Government Cloud Market Report

Published Date: 31 January 2026 | Report Code: government-cloud

Government Cloud Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Government Cloud market, exploring current trends, regional insights, and future forecasts from 2023 to 2033. Key data on market size, segment performance, and leading players are presented for stakeholders in the government and cloud technology sectors.

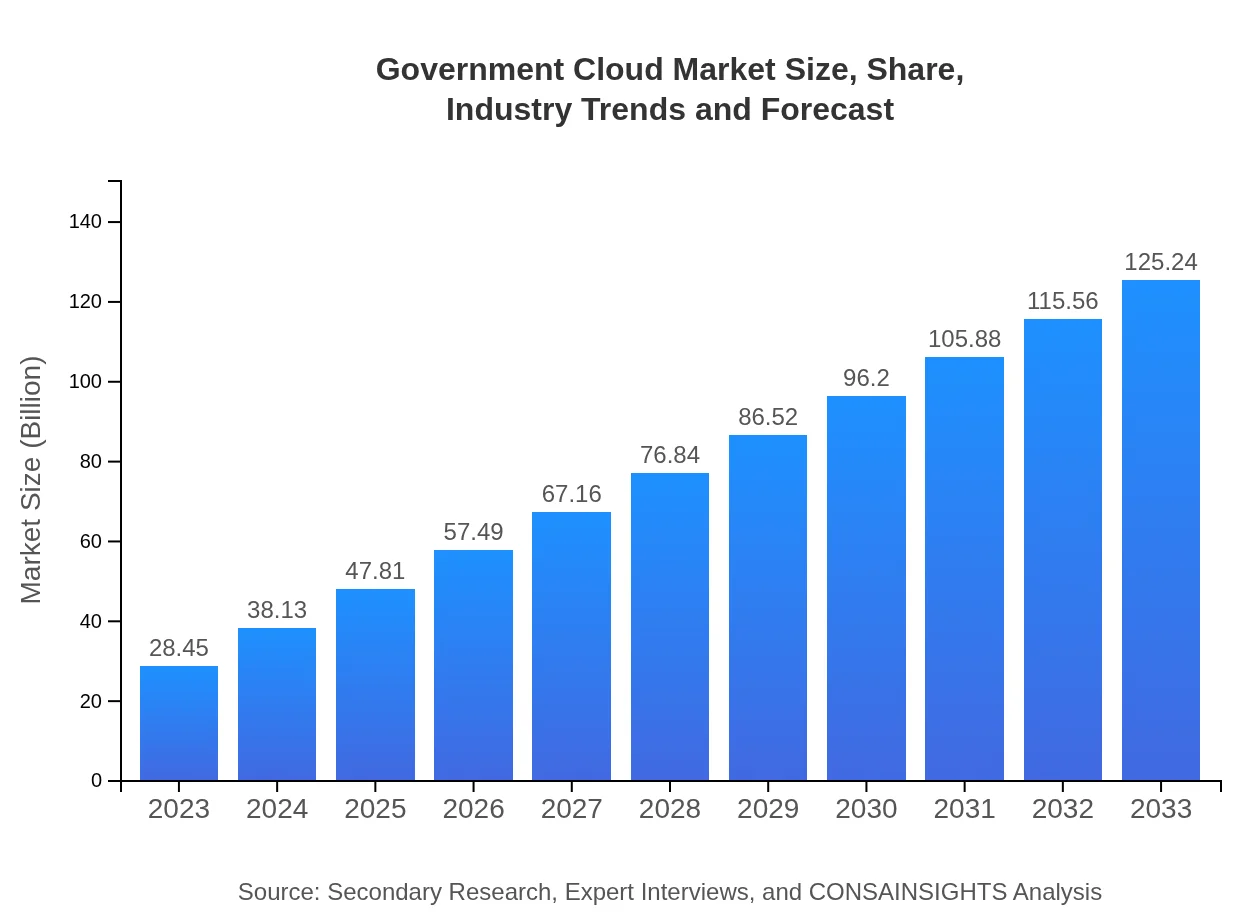

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $28.45 Billion |

| CAGR (2023-2033) | 15.2% |

| 2033 Market Size | $125.24 Billion |

| Top Companies | Microsoft Azure Government, Amazon Web Services (AWS) GovCloud, IBM Cloud for Government, Google Cloud for Government, Oracle Cloud Government |

| Last Modified Date | 31 January 2026 |

Government Cloud Market Overview

Customize Government Cloud Market Report market research report

- ✔ Get in-depth analysis of Government Cloud market size, growth, and forecasts.

- ✔ Understand Government Cloud's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Government Cloud

What is the Market Size & CAGR of Government Cloud market in 2023?

Government Cloud Industry Analysis

Government Cloud Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Government Cloud Market Analysis Report by Region

Europe Government Cloud Market Report:

Europe's market is anticipated to grow from USD 9.31 billion in 2023 to USD 40.98 billion by 2033. The European Union's push for digital sovereignty is prompting initiatives aimed at utilizing local cloud services to maintain data privacy and security.Asia Pacific Government Cloud Market Report:

The Asia Pacific region, valued at USD 5.41 billion in 2023, is anticipated to grow to USD 23.82 billion by 2033. This growth is propelled by increasing government initiatives to digitize services and enhance public service delivery. Countries like India, Australia, and Japan are leading investments in cloud infrastructure to advance smart city initiatives.North America Government Cloud Market Report:

North America is the largest market for the Government Cloud, expected to grow from USD 9.43 billion in 2023 to USD 41.53 billion in 2033. The U.S. government is a significant player, often leading innovation in digital transformation, including the implementation of cloud-based services across various federal and state agencies.South America Government Cloud Market Report:

The South American market is projected to expand from USD 1.81 billion in 2023 to USD 7.97 billion by 2033. Governments in this region are focusing on modernizing their IT systems with cloud solutions, driven by increased demand for transparency and efficiency in public administration.Middle East & Africa Government Cloud Market Report:

The Middle East and Africa region is set to grow from USD 2.49 billion in 2023 to USD 10.95 billion by 2033, as governments increasingly adopt cloud solutions to improve services and drive economic growth. Countries like the UAE and Saudi Arabia are investing heavily in cloud infrastructure as part of their digital initiatives.Tell us your focus area and get a customized research report.

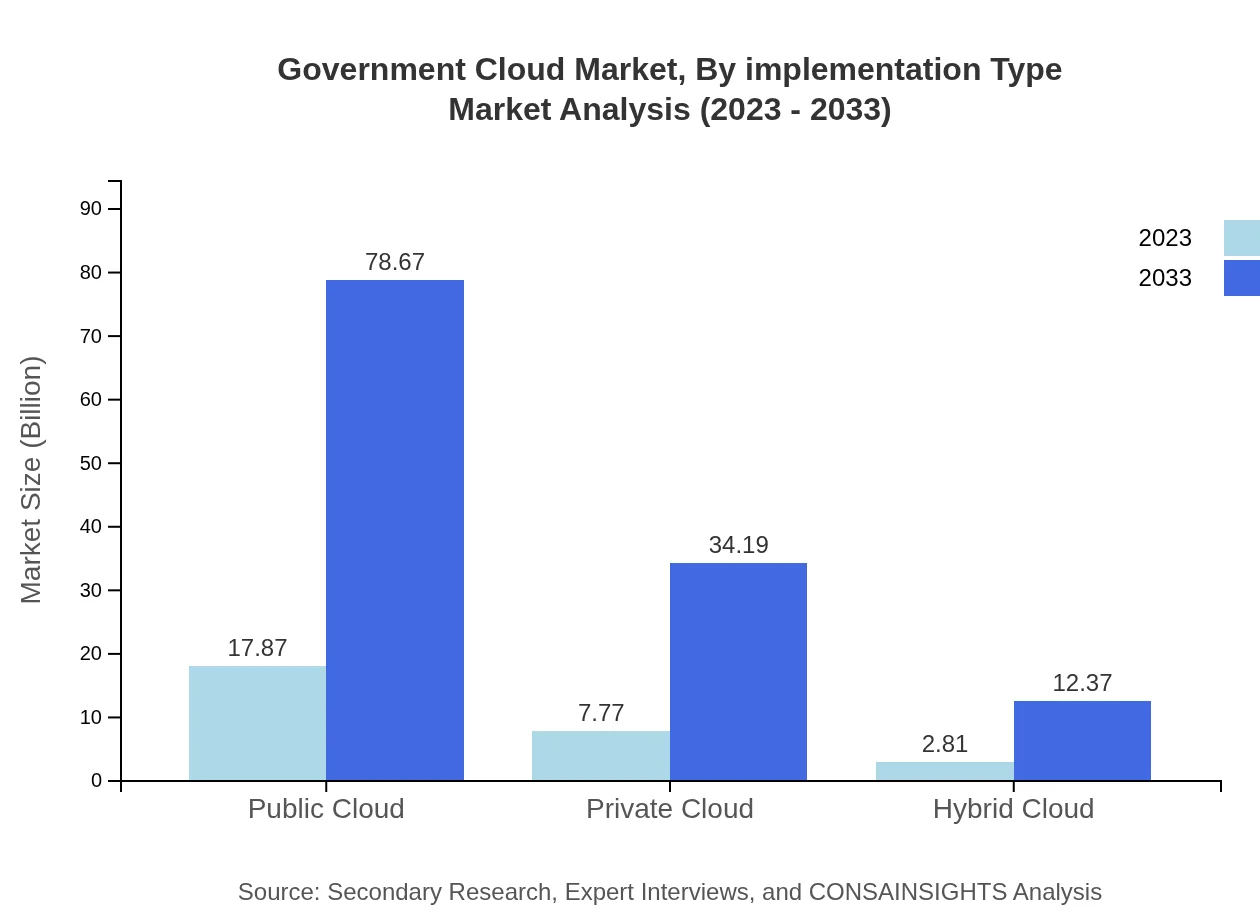

Government Cloud Market Analysis By Implementation Type

The Government Cloud segment comprises Public Cloud, Private Cloud, and Hybrid Cloud. The Public Cloud segment, valued at USD 17.87 billion in 2023 and projected to reach USD 78.67 billion by 2033, currently holds the largest market share due to its cost-effectiveness and scalability. The Private Cloud is also gaining traction, particularly among federal agencies, due to heightened security concerns, growing from USD 7.77 billion to USD 34.19 billion by 2033. Hybrid Cloud solutions offer flexibility, attracting agencies looking for a balanced approach to cloud adoption.

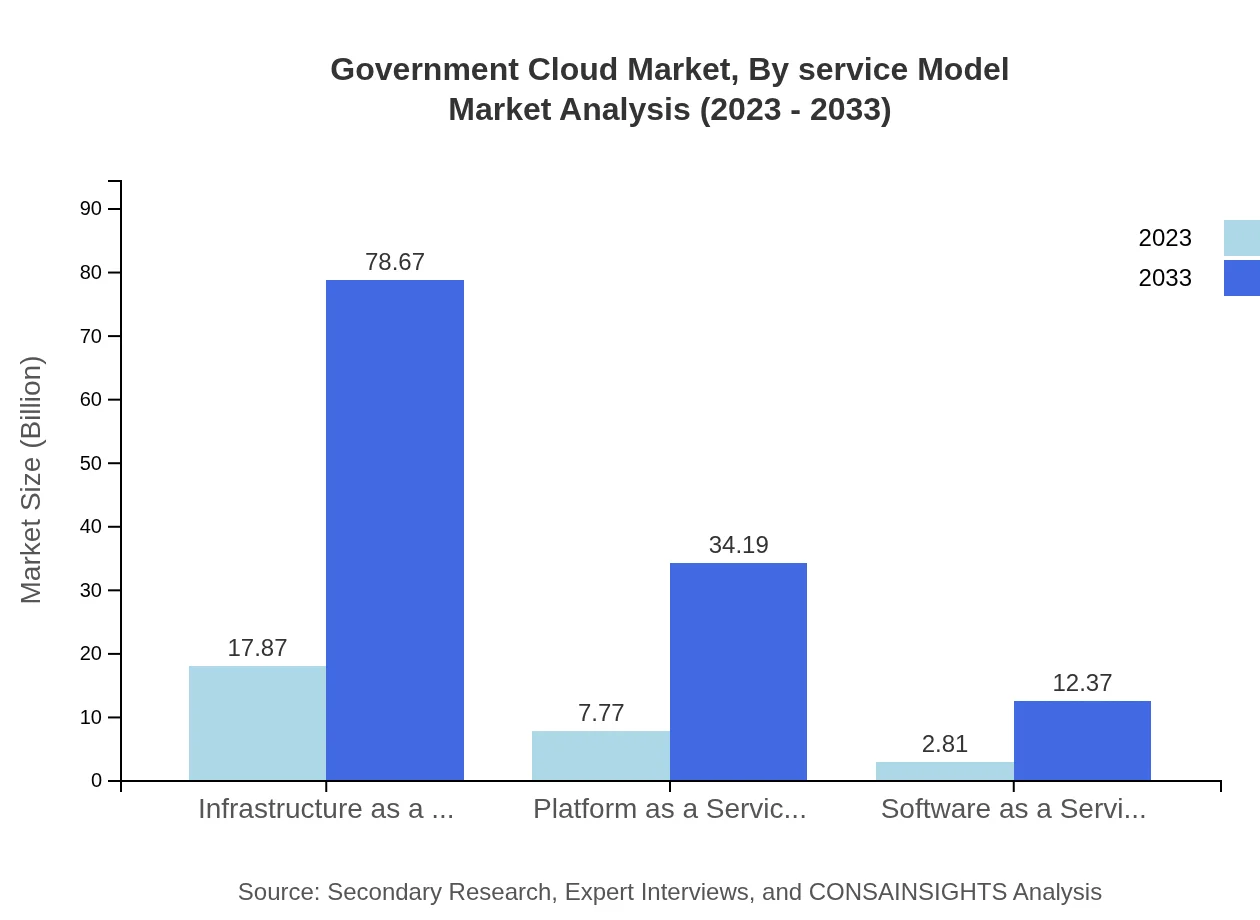

Government Cloud Market Analysis By Service Model

Within the service model category, IaaS remains a dominant force, representing USD 17.87 billion in 2023 and expected to grow to USD 78.67 billion by 2033. PaaS and SaaS follow, with significant growth projected due to their ability to facilitate rapid deployment and reduce the cost of application development, moving from USD 7.77 billion and USD 2.81 billion respectively in 2023 to USD 34.19 billion and USD 12.37 billion by 2033.

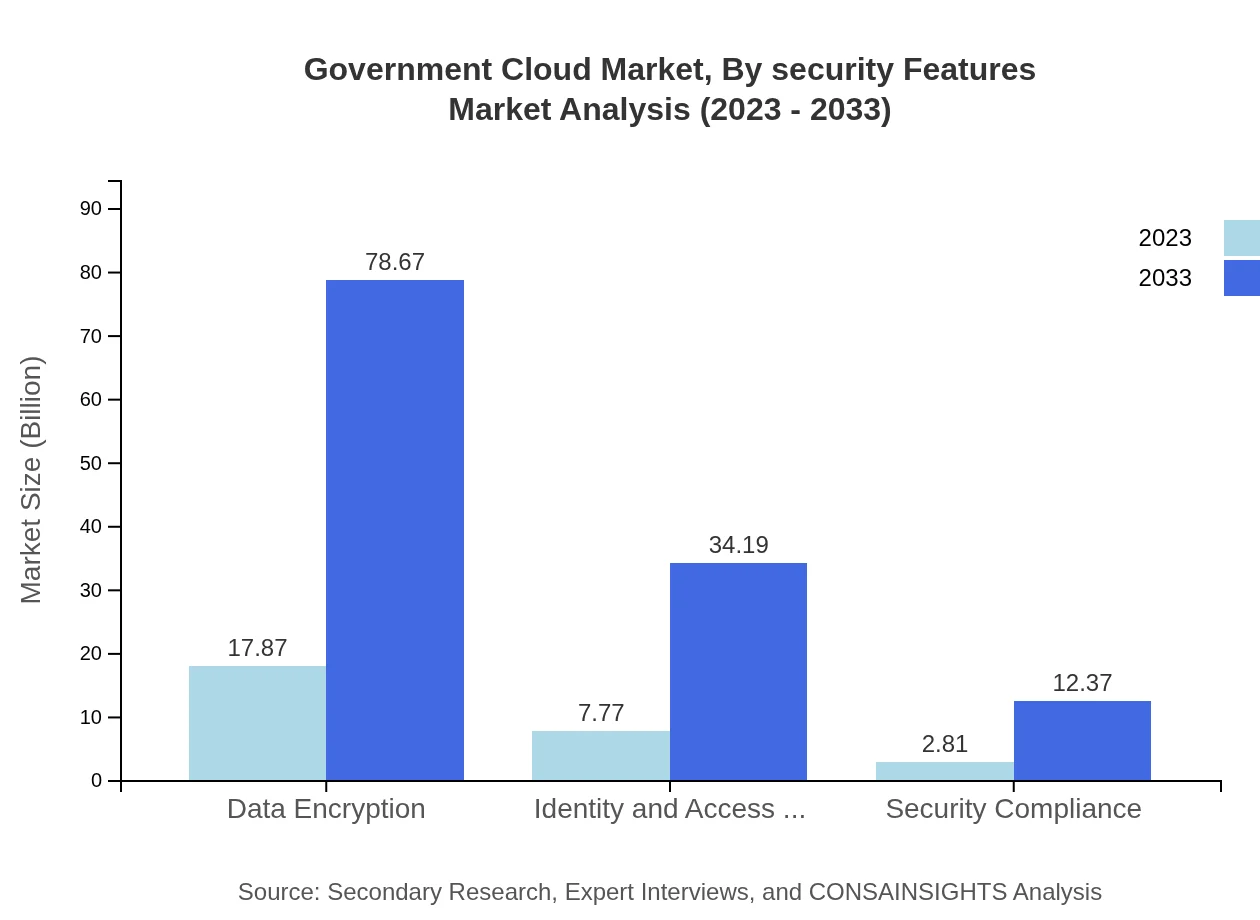

Government Cloud Market Analysis By Security Features

Security is paramount in the Government Cloud space, leading to a substantial focus on Identity and Access Management, Data Encryption, and Security Compliance. In 2023, Data Encryption alone is expected to generate USD 17.87 billion, growing to USD 78.67 billion by 2033, showcasing the prioritization of data protection strategies among government users.

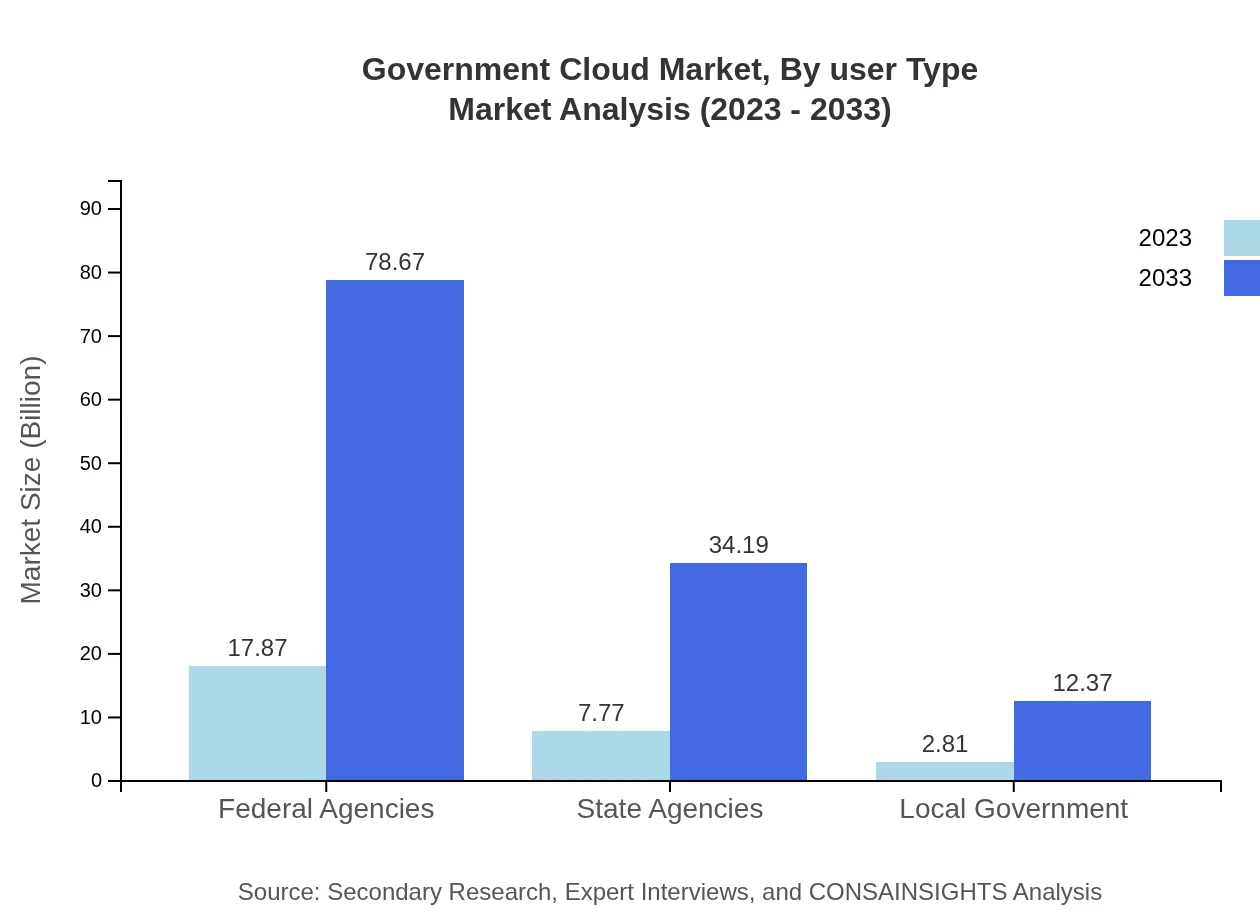

Government Cloud Market Analysis By User Type

The Government Cloud market is primarily driven by Federal Agencies, which accounted for USD 17.87 billion in 2023, expected to increase to USD 78.67 billion in 2033. State and Local Government Agencies also contribute significantly, with forecasts of USD 7.77 billion and USD 2.81 billion respectively in 2023, driven by their need for enhanced public services and operational efficiency.

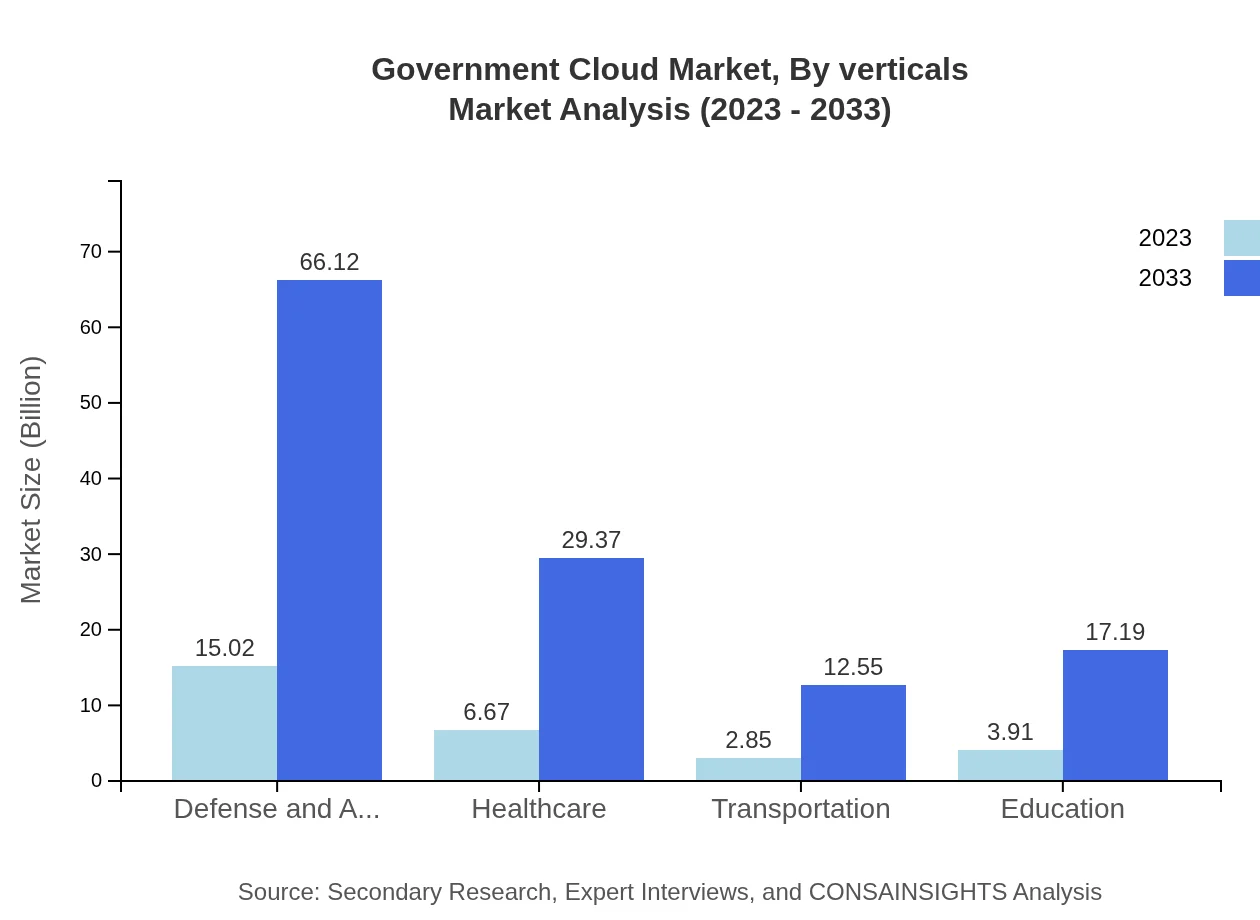

Government Cloud Market Analysis By Verticals

Various verticals are adopting cloud solutions, including Defense and Aerospace, Healthcare, Transportation, and Education. The Defense sector, valued at USD 15.02 billion in 2023, is projected to grow to USD 66.12 billion by 2033 as security and operational requirements mandate cutting-edge cloud services. Healthcare is following suit, driven by the need for secure patient data management.

Government Cloud Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Government Cloud Industry

Microsoft Azure Government:

Microsoft Azure Government provides a comprehensive cloud platform tailored for US government agencies, focusing on security, compliance, and scalability.Amazon Web Services (AWS) GovCloud:

AWS GovCloud is a dedicated cloud infrastructure designed to meet stringent government security requirements, offering a robust solution for federal, state, and local agencies.IBM Cloud for Government:

IBM Cloud for Government offers a secure and compliant cloud environment that empowers agencies to modernize their IT landscapes while ensuring the protection of sensitive data.Google Cloud for Government:

Google Cloud provides advanced analytics capabilities and a secure environment, driving innovation in government operations and public service delivery.Oracle Cloud Government:

Oracle Cloud for Government delivers an integrated solution for government agencies to optimize their business processes and enhance data-driven decision-making.We're grateful to work with incredible clients.

FAQs

What is the market size of government Cloud?

The government-cloud market is valued at approximately $28.45 billion in 2023 and is projected to grow at a CAGR of 15.2%, reaching substantial growth by 2033, reflecting the increasing adoption of cloud solutions by governmental entities globally.

What are the key market players or companies in the government Cloud industry?

Key players in the government-cloud industry include major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, IBM, and Oracle, which significantly contribute to the growth and innovation in this sector.

What are the primary factors driving the growth in the government Cloud industry?

The growth of the government-cloud industry is driven by increasing demand for cost-effective IT solutions, enhanced data security, interoperability among government agencies, and the shift towards digital transformation and modernization of public services.

Which region is the fastest Growing in the government Cloud market?

The fastest-growing region in the government-cloud market is Asia Pacific, which is expected to grow from $5.41 billion in 2023 to $23.82 billion by 2033, indicating a significant uptake of cloud technology in government operations.

Does ConsaInsights provide customized market report data for the government Cloud industry?

Yes, ConsaInsights offers customized market report data tailored to the government-cloud industry, catering to specific research needs and providing comprehensive insights into market dynamics, trends, and forecasts.

What deliverables can I expect from this government Cloud market research project?

Deliverables from the government-cloud market research project include detailed reports, market segmentation analysis, trend forecasts, competitive landscape insights, and actionable recommendations to assist in strategic decision-making.

What are the market trends of government Cloud?

Current trends in the government-cloud market include increased investment in security solutions, the rise of multi-cloud strategies, greater emphasis on compliance and governance, and an accelerating move towards adopting AI and data analytics capabilities.