Hcm Market Report

Published Date: 02 February 2026 | Report Code: hcm

Hcm Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Human Capital Management (HCM) market, detailing insights and data forecasts from 2023 to 2033, including market size, growth rates, and key industry trends.

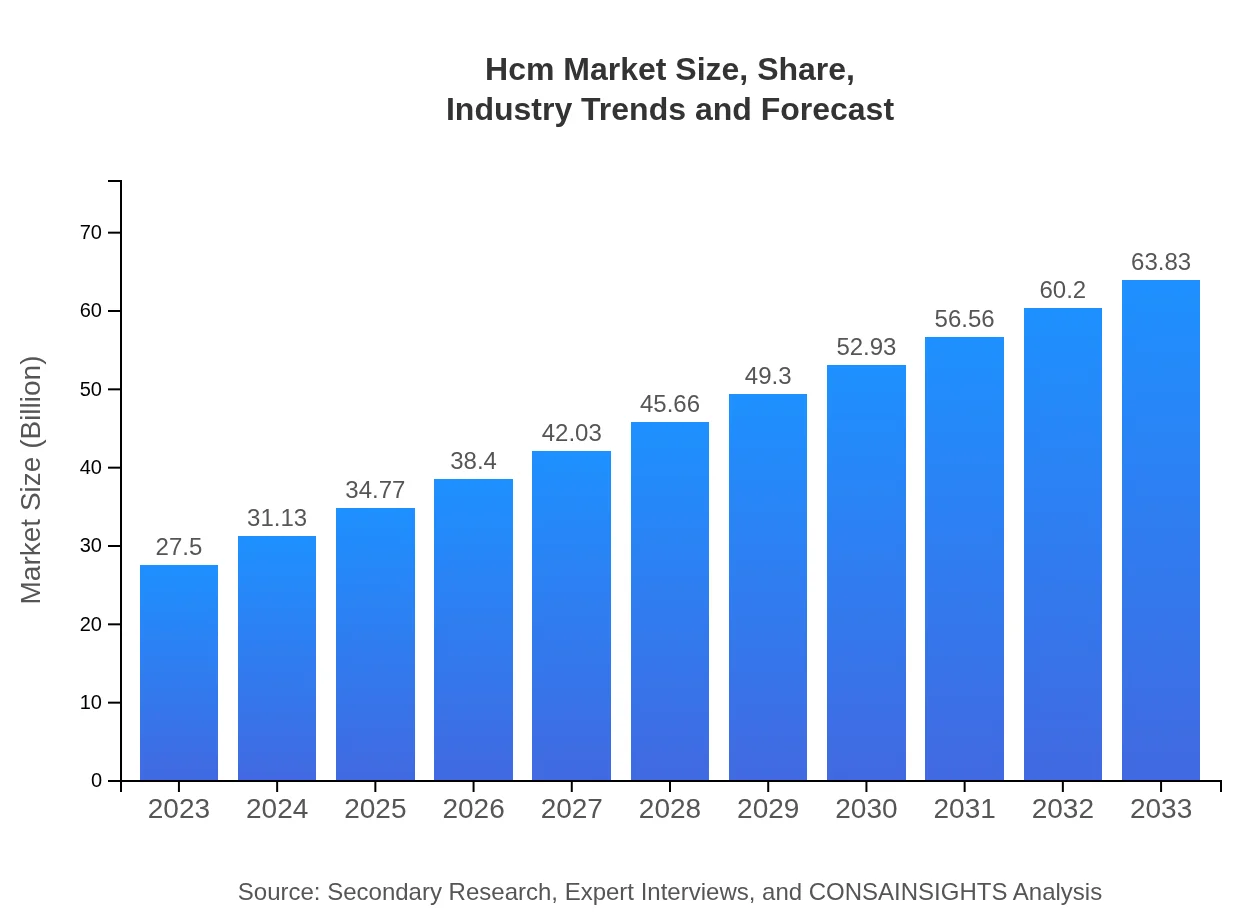

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $27.50 Billion |

| CAGR (2023-2033) | 8.5% |

| 2033 Market Size | $63.83 Billion |

| Top Companies | Workday, Inc., SAP SuccessFactors, Oracle HCM Cloud, ADP, Ceridian Dayforce |

| Last Modified Date | 02 February 2026 |

Hcm Market Overview

Customize Hcm Market Report market research report

- ✔ Get in-depth analysis of Hcm market size, growth, and forecasts.

- ✔ Understand Hcm's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hcm

What is the Market Size & CAGR of Hcm market in 2023?

Hcm Industry Analysis

Hcm Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hcm Market Analysis Report by Region

Europe Hcm Market Report:

The European HCM market is projected to increase from $8.70 billion in 2023 to around $20.18 billion in 2033. The market benefits from stringent labor laws and compliance requirements, which drive organizations to adopt sophisticated HCM solutions.Asia Pacific Hcm Market Report:

In 2023, the HCM market in the Asia Pacific region is valued at approximately $5.18 billion, with projections to reach around $12.03 billion by 2033, representing significant growth driven by increasing investment in advanced HR technologies and rising awareness of employee experience.North America Hcm Market Report:

North America leads the HCM market with a value of $9.56 billion in 2023, expected to grow to approximately $22.19 billion by 2033. This growth is propelled by established players, leading technology developments, and a high demand for innovative HCM solutions.South America Hcm Market Report:

The South American HCM market is anticipated to grow from $2.07 billion in 2023 to $4.81 billion by 2033, fueled by the digital transformation of HR practices and an emphasis on talent acquisition and retention strategies across emerging economies.Middle East & Africa Hcm Market Report:

In the Middle East and Africa, the HCM market size is forecasted to grow from $1.99 billion in 2023 to approximately $4.61 billion by 2033, supported by increasing workforce diversity and the growing adoption of digital HR platforms.Tell us your focus area and get a customized research report.

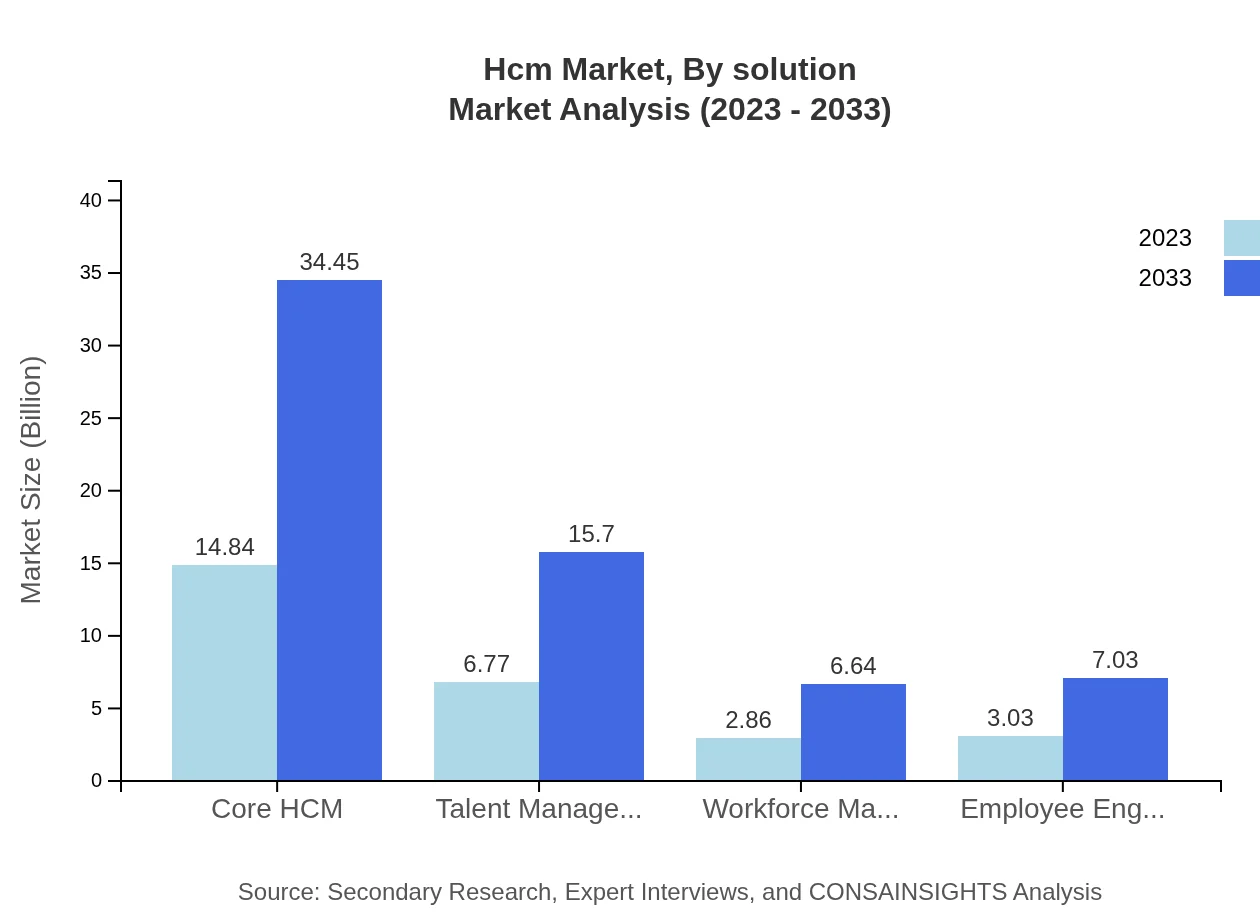

Hcm Market Analysis By Solution

The HCM market is segmented by solution into several key areas: Core HCM, Talent Management, Workforce Management, and Employee Engagement. Core HCM, which includes modules for payroll, benefits, and compliance, holds the largest market share at 53.97% and is anticipated to grow from $14.84 billion in 2023 to $34.45 billion by 2033. Talent Management focuses on recruitment, performance evaluation, and career development, growing from $6.77 billion in 2023 to $15.70 billion in 2033. Workforce Management solutions enhance scheduling and labor cost management, projected to grow to $6.64 billion. Employee Engagement tools aim to improve workplace satisfaction and productivity, expected to reach $7.03 billion.

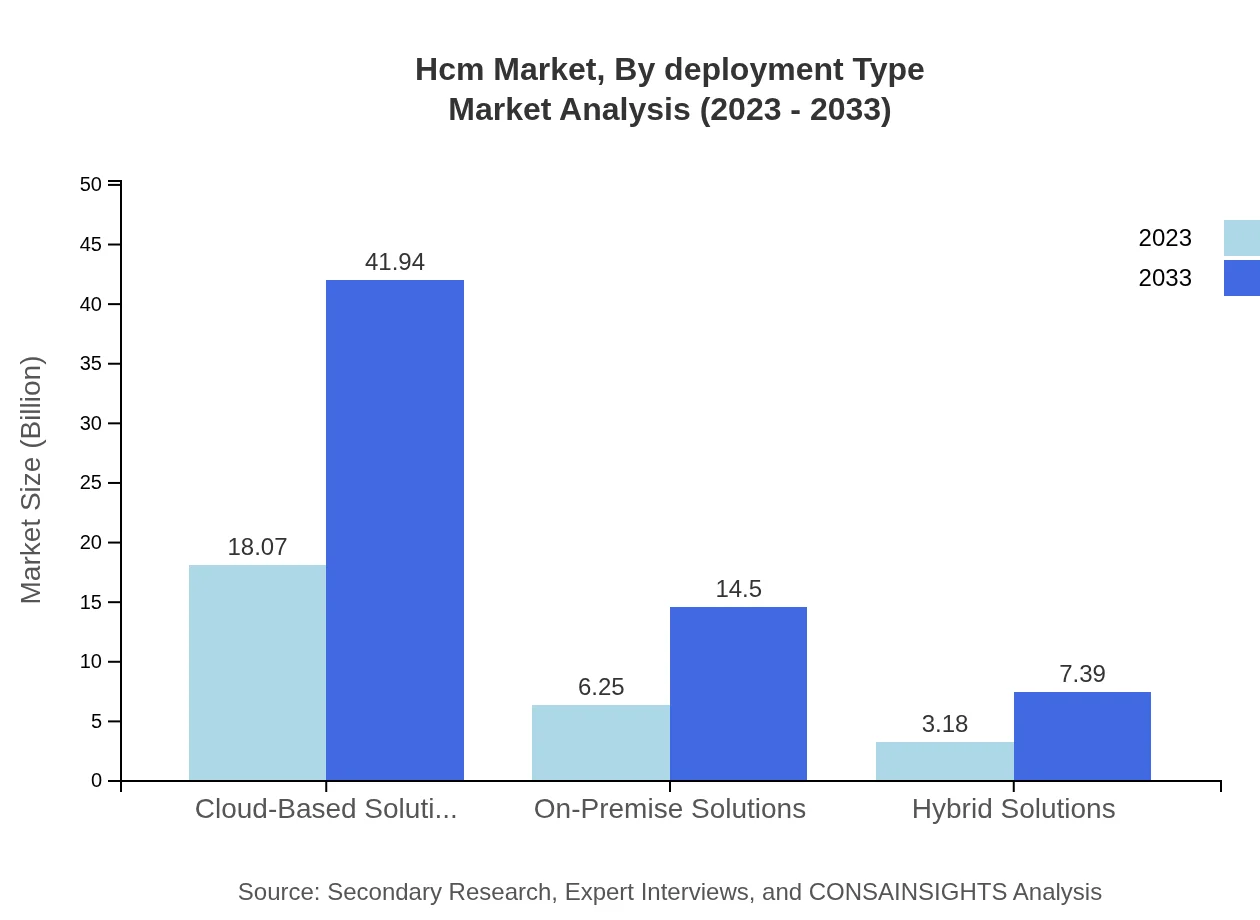

Hcm Market Analysis By Deployment Type

HCM solutions are categorized into Cloud-Based Solutions, On-Premise Solutions, and Hybrid Solutions, which play a role in shaping the market dynamics. Cloud-Based Solutions dominate the market with a share of 65.7%, growing from $18.07 billion in 2023 to $41.94 billion by 2033, driven by their flexibility and scalability. On-Premise Solutions account for 22.72% of the market, expected to increase from $6.25 billion in 2023 to $14.50 billion, while Hybrid Solutions, providing a balanced infrastructure, are also projected to grow steadily.

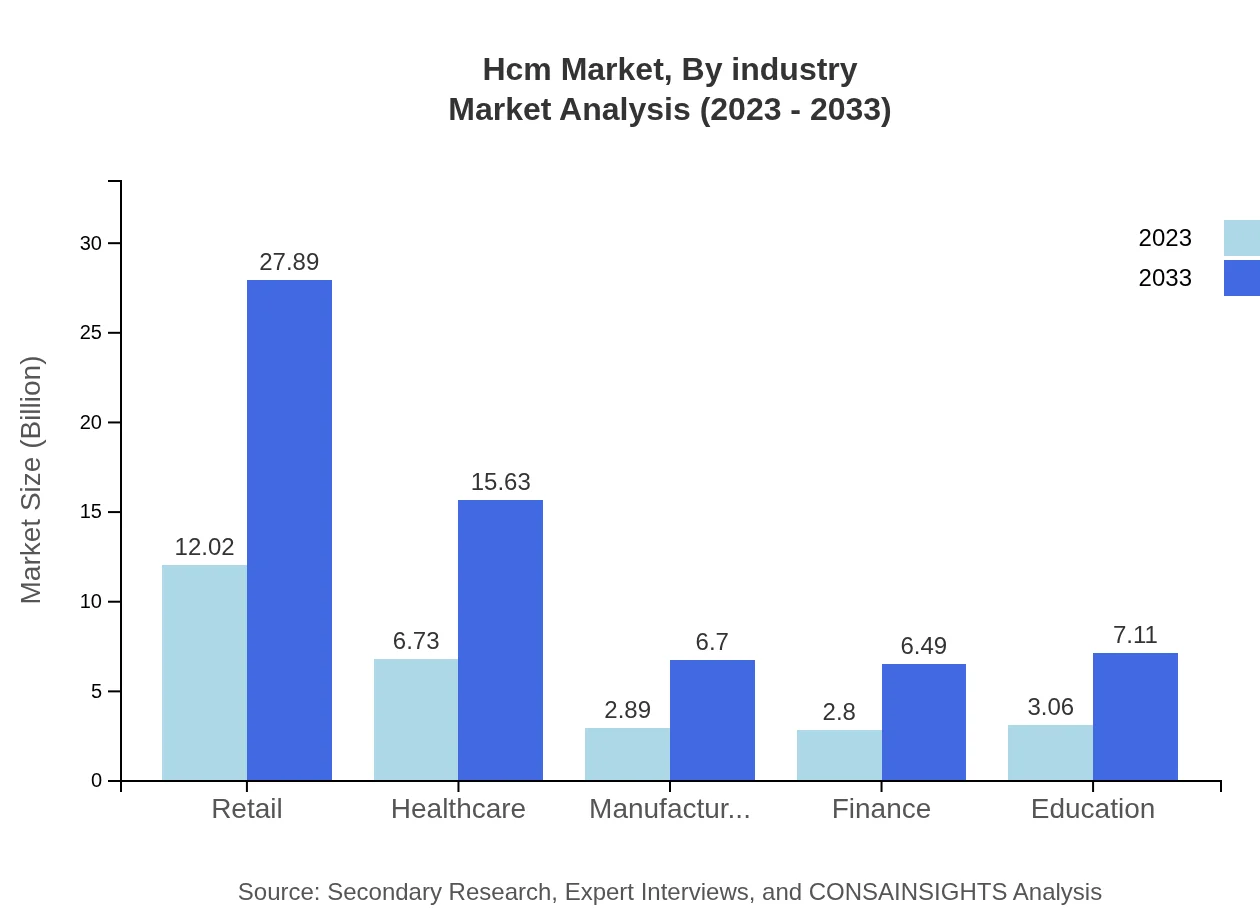

Hcm Market Analysis By Industry

Different industries exhibit varied trends in HCM adoption. Retail is a major contributor, with a market size of $12.02 billion in 2023, projected to grow to $27.89 billion by 2033, holding a share of 43.7%. Healthcare follows with an expected increase from $6.73 billion to $15.63 billion. The manufacturing sector shows a growing investment in HCM technology from $2.89 billion to $6.70 billion, while the finance industry aims to enhance operational efficiency, growing from $2.80 billion to $6.49 billion. Education also witnesses growth, from $3.06 billion in 2023 to $7.11 billion.

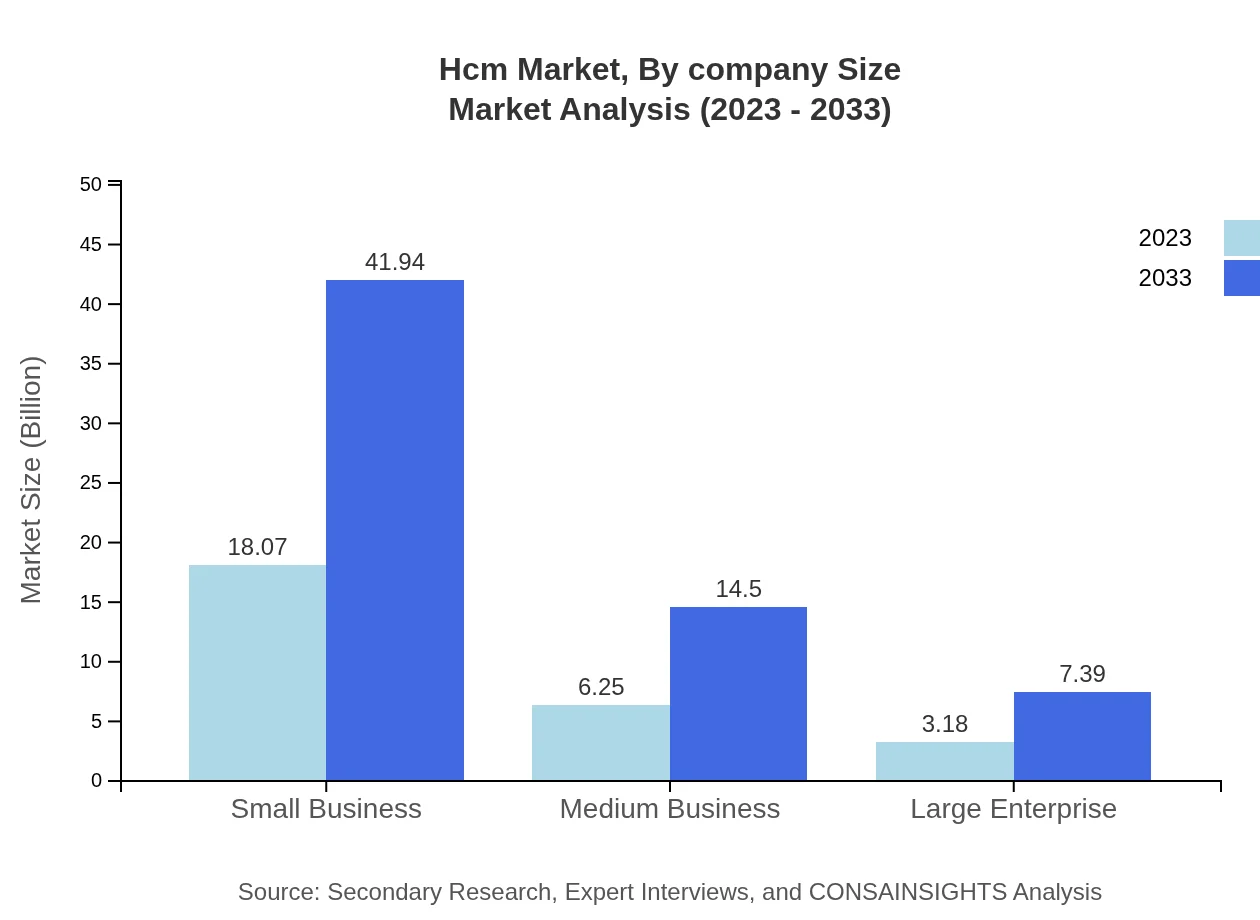

Hcm Market Analysis By Company Size

The segmentation by company size shows distinct trends where Small Businesses dominate the market with a size of $18.07 billion in 2023, maintaining a market share of 65.7% and growing to $41.94 billion by 2033. Medium-sized businesses are also expanding, projected to grow from $6.25 billion to $14.50 billion. Large Enterprises, while smaller in size, are expected to grow from $3.18 billion to $7.39 billion, highlighting their need for robust HCM systems to manage complex HR requirements.

Hcm Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hcm Industry

Workday, Inc.:

Known for its comprehensive HCM solutions, Workday offers cloud-based applications for human capital management, enabling organizations to streamline HR processes and improve workforce planning.SAP SuccessFactors:

Part of SAP's cloud offerings, SuccessFactors provides solutions for recruitment, onboarding, performance management, and employee engagement, helping organizations manage their talent effectively.Oracle HCM Cloud:

Oracle provides a robust HCM cloud platform that facilitates streamlined HR processes, talent management, and analytics-driven insights for enterprises.ADP:

As a leader in payroll services, ADP also offers comprehensive HCM solutions that integrate payroll, HR management, and compliance for small to large businesses.Ceridian Dayforce:

Ceridian offers Dayforce, a cloud-based HCM solution that facilitates human resource management with real-time data insights, enhancing operational efficiency and employee experience.We're grateful to work with incredible clients.

FAQs

What is the market size of HCM?

The global HCM market is projected to reach USD 27.5 billion by 2033, growing at a CAGR of 8.5%. In 2023, it stands at approximately USD 27.5 billion, reflecting the increasing demand for human capital management solutions across various sectors.

What are the key market players or companies in the HCM industry?

Key players in the HCM industry include established technology firms and specialized HR solution providers offering software and services that enhance workforce management, talent acquisition, and employee engagement. Significant companies drive innovation and market development.

What are the primary factors driving growth in the HCM industry?

Factors like the digitization of workplaces, rising focus on employee experience, regulatory compliance needs, and demand for data-driven HR decisions are driving growth in the HCM industry, as companies seek comprehensive solutions to optimize human resources.

Which region is the fastest Growing in the HCM market?

North America is the fastest-growing region within the HCM market, projected to grow from USD 9.56 billion in 2023 to USD 22.19 billion by 2033. This growth is fueled by rapid adoption of cloud technologies and workforce analytics.

Does ConsaInsights provide customized market report data for the HCM industry?

Yes, ConsaInsights offers customized market reports tailored to the specific needs of clients in the HCM industry, providing insights into market trends, competitive landscape, and opportunities for business growth.

What deliverables can I expect from this HCM market research project?

Deliverables from the HCM market research project typically include comprehensive reports, executive summaries, trend analyses, regional insights, and strategic recommendations designed to help businesses make informed decisions.

What are the market trends of HCM?

Key trends in the HCM market include the shift toward cloud-based solutions, increased focus on AI and automation in HR processes, and the growing importance of employee engagement tools, reflecting the need for adaptive workforce strategies.