Glyphosate Market Report

Published Date: 02 February 2026 | Report Code: glyphosate

Glyphosate Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Glyphosate market, including current trends, size, regional breakdowns, and future forecasts from 2023 to 2033. It offers insights into market dynamics, competitive landscape, and key developments shaping the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

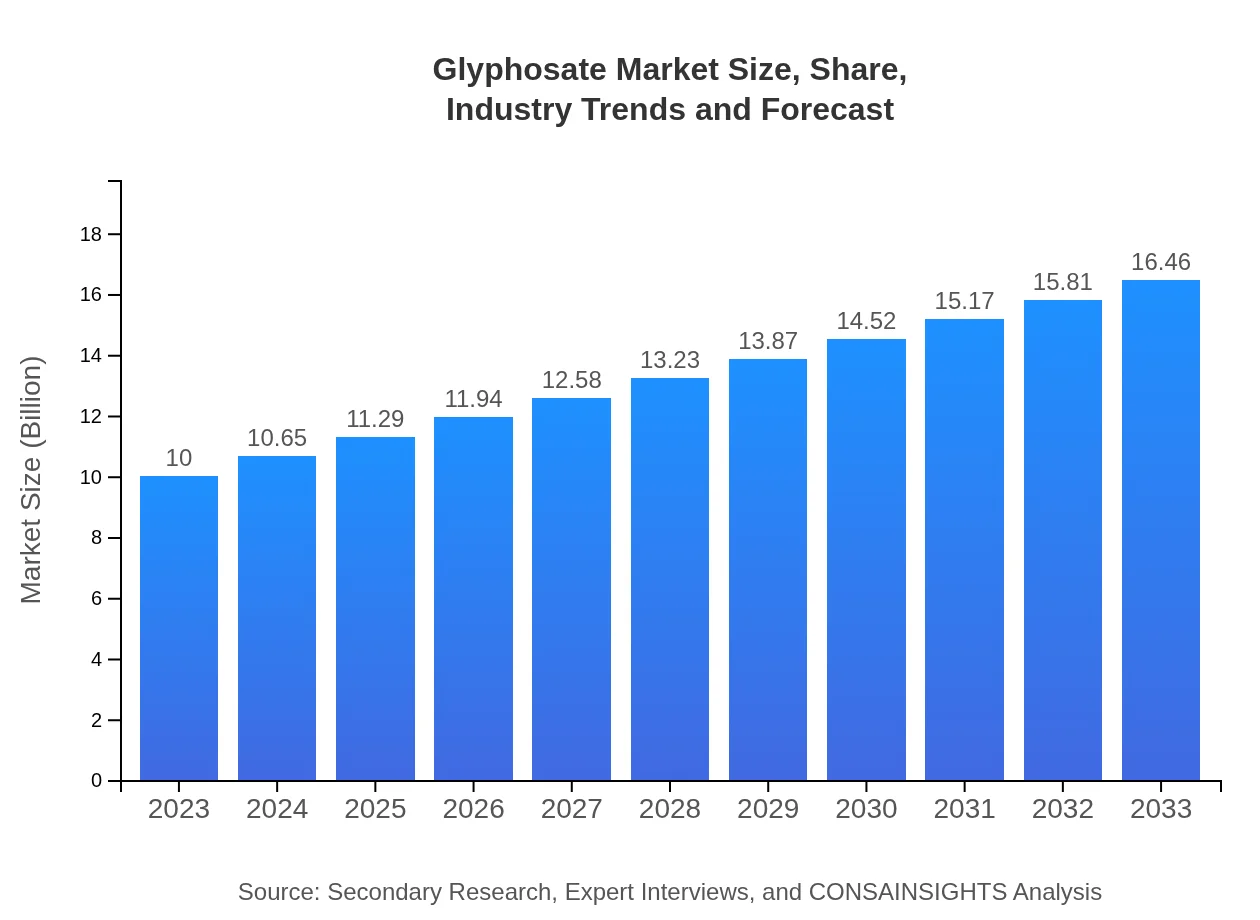

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Bayer AG, Corteva Agriscience, Syngenta AG, FMC Corporation, Nufarm Limited |

| Last Modified Date | 02 February 2026 |

Glyphosate Market Overview

Customize Glyphosate Market Report market research report

- ✔ Get in-depth analysis of Glyphosate market size, growth, and forecasts.

- ✔ Understand Glyphosate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Glyphosate

What is the Market Size & CAGR of Glyphosate market in 2023?

Glyphosate Industry Analysis

Glyphosate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Glyphosate Market Analysis Report by Region

Europe Glyphosate Market Report:

In Europe, the market is forecasted to increase from $3.35 billion in 2023 to $5.52 billion by 2033. Though stricter regulations regarding chemical usage pose challenges, the focus on crop yield and quality drives glyphosate usage across many member states.Asia Pacific Glyphosate Market Report:

In the Asia Pacific region, the glyphosate market is projected to grow from $1.69 billion in 2023 to $2.77 billion by 2033, driven by increasing agricultural production and adoption of modern farming techniques. The region remains a key contributor to global glyphosate consumption due to its vast arable land and growing population.North America Glyphosate Market Report:

The North American glyphosate market is strong, expected to grow from $3.60 billion in 2023 to $5.92 billion in 2033. A mixture of technologically advanced agriculture and high acceptance of genetically modified organisms (GMOs) continues to drive market demand in this region.South America Glyphosate Market Report:

South America shows a significant increase in glyphosate market value, from $0.87 billion in 2023 to $1.44 billion by 2033. The demand stems from its extensive soybean and maize industries, with glyphosate being essential for weed management in these high-demand crops.Middle East & Africa Glyphosate Market Report:

The Middle East and Africa market is expected to rise from $0.49 billion in 2023 to $0.80 billion by 2033, albeit at a slower pace. Agricultural developments in this region, alongside increasing food security needs, contribute to the observed growth.Tell us your focus area and get a customized research report.

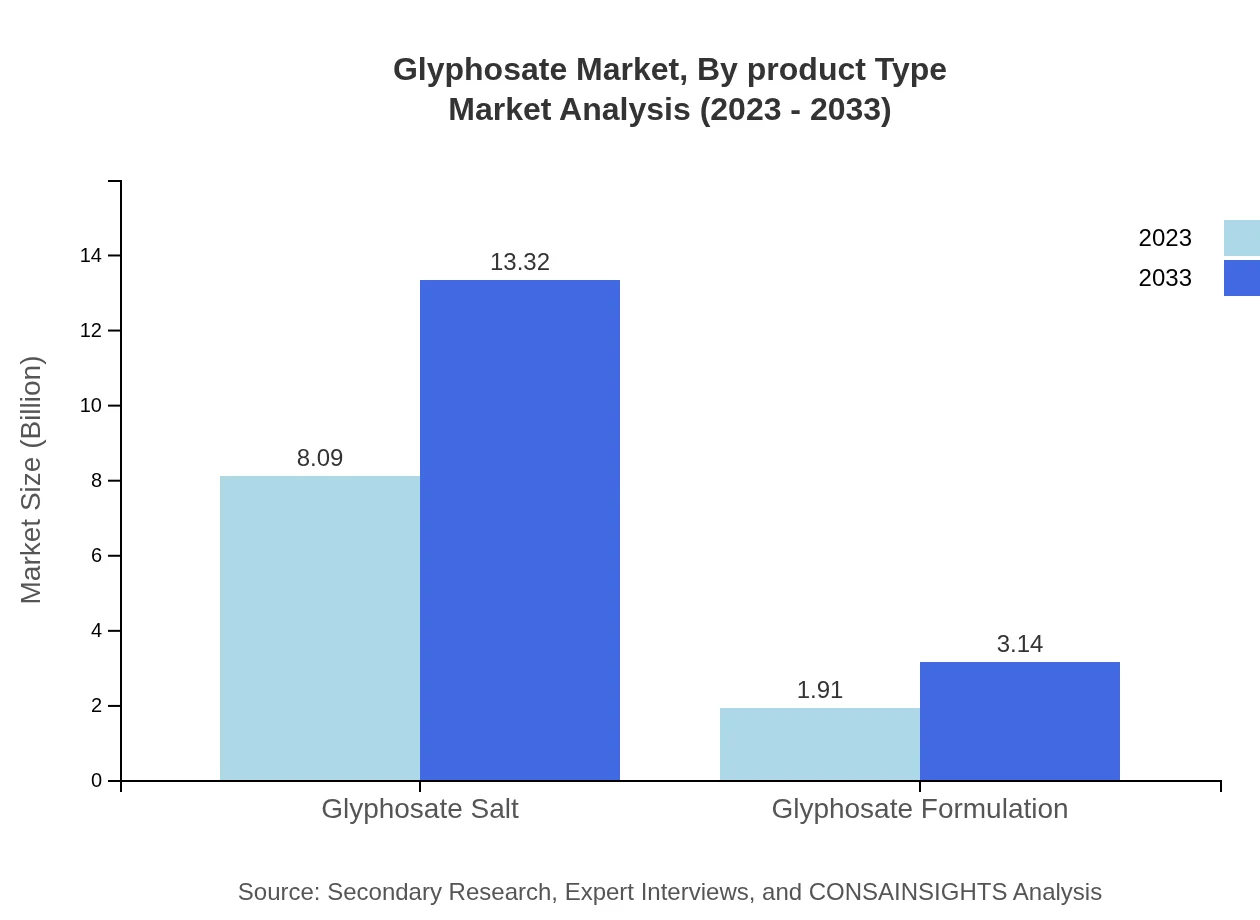

Glyphosate Market Analysis By Product Type

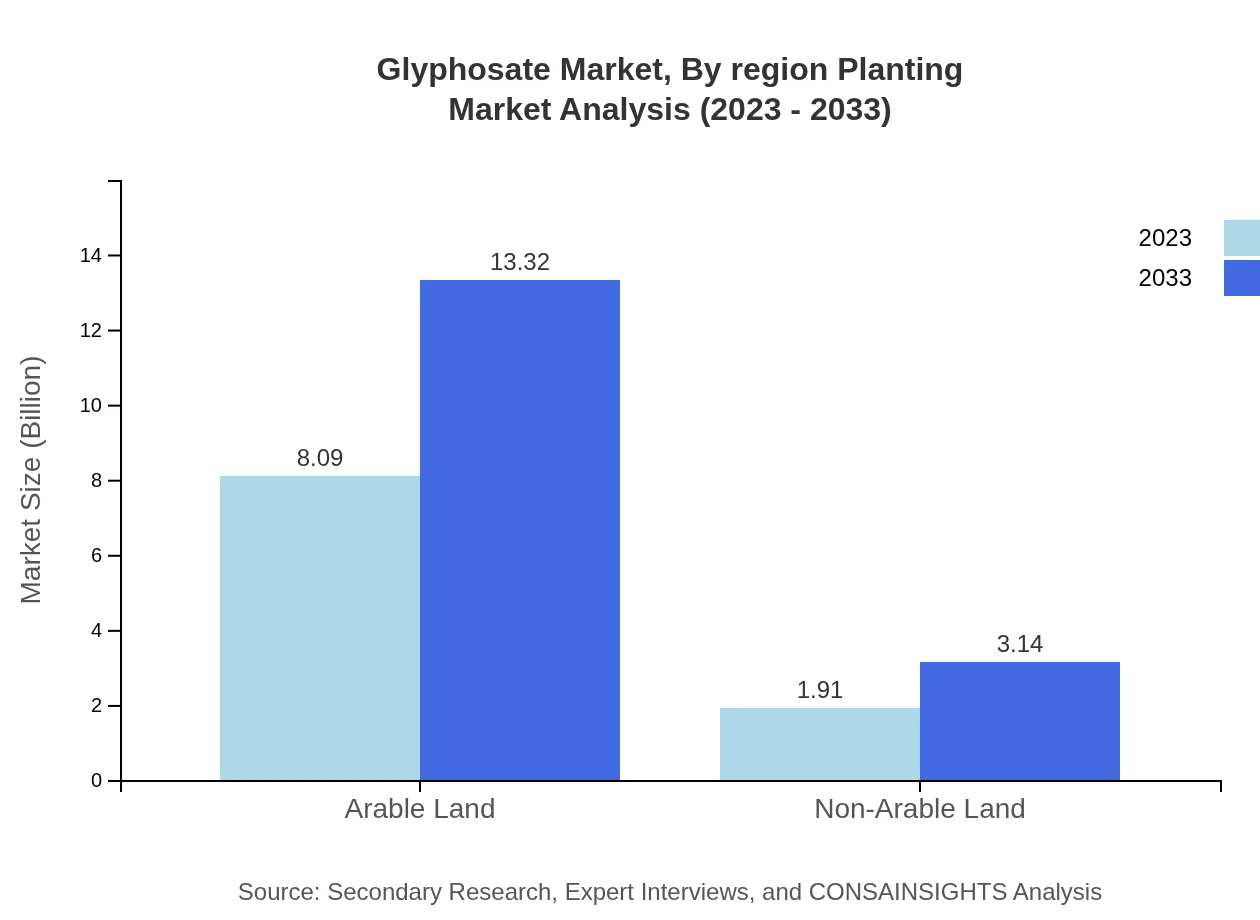

Glyphosate salt constitutes a major market share, expected to grow from $8.09 billion in 2023 to $13.32 billion by 2033, representing 80.92% of the overall market. Glyphosate formulations, while smaller in market size at $1.91 billion initially, are poised to increase to $3.14 billion by 2033, capturing 19.08% of the market.

Glyphosate Market Analysis By Application Area

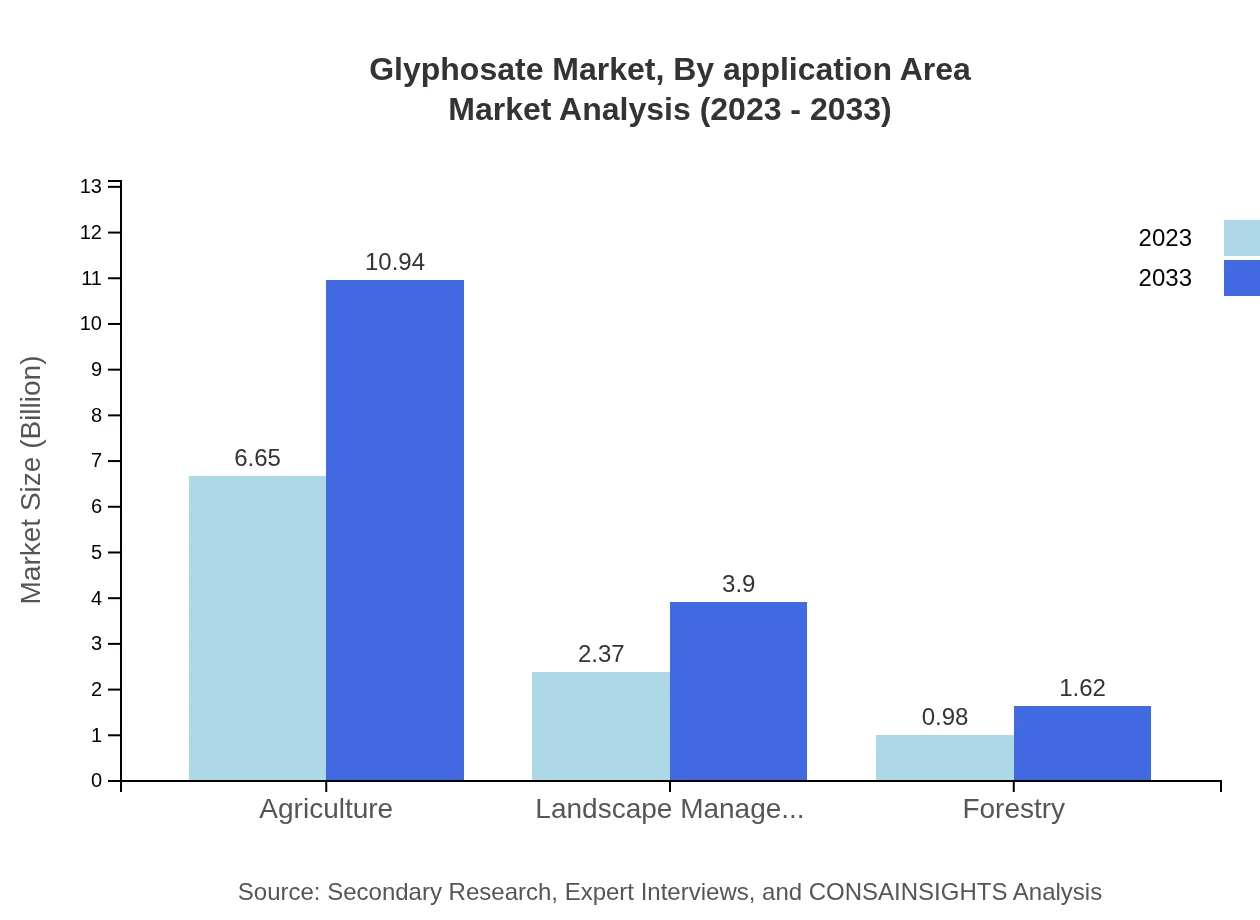

Predominantly used in agriculture, the glyphosate market for agricultural applications saw a value of $6.65 billion in 2023, growing to $10.94 billion by 2033. Landscape management is also significant, representing $2.37 billion initially, with growth expected to reach $3.90 billion.

Glyphosate Market Analysis By Formulation Type

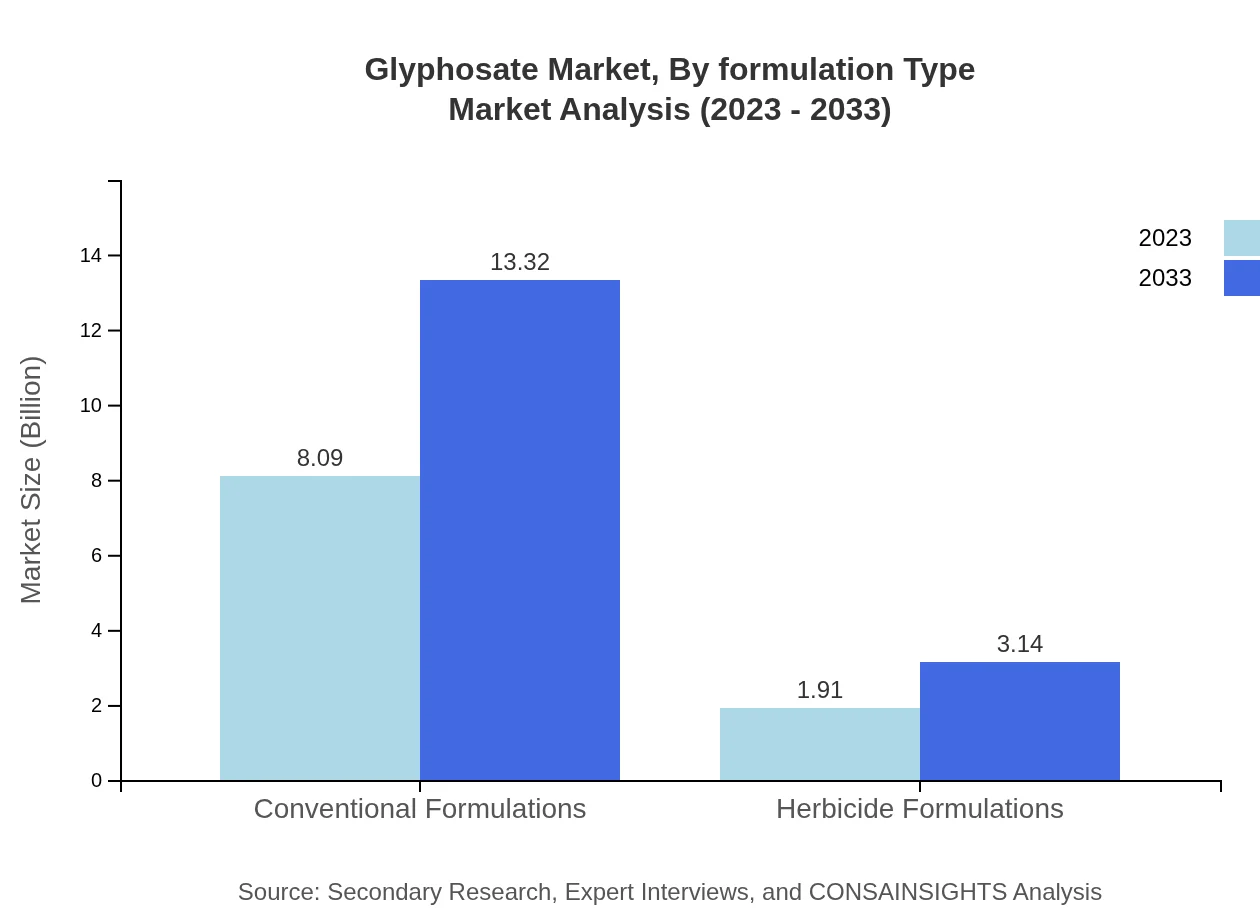

Conventional formulations remain dominant, valued at $8.09 billion in 2023 and expected to reach $13.32 billion by 2033. On the other hand, herbicide formulations, though smaller at $1.91 billion, are anticipated to expand to approximately $3.14 billion in the same period.

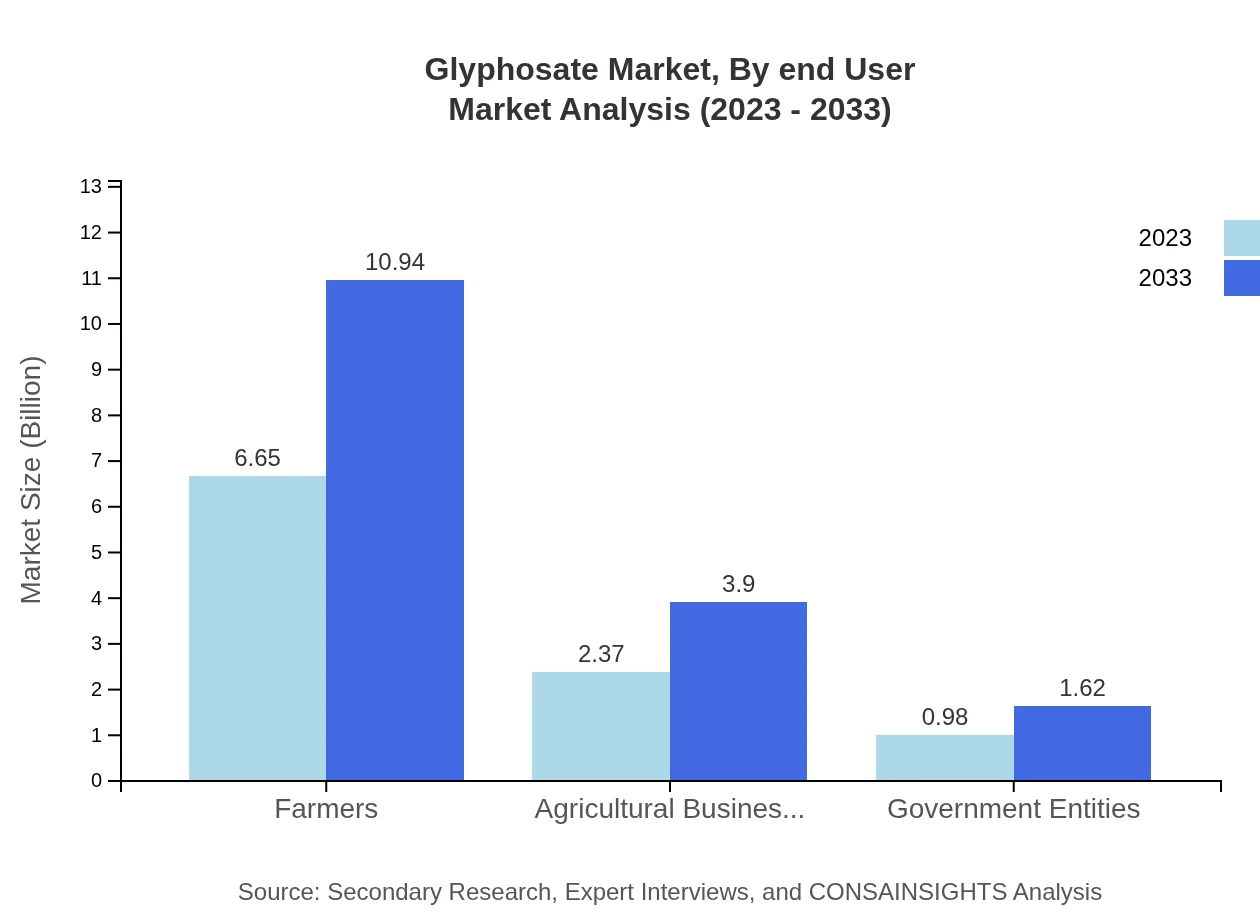

Glyphosate Market Analysis By End User

Farmers comprise the major customer segment for glyphosate, with market sizes of $6.65 billion in 2023 and projections of $10.94 billion by 2033, holding a stable share of 66.48%. Agricultural businesses and government entities represent smaller but growing sectors, with market sizes of $2.37 billion and $0.98 billion respectively.

Glyphosate Market Analysis By Region Planting

The analysis by planting area reveals that arable land dominates glyphosate utilization, with sizes at $8.09 billion in 2023 projected to grow to $13.32 billion by 2033. Non-arable land uses are smaller but still contribute notably, growing from $1.91 billion to $3.14 billion.

Glyphosate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Glyphosate Industry

Bayer AG:

A leading global enterprise with core competencies in the life science fields of health care and agriculture. Bayer's extensive glyphosate portfolio aligns with modern agricultural practices, focusing heavily on innovation.Corteva Agriscience:

As a major player in the agri-sciences, Corteva excels in seed and crop protection, including glyphosate, contributing to sustainable agricultural practices globally.Syngenta AG:

This agrochemical company is a heavyweight in crop protection products and has made significant contributions to glyphosate formulation technologies. Syngenta emphasizes sustainability in agriculture.FMC Corporation:

FMC focuses on crop protection solutions and has a robust glyphosate product lineup, aimed at effective weed control in various agricultural applications.Nufarm Limited:

An Australian agricultural chemicals company, Nufarm is involved in the production and marketing of glyphosate herbicides aimed at enhancing agricultural productivity.We're grateful to work with incredible clients.

FAQs

What is the market size of glyphosate?

The global glyphosate market is projected to reach $10 billion by 2033, growing at a CAGR of 5% from 2023. This steady growth reflects increasing demand across agricultural segments and wider acceptance in various farming practices.

What are the key market players or companies in the glyphosate industry?

Prominent players in the glyphosate market include Bayer AG, Corteva Agriscience, Syngenta AG, and BASF SE. These companies lead through comprehensive product portfolios and substantial R&D, catering predominantly to agricultural needs.

What are the primary factors driving the growth in the glyphosate industry?

Key growth drivers include rising global food demand, advancements in agricultural technologies, growth in organic farming sectors, and increasing adoption of herbicides among farmers to enhance crop yields and efficiency.

Which region is the fastest Growing in the glyphosate market?

Europe is the fastest-growing region in the glyphosate market, with market size growing from $3.35 billion in 2023 to $5.52 billion by 2033, driven by strong agricultural practices and increasing herbicide regulations.

Does ConsaInsights provide customized market report data for the glyphosate industry?

Yes, ConsaInsights offers tailored market report data for the glyphosate industry, adapting insights based on specific client needs, regional analyses, and detailed segmentation to enhance strategic decision-making.

What deliverables can I expect from this glyphosate market research project?

Deliverables include comprehensive market reports, regional analyses, segment insights, growth forecasts, competitive landscape assessments, and tailored recommendations to assist in strategic planning and investment decisions.

What are the market trends of glyphosate?

Market trends indicate a strong preference towards glyphosate formulations among farmers, with shares of 66.48% for agriculture and increasing investment in sustainable practices, responding to regulatory pressures and price sensitivity in the agricultural sector.