Healthcare Integration Market Report

Published Date: 31 January 2026 | Report Code: healthcare-integration

Healthcare Integration Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Healthcare Integration market, including current trends, market size, industry dynamics, regional insights, and forecasts from 2023 to 2033. Detailed segmentation and strategic recommendations are included for stakeholders.

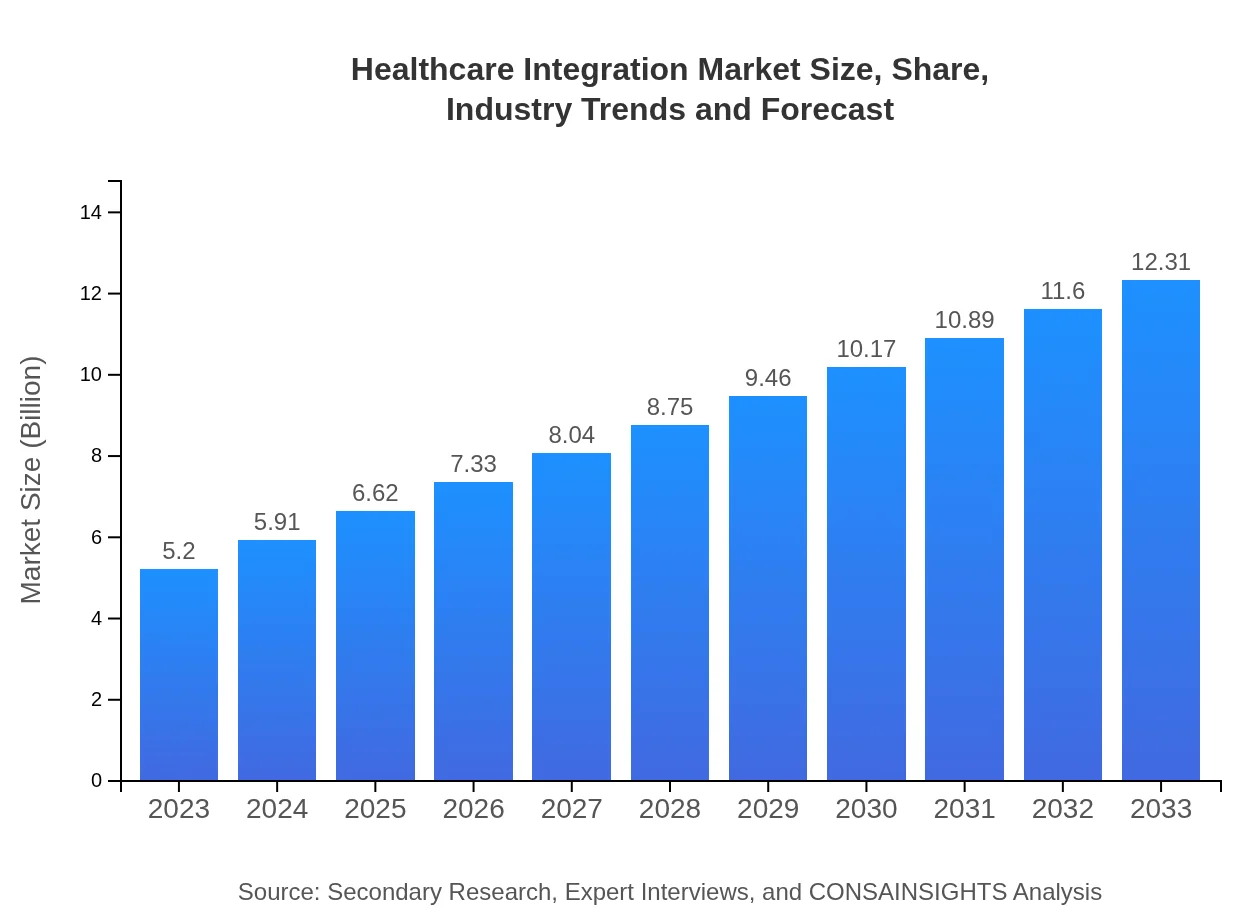

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 8.7% |

| 2033 Market Size | $12.31 Billion |

| Top Companies | Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, MediTech, InterSystems |

| Last Modified Date | 31 January 2026 |

Healthcare Integration Market Overview

Customize Healthcare Integration Market Report market research report

- ✔ Get in-depth analysis of Healthcare Integration market size, growth, and forecasts.

- ✔ Understand Healthcare Integration's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Integration

What is the Market Size & CAGR of Healthcare Integration market in 2023?

Healthcare Integration Industry Analysis

Healthcare Integration Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Integration Market Analysis Report by Region

Europe Healthcare Integration Market Report:

Europe's Healthcare Integration market is predicted to rise from USD 1.64 billion in 2023 to USD 3.89 billion by 2033, supported by advanced healthcare systems and growing integration of IT solutions with patient management systems.Asia Pacific Healthcare Integration Market Report:

In the Asia Pacific region, the market for Healthcare Integration is projected to increase from USD 0.94 billion in 2023 to USD 2.23 billion by 2033, reflecting rapid urbanization and healthcare investments. The rise of telemedicine and demand for electronic health records significantly drive this growth.North America Healthcare Integration Market Report:

North America maintains a leading market position, with the size expected to grow from USD 1.84 billion in 2023 to USD 4.36 billion by 2033. Factors include high healthcare IT adoption rates and stringent regulatory compliance requirements.South America Healthcare Integration Market Report:

South America offers a modest growth opportunity, moving from USD 0.48 billion in 2023 to a projected USD 1.13 billion in 2033. The emphasis on healthcare modernization and increased governmental investment in health IT systems will positively impact the market.Middle East & Africa Healthcare Integration Market Report:

The Middle East and Africa region is anticipated to experience growth from USD 0.29 billion in 2023 to USD 0.70 billion by 2033. Investments in healthcare infrastructure and the adoption of integrated solutions are key trends driving market growth.Tell us your focus area and get a customized research report.

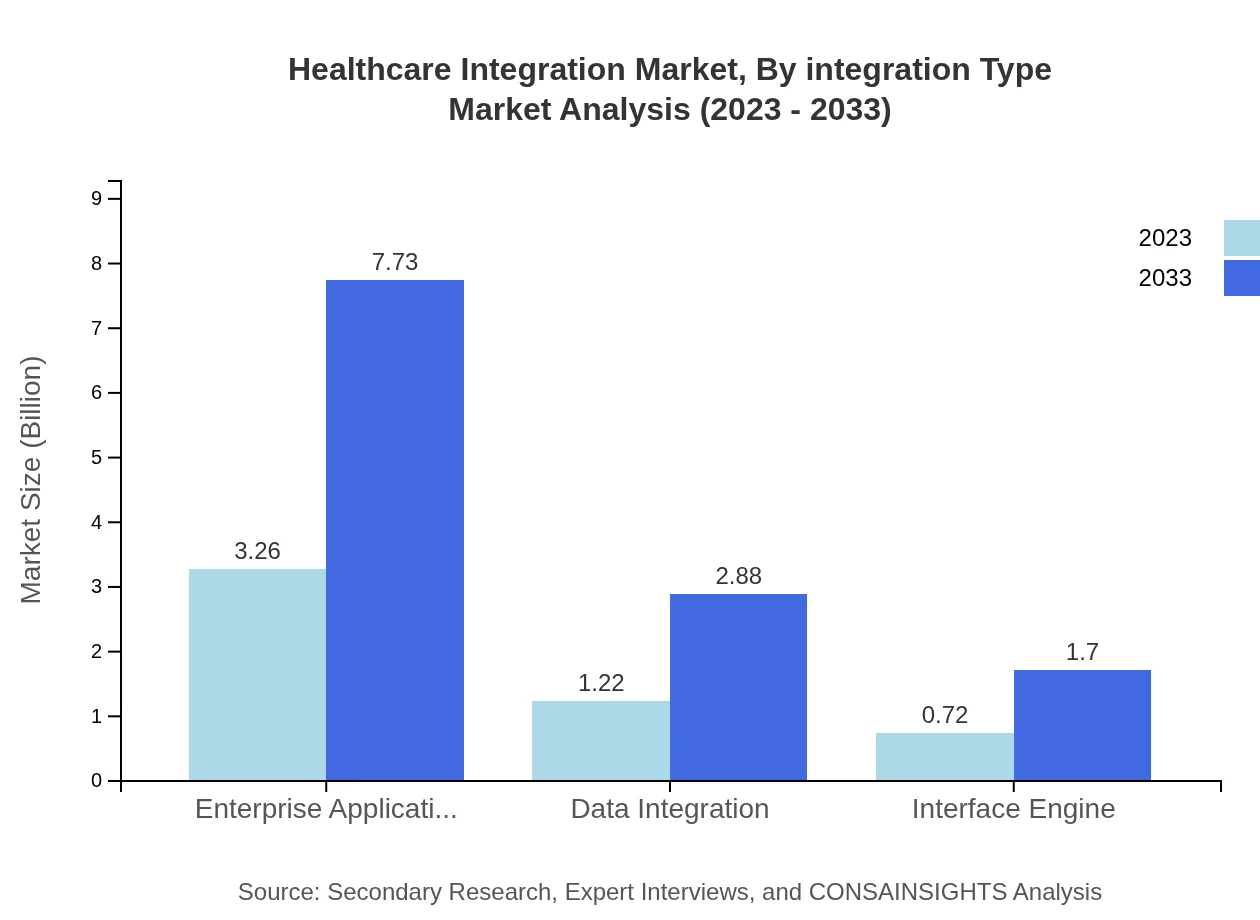

Healthcare Integration Market Analysis By Integration Type

The integration by type segment is witnessing robust growth characterized by Clinical Integration contributing USD 3.26 billion in 2023 and expected to reach USD 7.73 billion by 2033. Administrative Integration's market share highlights an upward trend, moving from USD 1.22 billion to USD 2.88 billion over the same period.

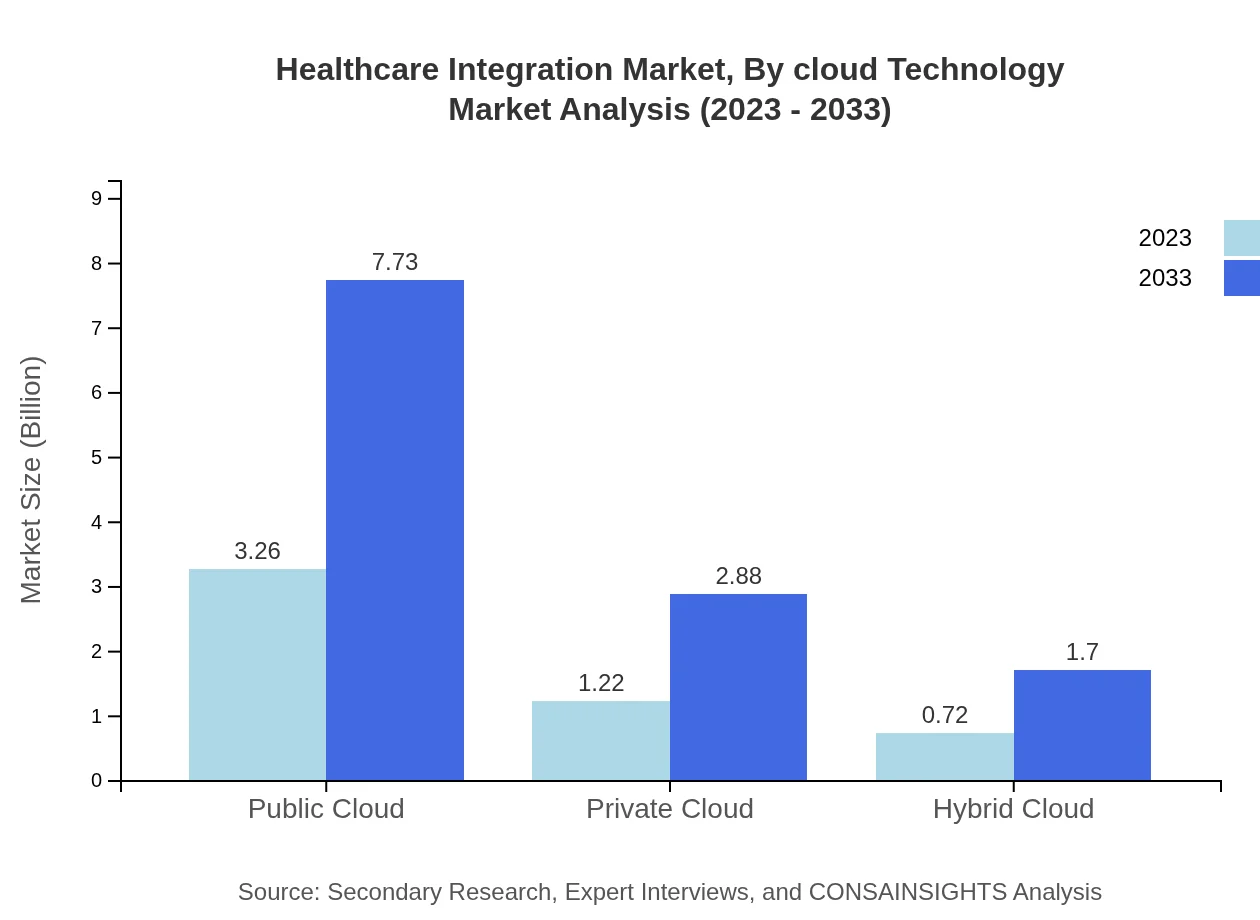

Healthcare Integration Market Analysis By Cloud Technology

In the cloud technology segment, Public Cloud integration holds the largest market share, accounting for USD 3.26 billion in 2023 and expected to grow to USD 7.73 billion by 2033, driven by the flexibility and scalability it offers to healthcare organizations.

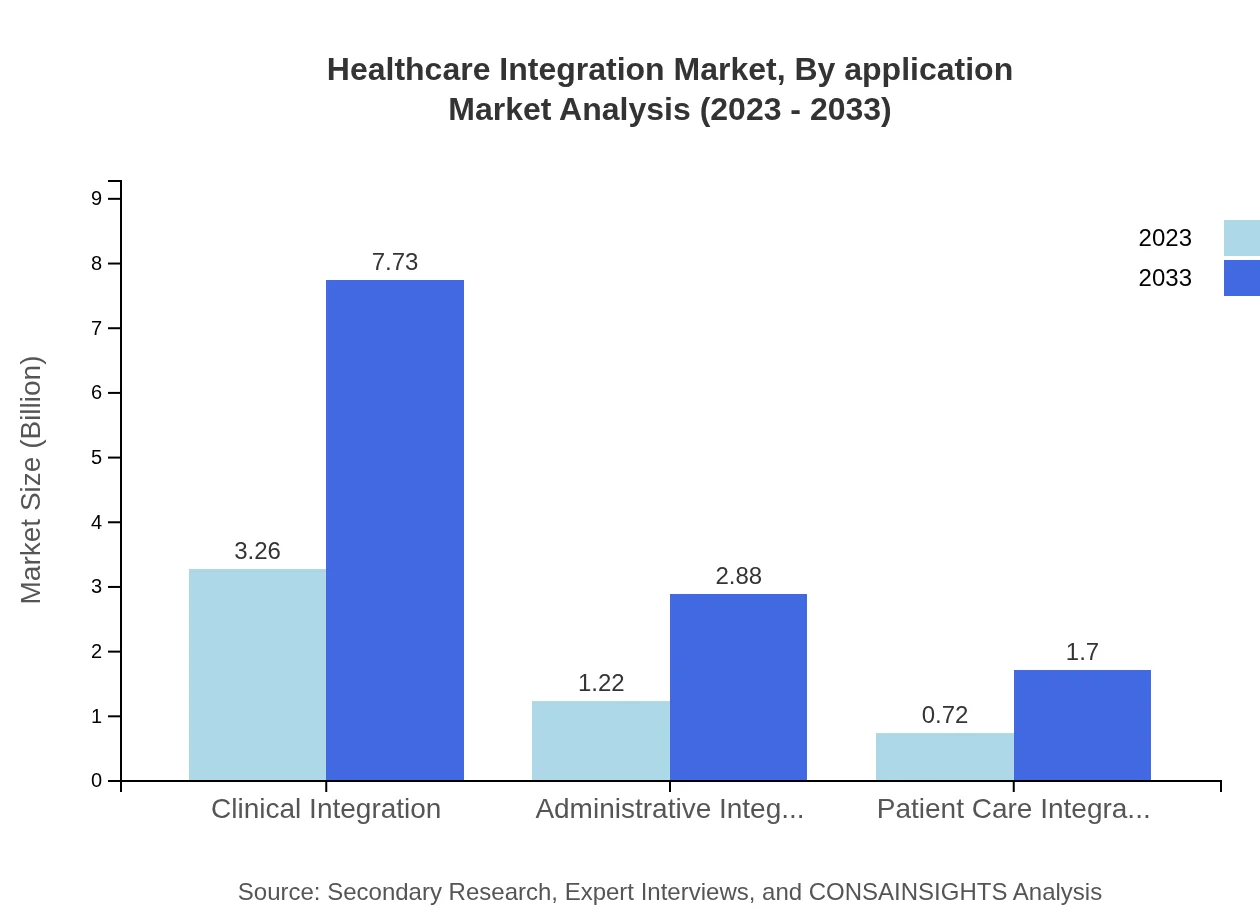

Healthcare Integration Market Analysis By Application

The application segment shows significant demand for Data Integration solutions, forecasted to grow from USD 1.22 billion in 2023 to USD 2.88 billion by 2033. This growth is driven by the need for comprehensive data management and decision support systems.

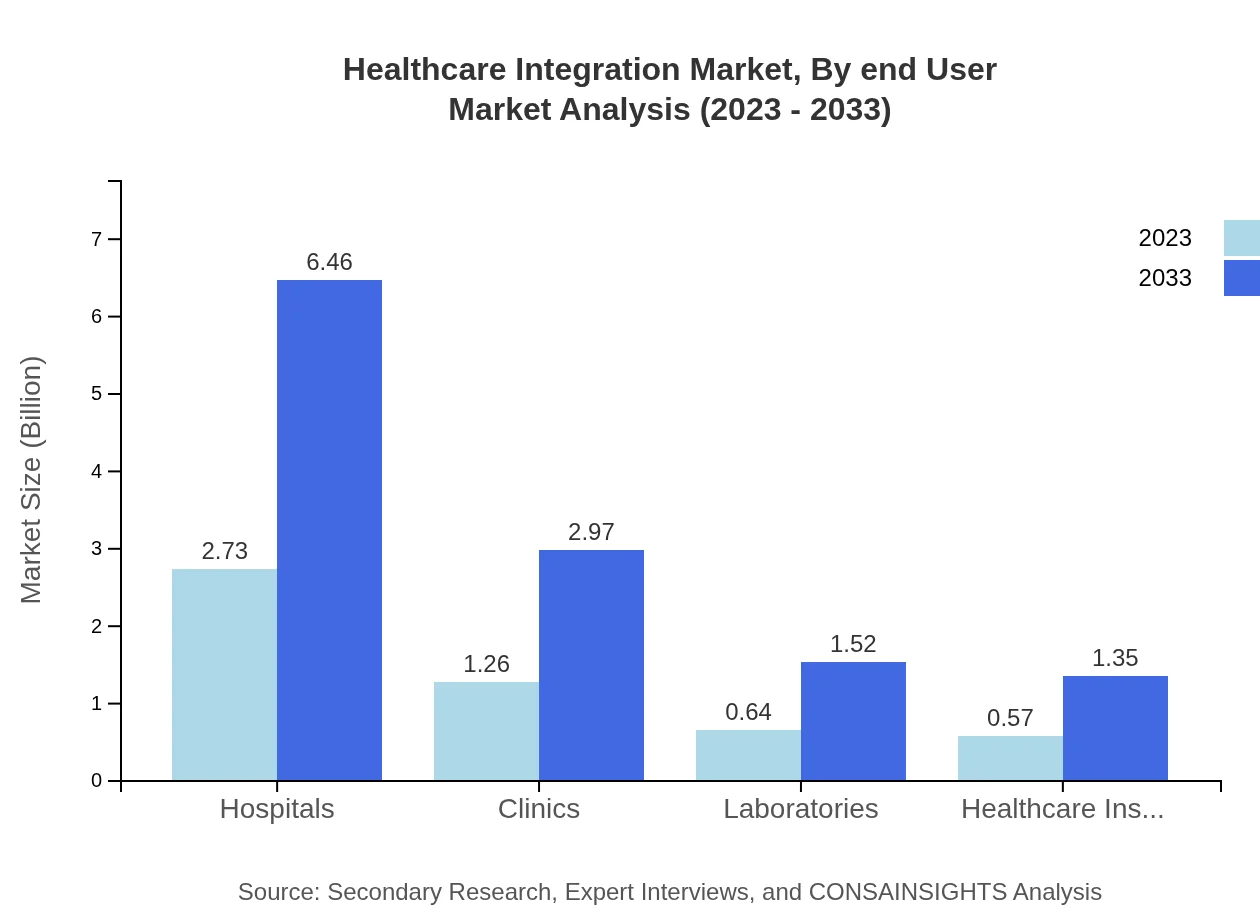

Healthcare Integration Market Analysis By End User

Hospitals remain the largest segment within end-users, contributing significantly at USD 2.73 billion in 2023 and projected to expand to USD 6.46 billion by 2033, driven by integration needs stemming from complex patient care requirements.

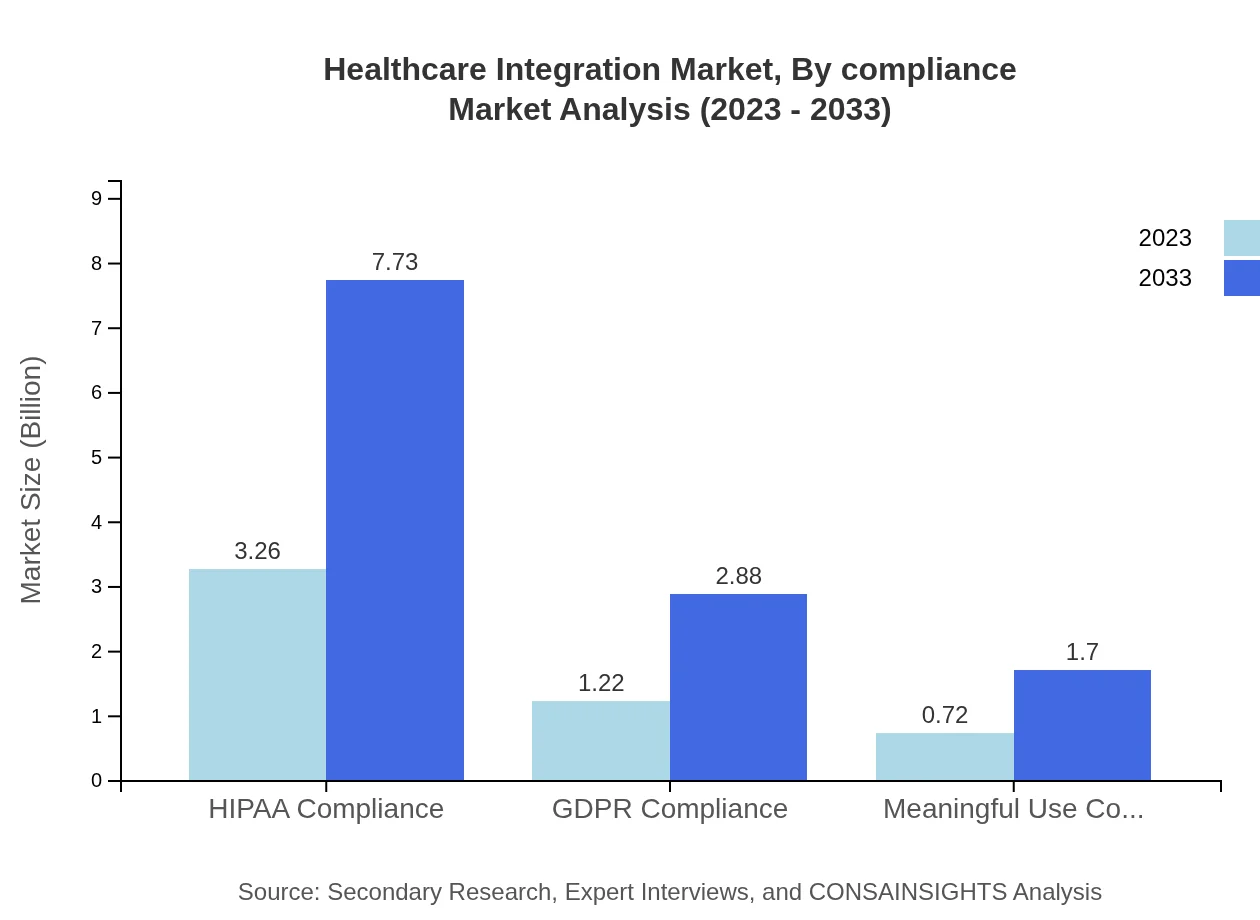

Healthcare Integration Market Analysis By Compliance

The focus on compliance is evident with HIPAA Compliance holding a substantial market share at USD 3.26 billion in 2023, growing to USD 7.73 billion by 2033. This reflects the ongoing priority to adhere to stringent regulations and ensure patient data security.

Healthcare Integration Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Integration Industry

Epic Systems Corporation:

Epic is a leading provider of electronic health records and integration solutions that empower healthcare organizations to share information seamlessly and improve patient care.Cerner Corporation:

Cerner offers comprehensive health information technologies, focusing on liberal data exchange and integration solutions that enhance patient engagement and clinical decision-making.Allscripts Healthcare Solutions:

Allscripts provides EHR systems and healthcare integration platforms that optimize workflows and enable connected health solutions for various healthcare providers.MediTech:

MediTech is renowned for its hospital information systems and robust integration services that streamline operations and improve the quality of care.InterSystems:

InterSystems delivers innovative integration technologies and a range of interoperable systems to help healthcare organizations improve outcomes through better connectivity.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare Integration?

The healthcare integration market is projected to reach a size of $5.2 billion in 2023, with a compound annual growth rate (CAGR) of 8.7%, indicating a robust growth trajectory for the upcoming years.

What are the key market players or companies in the healthcare Integration industry?

Key players in the healthcare integration market include major technology providers and healthcare IT firms that develop solutions for seamless data exchange and interoperability, enhancing patient care and operational efficiency.

What are the primary factors driving the growth in the healthcare integration industry?

Factors driving growth include increased regulatory requirements, the need for improved healthcare efficiency, rising patient expectations, and technological advancements enhancing interoperability of healthcare systems.

Which region is the fastest Growing in the healthcare integration market?

North America is the fastest-growing region in the healthcare integration market, expected to grow from $1.84 billion in 2023 to $4.36 billion by 2033, driven by technological advancements and increasing healthcare compliance requirements.

Does ConsaInsights provide customized market report data for the healthcare integration industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, providing in-depth insights into market trends, size, competitive landscape, and growth opportunities within the healthcare integration industry.

What deliverables can I expect from this healthcare integration market research project?

Deliverables typically include comprehensive reports detailing market size, trends, competitive analysis, segmentation, regional insights, and forecasts, enabling strategic business planning and decision-making.

What are the market trends of healthcare integration?

Current trends include an increasing focus on cloud-based solutions, emphasis on regulatory compliance like HIPAA, and the growing importance of data analytics and interoperability to enhance patient outcomes and operational efficiency.