Gpu Database Market Report

Published Date: 31 January 2026 | Report Code: gpu-database

Gpu Database Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Gpu Database market, exploring key insights, industry trends, and forecasts from 2023 to 2033. It offers valuable data related to market growth, segmentation, regional insights, and prominent players in the industry.

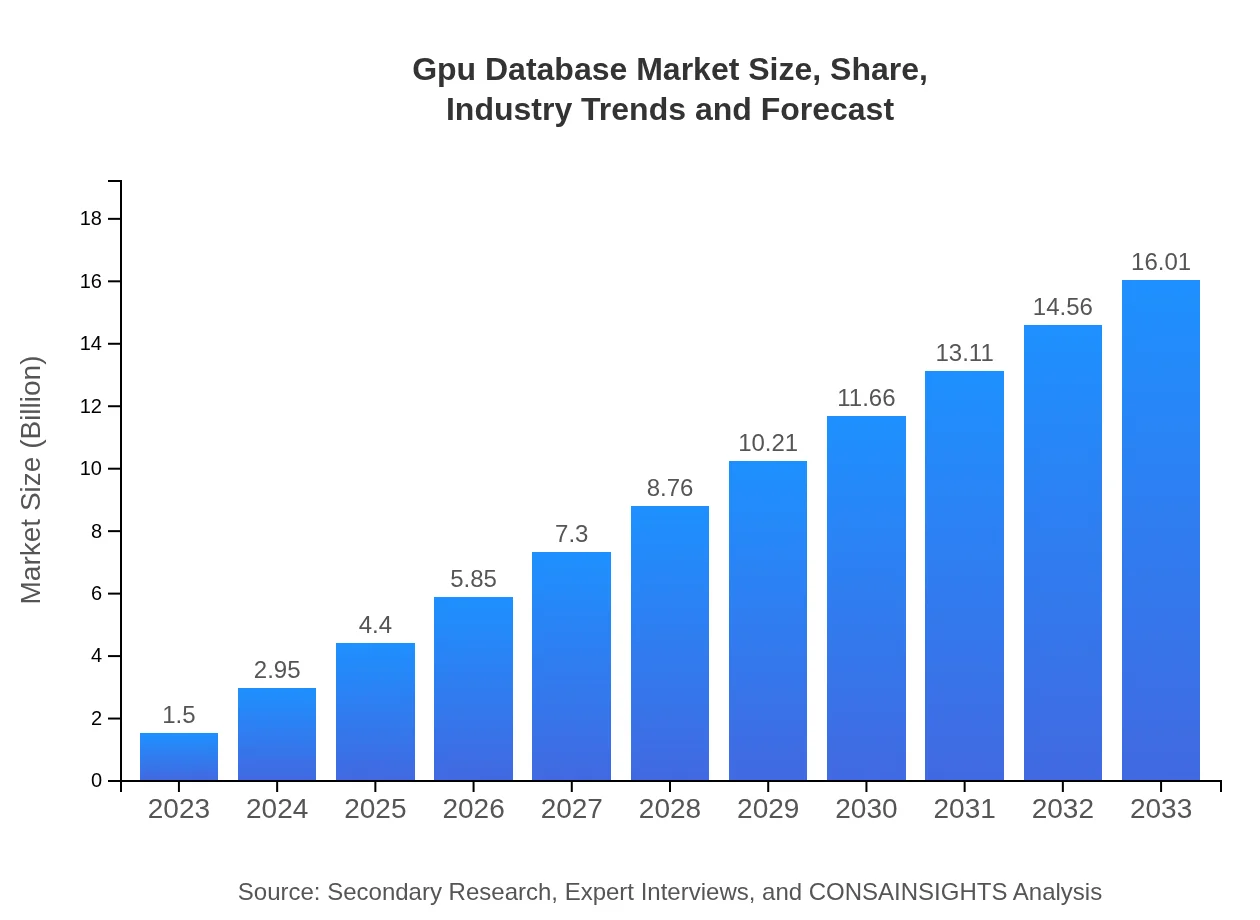

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 25% |

| 2033 Market Size | $16.01 Billion |

| Top Companies | NVIDIA Corporation, IBM Corporation, Oracle Corporation, Microsoft Azure |

| Last Modified Date | 31 January 2026 |

Gpu Database Market Overview

Customize Gpu Database Market Report market research report

- ✔ Get in-depth analysis of Gpu Database market size, growth, and forecasts.

- ✔ Understand Gpu Database's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gpu Database

What is the Market Size & CAGR of the Gpu Database market in 2023?

Gpu Database Industry Analysis

Gpu Database Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gpu Database Market Analysis Report by Region

Europe Gpu Database Market Report:

The European Gpu Database market is set to grow from $0.38 billion in 2023 to $4.08 billion by 2033. Increasing policies directed towards digital transformation and heavy investments into AI and machine learning applications are significant contributors to this growth.Asia Pacific Gpu Database Market Report:

The Asia Pacific region is witnessing tremendous growth in the Gpu Database market, projected to increase from $0.31 billion in 2023 to $3.29 billion by 2033. This growth is attributed to the rising adoption of advanced technologies across industries such as healthcare, automotive, and finance, spear-heading a demand for high-processing capabilities in data handling.North America Gpu Database Market Report:

North America remains a leader in the Gpu Database market, with the size expected to expand from $0.58 billion in 2023 to $6.24 billion by 2033. The region's strong technological infrastructure, coupled with pronounced investment from tech giants, continues to bolster the demand for GPU-enhanced databases.South America Gpu Database Market Report:

In South America, the Gpu Database market is expected to grow from $0.09 billion in 2023 to $1.01 billion in 2033. Rising investments in technology and increased reliance on data analytics are driving the growth of GPU databases in this region, allowing companies to streamline operations and improve decision-making.Middle East & Africa Gpu Database Market Report:

In the Middle East and Africa, the Gpu Database market is estimated to grow from $0.13 billion in 2023 to $1.39 billion by 2033, supported by enhancements in IT infrastructure and growing demand for cloud-based solutions across industries.Tell us your focus area and get a customized research report.

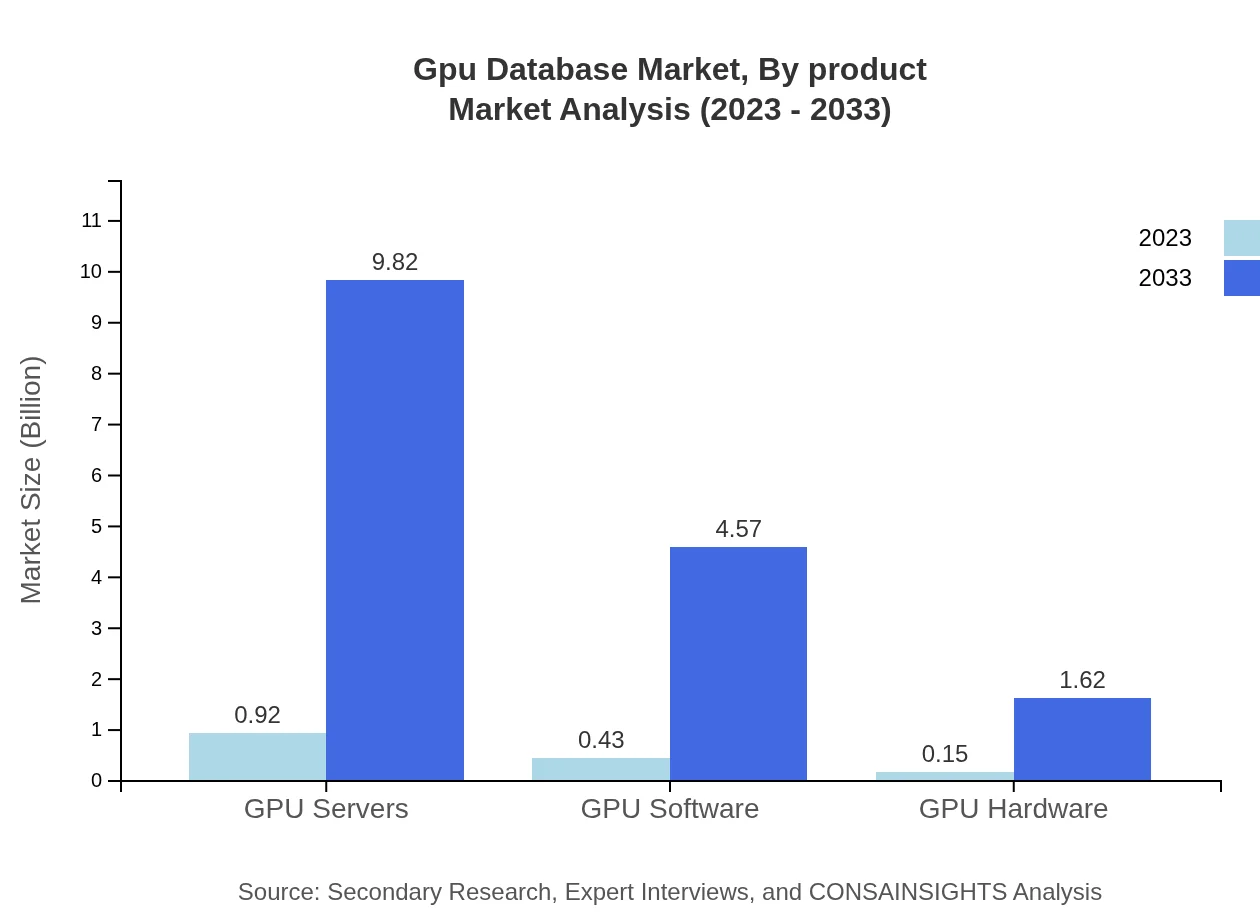

Gpu Database Market Analysis By Product

In 2023, GPU Servers lead the market at $0.92 billion, projected to reach $9.82 billion by 2033, indicating a significant share of 61.33% throughout the forecast period. GPU Software and Hardware follow closely, with projected growth from $0.43 billion to $4.57 billion for Software and $0.15 billion to $1.62 billion for Hardware.

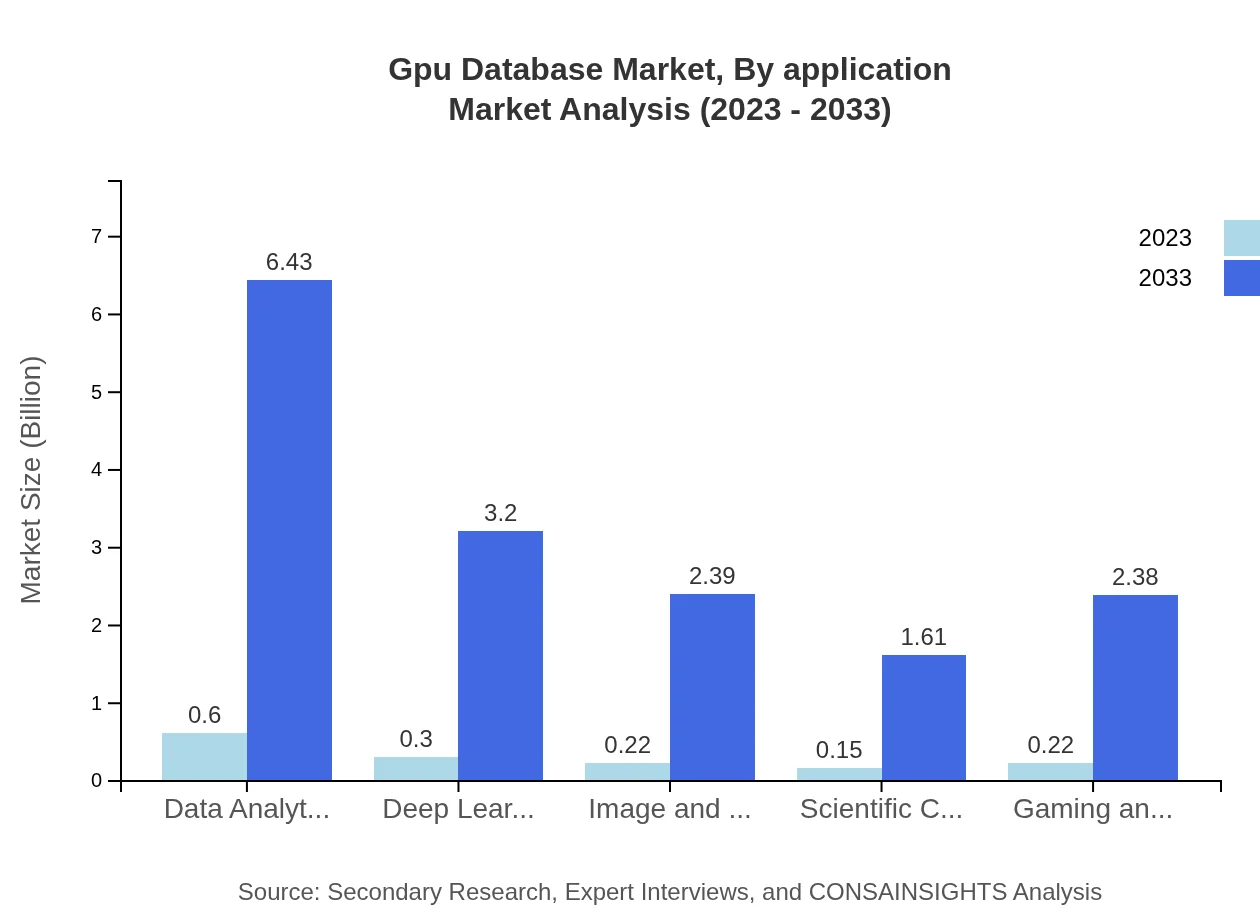

Gpu Database Market Analysis By Application

The Data Analytics sector dominates the market by application, with a size of $0.60 billion in 2023 and expected to grow to $6.43 billion in 2033. Other significant applications include IT and Telecom, Healthcare, Automotive, and Gaming with respective shares facilitating extensive growth in GPU database adoption.

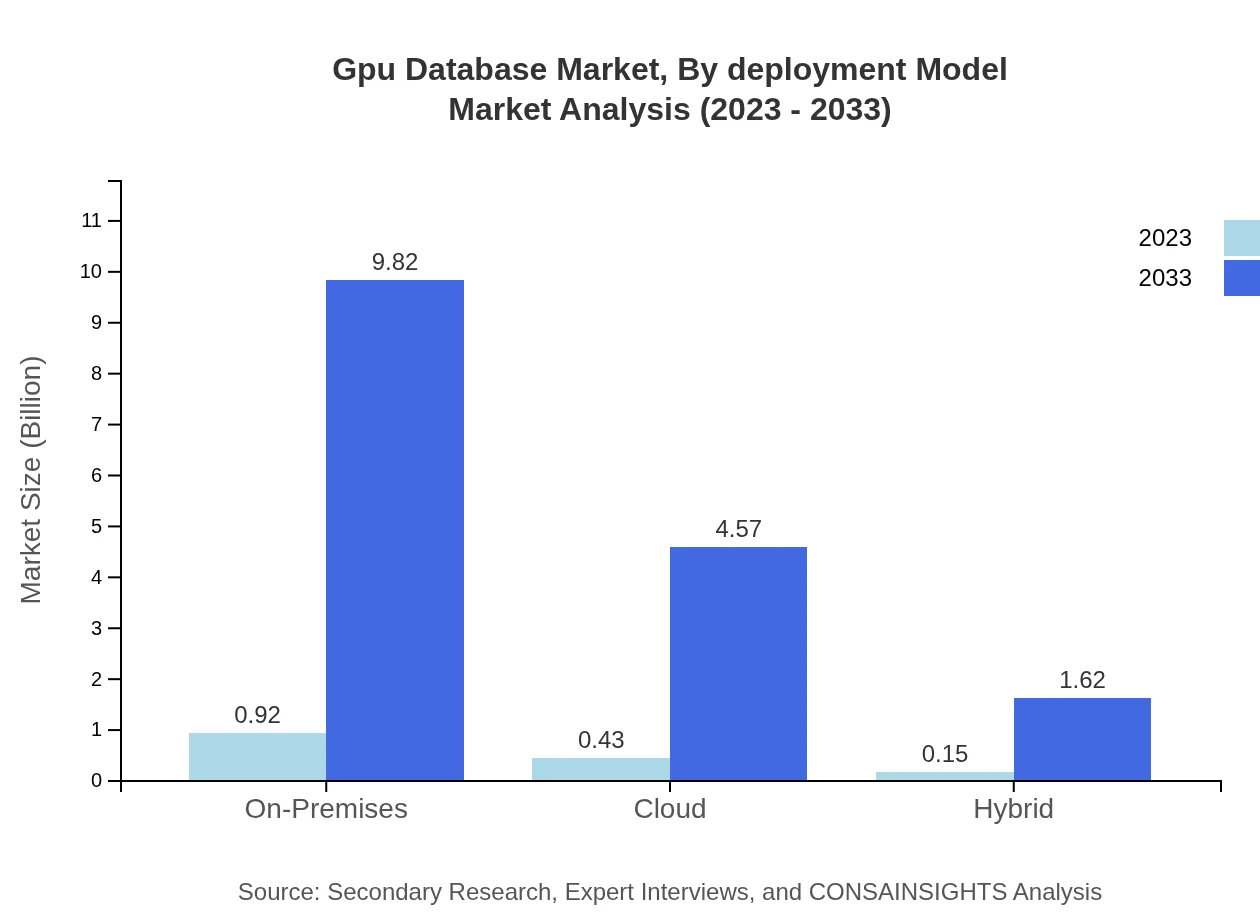

Gpu Database Market Analysis By Deployment Model

On-Premises deployment currently commands the market share, valued at $0.92 billion in 2023 with an anticipated rise to $9.82 billion by 2033. Cloud and Hybrid models are also gaining popularity, indicated by their projections from $0.43 billion to $4.57 billion and $0.15 billion to $1.62 billion, respectively.

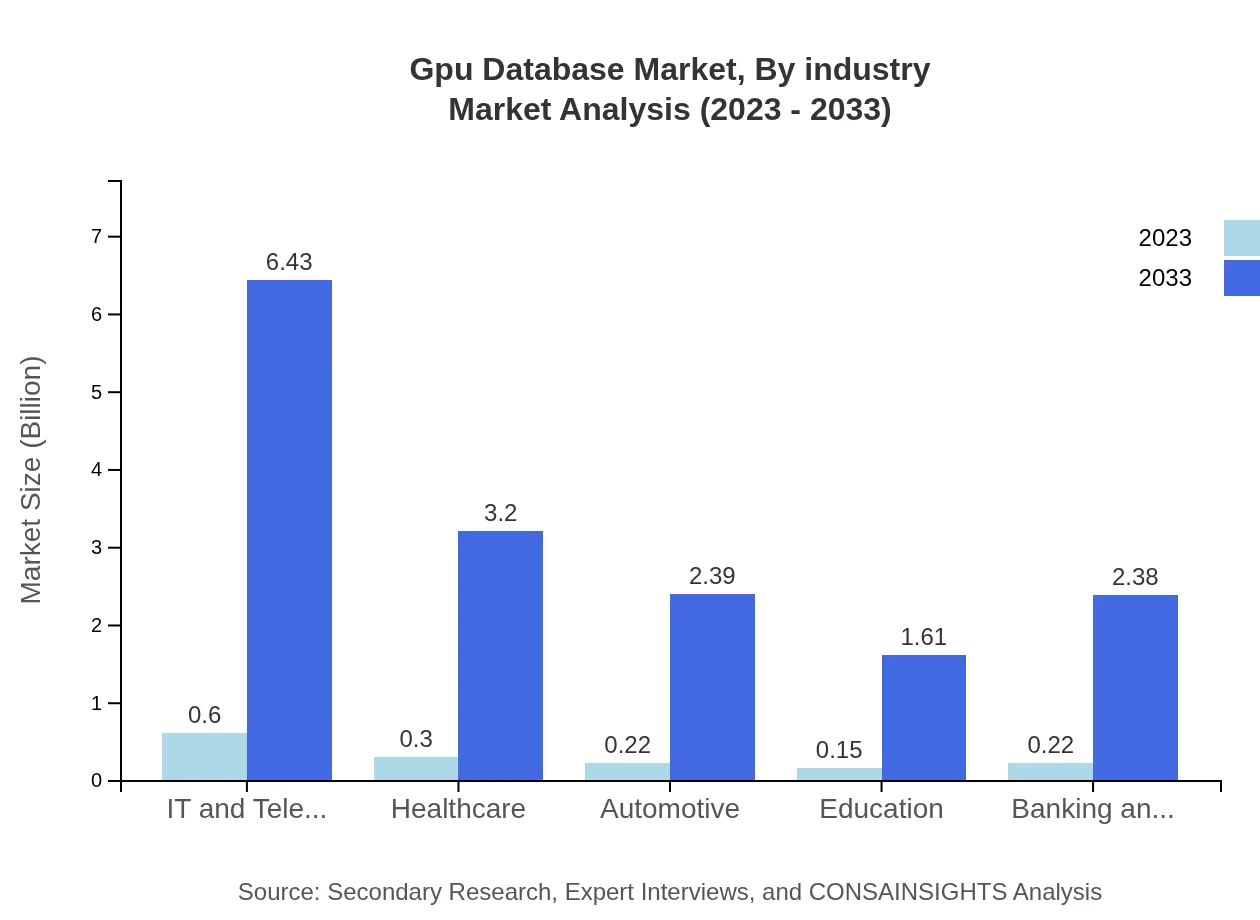

Gpu Database Market Analysis By Industry

Key end-user industries like IT and Telecom, and Healthcare, show substantial investments in GPU databases, with sizes of $0.60 billion and $0.30 billion in 2023, likely to grow to $6.43 billion and $3.20 billion by 2033. Other industries include Banking and Financial Services, Automotive, Education, and more, each contributing to the expansive industry growth.

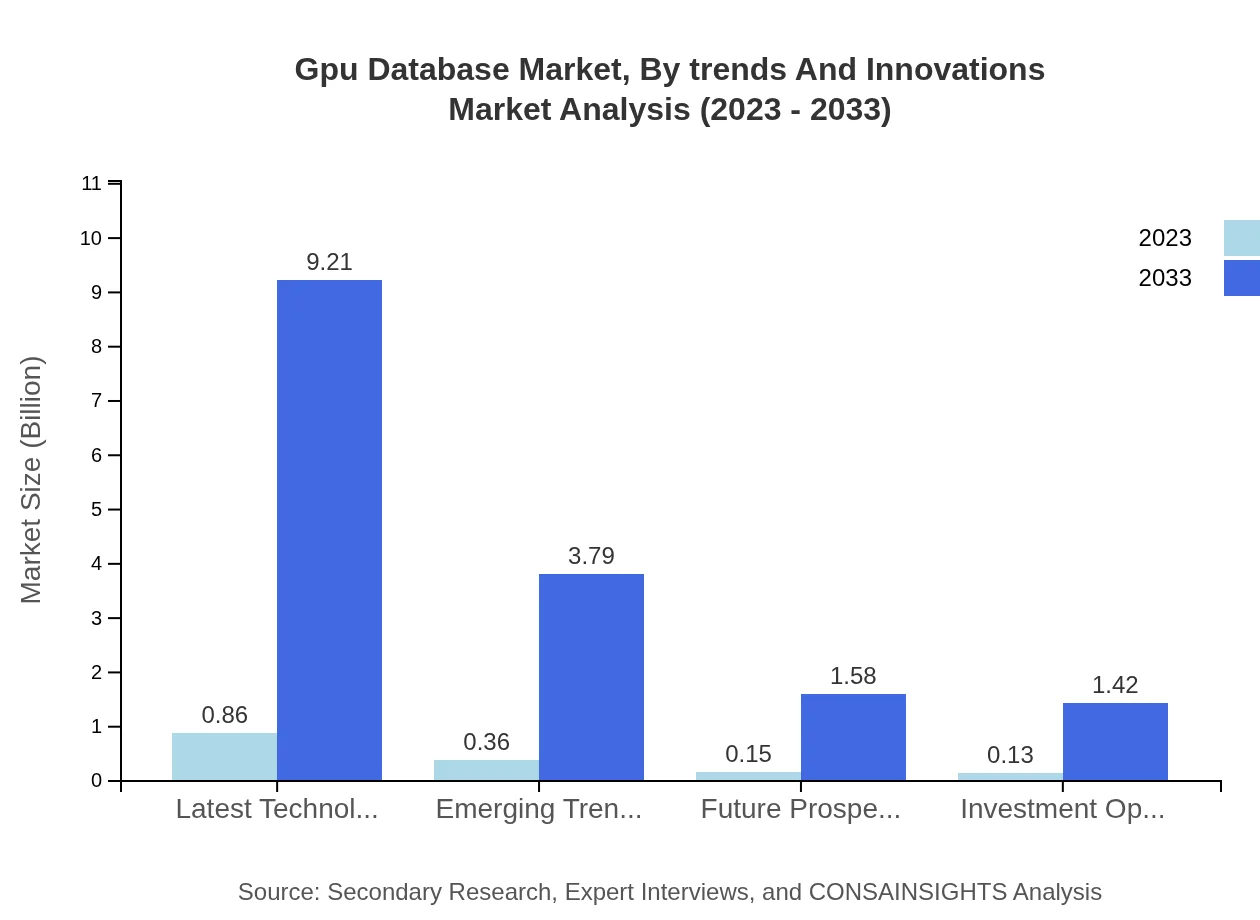

Gpu Database Market Analysis By Trends And Innovations

The trend towards real-time analytics and cloud integration is reshaping the Gpu Database industry. Innovations in GPU technologies, such as improved parallel processing capabilities, continue to draw more users towards adopting GPU databases, enhancing productivity across data-heavy applications.

Gpu Database Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gpu Database Industry

NVIDIA Corporation:

NVIDIA is a leader in GPU design and manufacturing, offering advanced computing solutions including GPU Database technologies that facilitate high-speed data processing and analytics.IBM Corporation:

IBM has developed various data solutions leveraging GPU technologies, focusing on AI and machine learning integrations to enhance database capabilities.Oracle Corporation:

Oracle is known for its database services and has embraced GPU technologies to improve data processing speeds and analytics.Microsoft Azure:

Microsoft provides cloud services integrating GPU capabilities, allowing for enhanced performance in data management solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of gpu Database?

The global GPU Database market is valued at approximately $1.5 billion as of 2023 and is projected to grow at a CAGR of 25% through 2033, indicating robust demand and expansion in various sectors.

What are the key market players or companies in this gpu Database industry?

Key players in the GPU Database industry include major technology firms specializing in GPU hardware and software, data analytics companies, and cloud service providers, driving advancements in data processing and computational capabilities.

What are the primary factors driving the growth in the gpu Database industry?

Growth in the GPU Database market is driven by increasing demand for high-performance computing, advancements in AI and machine learning, a surge in big data analytics, and widespread adoption across sectors such as healthcare, finance, and gaming.

Which region is the fastest Growing in the gpu Database?

The fastest-growing region in the GPU Database market is North America, expected to rise from $0.58 billion in 2023 to $6.24 billion by 2033, fueled by robust technological innovation and investment in data centers.

Does ConsaInsights provide customized market report data for the gpu Database industry?

Yes, ConsaInsights offers customized market reports tailored to client specifications within the GPU Database industry, focusing on specific trends, regional analyses, and targeted segments, enhancing decision-making capabilities.

What deliverables can I expect from this gpu Database market research project?

You can expect comprehensive deliverables including market size analysis, growth forecasts, competitive landscape details, regional breakdowns, and insights into key players and emerging trends within the GPU Database market.

What are the market trends of gpu Database?

Market trends in the GPU Database industry include increasing cloud adoption, the rise of AI-driven applications, a shift toward hybrid computing environments, and a growing focus on performance optimization in data-intensive operations.