Healthcare And Medical System Integrators Market Report

Published Date: 31 January 2026 | Report Code: healthcare-and-medical-system-integrators

Healthcare And Medical System Integrators Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Healthcare and Medical System Integrators market from 2023 to 2033, highlighting market size, growth trends, segmentation, and regional insights to guide stakeholders. The report aims to equip readers with valuable data for informed decision-making.

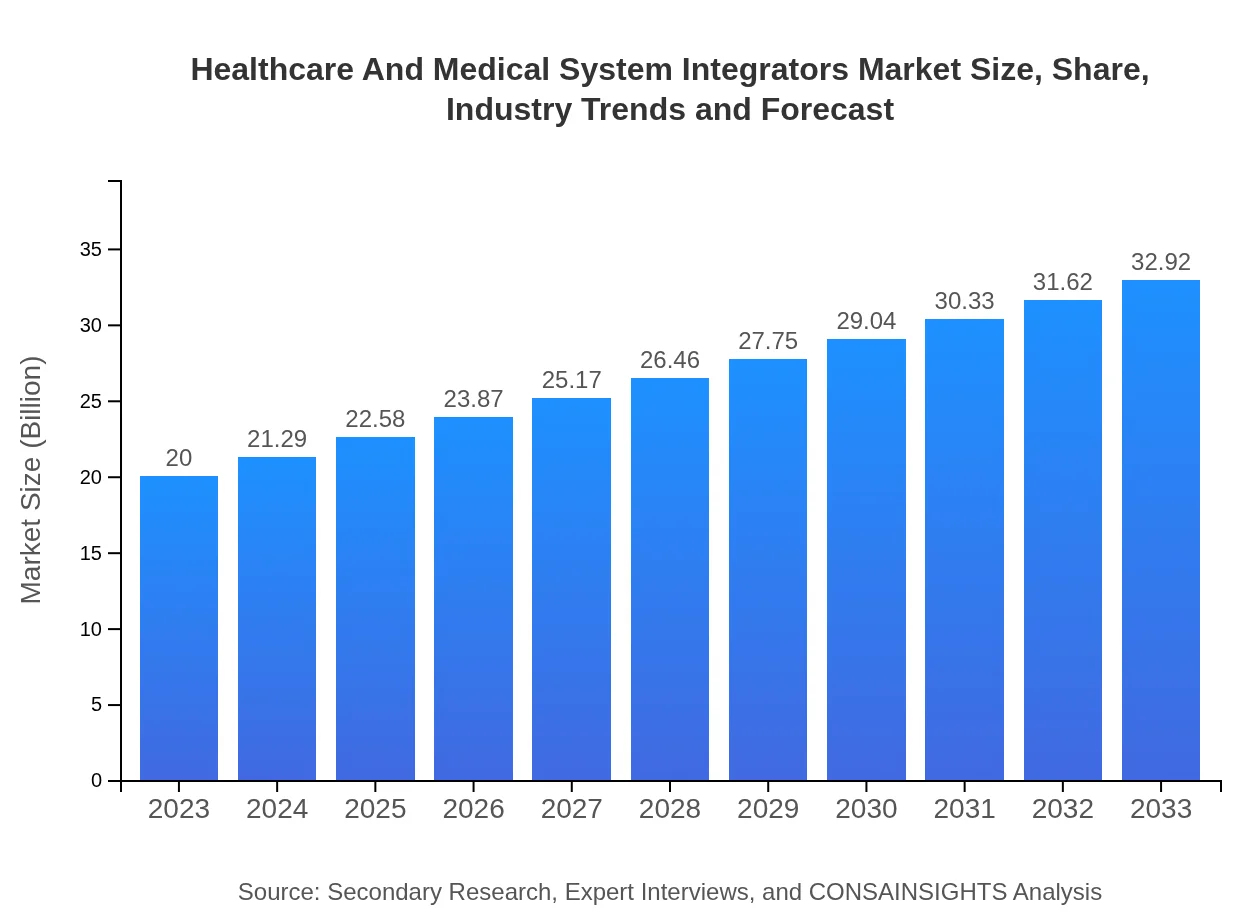

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $32.92 Billion |

| Top Companies | Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions, Siemens Healthineers |

| Last Modified Date | 31 January 2026 |

Healthcare And Medical System Integrators Market Overview

Customize Healthcare And Medical System Integrators Market Report market research report

- ✔ Get in-depth analysis of Healthcare And Medical System Integrators market size, growth, and forecasts.

- ✔ Understand Healthcare And Medical System Integrators's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare And Medical System Integrators

What is the Market Size & CAGR of Healthcare And Medical System Integrators market in 2023 and 2033?

Healthcare And Medical System Integrators Industry Analysis

Healthcare And Medical System Integrators Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare And Medical System Integrators Market Analysis Report by Region

Europe Healthcare And Medical System Integrators Market Report:

In Europe, the market is expected to grow from $5.62 billion in 2023 to $9.26 billion by 2033. The European region benefits from robust healthcare spending, regulatory support for integrated healthcare solutions, and a strong emphasis on data security and interoperability.Asia Pacific Healthcare And Medical System Integrators Market Report:

In the Asia Pacific region, the Healthcare and Medical System Integrators market was valued at $4.14 billion in 2023 and is projected to reach $6.81 billion by 2033. Factors driving this growth include increasing healthcare expenditure, a growing aging population, and heightened focus on digital healthcare technologies, particularly in countries like China and India.North America Healthcare And Medical System Integrators Market Report:

North America held the largest market share, valued at $6.61 billion in 2023, anticipated to reach $10.88 billion by 2033. The increasing penetration of digital health solutions and government initiatives to enhance healthcare delivery systems are key drivers in this region, where advanced integrated systems are increasingly adopted.South America Healthcare And Medical System Integrators Market Report:

South America is experiencing gradual growth in the Healthcare and Medical System Integrators market, with a value of $0.92 billion in 2023, expected to rise to $1.51 billion by 2033. The region is witnessing investments in healthcare infrastructure and the adoption of advanced technologies, although challenges such as regulatory barriers remain.Middle East & Africa Healthcare And Medical System Integrators Market Report:

The Middle East and Africa region is projected to see growth from $2.71 billion in 2023 to $4.46 billion by 2033. Increased investments in healthcare infrastructure and growing government support for healthcare IT innovation are propelling this market forward, despite ongoing economic challenges in some areas.Tell us your focus area and get a customized research report.

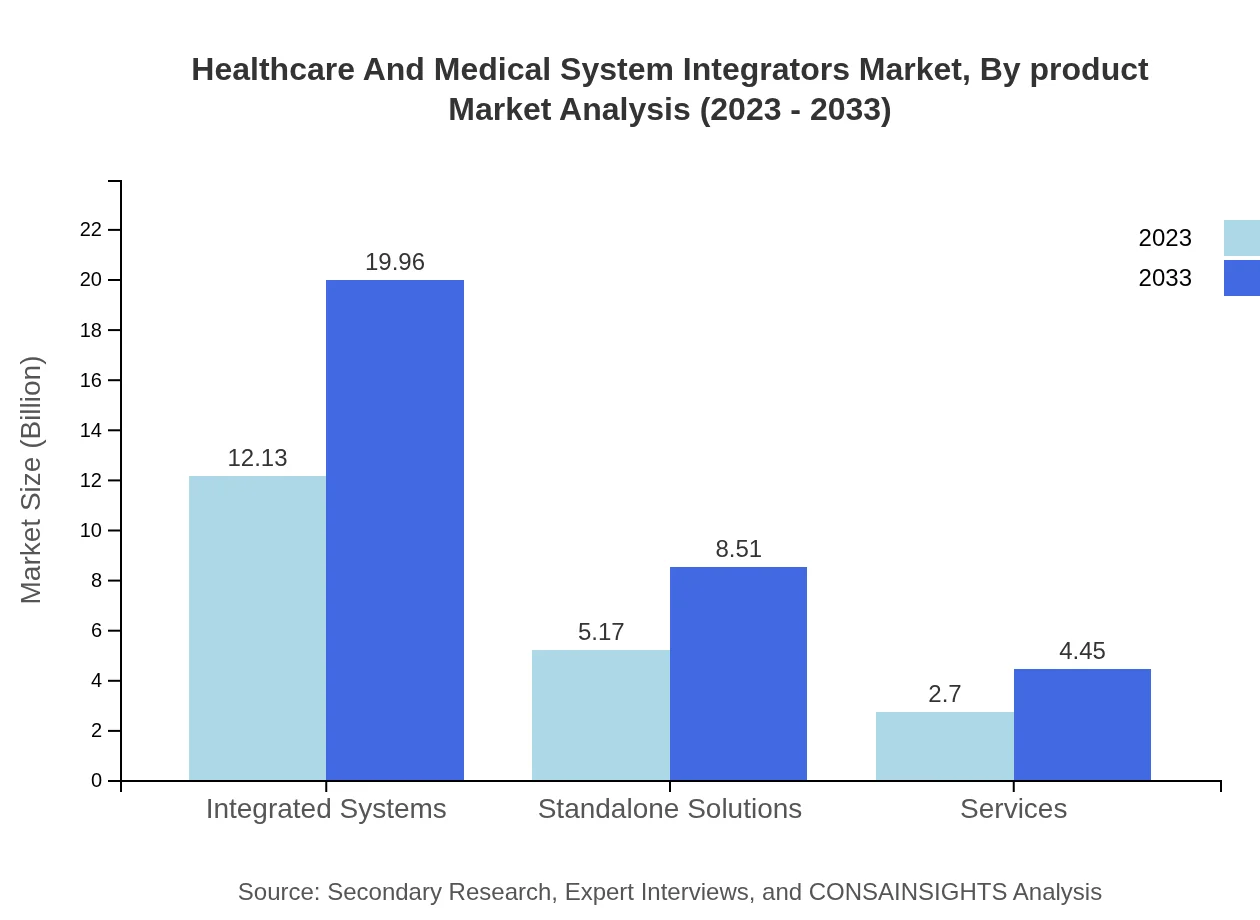

Healthcare And Medical System Integrators Market Analysis By Product

The healthcare and medical system integrators market, by product, emphasizes integrated systems which dominate the market with a size of $12.13 billion in 2023, projected to grow to $19.96 billion by 2033, representing 60.63% share. Standalone solutions follow, valued at $5.17 billion in 2023 and expected to reach $8.51 billion by 2033. Services comprise the smallest segment worth $2.70 billion in 2023, growing to $4.45 billion by 2033.

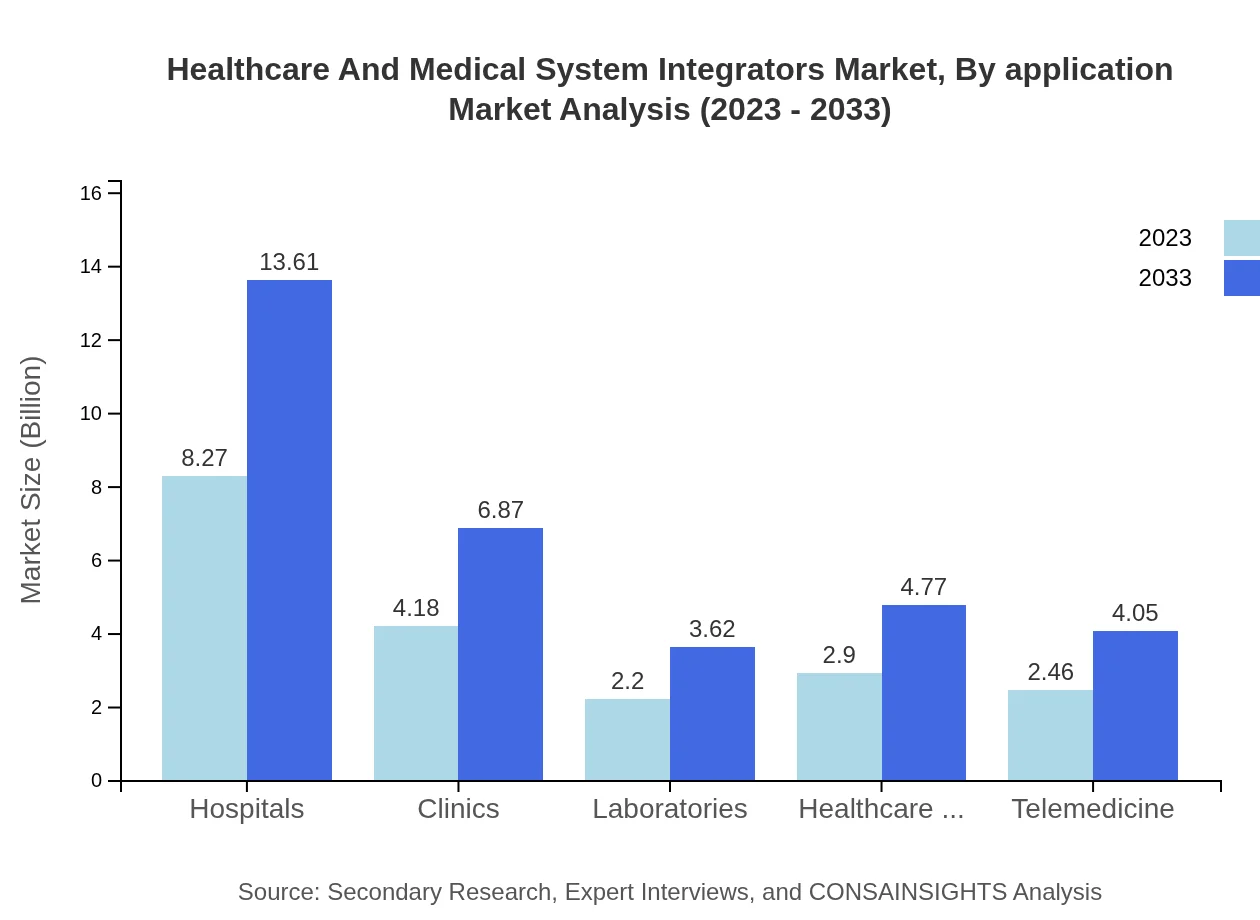

Healthcare And Medical System Integrators Market Analysis By Application

By application, hospitals lead the market, representing 41.35% share in 2023 at $8.27 billion and forecasted to reach $13.61 billion by 2033. Ambulatory surgical centers and diagnostic centers also contribute significantly, at $4.18 billion and $2.20 billion respectively in 2023 and predicted to grow substantially in the next decade.

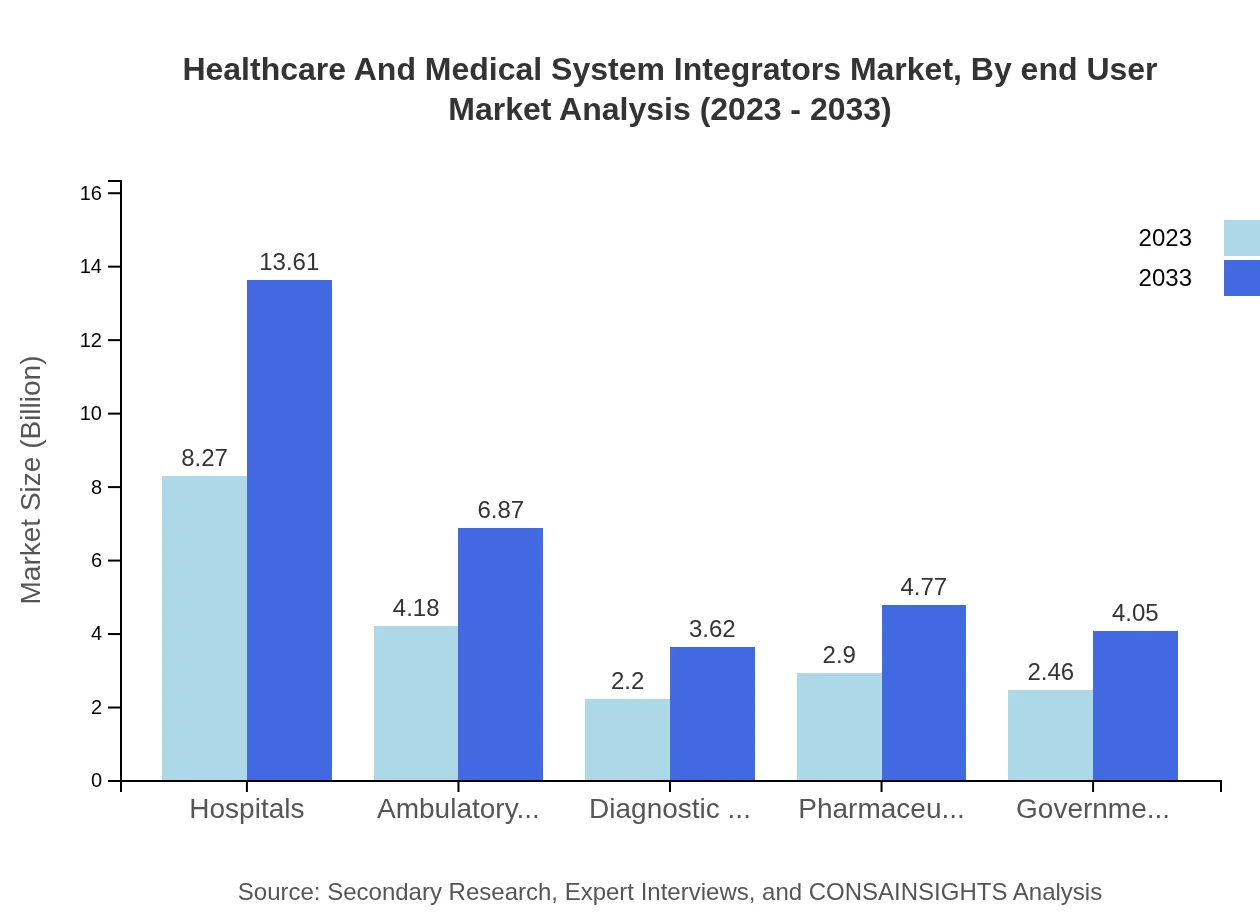

Healthcare And Medical System Integrators Market Analysis By End User

The market is segmented by end-user into hospitals, clinics, diagnostic centers, and pharmaceutical companies. Hospitals are the largest segment due to their comprehensive operational needs, followed by clinics which hold a significant portion furthering the need for integrated solutions. Government organizations also play a pivotal role in the adoption of integrated healthcare solutions.

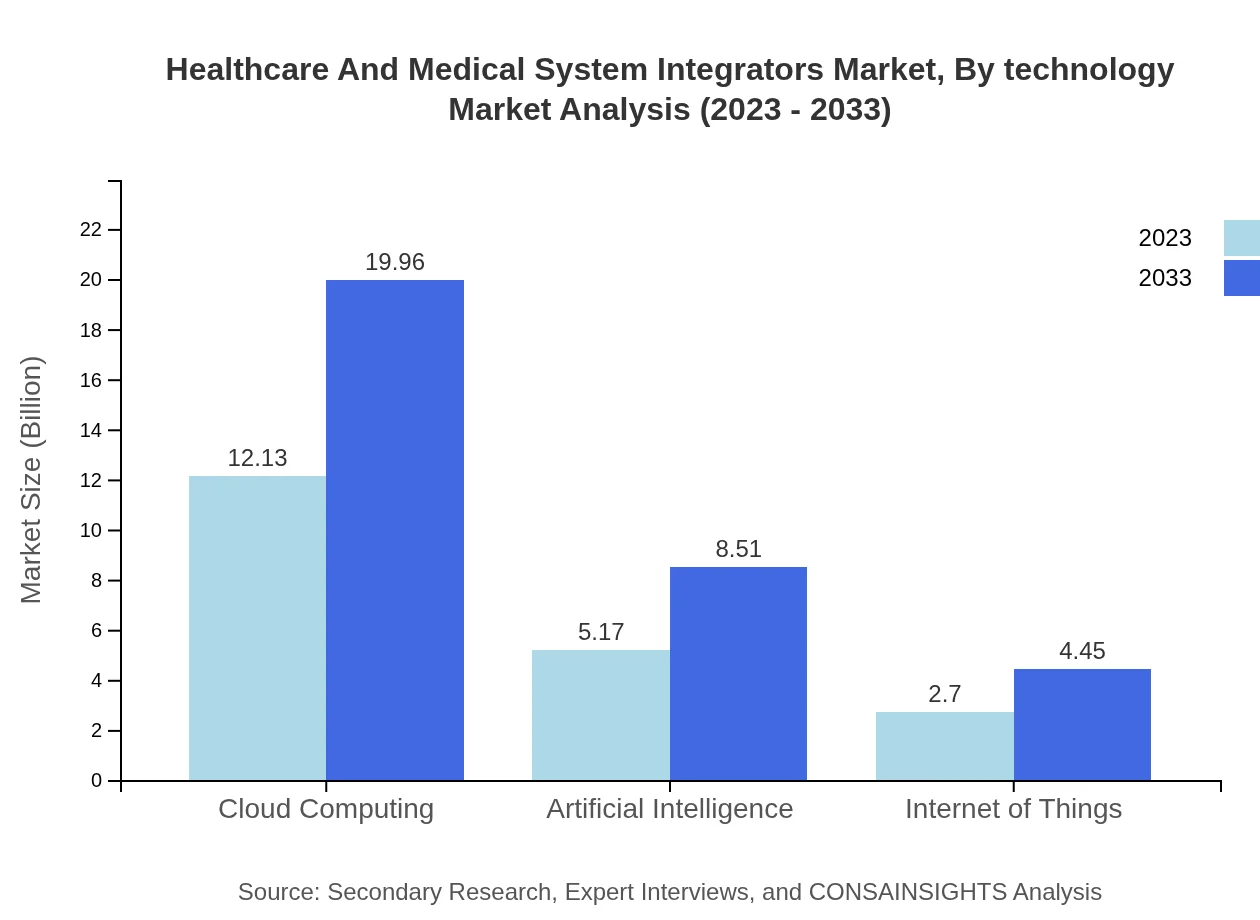

Healthcare And Medical System Integrators Market Analysis By Technology

Cloud computing and artificial intelligence dominate the technology segment, with cloud computing projected to rise from $12.13 billion in 2023 to $19.96 billion by 2033. Artificial intelligence follows with significant growth anticipated, from $5.17 billion in 2023 to $8.51 billion by 2033, underlining the increasing importance of these technologies in healthcare integration.

Healthcare And Medical System Integrators Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare And Medical System Integrators Industry

Cerner Corporation:

Cerner Corporation provides healthcare technology solutions that integrate various health systems to enhance patient care and streamline hospital operations.Epic Systems Corporation:

Epic Systems specializes in software for healthcare organizations, focusing on providing EHR and data analytics that are essential for effective system integration.Allscripts Healthcare Solutions:

Allscripts offers a wide range of solutions targeting care coordination and health management, playing a key role in system integration.Siemens Healthineers:

Siemens Healthineers provides technologies and services for healthcare integration that enable comprehensive data management and improved diagnostic capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare and medical system integrators?

The healthcare and medical system integrators market is currently valued at approximately $20 billion and is projected to grow at a CAGR of 5% through 2033. This growth reflects increasing demands for integrated solutions in the healthcare sector.

What are the key market players or companies in this healthcare and medical system integrators industry?

Key players in the healthcare and medical system integrators industry include major companies that specialize in system integration, software solutions, and healthcare technology. Notable names are not specified, but firms with innovative technologies and strong market presence are pivotal.

What are the primary factors driving the growth in the healthcare and medical system integrators industry?

The growth in this industry is driven by the increasing adoption of digital health solutions, the demand for interoperability among healthcare systems, and the need for enhanced patient care efficiencies, fostering the shift towards integrated systems.

Which region is the fastest Growing in the healthcare and medical system integrators?

The fastest-growing region for healthcare and medical system integrators is North America, projected to grow from $6.61 billion in 2023 to $10.88 billion by 2033, driven by technological advancements and robust healthcare infrastructure.

Does ConsaInsights provide customized market report data for the healthcare and medical system integrators industry?

Yes, ConsaInsights offers customized market reports for the healthcare and medical system integrators industry. These reports can be tailored to meet specific client needs, goals, and unique market interests.

What deliverables can I expect from this healthcare and medical system integrators market research project?

Deliverables from this market research project typically include detailed reports on market size, growth projections, segment analyses, competitive landscape assessments, and actionable insights to inform strategic decision-making.

What are the market trends of healthcare and medical system integrators?

Current market trends indicate a rising focus on cloud computing and AI solutions within healthcare systems, as well as a growing emphasis on patient-centric approaches, interoperability, and telemedicine solutions, which are reshaping the industry.