Healthcare Distribution Market Report

Published Date: 31 January 2026 | Report Code: healthcare-distribution

Healthcare Distribution Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Healthcare Distribution market, examining current trends, market size forecasts, and insights from 2023 to 2033, offering valuable data for stakeholders in the healthcare sector.

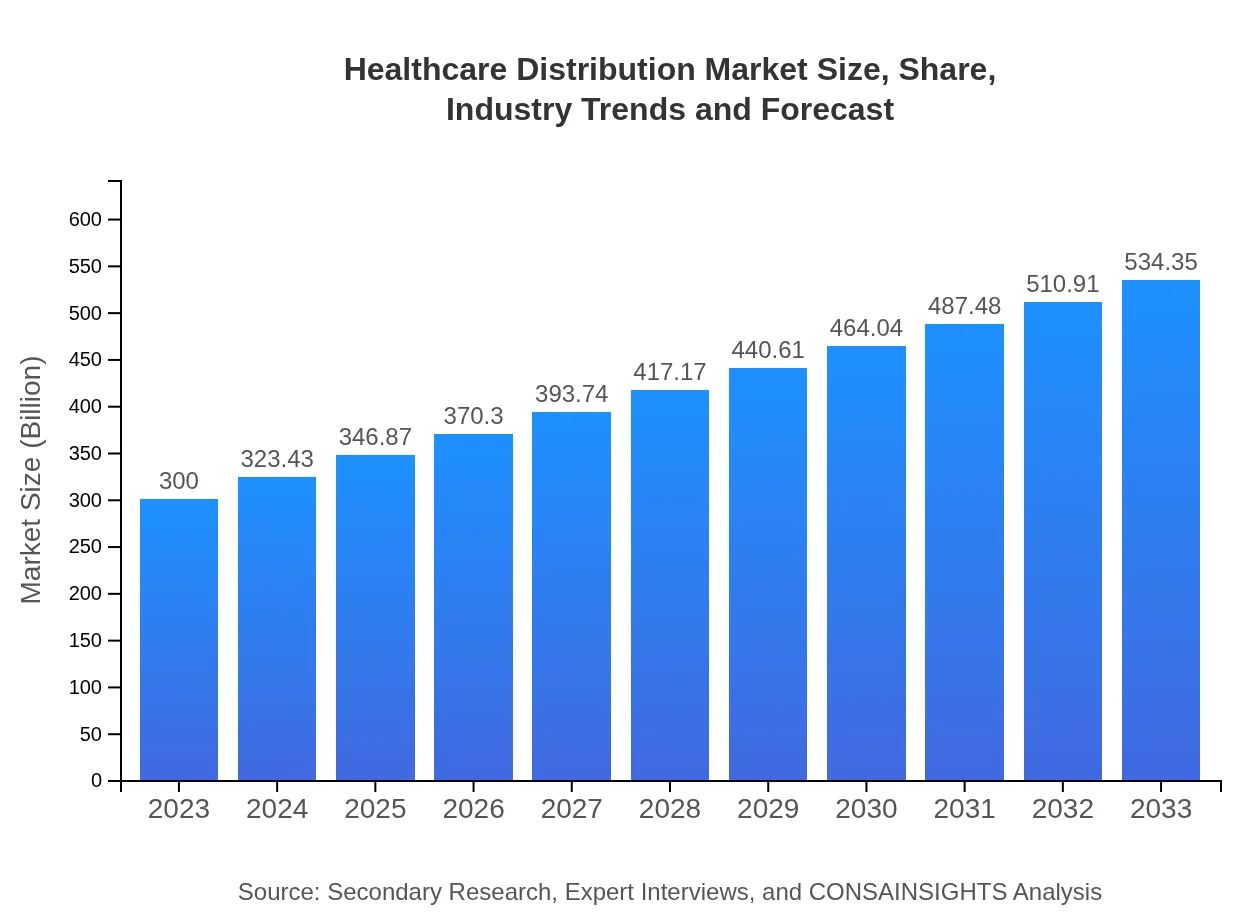

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $300.00 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $534.35 Billion |

| Top Companies | McKesson Corporation, AmerisourceBergen, Cardinal Health, Celesio AG, BD (Becton, Dickinson and Company) |

| Last Modified Date | 31 January 2026 |

Healthcare Distribution Market Overview

Customize Healthcare Distribution Market Report market research report

- ✔ Get in-depth analysis of Healthcare Distribution market size, growth, and forecasts.

- ✔ Understand Healthcare Distribution's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Distribution

What is the Market Size & CAGR of Healthcare Distribution market in 2023?

Healthcare Distribution Industry Analysis

Healthcare Distribution Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Distribution Market Analysis Report by Region

Europe Healthcare Distribution Market Report:

Europe's Healthcare Distribution market, valued at 105.57 billion USD in 2023, is projected to grow to 188.04 billion USD by 2033. The market is characterized by strong regulatory frameworks and a move towards integrated digital delivery systems. Innovation in logistics and supply chain management is enabling European companies to enhance operational efficiencies.Asia Pacific Healthcare Distribution Market Report:

The Asia-Pacific region, valued at 51.24 billion USD in 2023, is expected to grow to 91.27 billion USD by 2033. Growth factors include rising populations, increasing healthcare access, and government initiatives aimed at improving healthcare infrastructure. The region is experiencing significant developments in telemedicine and home care, further driving the demand for efficient distribution networks.North America Healthcare Distribution Market Report:

The North American market is estimated at 103.77 billion USD in 2023 and is anticipated to increase to 184.83 billion USD by 2033. This region is the largest market for healthcare distribution, driven by advanced healthcare infrastructure, a high prevalence of chronic diseases, and significant investments in health technologies. The ongoing digitization of healthcare services is reshaping distribution models.South America Healthcare Distribution Market Report:

In South America, the Healthcare Distribution market size stands at 2.22 billion USD in 2023 and is projected to reach 3.95 billion USD by 2033. Although the market is smaller than other regions, there is a growing focus on enhancing healthcare access and improving distribution efficiency, particularly in urban areas. The gradual shift towards private healthcare and investments in healthcare infrastructure are expected to contribute to market growth.Middle East & Africa Healthcare Distribution Market Report:

The Middle East and Africa region shows a market size of 37.20 billion USD in 2023, expected to reach 66.26 billion USD by 2033. With rapid urbanization and increasing healthcare investments, this region is witnessing improvements in healthcare distribution. The need for enhanced distribution networks is growing as countries seek to ensure availability and access to healthcare products.Tell us your focus area and get a customized research report.

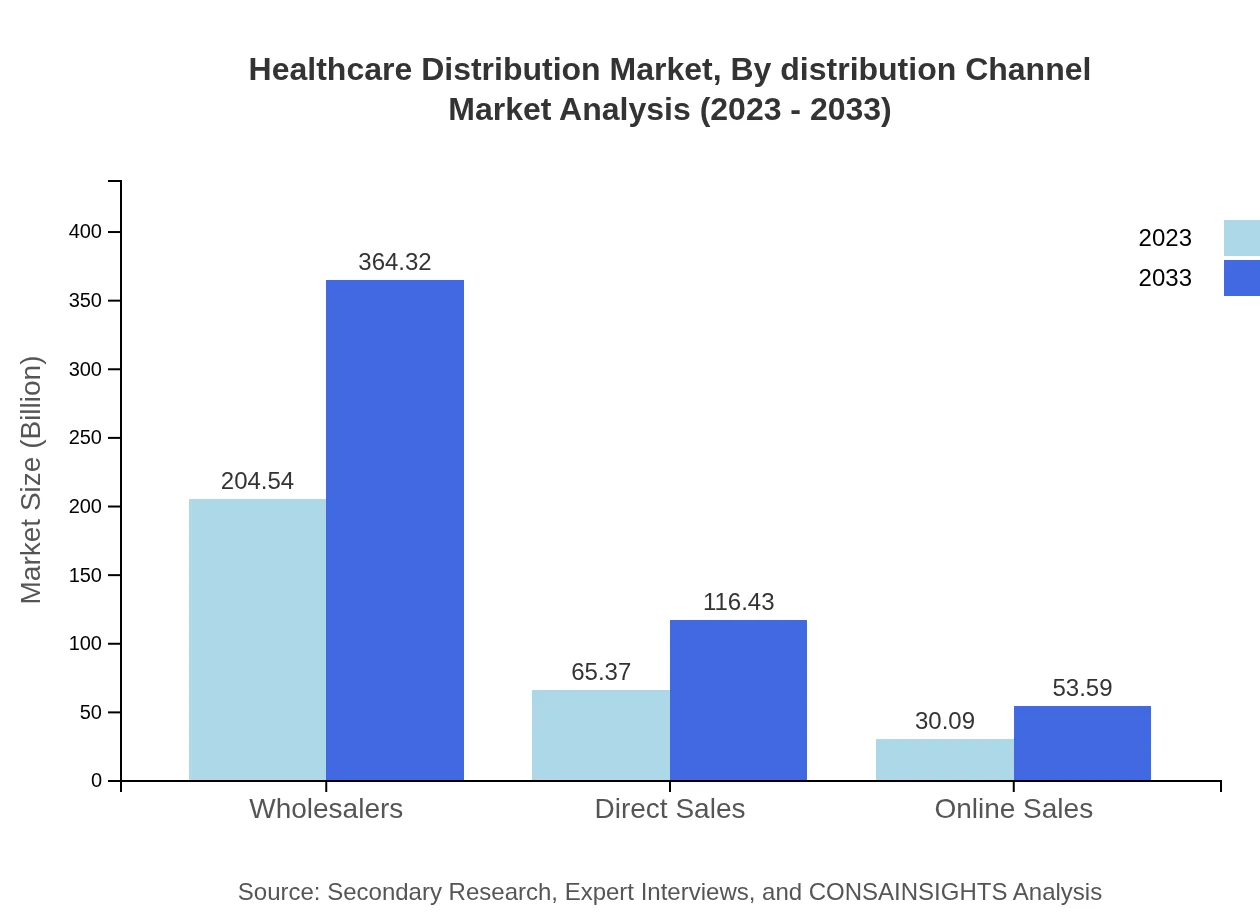

Healthcare Distribution Market Analysis By Distribution Channel

The Healthcare Distribution market can be segmented into various distribution channels, including wholesalers, direct sales, online sales, and automated systems. Wholesalers dominate the market with a significant share due to their extensive networks. Direct sales represent a growing avenue, especially for specialized healthcare products. Online sales have gained traction, particularly post-COVID-19, as healthcare providers seek convenience and efficiency in procurement. Automated systems are also becoming increasingly popular due to their ability to streamline operations and reduce costs.

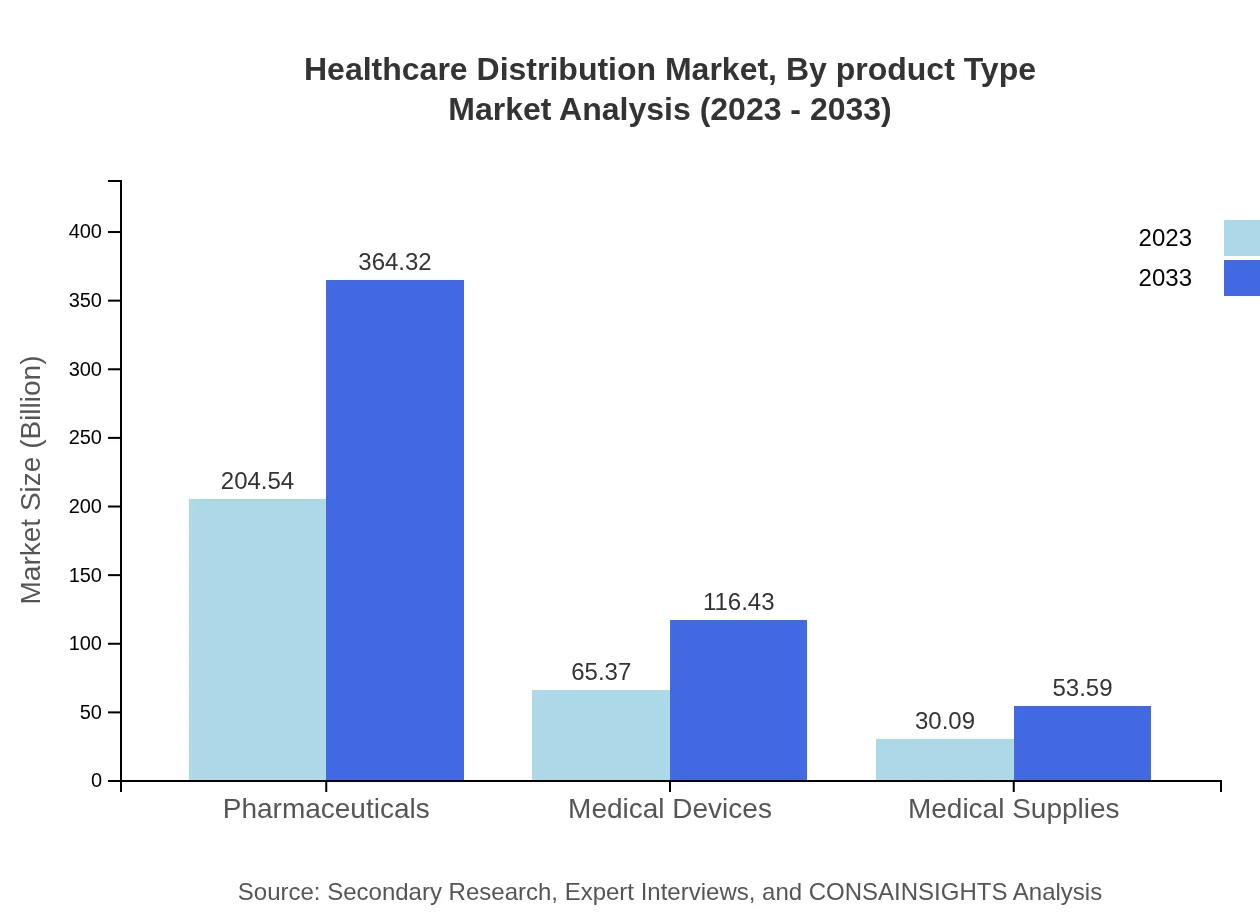

Healthcare Distribution Market Analysis By Product Type

The Healthcare Distribution market is segmented based on product types such as pharmaceuticals, medical devices, and medical supplies. Pharmaceuticals remain the largest segment, accounting for approximately 68.18% of the market share in 2023, with a projected increase to 68.18% in 2033. Medical devices and supplies also hold notable market positions, given their essential role in patient care.

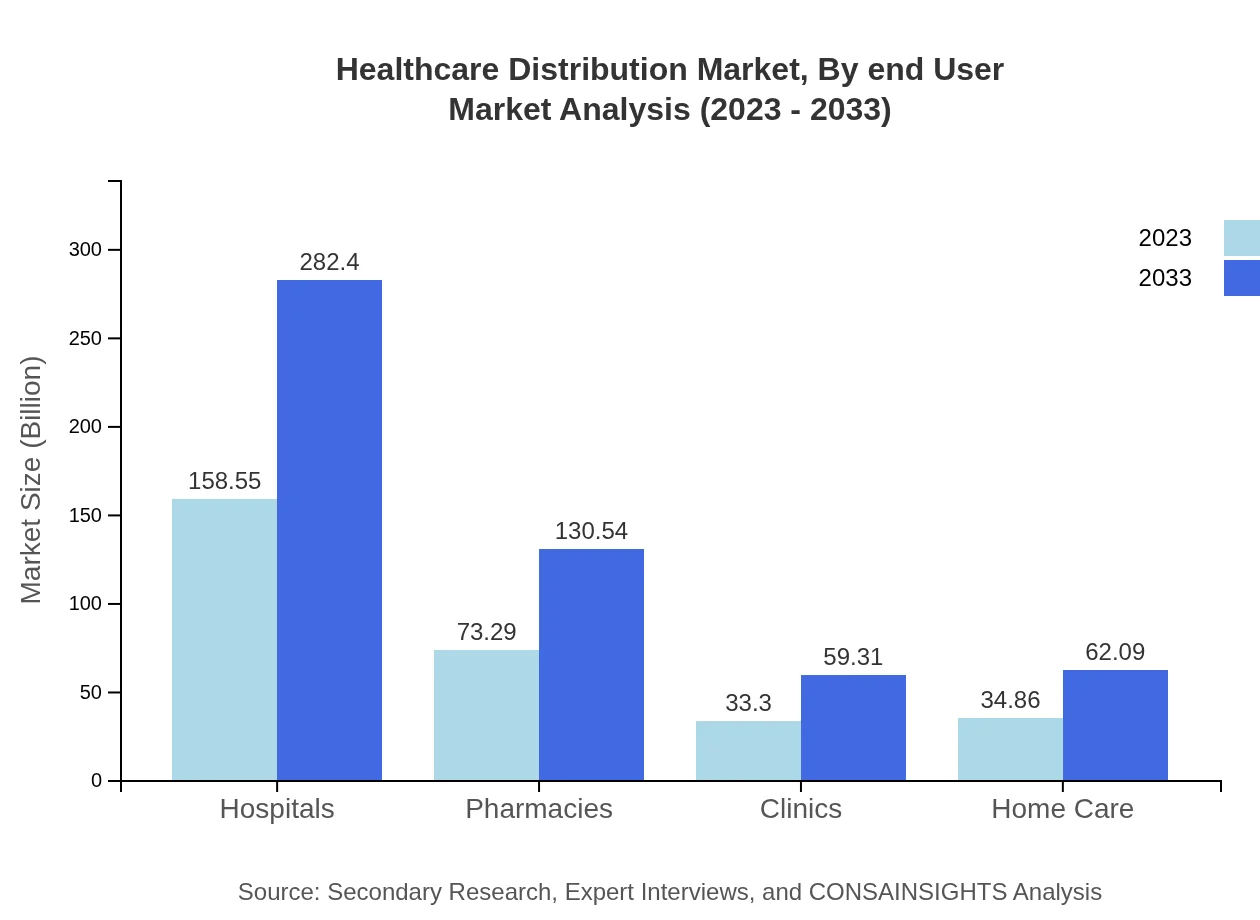

Healthcare Distribution Market Analysis By End User

The end-user segment includes hospitals, pharmacies, clinics, and home care services. Hospitals are the largest end-user segment, holding a significant share at 52.85% in 2023 and maintaining that proportion into 2033. Pharmacies also play a crucial role, and home care services are expanding rapidly, driven by the aging population and a shift towards more personalized care in the home.

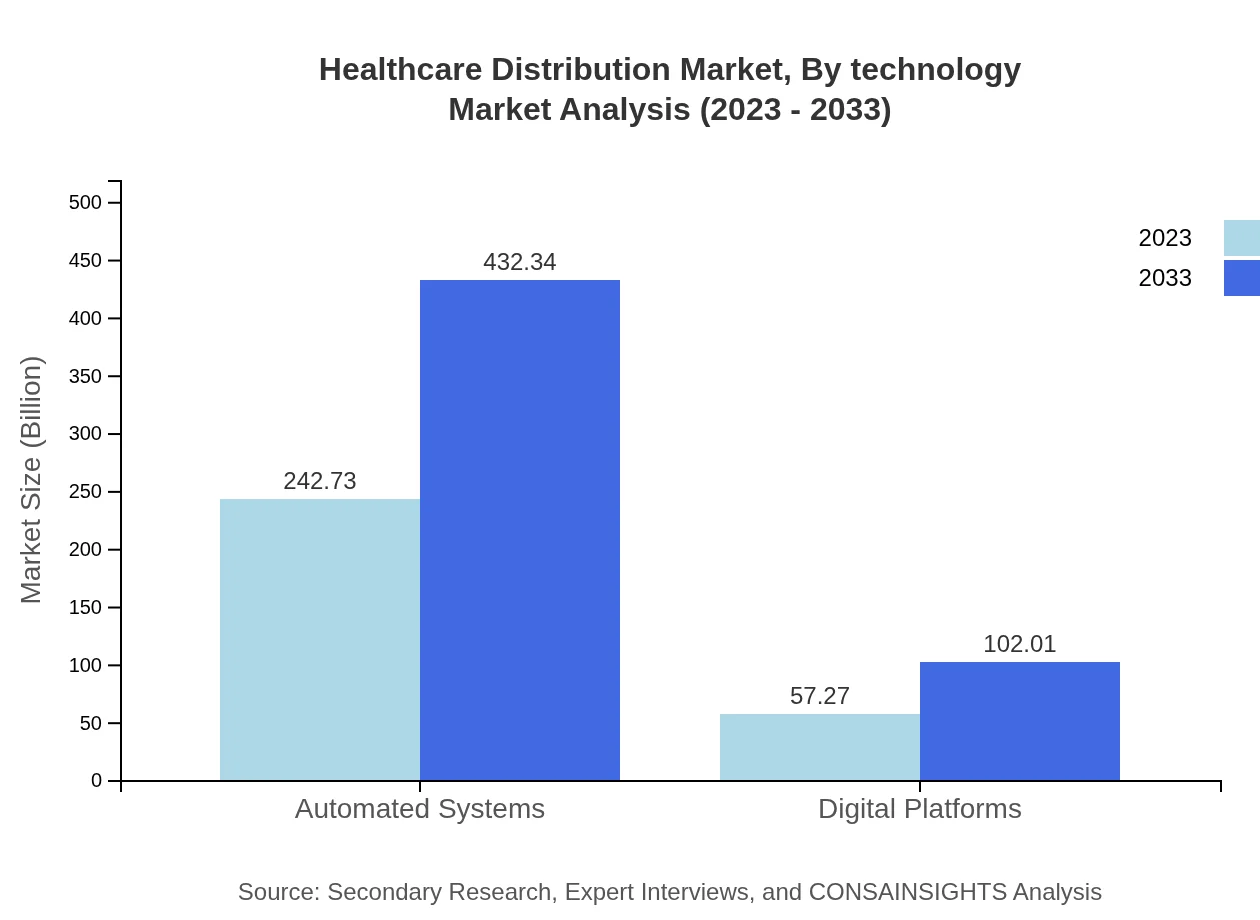

Healthcare Distribution Market Analysis By Technology

Technology is transforming the Healthcare Distribution landscape. The adoption of digital platforms, automated inventory systems, and advanced data analytics enables more efficient logistics and enhanced supply chain visibility. The market for automated systems is particularly notable, expected to grow from 242.73 billion USD in 2023 to 432.34 billion USD by 2033, highlighting the increasing reliance on technology to drive efficiency and performance in healthcare distribution.

Healthcare Distribution Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Distribution Industry

McKesson Corporation:

A leading healthcare distribution company providing pharmaceuticals, medical supplies, and healthcare management services to the healthcare sector globally.AmerisourceBergen:

A top global pharmaceutical sourcing and distribution services company, committed to providing high-quality healthcare products and services.Cardinal Health:

A key player in the healthcare supply chain, Cardinal Health distributes pharmaceuticals and medical products while offering supply chain solutions.Celesio AG:

A European leader in pharmacy wholesaling, providing comprehensive supply chain management and logistics services in the healthcare sector.BD (Becton, Dickinson and Company):

Specializing in medical technology, BD is a significant provider of medical supplies and devices, enhancing the delivery of healthcare through effective distribution channels.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare distribution?

The global healthcare distribution market is valued at approximately $300 billion in 2023, with a projected CAGR of 5.8% from 2023 to 2033, indicating robust growth driven by an increasing demand for efficient distribution networks.

What are the key market players or companies in the healthcare distribution industry?

Key players in the healthcare distribution sector include major wholesalers, distributors specializing in pharmaceuticals, medical devices, and online platforms, which are focusing on expanding their market reach and leveraging technology for improved service delivery.

What are the primary factors driving the growth in the healthcare distribution industry?

Growth in the healthcare distribution industry is primarily driven by the increasing prevalence of chronic diseases, technological advancements in distribution processes, and the rising demand for cost-effective healthcare solutions across various markets globally.

Which region is the fastest Growing in healthcare distribution?

The Asia Pacific region emerges as the fastest-growing market for healthcare distribution, expected to rise from $51.24 billion in 2023 to $91.27 billion by 2033, reflecting significant investments and expanding healthcare infrastructure.

Does ConsaInsights provide customized market report data for the healthcare distribution industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the healthcare distribution industry, enabling businesses to make informed decisions based on detailed market analysis and trends.

What deliverables can I expect from this healthcare distribution market research project?

Expect comprehensive deliverables including market analysis reports, competitor benchmarking, regional insights, and segment-specific data that provide a holistic view of the healthcare distribution landscape.

What are the market trends of healthcare distribution?

Key market trends include the rise of digital platforms for distribution, increased automation in supply chains, and a focus on sustainability and environmental-friendly practices, shaping the future of healthcare distribution.