Healthcare Information Software Market Report

Published Date: 31 January 2026 | Report Code: healthcare-information-software

Healthcare Information Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Healthcare Information Software market, detailing insights on market sizing, segment performance, regional analysis, and trends from 2023 to 2033.

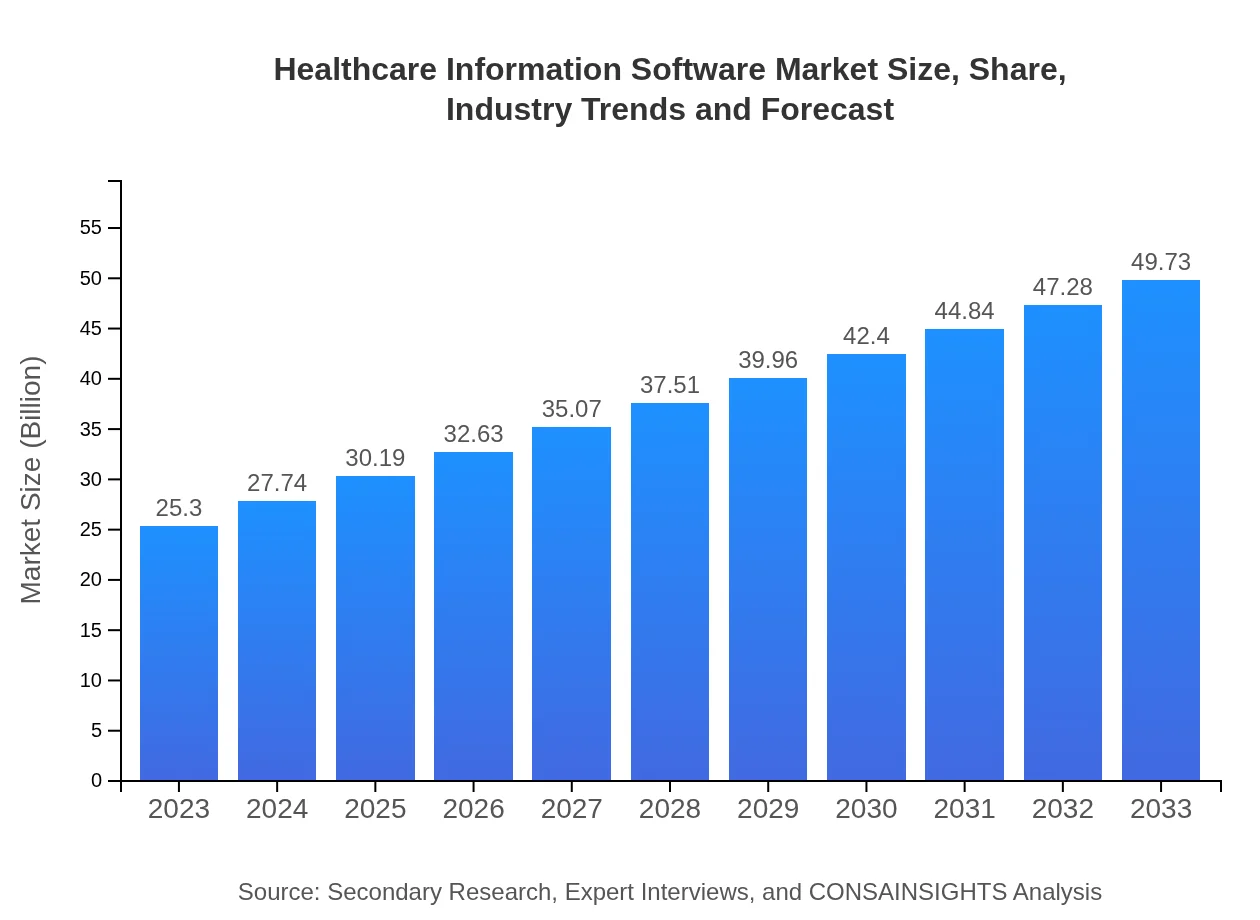

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $49.73 Billion |

| Top Companies | Epic Systems Corporation, Cerner Corporation, McKesson Corporation, Allscripts Healthcare Solutions, Athenahealth, Inc. |

| Last Modified Date | 31 January 2026 |

Healthcare Information Software Market Overview

Customize Healthcare Information Software Market Report market research report

- ✔ Get in-depth analysis of Healthcare Information Software market size, growth, and forecasts.

- ✔ Understand Healthcare Information Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Information Software

What is the Market Size & CAGR of the Healthcare Information Software market in 2023?

Healthcare Information Software Industry Analysis

Healthcare Information Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Information Software Market Analysis Report by Region

Europe Healthcare Information Software Market Report:

Europe's market is expected to grow from USD 6.59 billion in 2023 to USD 12.95 billion by 2033, with a strong emphasis on regulations and compliance driving the adoption of healthcare information software.Asia Pacific Healthcare Information Software Market Report:

The Asia Pacific region is expected to grow significantly, reaching a market size of USD 10.27 billion by 2033, up from USD 5.22 billion in 2023, marked by increasing healthcare infrastructure investments and a growing patient population demanding better healthcare services.North America Healthcare Information Software Market Report:

North America holds a substantial market share, with anticipated growth from USD 8.24 billion in 2023 to USD 16.20 billion by 2033. The region is characterized by high technology adoption rates and a strong focus on enhancing healthcare quality through innovative IT solutions.South America Healthcare Information Software Market Report:

In South America, the market is projected to expand from USD 1.89 billion in 2023 to USD 3.71 billion by 2033. This growth is primarily driven by increasing digitalization in healthcare and government initiatives promoting healthcare access.Middle East & Africa Healthcare Information Software Market Report:

In the Middle East and Africa, the market is expected to increase from USD 3.35 billion in 2023 to USD 6.59 billion by 2033. Factors fueling this growth include rising healthcare needs and investments in medical technology.Tell us your focus area and get a customized research report.

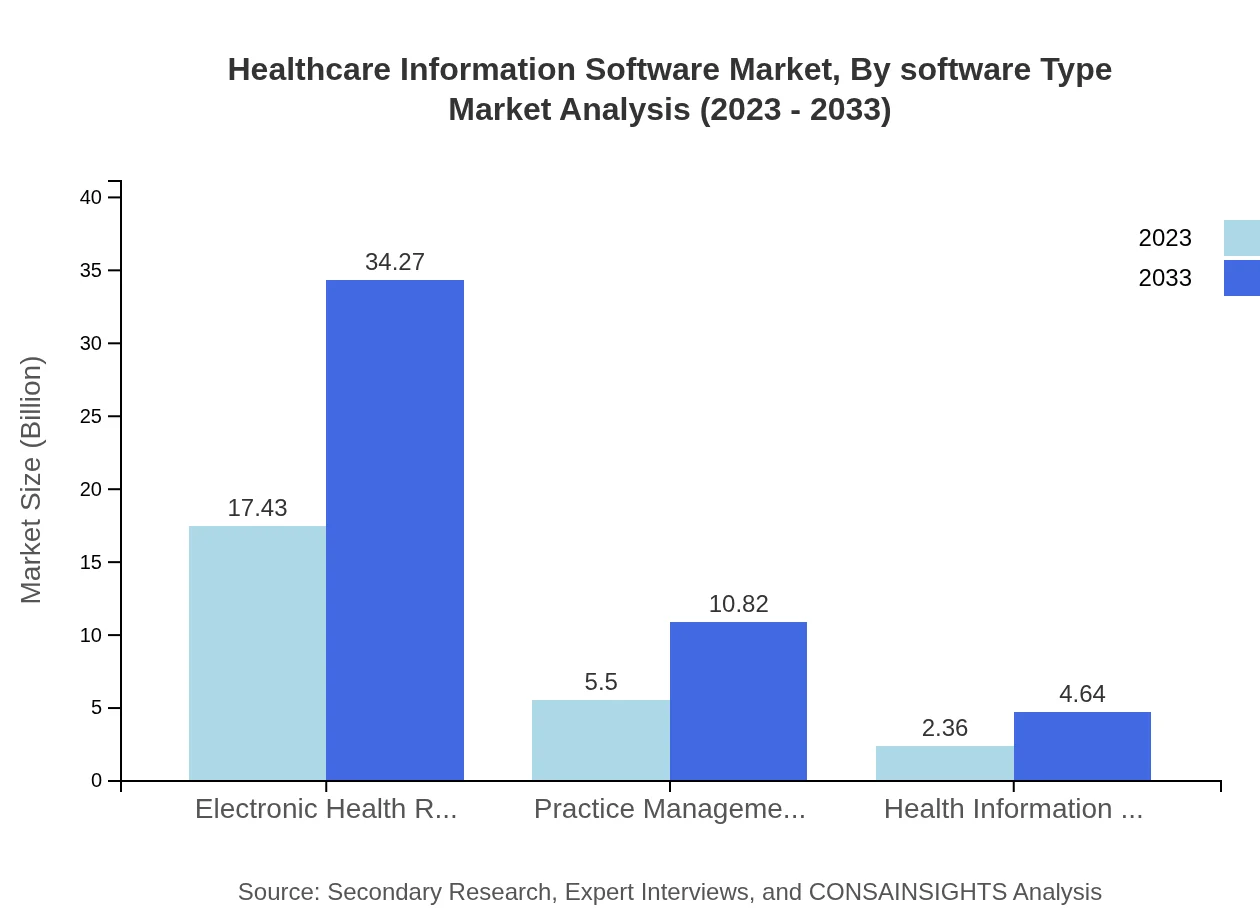

Healthcare Information Software Market Analysis By Software Type

The Healthcare Information Software market, segmented by software type, shows Electronic Health Records (EHR) leading with a size of USD 17.43 billion in 2023 and projected to double to USD 34.27 billion by 2033. Clinical Management solutions also display high performance, starting at USD 17.43 billion with similar growth trends. Other segments such as Billing and Revenue Cycle Management and Patient Engagement Solutions contribute significantly to market dynamics.

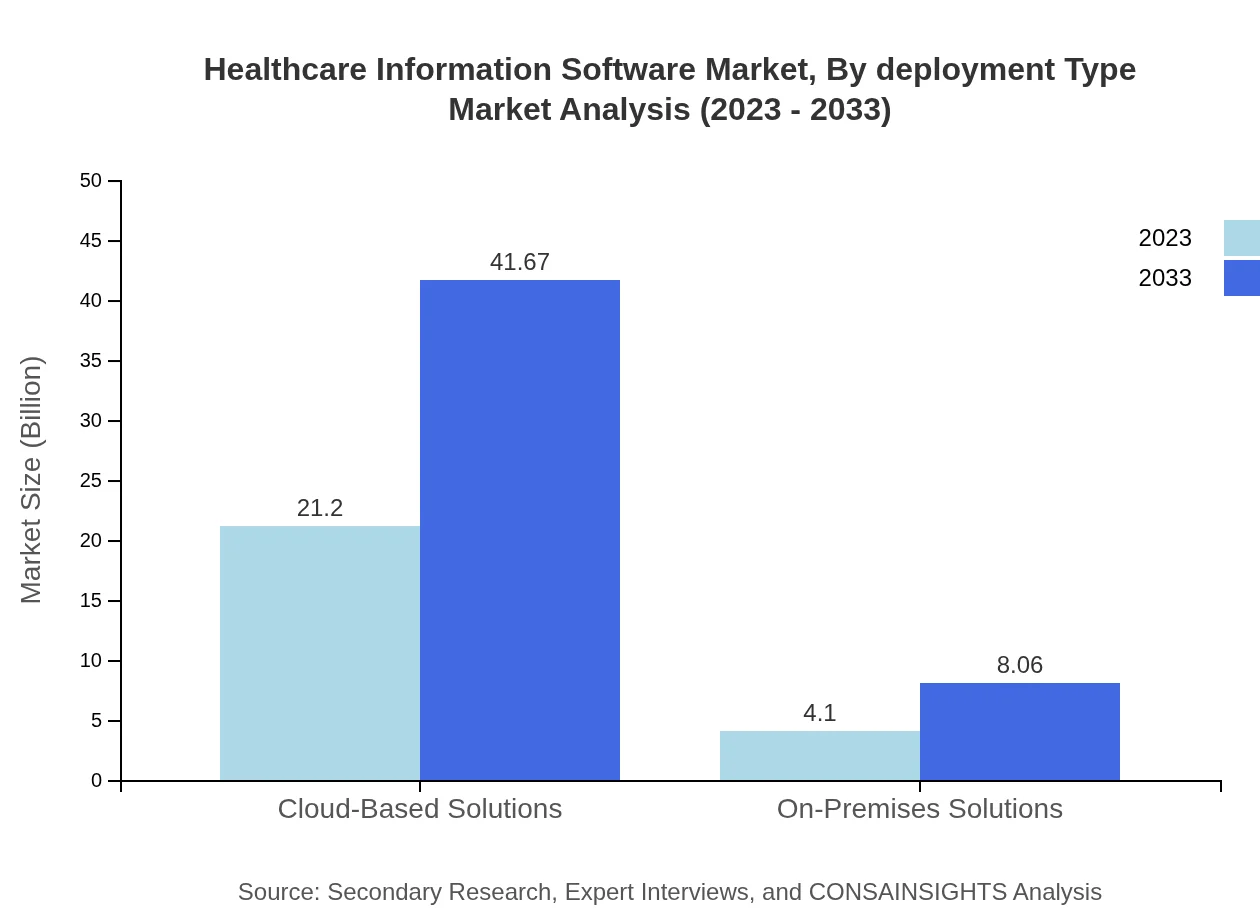

Healthcare Information Software Market Analysis By Deployment Type

In terms of deployment type, Cloud-Based Solutions dominate the landscape with a size of USD 21.20 billion in 2023, expected to increase to USD 41.67 billion by 2033. This significant growth emphasizes the trend towards digital transformation and flexibility in managing healthcare data.

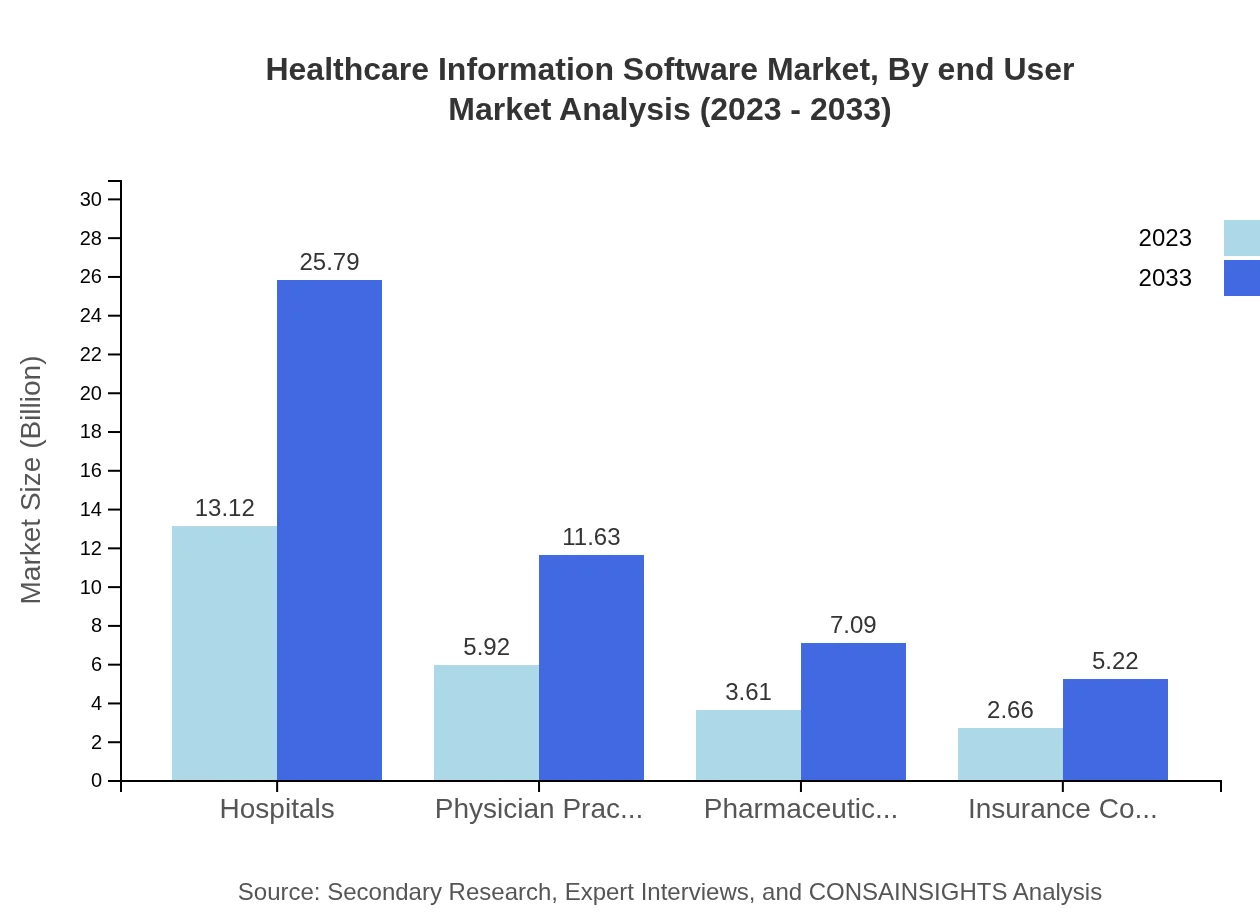

Healthcare Information Software Market Analysis By End User

Hospitals are the predominant end-users, accounting for USD 13.12 billion in 2023 and expected to reach USD 25.79 billion by 2033. Physician practices and pharmaceutical companies also play a vital role, ensuring that the healthcare ecosystem benefits from comprehensive information solutions.

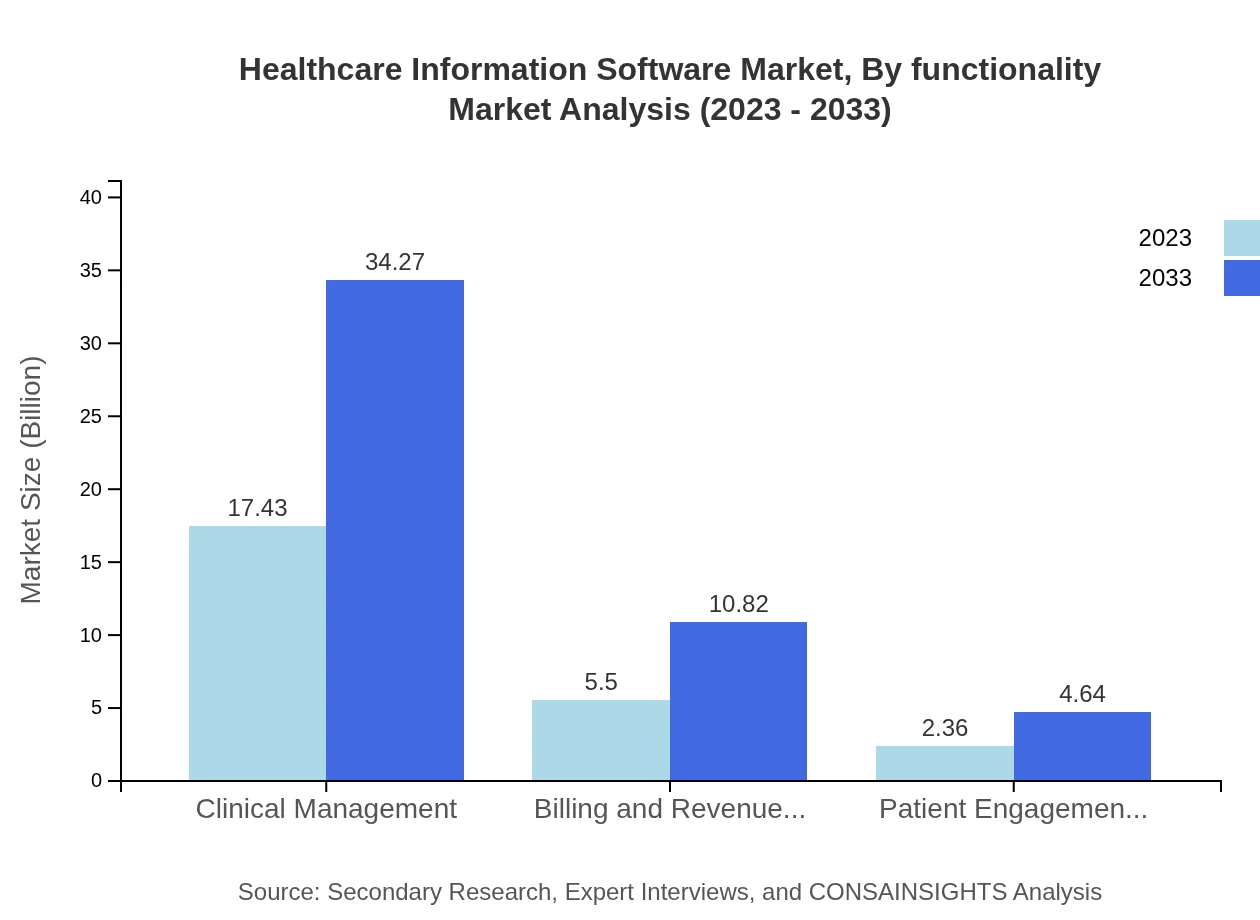

Healthcare Information Software Market Analysis By Functionality

Market functionality analysis reveals Clinical Management is crucial, with a sizeable share of 68.91% in 2023, projected to maintain similar dominance by 2033. This functionality is closely followed by Billing and Revenue Cycle Management, which reflects the competitive nature of the healthcare finance landscape.

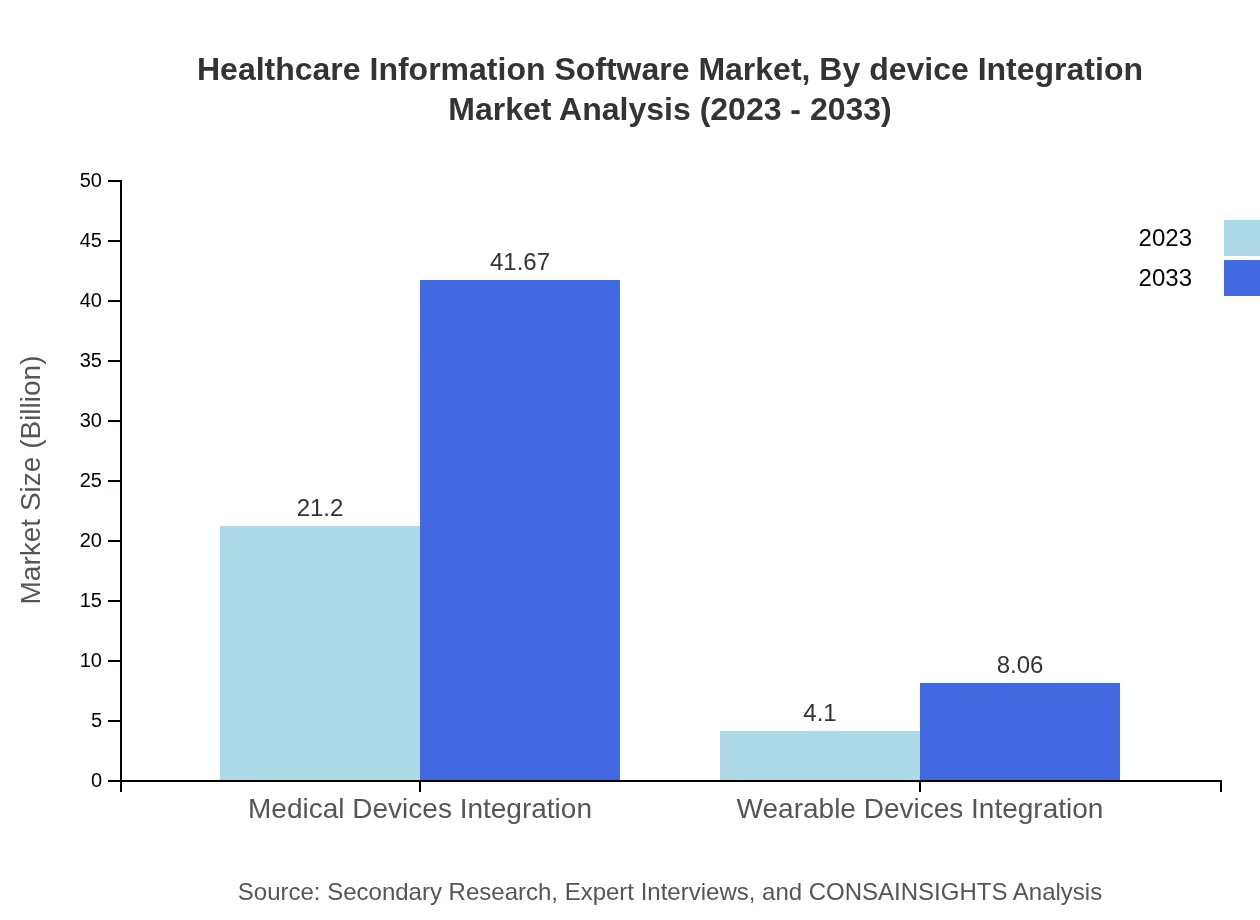

Healthcare Information Software Market Analysis By Device Integration

Device integration is pivotal, particularly for solutions involving Medical Devices and Wearable Device Integrations, which boast substantial shares of 83.8% each, indicating the convergence of technology and healthcare and its impact on improving patient care.

Healthcare Information Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Information Software Industry

Epic Systems Corporation:

Epic Systems is a leading provider of healthcare information software, specializing in EHR and clinical management systems. The company is renowned for its innovative solutions that enhance healthcare delivery and operational efficiency.Cerner Corporation:

Cerner Corporation is a key player in the Healthcare Information Software market, providing comprehensive solutions that range from EHR to health information exchange. Their services focus on improving patient outcomes through advanced technology.McKesson Corporation:

As a global leader in healthcare management, McKesson Corporation offers technology-driven services aimed at improving health care services' efficiency. They produce customized software for various healthcare needs, enhancing patient engagement.Allscripts Healthcare Solutions:

Allscripts focuses on creating connected healthcare solutions for medical practices and hospitals. Their software solutions support population health management and patient engagement.Athenahealth, Inc.:

Athenahealth provides cloud-based services to healthcare providers, emphasizing billing, EHR, and medical practice management software, supporting better outcomes and operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare information software?

The healthcare information software market is valued at approximately $25.3 billion in 2023, with a projected CAGR of 6.8%, anticipated to reach significant market growth by 2033.

What are the key market players or companies in this healthcare information software industry?

Key players in the healthcare information software industry include major companies such as Epic Systems, Cerner Corporation, Allscripts Healthcare Solutions, and Meditech, among others, offering a range of software solutions.

What are the primary factors driving the growth in the healthcare information software industry?

The growth in the healthcare information software industry is driven by factors such as increasing demand for efficient healthcare management, advancements in technology, and the growing adoption of electronic health records (EHRs) by healthcare providers.

Which region is the fastest Growing in the healthcare information software market?

The fastest-growing region in the healthcare information software market is North America, projected to grow from $8.24 billion in 2023 to $16.20 billion by 2033, bolstered by advanced healthcare infrastructure.

Does ConsaInsights provide customized market report data for the healthcare information software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the healthcare information software industry, ensuring that clients receive relevant and actionable insights.

What deliverables can I expect from this healthcare information software market research project?

From the healthcare information software market research project, you can expect detailed reports, market size analysis, growth forecasts, competitive landscapes, and actionable recommendations for strategic decision-making.

What are the market trends of healthcare information software?

Current trends in the healthcare information software market include a shift towards cloud-based solutions, increasing use of telemedicine, and a focus on patient engagement tools, driving innovation and adoption.