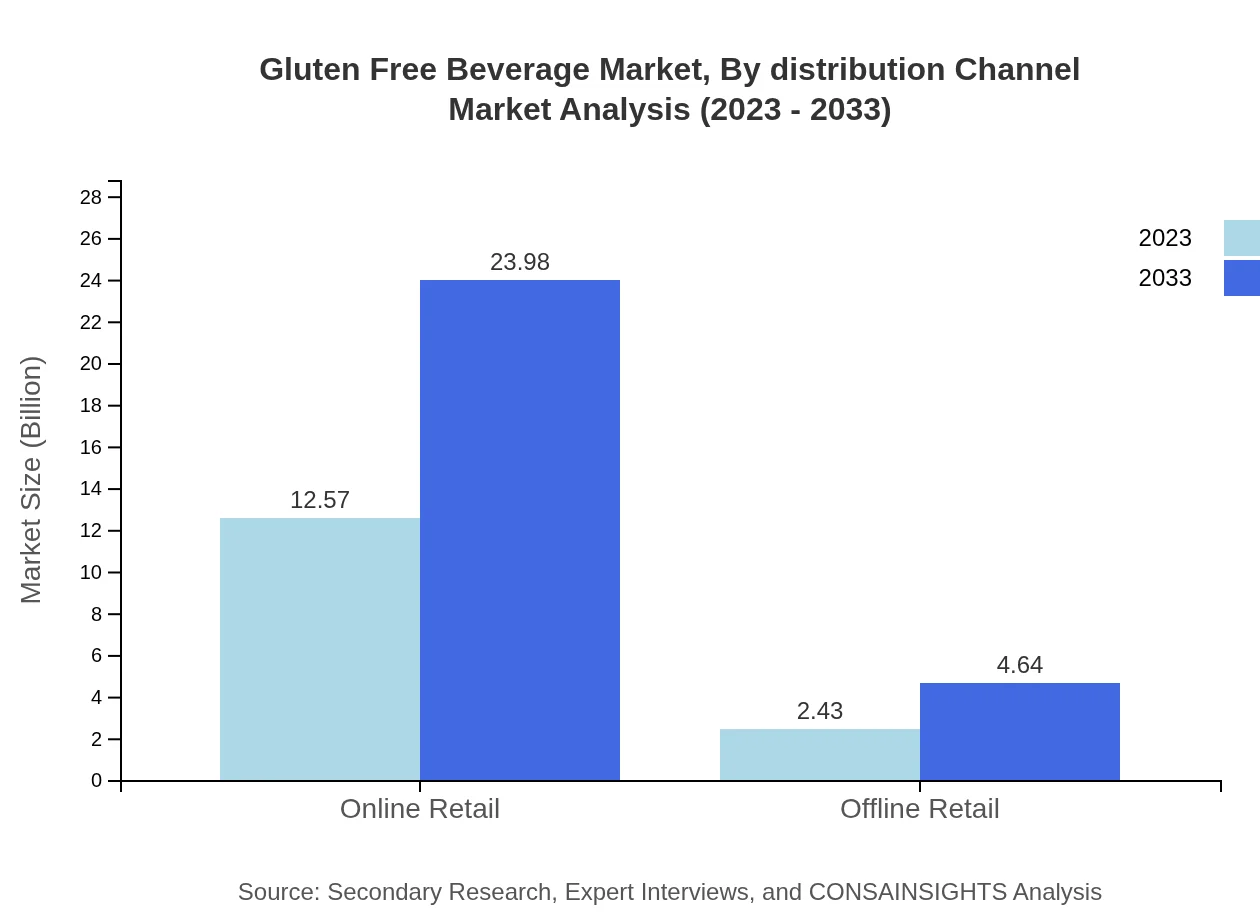

Gluten Free Beverage Market Analysis By Distribution Channel

The market distribution is mostly online, which constitutes a growing share as e-commerce provides better accessibility and variety. Offline retail channels, despite being traditionally robust, are showing slower growth as consumers shift towards the convenience of online shopping. Brands are increasingly focusing on robust online strategies to tap into this trend.

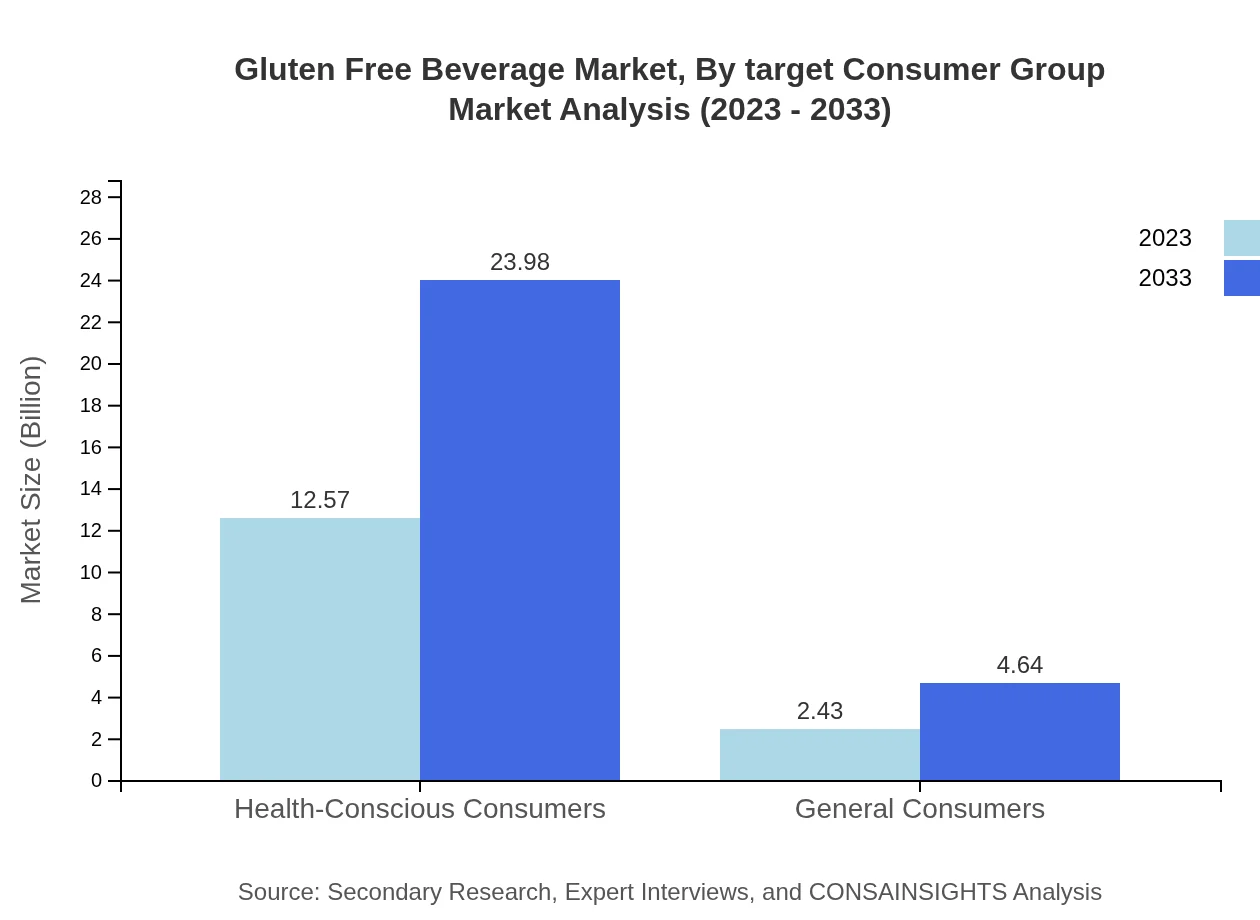

Gluten Free Beverage Market Analysis By Target Consumer Group

Health-conscious consumers drive the gluten-free beverage market, accounting for the majority of market demand. This group is increasingly proactive about dietary restrictions, pushing brands to innovate and offer healthier gluten-free options. General consumers are also beginning to explore gluten-free beverages as part of a wider health trend, contributing to market growth.

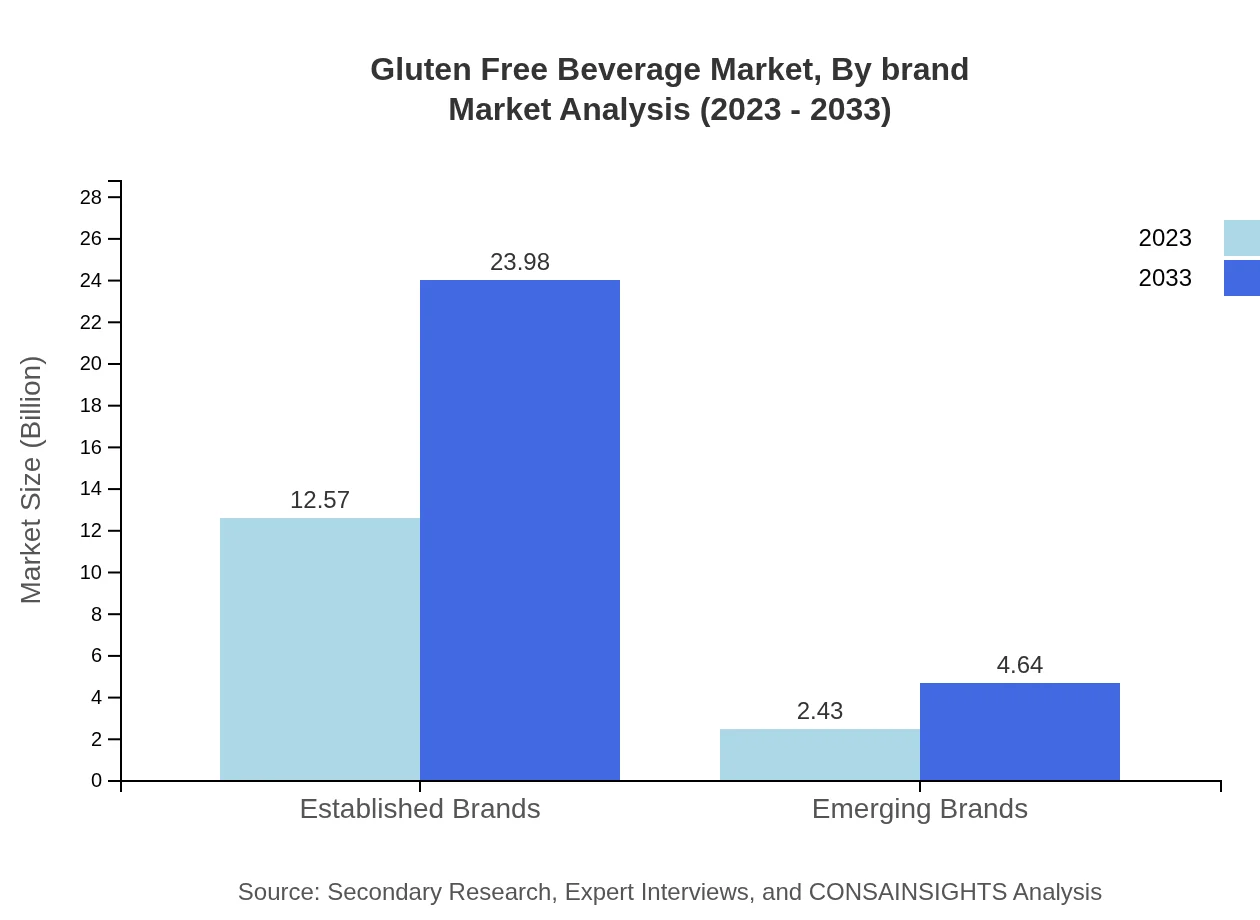

Gluten Free Beverage Market Analysis By Brand

Established brands dominate the gluten-free beverage sector, holding significant market shares due to their reputations and extensive distribution networks. Emerging brands, while smaller, are quickly gaining attention by offering unique flavors and products that cater to specialized diets, helping diversify the market.

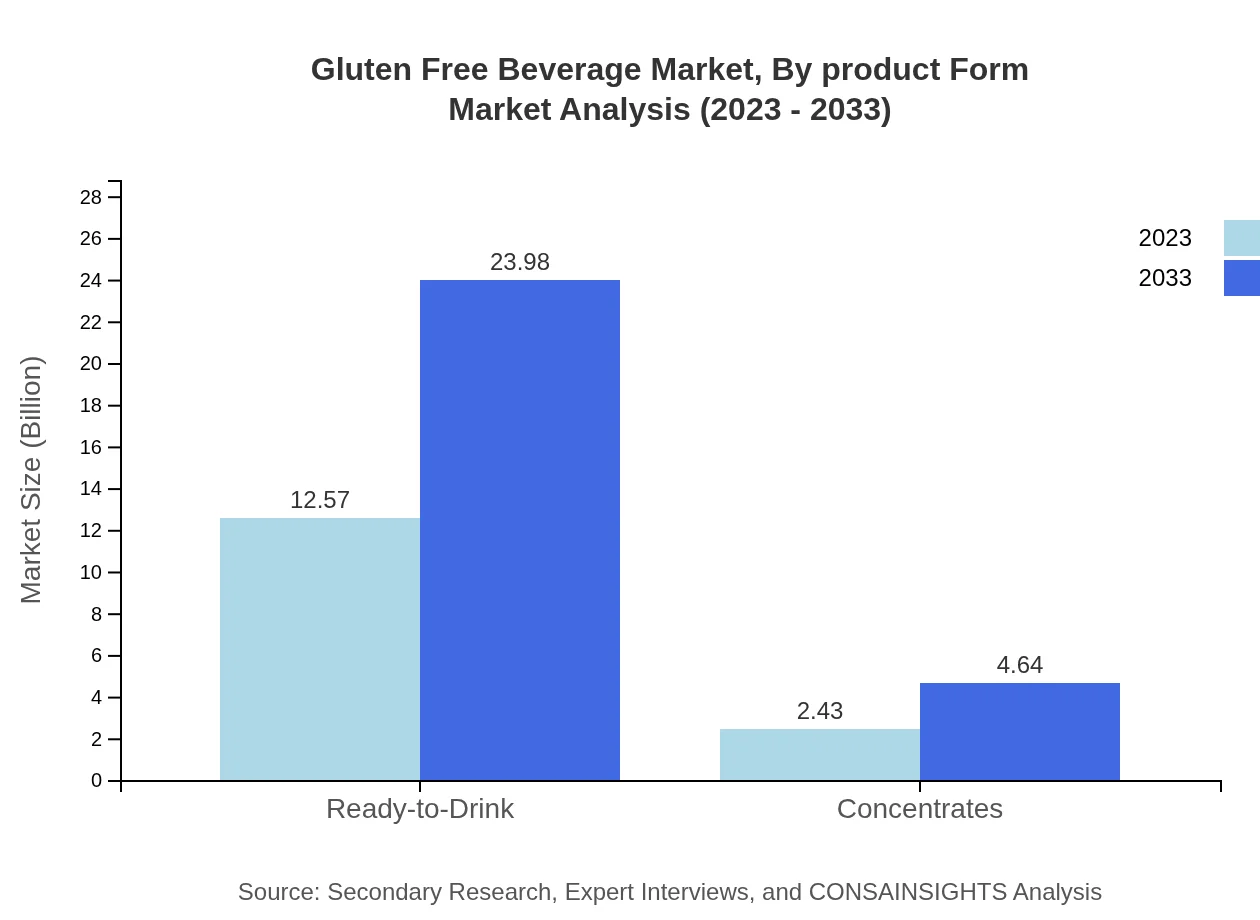

Gluten Free Beverage Market Analysis By Product Form

Products in ready-to-drink formats lead the gluten-free beverage market, driven by the increasing consumer preference for convenience. As busy lifestyles continue to rise, consumers favor products that are readily available. Concentrates are also available but constitute a smaller yet growing segment due to specific consumer preferences.

Gluten Free Beverage Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gluten Free Beverage Industry

Coca-Cola :

A leading global beverage manufacturer, Coca-Cola offers a range of gluten-free beverage options, reinforcing its commitment to health-conscious consumers.PepsiCo:

PepsiCo is recognized for its wide portfolio of gluten-free drinks, including juices and sparkling waters, helping it cater to diverse consumer needs.Nestlé:

This multinational food and beverage company has expanded its gluten-free product line, focusing on innovation in health-centric drinks.Dr Pepper Snapple Group:

Known for various non-alcoholic beverages, this company is actively investing in gluten-free options, appealing to health-oriented consumers.Anheuser-Busch InBev:

As one of the largest brewers globally, Anheuser-Busch has successfully introduced gluten-free beer, tapping into the growing market segment.We're grateful to work with incredible clients.

FAQs

What is the market size of gluten Free Beverage?

The gluten-free beverage market is currently valued at approximately $15 billion, with a projected compound annual growth rate (CAGR) of 6.5% through the upcoming years. This growth reflects increasing demand among health-conscious consumers.

What are the key market players or companies in this gluten Free Beverage industry?

Major companies in the gluten-free beverage market include leading brands and emerging players focusing on innovative products. Market leaders cater to growing consumer preferences while startups introduce unique flavors and formulations to capture niche markets.

What are the primary factors driving the growth in the gluten Free Beverage industry?

Driving factors for growth in the gluten-free beverage industry include rising awareness of dietary restrictions, the increasing adoption of gluten-free lifestyles due to health concerns, and a growing trend toward organic and natural ingredients among consumers.

Which region is the fastest Growing in the gluten Free Beverage?

North America is currently leading the gluten-free beverage market, valued at $5.20 billion in 2023, and is projected to grow to $9.92 billion by 2033. Europe also displays significant growth potential, with a rise from $4.96 billion to $9.46 billion.

Does ConsaInsights provide customized market report data for the gluten Free Beverage industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements in the gluten-free beverage industry. This allows businesses to gain insights unique to their operational needs and market interests.

What deliverables can I expect from this gluten Free Beverage market research project?

Deliverables from the gluten-free beverage market research project will include comprehensive reports on market size, growth forecasts, competitive landscape analysis, regional insights, and segment data, enabling informed strategic decisions.

What are the market trends of gluten Free Beverage?

Trends in the gluten-free beverage market include increasing product diversification, more health-focused variants like non-alcoholic options, and a shift toward online retail, which is projected to significantly increase its share by 2033.