Gnss Chip Market Report

Published Date: 31 January 2026 | Report Code: gnss-chip

Gnss Chip Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the GNSS Chip market, offering insights into market size, trends, and forecasts for the period 2023 to 2033. It covers various segmentation, regional analysis, and technological advancements relevant to the GNSS Chip industry.

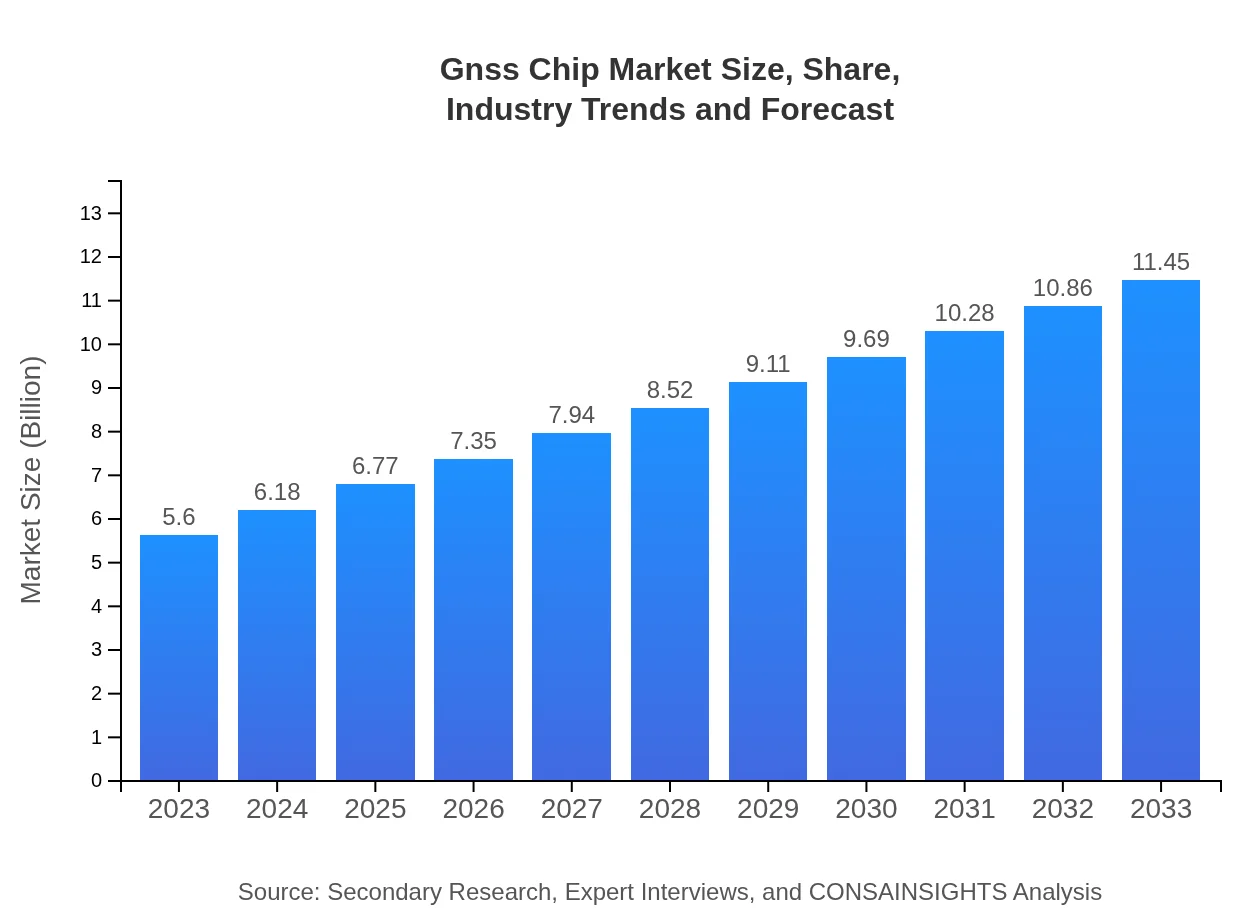

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Qualcomm , Intel, STMicroelectronics, Broadcom |

| Last Modified Date | 31 January 2026 |

Gnss Chip Market Overview

Customize Gnss Chip Market Report market research report

- ✔ Get in-depth analysis of Gnss Chip market size, growth, and forecasts.

- ✔ Understand Gnss Chip's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gnss Chip

What is the Market Size & CAGR of the GNSS Chip market in 2023?

GNSS Chip Industry Analysis

GNSS Chip Market Segmentation and Scope

Tell us your focus area and get a customized research report.

GNSS Chip Market Analysis Report by Region

Europe Gnss Chip Market Report:

Europe's market, valued at USD 1.85 billion in 2023 with projections reaching USD 3.78 billion by 2033, reflects a strong demand for GNSS solutions in the aerospace and automotive sectors, supported by stringent regulations enhancing navigational safety and accuracy.Asia Pacific Gnss Chip Market Report:

The Asia-Pacific region, with a market size of USD 0.91 billion in 2023 projected to grow to USD 1.86 billion by 2033, is witnessing rapid adoption of GNSS technology in automotive and consumer electronics. Countries like China and Japan are major contributors due to advancements in autonomous driving and IoT services.North America Gnss Chip Market Report:

North America leads the GNSS Chip market with a size of USD 2.04 billion in 2023, anticipated to grow to USD 4.16 billion by 2033. The region is dominated by significant investments in autonomous vehicle technologies, GPS applications, and telecommunications, highlighting its pivotal role in driving market developments.South America Gnss Chip Market Report:

Latin America, starting at USD 0.50 billion in 2023 and expected to reach USD 1.01 billion by 2033, is experiencing growth driven by improved infrastructure and the drive towards smart city initiatives, increasing GNSS chip integration in transportation and logistics.Middle East & Africa Gnss Chip Market Report:

In the Middle East and Africa, the market is expected to grow from USD 0.31 billion in 2023 to USD 0.63 billion by 2033. The growth trajectory is propelled by increasing investments in telecommunications infrastructure and smart city initiatives, driving demand for GNSS chips.Tell us your focus area and get a customized research report.

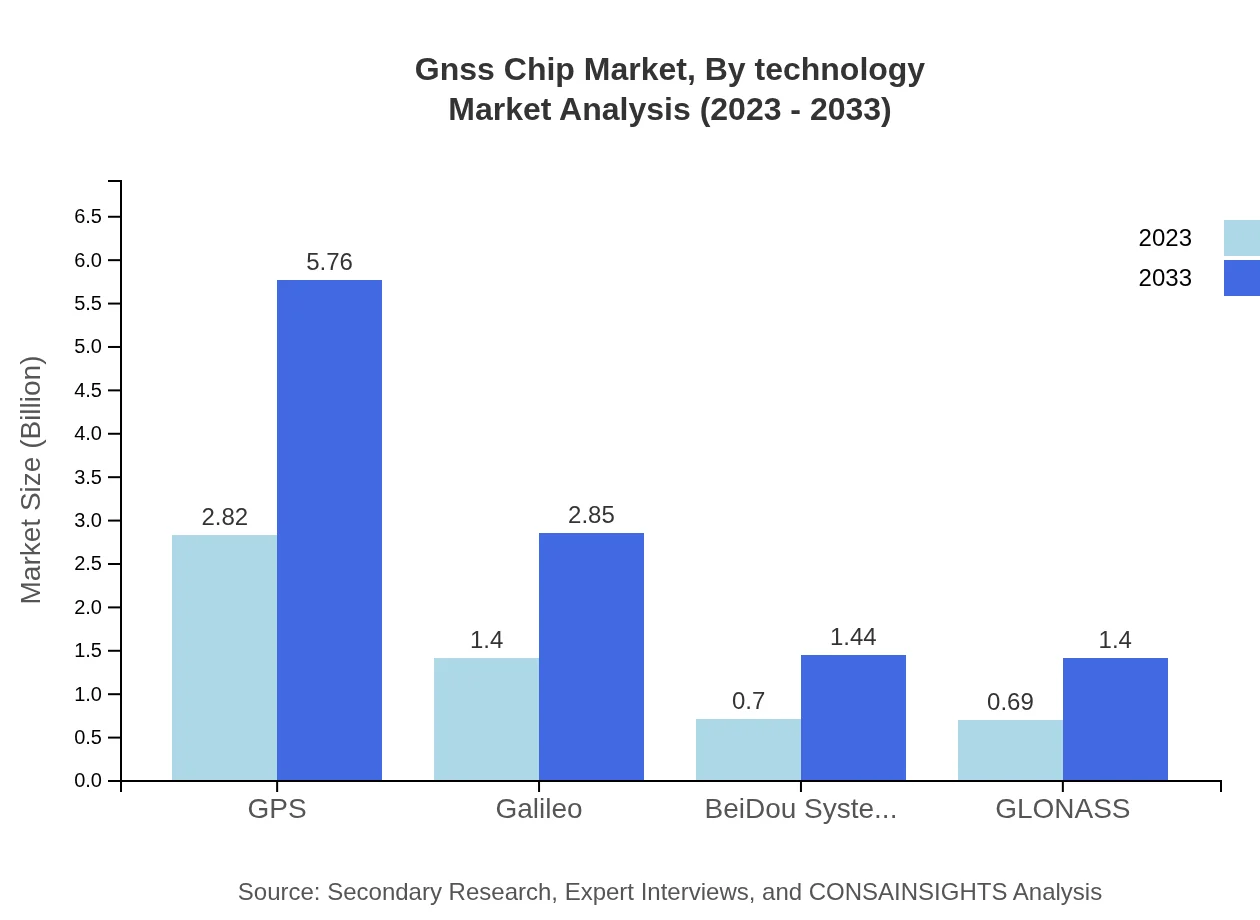

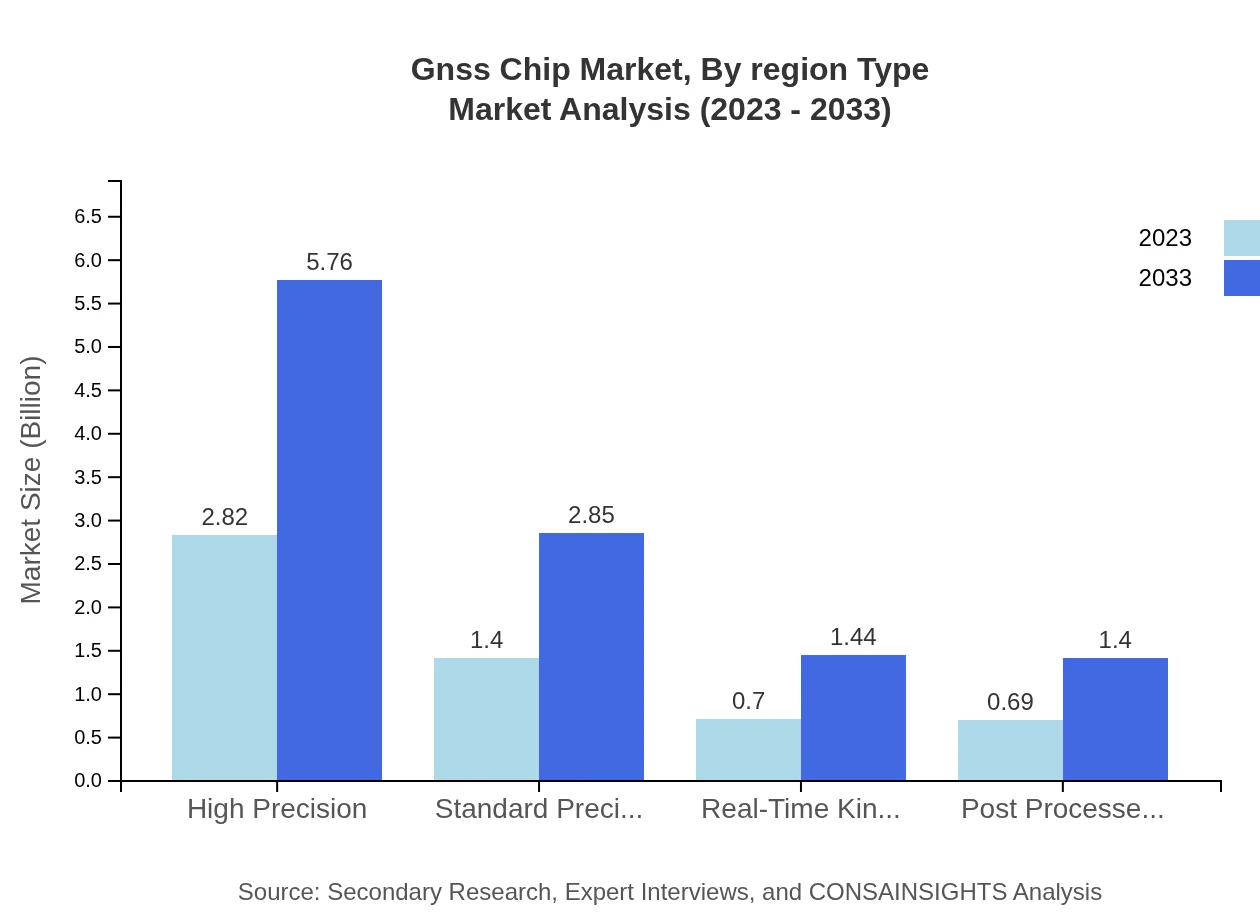

Gnss Chip Market Analysis By Technology

The GNSS Chip market by technology segment includes GPS, Galileo, BeiDou, and GLONASS. GPS continues to dominate with a size of USD 2.82 billion in 2023, projected to reach USD 5.76 billion by 2033. Galileo follows with a market size of USD 1.40 billion in 2023, anticipated to expand to USD 2.85 billion. BeiDou's growth is also notable, with a rise from USD 0.70 billion to USD 1.44 billion over the same period, reflecting its increasing global presence.

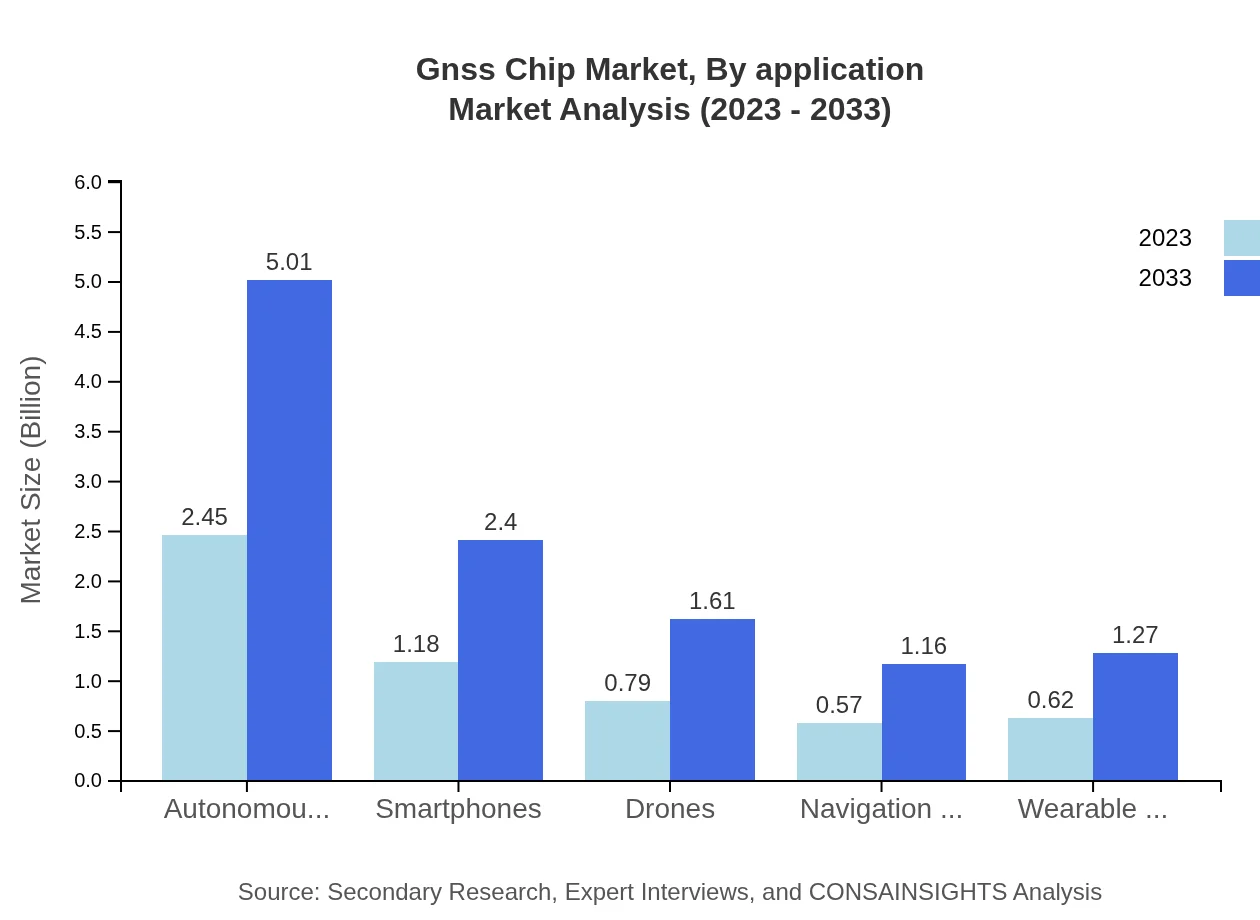

Gnss Chip Market Analysis By Application

Applications of GNSS chips span various sectors, with consumer electronics being the most significant. It accounted for USD 2.45 billion in 2023 and is expected to reach USD 5.01 billion by 2033. The automotive segment is also notable, starting at USD 1.18 billion in 2023 and growing to USD 2.40 billion by 2033, driven by the rise of autonomous vehicles and smart navigation systems.

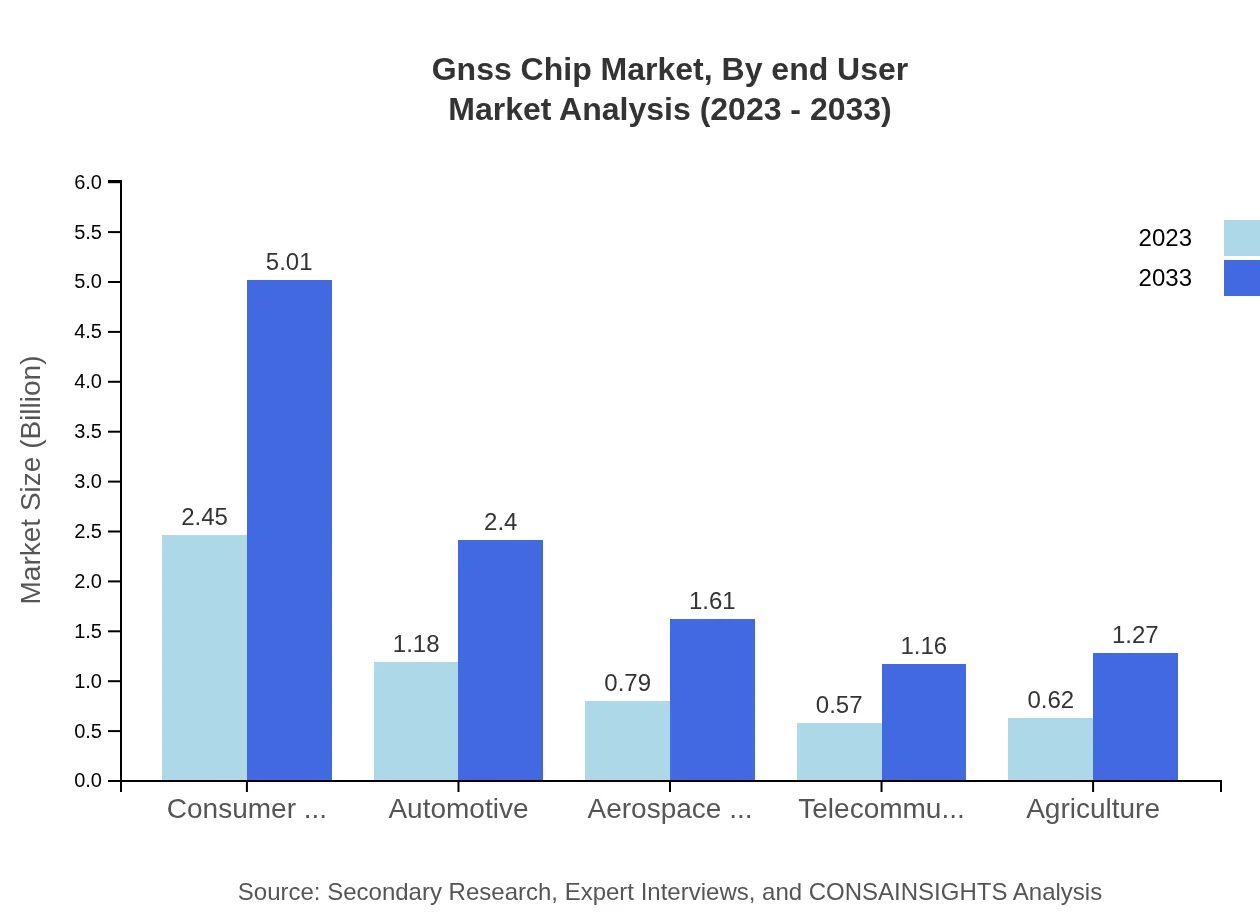

Gnss Chip Market Analysis By End User

End-user industries utilizing GNSS technology show varying degrees of adoption. The aerospace and defense sector, valued at USD 0.79 billion in 2023, is projected to expand to USD 1.61 billion by 2033, reflecting increased investments in defense systems. The telecommunications sector has seen a rise from USD 0.57 billion in 2023 to USD 1.16 billion by 2033, marking the expansion of mobile and IoT devices.

Gnss Chip Market Analysis By Region Type

The regional breakdown further highlights growth opportunities. North America stands out due to significant advanced applications in GNSS, whereas Asia-Pacific shows rapid growth driven by technological advancements in consumer electronics. Europe remains strong in aerospace applications, and Latin America and MEA present emerging growth prospects due to increasing infrastructure developments.

GNSS Chip Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in GNSS Chip Industry

Qualcomm :

A leading provider of wireless technology and mobile chipsets, Qualcomm plays a pivotal role in the GNSS market by offering GPS solution chips that power various consumer electronics.Intel:

Intel's innovation in semiconductor technology extends to GNSS chip solutions, driving advancements in positioning technology across multiple sectors including automotive and IoT.STMicroelectronics:

STMicroelectronics offers a range of GNSS chips suited for diverse applications from automotive to mobile devices, focusing on energy efficiency and compact design.Broadcom :

Broadcom is significant in the GNSS market space, providing high-performance GNSS chips that cater to both consumer and industrial sectors, enhancing navigation capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of gnss Chip?

The global GNSS chip market is projected to reach a size of $5.6 billion by 2033, with a steady compound annual growth rate (CAGR) of 7.2%. This reflects the growing demand for precise positioning technology across various industries.

What are the key market players or companies in the gnss Chip industry?

Key players in the GNSS chip market include industry leaders such as Qualcomm, Intel, Broadcom, u-blox, and STMicroelectronics. These companies are recognized for their innovative technologies and significant market share.

What are the primary factors driving the growth in the gnss Chip industry?

Growth in the GNSS chip market is driven by factors such as increased demand for navigation solutions in consumer electronics, rising adoption of autonomous vehicles, and advancements in satellite technology enhancing position accuracy.

Which region is the fastest Growing in the gnss Chip?

Asia Pacific is the fastest-growing region in the GNSS chip market. The market is expected to grow from $0.91 billion in 2023 to $1.86 billion by 2033, reflecting significant technological advancements and automotive applications.

Does ConsaInsights provide customized market report data for the gnss Chip industry?

Yes, ConsaInsights offers tailored market report data for the GNSS chip industry. Custom reports can be generated to meet specific client needs, addressing unique regional dynamics and market segmentation.

What deliverables can I expect from this gnss Chip market research project?

Expect comprehensive deliverables, including market size analysis, growth forecasts, competitive landscape overviews, regional breakdowns, and segmented insights tailored for specific applications like consumer electronics and automotive.

What are the market trends of gnss Chip?

Market trends for GNSS chips include heightened integration in autonomous vehicles, growth in high-precision applications, and increasing use in IoT devices. These trends reflect a shift towards more connected and automated systems.