Health It Security Market Report

Published Date: 31 January 2026 | Report Code: health-it-security

Health It Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Health IT Security market, covering current trends, market size, forecasts from 2023 to 2033, and insights on technologies and key players shaping the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

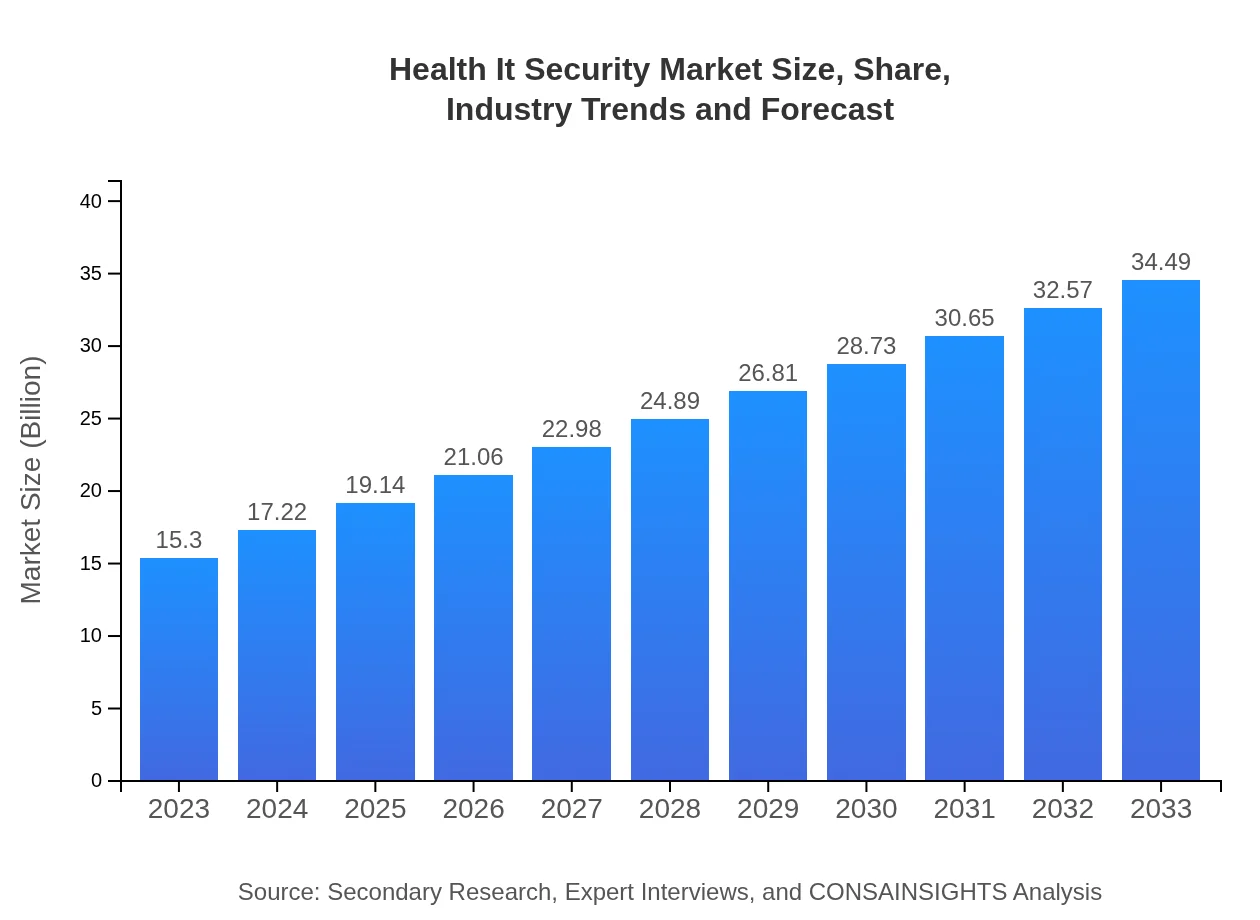

| 2023 Market Size | $15.30 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $34.49 Billion |

| Top Companies | McAfee LLC, IBM Corporation, Anthem, Inc., Cisco Systems, Inc., Qualys, Inc. |

| Last Modified Date | 31 January 2026 |

Health IT Security Market Overview

Customize Health It Security Market Report market research report

- ✔ Get in-depth analysis of Health It Security market size, growth, and forecasts.

- ✔ Understand Health It Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Health It Security

What is the Market Size & CAGR of Health IT Security market in 2023?

Health IT Security Industry Analysis

Health IT Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Health IT Security Market Analysis Report by Region

Europe Health It Security Market Report:

The European market, valued at $4.72 billion in 2023, is expected to reach $10.65 billion by 2033. The increasing focus on GDPR compliance and patient data protection efforts contribute significantly to this growth. Moreover, European countries are investing heavily in healthcare IT infrastructure enhancements.Asia Pacific Health It Security Market Report:

The Asia Pacific region, with a market size of $2.78 billion in 2023, is expected to grow to $6.26 billion by 2033. This growth is driven by increasing digital healthcare initiatives, government investments in healthcare IT infrastructure, and the rising prevalence of cyber threats. Countries like India and China are leading this trend by implementing advanced security protocols.North America Health It Security Market Report:

North America remains a dominant player in the Health IT Security market, with a value of $5.62 billion in 2023, anticipated to rise to $12.67 billion by 2033. The strong market is attributed to the presence of major healthcare organizations, high levels of investment in cybersecurity solutions, and stringent regulatory standards such as HIPAA.South America Health It Security Market Report:

In South America, the Health IT Security market size is projected to grow from $0.64 billion in 2023 to $1.43 billion by 2033. Factors such as regulatory changes, increasing awareness about data privacy, and the need to protect sensitive health information are fueling market growth in this region.Middle East & Africa Health It Security Market Report:

The Middle East and Africa market, starting from $1.54 billion in 2023 and projected to reach $3.48 billion in 2033, is growing due to increased healthcare expenditures and a rising number of cyberattacks. Countries are recognizing the importance of effective IT security measures to safeguard health information.Tell us your focus area and get a customized research report.

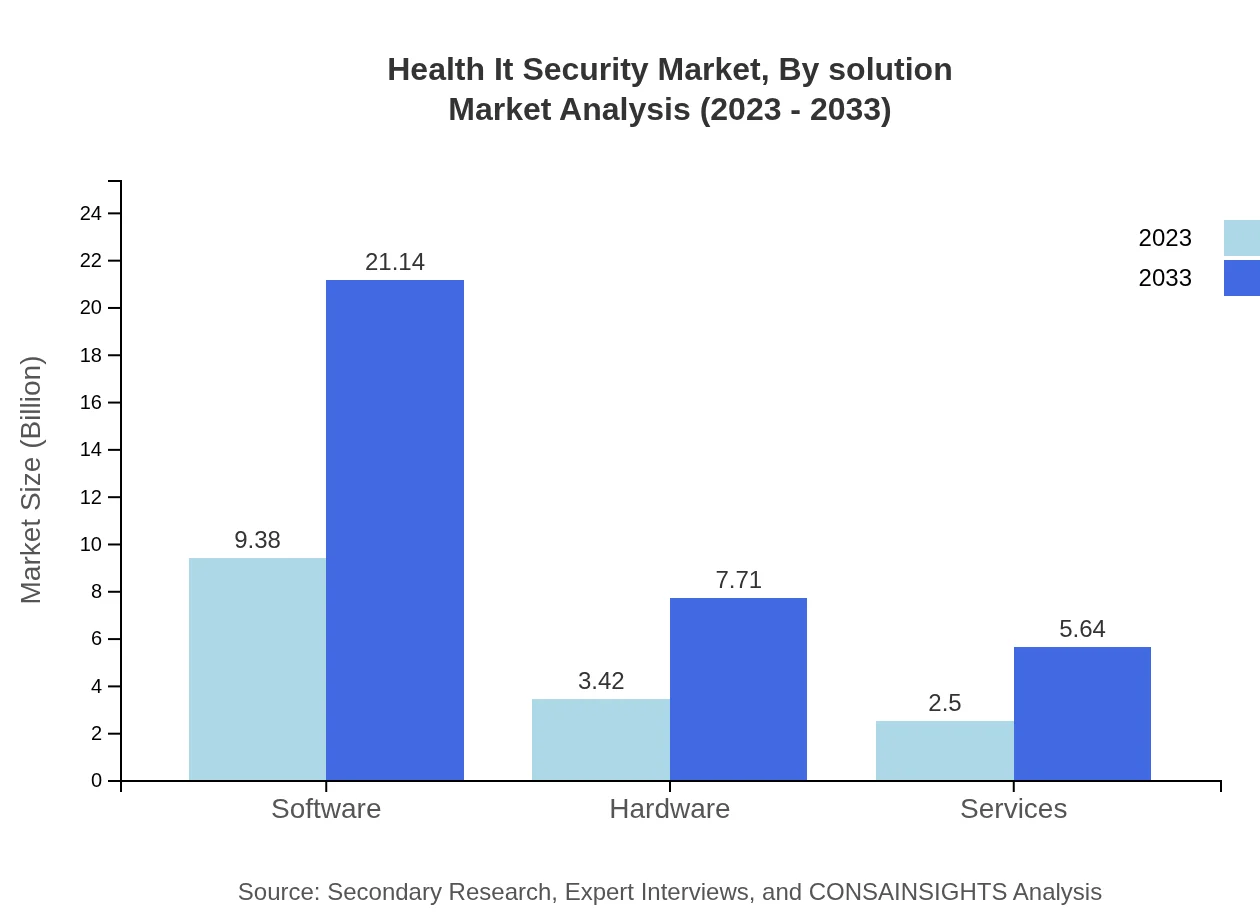

Health It Security Market Analysis By Solution

The Health IT Security market by solution includes segments like network security, endpoint security, application security, and data encryption, with software dominating the market with a size of $9.38 billion in 2023 and projected to reach $21.14 billion by 2033. This sector’s focus on developing cutting-edge security measures emphasizes leveraging technologies such as artificial intelligence and machine learning.

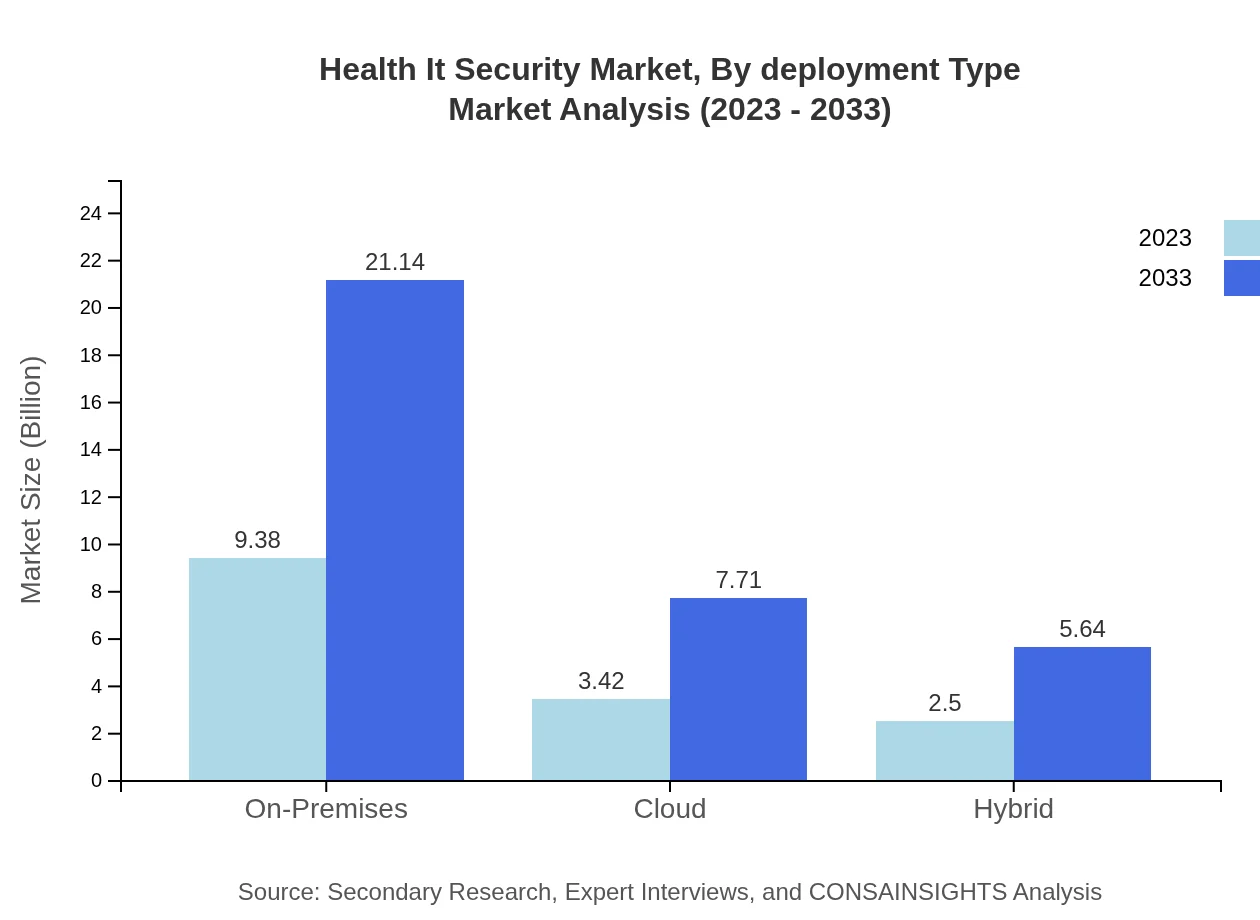

Health It Security Market Analysis By Deployment Type

The deployment type segment outlines the market dynamics of on-premises, cloud-based, and hybrid models. The on-premises segment leads with a size of $9.38 billion in 2023, highlighting organizations' preference for maintaining control over data security protocols, while cloud solutions are rapidly gaining traction due to scalability and cost-effectiveness.

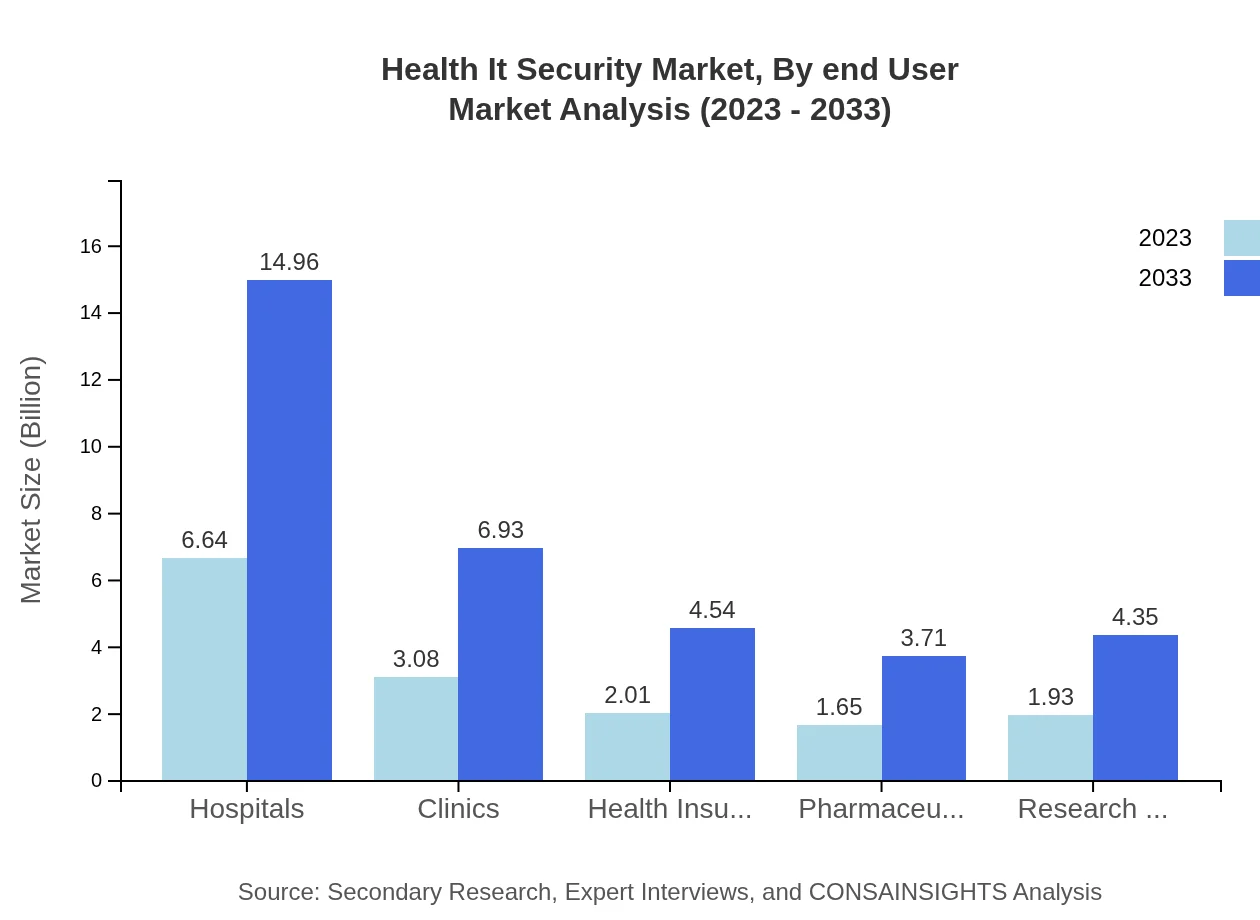

Health It Security Market Analysis By End User

Key end-user segments include hospitals, clinics, health insurers, pharmaceuticals, and research organizations. Hospitals dominate the market with a size of $6.64 billion in 2023, showcasing their need for comprehensive security due to high volumes of sensitive data and regulatory compliance requirements.

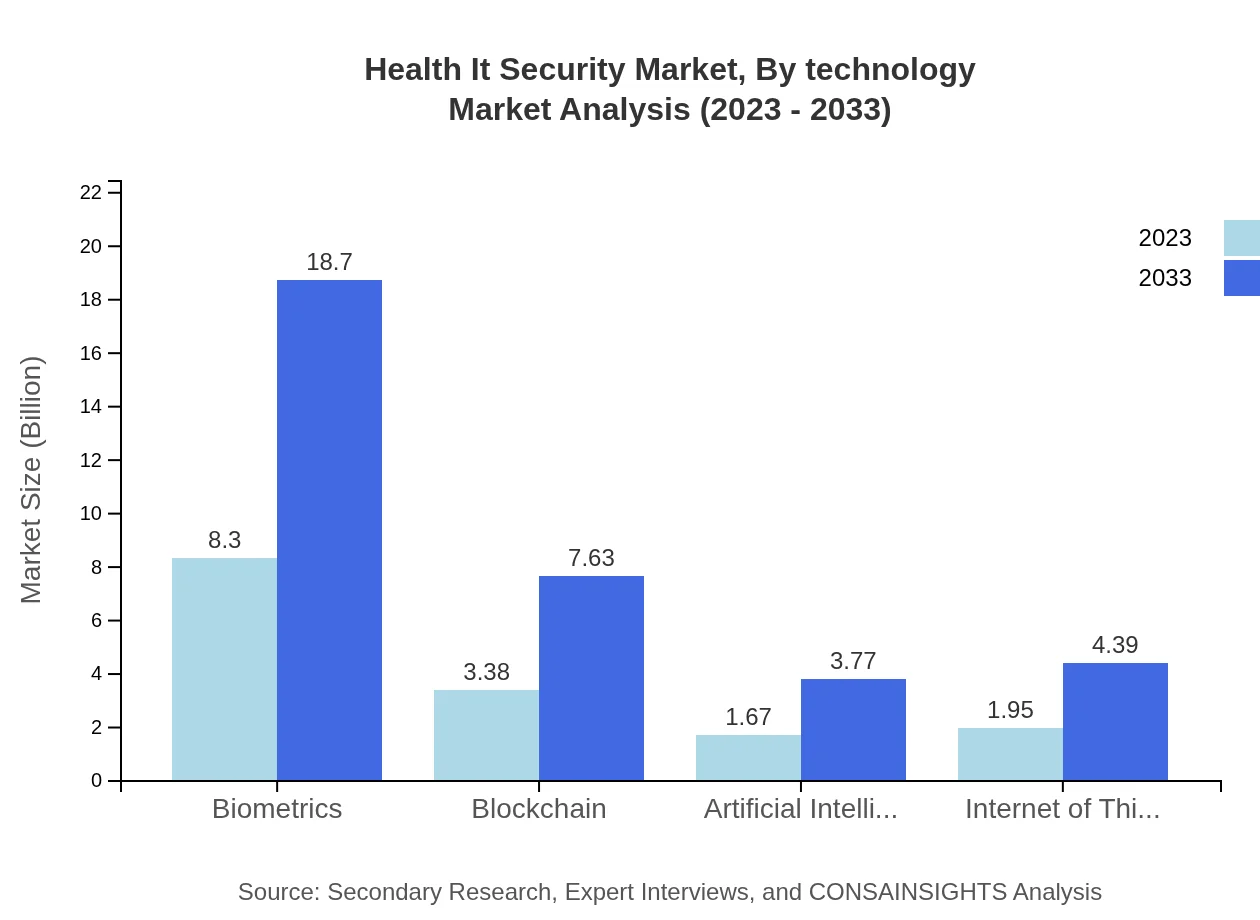

Health It Security Market Analysis By Technology

Technological advancements play a critical role, with biometrics leading the market at a size of $8.30 billion in 2023, emphasizing the push towards secure authentication measures in healthcare. Other technologies like blockchain, AI, and IoT are also witnessing increased investment as healthcare organizations prioritize data integrity and enhanced threat detection.

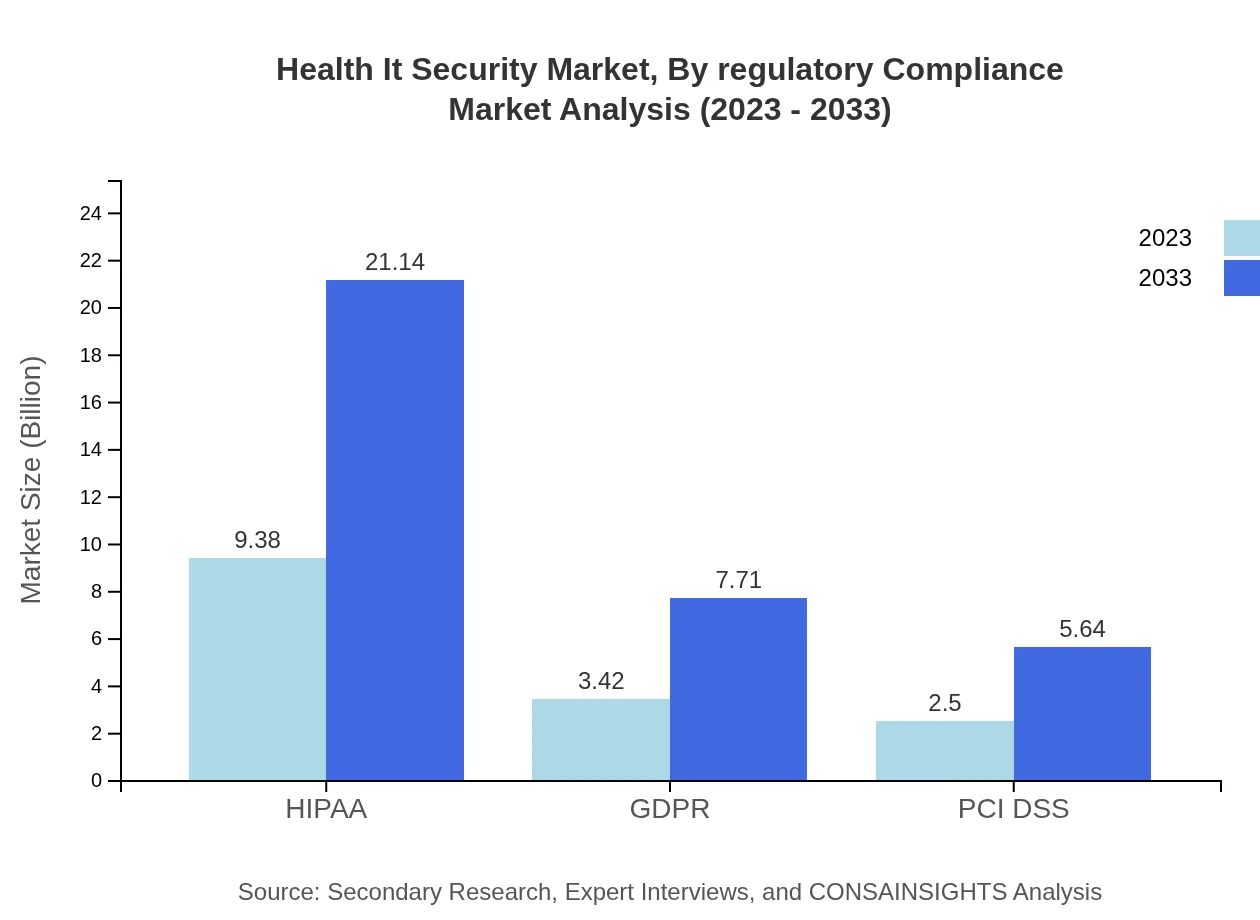

Health It Security Market Analysis By Regulatory Compliance

Regulatory compliance has a profound impact on the market, particularly HIPAA, GDPR, and PCI DSS. The HIPAA segment alone represents a substantial market share, valued at $9.38 billion in 2023, reflecting the stringent requirements for protecting patient information in the U.S.

Health IT Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Health IT Security Industry

McAfee LLC:

McAfee provides advanced cybersecurity solutions specifically tailored for healthcare institutions, helping them protect sensitive patient data and comply with regulatory standards.IBM Corporation:

IBM offers comprehensive security solutions for the healthcare sector, utilizing AI and cloud security strategies to safeguard health IT infrastructures.Anthem, Inc.:

Anthem is a leading health insurance company focusing on security measures to protect patient data across its services through innovative IT security strategies.Cisco Systems, Inc.:

Cisco provides robust network security solutions that enable healthcare organizations to defend against increasing cyber threats while ensuring secure communication.Qualys, Inc.:

Qualys specializes in cloud security and compliance solutions for the healthcare sector, offering tools that help organizations maintain effective risk management.We're grateful to work with incredible clients.

FAQs

What is the market size of health It Security?

The health IT security market was valued at approximately $15.3 billion in 2023 and is expected to grow at a CAGR of 8.2%, reaching a substantial size by 2033.

What are the key market players or companies in this health It Security industry?

Key players in the health IT security industry include major software providers, healthcare system integrators, and cybersecurity firms that specialize in protecting sensitive health information.

What are the primary factors driving the growth in the health It Security industry?

Growth drivers include increasing cyber threats to healthcare data, regulatory requirements for data protection, and rising investments in health IT security solutions.

Which region is the fastest Growing in the health It Security?

North America is the fastest-growing region, projected to expand from $5.62 billion in 2023 to $12.67 billion by 2033, followed closely by Europe.

Does ConsaInsights provide customized market report data for the health It Security industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs and focuses within the health IT security industry.

What deliverables can I expect from this health It Security market research project?

Deliverables include detailed market analysis, regional insights, segment breakdowns, and future trend forecasts, all tailored to your specific requirements.

What are the market trends of health It Security?

Current trends include increased adoption of cloud security solutions, a rise in biometric authentication, and the implementation of AI-driven security measures across healthcare organizations.