Healthcare Contract Management Software Market Report

Published Date: 31 January 2026 | Report Code: healthcare-contract-management-software

Healthcare Contract Management Software Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Healthcare Contract Management Software market, providing insights from 2023 to 2033. It covers market size, regional analysis, product categorization, and key trends, offering a comprehensive view of the evolving landscape of healthcare contract management solutions.

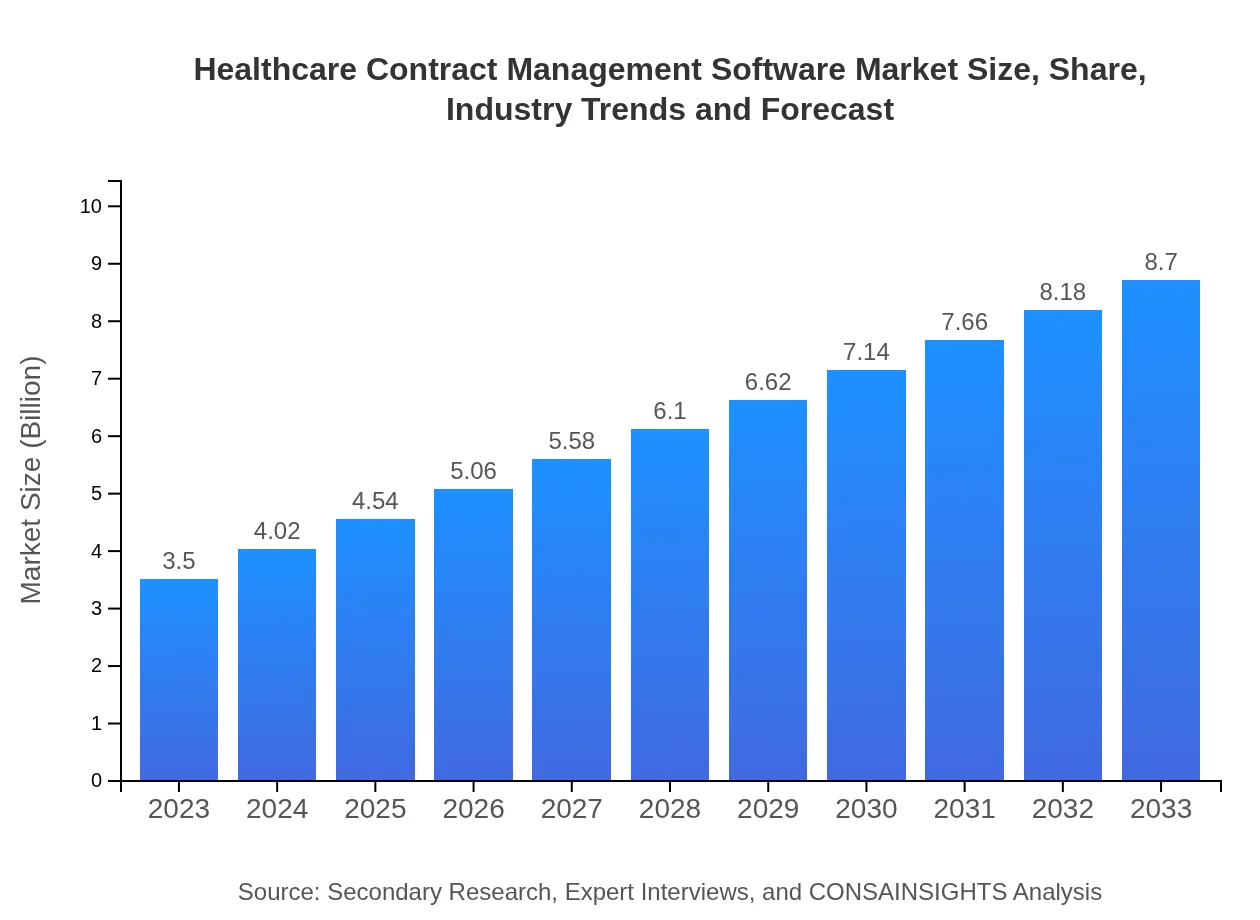

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $8.70 Billion |

| Top Companies | SAP SE, Oracle Corporation, IBM, Coupa Software, DocuSign |

| Last Modified Date | 31 January 2026 |

Healthcare Contract Management Software Market Overview

Customize Healthcare Contract Management Software Market Report market research report

- ✔ Get in-depth analysis of Healthcare Contract Management Software market size, growth, and forecasts.

- ✔ Understand Healthcare Contract Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Contract Management Software

What is the Market Size & CAGR of Healthcare Contract Management Software market in 2023?

Healthcare Contract Management Software Industry Analysis

Healthcare Contract Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Contract Management Software Market Analysis Report by Region

Europe Healthcare Contract Management Software Market Report:

The European market will expand from $1.01 billion in 2023 to $2.52 billion by 2033. Factors such as stringent regulations surrounding data protection and contract management, alongside a growing emphasis on healthcare digitalization, are propelling growth in this region.Asia Pacific Healthcare Contract Management Software Market Report:

The Asia Pacific market is expected to grow from $0.68 billion in 2023 to $1.69 billion by 2033, fueled by an increase in healthcare expenditures, the rising adoption of advanced software solutions, and a growing emphasis on regulatory compliance across healthcare providers in countries like Japan, India, and China.North America Healthcare Contract Management Software Market Report:

North America captures the largest share of the market, expected to grow from $1.26 billion in 2023 to $3.14 billion by 2033. The presence of key market players, increasing healthcare costs, and a focus on value-based care are pivotal drivers for this growth, coupled with technological advancements that enhance efficiency.South America Healthcare Contract Management Software Market Report:

In South America, the market size is projected to increase from $0.11 billion in 2023 to $0.27 billion by 2033. Factors such as increasing regulations in healthcare contracts and the digital transformation of healthcare practices will drive growth in this region, although the market is still relatively nascent compared to more developed regions.Middle East & Africa Healthcare Contract Management Software Market Report:

The Middle East and Africa market is expected to grow from $0.43 billion in 2023 to $1.08 billion by 2033. Increasing investments in healthcare infrastructure and the gradual shift towards digital solutions in contract management are key drivers of this growth.Tell us your focus area and get a customized research report.

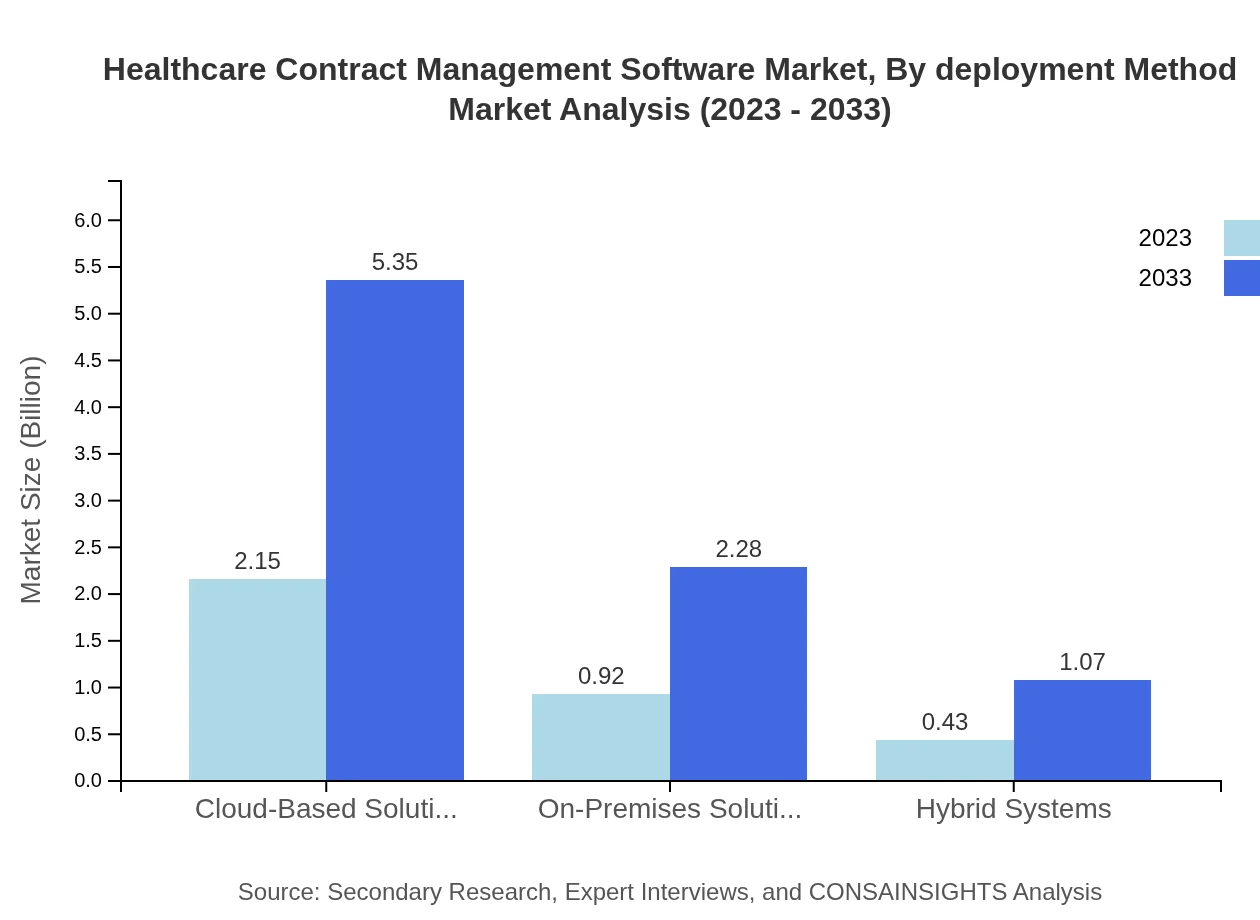

Healthcare Contract Management Software Market Analysis By Product Type

The product type segment is dominated by contract management software, valued at $2.15 billion in 2023 and projected to reach $5.35 billion by 2033, reflecting a 61.49% market share. Electronic/digital signature solutions follow with a market value of $0.92 billion in 2023, forecasted to rise to $2.28 billion by 2033, comprising a 26.23% share. Workflow automation tools and compliance management solutions also play critical roles, indicating a trend toward integrated functionalities that promote operational efficiency.

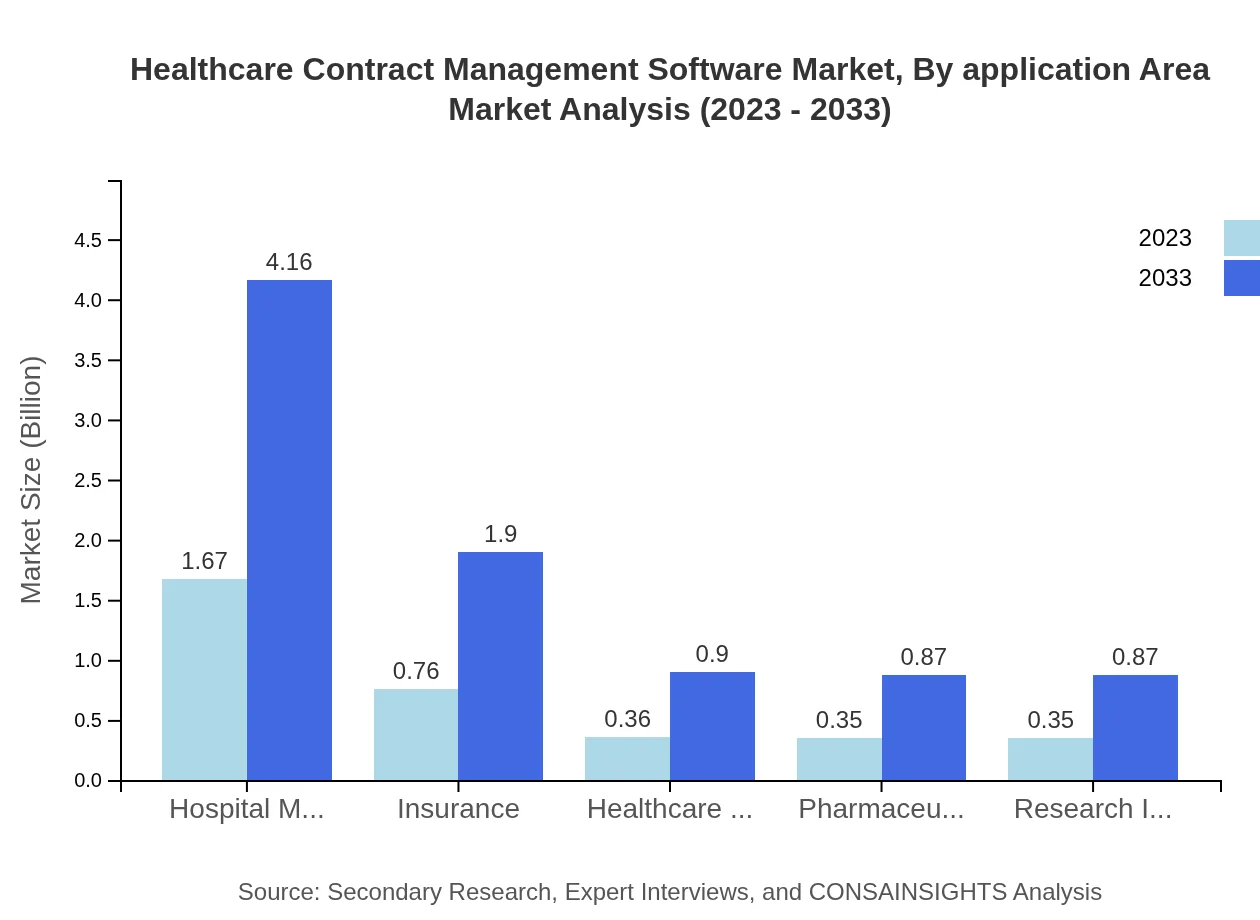

Healthcare Contract Management Software Market Analysis By Application Area

The application area encompasses various sectors, including hospital management, which accounts for a significant portion of the market with a share of 47.81%. In 2023, hospital management solutions are expected to generate a market value of $1.67 billion, increasing to $4.16 billion by 2033. Insurance and healthcare practices follow, with market values of $0.76 billion and $0.36 billion respectively in 2023, and both sectors are anticipated to grow substantially reflecting the increasing need for systematic contract management.

Healthcare Contract Management Software Market Analysis By Deployment Method

Deployment methods are primarily segmented into cloud-based solutions, which dominate with a market share of 61.49%, expected to grow from $2.15 billion in 2023 to $5.35 billion by 2033. On-premises solutions hold a notable market share of 26.23% and will increase from $0.92 billion to $2.28 billion, while hybrid systems account for 12.28%, rising from $0.43 billion to $1.07 billion. These trends illustrate a preference for flexible deployment options suited to diverse organizational needs.

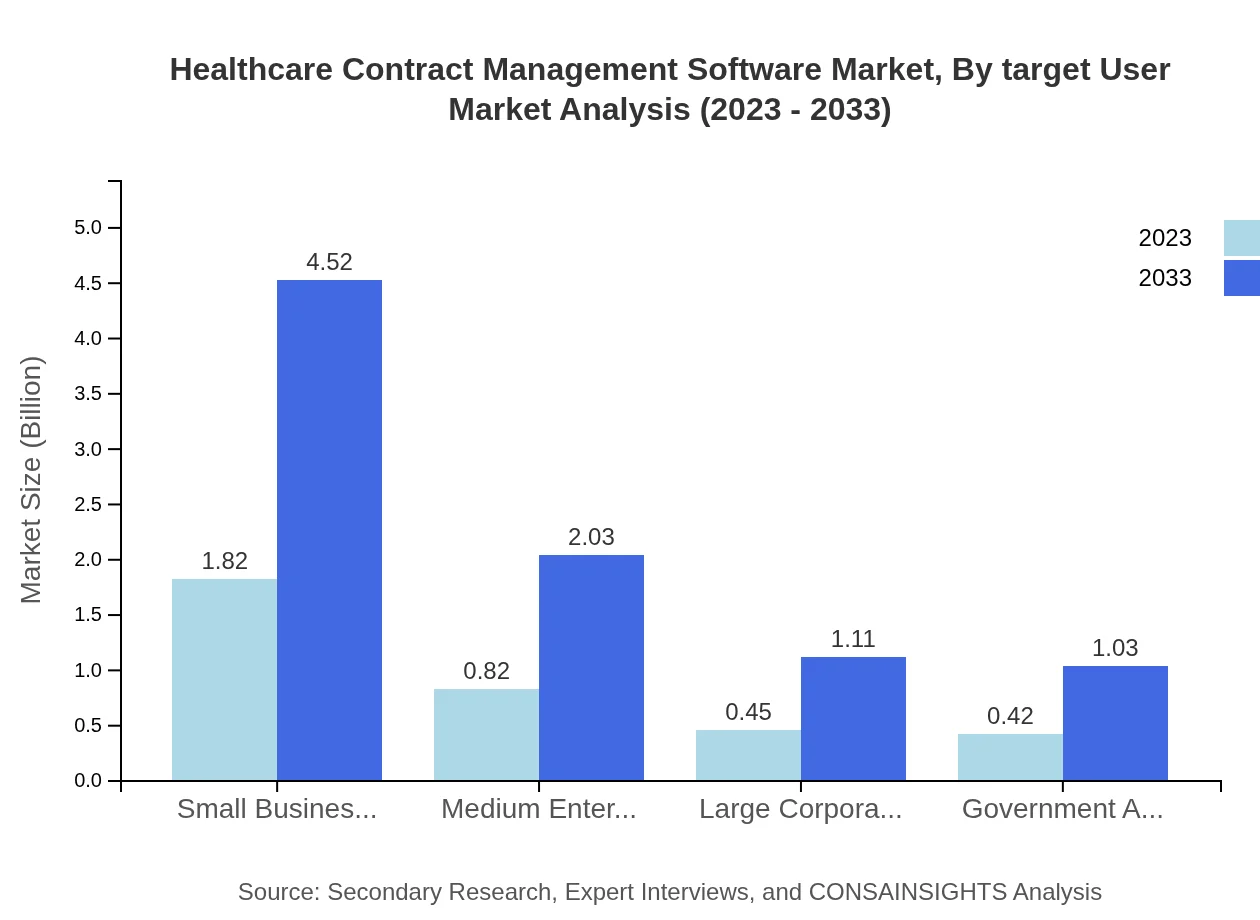

Healthcare Contract Management Software Market Analysis By Target User

In terms of target users, small businesses lead the market with a size of $1.82 billion in 2023, and are expected to grow to $4.52 billion by 2033, maintaining a 52.02% market share. Medium enterprises are dynamically increasing as well, seeing growth from $0.82 billion in 2023 to $2.03 billion by 2033. Large corporations and government agencies comprise significant users, with specific needs that drive tailored solutions in contract management.

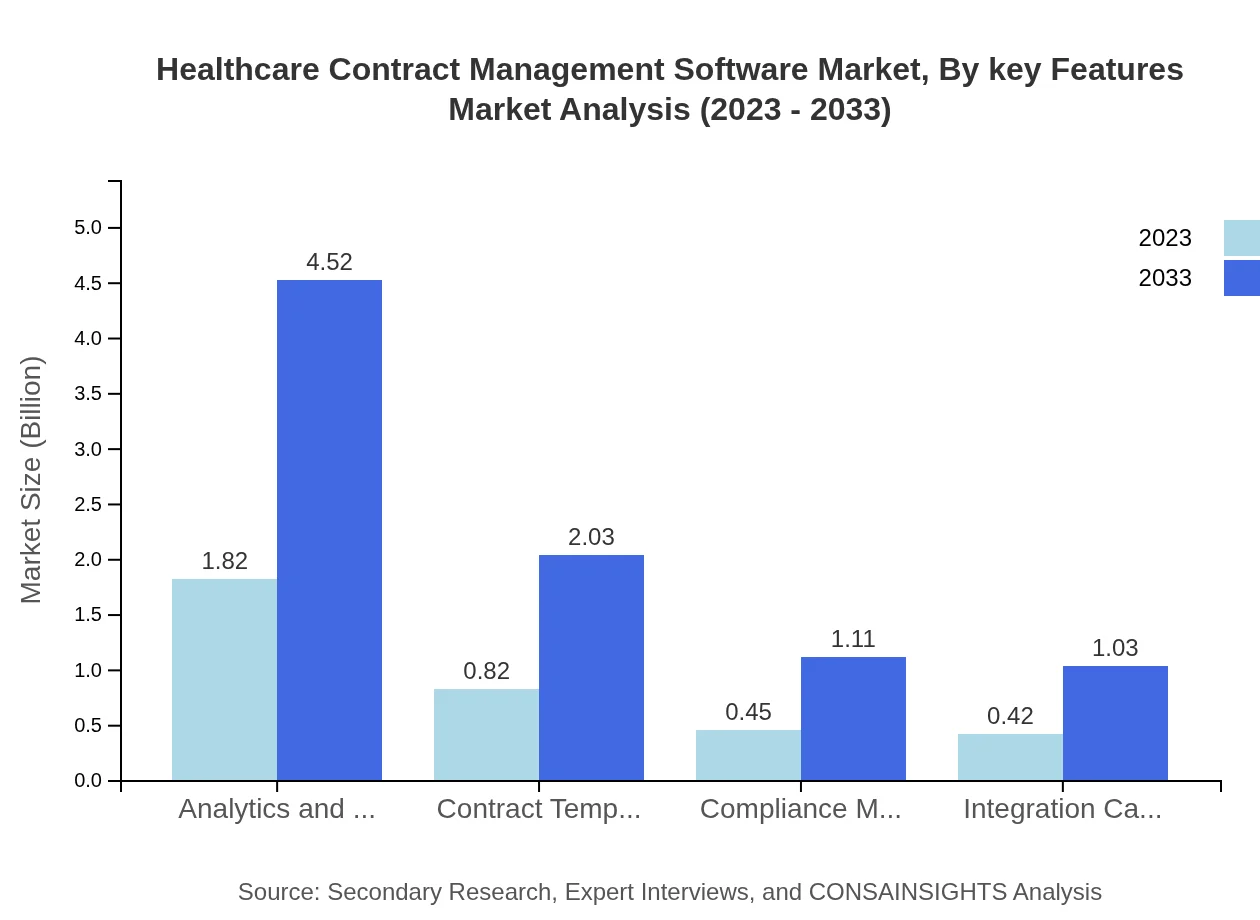

Healthcare Contract Management Software Market Analysis By Key Features

Key features such as analytics and reporting stand out, with a size of $1.82 billion in 2023 and an expected growth to $4.52 billion by 2033, representing a 52.02% share. Contract template management and compliance management also show significant potential, with respective growth trajectories reflecting the increasing demand for efficiency, accuracy, and regulatory adherence within healthcare contract management processes.

Healthcare Contract Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Contract Management Software Industry

SAP SE:

SAP SE is a leading provider of business software solutions including contract management systems tailored for the healthcare industry, known for integrating big data and analytics into their offerings.Oracle Corporation:

Oracle Corporation offers comprehensive healthcare contract management solutions that facilitate compliance, risk management, and contract performance measurement through cloud-based platforms.IBM:

IBM provides AI-driven healthcare contract management solutions that emphasize automation and data analytics, helping healthcare providers enhance operational efficiencies.Coupa Software:

Coupa Software delivers cloud-based spend management solutions with contract management capabilities aimed at streamlining procurement and vendor management processes.DocuSign:

DocuSign is a pioneer in electronic signature technologies and offers contract lifecycle management solutions tailored explicitly for healthcare organizations.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare Contract Management Software?

The healthcare contract management software market is currently valued at approximately $3.5 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 9.2%. This growth indicates robust demand and opportunities for software providers in the next decade.

What are the key market players or companies in this healthcare Contract Management Software industry?

Key players in the healthcare contract management software industry include major providers such as Oracle, SAP, DocuSign, and Icertis. These companies are recognized for their comprehensive solutions that cater to diverse healthcare needs.

What are the primary factors driving the growth in the healthcare Contract Management Software industry?

Primary growth drivers include the increasing need for efficiency in contract management, rising regulatory compliance demands, and the adoption of advanced technologies such as cloud computing and automation, which enhance operational capabilities within healthcare organizations.

Which region is the fastest Growing in the healthcare Contract Management Software?

North America is anticipated to be the fastest-growing region in the healthcare contract management software market, with an increase from $1.26 billion in 2023 to $3.14 billion by 2033. This growth is attributed to significant investments in healthcare IT.

Does ConsaInsights provide customized market report data for the healthcare Contract Management Software industry?

Yes, ConsaInsights offers tailored market report data for the healthcare contract management software industry to meet specific client needs, ensuring detailed insights into market trends, player analysis, and growth forecasts.

What deliverables can I expect from this healthcare Contract Management Software market research project?

Deliverables include comprehensive market analysis reports, segmented data, competitive landscape reviews, growth forecasts, and actionable insights tailored to strategic decision-making in the healthcare contract management sector.

What are the market trends of healthcare Contract Management Software?

Current trends in the healthcare contract management software market include a shift towards cloud-based solutions, increased integration capabilities, and the demand for compliance management tools, reflecting a push for efficiency and data management.