Ground Handling Software Market Report

Published Date: 03 February 2026 | Report Code: ground-handling-software

Ground Handling Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Ground Handling Software market, highlighting trends, market size, growth forecasts from 2023 to 2033, and various segmentation analyses including technology and regional insights.

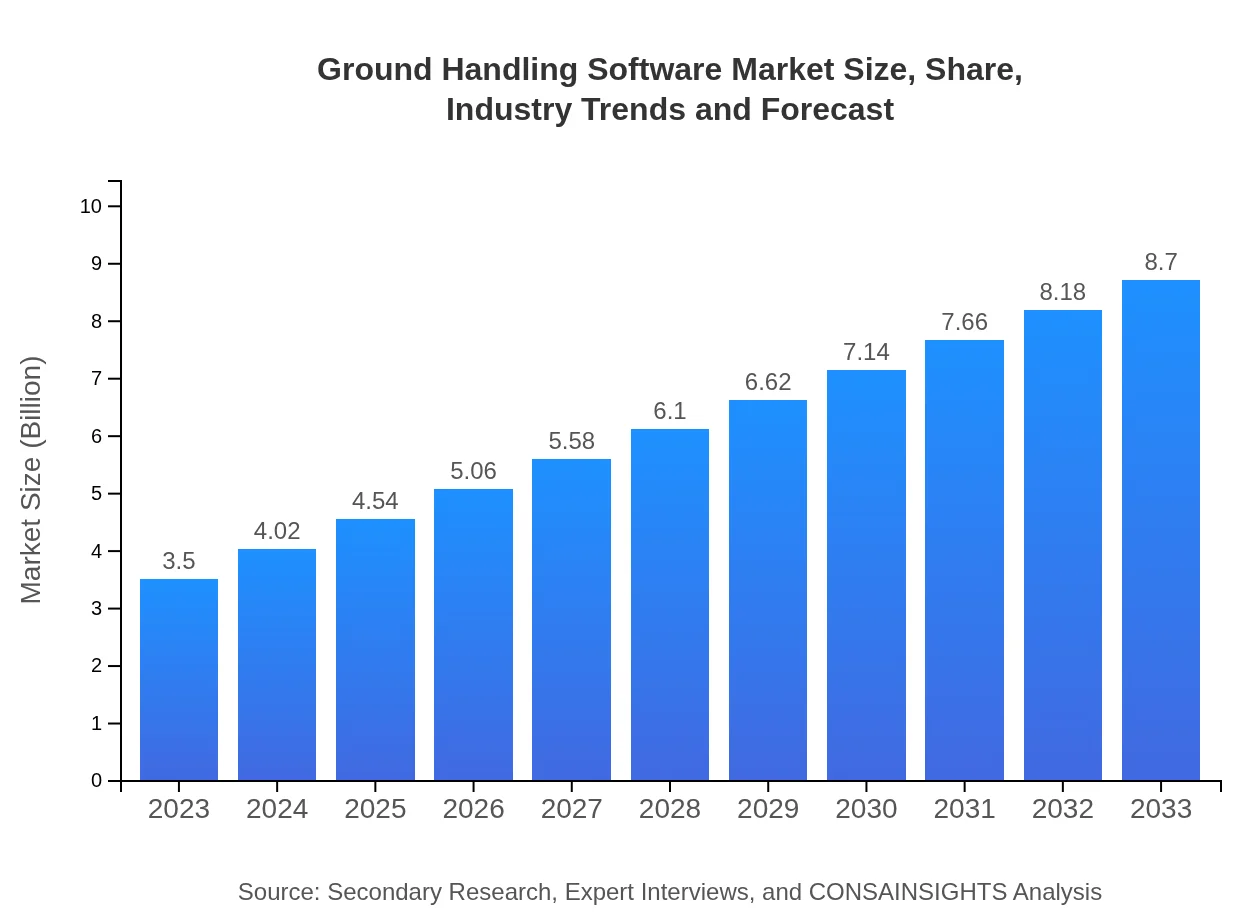

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $8.70 Billion |

| Top Companies | Amadeus IT Group, SITA, Rockwell Collins, Boeing |

| Last Modified Date | 03 February 2026 |

Ground Handling Software Market Overview

Customize Ground Handling Software Market Report market research report

- ✔ Get in-depth analysis of Ground Handling Software market size, growth, and forecasts.

- ✔ Understand Ground Handling Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ground Handling Software

What is the Market Size & CAGR of Ground Handling Software market in 2023?

Ground Handling Software Industry Analysis

Ground Handling Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ground Handling Software Market Analysis Report by Region

Europe Ground Handling Software Market Report:

Europe is projected to grow from $0.89 billion in 2023 to $2.22 billion by 2033. European airports are increasingly investing in integrated software solutions to enhance operational efficiency and comply with stringent regulations.Asia Pacific Ground Handling Software Market Report:

In 2023, the Asia Pacific region's Ground Handling Software market is valued at $0.76 billion and is projected to reach $1.89 billion by 2033. The significant growth is attributed to the rapid expansion of air travel, particularly in emerging economies like India and China, necessitating enhanced ground handling capabilities.North America Ground Handling Software Market Report:

North America holds a significant portion of the market, valued at $1.15 billion in 2023, forecasted to reach $2.85 billion by 2033, driven by technological advancements and high adoption rates of automated solutions in airports.South America Ground Handling Software Market Report:

The South American market is expected to grow from $0.29 billion in 2023 to $0.72 billion by 2033. The growth can be linked to improving infrastructure and increasing international travel, fostering the demand for efficient ground handling systems.Middle East & Africa Ground Handling Software Market Report:

The Middle East and Africa market is expected to grow from $0.41 billion in 2023 to $1.02 billion by 2033, primarily fueled by a booming aviation sector and increasing investments in airport infrastructure.Tell us your focus area and get a customized research report.

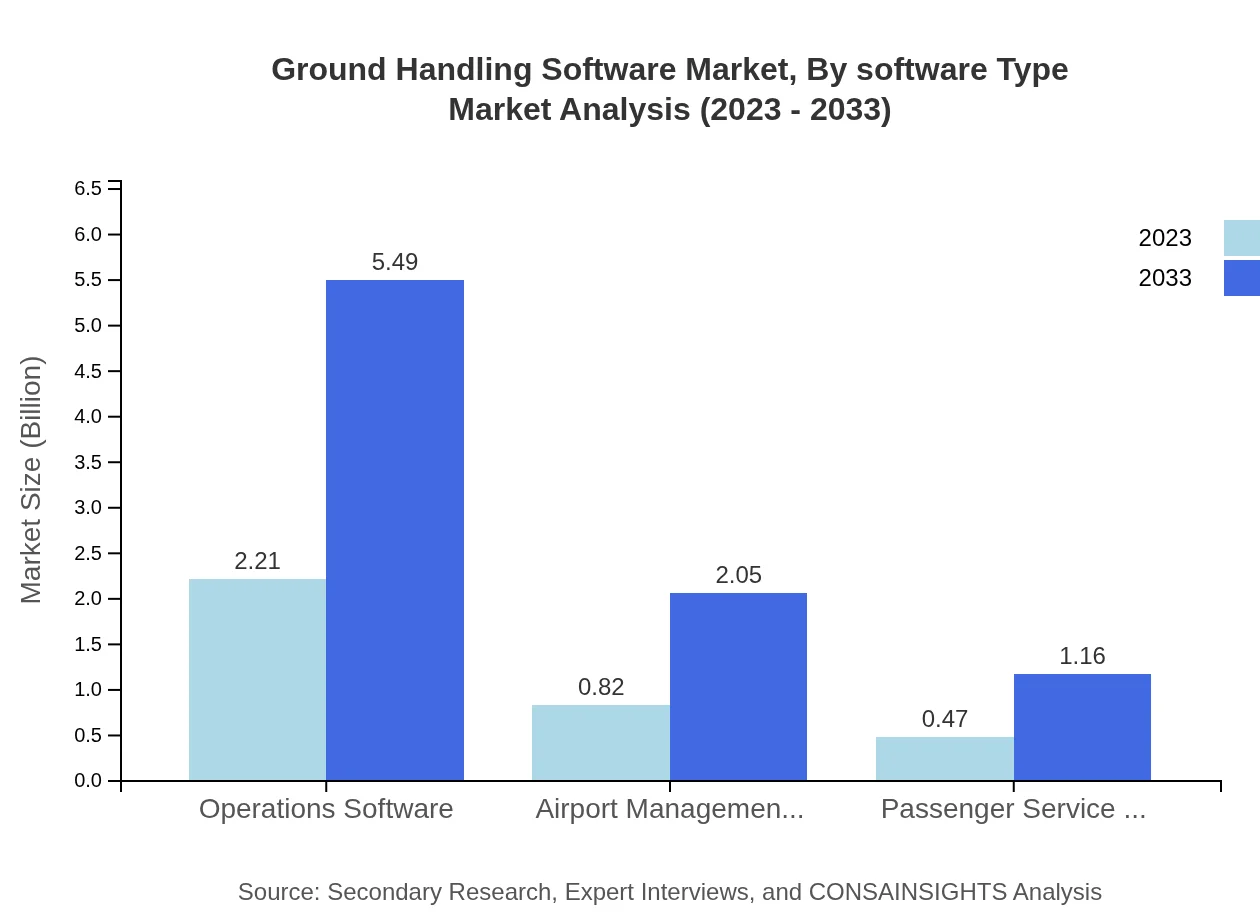

Ground Handling Software Market Analysis By Software Type

The analysis of software types reveals that Operations Software dominates the market with a share of 63.15%, accounting for a market size of $2.21 billion in 2023, and is expected to grow to $5.49 billion by 2033. Following closely is Cloud-Based Solutions, capturing 82.12% of the market in 2023, projected to reach $7.14 billion by 2033, evidencing a clear trend towards cloud technology. Other segments such as On-Premises Solutions are also significant, albeit smaller, with a share of 17.88%.

Ground Handling Software Market Analysis By Application Area

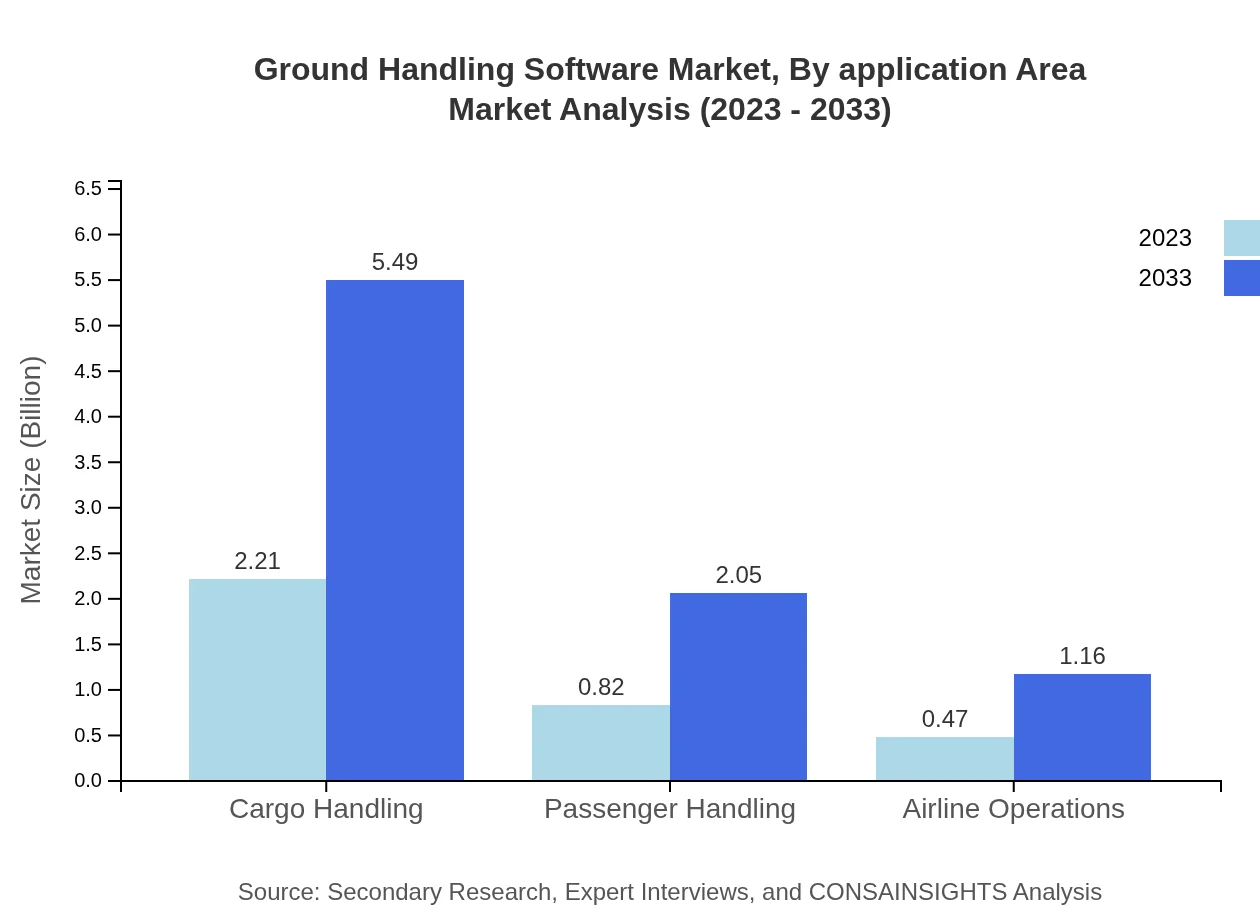

In terms of application areas, Cargo Handling and Passenger Handling software maintain leading positions with respective market shares of 63.15% and 23.52% in 2023. Cargo Handling software, valued at $2.21 billion in 2023, is expected to grow phenomenally, indicating an increase in logistics efficiency in airports globally. Similarly, Passenger Handling software is advancing due to the rise in passenger numbers and the need for efficient check-in and boarding process management.

Ground Handling Software Market Analysis By Deployment Type

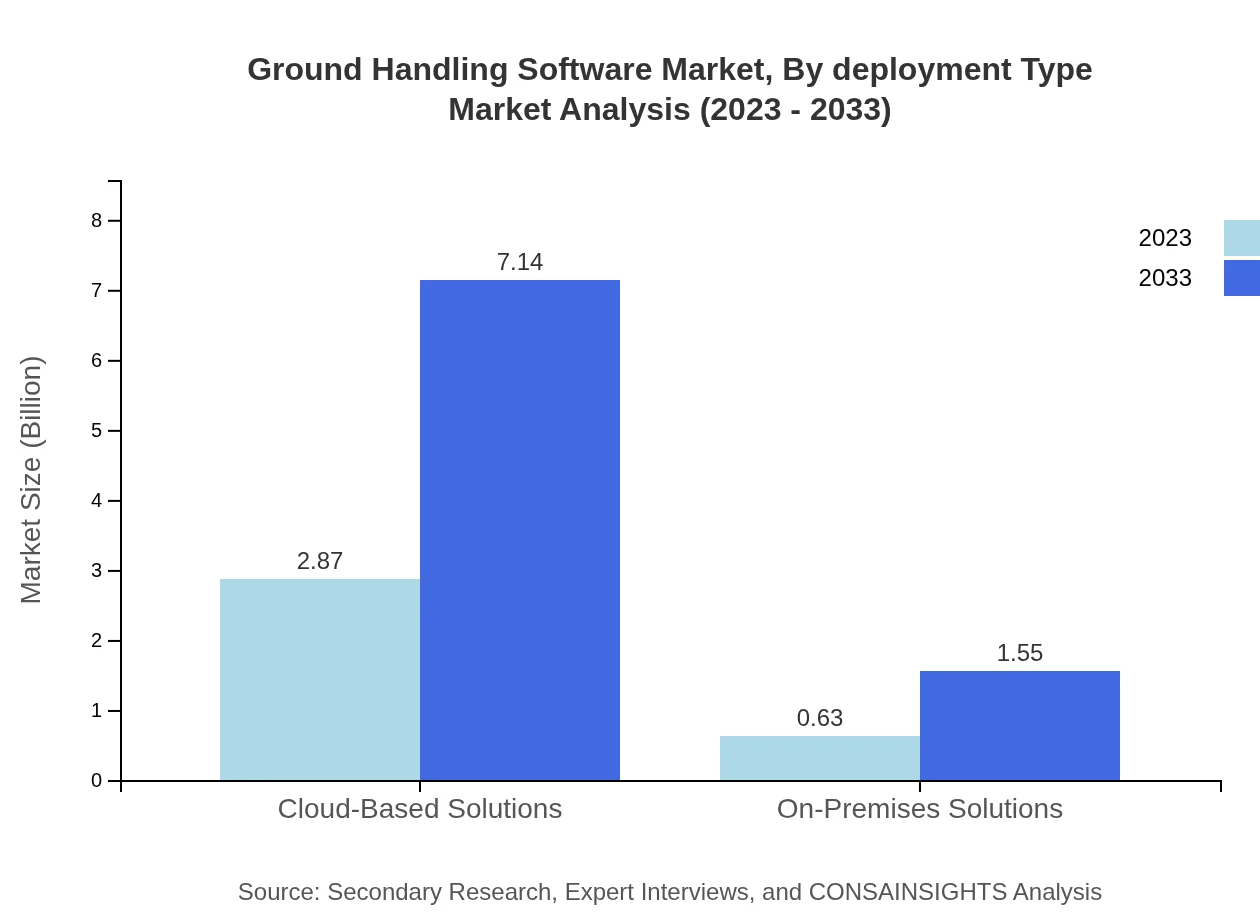

Deployment types are bifurcated into Cloud-Based and On-Premises Solutions. The flexibility offered by Cloud-Based Solutions accounts for 82.12% of the market share in 2023, corresponding to the rising trend towards digital transformation in the aviation sector. On-Premises Solutions, while a smaller share at 17.88%, still serve sectors requiring controlled environments and stringent data protections.

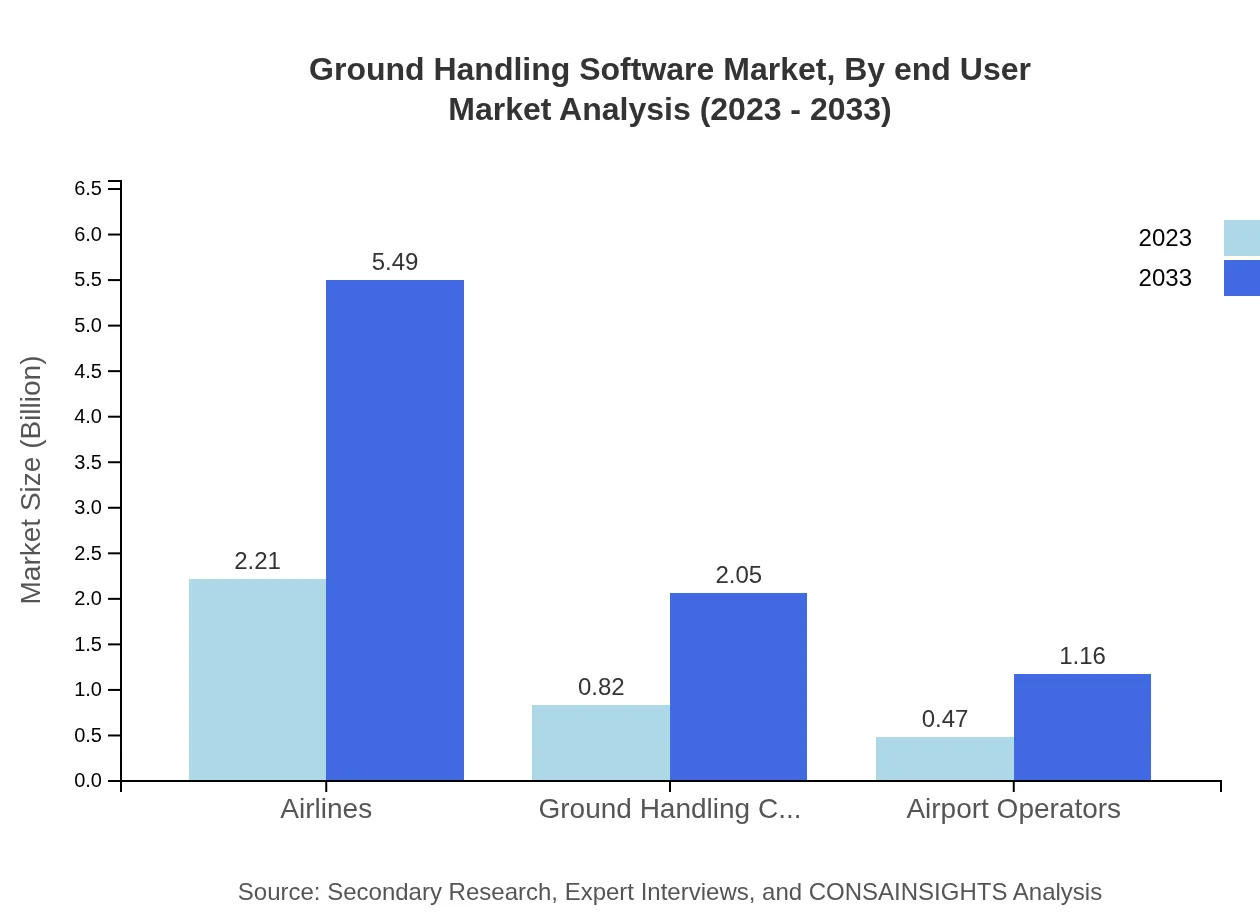

Ground Handling Software Market Analysis By End User

Airlines dominate the end-user segment, with a substantial market share of 63.15% in 2023, driven by necessity to streamline operations. Ground Handling Companies and Airport Operators also contribute significantly, with shares of 23.52% and 13.33%, respectively, showcasing the broad usage of ground handling software across various operational domains.

Ground Handling Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ground Handling Software Industry

Amadeus IT Group:

A leading provider of IT solutions to the global travel and tourism industry, Amadeus offers innovative ground handling software that optimizes airport operations and improves customer experience.SITA:

Specializing in communications and IT solutions for the air transport industry, SITA develops software products that enhance operational efficiency and safety for ground handling operations.Rockwell Collins:

Rockwell Collins, now part of Collins Aerospace, offers software solutions that streamline ground operations and ensure seamless integration with other airport systems.Boeing :

Boeing’s software solutions include operational efficiencies primarily targeted towards cargo handling, contributing to the smooth functioning of airport logistics.We're grateful to work with incredible clients.

FAQs

What is the market size of ground Handling Software?

The global ground-handling software market is valued at approximately $3.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 9.2% through 2033. This growth indicates a strong demand for efficient operational solutions in the aviation sector.

What are the key market players or companies in this ground Handling Software industry?

Key players in the ground-handling software market include well-established companies such as SITA, Vanderlande, and Amadeus. These organizations lead in innovation and technology, significantly impacting the market's growth trajectory and enhancing service efficiency across the aviation sector.

What are the primary factors driving the growth in the ground Handling Software industry?

The primary drivers of growth in the ground-handling software industry include increased air travel demand, the need for operational efficiency, and the adoption of automation technologies. Additionally, more sophisticated software solutions that enhance cargo and passenger handling operations are fueling market expansion.

Which region is the fastest Growing in the ground Handling Software?

The fastest-growing region in the ground-handling software market is Europe, expected to reach $2.22 billion by 2033, up from $0.89 billion in 2023. Asia Pacific follows, projected to grow from $0.76 billion to $1.89 billion during the same period, reflecting growing airport infrastructure.

Does ConsaInsights provide customized market report data for the ground Handling Software industry?

Yes, ConsaInsights offers customized market report data for the ground-handling software industry. Tailored insights are provided based on specific client needs, ensuring that stakeholders receive relevant information to make informed decisions in this dynamic market.

What deliverables can I expect from this ground Handling Software market research project?

Deliverables from the ground-handling software market research project include comprehensive market analysis, competitive landscape assessments, and detailed regional breakdowns. Each report is designed to provide insights on trends, opportunities, and challenges essential for strategic planning.

What are the market trends of ground Handling Software?

Market trends in the ground-handling software sector reflect a move towards cloud-based solutions, enhancing operational agility. There is a growing emphasis on automation and real-time data analytics to improve efficiency in passenger and cargo handling, aligning with industry digitization efforts.