Healthcare Information Systems Market Report

Published Date: 31 January 2026 | Report Code: healthcare-information-systems

Healthcare Information Systems Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Healthcare Information Systems market, offering insights into current trends, market size, and forecasts from 2023 to 2033. It encompasses a thorough analysis of segmentation, regional performance, key players, and emerging technologies shaping the industry.

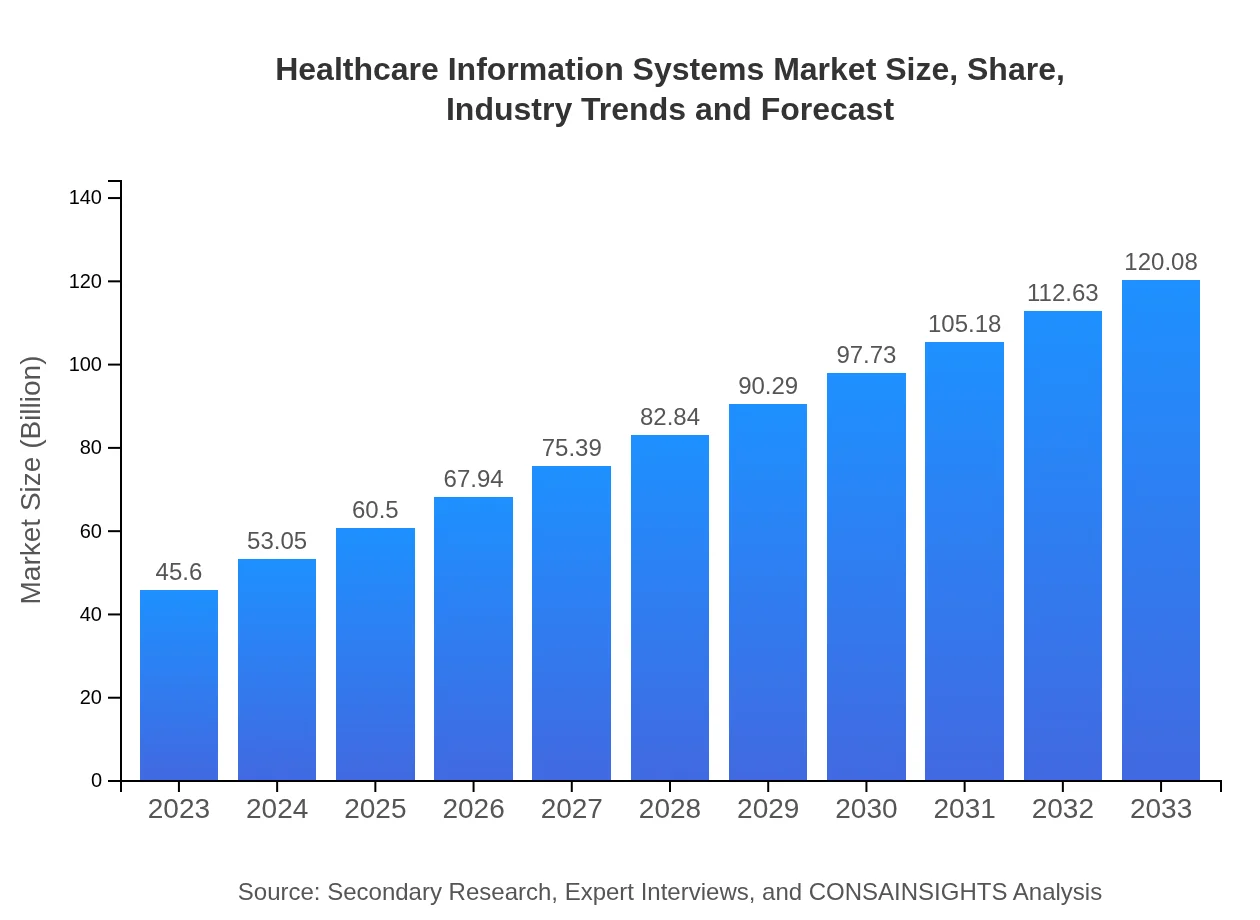

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.60 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $120.08 Billion |

| Top Companies | Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, McKesson Corporation |

| Last Modified Date | 31 January 2026 |

Healthcare Information Systems Market Overview

Customize Healthcare Information Systems Market Report market research report

- ✔ Get in-depth analysis of Healthcare Information Systems market size, growth, and forecasts.

- ✔ Understand Healthcare Information Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Information Systems

What is the Market Size & CAGR of Healthcare Information Systems market in 2033?

Healthcare Information Systems Industry Analysis

Healthcare Information Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Information Systems Market Analysis Report by Region

Europe Healthcare Information Systems Market Report:

Europe's Healthcare Information Systems market is set to expand from $13.42 billion in 2023 to $35.34 billion by 2033. The expansion is spurred by increasing initiatives aimed at improving public health through data sharing across healthcare ecosystems, particularly in countries like Germany and the UK.Asia Pacific Healthcare Information Systems Market Report:

In the Asia Pacific region, the healthcare information systems market is expected to grow from $8.70 billion in 2023 to $22.90 billion by 2033. This growth is largely attributed to increasing healthcare expenditures, a surge in telehealth services, and the push towards digital health solutions amidst the pandemic.North America Healthcare Information Systems Market Report:

North America remains the dominant market, with projections soaring from $16.57 billion in 2023 to $43.62 billion by 2033. The region leads in technology adoption, with a well-established preference for digital solutions and significant investments in health IT infrastructure.South America Healthcare Information Systems Market Report:

The South American market anticipates growth from $3.52 billion in 2023 to $9.26 billion by 2033. Factors driving this growth include heightened demand for healthcare accessibility and the adoption of cloud-based healthcare systems, particularly in Brazil and Argentina.Middle East & Africa Healthcare Information Systems Market Report:

The Middle East and Africa region is projected to grow from $3.40 billion in 2023 to $8.96 billion by 2033. Growing healthcare frameworks and an increasing focus on enhancing healthcare quality are motivating this market growth.Tell us your focus area and get a customized research report.

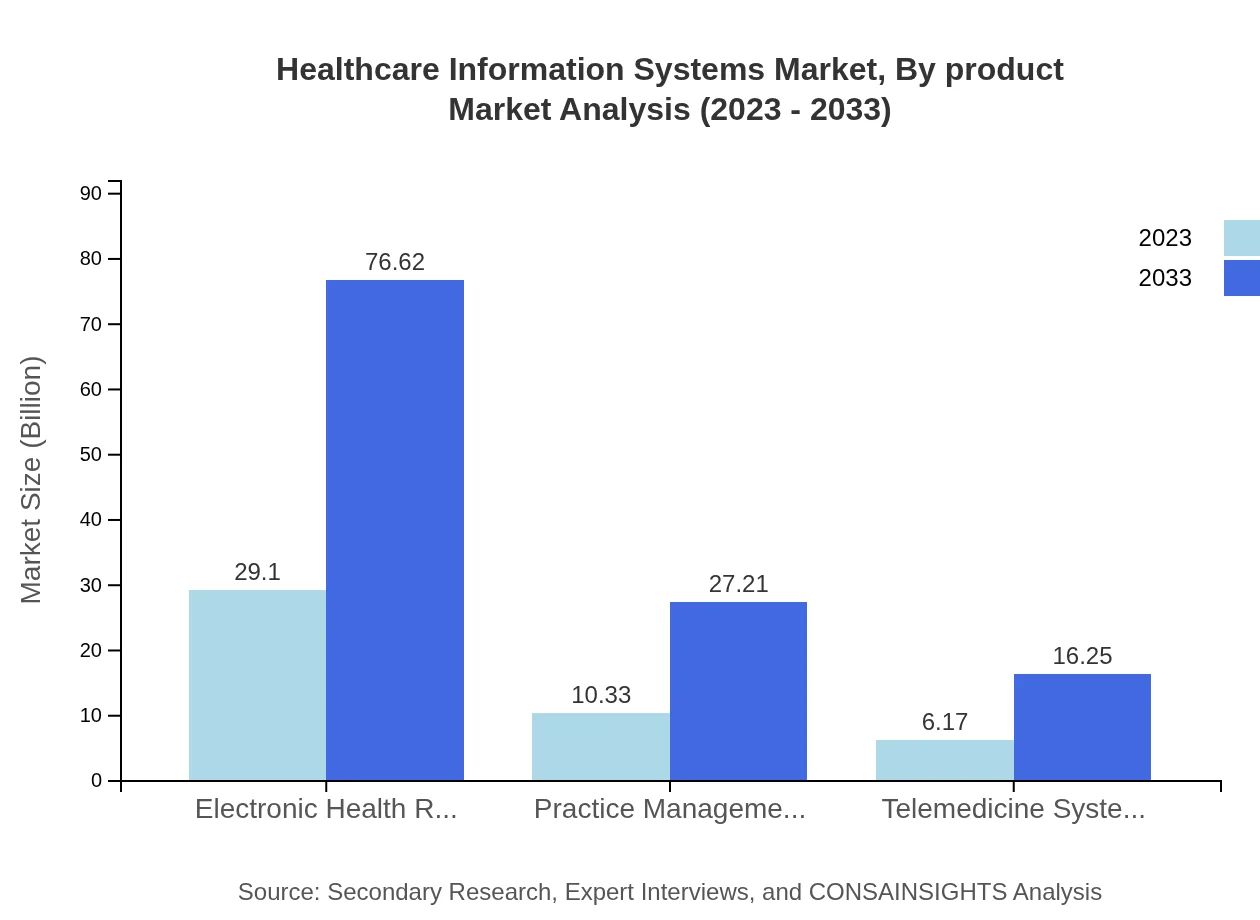

Healthcare Information Systems Market Analysis By Product

The Healthcare Information Systems market is heavily dominated by Electronic Health Records (EHR), which represent a size of $29.10 billion in 2023, forecasted to reach $76.62 billion by 2033. EHRs hold a market share of approximately 63.81%. Other critical segments include Practice Management Systems, valued at $10.33 billion in 2023, expected to expand to $27.21 billion, sharing 22.66% of the market. Telemedicine Systems are growing rapidly with an upgraded market size from $6.17 billion to $16.25 billion (13.53% share).

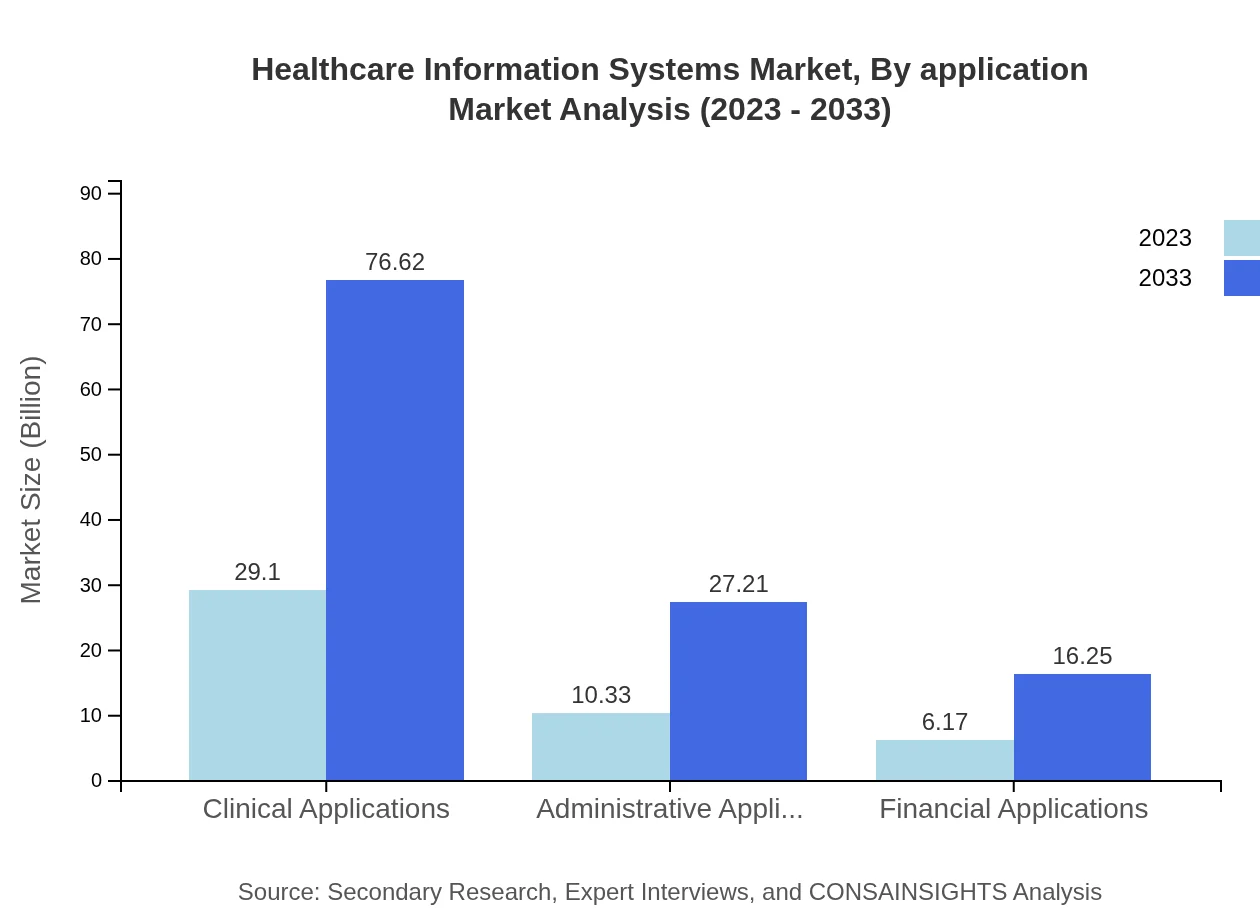

Healthcare Information Systems Market Analysis By Application

Applications within Healthcare Information Systems have seen a varied performance, with Clinical Applications leading, commencing at $29.10 billion in 2023 and moving to $76.62 billion by 2033 (63.81% market share). Administrative Applications were valued at $10.33 billion in 2023, likely reaching $27.21 billion alongside a market share of 22.66%. Financial Applications hold a steady segment starting from $6.17 billion to $16.25 billion (13.53% share).

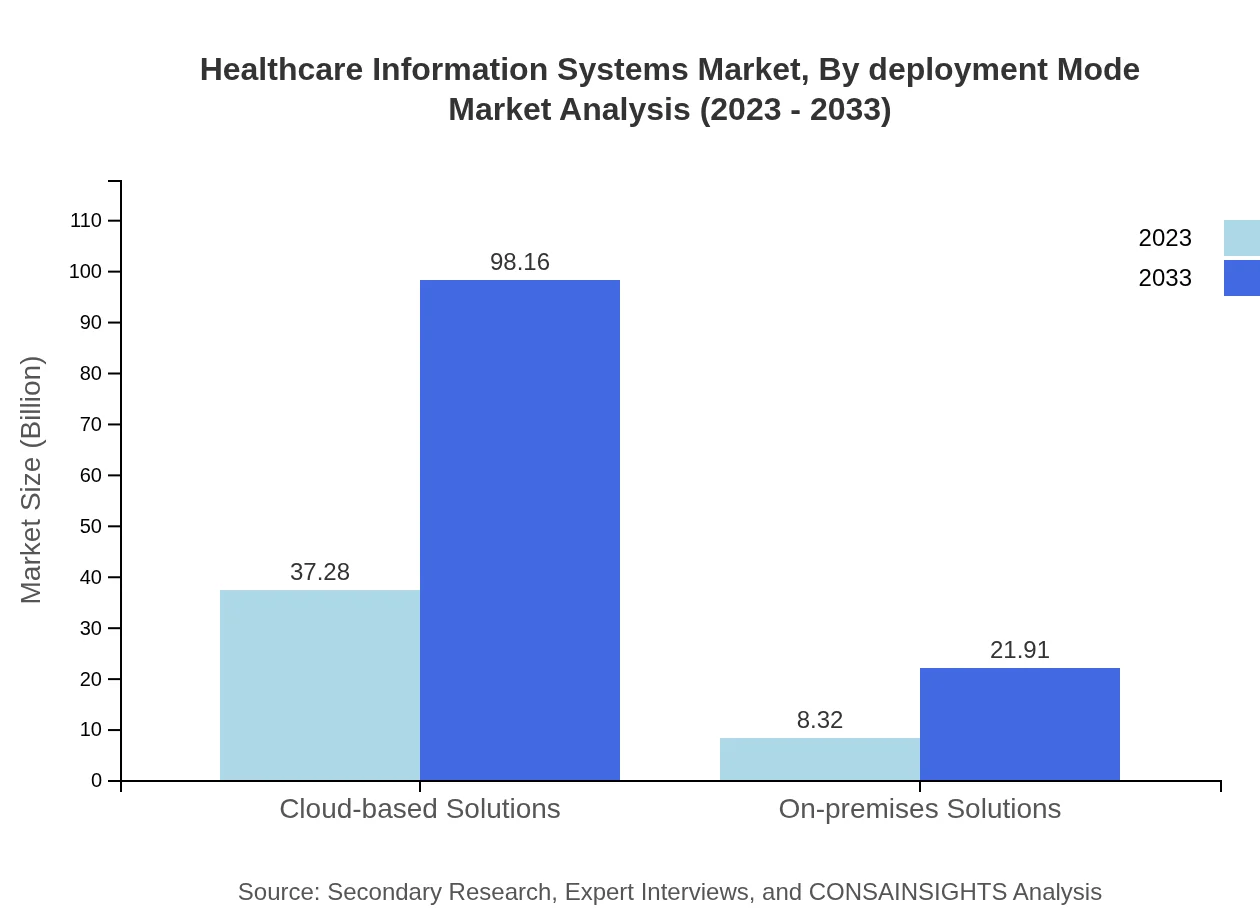

Healthcare Information Systems Market Analysis By Deployment Mode

The market deployment is chiefly split into cloud-based and on-premises solutions. Cloud-based Solutions dominate with a size of $37.28 billion in 2023, scaling to $98.16 billion by 2033 (81.75% market share). Conversely, on-premises solutions, while smaller in scale at $8.32 billion, anticipate an increase to $21.91 billion (18.25% market share) as organizations aim for greater security frameworks.

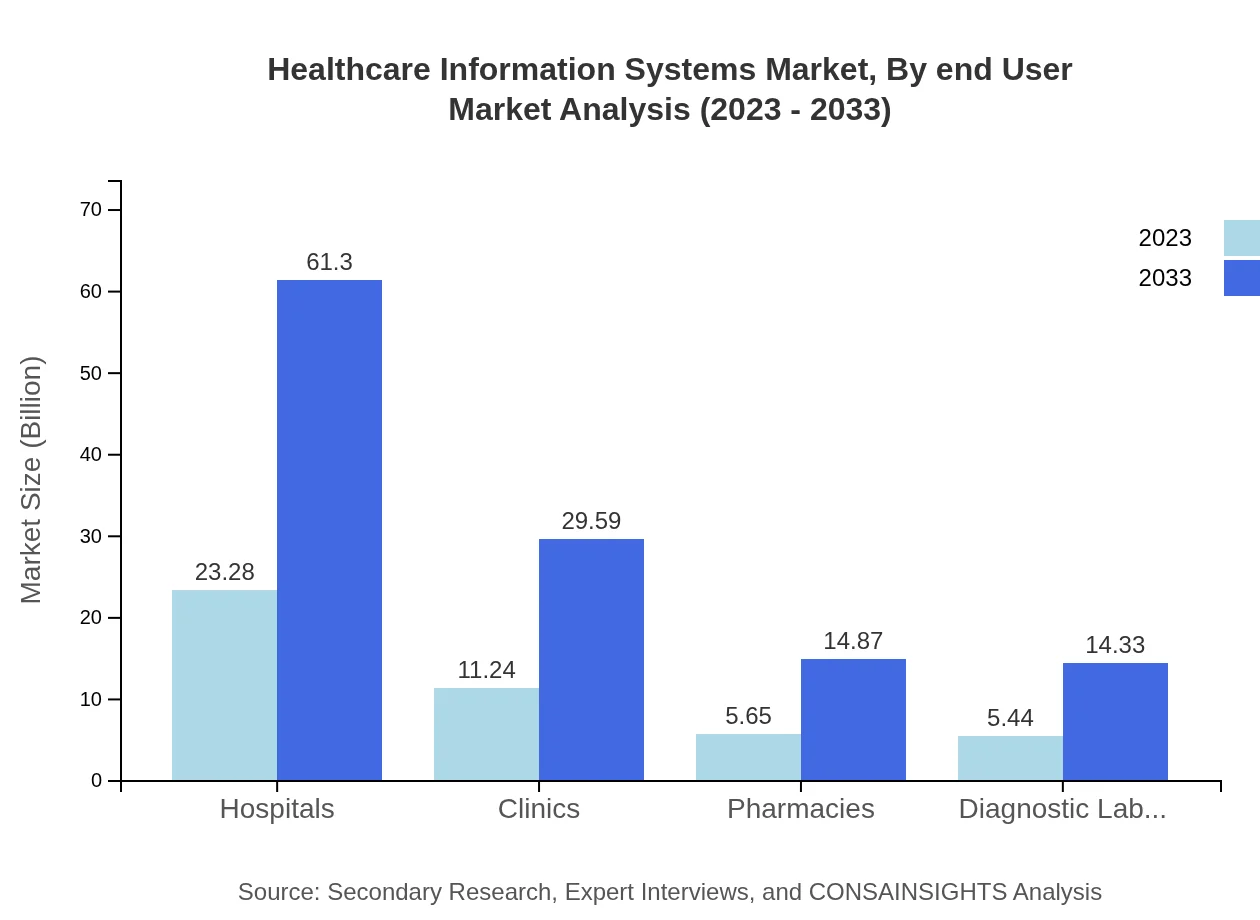

Healthcare Information Systems Market Analysis By End User

Hospitals remain the key end-users of Healthcare Information Systems, with market sizes of $23.28 billion in 2023 projected to grow to $61.30 billion by 2033 (51.05% market share). Clinics, which constituted $11.24 billion, are anticipated up to $29.59 billion (24.64% share). Pharmacies and Diagnostic Laboratories are also integral, starting from $5.65 billion and $5.44 billion to $14.87 billion and $14.33 billion respectively.

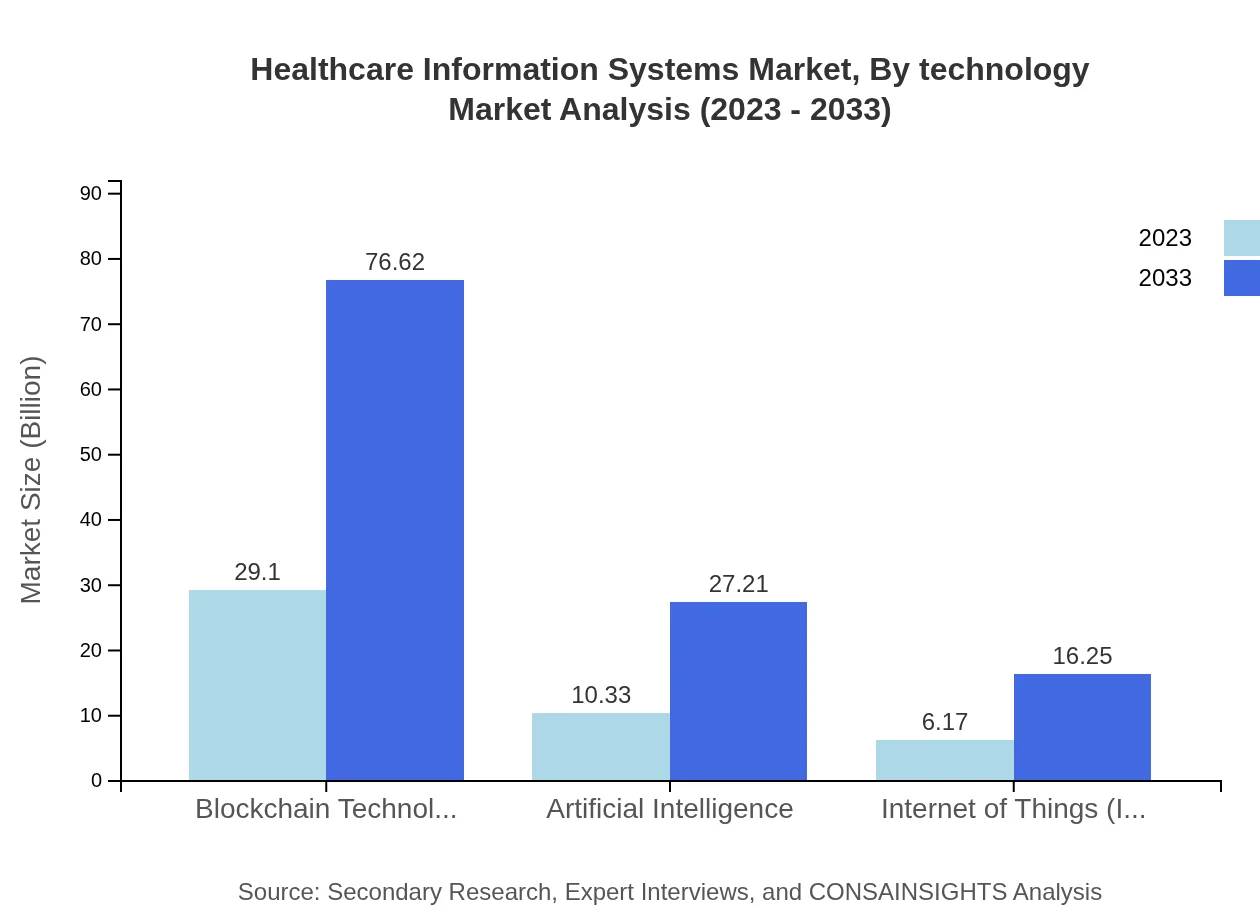

Healthcare Information Systems Market Analysis By Technology

Key technologies reshaping the HIS landscape include Blockchain Technology, with a remarkable market size of $29.10 billion expected to grow to $76.62 billion (63.81% share). Advances in Artificial Intelligence are forecasted to walk from $10.33 billion in 2023 towards $27.21 billion (22.66% share). The Internet of Things (IoT) is also significant, increasing from $6.17 billion to $16.25 billion (13.53% share), enhancing real-time patient monitoring capabilities.

Healthcare Information Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Information Systems Industry

Epic Systems Corporation:

A leader in the development of EHR software, Epic Systems provides healthcare organizations with integrated solutions for improved patient engagement and operational efficiency.Cerner Corporation:

Cerner offers technology solutions designed to manage and optimize health data and workflows, serving hospitals and clinics globally, with a strong focus on interoperability.Allscripts Healthcare Solutions:

Allscripts specializes in EHR systems and integrated software solutions that help healthcare providers enhance productivity, improve care quality, and facilitate interoperability.McKesson Corporation:

As one of America's largest healthcare companies, McKesson provides supply chain services and supports providers by equipping them with sophisticated diagnostics and data management tools.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare Information Systems?

The healthcare information systems market is valued at $45.6 billion in 2023, with a projected growth at a CAGR of 9.8%, suggesting a dynamic industry evolution towards the next decade.

What are the key market players or companies in this healthcare Information Systems industry?

Key players in the healthcare information systems industry include prominent organizations like Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions, and McKesson Corporation, each contributing significantly to market advancements.

What are the primary factors driving the growth in the healthcare Information Systems industry?

Growth in the healthcare information systems sector is fueled by advancements in technology, regulatory mandates for electronic health records, rising demand for telehealth services, and a growing focus on healthcare efficiency.

Which region is the fastest Growing in the healthcare Information Systems?

North America is the fastest-growing region in the healthcare information systems market, projected to increase its market value from $16.57 billion in 2023 to $43.62 billion by 2033.

Does ConsaInsights provide customized market report data for the healthcare Information Systems industry?

Yes, ConsaInsights offers customized market report data tailored to the healthcare information systems industry, allowing businesses to gain specific insights based on their unique requirements.

What deliverables can I expect from this healthcare Information Systems market research project?

Expected deliverables from the healthcare information systems market research project include comprehensive market analysis, growth forecasts, competitive landscape assessment, and insightful recommendations for strategic planning.

What are the market trends of healthcare Information Systems?

Current trends in the healthcare information systems market include the increasing adoption of cloud-based solutions, integration of AI technologies, and a shift towards telemedicine and mobile health applications.