Ground Based Aircraft And Missile Defense Systems Market Report

Published Date: 03 February 2026 | Report Code: ground-based-aircraft-and-missile-defense-systems

Ground Based Aircraft And Missile Defense Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Ground Based Aircraft and Missile Defense Systems market, including market size, trends, and forecasts from 2023 to 2033. It includes valuable insights on segmentation, regional analysis, and key market players.

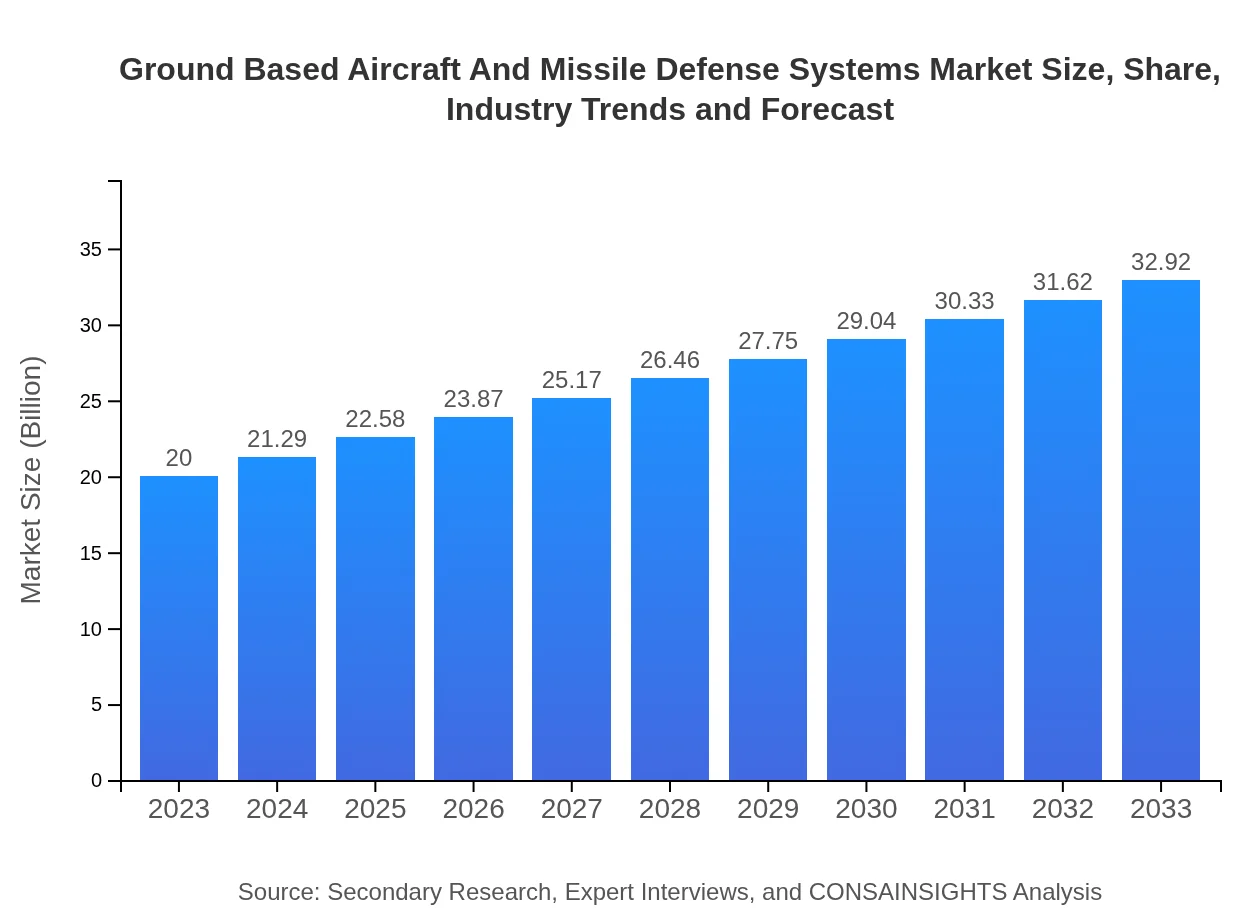

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $32.92 Billion |

| Top Companies | Raytheon Technologies, Lockheed Martin, Northrop Grumman, Thales Group |

| Last Modified Date | 03 February 2026 |

Ground Based Aircraft And Missile Defense Systems Market Overview

Customize Ground Based Aircraft And Missile Defense Systems Market Report market research report

- ✔ Get in-depth analysis of Ground Based Aircraft And Missile Defense Systems market size, growth, and forecasts.

- ✔ Understand Ground Based Aircraft And Missile Defense Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ground Based Aircraft And Missile Defense Systems

What is the Market Size & CAGR of Ground Based Aircraft And Missile Defense Systems market in 2023?

Ground Based Aircraft And Missile Defense Systems Industry Analysis

Ground Based Aircraft And Missile Defense Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ground Based Aircraft And Missile Defense Systems Market Analysis Report by Region

Europe Ground Based Aircraft And Missile Defense Systems Market Report:

The European market will also see significant expansion, expected to grow from $6.46 billion in 2023 to $10.63 billion by 2033, driven by NATO initiatives and individual country defense spending.Asia Pacific Ground Based Aircraft And Missile Defense Systems Market Report:

The Asia Pacific region is expected to show robust growth, with its market size projected to rise from $3.63 billion in 2023 to $5.97 billion by 2033. Countries like India, Japan, and Australia are ramping up their defense capabilities amid regional tensions.North America Ground Based Aircraft And Missile Defense Systems Market Report:

North America continues to dominate the market with a size of $7.15 billion in 2023, projected to increase to $11.77 billion by 2033. The U.S. military invests heavily in advanced defense technologies, particularly missile defense systems.South America Ground Based Aircraft And Missile Defense Systems Market Report:

In South America, the market is anticipated to grow from $0.39 billion in 2023 to $0.64 billion by 2033. Nations are increasingly aware of the importance of defense systems due to rising security threats.Middle East & Africa Ground Based Aircraft And Missile Defense Systems Market Report:

In the Middle East and Africa, the market is expected to increase from $2.37 billion in 2023 to $3.90 billion by 2033. Regional conflicts and the need for stable security measures are catalysts for growth.Tell us your focus area and get a customized research report.

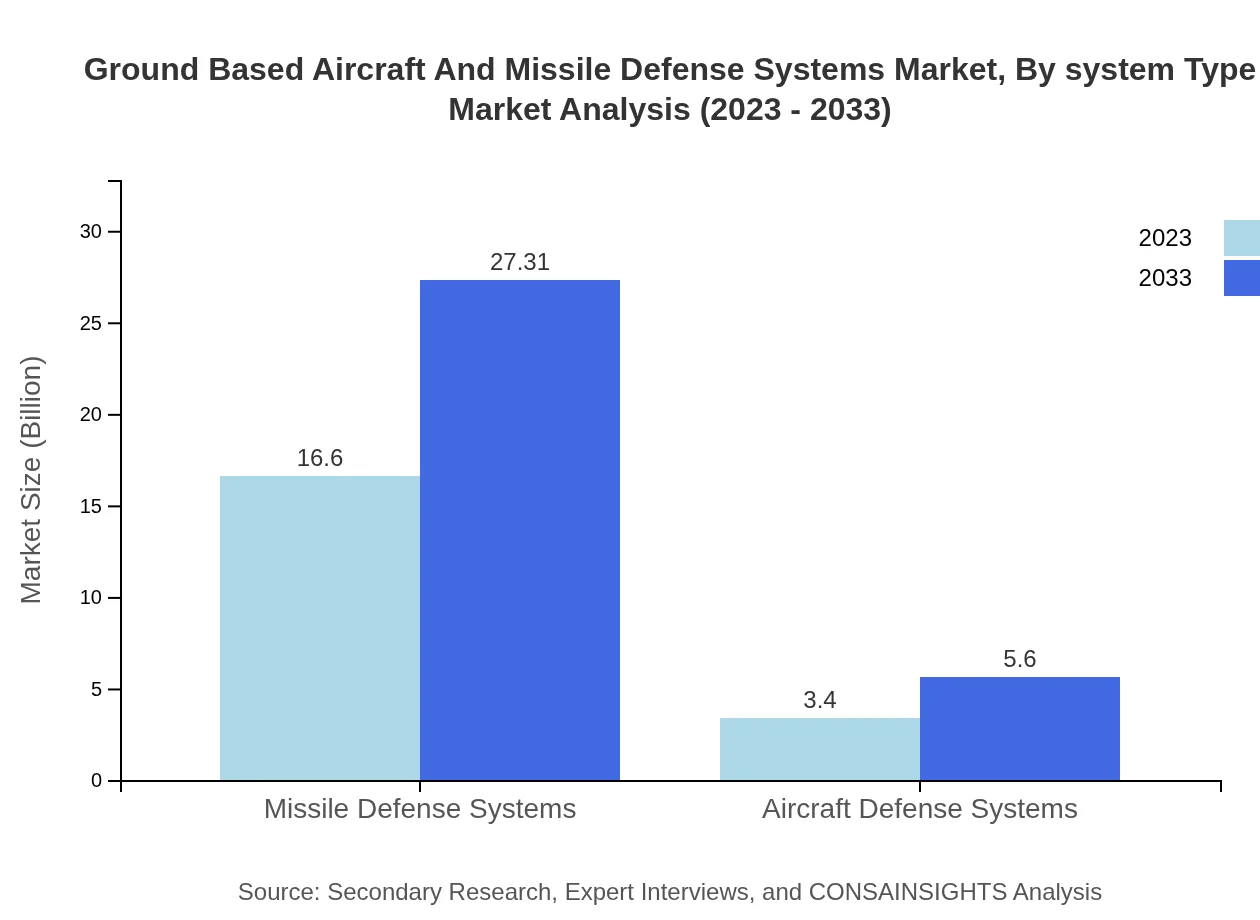

Ground Based Aircraft And Missile Defense Systems Market Analysis By System Type

The Ground-Based Aircraft and Missile Defense Systems market, by system type, focuses primarily on missile defense and aircraft defense systems. In 2023, missile defense systems dominate with a market size of $16.60 billion, projected to grow to $27.31 billion by 2033, comprising 82.98% of the market share. Aircraft defense systems follow with an estimated size of $3.40 billion, expected to reach $5.60 billion by 2033, representing 17.02% of the market share.

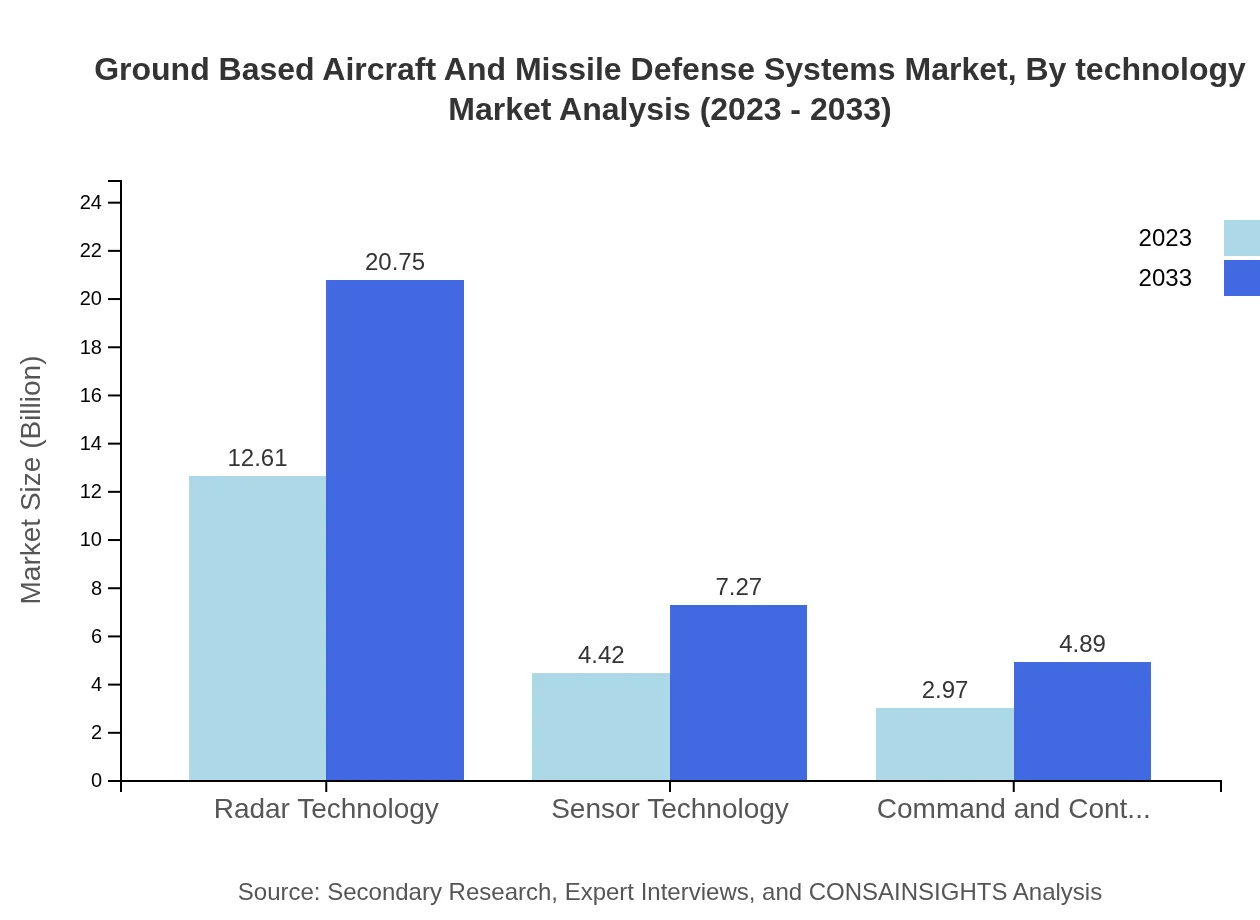

Ground Based Aircraft And Missile Defense Systems Market Analysis By Technology

In terms of technology, the market is driven by radar technology, sensor technology, and command and control technology. Radar technology leads with a market size of $12.61 billion in 2023, projected to hit $20.75 billion by 2033. Sensor technology comprises a market size of $4.42 billion, increasing to $7.27 billion by 2033. Command and control technology shows growth from $2.97 billion in 2023 to $4.89 billion by 2033.

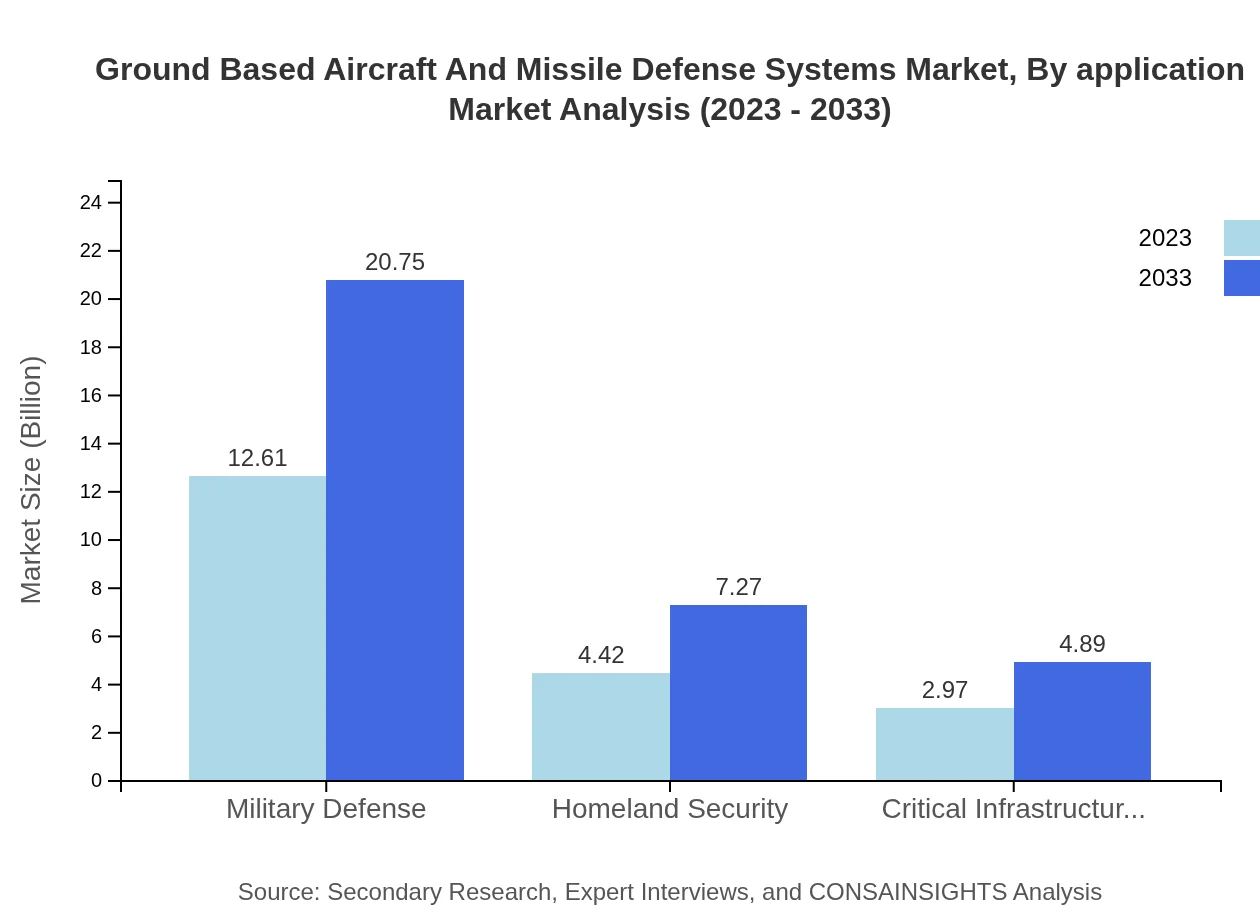

Ground Based Aircraft And Missile Defense Systems Market Analysis By Application

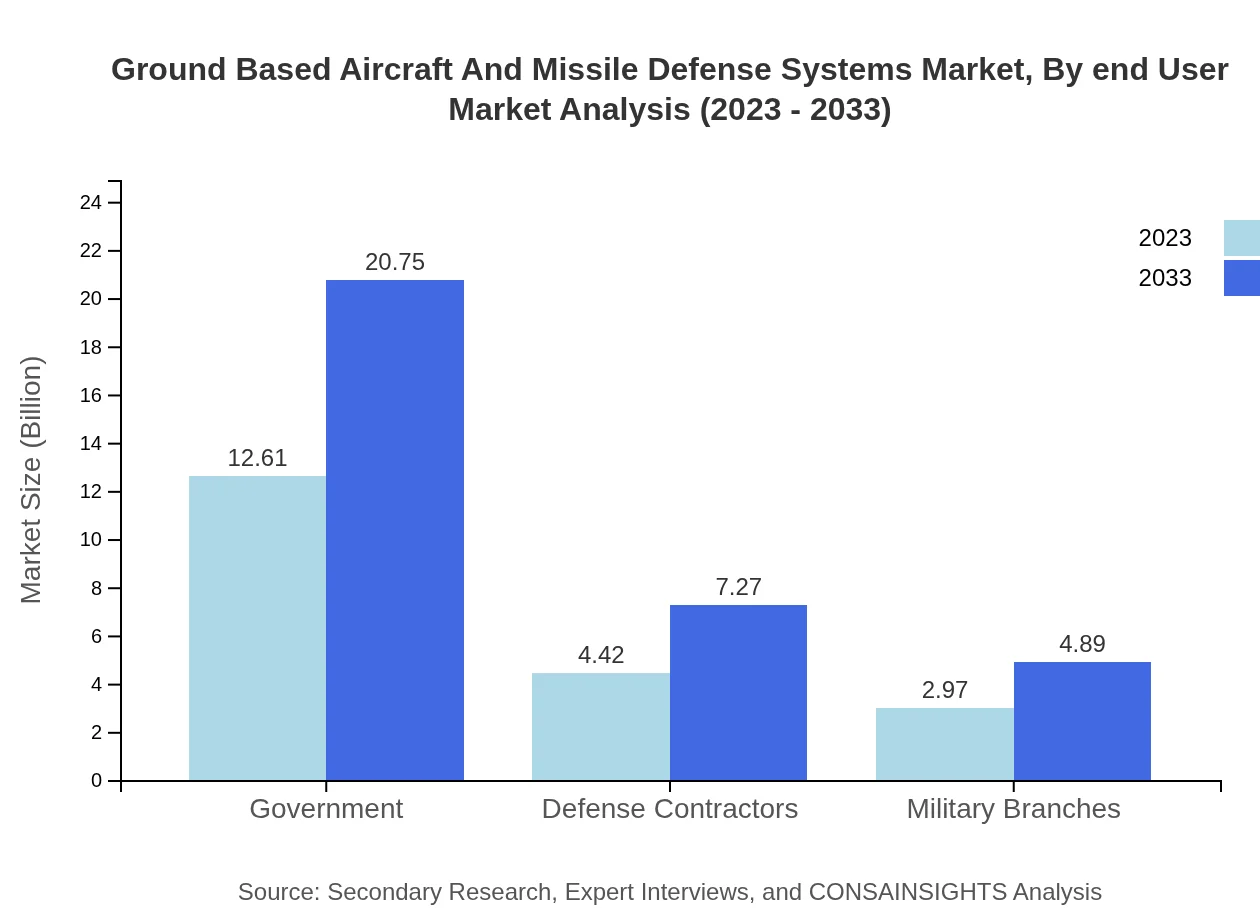

The applications of Ground-Based Aircraft and Missile Defense Systems are diversified, serving government, defense contractors, and military branches. Government applications dominate with a projected size of $12.61 billion in 2023, likely to increase to $20.75 billion by 2033, accounting for 63.05% of the market share. Defense contractors will reach $7.27 billion by 2033 from $4.42 billion in 2023, and military branches are to grow from $2.97 billion to $4.89 billion over the same period.

Ground Based Aircraft And Missile Defense Systems Market Analysis By End User

End-users predominantly encompass military defense, homeland security, and critical infrastructure protection. Military defense trails in size from $12.61 billion in 2023 to $20.75 billion by 2033, reinforcing its 63.05% share. Homeland security is set to grow from $4.42 billion to $7.27 billion, while critical infrastructure protection sees growth from $2.97 billion to $4.89 billion between 2023 and 2033.

Ground Based Aircraft And Missile Defense Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ground Based Aircraft And Missile Defense Systems Industry

Raytheon Technologies:

Raytheon Technologies is a leader in missile and defense systems, known for its cutting-edge technologies in radar and missile defense, contributing significantly to ground-based defense solutions.Lockheed Martin:

Lockheed Martin is a prominent defense contractor specializing in advanced technology systems, including ground-based missile defense solutions that enhance national security.Northrop Grumman:

Northrop Grumman provides innovative defense solutions, focusing on cutting-edge radar and missile systems that bolster ground-based defense capabilities.Thales Group:

Thales Group is notable for its integrated defense solutions, including state-of-the-art airborne surveillance and missile defense systems to counter aerial threats.We're grateful to work with incredible clients.

FAQs

What is the market size of ground Based Aircraft And Missile Defense Systems?

The global Ground Based Aircraft and Missile Defense Systems market is projected to reach approximately $20 billion in 2023, growing at a CAGR of 5% to reach $33 billion by 2033.

What are the key market players or companies in this ground Based Aircraft And Missile Defense Systems industry?

Key players in this market include Northrop Grumman Corporation, Raytheon Technologies, Lockheed Martin, BAE Systems, and Thales Group. These companies lead in innovation and development of advanced defense systems.

What are the primary factors driving the growth in the ground Based Aircraft And Missile Defense Systems industry?

The growth in this industry is driven by increasing geopolitical tensions, advancements in defense technologies, rising defense budgets in emerging economies, and the need for enhanced national security measures.

Which region is the fastest Growing in the ground Based Aircraft And Missile Defense Systems?

The Asia Pacific region is the fastest-growing, with the market projected to increase from $3.63 billion in 2023 to $5.97 billion by 2033, driven by significant investments in defense capabilities.

Does ConsaInsights provide customized market report data for the ground Based Aircraft And Missile Defense Systems industry?

Yes, ConsaInsights offers tailored market report data based on specific client needs, including detailed insights for the ground-based aircraft and missile defense systems industry.

What deliverables can I expect from this ground Based Aircraft And Missile Defense Systems market research project?

Deliverables include comprehensive market analysis reports, segmentation data, regional insights, competitive landscape evaluations, and actionable recommendations for strategic planning.

What are the market trends of ground Based Aircraft And Missile Defense Systems?

Key trends include increased automation in defense systems, integration of AI and machine learning for threat assessment, and the shift towards multi-domain operations in defense strategies.