Halal Food Beverage Market Report

Published Date: 31 January 2026 | Report Code: halal-food-beverage

Halal Food Beverage Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Halal Food Beverage market, covering insights on market size, growth trends, regional analysis, and future forecasts for the years 2023 to 2033.

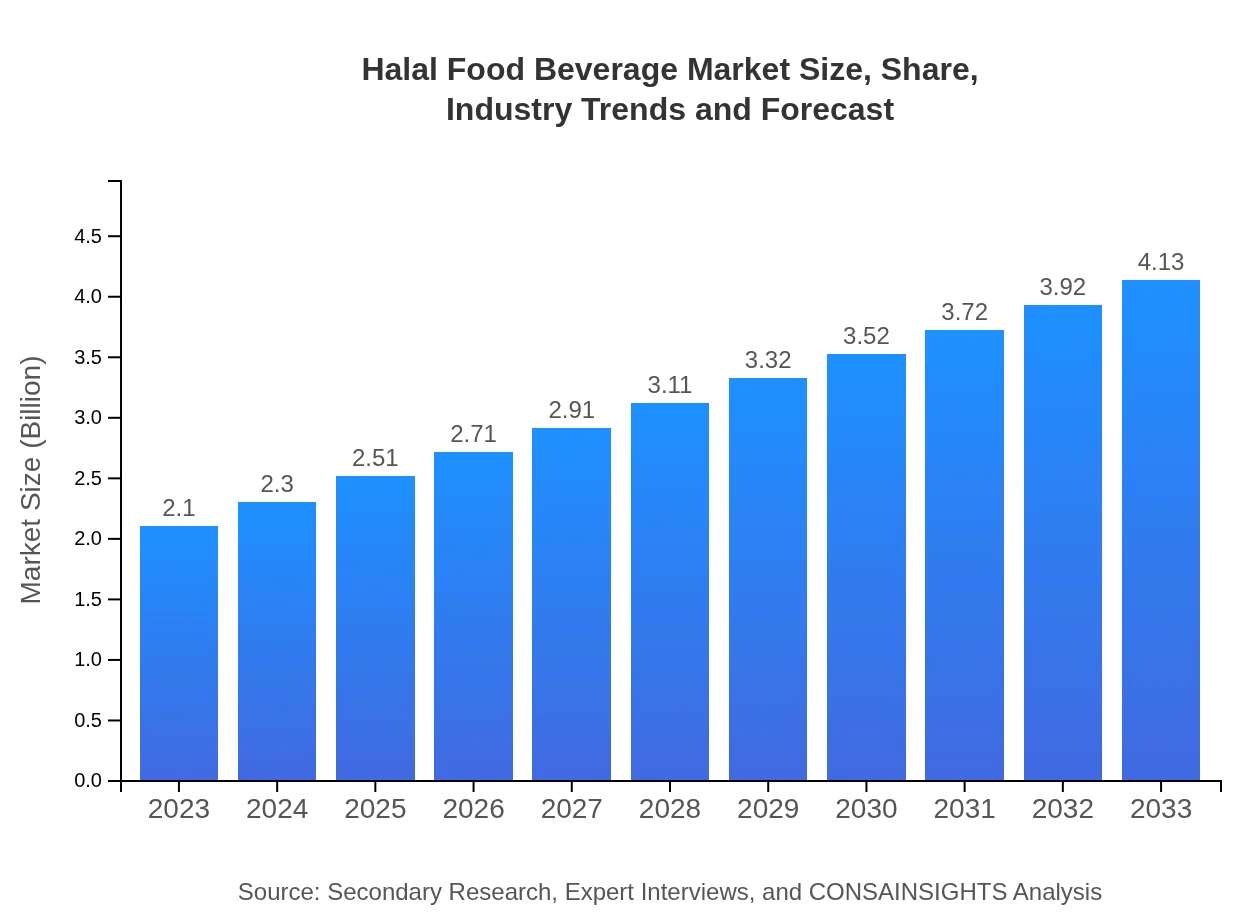

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.10 Trillion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.13 Trillion |

| Top Companies | Nestlé, Unilever, Kraft Heinz Company, Al-Falah Halal, Cargill |

| Last Modified Date | 31 January 2026 |

Halal Food Beverage Market Overview

Customize Halal Food Beverage Market Report market research report

- ✔ Get in-depth analysis of Halal Food Beverage market size, growth, and forecasts.

- ✔ Understand Halal Food Beverage's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Halal Food Beverage

What is the Market Size & CAGR of Halal Food Beverage market in 2023?

Halal Food Beverage Industry Analysis

Halal Food Beverage Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Halal Food Beverage Market Analysis Report by Region

Europe Halal Food Beverage Market Report:

Europe’s Halal Food Beverage market is expected to expand from $0.71 billion in 2023 to $1.40 billion by 2033. The region is characterized by a growing Muslim demographic and increasing awareness among the general population about the benefits of Halal certified foods.Asia Pacific Halal Food Beverage Market Report:

The Asia Pacific region holds a significant share of the Halal Food Beverage market, valued at approximately $0.35 billion in 2023 and expected to reach $0.69 billion by 2033. The growth can be attributed to the substantial Muslim population and increasing demand for Halal products among non-Muslims looking for healthy options.North America Halal Food Beverage Market Report:

The North American market is projected to grow from $0.75 billion in 2023 to $1.47 billion in 2033. This region experiences solid demand driven by a multicultural population and an increasing number of certified Halal products available in mainstream retail chains.South America Halal Food Beverage Market Report:

In South America, the market size for Halal Food Beverage was $0.02 billion in 2023 and is projected to grow to $0.05 billion by 2033. Factors such as rising interest in diverse food options and tourism significantly influence this growth, albeit on a smaller scale compared to other regions.Middle East & Africa Halal Food Beverage Market Report:

The Middle East and Africa market is set to double in size, increasing from $0.26 billion in 2023 to $0.52 billion by 2033. The demand in this region is bolstered by cultural and religious adherence to Halal practices, along with a growing expatriate community seeking familiar food options.Tell us your focus area and get a customized research report.

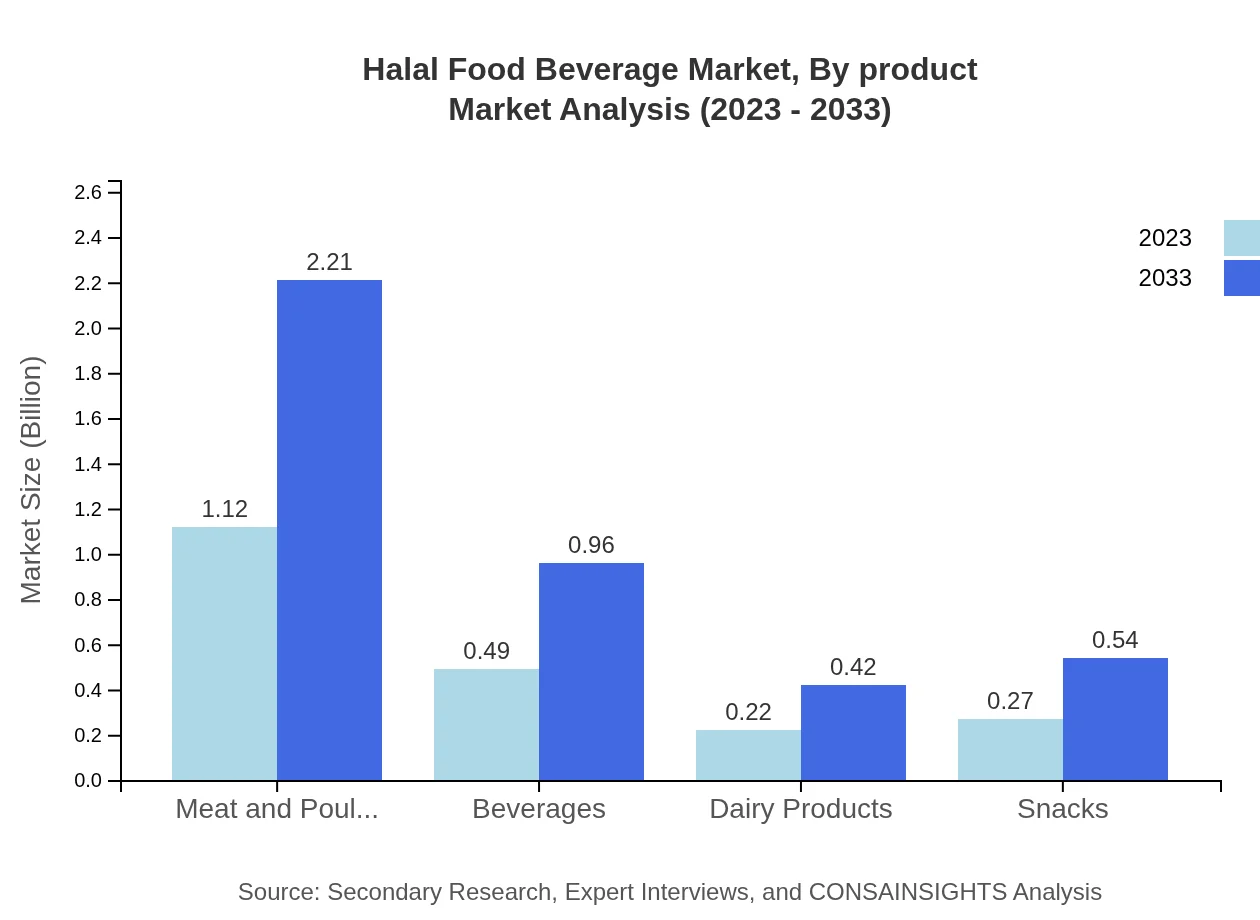

Halal Food Beverage Market Analysis By Product

The Halal Food Beverage market is predominantly driven by the meat and poultry segment, which accounted for $1.12 billion in 2023 and is expected to grow to $2.21 billion by 2033. This segment represents a 53.53% share. Other notable segments include beverages ($0.49 billion) and dairy products ($0.22 billion) as they increasingly attract consumer interest, with significant growth prospects.

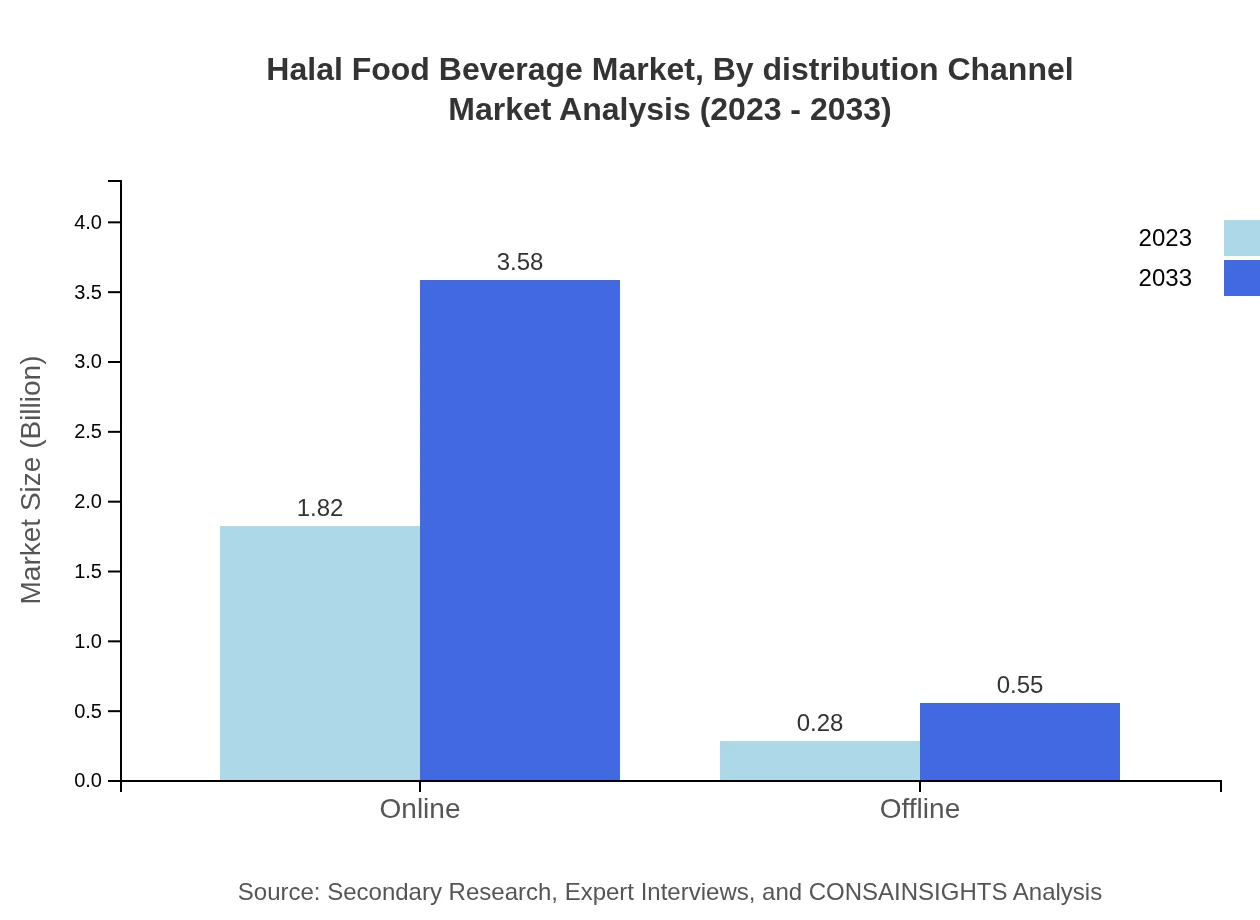

Halal Food Beverage Market Analysis By Distribution Channel

The distribution of Halal Food Beverages is rapidly evolving, with online sales channels leading the way. In 2023, online sales constituted 86.73% of the market ($1.82 billion) and are projected to grow to $3.58 billion by 2033. Offline channels remain relevant but are witnessing lower growth as e-commerce strategies dominate.

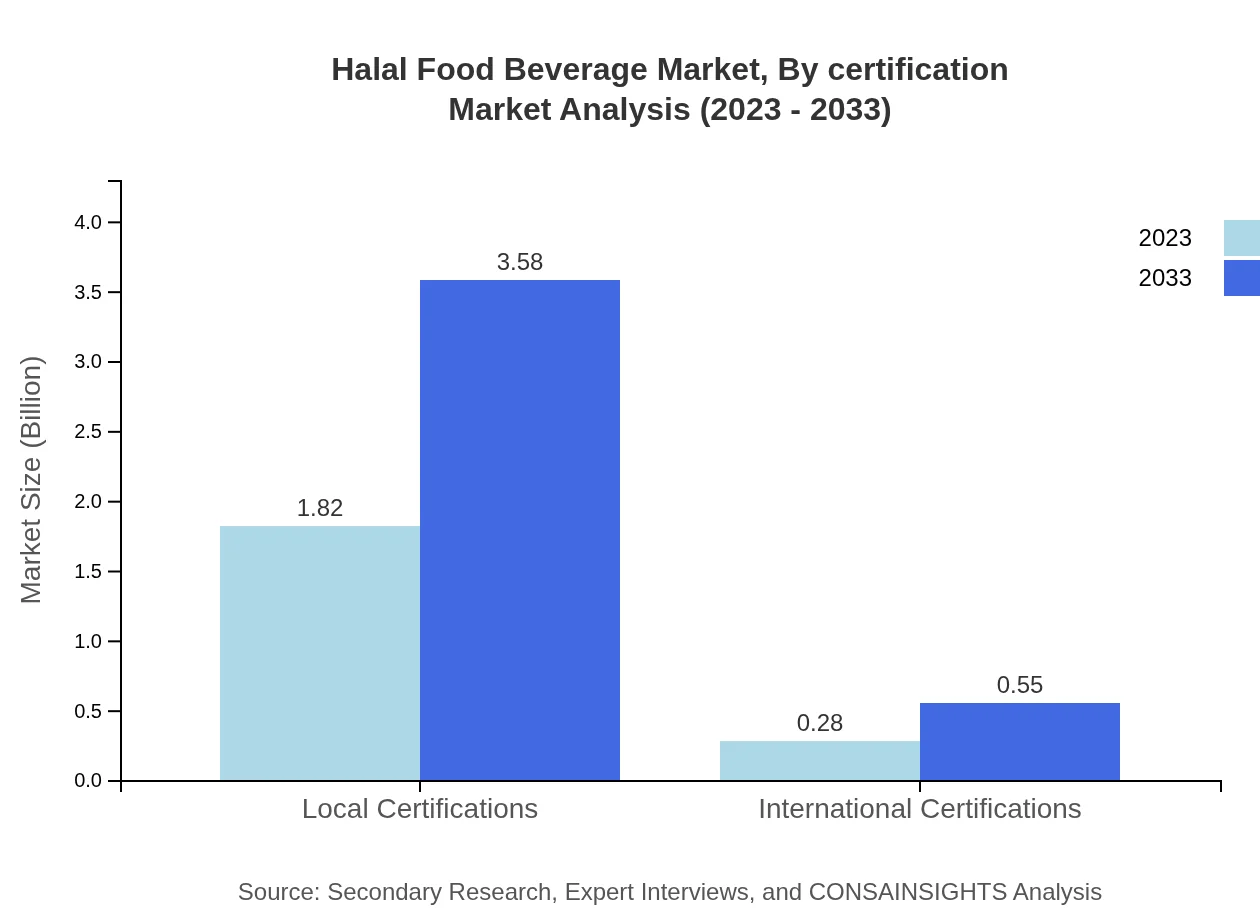

Halal Food Beverage Market Analysis By Certification

Certifications play a crucial role in the Halal Food Beverage market. Local certifications accounted for a substantial share of 86.73% in 2023 ($1.82 billion), reflecting the importance of local trust in food products. In contrast, international certifications are set to grow from $0.28 billion in 2023 to $0.55 billion by 2033, catering to a more global consumer base.

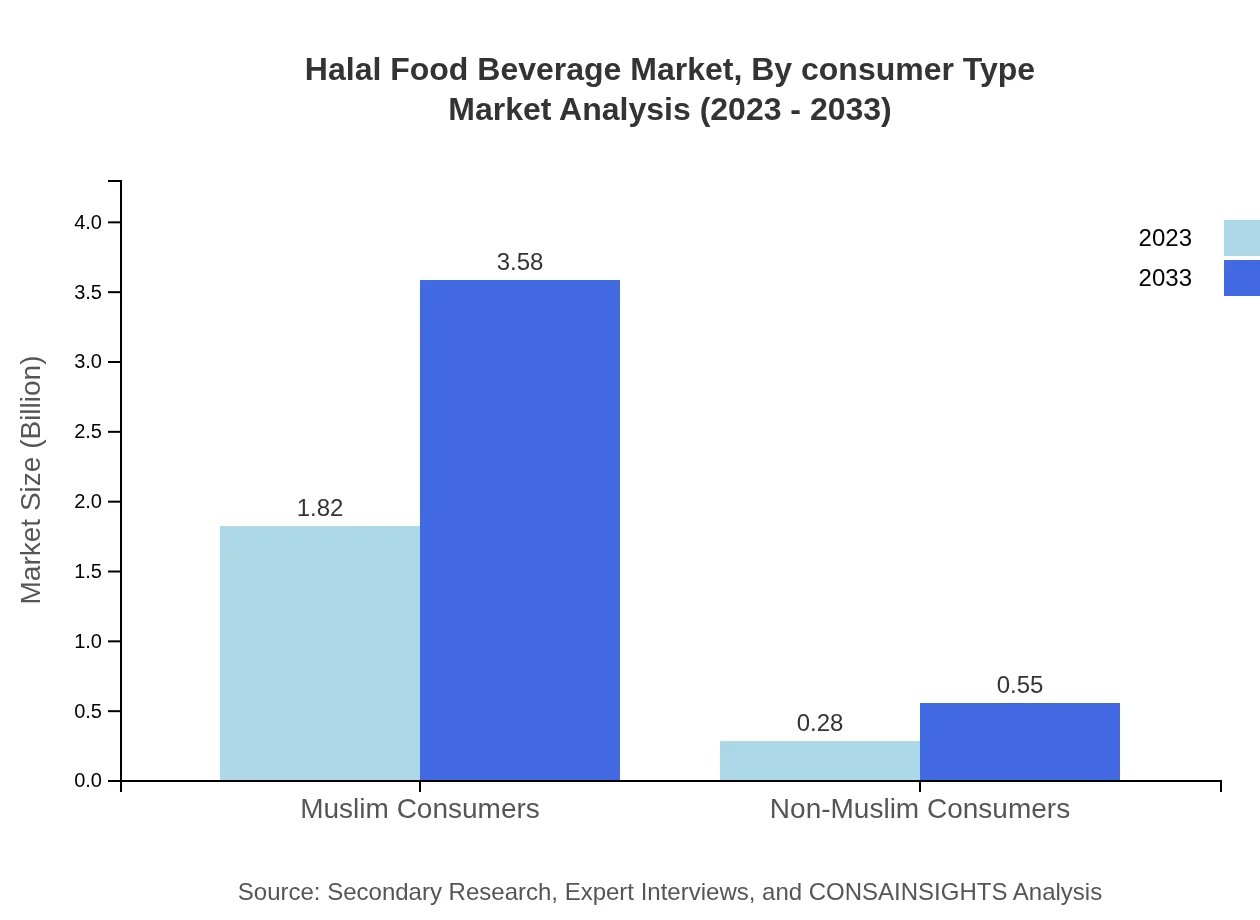

Halal Food Beverage Market Analysis By Consumer Type

The consumer base for Halal products includes a significant proportion of Muslim consumers, commanding 86.73% of the market in 2023 ($1.82 billion). Non-Muslim consumers are increasingly adopting Halal foods for health and ethical reasons, with a market size of $0.28 billion, expected to grow to $0.55 billion by 2033.

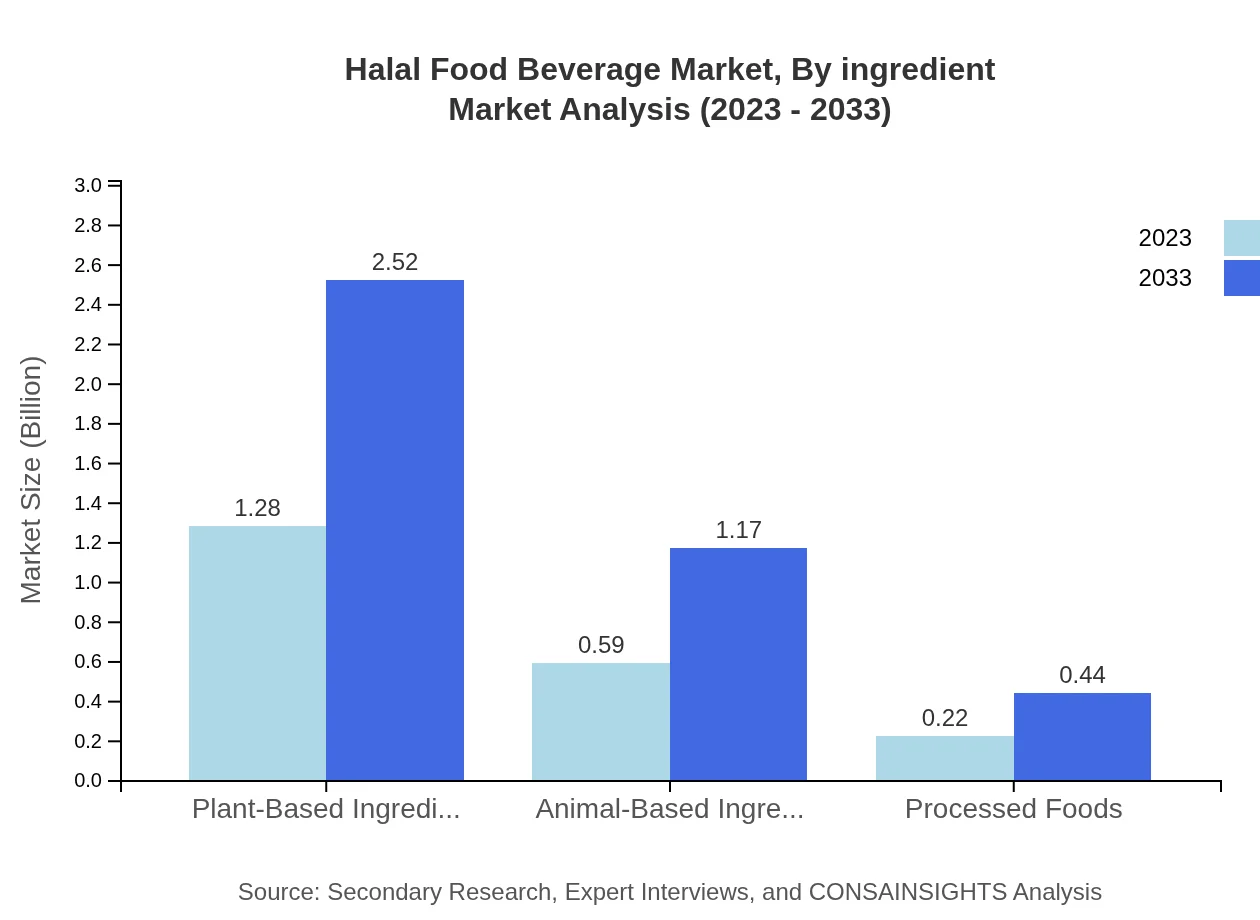

Halal Food Beverage Market Analysis By Ingredient

Plant-Based Ingredients dominate the Halal Food Beverage market with a significant share of 61.1% in 2023 ($1.28 billion), projected to expand to $2.52 billion by 2033. Animal-based ingredients also show demand, expected to rise from $0.59 billion to $1.17 billion over the same period.

Halal Food Beverage Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Halal Food Beverage Industry

Nestlé:

A global leader in food and beverage products with a vast range of Halal-certified lines catering to diverse consumer needs.Unilever:

A multinational company with a significant portfolio of Halal-certified products, actively promoting health-conscious food options.Kraft Heinz Company:

Known for its wide-ranging food products, the company has invested in developing Halal products to reach a broader audience.Al-Falah Halal:

An emerging player dedicated to offering high-quality Halal products, emphasizing local sourcing and community engagement.Cargill :

A major player in the food sector providing a range of Halal ingredients and solutions for various food manufacturers.We're grateful to work with incredible clients.

FAQs

What is the market size of halal Food Beverage?

The global halal food and beverage market is projected to reach $2.1 trillion by 2033, growing at a CAGR of 6.8%. This significant demand reflects an expansive growth trajectory alongside increasing consumer preferences for halal products.

What are the key market players or companies in the halal Food Beverage industry?

Key players in the halal food and beverage industry include major market leaders like Nestlé, Unilever, and Tyson Foods. These companies are recognized for their halal-certified products and robust distribution networks that cater to diverse populations.

What are the primary factors driving the growth in the halal food Beverage industry?

The main growth drivers include rising Muslim populations, increasing awareness about halal dietary laws, and a growing trend towards health and ethical food consumption. Additionally, expansions in global trade allow wider access to halal products.

Which region is the fastest Growing in the halal Food Beverage?

The fastest-growing region for the halal food and beverage market is Europe, with a market size projected to grow from $0.71 trillion in 2023 to $1.40 trillion by 2033, capturing a significant segment of global consumers.

Does Consainsights provide customized market report data for the halal Food Beverage industry?

Yes, Consainsights offers customized market report data tailored to specific business needs within the halal food and beverage industry. Clients can receive insights based on their unique criteria.

What deliverables can I expect from this halal Food Beverage market research project?

Deliverables typically include detailed market analysis, segmentation data, consumer insights, and competitive landscape reviews. Customized reports can further enhance decision-making for stakeholders in the halal food and beverage sector.

What are the market trends of halal Food Beverage?

Current trends in the halal food and beverage market include significant growth in plant-based ingredients and increasing online sales, with 86.73% of the market share for halal products recorded online, highlighting shifts towards digital consumer engagement.