Grain Cereal Crop Protection Chemicals Market Report

Published Date: 02 February 2026 | Report Code: grain-cereal-crop-protection-chemicals

Grain Cereal Crop Protection Chemicals Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Grain Cereal Crop Protection Chemicals market, outlining industry trends, forecasts for the years 2023-2033, and insights into market dynamics. Key segments, regional performances, and competitive landscapes are also detailed.

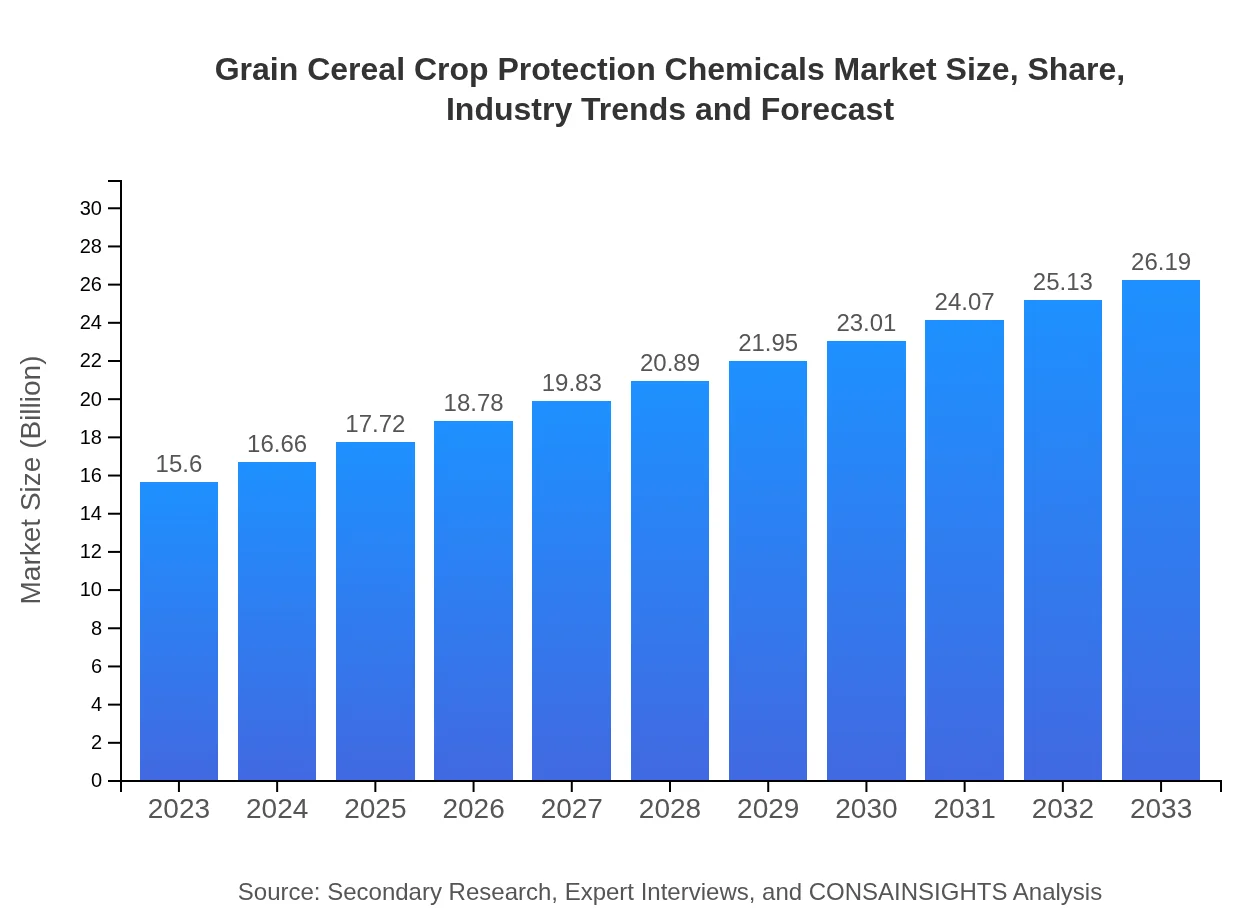

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $26.19 Billion |

| Top Companies | BASF S.E., Syngenta AG, Dow AgroSciences, DuPont de Nemours, Inc., FMC Corporation |

| Last Modified Date | 02 February 2026 |

Grain Cereal Crop Protection Chemicals Market Overview

Customize Grain Cereal Crop Protection Chemicals Market Report market research report

- ✔ Get in-depth analysis of Grain Cereal Crop Protection Chemicals market size, growth, and forecasts.

- ✔ Understand Grain Cereal Crop Protection Chemicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Grain Cereal Crop Protection Chemicals

What is the Market Size & CAGR of Grain Cereal Crop Protection Chemicals market in 2023?

Grain Cereal Crop Protection Chemicals Industry Analysis

Grain Cereal Crop Protection Chemicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Grain Cereal Crop Protection Chemicals Market Analysis Report by Region

Europe Grain Cereal Crop Protection Chemicals Market Report:

Europe's market size stood at $4.60 billion in 2023, expected to reach $7.73 billion by 2033. European markets are increasingly focused on sustainability with regulations favoring bio-based chemicals, enhanced by consumer demand for organic products.Asia Pacific Grain Cereal Crop Protection Chemicals Market Report:

The Asia Pacific region accounted for a market size of $2.84 billion in 2023, projected to grow to $4.77 billion by 2033. The region benefits from a large agricultural base and increasing adoption of advanced agricultural practices, though challenges include varying regulatory environments and crop diversity.North America Grain Cereal Crop Protection Chemicals Market Report:

The North American market is the largest, valued at $5.83 billion in 2023 and anticipated to grow to $9.79 billion by 2033. Strong innovation and R&D spending characterize the market dynamics, along with compliance to stringent environmental regulations.South America Grain Cereal Crop Protection Chemicals Market Report:

In South America, the market was valued at $0.98 billion in 2023, with growth expected to reach $1.65 billion by 2033. Key drivers include expanding crop acreage and demand for high-yield varieties. However, the region faces challenges in pest resistance and climatic variability.Middle East & Africa Grain Cereal Crop Protection Chemicals Market Report:

In the Middle East and Africa, the market was $1.34 billion in 2023, anticipated to grow to $2.25 billion by 2033. Challenges such as limited agricultural practices and varying levels of access to crop protection technologies impact market growth.Tell us your focus area and get a customized research report.

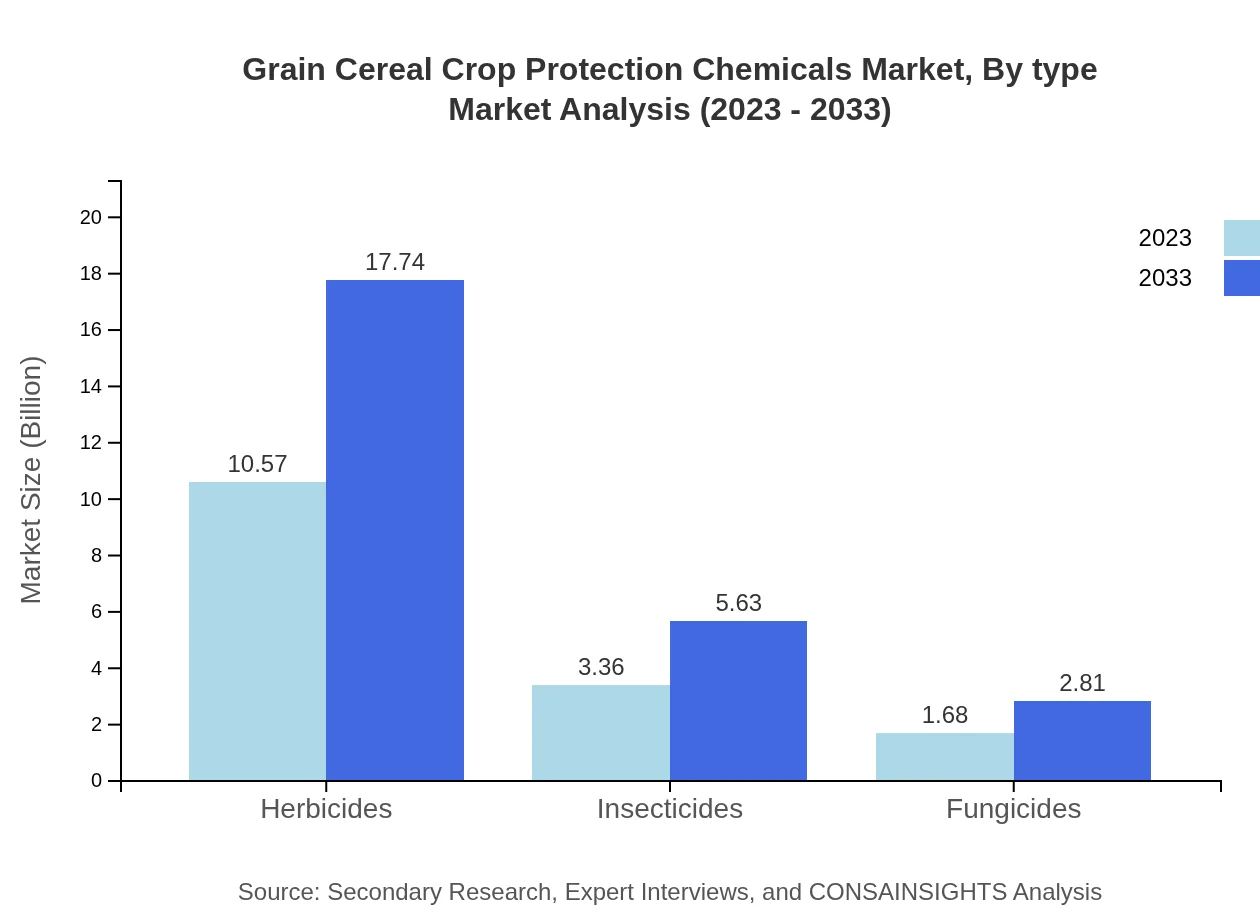

Grain Cereal Crop Protection Chemicals Market Analysis By Type

The market, by type, includes herbicides, insecticides, and fungicides. Herbicides represent approximately 67.75% of the total market share, with a value of $10.57 billion in 2023, projected to expand to $17.74 billion by 2033. Insecticides and fungicides follow with shares of 21.51% and 10.74% respectively, indicating their essential roles in integrated pest management.

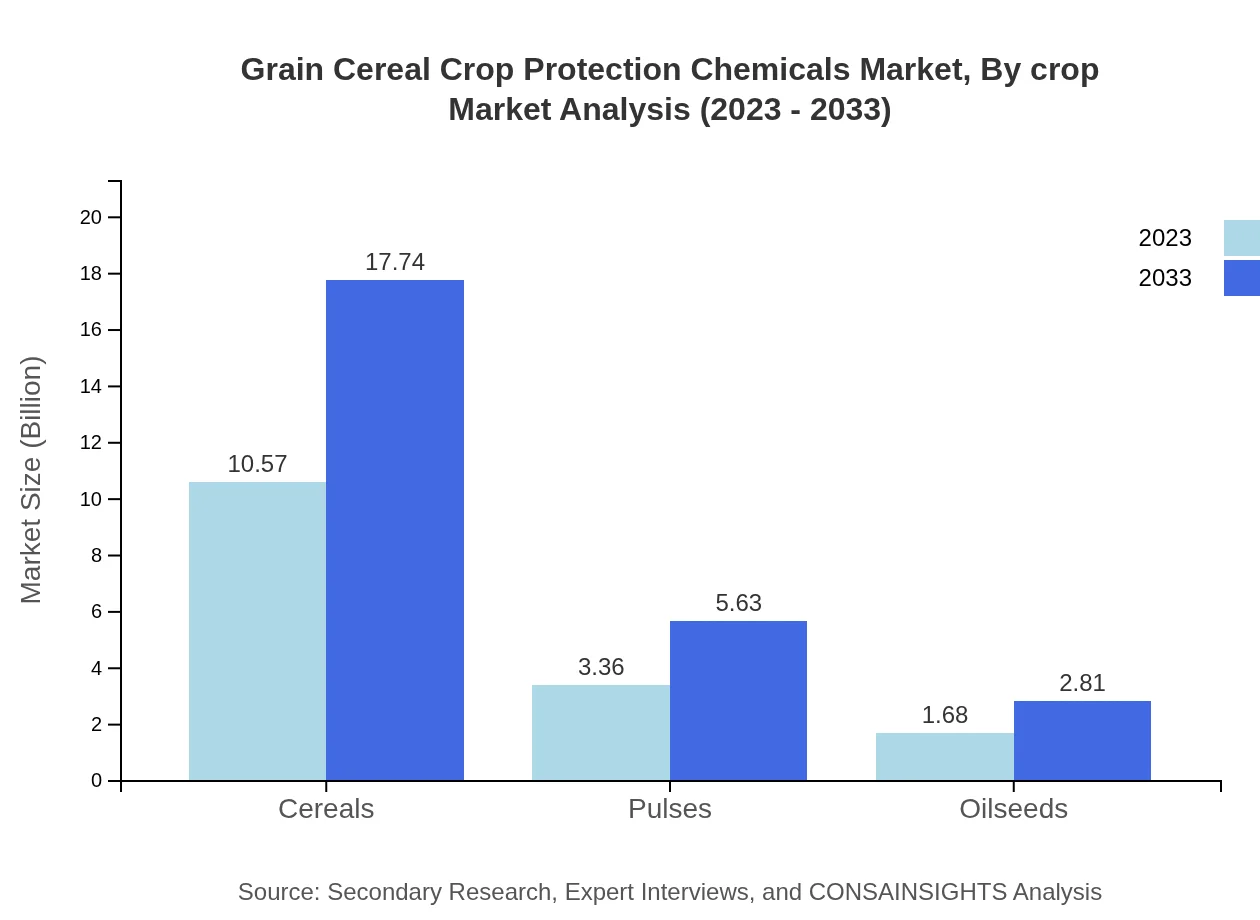

Grain Cereal Crop Protection Chemicals Market Analysis By Crop

Cereals dominate the crop segment holding a market size of $10.57 billion in 2023 and estimated to reach $17.74 billion by 2033, capturing 67.75% of the market share. Pulses and oilseeds follow, showcasing important roles in dietary diversity and food security.

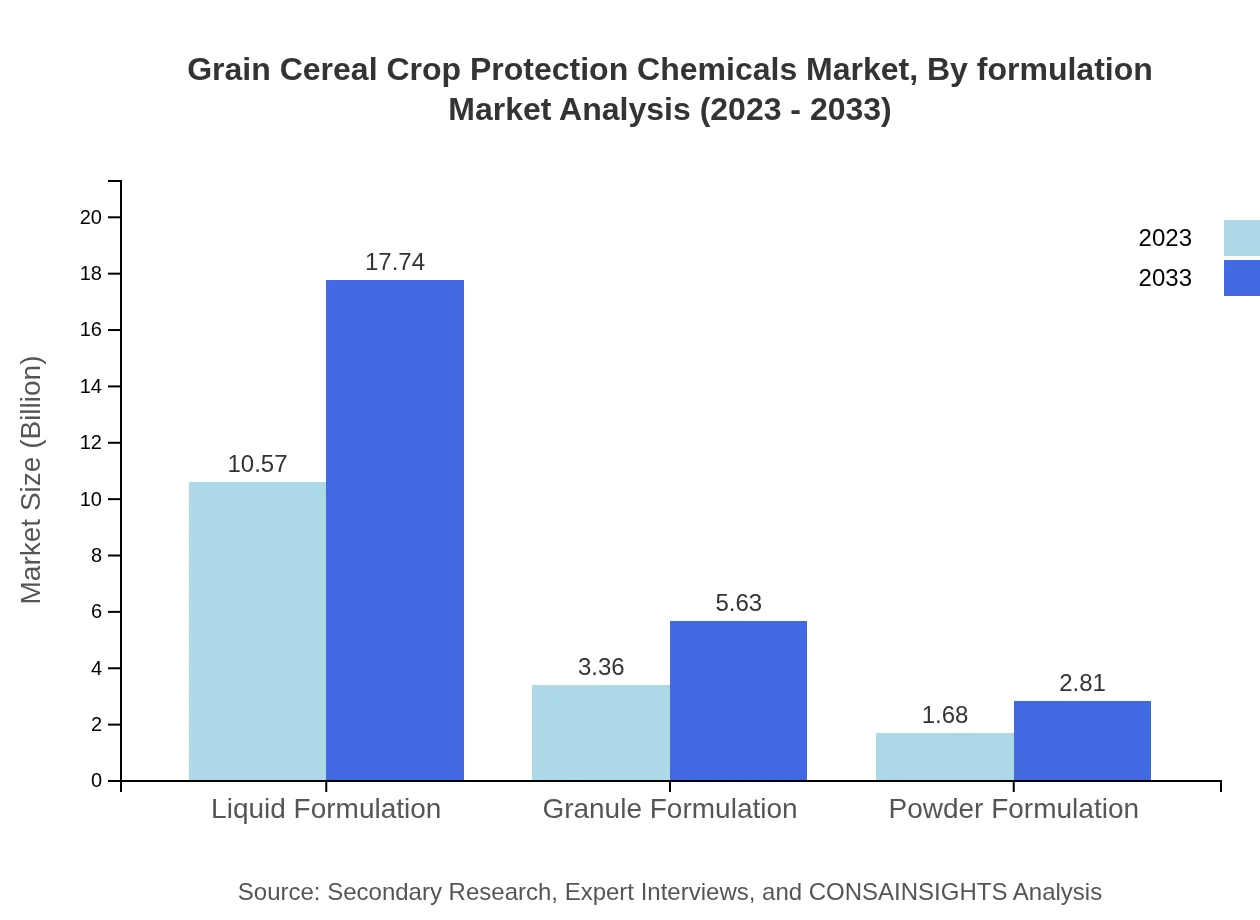

Grain Cereal Crop Protection Chemicals Market Analysis By Formulation

Liquid formulations are prevalent at $10.57 billion in 2023, projecting to grow to $17.74 billion by 2033, maintaining a 67.75% market share. Granule and powder formulations, though lower in market size, cater to specific application needs, enhancing overall crop protection strategies.

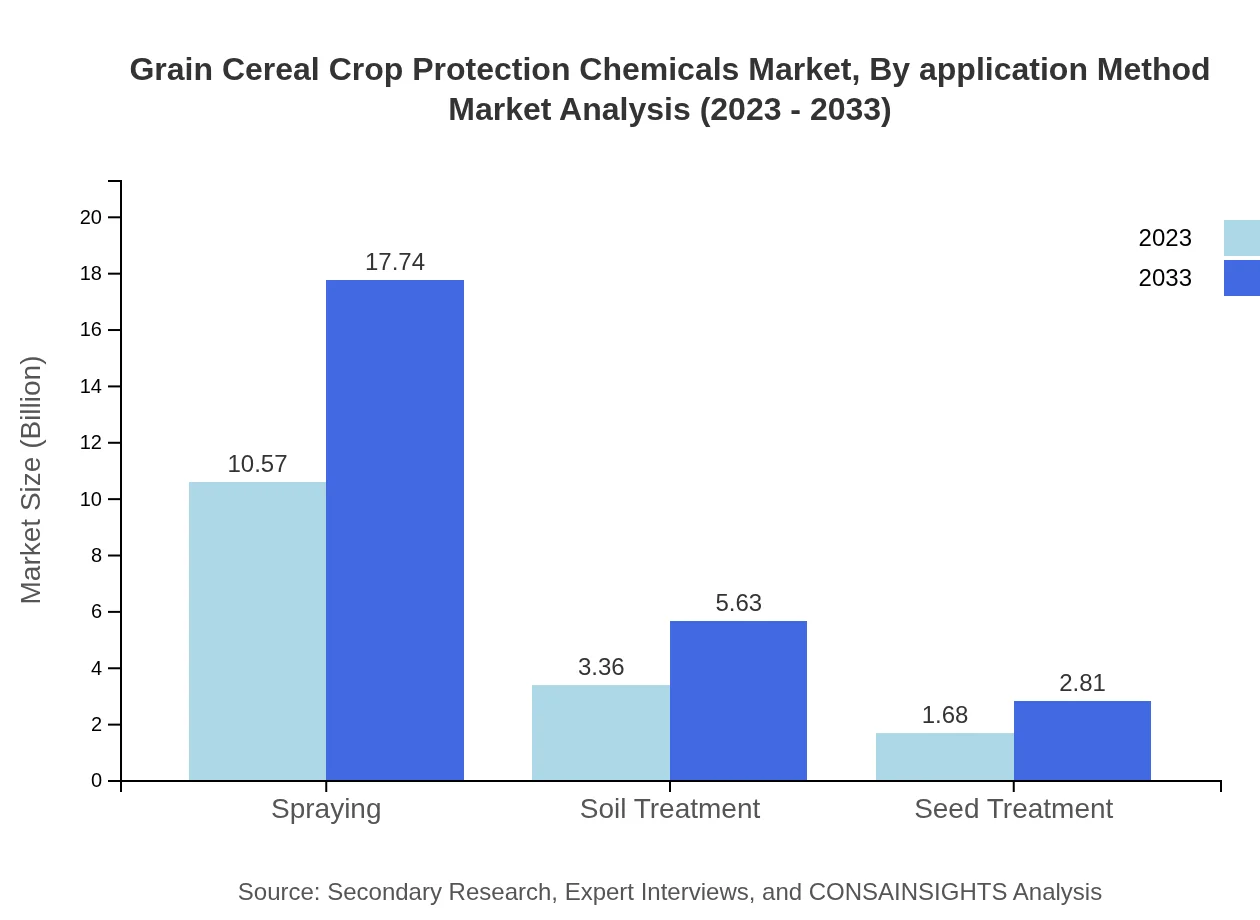

Grain Cereal Crop Protection Chemicals Market Analysis By Application Method

Spraying as an application method holds a significant share at $10.57 billion in 2023, expected to increase to $17.74 billion by 2033. Soil treatment and seed treatment have their niches focusing on specific pest threats and optimizing crop protection.

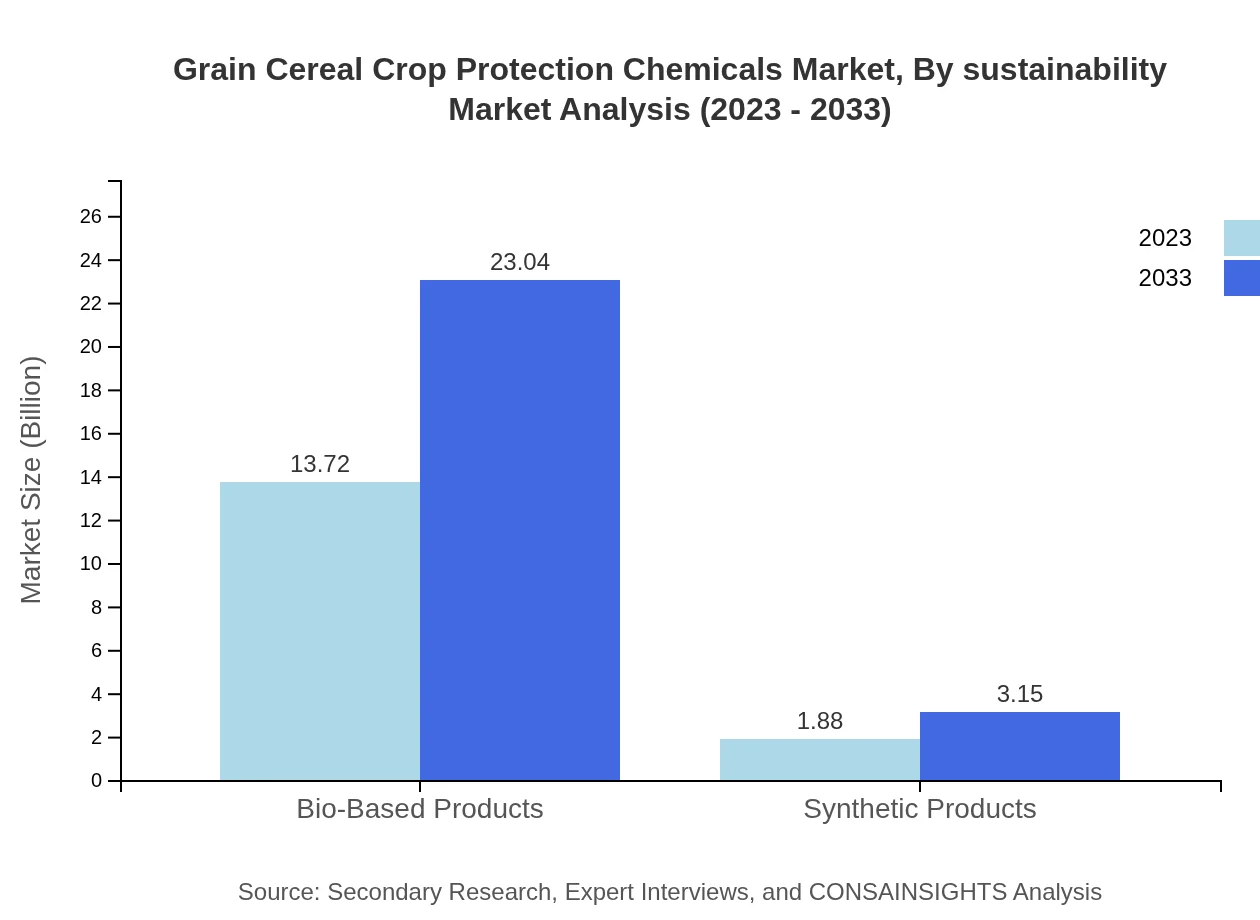

Grain Cereal Crop Protection Chemicals Market Analysis By Sustainability

Bio-based products lead the segment, valued at $13.72 billion in 2023 and expected to reach $23.04 billion by 2033 with nearly 88% market share. The rise of synthetic products, valued at $1.88 billion mirrors the industry's gradual shift towards more sustainable practices.

Grain Cereal Crop Protection Chemicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Grain Cereal Crop Protection Chemicals Industry

BASF S.E.:

A global leader in chemical manufacturing, BASF provides innovative agricultural solutions focusing on sustainable crop protection and high-quality products.Syngenta AG:

Syngenta is recognized for its cutting-edge research in crop protection, producing a diverse range of pesticides and herbicides tailored for various crop needs.Dow AgroSciences:

A major player in the agricultural sector focused on developing crop protection products that ensure effective plant health management.DuPont de Nemours, Inc.:

DuPont is known for its wide array of agricultural solutions, prioritizing innovation and technology in crop protection and genetic seed development.FMC Corporation:

FMC Corporation specializes in agricultural products and has a strong portfolio of pest management and crop protection solutions on a global scale.We're grateful to work with incredible clients.

FAQs

What is the market size of Grain Cereal Crop Protection Chemicals?

The Grain Cereal Crop Protection Chemicals market is projected at $15.6 billion in 2023, with an estimated CAGR of 5.2% through 2033. This growth reflects increasing demand for crop protection solutions in agriculture.

What are the key market players or companies in the Grain Cereal Crop Protection Chemicals industry?

Major players in the grain cereal crop protection chemicals market include Bayer AG, Syngenta AG, BASF SE, Corteva AgriScience, and FMC Corporation. These companies dominate the market with their extensive product portfolios and innovative research.

What are the primary factors driving the growth in the Grain Cereal Crop Protection Chemicals industry?

Key drivers of growth include the rising global population necessitating higher food production, advancements in agricultural technologies, increased pest resistance, and the demand for sustainable farming practices, enhancing the use of crop protection chemicals.

Which region is the fastest Growing in the Grain Cereal Crop Protection Chemicals?

The Asia Pacific region is the fastest-growing market, with a projected increase from $2.84 billion in 2023 to $4.77 billion by 2033. This growth is attributed to expanding agricultural activities and increased awareness about crop protection.

Does ConsaInsights provide customized market report data for the Grain Cereal Crop Protection Chemicals industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Grain Cereal Crop Protection Chemicals industry, ensuring comprehensive insights tailored to particular market segments and competitive landscapes.

What deliverables can I expect from this Grain Cereal Crop Protection Chemicals market research project?

You can expect detailed reports including market size, CAGR projections, competitive analysis, segment breakdowns, and regional insights, providing a holistic view of current market dynamics and future trends.

What are the market trends of Grain Cereal Crop Protection Chemicals?

Current trends include a shift towards bio-based products, increased adoption of integrated pest management, innovations in formulation technologies, and a growing emphasis on environmentally friendly practices in crop protection.