Guidewires Market Report

Published Date: 31 January 2026 | Report Code: guidewires

Guidewires Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Guidewires market from 2023 to 2033, providing valuable insights into market size, trends, and forecasts. We delve into key segments, regional breakdowns, and technological advancements impacting growth in this critical industry.

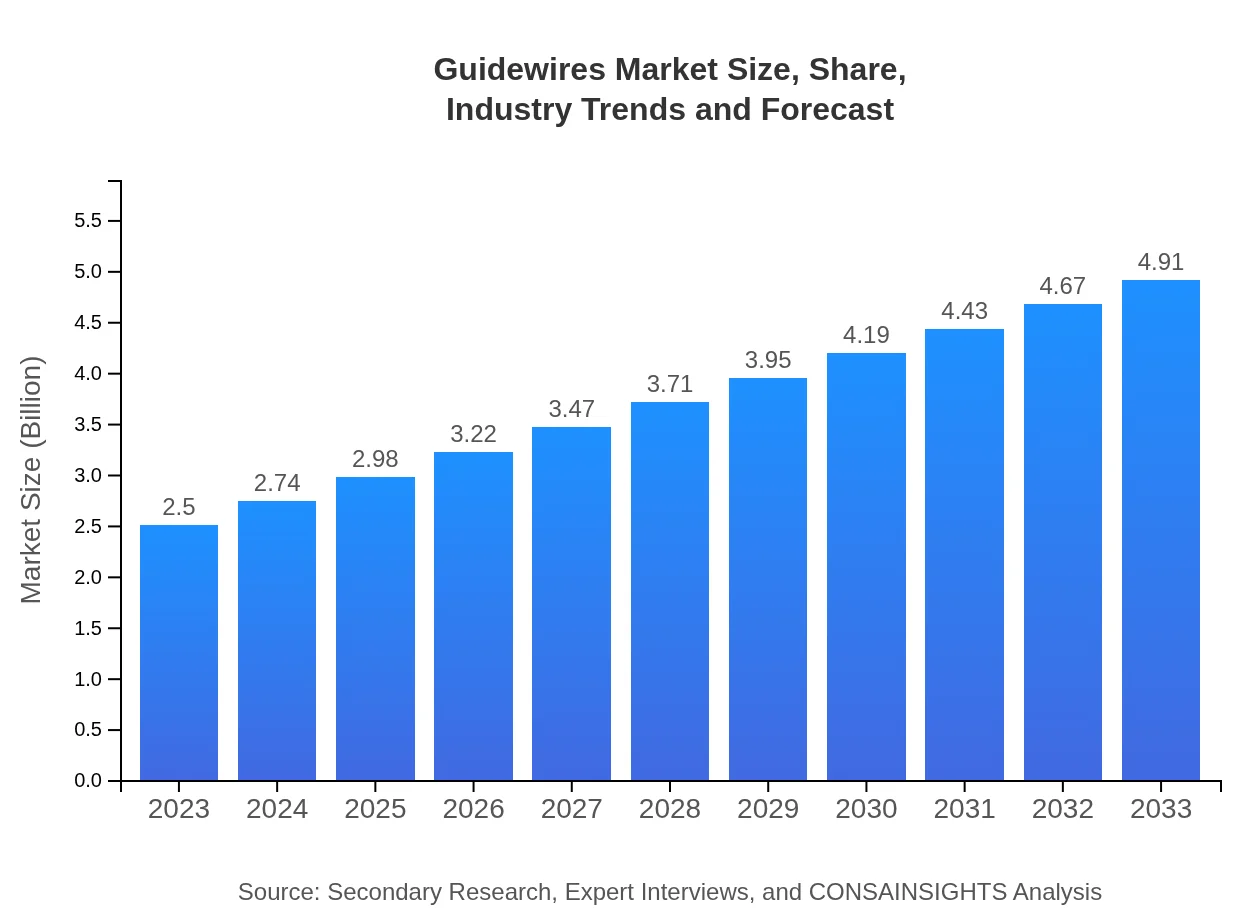

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Boston Scientific Corporation, Medtronic PLC, Abbott Laboratories, Terumo Corporation |

| Last Modified Date | 31 January 2026 |

Guidewires Market Overview

Customize Guidewires Market Report market research report

- ✔ Get in-depth analysis of Guidewires market size, growth, and forecasts.

- ✔ Understand Guidewires's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Guidewires

What is the Market Size & CAGR of Guidewires market in 2023?

Guidewires Industry Analysis

Guidewires Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Guidewires Market Analysis Report by Region

Europe Guidewires Market Report:

The European Guidewires market is anticipated to grow significantly from $0.75 billion in 2023 to $1.47 billion in 2033. High spending in healthcare, combined with the presence of key market players, is accelerating market development.Asia Pacific Guidewires Market Report:

In the Asia Pacific, the Guidewires market is projected to grow from $0.48 billion in 2023 to $0.94 billion by 2033, fueled by increasing healthcare investments and a rising patient population. Gradual adoption of advanced medical technologies is leading to greater acceptance of guidewire applications in surgical procedures.North America Guidewires Market Report:

In North America, the market size is set to increase from $0.88 billion in 2023 to $1.73 billion by 2033. Advanced healthcare infrastructure and high prevalence of chronic diseases are key factors driving market growth in this region.South America Guidewires Market Report:

The South American region is expected to see a rise from $0.08 billion in 2023 to $0.16 billion by 2033. Despite slower growth compared to other regions, increasing awareness and accessibility to healthcare facilities are contributing to market expansion.Middle East & Africa Guidewires Market Report:

The Middle East and Africa region is projected to grow from $0.31 billion in 2023 to $0.61 billion by 2033, propelled by improvements in healthcare infrastructure and increased investments in medical technologies.Tell us your focus area and get a customized research report.

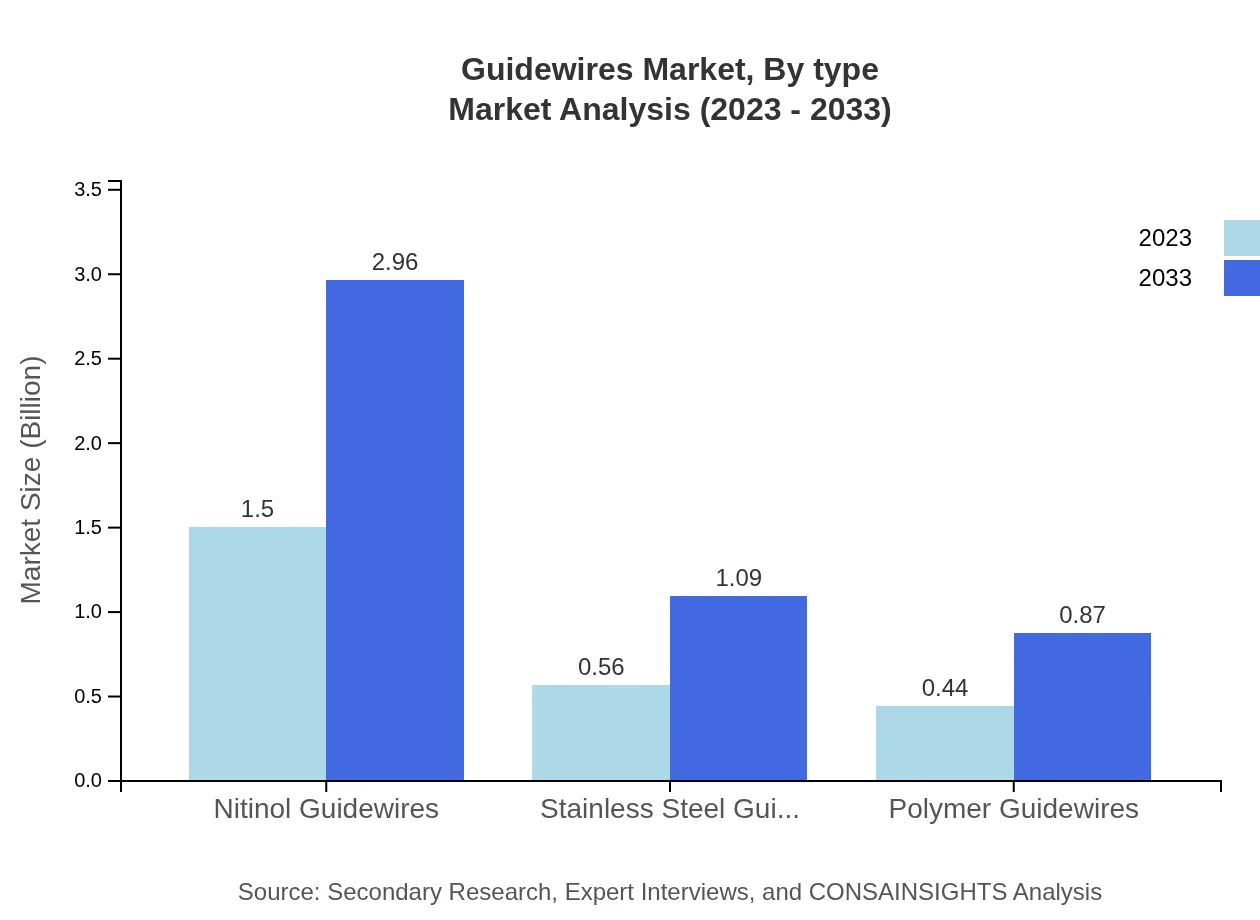

Guidewires Market Analysis By Type

The Guidewires market is significantly segmented by type, with Nitinol guidewires dominating the market, accounting for approximately 60.15% share, valued at $1.50 billion in 2023 and expected to reach $2.96 billion by 2033. Stainless Steel guidewires follow, valued at $0.56 billion in 2023 and forecasted to reach $1.09 billion by 2033, accounting for a 22.21% share. Polymer guidewires also contribute, with a market size of $0.44 billion in 2023, growing to $0.87 billion by 2033, reflecting a 17.64% share. Overall, the diverse types of guidewires cater to a range of medical applications and patient needs.

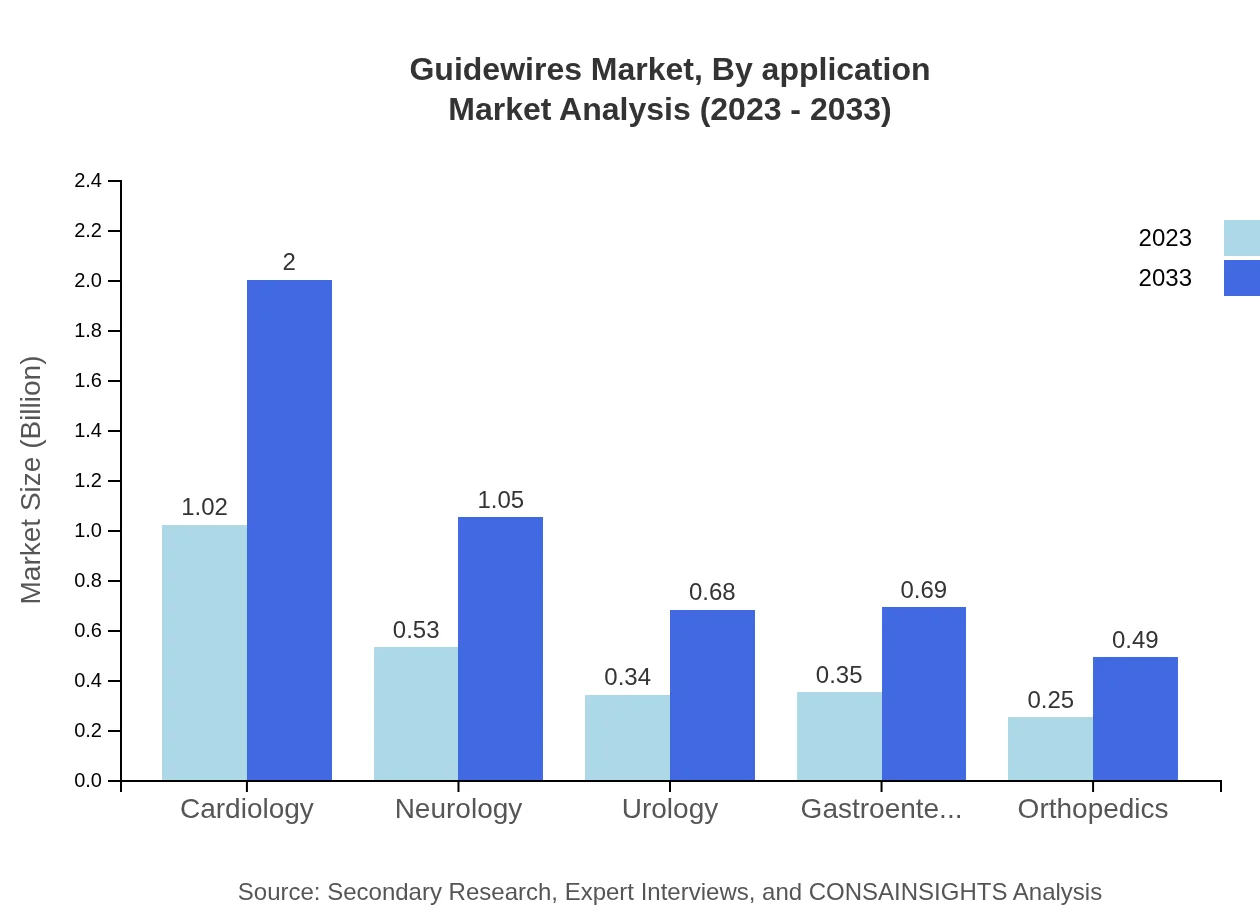

Guidewires Market Analysis By Application

In terms of application, cardiology remains the leading segment, valued at $1.02 billion in 2023 and projected to rise to $2.00 billion by 2033, constituting a 40.67% market share. Neurology follows with a market value of $0.53 billion, expected to reach $1.05 billion. Other applications such as urology and gastroenterology also show steady growth, with respective market sizes of $0.34 billion and $0.35 billion in 2023, indicating the vital role guidewires play across various specialties.

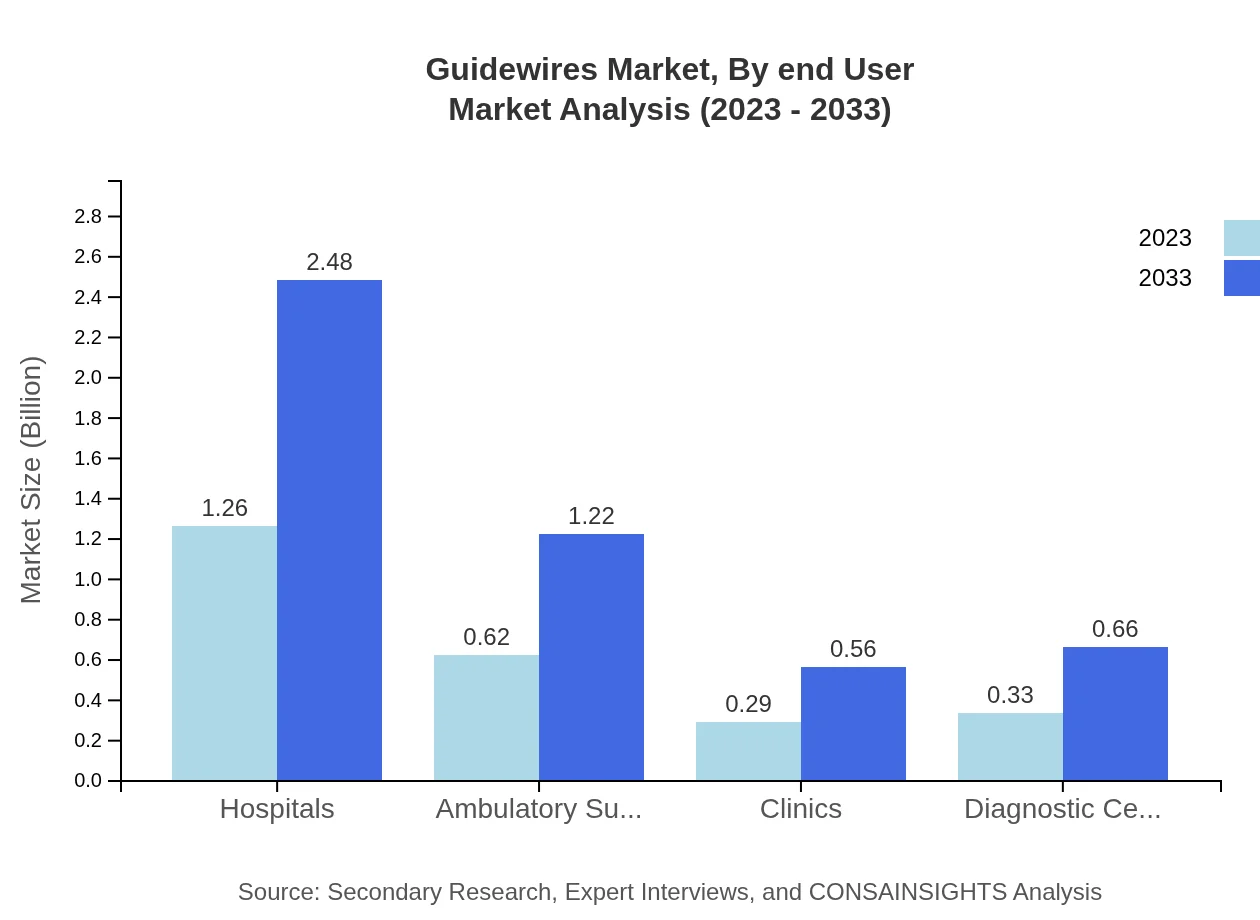

Guidewires Market Analysis By End User

The end-user segmentation reveals that hospitals are the predominant users of guidewires, with a valuation of $1.26 billion in 2023, expected to grow to $2.48 billion by 2033, holding a 50.43% market share. Ambulatory surgical centers contribute significantly as well, with sizes of $0.62 billion rising to $1.22 billion during the forecast period. The increasing preference for outpatient care is enhancing the role of ambulatory settings in guidewire usage.

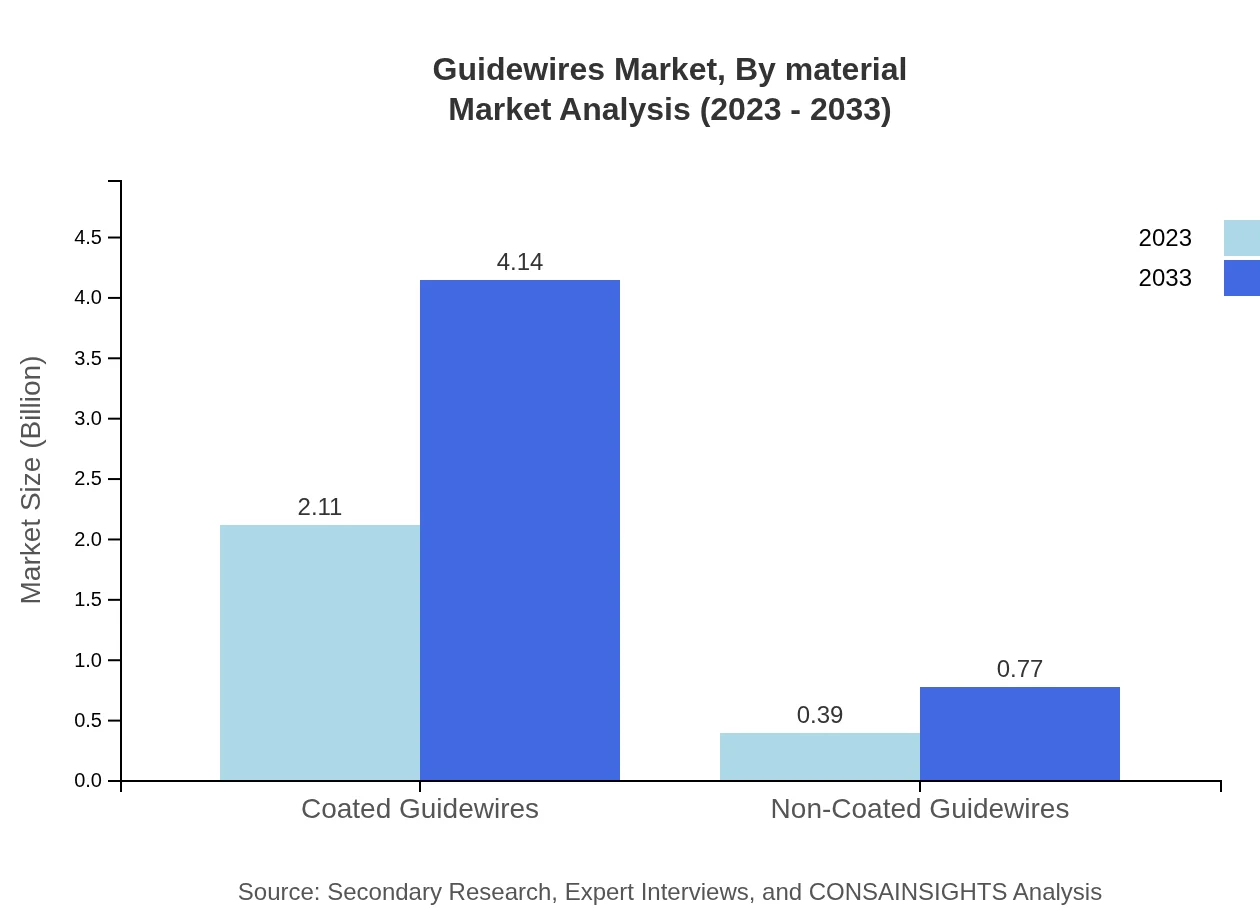

Guidewires Market Analysis By Material

The material composition of guidewires is a crucial market differentiator. Coated guidewires are the most significant segment, holding an 84.24% market share with a valuation of $2.11 billion in 2023, accelerating to $4.14 billion by 2033. Non-coated guidewires, accounting for 15.76% of the market, are also important, with sizes expected to grow from $0.39 billion to $0.77 billion during the same period.

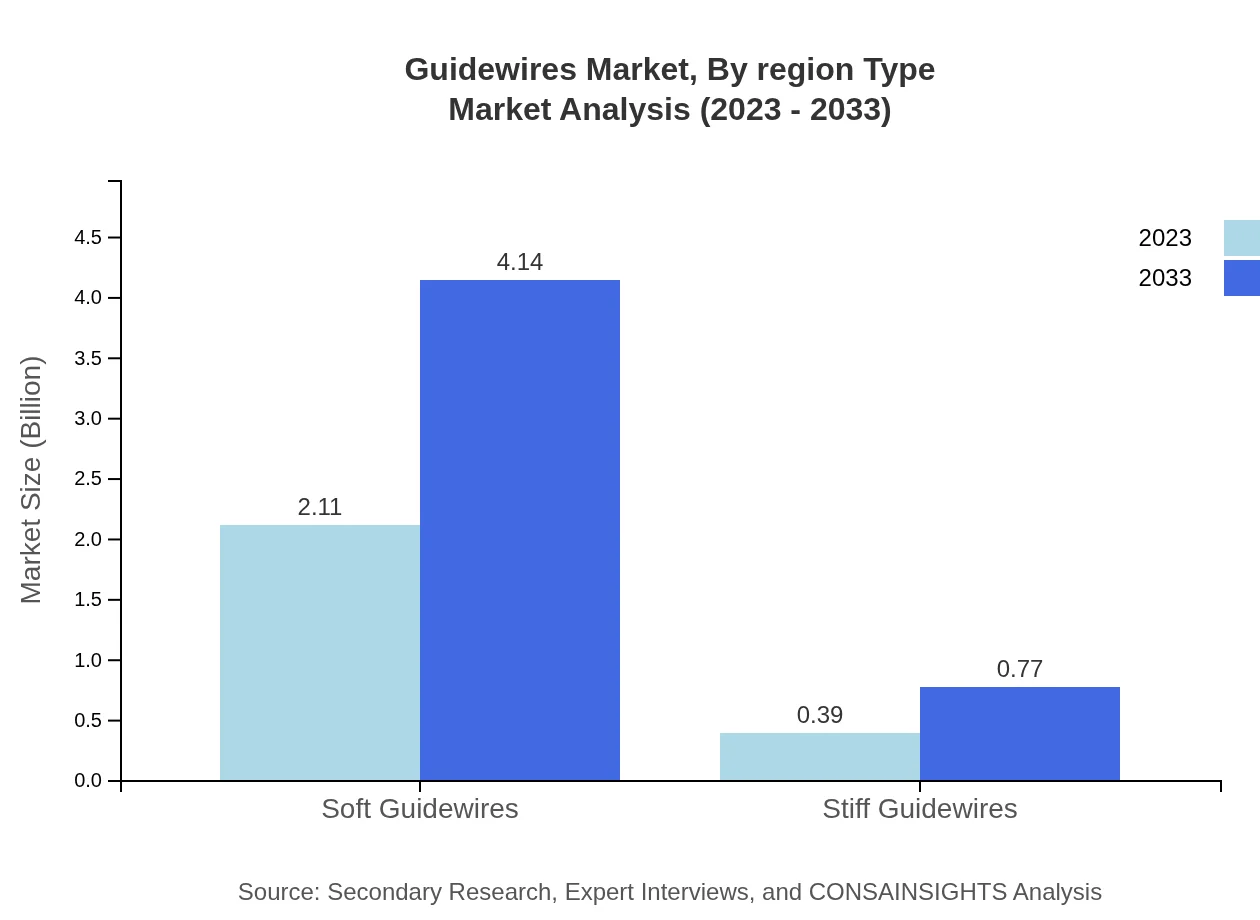

Guidewires Market Analysis By Region Type

The regional analysis illustrates distinct market dynamics, with North America leading in market share and size, while Asia Pacific exhibits rapid growth potential. Europe holds a substantial market but faces competition from emerging markets in Asia and South America, which are increasing their healthcare capabilities. Overall trends indicate that North America and Europe will maintain robust market shares, while Asian markets are likely to witness the highest growth rates.

Guidewires Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Guidewires Industry

Boston Scientific Corporation:

A leading global company in the development of innovative medical devices, Boston Scientific is known for its pioneering solutions for minimally invasive procedures in cardiology and other specialties.Medtronic PLC:

Medtronic is a global leader that provides healthcare solutions in various fields. Their comprehensive range of guidewires is designed to improve patient outcomes in complex interventional procedures.Abbott Laboratories:

Known for their high-quality medical devices and technologies, Abbott's guidewires are crafted for reliability and advanced performance in various applications, particularly in cardiovascular care.Terumo Corporation:

Terumo is dedicated to developing innovative healthcare solutions and provides an extensive portfolio of guidewires that cater to diverse medical needs, focusing on safety and efficacy.We're grateful to work with incredible clients.

FAQs

What is the market size of guidewires?

The guidewires market is valued at approximately $2.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching substantial growth through 2033, reflecting increasing demand in medical procedures.

What are the key market players or companies in the guidewires industry?

Key players in the guidewires market include Johnson & Johnson, Boston Scientific, Medtronic, and Terumo Corporation, among others, which significantly influence market advancements and innovations.

What are the primary factors driving the growth in the guidewires industry?

Growth drivers consist of the rising prevalence of cardiovascular diseases, technological advancements in medical devices, and increasing numbers of surgical procedures globally, leading to higher guidewire demand.

Which region is the fastest Growing in the guidewires market?

The fastest-growing region in the guidewires market is North America, expected to grow from $0.88 billion in 2023 to $1.73 billion by 2033, driven by advanced healthcare infrastructure and high medical device adoption.

Does ConsaInsights provide customized market report data for the guidewires industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the guidewires industry, enabling clients to derive insights aligned with their business strategies and market conditions.

What deliverables can I expect from this guidewires market research project?

Expect comprehensive deliverables including market analysis reports, segmentation studies, growth forecasts, and competitive landscape assessments, providing a holistic view of the guidewires market dynamics.

What are the market trends of guidewires?

Current trends in the guidewires market include increasing preference for Nitinol guidewires, advancements in coatings for enhanced performance, and growth in minimally invasive surgical techniques.