Healthcare Equipment Leasing Market Report

Published Date: 31 January 2026 | Report Code: healthcare-equipment-leasing

Healthcare Equipment Leasing Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Healthcare Equipment Leasing market from 2023 to 2033, examining its size, growth trends, regional insights, and key players shaping the industry landscape. It offers data-driven forecasts and insights into leasing models and market segmentation.

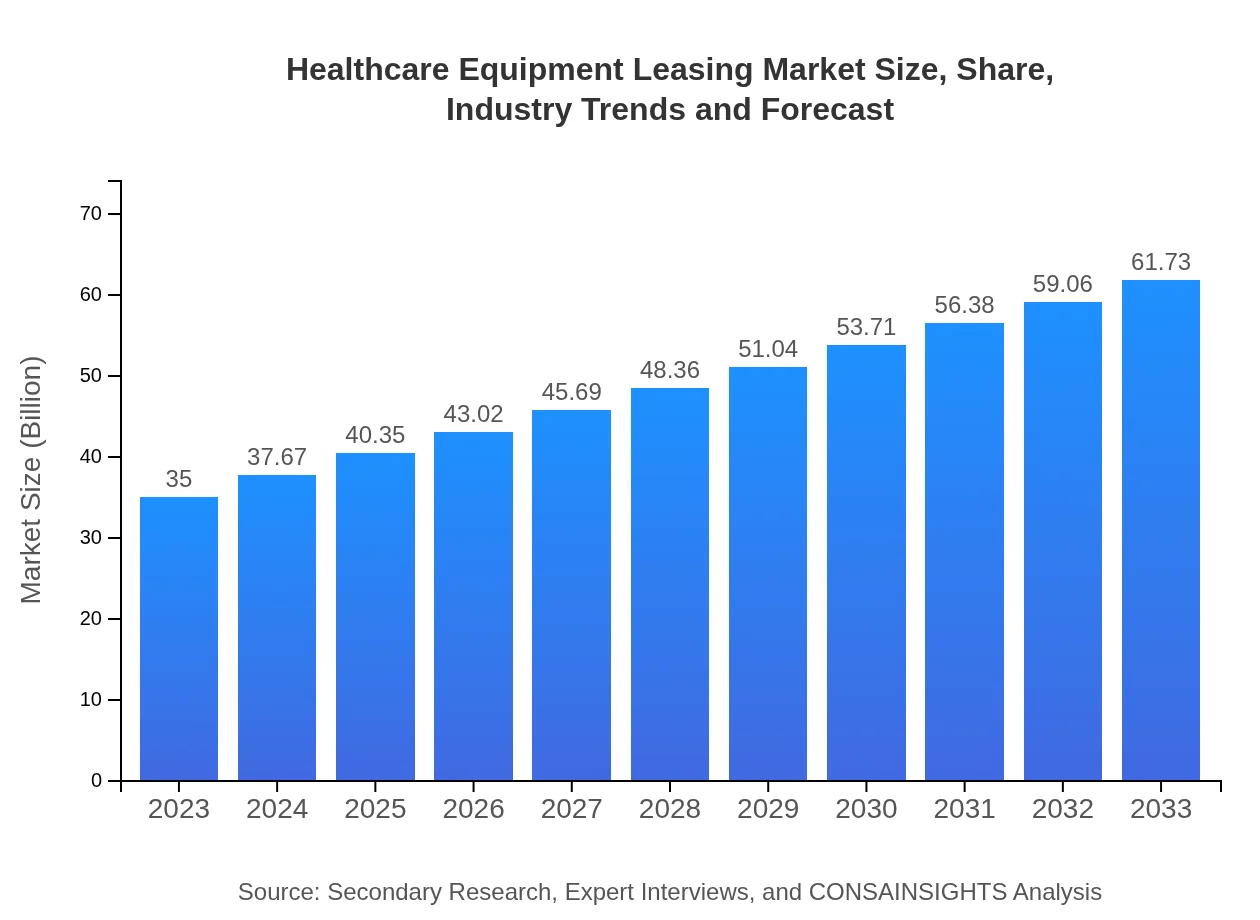

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $35.00 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $61.73 Billion |

| Top Companies | GE Healthcare, Siemens Healthineers, Philips Healthcare, Fujifilm Medical Systems |

| Last Modified Date | 31 January 2026 |

Healthcare Equipment Leasing Market Overview

Customize Healthcare Equipment Leasing Market Report market research report

- ✔ Get in-depth analysis of Healthcare Equipment Leasing market size, growth, and forecasts.

- ✔ Understand Healthcare Equipment Leasing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Equipment Leasing

What is the Market Size & CAGR of Healthcare Equipment Leasing market in 2023?

Healthcare Equipment Leasing Industry Analysis

Healthcare Equipment Leasing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Equipment Leasing Market Analysis Report by Region

Europe Healthcare Equipment Leasing Market Report:

Europe's Healthcare Equipment Leasing market was valued at $9.01 billion in 2023, projected to grow to $15.88 billion by 2033. The European market is characterized by a mix of advanced healthcare systems and a growing number of healthcare startups adopting leasing options to remain agile and cost-effective.Asia Pacific Healthcare Equipment Leasing Market Report:

In 2023, the Asia Pacific Healthcare Equipment Leasing market is valued at approximately $7.02 billion and is projected to reach $12.38 billion by 2033. The growth is driven by expanding healthcare infrastructure, particularly in countries like India and China, where both government and private sectors are heavily investing in medical facilities.North America Healthcare Equipment Leasing Market Report:

North America holds the largest market share with a 2023 valuation of 11.38 billion dollars, expected to surge to $20.06 billion by 2033. The U.S. leads in healthcare spending and technological innovation, further benefiting from a regulatory environment favorable to leasing solutions.South America Healthcare Equipment Leasing Market Report:

The South American market is valued at about $3.31 billion in 2023, likely growing to $5.84 billion by 2033. Economic factors and increasing healthcare access are pushing hospitals and clinics in this region to adopt leasing strategies for new technologies to enhance treatment options.Middle East & Africa Healthcare Equipment Leasing Market Report:

The Middle East and Africa market is growing steadily, with a market size of $4.29 billion in 2023 projected to reach $7.56 billion by 2033. Regional investments in healthcare infrastructure and a focus on enhancing healthcare service delivery standards drive this growth.Tell us your focus area and get a customized research report.

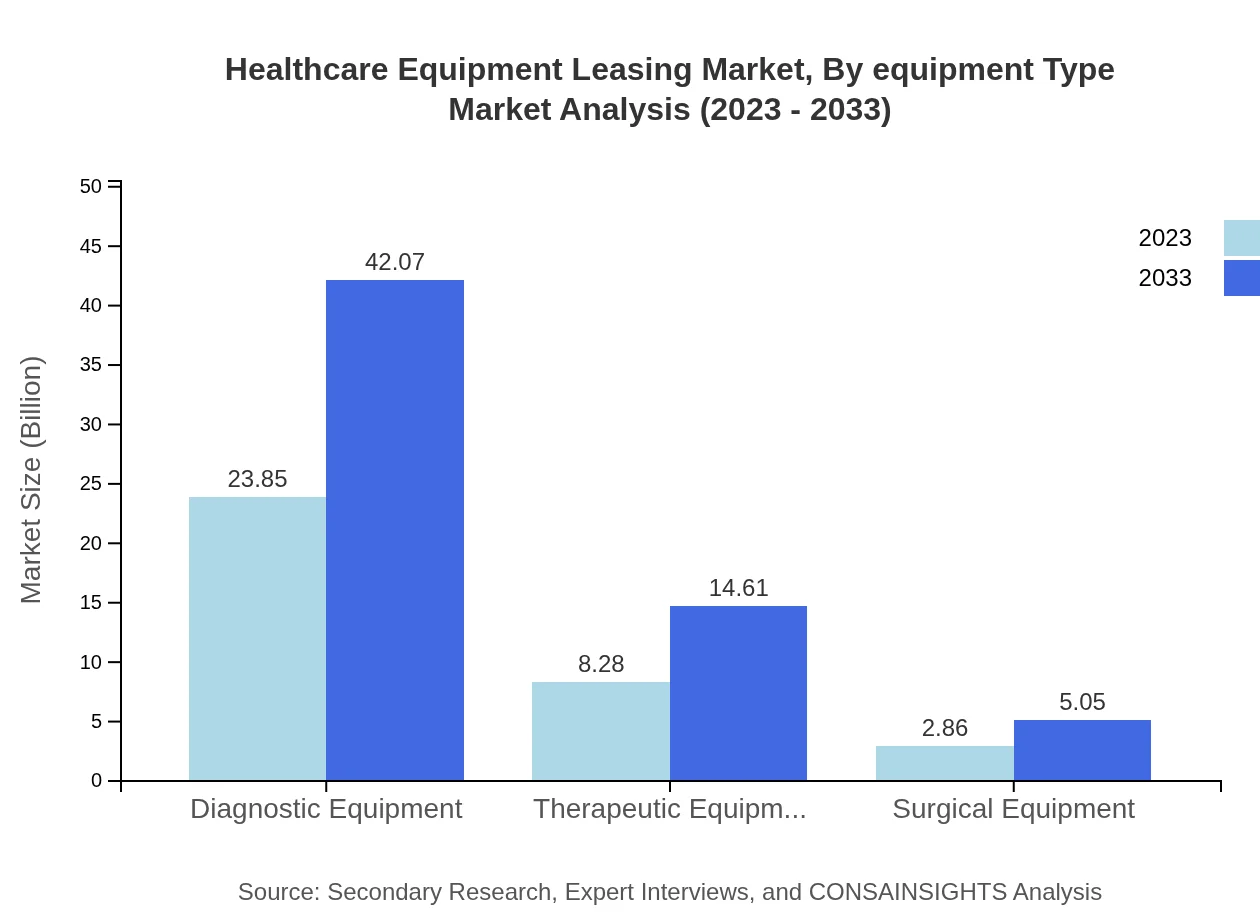

Healthcare Equipment Leasing Market Analysis By Equipment Type

The equipment type segment shows significant diversity, with the market for diagnostic equipment expected to grow from $23.85 billion in 2023 to $42.07 billion by 2033, capturing a dominant market share of 68.15%. Therapeutic and surgical equipment also hold promising potentials, with notably healthy increases in market size as medical advancements require frequent upgrades. Operating leases continue to lead, accounting for 68.15% of the leasing strategy, with their size predicted to rise accordingly.

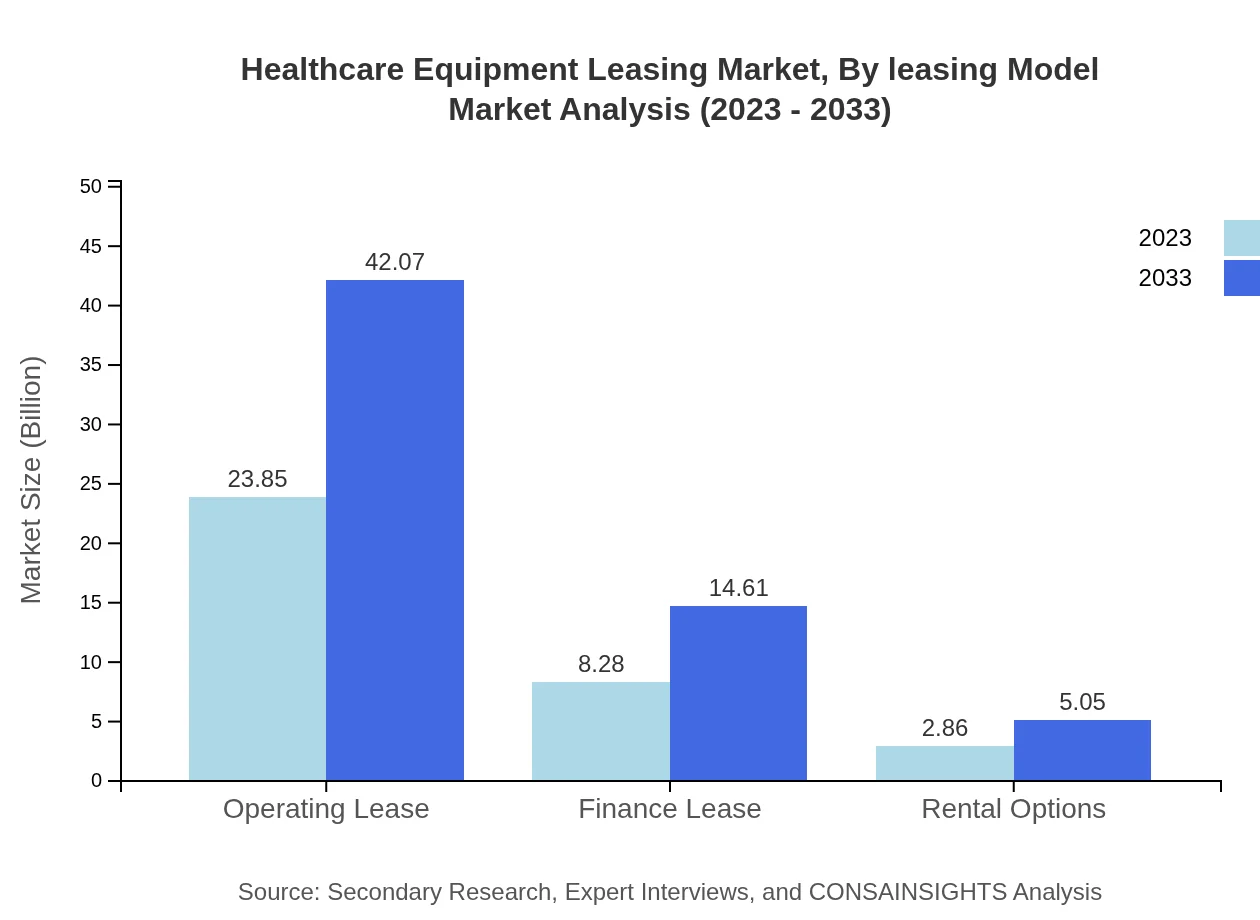

Healthcare Equipment Leasing Market Analysis By Leasing Model

Operating leases dominate the Healthcare Equipment Leasing landscape, valued at $23.85 billion in 2023 and expected to reach $42.07 billion by 2033. Finance leases are growing in popularity, transitioning from $8.28 billion to $14.61 billion over the same period while holding a consistent share of the overall leasing strategy. Rental options present a smaller segment with increasing attractiveness, especially for short-term needs.

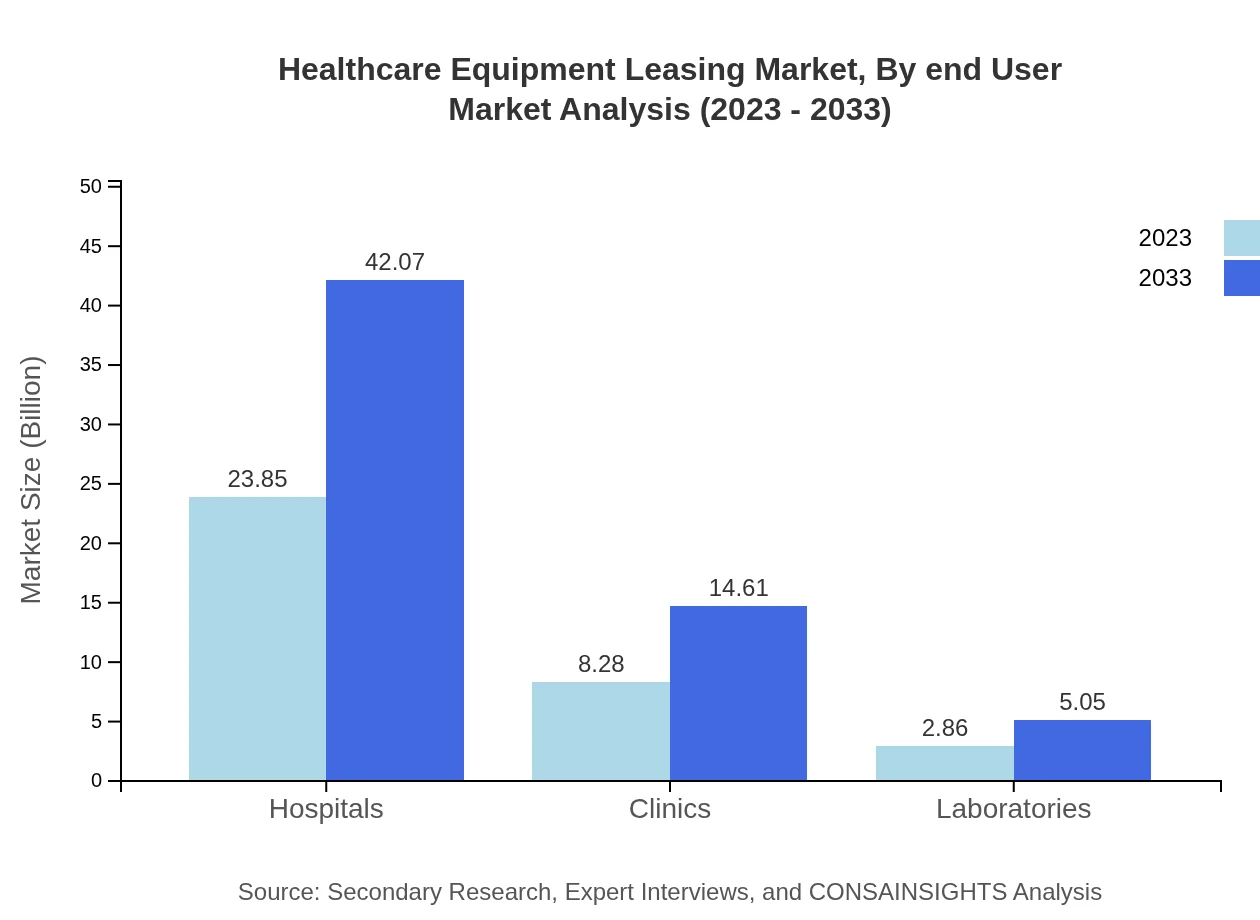

Healthcare Equipment Leasing Market Analysis By End User

The market by end-user identifies hospitals as the main consumer, growing from $23.85 billion in 2023 to $42.07 billion by 2033, consistently capturing a market share of 68.15%. Clinics and laboratories are also notable players, with clinics projected to grow from $8.28 billion to $14.61 billion, while laboratories' leasing needs increase gradually as technology in diagnostics advances.

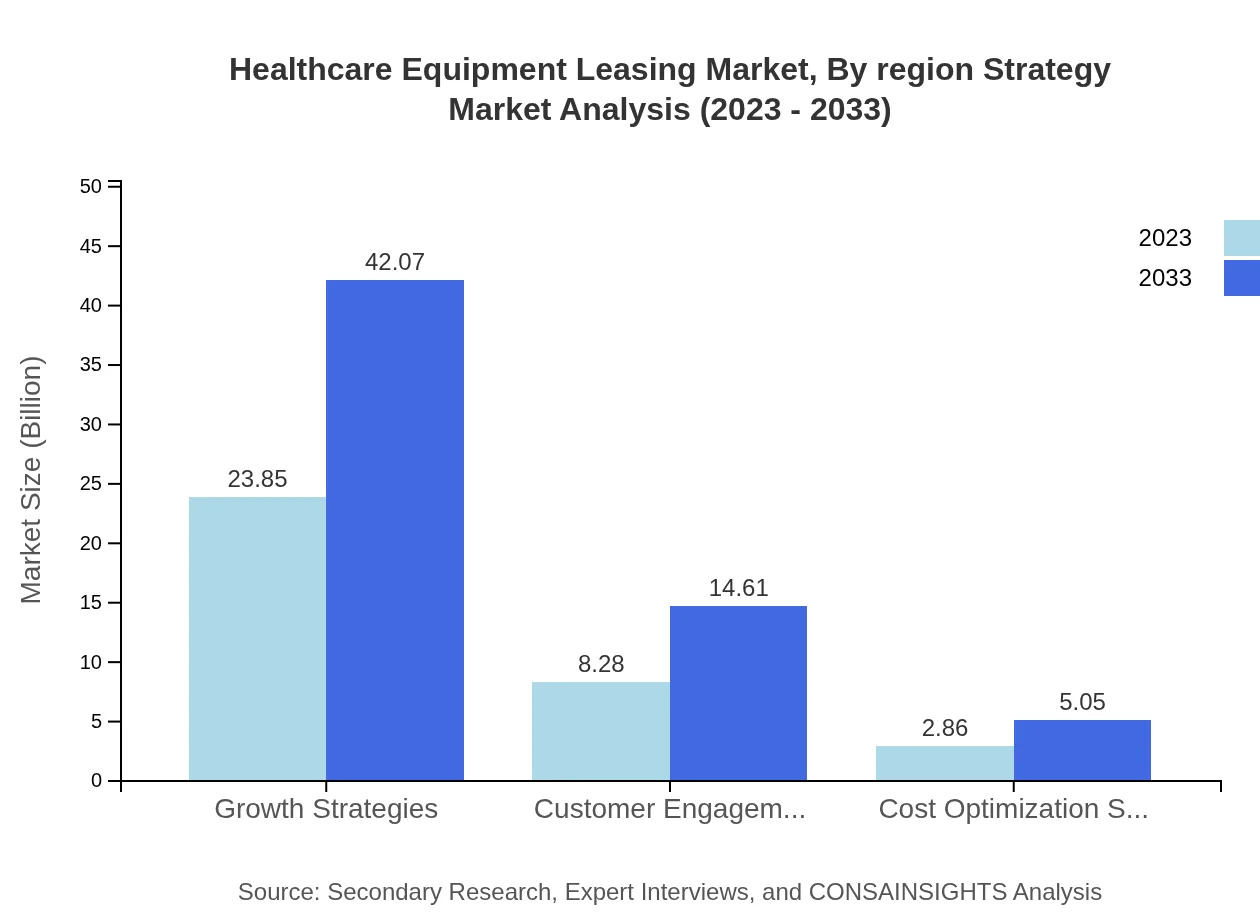

Healthcare Equipment Leasing Market Analysis By Region Strategy

Regions adopt unique strategies for equipment leasing, including growth strategies focused on infrastructure development and customer engagement strategies aimed at enhancing service delivery. In North America, cost optimization strategies are prevalent, helping organizations fine-tune operational efficiencies, while in the Asia Pacific, innovative leasing models are emerging to meet local needs.

Healthcare Equipment Leasing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Equipment Leasing Industry

GE Healthcare:

A subsidiary of General Electric, GE Healthcare is a pioneer in medical technology and digital solutions, offering innovative leasing options for imaging equipment and monitoring solutions.Siemens Healthineers:

Focusing on diagnostic and therapeutic imaging, Siemens Healthineers provides flexible leasing agreements allowing healthcare providers to leverage cutting-edge technology continuously.Philips Healthcare:

Philips Healthcare specializes in providing a broad spectrum of healthcare equipment leasing options, emphasizing efficiency and cost-effectiveness in its contracts.Fujifilm Medical Systems:

Fujifilm offers advanced medical imaging and diagnostic products, combining them with strategic leasing options to help healthcare facilities modernize affordably.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare Equipment Leasing?

The healthcare equipment leasing market is valued at approximately $35 billion in 2023, with expectations for growth at a CAGR of 5.7% through 2033. This growth reflects increasing demand and the shift towards leasing models in healthcare services.

What are the key market players or companies in the healthcare Equipment Leasing industry?

Key players in the healthcare equipment leasing market include leading companies such as MedAssets, GE Capital, and Siemens Financial Services, among others. These companies provide diverse leasing options catering to various healthcare establishments that need advanced equipment.

What are the primary factors driving the growth in the healthcare Equipment Leasing industry?

Several factors drive growth in the healthcare equipment leasing industry, including rising healthcare costs, technological advancements, the need for regular upgrades, and financial flexibility offered by leasing solutions, allowing organizations to access the latest medical equipment without upfront capital investments.

Which region is the fastest Growing in the healthcare Equipment Leasing?

North America is the fastest-growing region in the healthcare equipment leasing market, with projected growth from $11.38 billion in 2023 to $20.06 billion by 2033. Factors include high adoption rates of advanced technologies and a rising number of healthcare facilities.

Does ConsaInsights provide customized market report data for the healthcare Equipment Leasing industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the healthcare equipment leasing industry. This personalized approach ensures clients receive relevant insights that meet their unique market strategy and operational objectives.

What deliverables can I expect from this healthcare Equipment Leasing market research project?

From this healthcare equipment leasing market research project, clients can expect comprehensive reports that include market size, trends, competitive landscape, segment analysis, and forecasts, enabling well-informed decision-making and strategic planning for growth.

What are the market trends of healthcare Equipment Leasing?

Current trends in the healthcare equipment leasing market include a shift towards operational leases, increased investment in telehealth technologies, and expanded service offerings. These trends reflect changing demands for flexible and scalable healthcare solutions.