Gluten Free Labeling Market Report

Published Date: 31 January 2026 | Report Code: gluten-free-labeling

Gluten Free Labeling Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Gluten Free Labeling market from 2023 to 2033, highlighting insights on market trends, size, segmentation, regional dynamics, and key players within the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

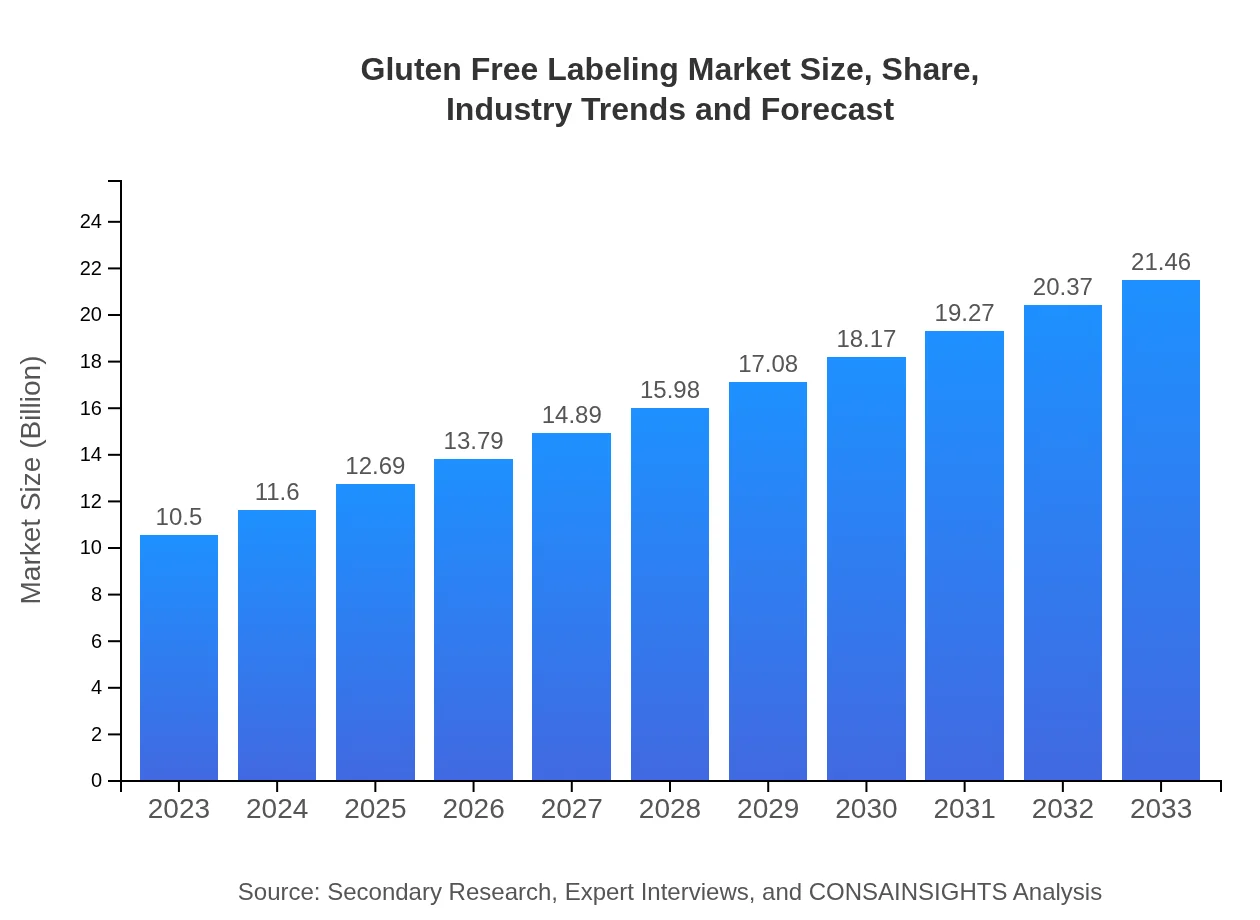

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | General Mills Inc., Nestlé S.A., Kraft Heinz Company, Bob's Red Mill Natural Foods, Gluten-Free Prairie |

| Last Modified Date | 31 January 2026 |

Gluten Free Labeling Market Overview

Customize Gluten Free Labeling Market Report market research report

- ✔ Get in-depth analysis of Gluten Free Labeling market size, growth, and forecasts.

- ✔ Understand Gluten Free Labeling's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gluten Free Labeling

What is the Market Size & CAGR of Gluten Free Labeling market in 2023?

Gluten Free Labeling Industry Analysis

Gluten Free Labeling Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gluten Free Labeling Market Analysis Report by Region

Europe Gluten Free Labeling Market Report:

Europe’s gluten-free market is set to grow significantly, from USD 3.02 billion in 2023 to USD 6.17 billion by 2033. The European region exhibits stringent regulatory frameworks for gluten-free labeling, supporting consumer trust in gluten-free products. Countries like Germany and the UK lead the market.Asia Pacific Gluten Free Labeling Market Report:

In the Asia Pacific region, the Gluten Free Labeling market is expected to grow from USD 1.96 billion in 2023 to USD 4.00 billion by 2033, riding on the back of increasing awareness regarding health and diet. Countries like Australia and Japan are key markets where gluten free products are witnessing growing acceptance among consumers.North America Gluten Free Labeling Market Report:

North America remains a frontrunner in the Gluten Free Labeling market, with market size expected to surge from USD 4.01 billion in 2023 to USD 8.19 billion by 2033. This growth is largely attributed to the high prevalence of gluten intolerance, coupled with the region's well-established health food retail network.South America Gluten Free Labeling Market Report:

The South American market for gluten-free labeling is projected to increase from USD 0.73 billion in 2023 to USD 1.49 billion by 2033. Countries like Brazil are experiencing a gradual rise in gluten-free product adoption among health-conscious consumers, fueled by local health trends and international exposure.Middle East & Africa Gluten Free Labeling Market Report:

The Middle East and Africa market is projected to expand from USD 0.79 billion in 2023 to USD 1.61 billion by 2033, driven by increasing urbanization and awareness of dietary health among consumers. The region is gradually adopting gluten-free diets, offering prospects for future growth.Tell us your focus area and get a customized research report.

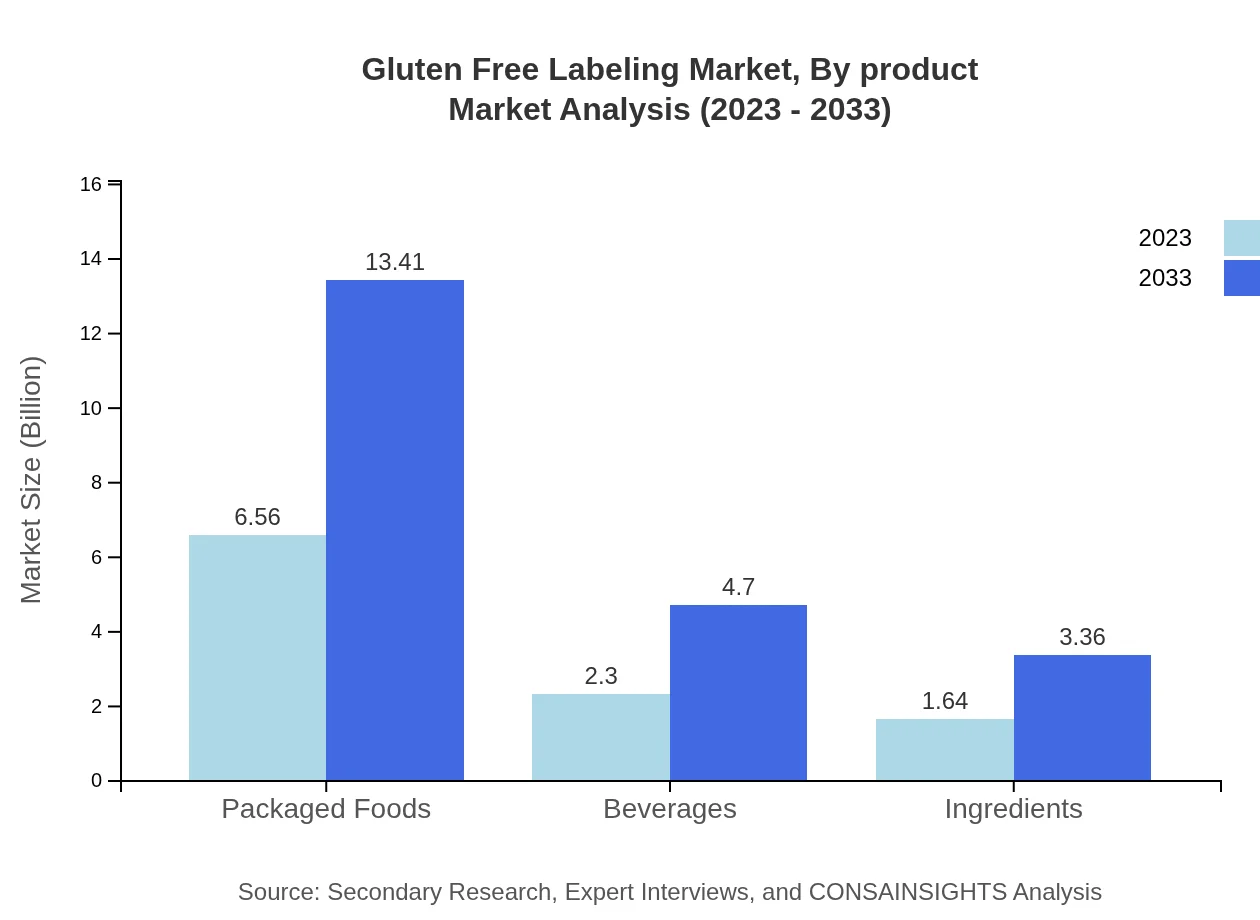

Gluten Free Labeling Market Analysis By Product

In the product segment, packaged foods dominate the market, accounting for 62.46% of the total size in 2023 with an anticipated growth to USD 13.41 billion by 2033. Beverages contribute significantly, comprising 21.88% of the market. The ingredient segment is also notable, with a steady increase, providing essential gluten-free options for manufacturers.

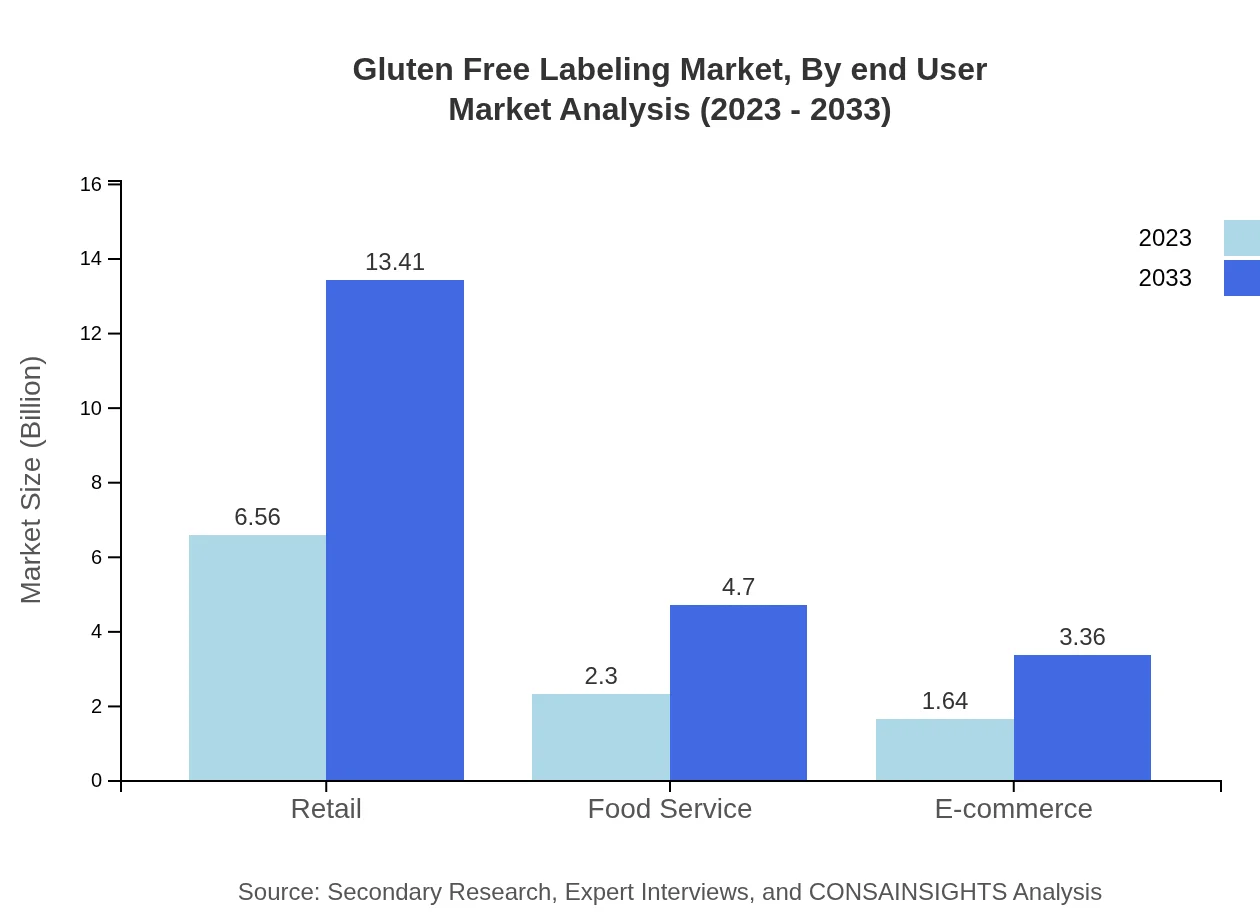

Gluten Free Labeling Market Analysis By End User

The end-user segmentation shows retail as a significant channel, particularly supermarkets and specialty stores, encompassing a large share of sales. The retail market is poised to maintain its dominance, focusing on both physical and online shopping experiences, catering to health-focused consumers.

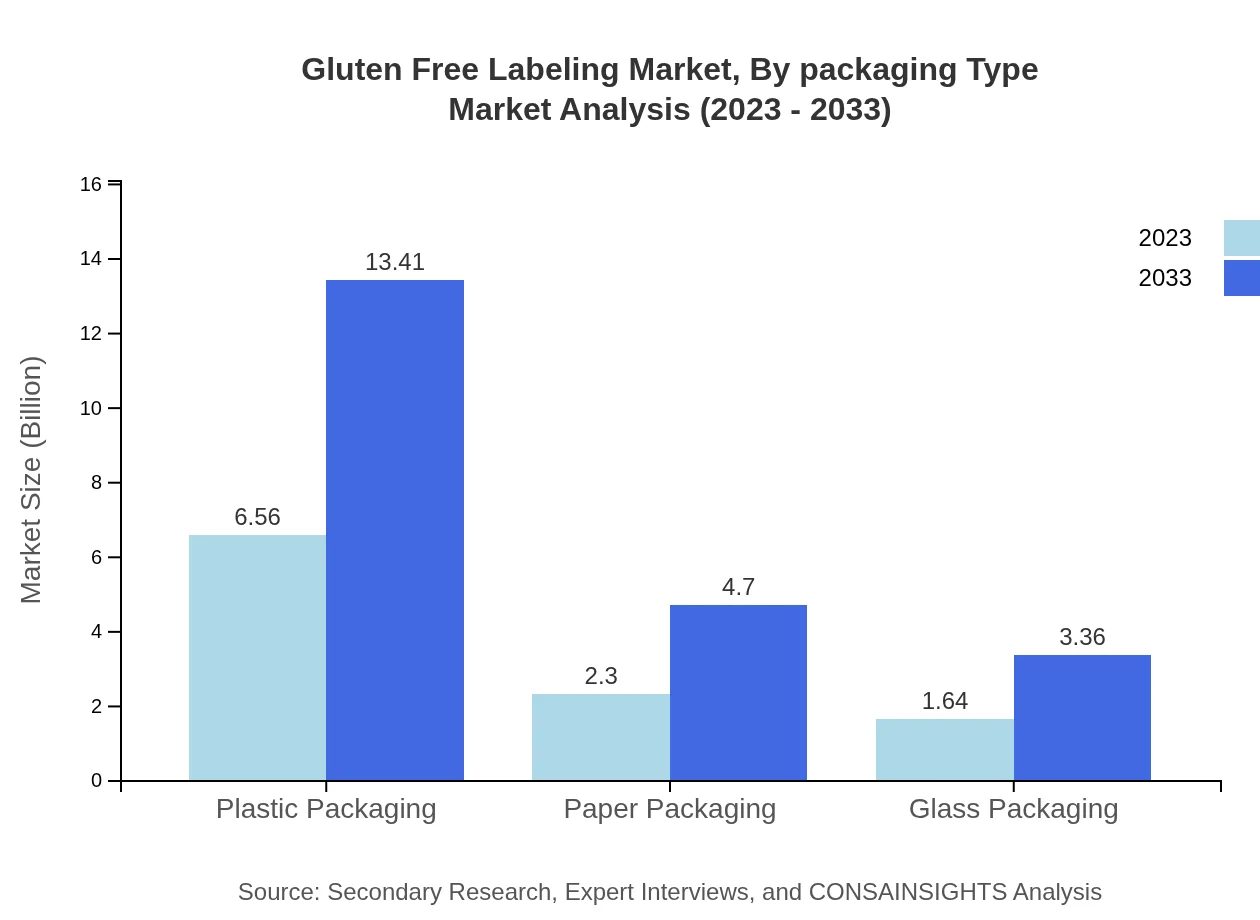

Gluten Free Labeling Market Analysis By Packaging Type

The packaging type segment highlights plastic packaging as the most commonly used, due to its convenience and functionality. Paper and glass packaging are also relevant, especially among brands focusing on sustainability to attract environmentally conscious consumers.

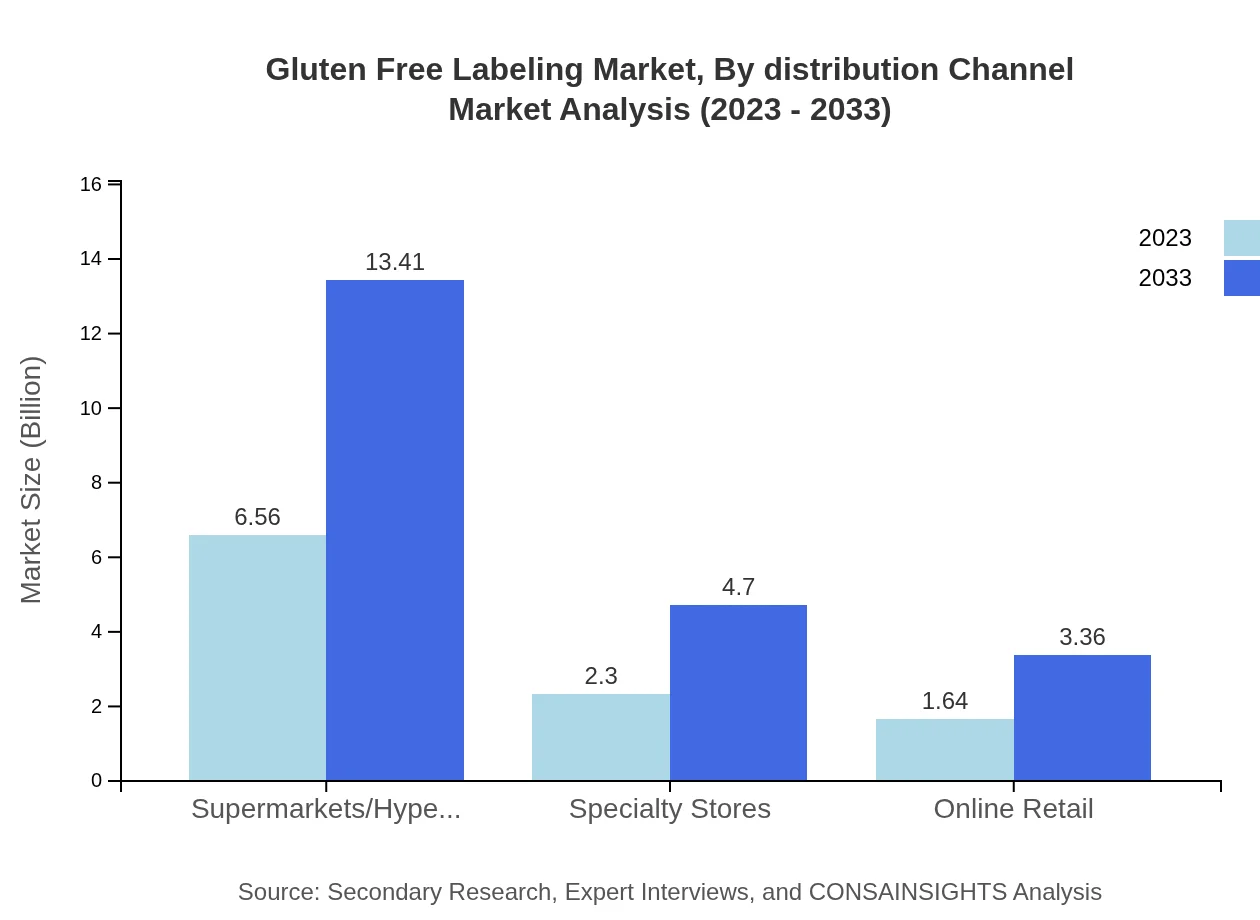

Gluten Free Labeling Market Analysis By Distribution Channel

In terms of distribution, supermarkets, hypermarkets, and online retail dominate the channels for gluten-free products. E-commerce is predicted to grow considerably, reflecting shifting consumer habits, with more shoppers turning to online platforms for their grocery needs.

Gluten Free Labeling Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gluten Free Labeling Industry

General Mills Inc.:

A leading global player in the packaged foods industry, General Mills has expanded its gluten-free product lines significantly, focusing on innovation and consumer preferences.Nestlé S.A.:

Nestlé is a prominent player in the food industry, offering a wide range of gluten-free products catering to diverse dietary needs, leveraging its strong distribution network.Kraft Heinz Company:

Known for its extensive portfolio of food products, Kraft Heinz has embraced the gluten-free trend, enabling consumers to enjoy their favored foods without gluten.Bob's Red Mill Natural Foods:

A company specializing in whole grain and gluten-free products, Bob's Red Mill is recognized for its dedication to natural food production and community engagement.Gluten-Free Prairie:

A company focused solely on gluten-free products, offering a variety of premium quality gluten-free grains and mixes, targeting health-conscious consumers.We're grateful to work with incredible clients.

FAQs

What is the market size of gluten Free Labeling?

The gluten-free labeling market size was valued at approximately $10.5 billion in 2023, with a projected CAGR of 7.2% through 2033. This growth reflects increasing consumer awareness and demand for gluten-free products.

What are the key market players or companies in this gluten Free Labeling industry?

Key players in the gluten-free labeling industry include major food manufacturers and retailers known for gluten-free product lines. These companies contribute significantly to market dynamics with innovative labeling practices and extensive product distribution.

What are the primary factors driving the growth in the gluten Free labeling industry?

Growth in gluten-free labeling is driven by rising health consciousness, increased prevalence of gluten sensitivities, and demand for allergen-free products among consumers. Additionally, expanded availability of gluten-free labeled foods supports market growth.

Which region is the fastest Growing in the gluten Free labeling market?

The fastest-growing region in the gluten-free labeling market is Europe, where the market is expected to grow from $3.02 billion in 2023 to $6.17 billion by 2033, reflecting significant consumer demand and awareness.

Does ConsaInsights provide customized market report data for the gluten Free labeling industry?

Yes, ConsaInsights offers customized market report data for the gluten-free labeling industry. Clients can request specific insights tailored to their business needs, ensuring relevant and actionable data for strategic decision-making.

What deliverables can I expect from this gluten Free labeling market research project?

From the gluten-free labeling market research project, expect comprehensive reports including market size analysis, growth forecasts, trends, and competitive landscape evaluations that assist in informed business strategies and planning.

What are the market trends of gluten Free labeling?

Market trends in gluten-free labeling include an increasing variety of products, innovation in food technology, a rise in e-commerce sales, and an emphasis on sustainable packaging, reflecting evolving consumer preferences and environmental consciousness.