Guaranteed Asset Protection Insurance Market Report

Published Date: 31 January 2026 | Report Code: guaranteed-asset-protection-insurance

Guaranteed Asset Protection Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Guaranteed Asset Protection Insurance (GAP) market from 2023 to 2033, encompassing market size, growth trends, regional insights, and key company profiles, along with future forecasts in the industry.

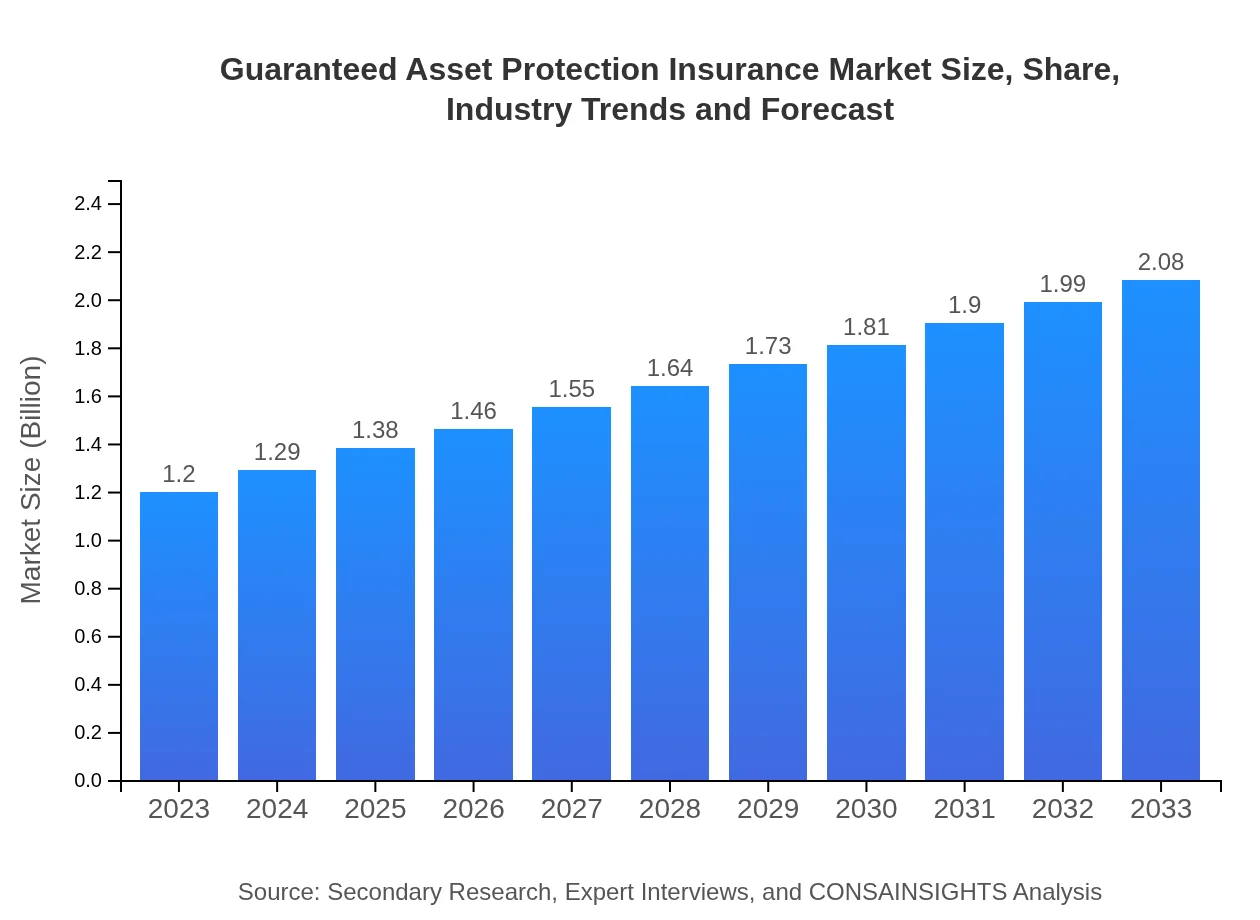

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 5.5% |

| 2033 Market Size | $2.08 Billion |

| Top Companies | National Automobile Dealers Association (NADA), Allstate Insurance Company, Geico |

| Last Modified Date | 31 January 2026 |

Guaranteed Asset Protection Insurance Market Overview

Customize Guaranteed Asset Protection Insurance Market Report market research report

- ✔ Get in-depth analysis of Guaranteed Asset Protection Insurance market size, growth, and forecasts.

- ✔ Understand Guaranteed Asset Protection Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Guaranteed Asset Protection Insurance

What is the Market Size & CAGR of Guaranteed Asset Protection Insurance market in 2023?

Guaranteed Asset Protection Insurance Industry Analysis

Guaranteed Asset Protection Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Guaranteed Asset Protection Insurance Market Analysis Report by Region

Europe Guaranteed Asset Protection Insurance Market Report:

In Europe, the market is expected to expand from USD 0.30 billion in 2023 to USD 0.51 billion by 2033. The regulatory framework and increased focus on vehicle safety and conservation of investment are central to this growth.Asia Pacific Guaranteed Asset Protection Insurance Market Report:

The Asia-Pacific region is witnessing significant growth in the GAP insurance market, expected to rise from USD 0.24 billion in 2023 to USD 0.42 billion in 2033. The burgeoning middle class and growth in vehicle ownership drive demand, alongside increasing insurance awareness.North America Guaranteed Asset Protection Insurance Market Report:

The North American market remains the largest, with expectations to grow from USD 0.47 billion in 2023 to USD 0.81 billion by 2033. The high rate of vehicle financing and consumer awareness significantly contribute to this growth.South America Guaranteed Asset Protection Insurance Market Report:

The South American market, although smaller, is projected to grow from USD 0.11 billion in 2023 to USD 0.19 billion by 2033. Growth is primarily linked to rising urbanization and economic improvements, which increase vehicle sales.Middle East & Africa Guaranteed Asset Protection Insurance Market Report:

The Middle East and Africa market is relatively nascent but is anticipated to grow from USD 0.08 billion in 2023 to USD 0.14 billion by 2033, benefiting from improving economic conditions and regulatory environments.Tell us your focus area and get a customized research report.

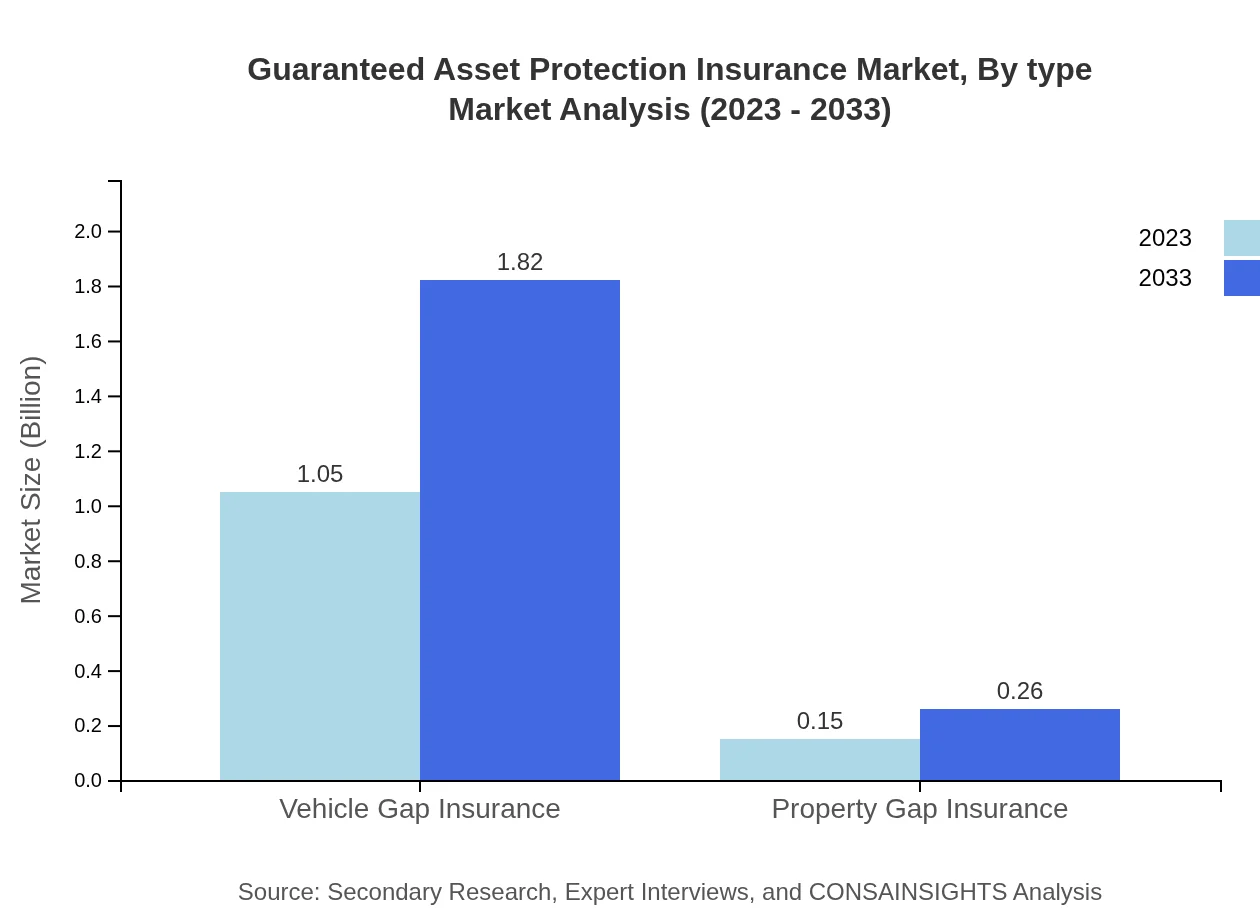

Guaranteed Asset Protection Insurance Market Analysis By Type

In the Guaranteed Asset Protection Insurance market, Vehicle GAP Insurance dominates, projected to grow from USD 1.05 billion in 2023 to USD 1.82 billion by 2033, maintaining a significant share of 87.53%. Property GAP Insurance, while smaller, also shows growth potential, increasing from USD 0.15 billion to USD 0.26 billion over the same period.

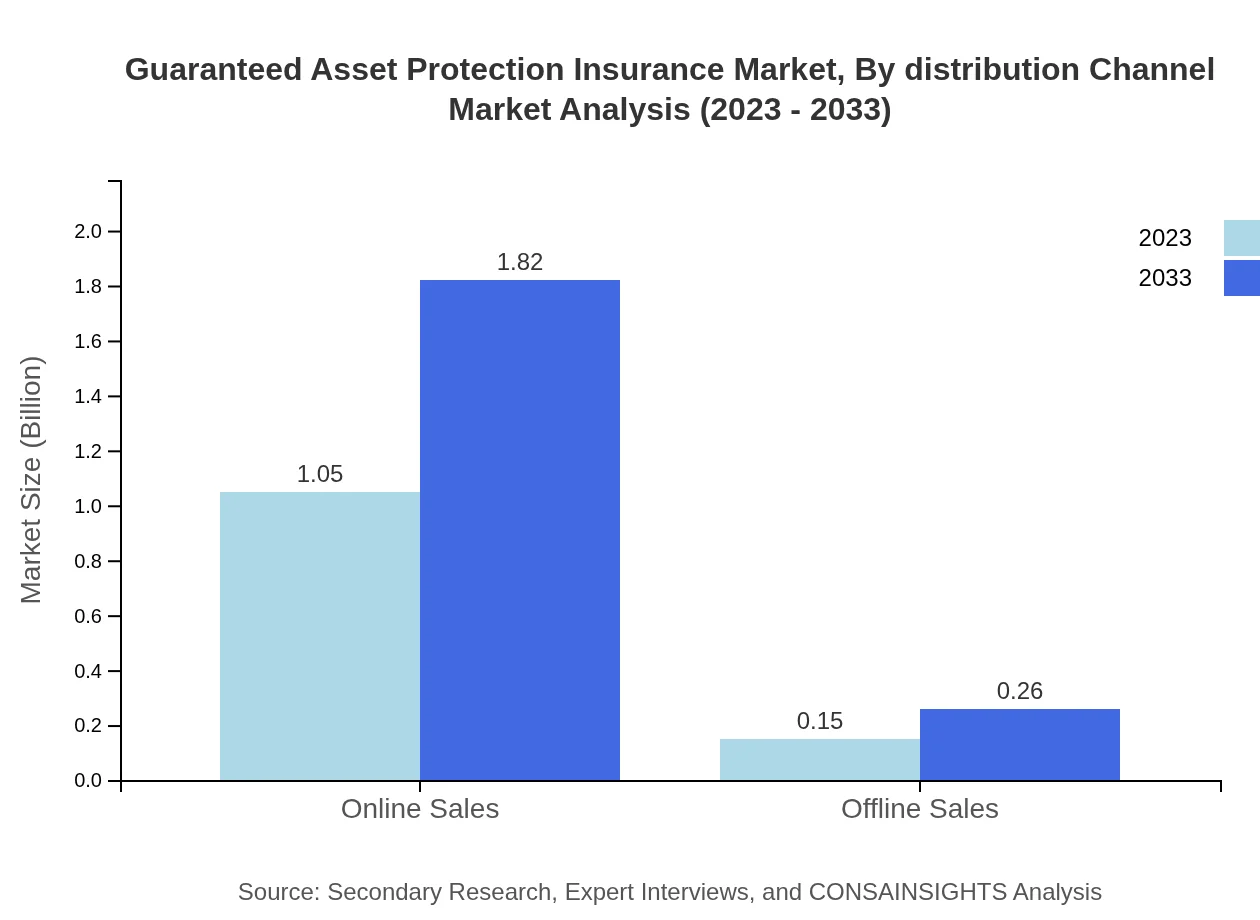

Guaranteed Asset Protection Insurance Market Analysis By Distribution Channel

Online sales channels are leading in the distribution of GAP insurance, with values expected to rise from USD 1.05 billion in 2023 to USD 1.82 billion in 2033, holding an impressive market share of 87.53%. Offline sales, while still relevant, will grow more slowly from USD 0.15 billion to USD 0.26 billion.

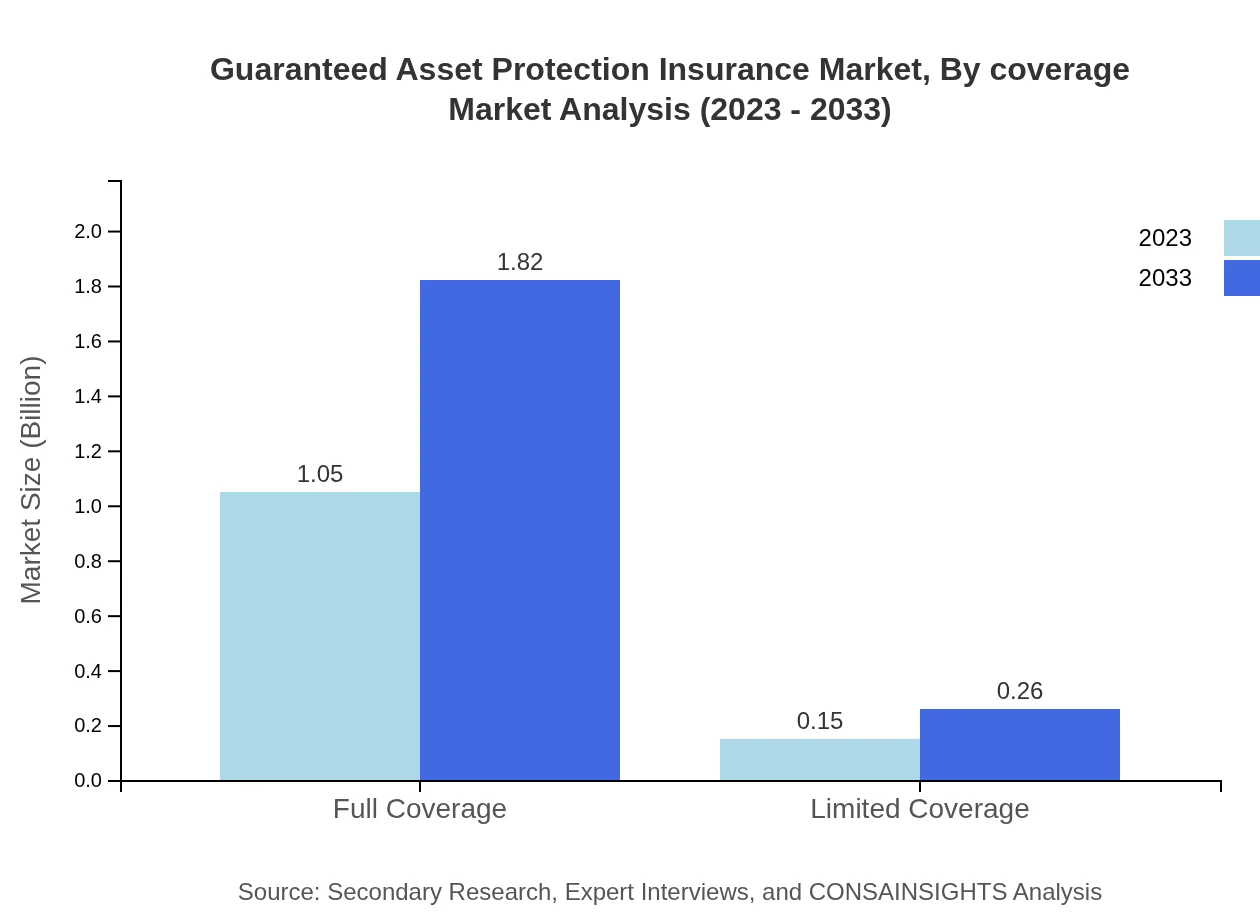

Guaranteed Asset Protection Insurance Market Analysis By Coverage

Full coverage GAP Insurance is the preferred choice for consumers, projected to grow from USD 1.05 billion in 2023 to USD 1.82 billion by 2033, with a stable market share of 87.53%. Limited coverage, in contrast, remains at a smaller share, expected to increase from USD 0.15 billion to USD 0.26 billion.

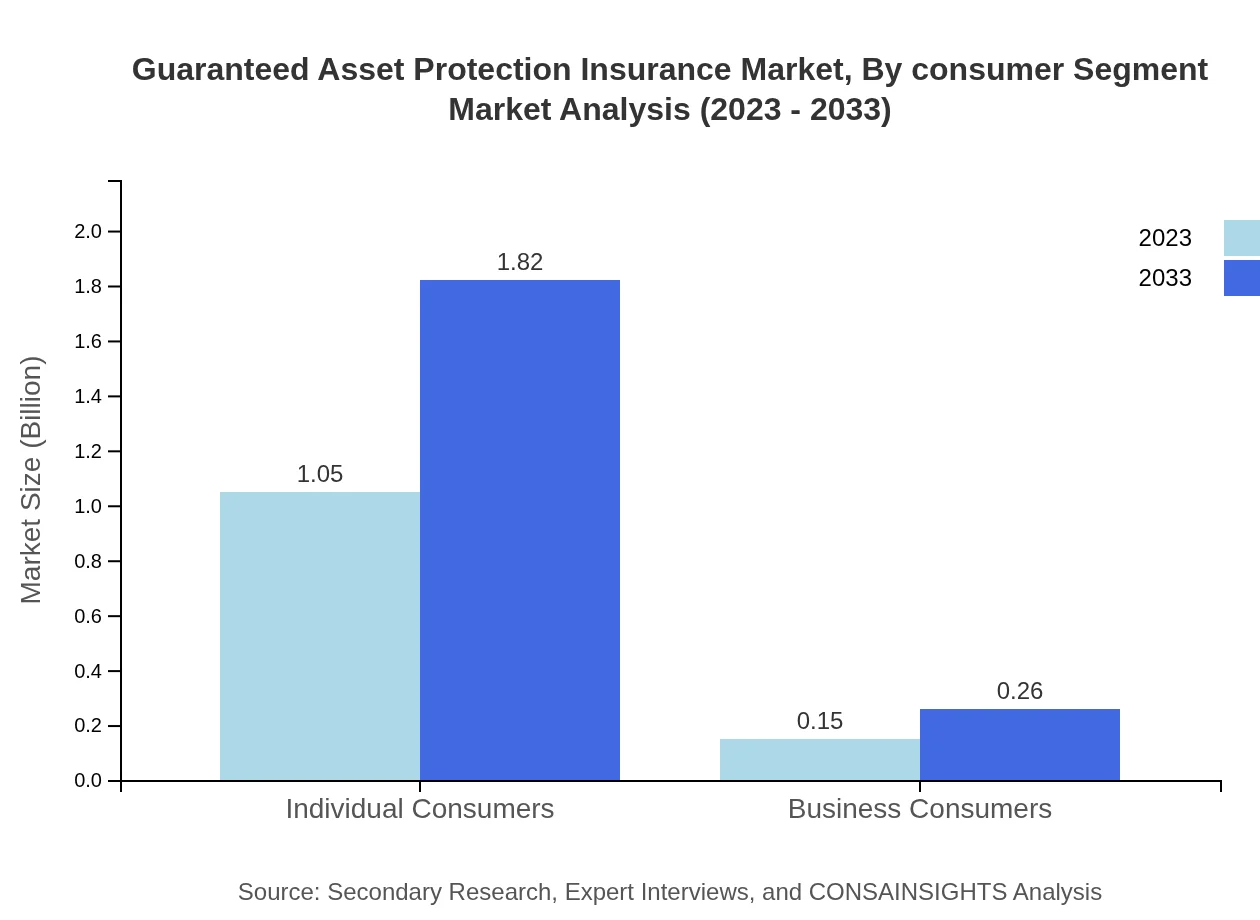

Guaranteed Asset Protection Insurance Market Analysis By Consumer Segment

Individual consumers represent the largest segment in GAP insurance, with the market size rising from USD 1.05 billion in 2023 to USD 1.82 billion by 2033, maintaining a strong share of 87.53%. Business consumers, while they form a smaller segment, are expected to increase from USD 0.15 billion to USD 0.26 billion.

Guaranteed Asset Protection Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Guaranteed Asset Protection Insurance Industry

National Automobile Dealers Association (NADA):

NADA offers GAP insurance products tailored to vehicle dealerships, enhancing their customer offerings and driving sales.Allstate Insurance Company:

Allstate provides various insurance products, including GAP insurance, focusing on consumer education and innovative underwriting solutions.Geico:

As a major player in the market, Geico offers competitive GAP insurance products that appeal to a broad consumer base, leveraging digital platforms for sales.We're grateful to work with incredible clients.

FAQs

What is the market size of guaranteed Asset Protection Insurance?

The global market size for Guaranteed Asset Protection Insurance is projected at $1.2 billion in 2023, with a compound annual growth rate (CAGR) of approximately 5.5%. It's expected to continue growing, reaching new heights in the next decade.

What are the key market players or companies in this guaranteed Asset Protection Insurance industry?

Major players in the Guaranteed Asset Protection Insurance industry include leading insurers and financial service providers. Their competitive strategies are shaping market landscapes, focusing on enhanced customer experiences, effective claim management, and technological advancements.

What are the primary factors driving the growth in the guaranteed Asset Protection Insurance industry?

Key factors driving growth include increased vehicular sales, rising awareness about asset protection, and a growing trend towards safety and security among consumers. Additionally, regulatory support plays a significant role in fostering market expansion.

Which region is the fastest Growing in the guaranteed Asset Protection Insurance?

North America is the fastest-growing region, currently valued at $0.47 billion in 2023 and projected to reach $0.81 billion by 2033. The increase is attributed to high penetration rates and consumer demand for protection plans.

Does ConsaInsights provide customized market report data for the guaranteed Asset Protection Insurance industry?

Yes, ConsaInsights offers customized market reports tailored to client specifications in the Guaranteed Asset Protection Insurance industry. This includes in-depth analysis and insights based on specific needs, market dynamics, and competitive landscape.

What deliverables can I expect from this guaranteed Asset Protection Insurance market research project?

Expect comprehensive reports including market size analytics, growth forecasts, competitive assessments, segmentation, and regional performance data. Tailored insights will guide strategic decision-making in the Guaranteed Asset Protection Insurance sector.

What are the market trends of guaranteed Asset Protection Insurance?

Current market trends include a shift towards online sales channels, heightened consumer awareness regarding financial risks, and increasing integration of technology in policy management. These trends indicate a progressive approach towards asset protection.