Healthcare Cold Chain Logistics Market Report

Published Date: 31 January 2026 | Report Code: healthcare-cold-chain-logistics

Healthcare Cold Chain Logistics Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Healthcare Cold Chain Logistics market, offering comprehensive insights and forecasts for 2023 to 2033, including market size, trends, significant players, and regional analysis to help stakeholders navigate this critical industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

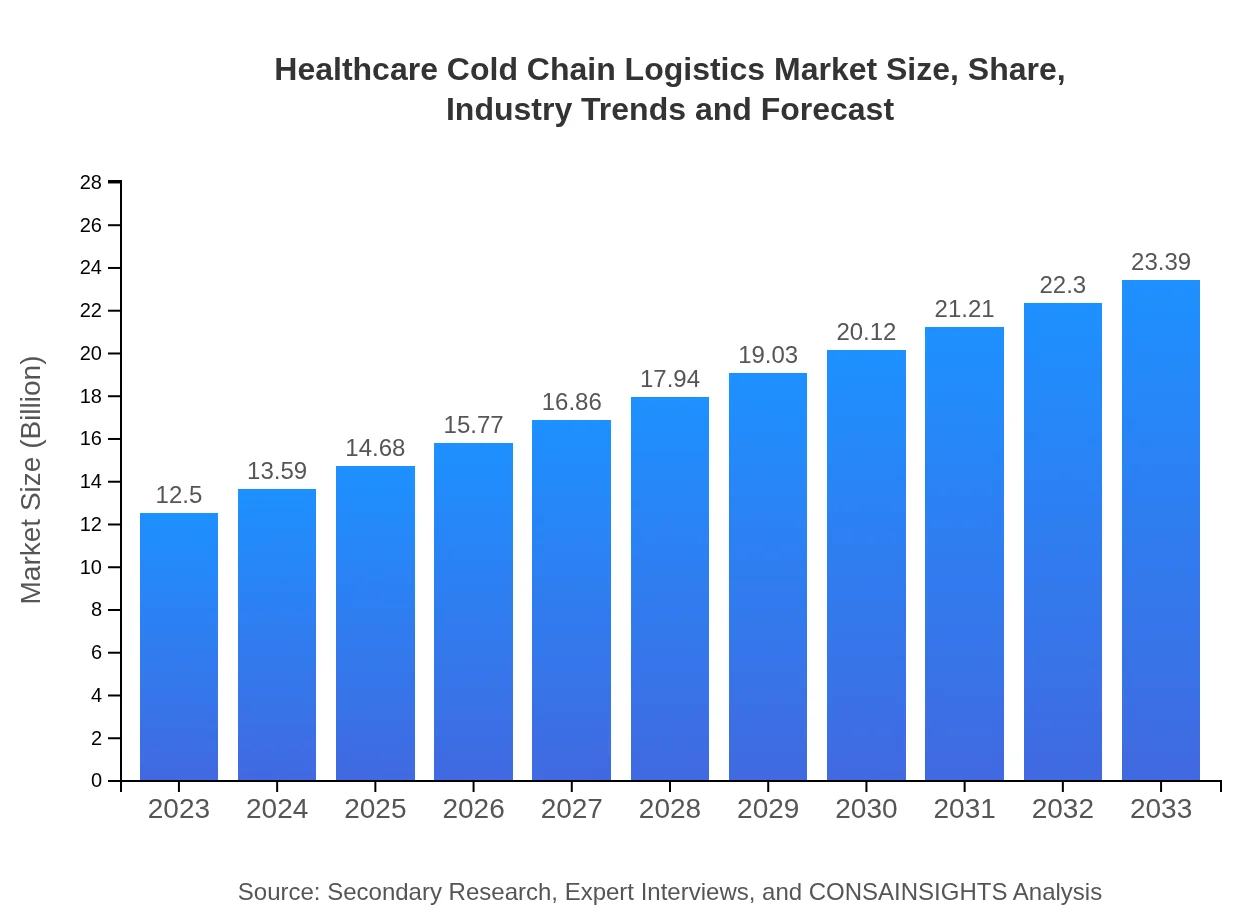

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $23.39 Billion |

| Top Companies | Thermo Fisher Scientific, DHL Supply Chain, Armstrong Logistics |

| Last Modified Date | 31 January 2026 |

Healthcare Cold Chain Logistics Market Overview

Customize Healthcare Cold Chain Logistics Market Report market research report

- ✔ Get in-depth analysis of Healthcare Cold Chain Logistics market size, growth, and forecasts.

- ✔ Understand Healthcare Cold Chain Logistics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Cold Chain Logistics

What is the Market Size & CAGR of Healthcare Cold Chain Logistics market in 2023?

Healthcare Cold Chain Logistics Industry Analysis

Healthcare Cold Chain Logistics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Cold Chain Logistics Market Analysis Report by Region

Europe Healthcare Cold Chain Logistics Market Report:

Europe's market is anticipated to grow from $4.14 billion in 2023 to $7.75 billion by 2033. The need for stringent compliance in pharmaceutical logistics demands extensive cold chain solutions, driven by a higher prevalence of chronic diseases and collaborative health initiatives.Asia Pacific Healthcare Cold Chain Logistics Market Report:

The Asia Pacific region accounted for a market value of $2.32 billion in 2023 and is expected to grow to $4.35 billion by 2033, representing rising healthcare expenditures and increasing government initiatives to improve healthcare infrastructure. The region sees a surge in vaccine logistic requirements that cater to a growing population.North America Healthcare Cold Chain Logistics Market Report:

North America leads the market with an estimated value of $4.29 billion in 2023, forecasted to reach $8.02 billion by 2033. This region's growth is attributed to robust pharmaceutical and biotech industries, coupled with advancements in cold chain technologies and logistics efficiency.South America Healthcare Cold Chain Logistics Market Report:

In South America, the market is currently valued at $0.42 billion in 2023, projected to increase to $0.79 billion by 2033. The growth is underpinned by the escalating need for improved healthcare standards and regulatory measures, significantly impacting cold chain logistics.Middle East & Africa Healthcare Cold Chain Logistics Market Report:

The Middle East and Africa region shows promising growth, with market values increasing from $1.32 billion in 2023 to $2.48 billion by 2033. Factors such as increasing health investments, coupled with a rising focus on vaccine distribution channels, fuel this growth.Tell us your focus area and get a customized research report.

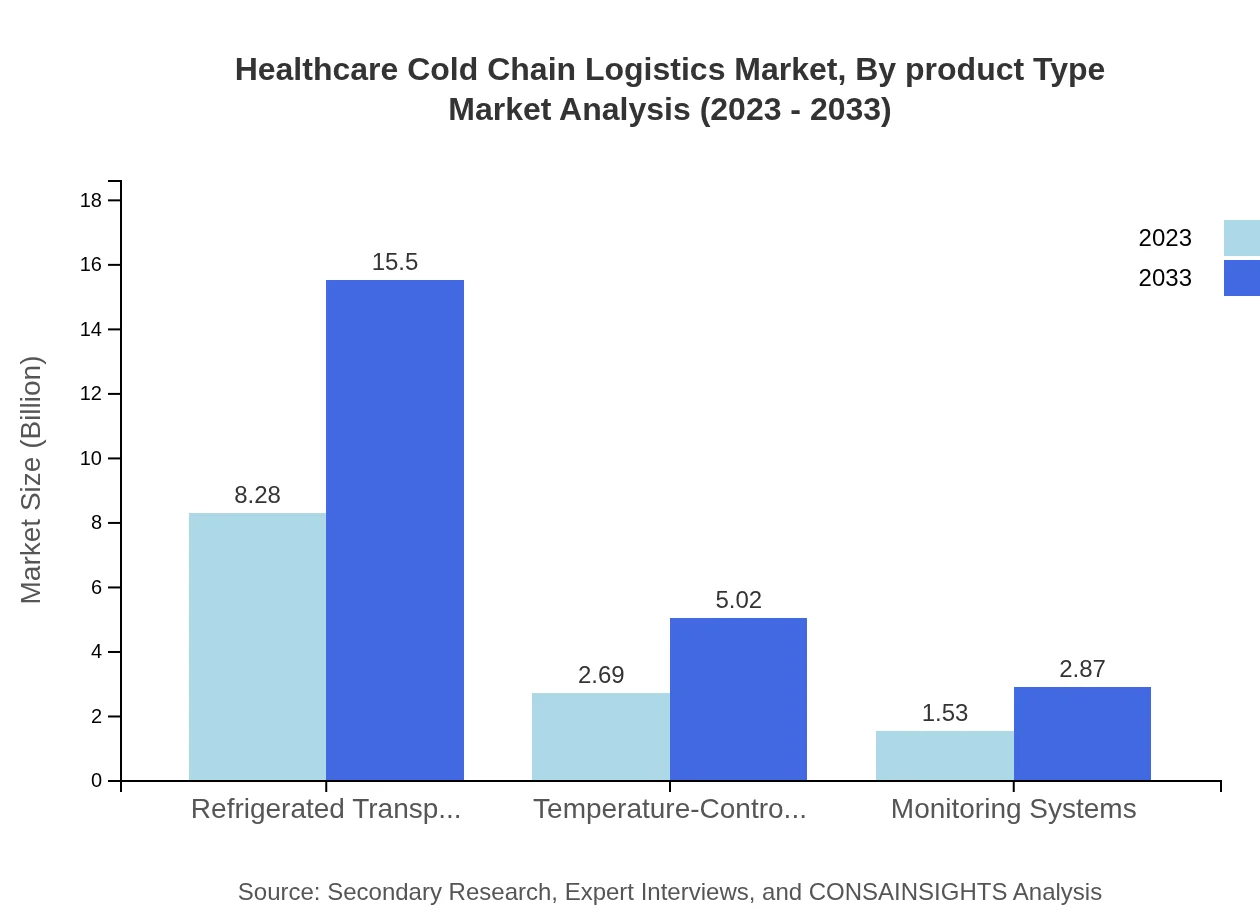

Healthcare Cold Chain Logistics Market Analysis By Product Type

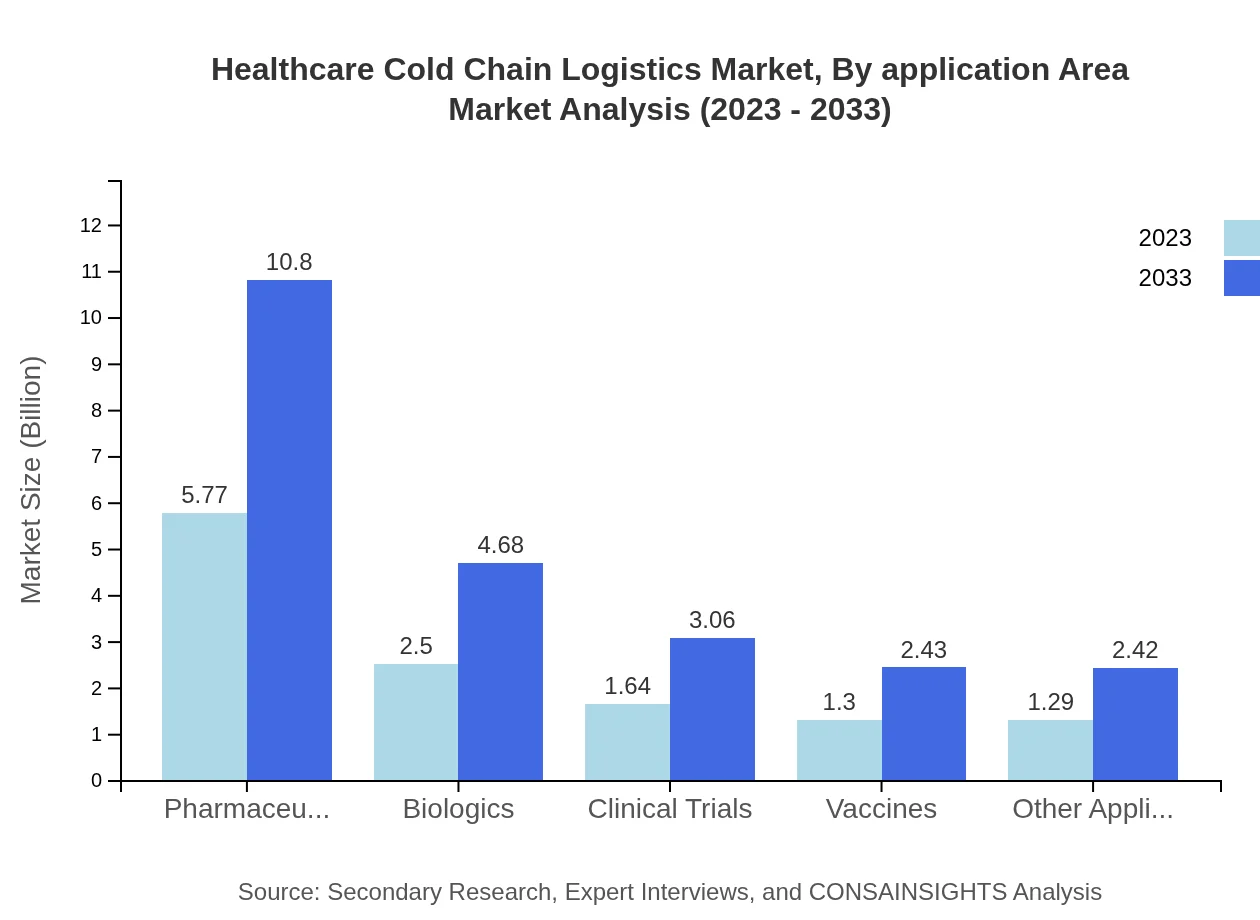

In terms of product type, the market is dominated by pharmaceuticals, accounting for $5.77 billion in 2023 and is expected to double this figure by 2033 to reach $10.80 billion. Other significant contributors include biologics with $2.50 billion and vaccines valued at $1.30 billion in 2023, showcasing an upward trajectory.

Healthcare Cold Chain Logistics Market Analysis By Application Area

Application areas cover pharmaceuticals, biologics, clinical trials, and vaccines. Each area reflects specific growth due to increasing health demands and innovations in treatment options. Vaccines, particularly, see heightened logistics activity driven by immunization programs against viral diseases.

Healthcare Cold Chain Logistics Market Analysis By Service

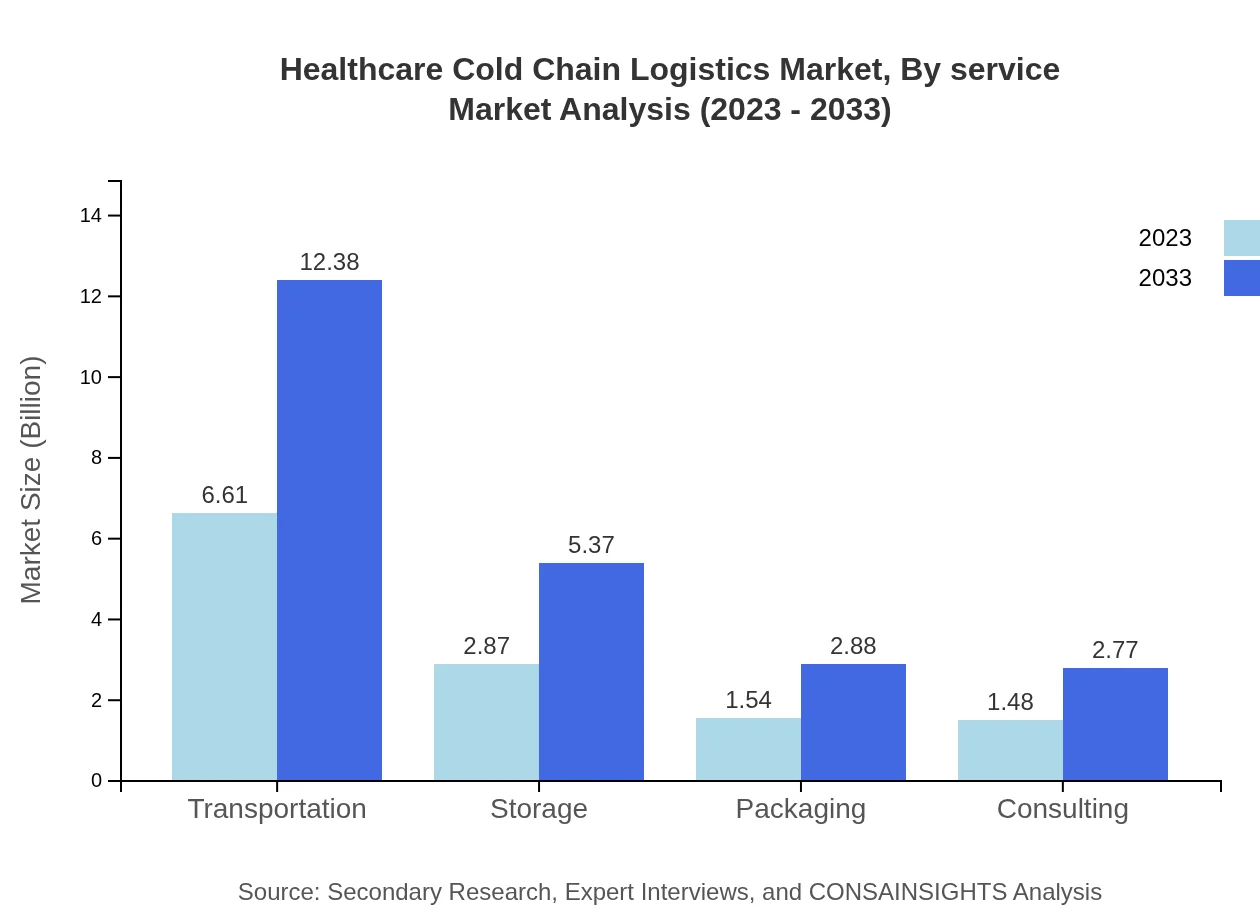

The service type segment features transportation as the primary focus, with market value rising from $6.61 billion in 2023 to $12.38 billion by 2033, while storage and packaging services also see substantial growth, highlighting the comprehensive nature of the healthcare logistics ecosystem.

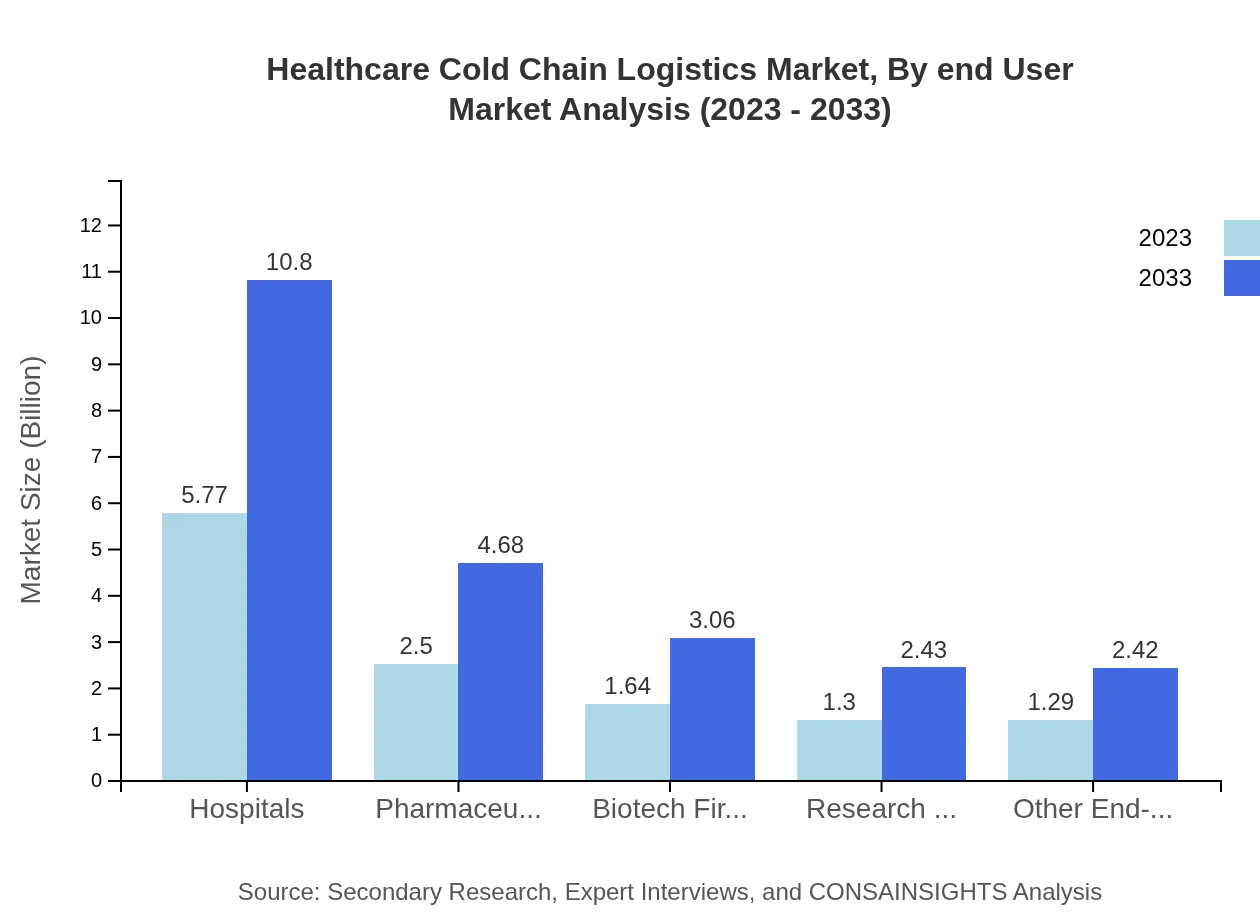

Healthcare Cold Chain Logistics Market Analysis By End User

End-users primarily include hospitals, pharmaceutical companies, and biotechnology firms. Hospitals have the largest share, representing $5.77 billion in 2023, indicating their reliance on cold chain logistics for medication and treatment delivery.

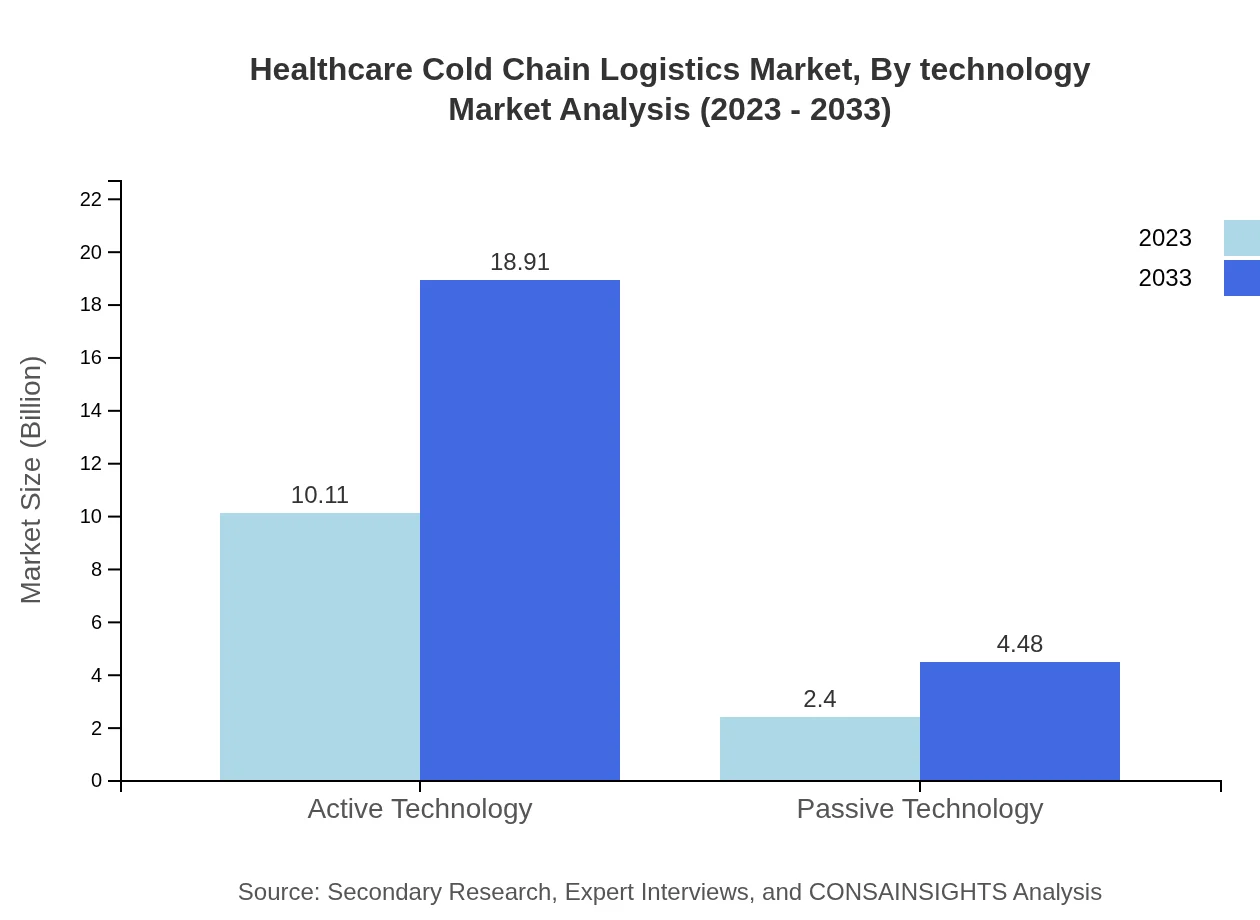

Healthcare Cold Chain Logistics Market Analysis By Technology

Active technology dominates with a market size of $10.11 billion in 2023, supported by innovations like IoT devices for real-time monitoring, while passive technologies also grow, indicating a diversification in approaches to cold chain efficiency.

Healthcare Cold Chain Logistics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Cold Chain Logistics Industry

Thermo Fisher Scientific:

A leader in healthcare logistics, Thermo Fisher Scientific offers comprehensive cold chain solutions for the safe transportation of temperature-sensitive products, with a strong focus on innovation and regulatory compliance.DHL Supply Chain:

DHL provides advanced cold chain solutions, emphasizing sustainability in logistics operations while ensuring that healthcare products are transported under optimal conditions.Armstrong Logistics:

Specializing in healthcare logistics, Armstrong Logistics utilizes cutting-edge technologies for the effective management of cold chain operations and maintaining compliance with industry standards.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare Cold Chain Logistics?

The global healthcare cold chain logistics market is estimated to be $12.5 billion in 2023, with a projected CAGR of 6.3% until 2033, indicating robust growth driven by increasing healthcare demands.

What are the key market players or companies in this healthcare Cold Chain Logistics industry?

Key players include major logistics companies such as UPS Healthcare, DHL Supply Chain, and FedEx, which dominate the healthcare cold chain space, providing temperature-controlled transportation and storage solutions.

What are the primary factors driving the growth in the healthcare Cold Chain Logistics industry?

Factors shaping growth include the rising demand for vaccines and biologics, increased regulatory requirements for temperature-sensitive products, and growth in global e-commerce for pharmaceuticals and biologics.

Which region is the fastest Growing in the healthcare Cold Chain Logistics?

The Asia Pacific region is expected to witness significant growth in the healthcare cold chain logistics market, with market figures growing from $2.32 billion in 2023 to $4.35 billion by 2033.

Does ConsaInsights provide customized market report data for the healthcare Cold Chain Logistics industry?

Yes, ConsaInsights offers customized market report data tailored to specific business needs within the healthcare cold chain logistics sector, covering various aspects such as market trends and competitive analysis.

What deliverables can I expect from this healthcare Cold Chain Logistics market research project?

Expect deliverables including a comprehensive market analysis report, competitive landscape assessment, regional insights, and forecasts, along with actionable recommendations tailored to your business objectives.

What are the market trends of healthcare Cold Chain Logistics?

Market trends include a shift towards integrated refrigerated transport solutions, increased utilization of monitoring technologies for compliance, and a growing emphasis on sustainable practices in logistics.