Healthcare Information Exchange Market Report

Published Date: 31 January 2026 | Report Code: healthcare-information-exchange

Healthcare Information Exchange Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Healthcare Information Exchange (HIE) market from 2023 to 2033. It covers market size, segmentation, regional insights, industry analysis, and forecasts, equipping stakeholders with comprehensive data and trends relevant to the evolving healthcare sector.

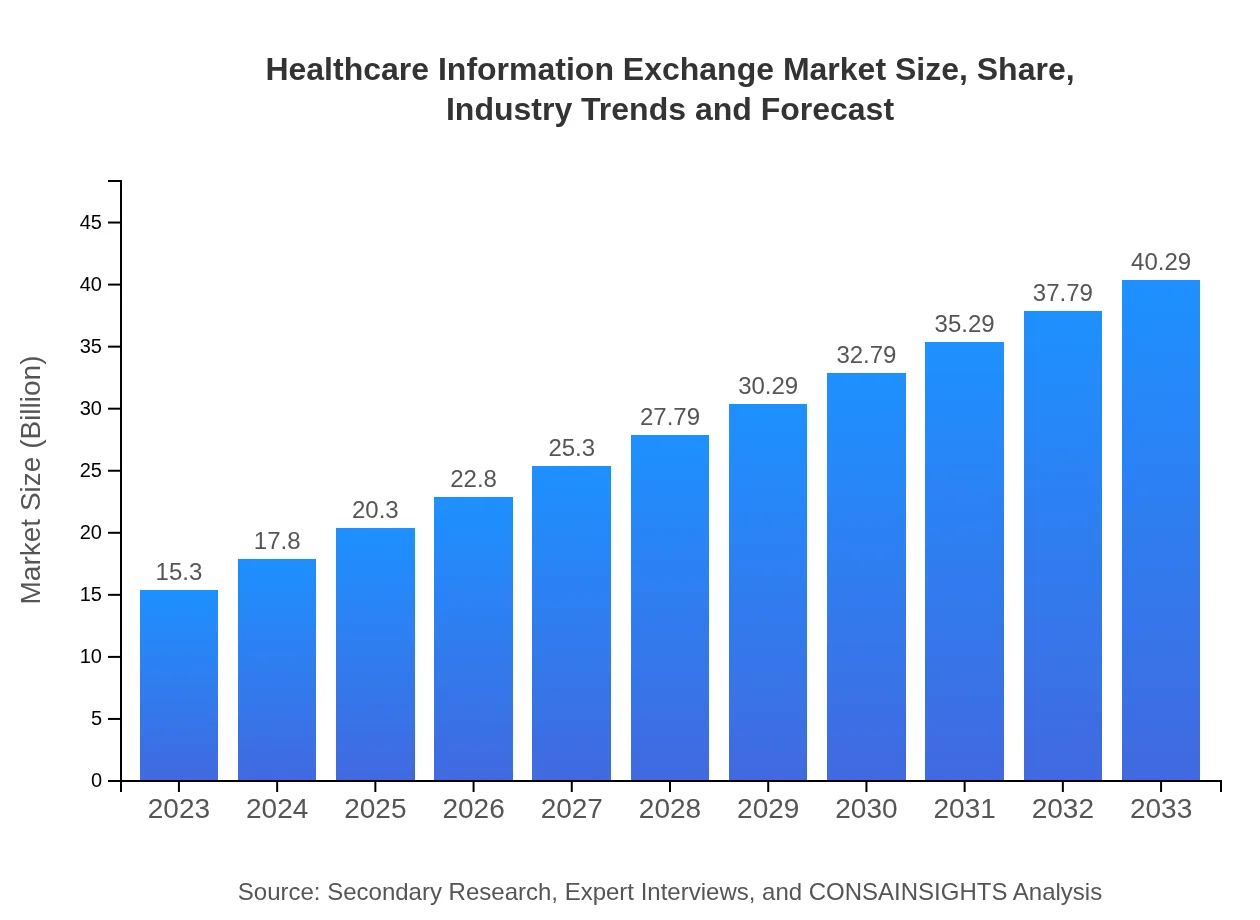

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.30 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $40.29 Billion |

| Top Companies | Epic Systems Corporation, Cerner Corporation, Health Catalyst, Allscripts Healthcare Solutions, InterSystems Corporation |

| Last Modified Date | 31 January 2026 |

Healthcare Information Exchange Market Overview

Customize Healthcare Information Exchange Market Report market research report

- ✔ Get in-depth analysis of Healthcare Information Exchange market size, growth, and forecasts.

- ✔ Understand Healthcare Information Exchange's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Information Exchange

What is the Market Size & CAGR of Healthcare Information Exchange market in 2023?

Healthcare Information Exchange Industry Analysis

Healthcare Information Exchange Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Information Exchange Market Analysis Report by Region

Europe Healthcare Information Exchange Market Report:

In Europe, the HIE market is valued at $4.07 billion in 2023 and is forecasted to reach $10.72 billion by 2033. The region's heightened focus on patient-centric care and the integration of cross-border health data exchange policies significantly impact market dynamics.Asia Pacific Healthcare Information Exchange Market Report:

In 2023, the Healthcare Information Exchange market in the Asia-Pacific region is valued at $3.13 billion and is projected to grow to $8.24 billion by 2033. This region experiences enhanced investment in digital health and governmental tools aimed at improving healthcare communication and information sharing. The rise of health technology startups is also accelerating HIE implementation across various countries.North America Healthcare Information Exchange Market Report:

North America dominates the Healthcare Information Exchange market with a size of approximately $5.55 billion in 2023, expected to grow to $14.62 billion by 2033. The U.S. government plays a pivotal role in promoting HIE adoption through policies aimed at enhancing the quality of care while reducing costs, influencing healthcare practitioners to increasingly embrace interoperable systems.South America Healthcare Information Exchange Market Report:

The South American healthcare sector is gradually adopting Healthcare Information Exchange practices, with a market worth $0.77 billion in 2023, potentially reaching $2.01 billion by 2033. The emphasis on enhanced healthcare access, insurance reforms, and interoperability solutions drives growth in this emerging market.Middle East & Africa Healthcare Information Exchange Market Report:

The Healthcare Information Exchange market in the Middle East and Africa is projected to expand from $1.78 billion in 2023 to $4.69 billion by 2033. The region is witnessing improved healthcare infrastructure, increased urbanization, and government initiatives pushing for health information sharing as key market drivers.Tell us your focus area and get a customized research report.

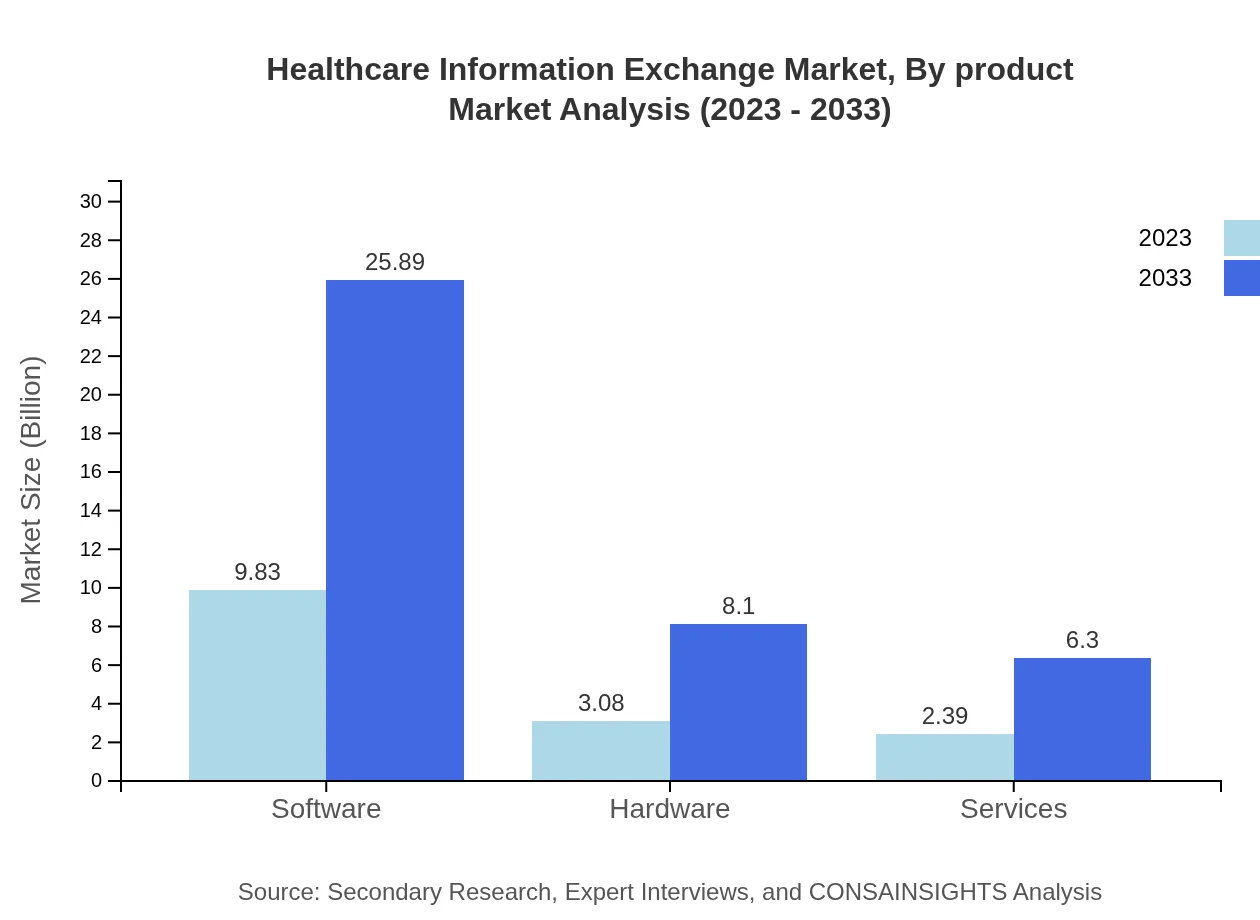

Healthcare Information Exchange Market Analysis By Product

The product segmentation indicates that software constitutes the largest segment within the Healthcare Information Exchange market, with a value of $9.83 billion in 2023 and forecasted to grow to $25.89 billion by 2033, capturing a significant market share. Hardware and services segments follow, with respective market sizes estimated to be $3.08 billion and $2.39 billion in 2023, growing to $8.10 billion and $6.30 billion by 2033.

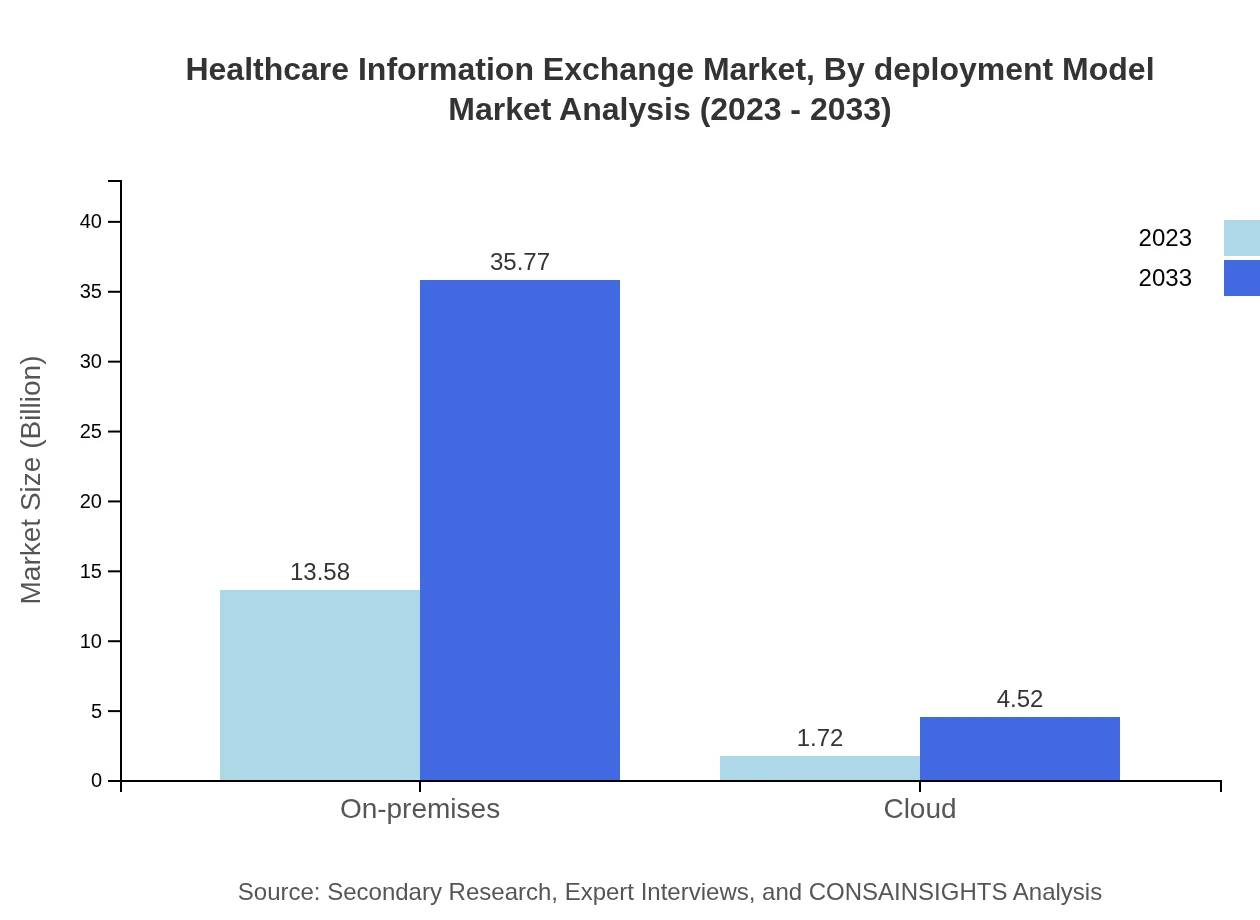

Healthcare Information Exchange Market Analysis By Deployment Model

The Healthcare Information Exchange market is significantly shaped by deployment models, with on-premises solutions dominating in 2023 at $13.58 billion. However, cloud solutions are anticipated to rise, moving from an initial size of $1.72 billion to $4.52 billion by 2033, reflecting increased adoption of flexible and scalable cloud services.

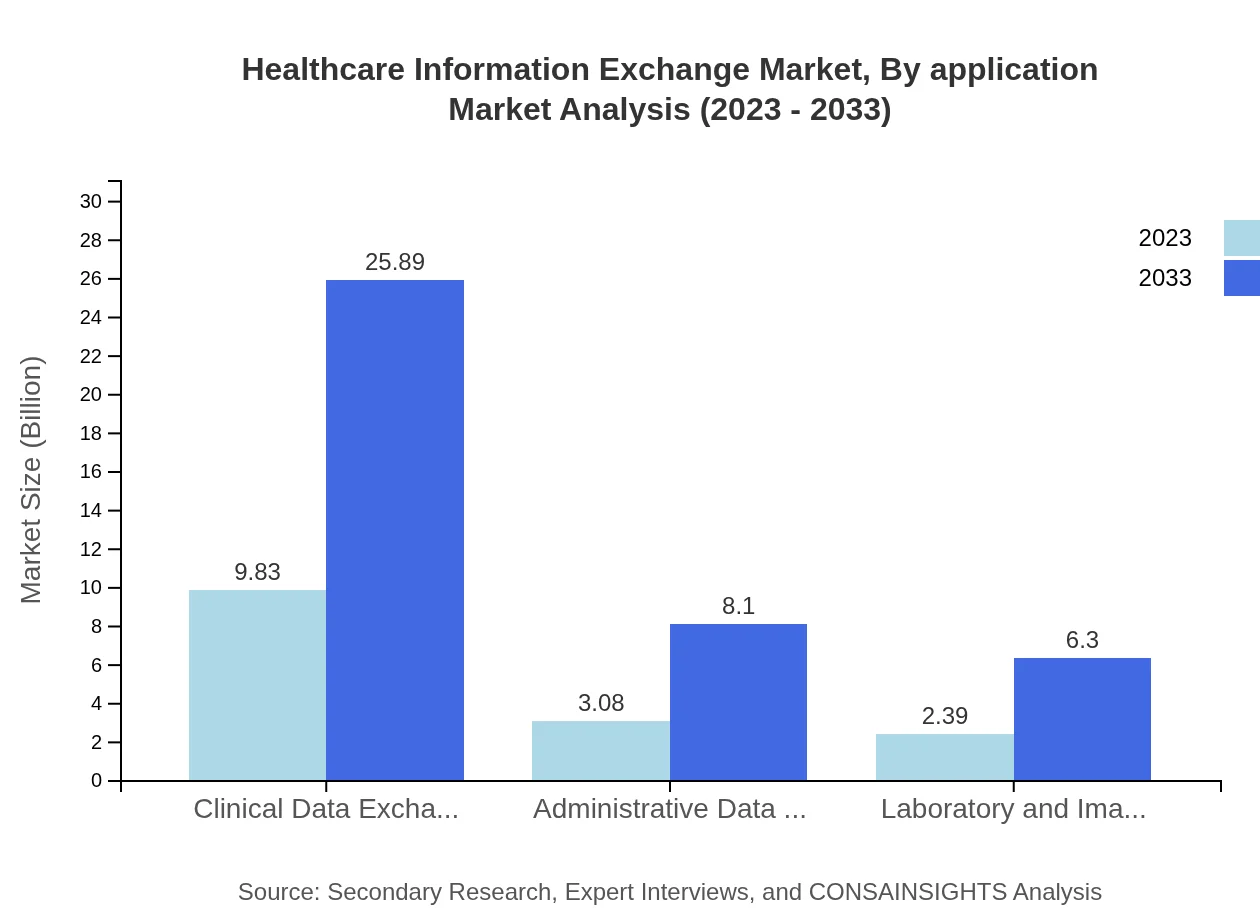

Healthcare Information Exchange Market Analysis By Application

Applications of HIE are categorized into clinical data exchange (size $9.83 billion), administrative data exchange ($3.08 billion), and laboratory and imaging data exchange ($2.39 billion) in 2023, all projected to experience growth in demand and size by 2033, emphasizing the various metrics utilized to enhance healthcare operations.

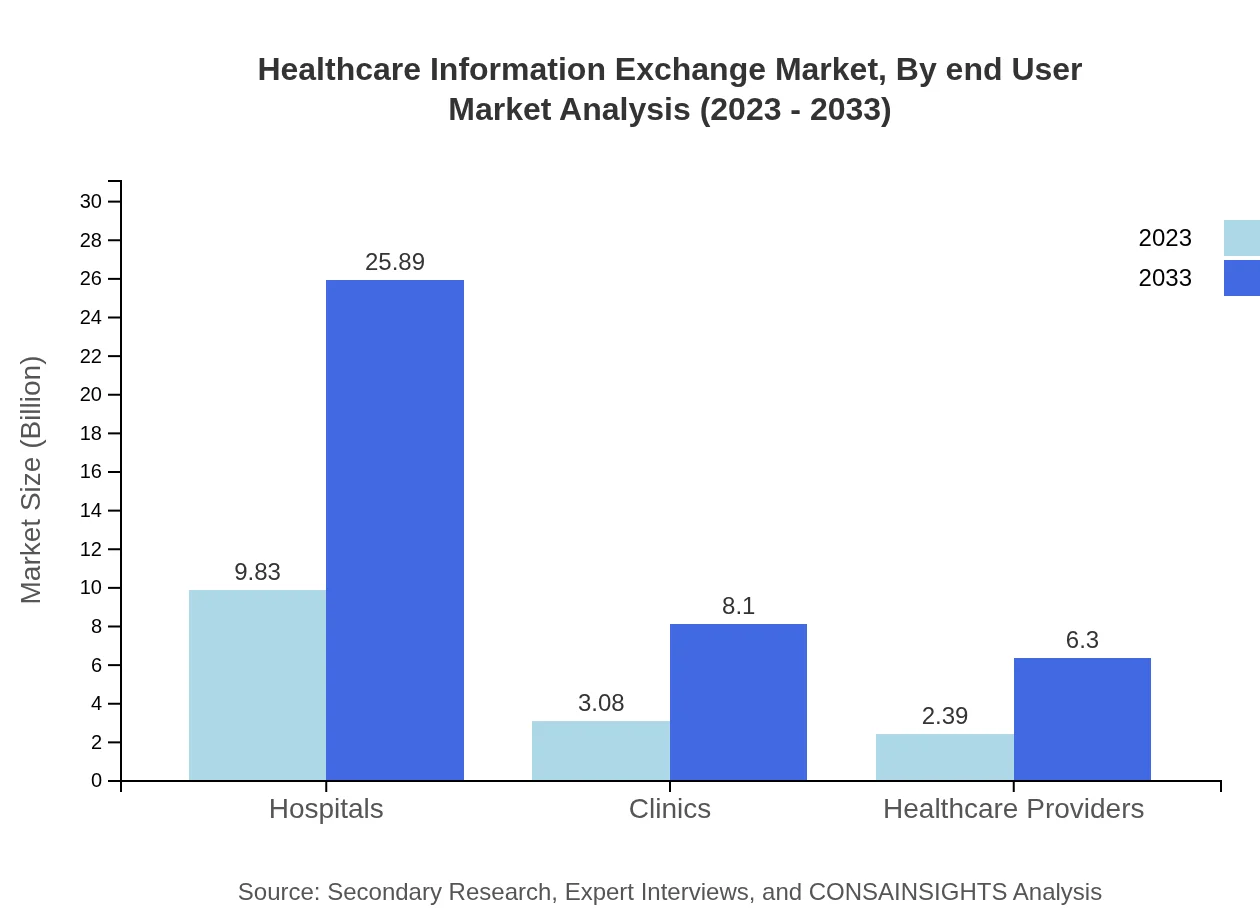

Healthcare Information Exchange Market Analysis By End User

The end-user segmentation portrays hospitals as the foremost consumers of HIE solutions, with a market size of $9.83 billion in 2023, which is expected to grow significantly by 2033. Clinics and healthcare providers also exhibit substantial growth, with respective market sizes of $3.08 billion and $2.39 billion presently.

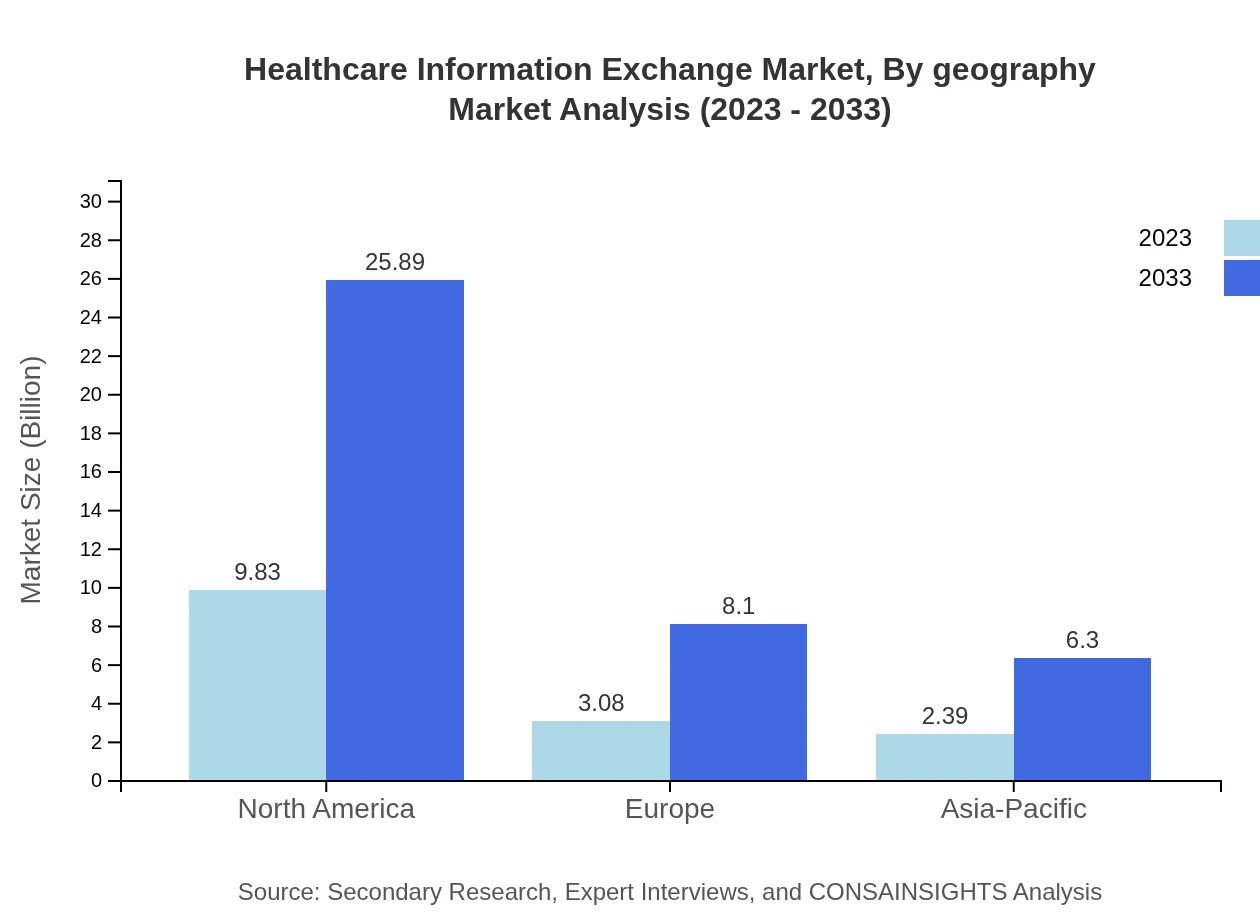

Healthcare Information Exchange Market Analysis By Geography

Geographic segmentation indicates that regions like North America and Europe lead in market share, followed by the Asia-Pacific. Each region displays its unique growth potential, shaped by local regulations, economic status, and technological advancements that impact the implementation of Healthcare Information Exchange systems.

Healthcare Information Exchange Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Information Exchange Industry

Epic Systems Corporation:

Epic Systems is a leading provider of healthcare software solutions, renowned for its comprehensive electronic health records system that enhances interoperability between organizations.Cerner Corporation:

Cerner is a major player in health information technology, offering innovative solutions that streamline data exchange and improve patient care through enhanced connectivity.Health Catalyst:

Health Catalyst provides a robust platform for improving healthcare outcomes through data integration and analytics, empowering organizations to leverage actionable insights effectively.Allscripts Healthcare Solutions:

Allscripts delivers EHR, revenue cycle management, and HIE systems, ensuring that healthcare providers can share and access vital patient information seamlessly.InterSystems Corporation:

InterSystems specializes in data management and integration solutions that support interoperability, making it easier for healthcare stakeholders to exchange information efficiently.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare Information Exchange?

The global Healthcare Information Exchange market is currently sized at $15.3 billion. It is projected to grow at a CAGR of 9.8% from 2023 to 2033, indicating substantial expansion in this sector over the next decade.

What are the key market players or companies in this healthcare Information Exchange industry?

Key players in the Healthcare Information Exchange industry include major technology firms and healthcare providers such as Epic Systems, Cerner Corporation, Allscripts Healthcare Solutions, NextGen Healthcare, Health Catalyst, and Meditech. These companies lead in software development and HIE solutions.

What are the primary factors driving the growth in the healthcare Information Exchange industry?

Factors driving growth in healthcare information exchange include increasing demand for interoperable solutions, a push for better patient outcomes, rising healthcare costs prompting efficiency, and government regulations promoting data sharing and electronic health records adoption across healthcare systems.

Which region is the fastest Growing in the healthcare Information Exchange?

The fastest-growing region in the healthcare information exchange market is North America, with a market size expected to reach $14.62 billion by 2033, up from $5.55 billion in 2023, showcasing significant growth due to advanced technological uptake and regulatory support.

Does ConsaInsights provide customized market report data for the healthcare Information Exchange industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the healthcare information exchange industry. Clients can expect bespoke insights, analysis, and forecasts that align with their individual business objectives and market strategies.

What deliverables can I expect from this healthcare Information Exchange market research project?

Clients can anticipate comprehensive deliverables including detailed reports, market segmentation analysis, competitive landscape assessments, growth forecasts, and actionable insights, all designed to equip stakeholders with the information needed for strategic decision-making in the healthcare information exchange sector.

What are the market trends of healthcare Information Exchange?

Current market trends in healthcare information exchange include increased adoption of cloud-based solutions, enhanced data security, the growing role of AI and predictive analytics, and a focus on patient-centered care models, which together drive the evolution of health information systems.