Ground Penetrating Radar Market Report

Published Date: 22 January 2026 | Report Code: ground-penetrating-radar

Ground Penetrating Radar Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Ground Penetrating Radar (GPR) market, covering insights, trends, and forecasts for the years 2023 to 2033. It includes market segmentation, regional breakdowns, and an overview of key players in the industry.

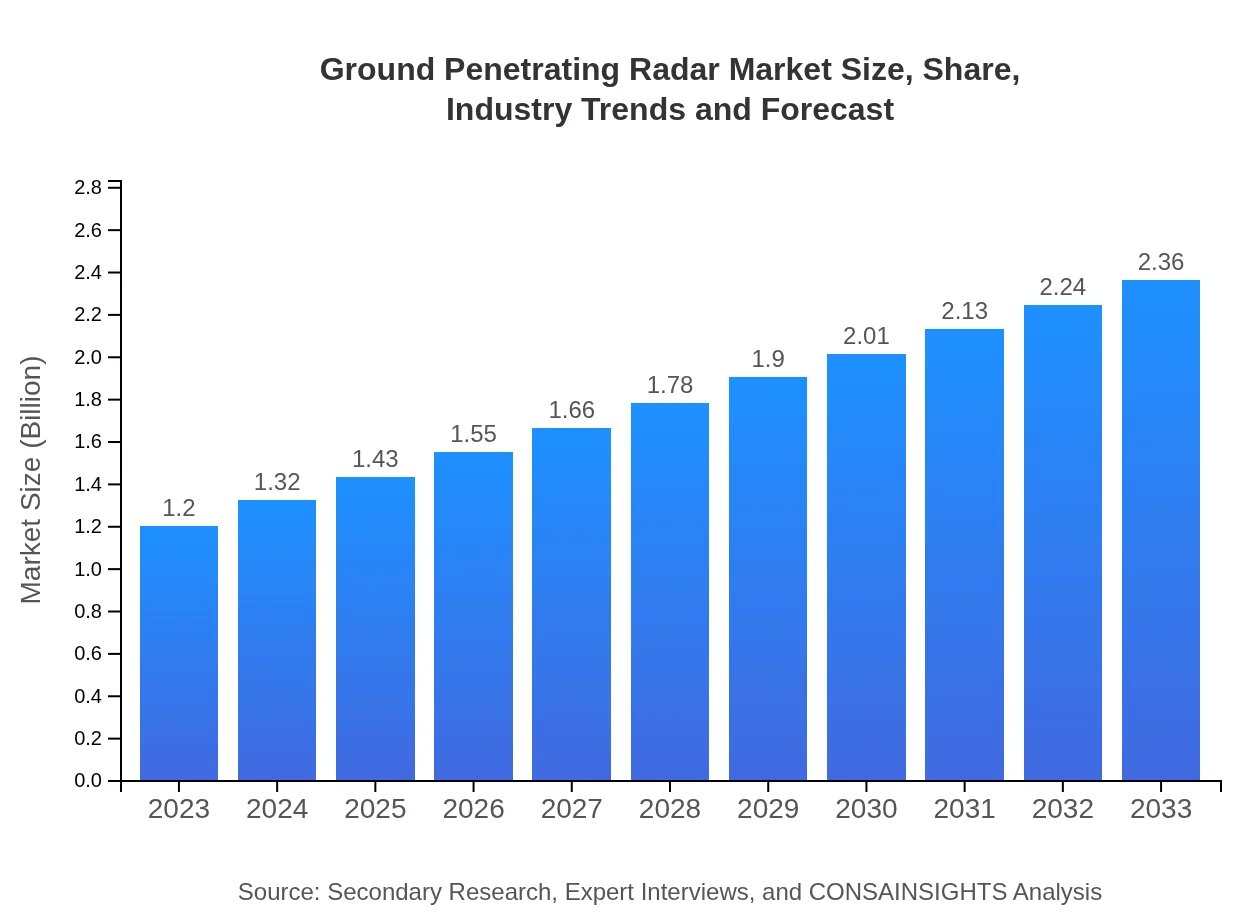

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.36 Billion |

| Top Companies | Geophysical Survey Systems, Inc. (GSSI), Mala Geoscience, Sensors & Software Inc., US Radar, Inc., ImpulseRadar |

| Last Modified Date | 22 January 2026 |

Ground Penetrating Radar Market Overview

Customize Ground Penetrating Radar Market Report market research report

- ✔ Get in-depth analysis of Ground Penetrating Radar market size, growth, and forecasts.

- ✔ Understand Ground Penetrating Radar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ground Penetrating Radar

What is the Market Size & CAGR of Ground Penetrating Radar market in 2023?

Ground Penetrating Radar Industry Analysis

Ground Penetrating Radar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

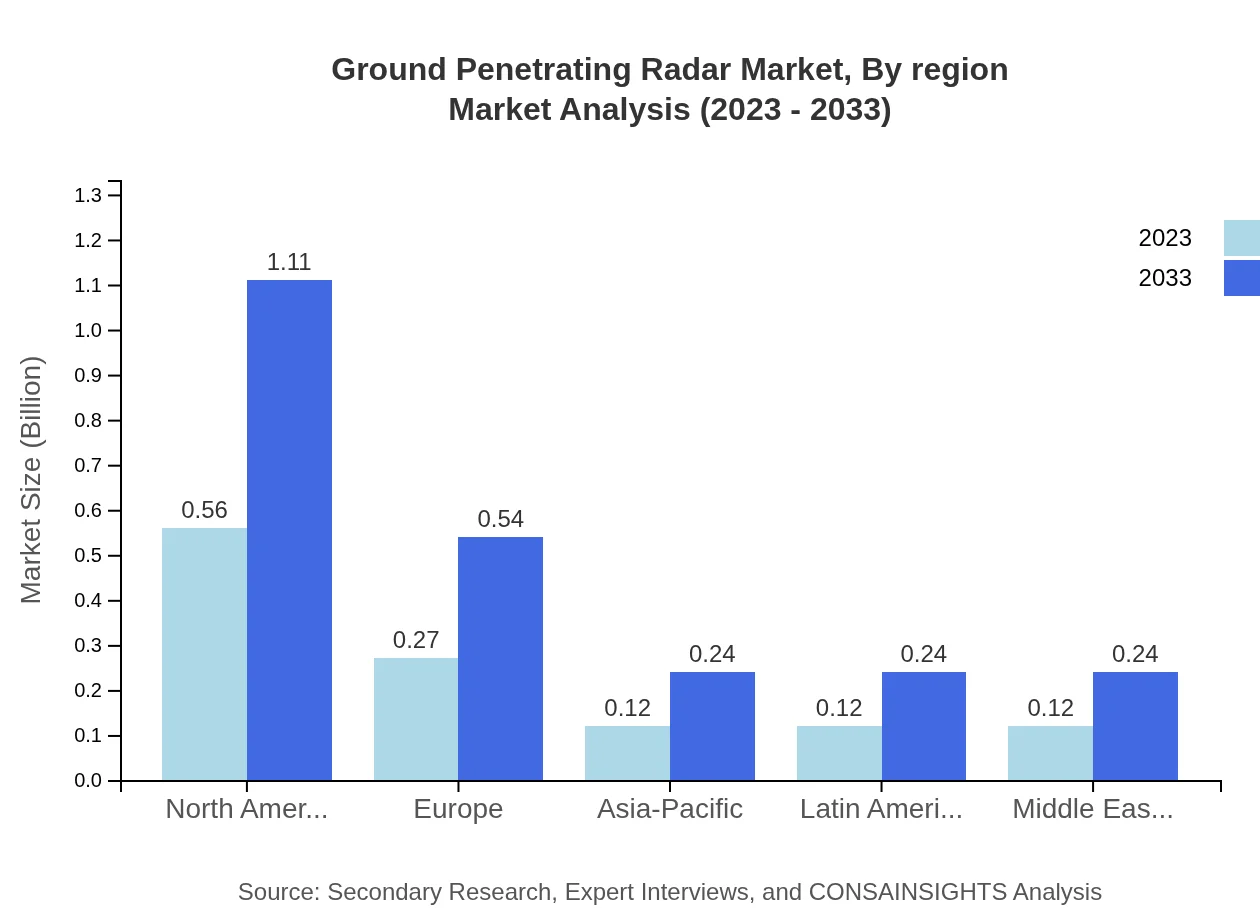

Ground Penetrating Radar Market Analysis Report by Region

Europe Ground Penetrating Radar Market Report:

The European market for GPR is expected to expand from $0.40 billion in 2023 to $0.80 billion by 2033. Stringent regulations regarding environmental monitoring and construction safety standards mandate the adoption of GPR systems across various applications.Asia Pacific Ground Penetrating Radar Market Report:

In the Asia Pacific region, the GPR market is anticipated to grow from $0.21 billion in 2023 to $0.42 billion by 2033. Increased urbanization and infrastructure developments in countries like China and India are driving the demand for GPR systems, particularly in construction and environmental monitoring.North America Ground Penetrating Radar Market Report:

North America remains a leader in the GPR market, with the size expected to surge from $0.42 billion in 2023 to $0.83 billion in 2033. A mature infrastructure sector and heightened concern for public safety are driving demand for GPR technology in this region.South America Ground Penetrating Radar Market Report:

The South American GPR market size is projected to increase from $0.01 billion in 2023 to $0.03 billion in 2033. Growing investments in construction and mining activities are contributing to the modest growth of GPR technologies in the region.Middle East & Africa Ground Penetrating Radar Market Report:

In the Middle East and Africa, the GPR market is forecasted to grow from $0.15 billion in 2023 to $0.30 billion in 2033, supported by governmental initiatives for infrastructure improvement and urban development projects.Tell us your focus area and get a customized research report.

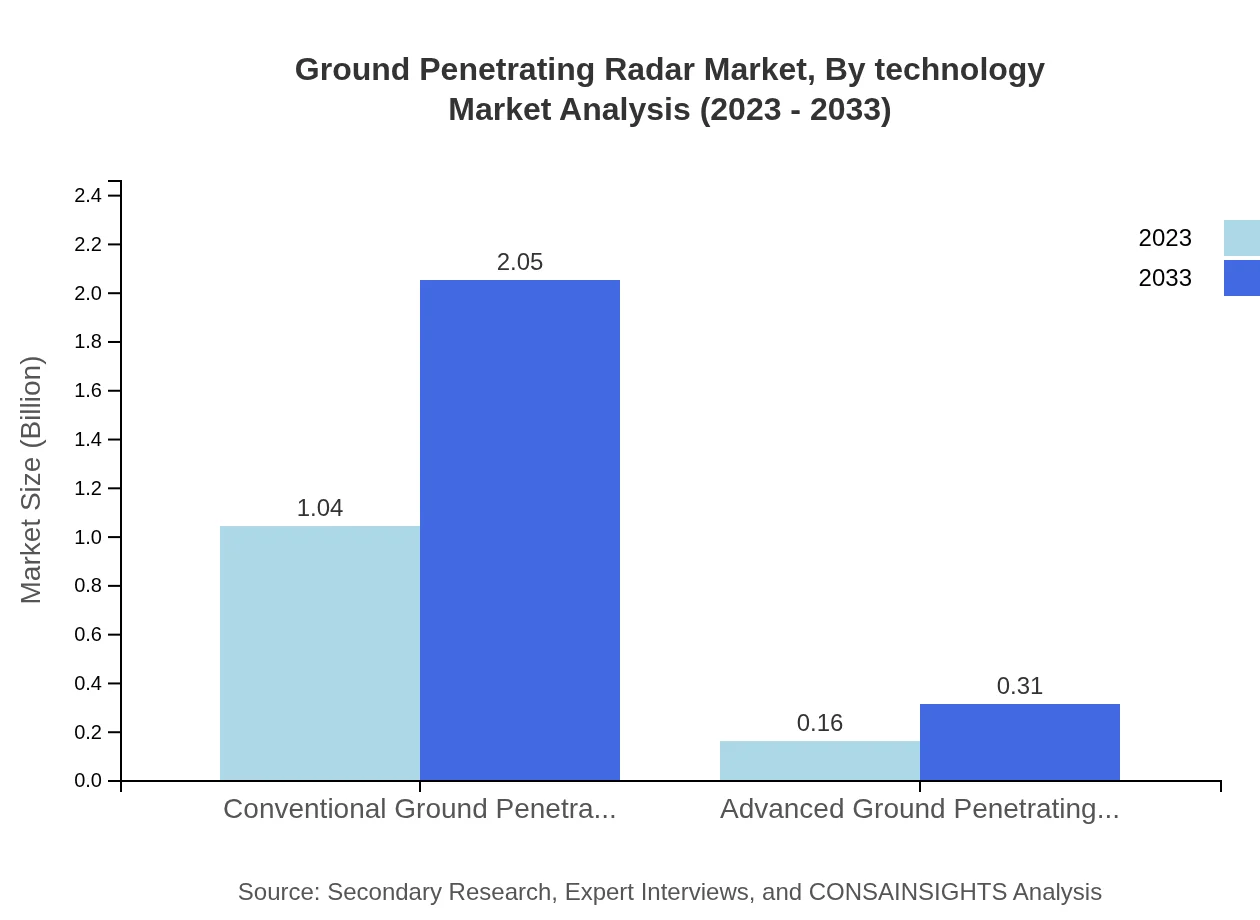

Ground Penetrating Radar Market Analysis By Technology

The GPR market is characterized by two primary technology segments: conventional and advanced ground penetrating radar systems. Conventional GPR remains the dominant technology, accounting for a significant market share, with an expected market growth from $1.04 billion in 2023 to $2.05 billion in 2033. Meanwhile, advanced GPR systems, employing enhanced technologies, are growing steadily, with market sizes forecasted from $0.16 billion in 2023 to $0.31 billion by 2033.

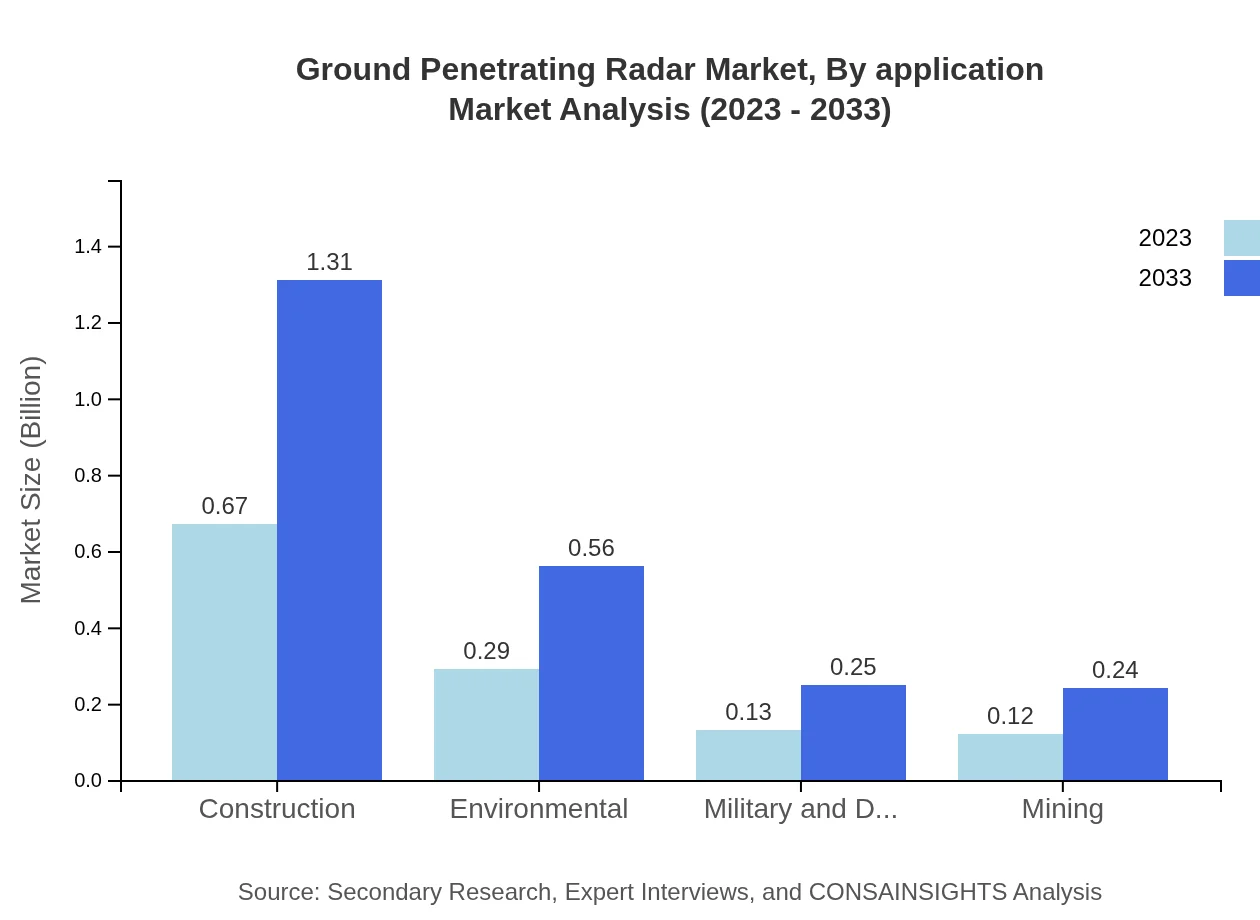

Ground Penetrating Radar Market Analysis By Application

Applications of ground penetrating radar are broad, covering utility mapping, archaeological exploration, construction assessments, and geological inspections. Government projects dominate this segment, holding a market share of approximately 55.5% in 2023. Other significant applications include construction (23.86%) and environmental assessments (10.07%). These segments are all projected to see increased investment and growth through 2033.

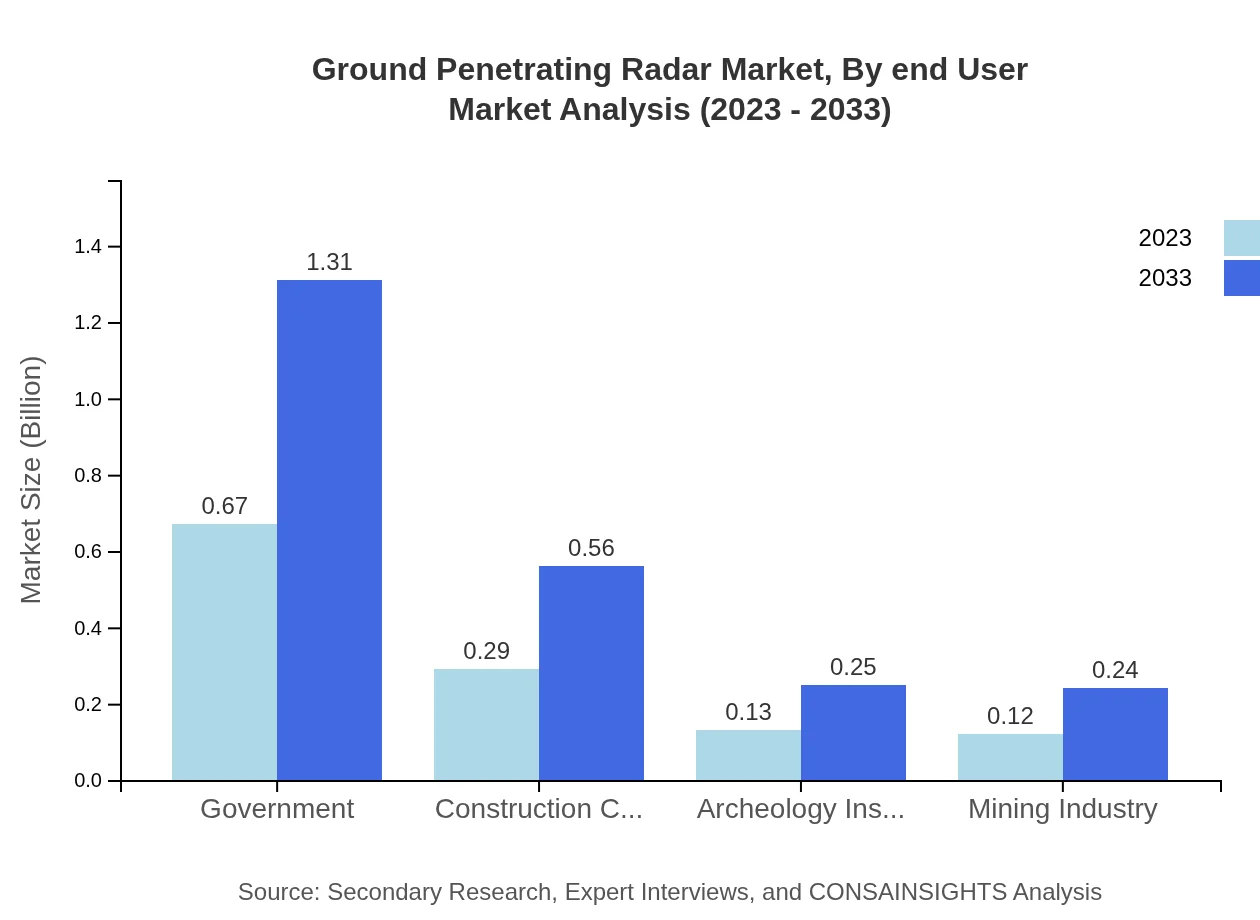

Ground Penetrating Radar Market Analysis By End User

Key end-users of GPR technology include government agencies, construction firms, and archeological institutions. Government utilization is leading with a market size expected to escalate from $0.67 billion in 2023 to $1.31 billion by 2033. The construction sector is also notable, expanding from $0.29 billion to $0.56 billion in the same period, reflecting significant investment in infrastructure and urban development.

Ground Penetrating Radar Market Analysis By Region

The regional segmentation reflects variable growth trends. North America leads with substantial market share and growth, while Europe and Asia Pacific show promising expansion due to increasing infrastructure needs. Latin America and the Middle East and Africa represent emerging markets, with growth driven primarily by construction and government investments.

Ground Penetrating Radar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ground Penetrating Radar Industry

Geophysical Survey Systems, Inc. (GSSI):

GSSI is a leading manufacturer of ground penetrating radar equipment, known for its innovative advanced GPR technology used in various applications including utility mapping, environmental studies, and structure scanning.Mala Geoscience:

Mala Geoscience is recognized for its broad spectrum of GPR systems, offering solutions for both industrial and academic projects. They emphasize user-friendly technology and real-time data acquisition.Sensors & Software Inc.:

Sensors & Software Inc. specializes in GPR equipment with a strong focus on data collection and analysis software. Their products are widely used in civil engineering and archaeological fields.US Radar, Inc.:

US Radar produces high-resolution GPR systems that are adaptable for numerous applications, supporting infrastructure inspection and utility mapping across various sectors.ImpulseRadar:

ImpulseRadar is known for its cutting-edge GPR technology that integrates advanced radar systems suitable for diverse applications, particularly in utility and civil engineering.We're grateful to work with incredible clients.

FAQs

What is the market size of ground Penetrating Radar?

The global ground-penetrating radar market size is valued at approximately USD 1.2 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 6.8% estimated until 2033.

What are the key market players or companies in the ground Penetrating Radar industry?

Key players in the ground-penetrating radar market include major firms such as GSSI, Hilti, and IDS GeoRadar, all leading the way in innovation and technology within the industry.

What are the primary factors driving the growth in the ground Penetrating Radar industry?

Growth in the ground-penetrating radar market is driven by increasing demand from construction and archaeological sectors, advancements in surveying technology, and heightened government regulations on infrastructure safety.

Which region is the fastest Growing in the ground Penetrating Radar?

The North America region is poised to be the fastest-growing market, projected to expand from USD 0.42 billion in 2023 to approximately USD 0.83 billion by 2033, reflecting growing integration of GPR technology.

Does ConsaInsights provide customized market report data for the ground Penetrating Radar industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and inquiries in the ground-penetrating radar industry, ensuring clients receive relevant insights.

What deliverables can I expect from this ground Penetrating Radar market research project?

Key deliverables from the ground-penetrating radar market research will include comprehensive market analysis reports, regional insights, competitive landscape studies, and actionable growth strategies tailored for your business.

What are the market trends of ground Penetrating Radar?

Current market trends indicate a shift towards advanced GPR systems, increased adoption across various sectors, and technological advancements in data interpretation methods that enhance operational efficiency.