Grain And Cereals Crop Protection Market Report

Published Date: 02 February 2026 | Report Code: grain-and-cereals-crop-protection

Grain And Cereals Crop Protection Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Grain and Cereals Crop Protection market, covering current trends, technologies, and forecasts from 2023 to 2033. It offers insights into market dynamics, competitive landscape, regional developments, and growth opportunities across different segments.

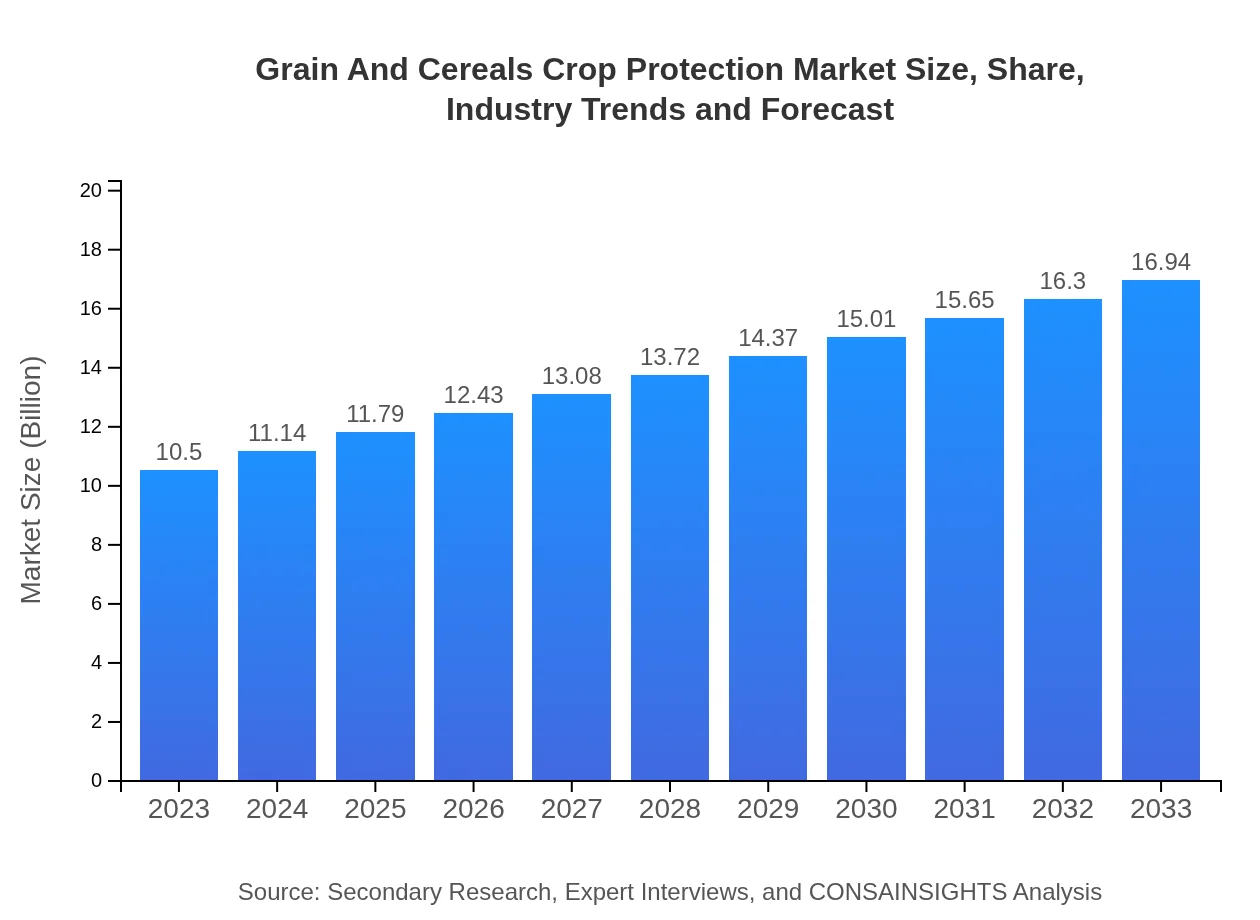

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $16.94 Billion |

| Top Companies | Bayer AG, Syngenta AG, Corteva Agriscience, FMC Corporation |

| Last Modified Date | 02 February 2026 |

Grain And Cereals Crop Protection Market Overview

Customize Grain And Cereals Crop Protection Market Report market research report

- ✔ Get in-depth analysis of Grain And Cereals Crop Protection market size, growth, and forecasts.

- ✔ Understand Grain And Cereals Crop Protection's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Grain And Cereals Crop Protection

What is the Market Size & CAGR of Grain And Cereals Crop Protection market in 2023?

Grain And Cereals Crop Protection Industry Analysis

Grain And Cereals Crop Protection Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Grain And Cereals Crop Protection Market Analysis Report by Region

Europe Grain And Cereals Crop Protection Market Report:

Europe's market is expected to grow from USD 3.96 billion in 2023 to USD 6.38 billion by 2033. Regulatory frameworks in this region have pushed for more sustainable practices, leading to increased investments in biopesticides and eco-friendly crop protection solutions.Asia Pacific Grain And Cereals Crop Protection Market Report:

The Asia-Pacific region is expected to witness robust growth, with market size projected to rise from USD 1.90 billion in 2023 to USD 3.07 billion by 2033. Increasing agricultural activity and government support for sustainable practices contribute to this growth. Nations like India and China are spearheading innovations in crop protection due to their large agricultural bases.North America Grain And Cereals Crop Protection Market Report:

North America, valued at USD 3.37 billion in 2023, is projected to reach USD 5.43 billion by 2033, benefiting from advanced agricultural practices and high adoption of technology in farming. The U.S. remains a leading market due to its extensive research and development in agrochemicals.South America Grain And Cereals Crop Protection Market Report:

In South America, the Grain and Cereals Crop Protection market is anticipated to grow from USD 0.45 billion in 2023 to USD 0.73 billion by 2033. The region's agricultural sector is heavily reliant on crop protection products to sustain output, particularly in countries like Brazil and Argentina, which are notorious for corn and soybean production.Middle East & Africa Grain And Cereals Crop Protection Market Report:

The Middle East and Africa region is projected to expand from USD 0.82 billion in 2023 to USD 1.33 billion by 2033. The growing need for food security and advancements in agricultural practices due to increasing population pressure support this growth.Tell us your focus area and get a customized research report.

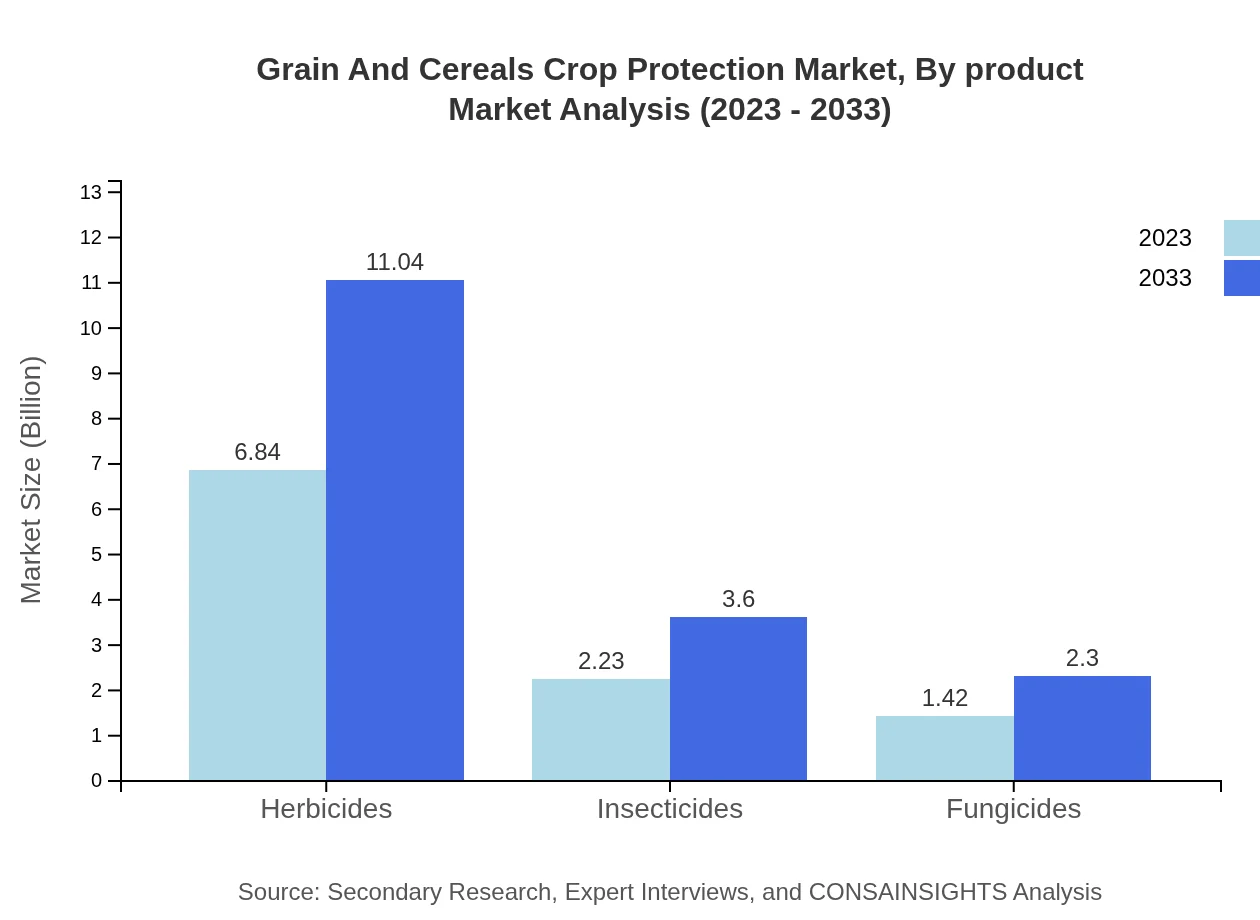

Grain And Cereals Crop Protection Market Analysis By Product

The segment is primarily dominated by herbicides, which accounted for approximately USD 6.84 billion in 2023 and is expected to reach USD 11.04 billion by 2033. Herbicides represent 65.19% market share due to their critical role in weed control. Insecticides, valued at USD 2.23 billion, are also significant with a share of 21.25%, growing steadily to USD 3.60 billion by 2033. Fungicides and biopesticides also play important roles in crop protection, capturing the remaining market share.

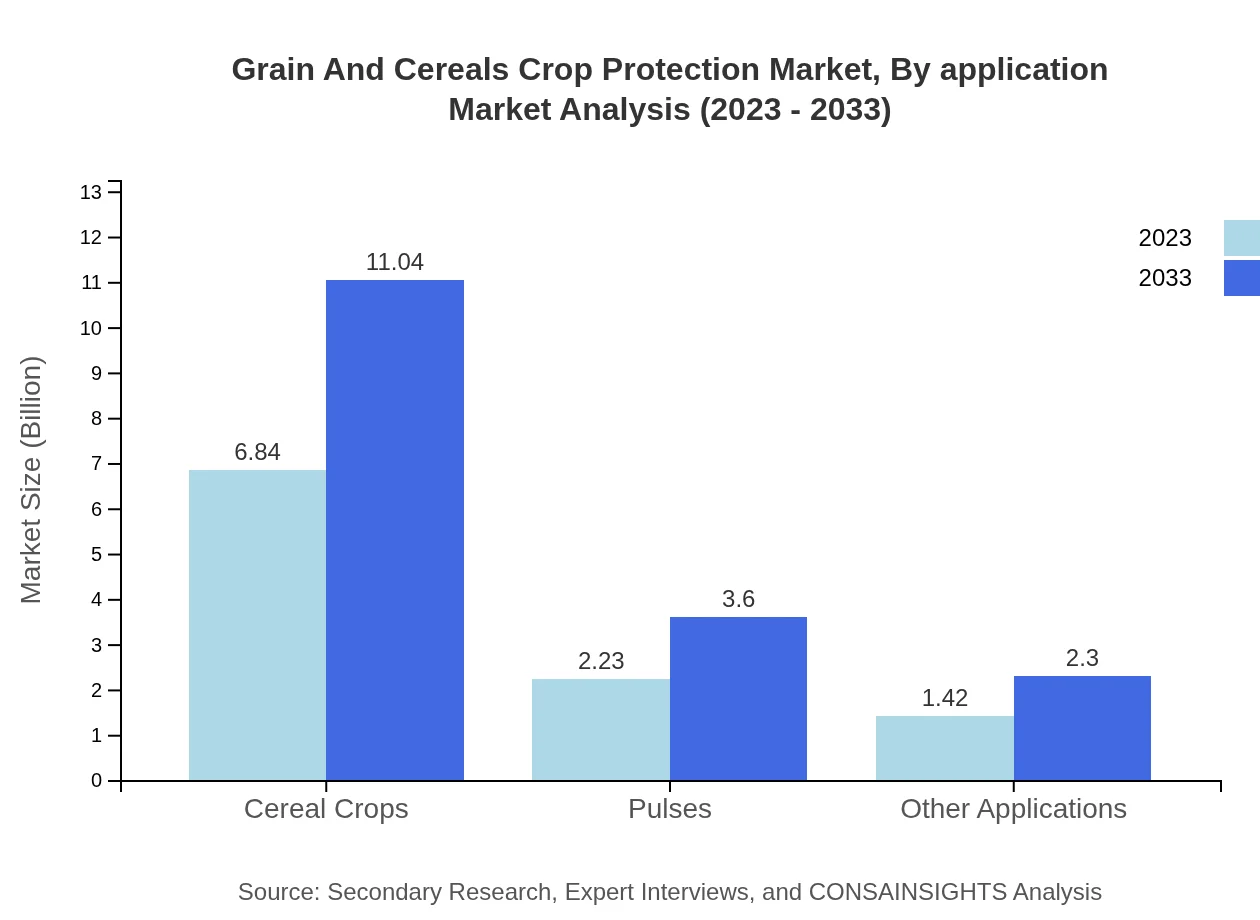

Grain And Cereals Crop Protection Market Analysis By Application

The primary application for crop protection products is in cereal crops, which currently holds a market size of USD 6.84 billion and accounts for a 65.19% share. Pulses constitute another critical segment with a market size of USD 2.23 billion (21.25% share) and are projected to maintain growth moving towards USD 3.60 billion by 2033. Other applications, including specialty crops, make up a smaller but significant part of the market.

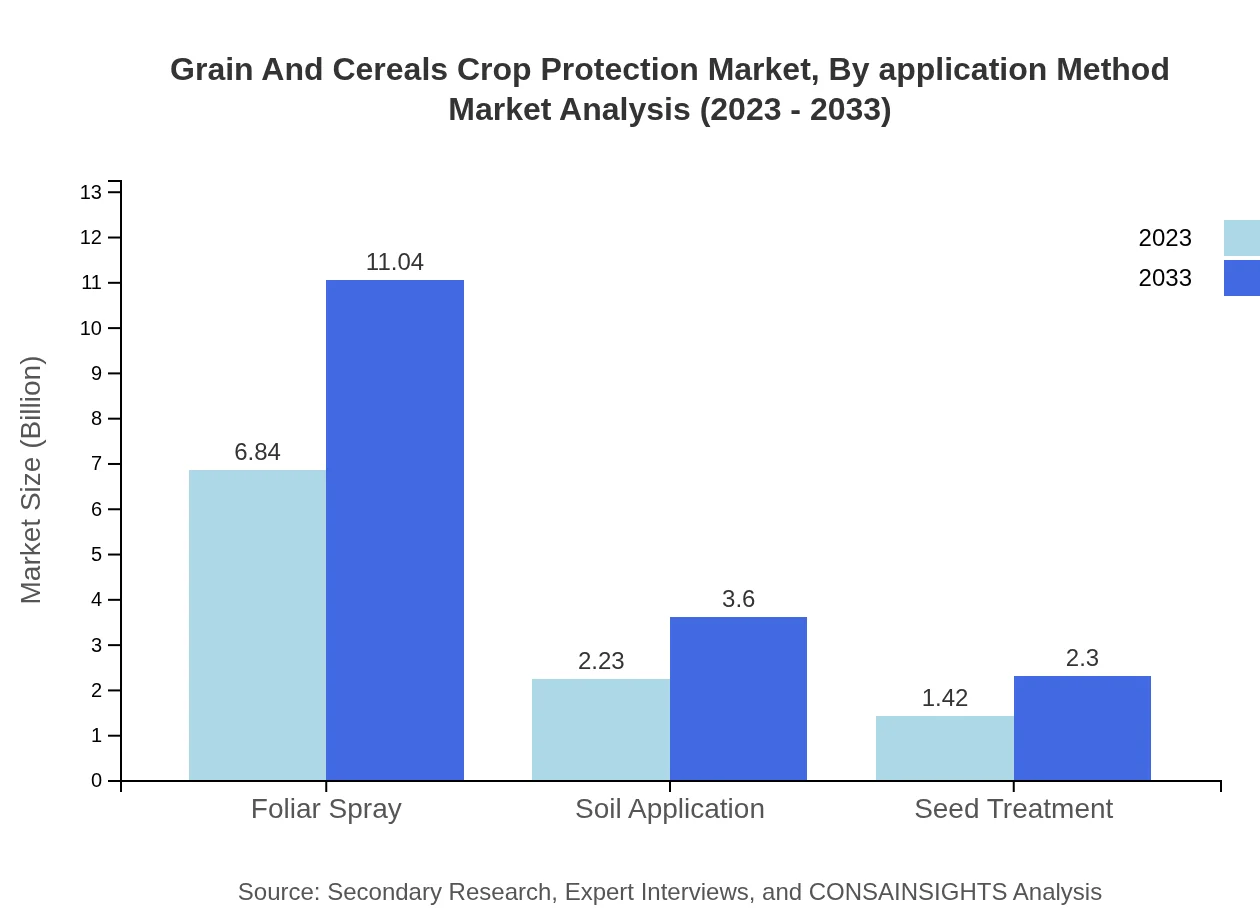

Grain And Cereals Crop Protection Market Analysis By Application Method

Foliar spray represents the most common application method, holding a market size of USD 6.84 billion in 2023, consistent across years. Soil application and seed treatment follow, with respective market sizes of USD 2.23 billion and USD 1.42 billion. These application methods are vital to ensure maximum efficacy and yield in agricultural practices.

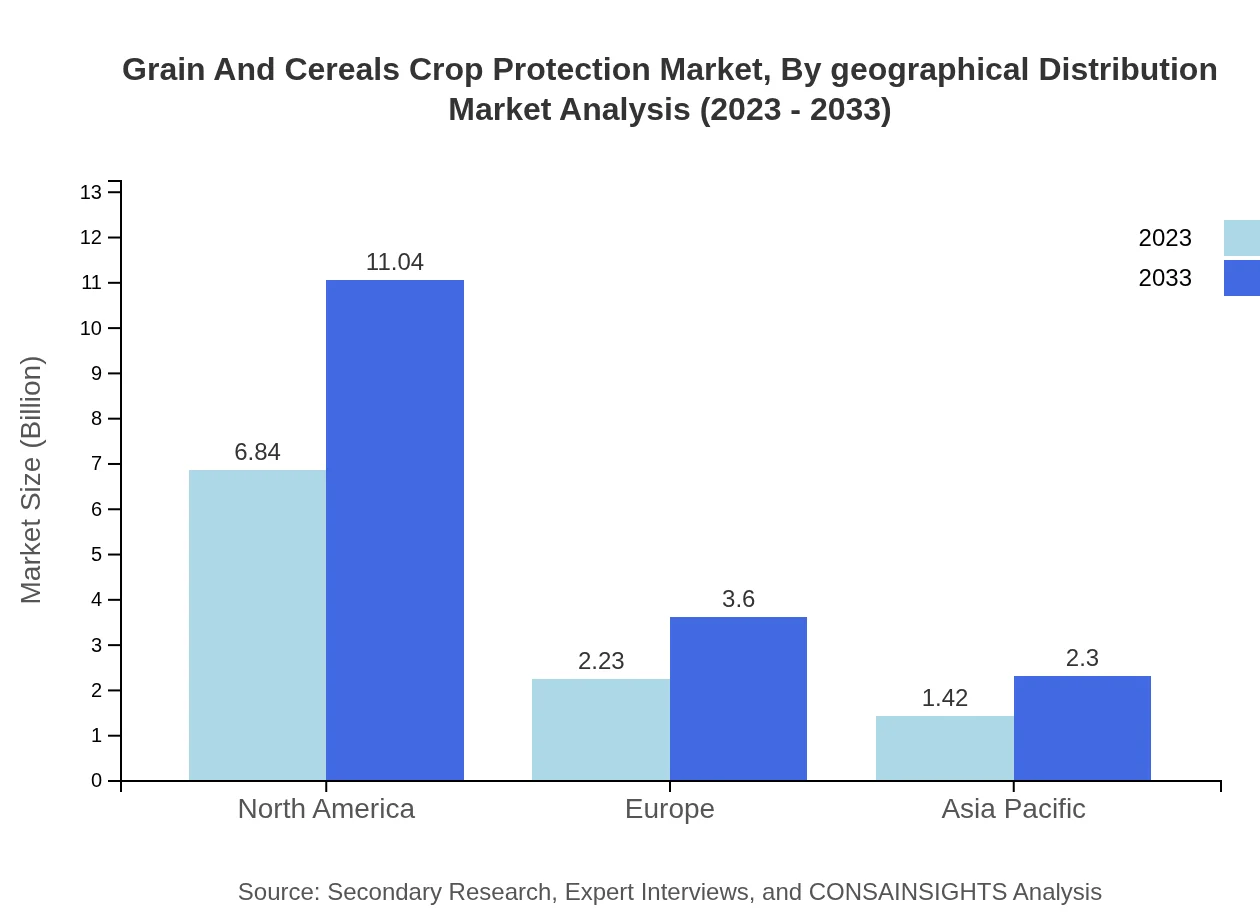

Grain And Cereals Crop Protection Market Analysis By Geographical Distribution

The market distribution across regions shows North America leading, followed by Europe and the Asia-Pacific. These regions contribute significantly to making advancements in crop protection techniques. Participants in the market are increasingly focusing on tailored strategies for different geographical needs.

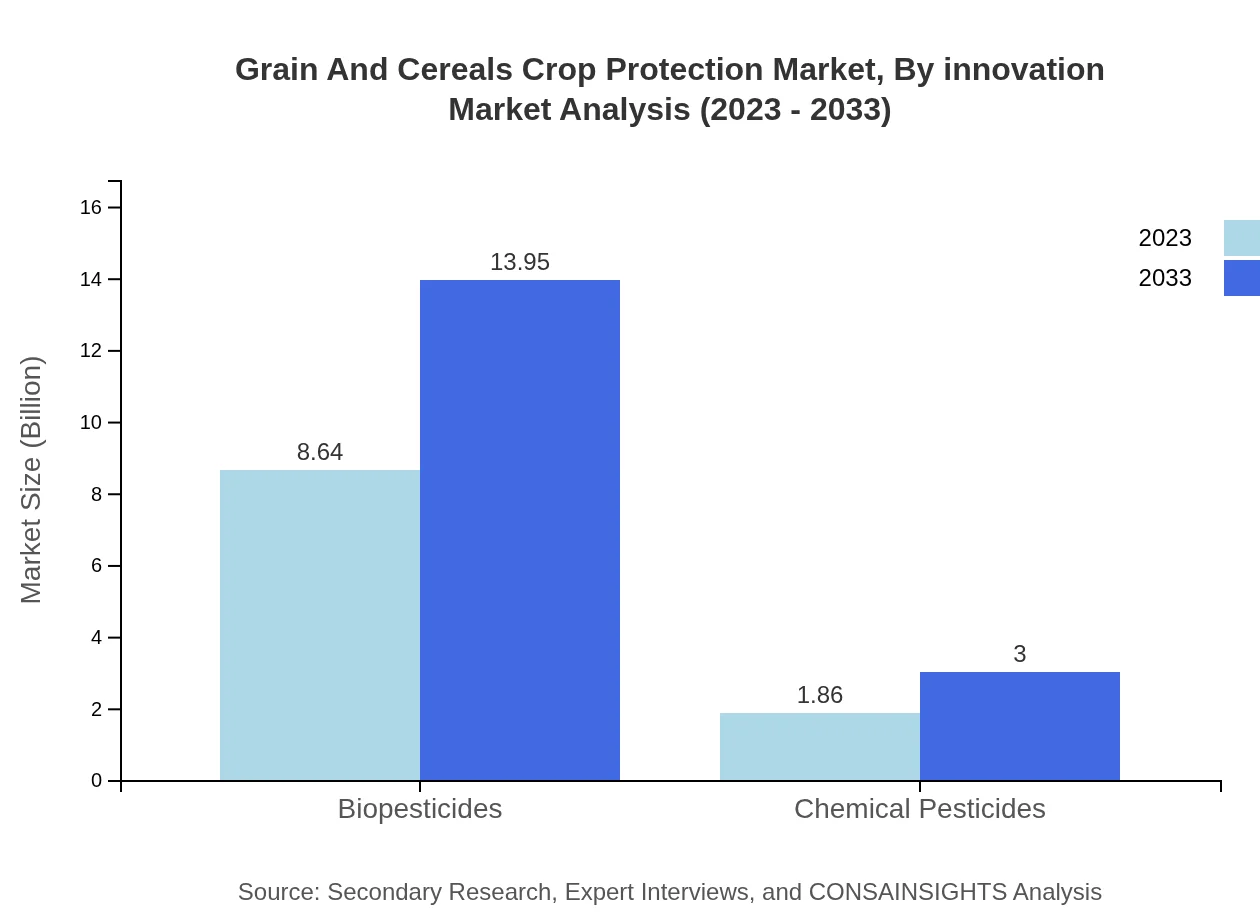

Grain And Cereals Crop Protection Market Analysis By Innovation

Technological innovation is shaping the market significantly, driving the development of precision agriculture and sophisticated crop management systems. The emphasis on biopesticides and environmentally friendly products is notable, as manufacturers seek to meet consumer demand and comply with stringent regulations.

Grain And Cereals Crop Protection Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Grain And Cereals Crop Protection Industry

Bayer AG:

Bayer is a global leader in agriculture providing a broad array of crop protection products including herbicides, fungicides, and biologically derived solutions. The company invests heavily in R&D to enhance agricultural productivity sustainably.Syngenta AG:

Syngenta is one of the leading companies in the agribusiness sector, offering a wide range of solutions including crop protection products aimed at enhancing crop quality and yield while addressing environmental concerns.Corteva Agriscience:

Corteva focuses on innovation in seed and crop protection markets, producing solutions that meet sustainable farming practices and increase yield potential for farmers globally.FMC Corporation:

FMC Corporation specializes in crop protection chemicals focused on providing efficient solutions to enhance agricultural productivity while reducing the environmental impact.We're grateful to work with incredible clients.

FAQs

What is the market size of Grain and Cereals Crop Protection?

The global Grain and Cereals Crop Protection market is valued at approximately $10.5 billion in 2023, with a projected growth at a CAGR of 4.8% through 2033. This growth mirrors the increasing demand for sustainable farming practices and effective pest management.

What are the key market players or companies in the Grain and Cereals Crop Protection industry?

The Grain and Cereals Crop Protection industry features key players such as Bayer AG, Syngenta AG, BASF SE, Corteva Agriscience, and FMC Corporation. These companies are leaders due to their innovation and extensive product portfolios aimed at enhancing crop yields.

What are the primary factors driving the growth in the Grain and Cereals Crop Protection industry?

Growth in the Grain and Cereals Crop Protection industry is largely driven by escalating demand for food security, technological advancements in crop protection measures, increasing awareness about sustainable agriculture, and the necessity of managing pests effectively.

Which region is the fastest Growing in the Grain and Cereals Crop Protection market?

Based on data, Europe is the fastest-growing region in the Grain and Cereals Crop Protection market, expanding from $3.96 billion in 2023 to $6.38 billion by 2033, influenced by increasing regulatory focus on sustainable agriculture.

Does ConsaInsights provide customized market report data for the Grain and Cereals Crop Protection industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the Grain and Cereals Crop Protection industry, enabling detailed insights and impactful strategic decisions for clients on various market aspects.

What deliverables can I expect from this Grain and Cereals Crop Protection market research project?

Deliverables from the Grain and Cereals Crop Protection market research project typically include comprehensive market analysis reports, trends forecast, segment data evaluations, competitive landscape overviews, and geographic insights to guide business strategies.

What are the market trends of Grain and Cereals Crop Protection?

Current trends in the Grain and Cereals Crop Protection market include increasing adoption of biopesticides, advancements in agricultural technology, a focus on environmental sustainability, and rising preferences for integrated pest management solutions among farmers.