Hardware Wallet Market Report

Published Date: 31 January 2026 | Report Code: hardware-wallet

Hardware Wallet Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive overview of the Hardware Wallet industry from 2023 to 2033, focusing on market trends, size, segmentation, regional insights, and future forecasts.

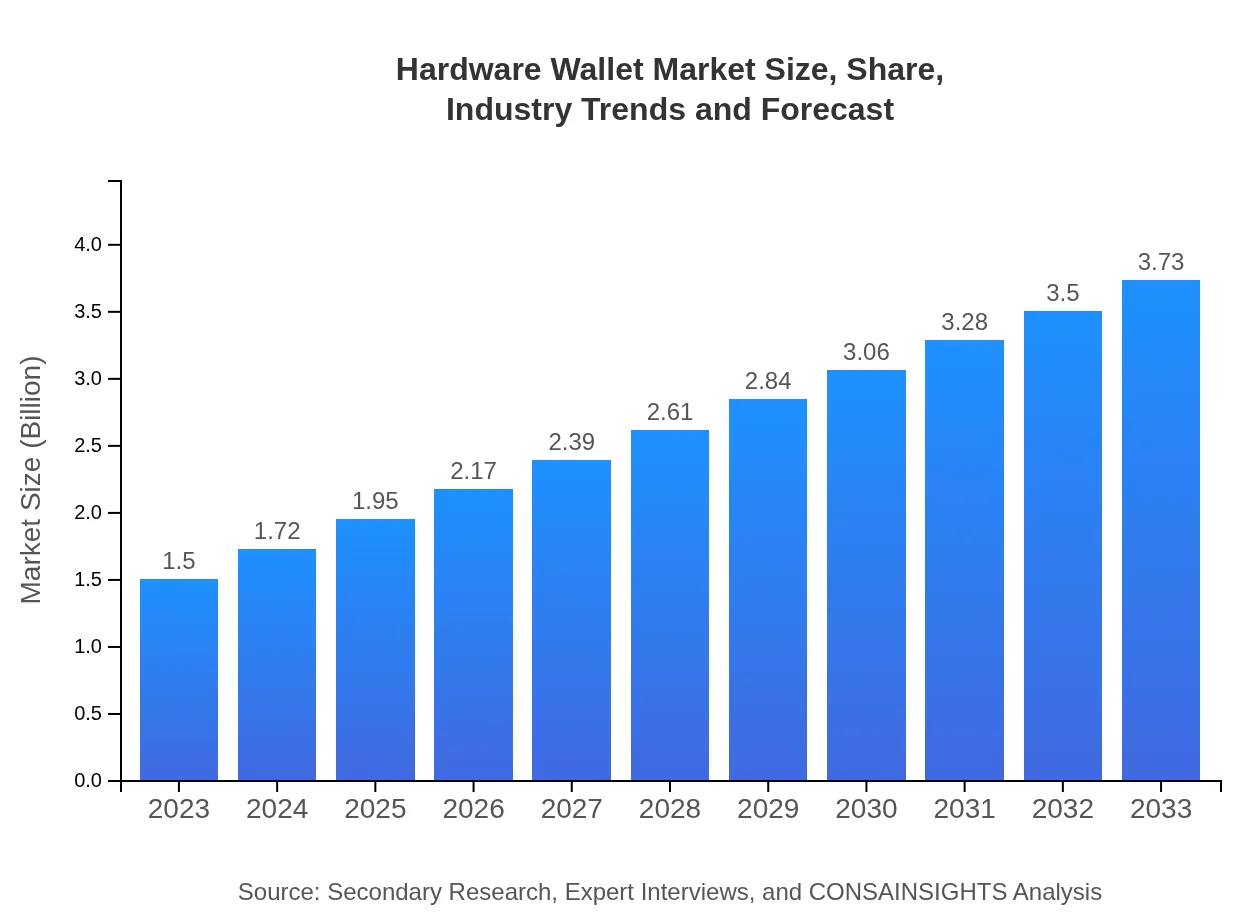

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $3.73 Billion |

| Top Companies | Ledger, Trezor, KeepKey, Coldcard |

| Last Modified Date | 31 January 2026 |

Hardware Wallet Market Overview

Customize Hardware Wallet Market Report market research report

- ✔ Get in-depth analysis of Hardware Wallet market size, growth, and forecasts.

- ✔ Understand Hardware Wallet's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hardware Wallet

What is the Market Size & CAGR of Hardware Wallet market in 2023-2033?

Hardware Wallet Industry Analysis

Hardware Wallet Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hardware Wallet Market Analysis Report by Region

Europe Hardware Wallet Market Report:

Europe's market is set to rise from $0.46 billion in 2023 to $1.13 billion by 2033, thanks to stringent regulatory measures on data security and a growing number of crypto investors seeking secure storage solutions.Asia Pacific Hardware Wallet Market Report:

Asia Pacific's Hardware Wallet market is poised for substantial growth, increasing from $0.26 billion in 2023 to $0.65 billion by 2033. The region's expanding digital currency adoption, coupled with a surge in cybersecurity awareness, supports this growth.North America Hardware Wallet Market Report:

North America leads the market, with the region projected to grow from $0.58 billion in 2023 to $1.44 billion by 2033. A robust investment landscape and high technological adoption rates play a significant role in market expansion.South America Hardware Wallet Market Report:

In South America, the market is expected to grow from $0.06 billion in 2023 to $0.15 billion by 2033. Factors such as the increase in cryptocurrencies and mobile payment solutions are driving demand for hardware wallets.Middle East & Africa Hardware Wallet Market Report:

The Middle East and Africa market is anticipated to grow from $0.14 billion in 2023 to $0.36 billion by 2033. Rising investments in fintech and growing awareness of cryptocurrency security are key drivers.Tell us your focus area and get a customized research report.

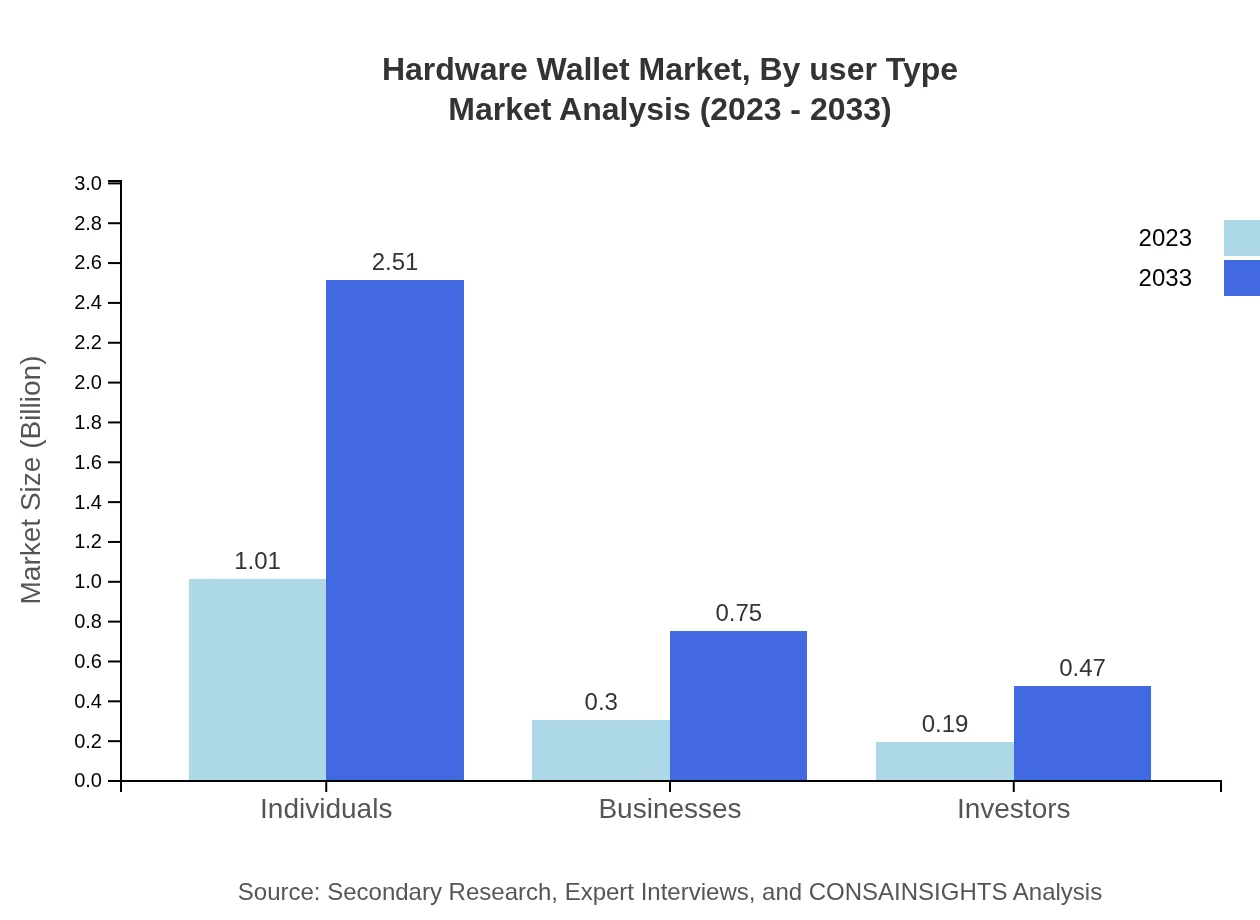

Hardware Wallet Market Analysis By User Type

In 2023, the individual user segment represents the largest market share, expected to reach $1.01 billion, and grow to $2.51 billion by 2033. Businesses account for $0.30 billion, growing to $0.75 billion, and investors are projected to grow from $0.19 billion to $0.47 billion in the same period.

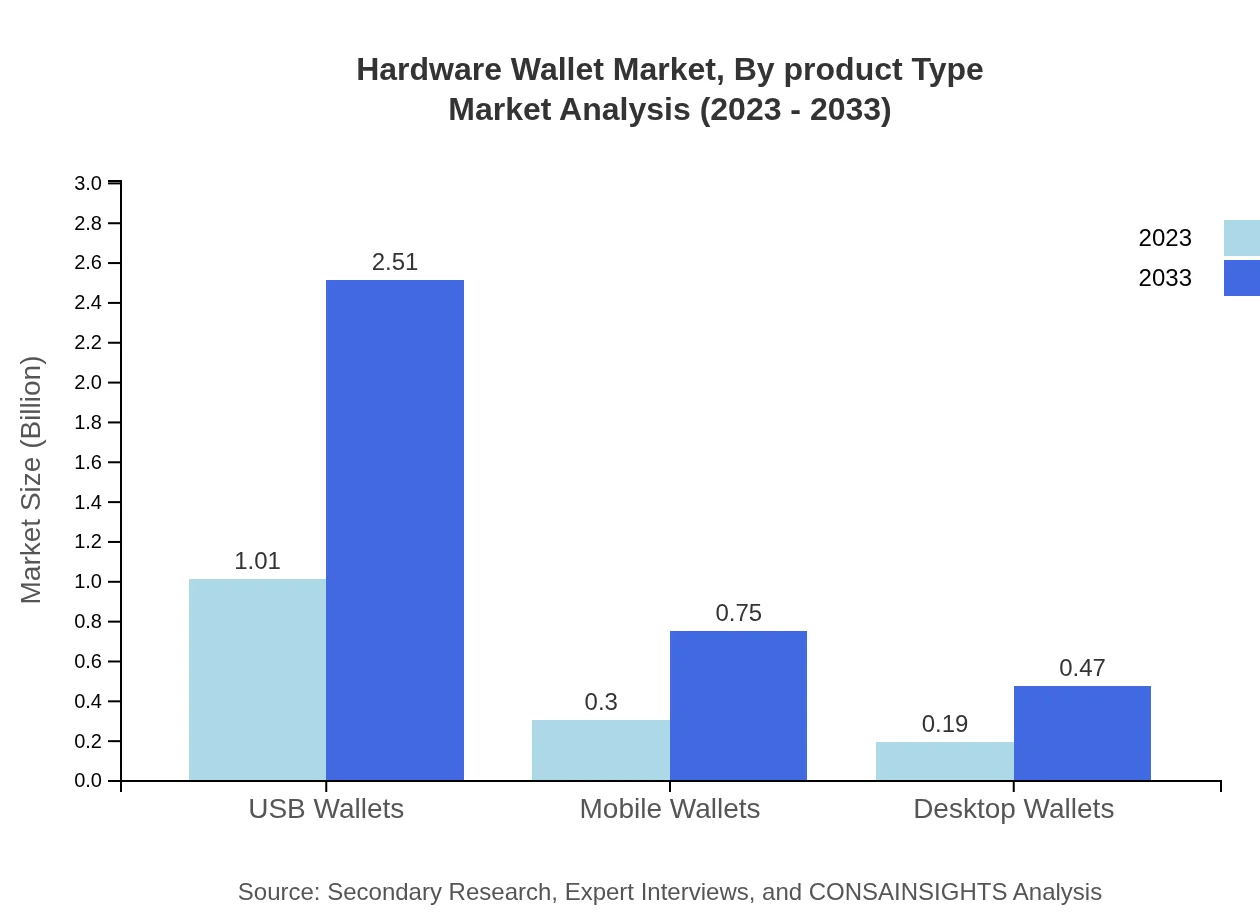

Hardware Wallet Market Analysis By Product Type

The market for USB wallets is substantial, with an expected growth from $1.01 billion in 2023 to $2.51 billion by 2033. Mobile wallets show growth from $0.30 billion to $0.75 billion, while desktop wallets are expected to expand from $0.19 billion to $0.47 billion.

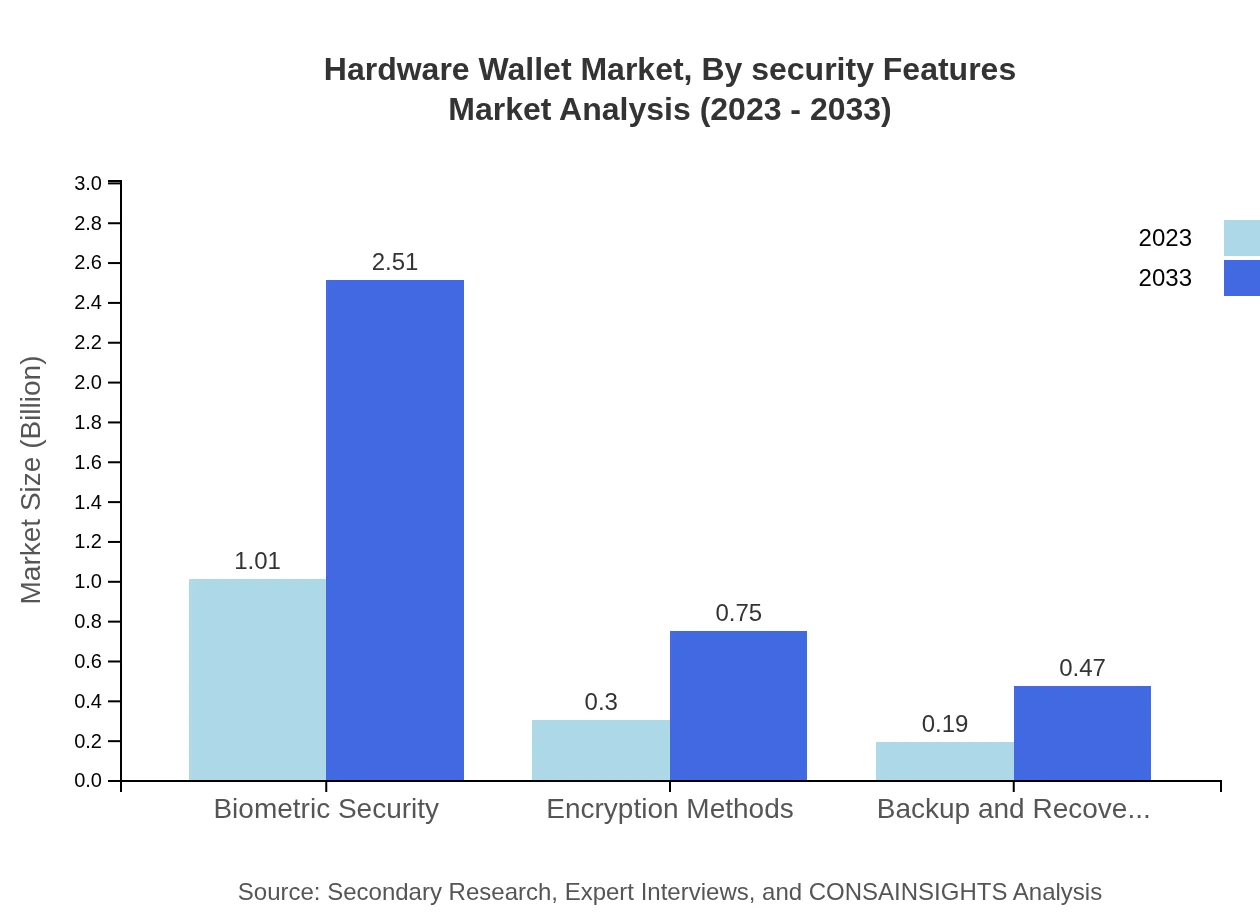

Hardware Wallet Market Analysis By Security Features

Main security features in demand include biometric security, encryption methods, and backup options, with biometric security projected to grow from $1.01 billion to $2.51 billion by 2033. Encryption methods and backup options start at $0.30 billion and $0.19 billion respectively and are expected to show clear growth.

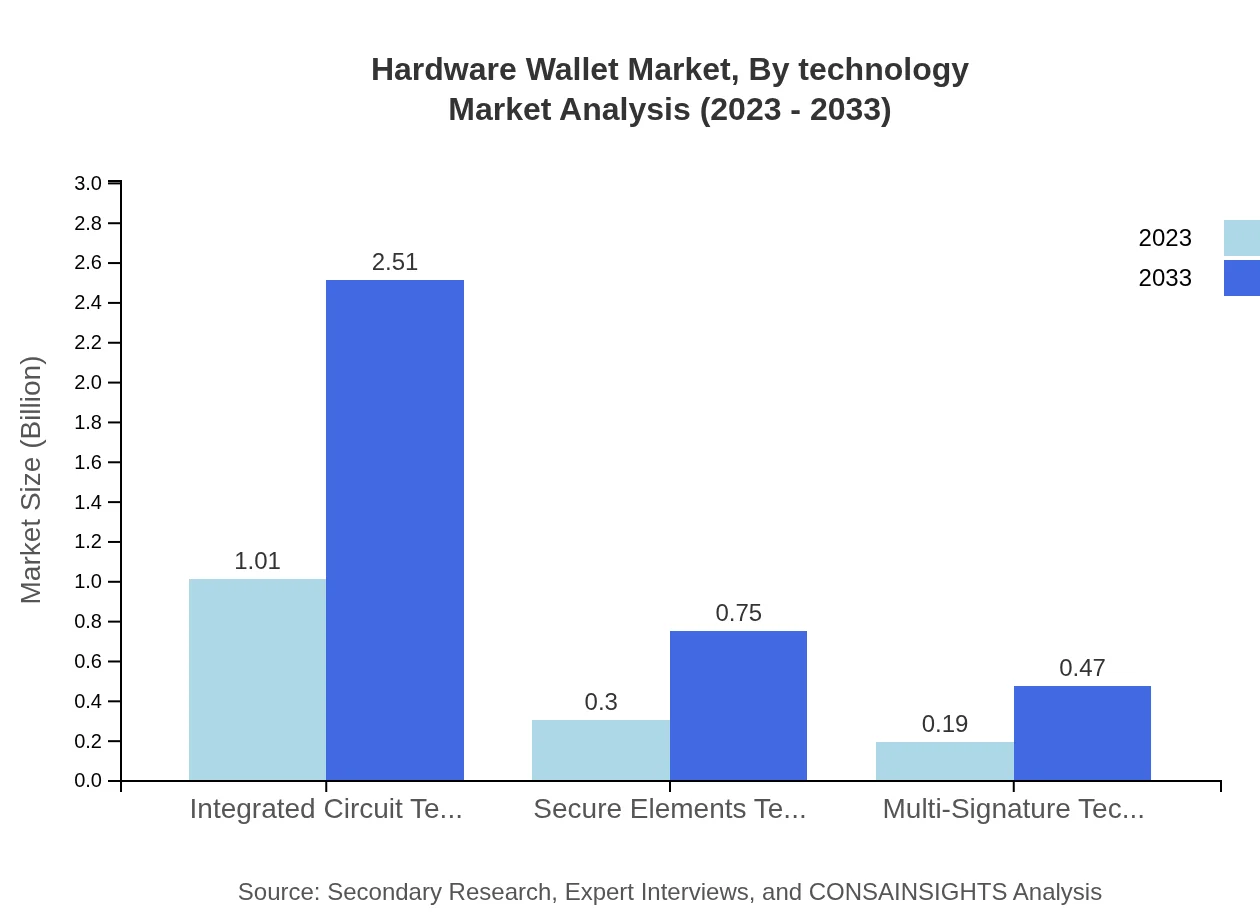

Hardware Wallet Market Analysis By Technology

Technological advancements are crucial. Integrated circuit technology maintains a significant share, witnessing a growth from $1.01 billion to $2.51 billion over the decade. Secure elements and multi-signature technology are also essential, growing from $0.30 billion to $0.75 billion and $0.19 billion to $0.47 billion respectively.

Hardware Wallet Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hardware Wallet Industry

Ledger:

Ledger is a prominent player known for its advanced security features and user-friendly devices, leading the hardware wallet market with innovative solutions.Trezor:

Trezor offers a range of secure hardware wallets and emphasizes open-source software, which enhances security and transparency in cryptocurrency storage.KeepKey:

KeepKey provides premium hardware wallets with integrated exchange features, appealing to both new and experienced cryptocurrency users.Coldcard:

Coldcard products focus on high-security features and hardware specifically designed for Bitcoin, catering to security-first users.We're grateful to work with incredible clients.

FAQs

What is the market size of hardware Wallet?

The global hardware wallet market is currently valued at approximately $1.5 billion and is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.2% from 2023 to 2033, indicating robust growth driven by increasing demand for secure digital asset storage.

What are the key market players or companies in this hardware Wallet industry?

Key players in the hardware wallet market include Ledger, Trezor, KeepKey, SafePal, and Ellipal. These companies dominate the landscape by offering advanced security features and user-friendly interfaces for managing cryptocurrencies.

What are the primary factors driving the growth in the hardware Wallet industry?

The growth in the hardware wallet industry is primarily driven by the rising adoption of cryptocurrencies, increasing cybersecurity threats, and a growing awareness about the importance of secure digital assets among investors and businesses.

Which region is the fastest Growing in the hardware Wallet?

North America is poised to be the fastest-growing region in the hardware wallet market, with a market size projected to increase from $0.58 billion in 2023 to $1.44 billion by 2033, reflecting a significant demand surge for secure crypto storage.

Does ConsaInsights provide customized market report data for the hardware Wallet industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the hardware wallet industry, allowing clients to gain insights relevant to their business strategies and market positioning.

What deliverables can I expect from this hardware Wallet market research project?

From the hardware-wallet market research project, expect detailed reports, market size analysis, growth projections, competitive landscape evaluations, and insights on regional trends and consumer behaviors to aid decision-making.

What are the market trends of hardware Wallet?

Market trends in the hardware wallet sector include advancements in biometric security features, the integration of multi-signature technologies, and an increasing focus on user-friendly designs to accommodate both individuals and businesses.