Hay Market Report

Published Date: 02 February 2026 | Report Code: hay

Hay Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Hay market, encompassing current trends, regional growth, technological advancements, and forecasts from 2023 to 2033, aimed at industry stakeholders and investors.

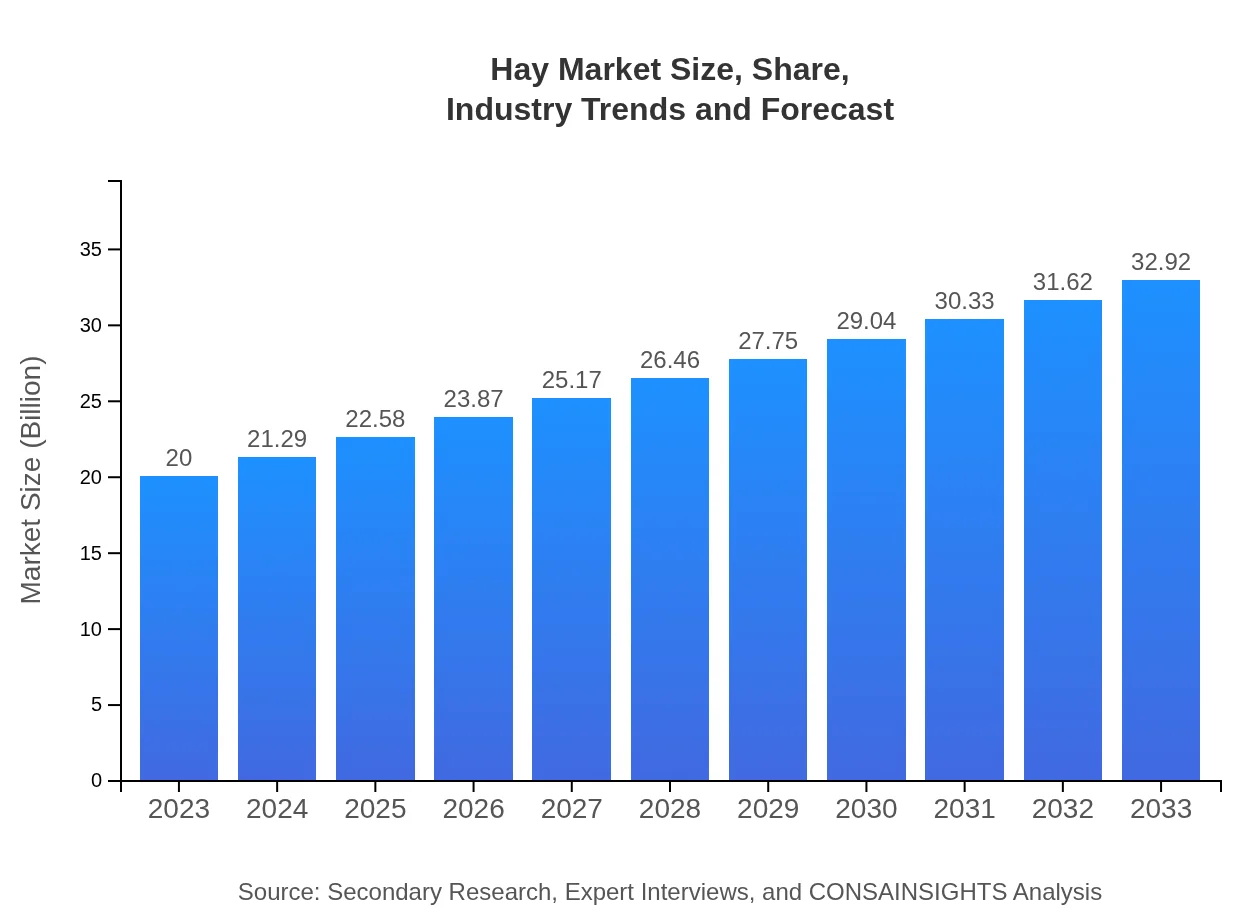

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $32.92 Billion |

| Top Companies | Hay USA, Royalty Hay, Western Hay |

| Last Modified Date | 02 February 2026 |

Hay Market Overview

Customize Hay Market Report market research report

- ✔ Get in-depth analysis of Hay market size, growth, and forecasts.

- ✔ Understand Hay's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hay

What is the Market Size & CAGR of Hay market in 2023 and 2033?

Hay Industry Analysis

Hay Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hay Market Analysis Report by Region

Europe Hay Market Report:

The European market is projected to grow from $4.87 billion in 2023 to $8.02 billion by 2033, driven by increased demand from both livestock and equestrian sectors. European Union regulations promoting sustainable agriculture practices are influencing production methods, with organic hay gaining popularity.Asia Pacific Hay Market Report:

The Asia Pacific region is witnessing robust growth in the Hay market, with a projected increase from $4.31 billion in 2023 to $7.10 billion in 2033. The rise in livestock farming, coupled with an increasing demand for quality animal feed, bolsters market performance. Countries such as China and India are key players, focusing on enhancing forage quality and distribution efficiency.North America Hay Market Report:

North America, particularly the United States and Canada, is the largest market, expected to expand from $6.42 billion in 2023 to $10.57 billion in 2033. The focus on high quality, organic hay products reflects changing consumer preferences, while technological innovations in farming continue to enhance productivity and sustainability.South America Hay Market Report:

In South America, the Hay market is expected to grow from $1.80 billion in 2023 to $2.96 billion by 2033. The growth is driven by rising meat and dairy production as global demand for protein increases. Brazil and Argentina are leading producers, leveraging favorable climatic conditions for hay cultivation.Middle East & Africa Hay Market Report:

In the Middle East and Africa, the Hay market is anticipated to rise from $2.60 billion in 2023 to $4.27 billion in 2033. The demand for hay is increasing in response to growing livestock sectors and the need for quality forage. Investment in agricultural practices and infrastructure improvements are essential for market growth.Tell us your focus area and get a customized research report.

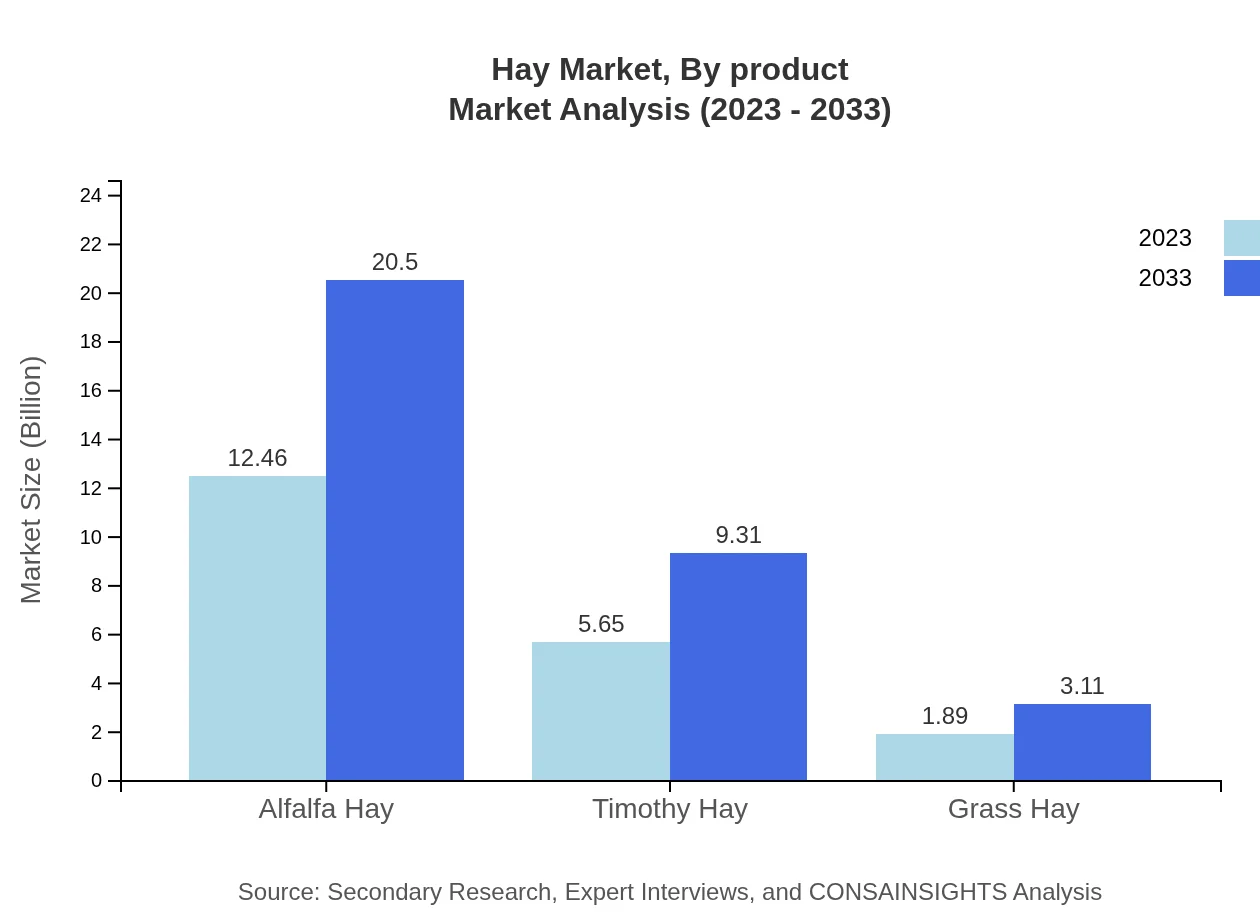

Hay Market Analysis By Product

Alfalfa hay dominates the market, projected to grow significantly from $12.46 billion in 2023 to $20.50 billion by 2033, capturing 62.29% of the market share. Timothy and Grass Hay follow, with substantial market growth expected due to their diverse applications in livestock and equestrian uses.

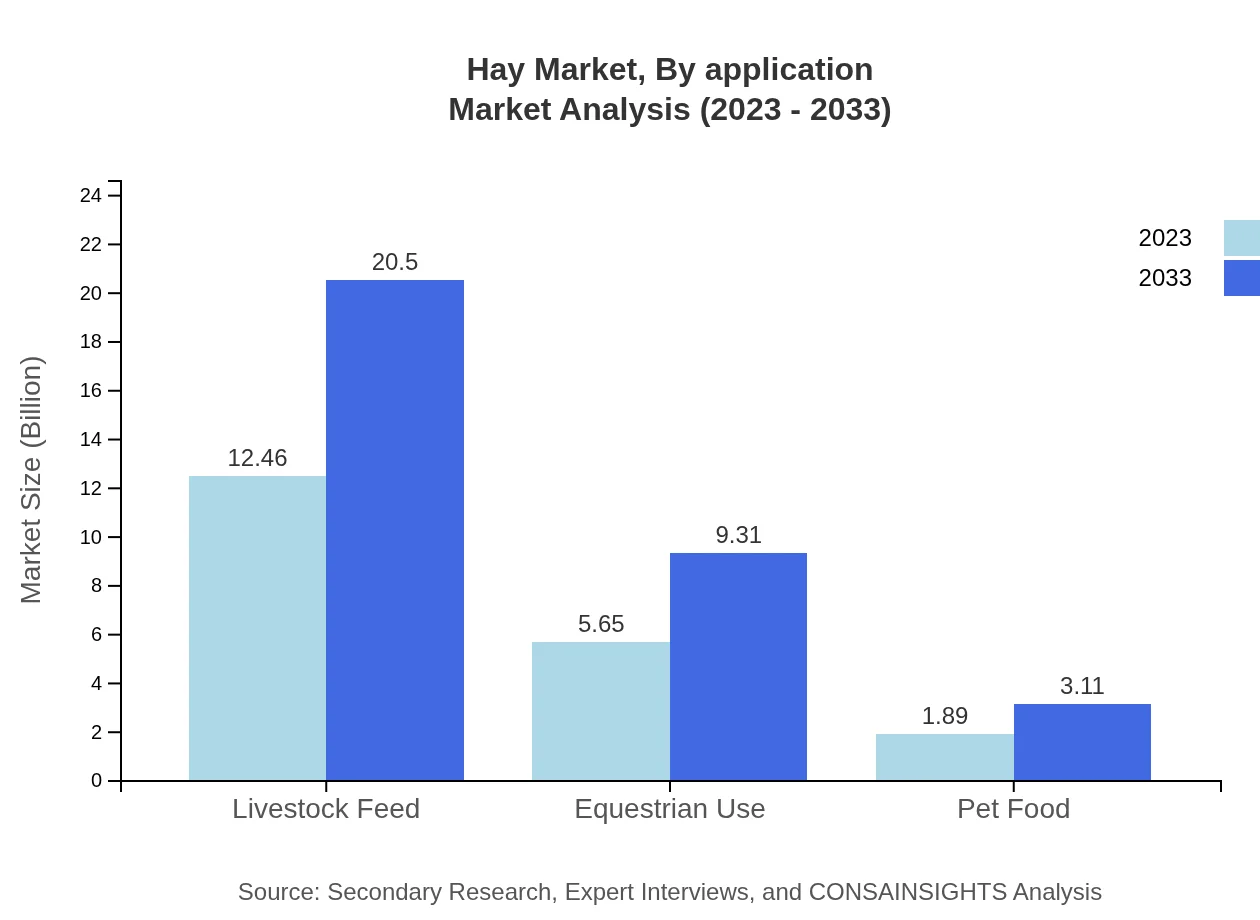

Hay Market Analysis By Application

The livestock feed segment leads the Hay market, accounting for 62.29% in 2023, with projections indicating substantial growth alongside the rising demand for pet food and equestrian use. This trend highlights the importance of quality forage across various animal farming practices.

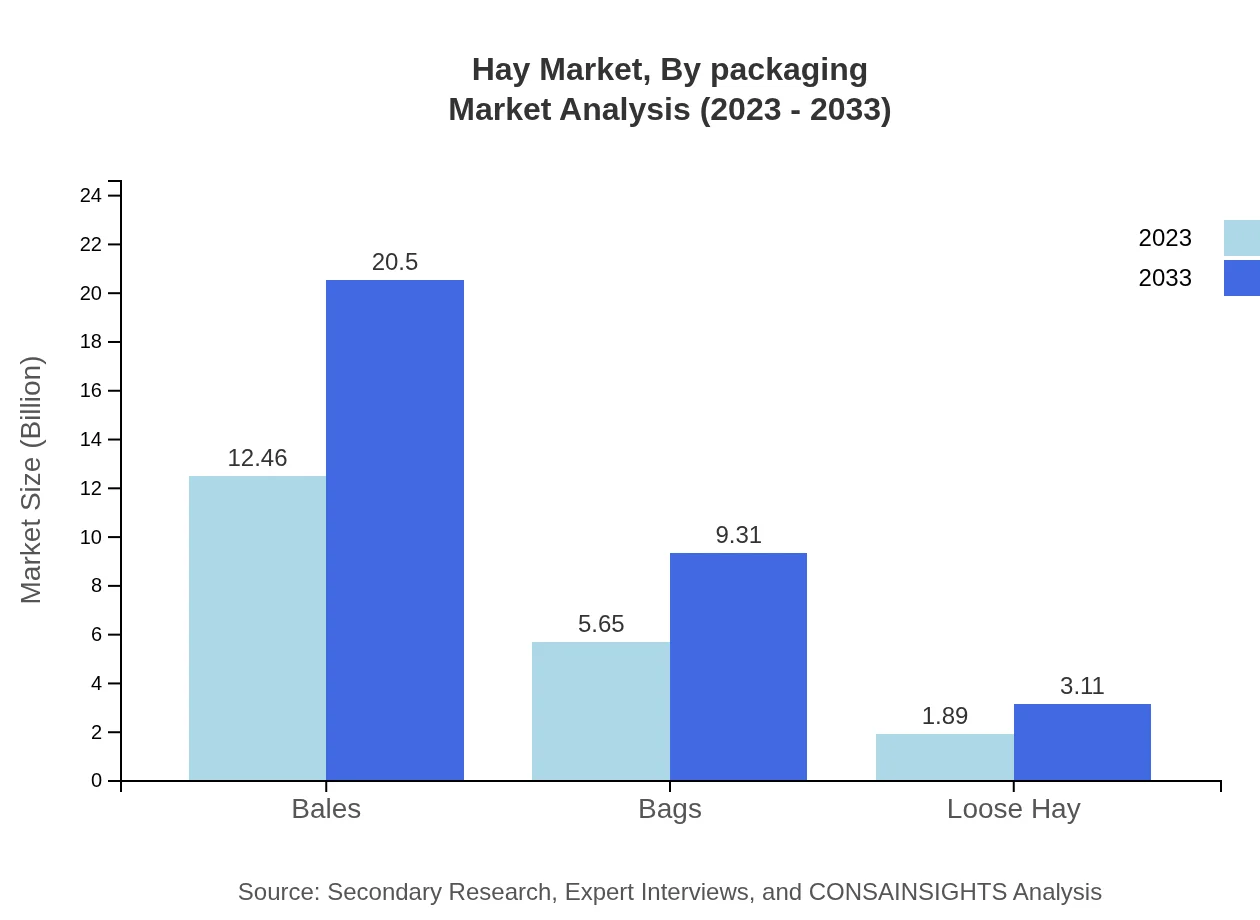

Hay Market Analysis By Packaging

Bales remain the most popular packaging format, holding 62.29% of the market share currently. With growing preference for convenience and quality assurance, other formats such as bags and loose hay are also experiencing robust growth, particularly for retail and online sales.

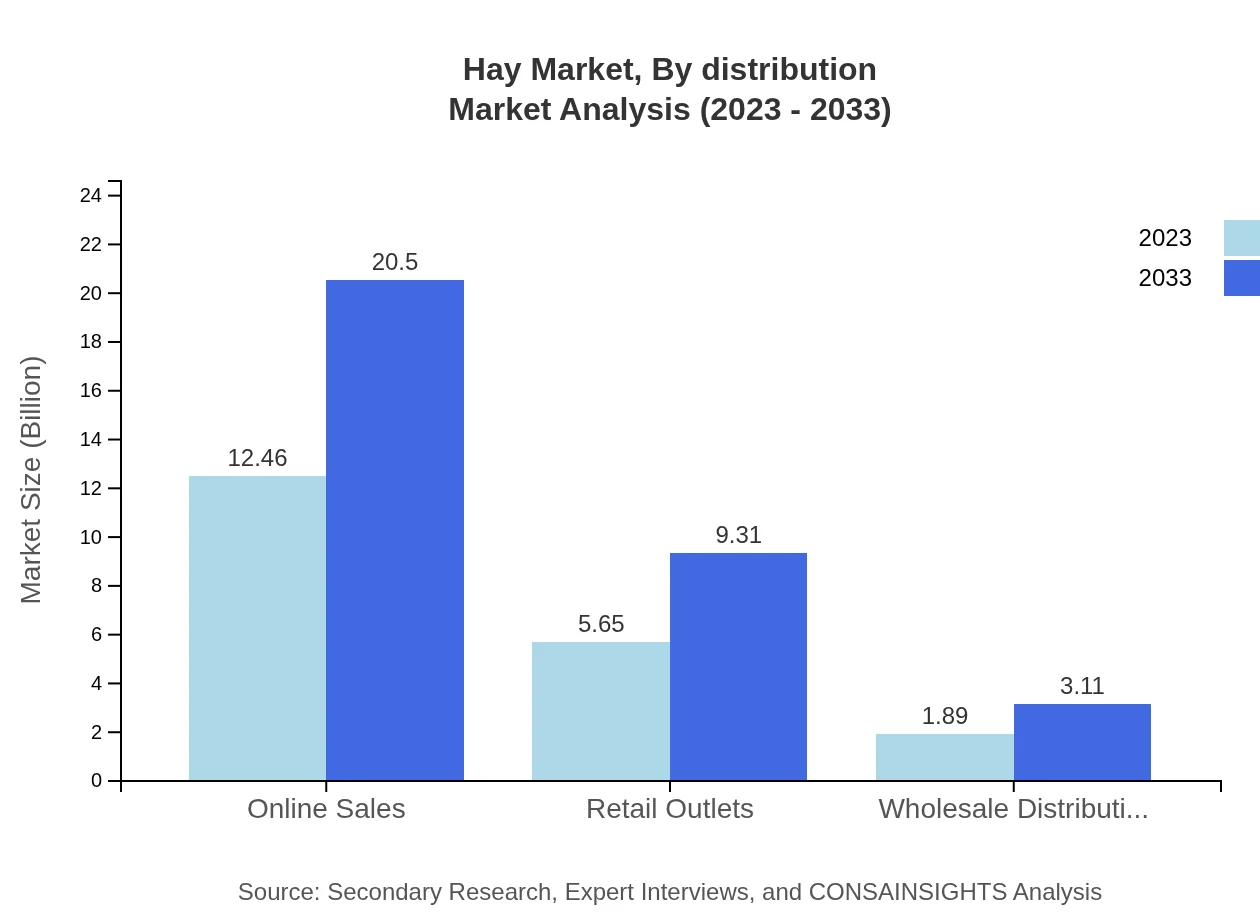

Hay Market Analysis By Distribution

Online sales are becoming increasingly significant, commanding 62.29% of the market in 2023. This growth is driven by the convenience offered to customers and a broader reach compared to traditional retail outlets, which also contribute substantially to the overall distribution landscape.

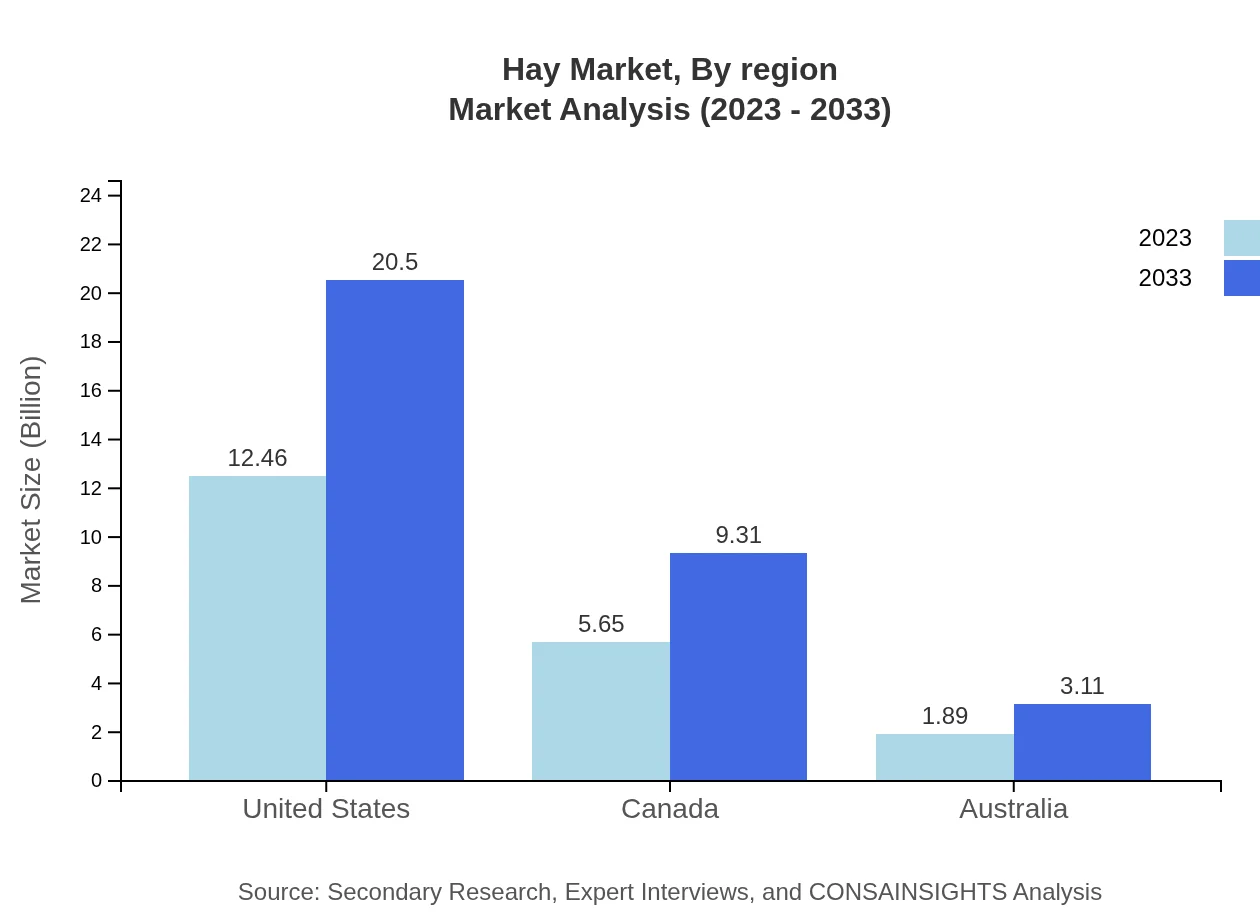

Hay Market Analysis By Region

Key producers in the Hay market include the United States, Canada, and Australia, collectively dominating production and contributing to more than 80% of the global output. Advances in farming practices and technologies among these countries are critical for maintaining competitive advantages in the global market.

Hay Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hay Industry

Hay USA:

A leading producer in the US focusing on high-quality alfalfa and Timothy hay with extensive distribution channels that cater to livestock feed and equestrian markets.Royalty Hay:

An innovator in organic hay production, Royalty Hay is recognized for its sustainable farming practices, offering a wide range of products for both livestock and pet food.Western Hay:

Specializes in exporting premium hay products globally, primarily catering to the equestrian market, backed by strong quality assurance programs.We're grateful to work with incredible clients.

FAQs

What is the market size of hay?

The global hay market is projected to reach a size of $20 billion by 2033, growing at a CAGR of 5% from 2023. This growth reflects increased demand across various sectors such as livestock feed and equestrian use.

What are the key market players or companies in this hay industry?

Key players in the hay market include major agricultural producers and suppliers. These companies focus on sustainable practices and innovation to meet demand and can significantly influence market trends through their operational capacity.

What are the primary factors driving the growth in the hay industry?

Growth in the hay industry is driven by increased livestock production globally, rising consumer demand for organic and quality animal feed, and expansion in equestrian sports, pushing for higher production of specific hay types.

Which region is the fastest Growing in the hay market?

The fastest-growing regions in the hay market include North America and Europe. By 2033, North America is projected to reach $10.57 billion, while Europe will grow to $8.02 billion, indicating robust agricultural practices.

Does ConsaInsights provide customized market report data for the hay industry?

Yes, ConsaInsights offers customized market reports tailored to client specifications in the hay industry. This includes specific segmentation data, growth projections, and regional insights to support strategic decision-making.

What deliverables can I expect from this hay market research project?

Deliverables from a hay market research project include comprehensive reports, market size analysis, growth forecasts, competitive landscape assessments, and customized insights to aid in decision-making for stakeholders.

What are the market trends of hay?

Key trends in the hay market include a shift towards organic hay production, increased online sales channels, and a burgeoning focus on sustainable agricultural practices, reflecting changing consumer preferences and regulatory pressures.