Healthcare Interoperability Solutions Market Report

Published Date: 31 January 2026 | Report Code: healthcare-interoperability-solutions

Healthcare Interoperability Solutions Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Healthcare Interoperability Solutions market, investigating current trends, growth potential, market size and CAGR from 2023 to 2033, along with a regional breakdown and insights into key segments of the industry.

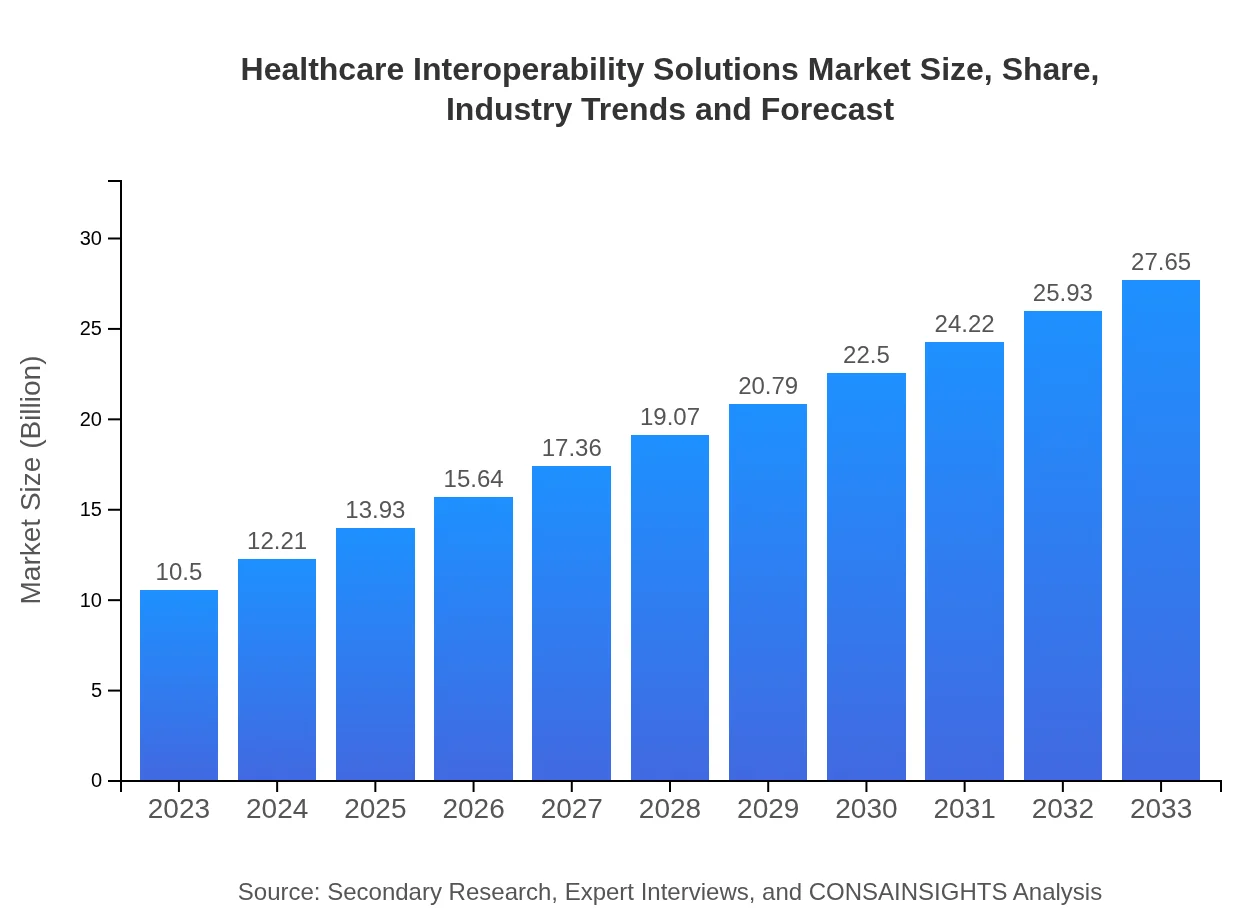

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $27.65 Billion |

| Top Companies | Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, MEDITECH, InterSystems |

| Last Modified Date | 31 January 2026 |

Healthcare Interoperability Solutions Market Overview

Customize Healthcare Interoperability Solutions Market Report market research report

- ✔ Get in-depth analysis of Healthcare Interoperability Solutions market size, growth, and forecasts.

- ✔ Understand Healthcare Interoperability Solutions's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Interoperability Solutions

What is the Market Size & CAGR of Healthcare Interoperability Solutions market in 2023?

Healthcare Interoperability Solutions Industry Analysis

Healthcare Interoperability Solutions Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Interoperability Solutions Market Analysis Report by Region

Europe Healthcare Interoperability Solutions Market Report:

The European Healthcare Interoperability Solutions market is forecasted to increase from $2.71 billion in 2023 to $7.13 billion by 2033. The region's growth is aided by government policies promoting electronic health records and integrated healthcare systems aimed at improving patient care and operational efficiency.Asia Pacific Healthcare Interoperability Solutions Market Report:

The Asia Pacific region is experiencing rapid growth in the Healthcare Interoperability Solutions market, projected to expand from $2.02 billion in 2023 to $5.31 billion by 2033. This growth is driven by increasing healthcare spending, technological advancements, and rising demand for efficient healthcare services. Government initiatives aimed at improving health IT infrastructure are also facilitating this expansion.North America Healthcare Interoperability Solutions Market Report:

North America holds the largest share of the Healthcare Interoperability Solutions market, valued at $3.61 billion in 2023 and projected to reach $9.51 billion by 2033. The growth is primarily driven by the presence of established healthcare IT infrastructure, stringent regulatory requirements for data exchange, and the proliferation of EHRs across healthcare settings.South America Healthcare Interoperability Solutions Market Report:

In South America, the market size for Healthcare Interoperability Solutions is expected to grow from $1.05 billion in 2023 to $2.76 billion by 2033. Factors such as rising health expenditures and the adoption of digital health solutions are propelling the demand for interoperability solutions in the region, improving healthcare access and quality.Middle East & Africa Healthcare Interoperability Solutions Market Report:

In the Middle East and Africa, the market is anticipated to grow from $1.12 billion in 2023 to $2.94 billion by 2033. The increasing focus on digital health technologies and initiatives to improve healthcare systems are paving the way for robust growth in interoperability solutions in this region.Tell us your focus area and get a customized research report.

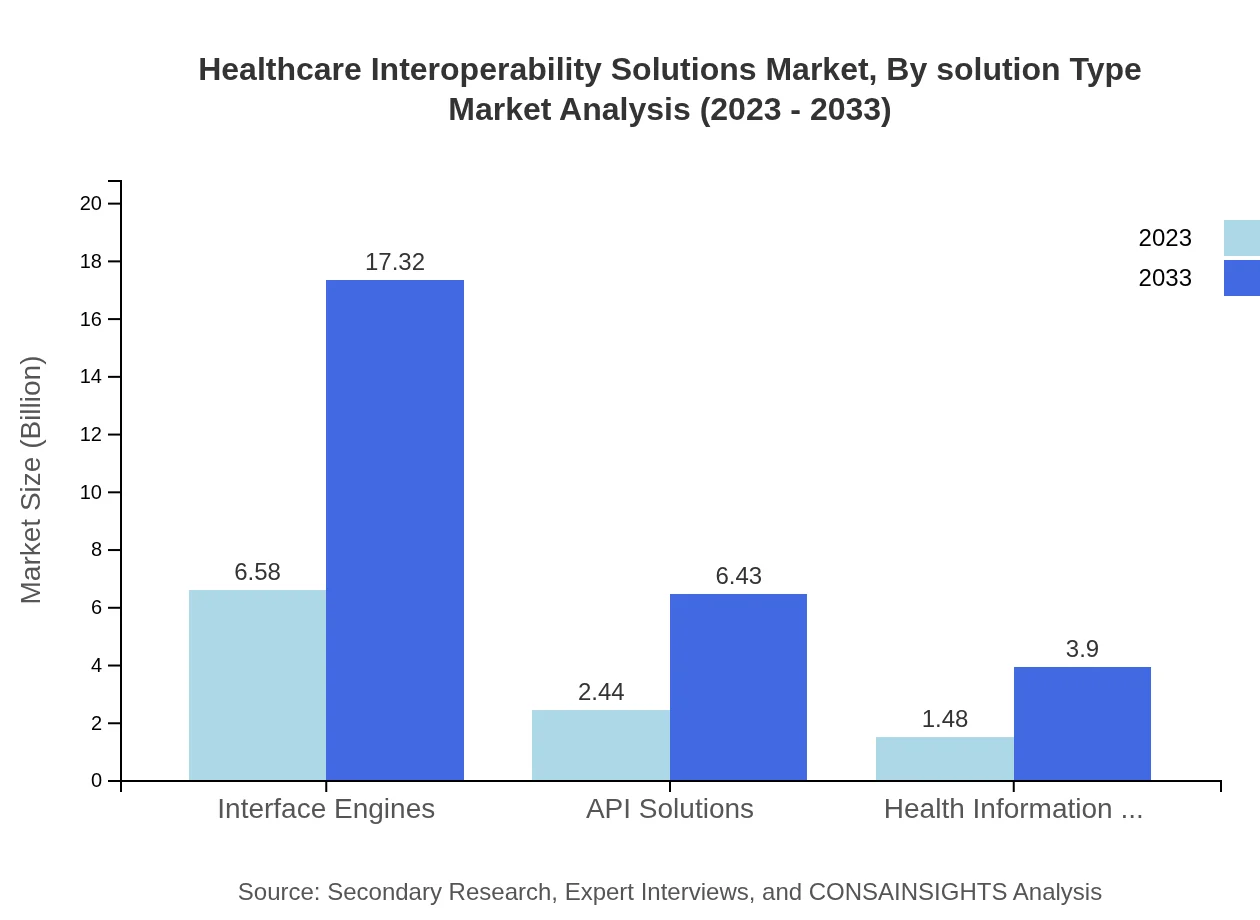

Healthcare Interoperability Solutions Market Analysis By Solution Type

In 2023, the Interface Engines segment will dominate the Healthcare Interoperability Solutions market with a size of $6.58 billion, expected to grow to $17.32 billion in 2033, maintaining a market share of 62.63%. Health Information Exchanges (HIEs) and API Solutions also hold significant shares, indicating a robust demand for seamless data exchange capabilities across healthcare systems.

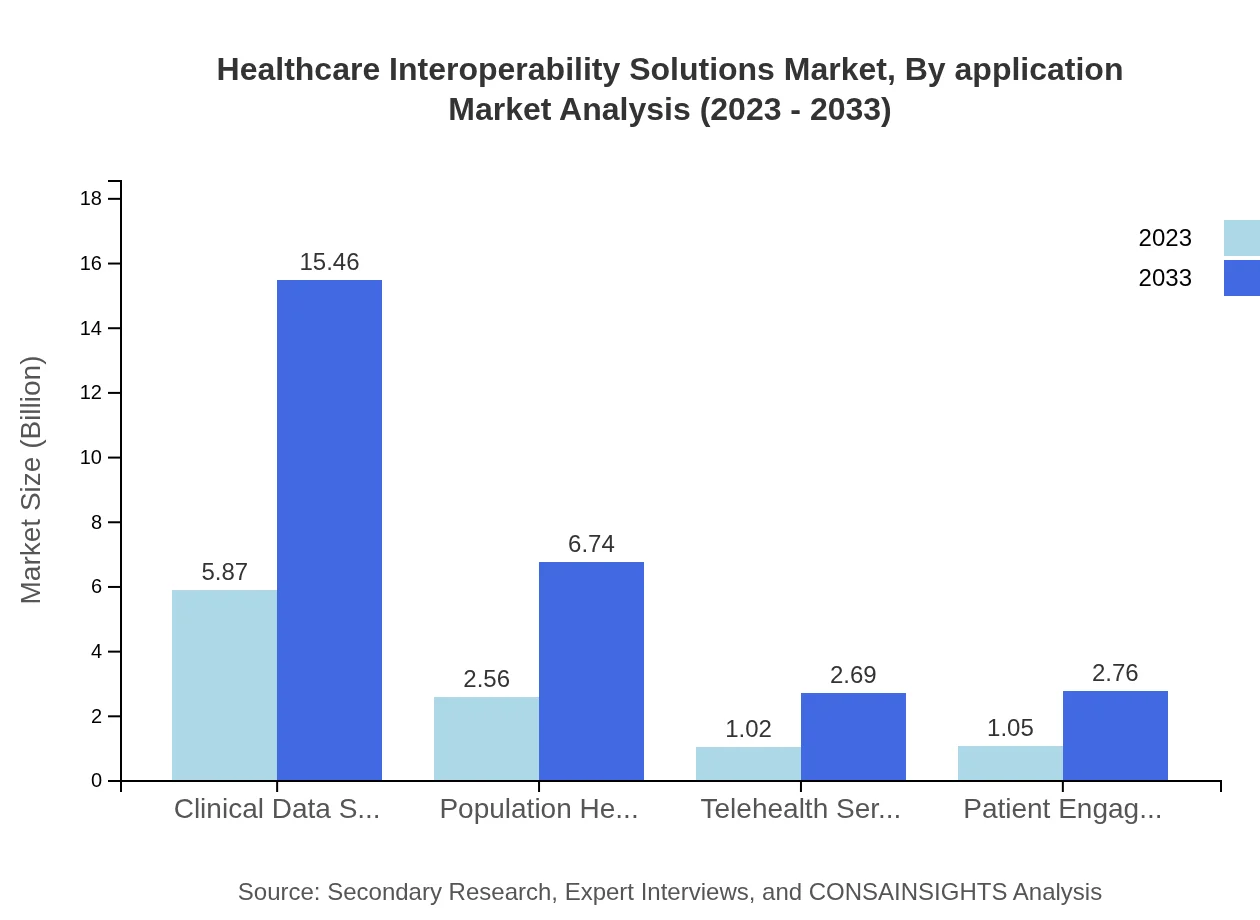

Healthcare Interoperability Solutions Market Analysis By Application

Clinical Data Sharing leads the way in application segments with a market size of $5.87 billion in 2023, anticipated to reach $15.46 billion by 2033, keeping a significant market share of 55.93%. Other applications like Population Health Management and Telehealth Services are also crucial for enhancing patient care and outcomes.

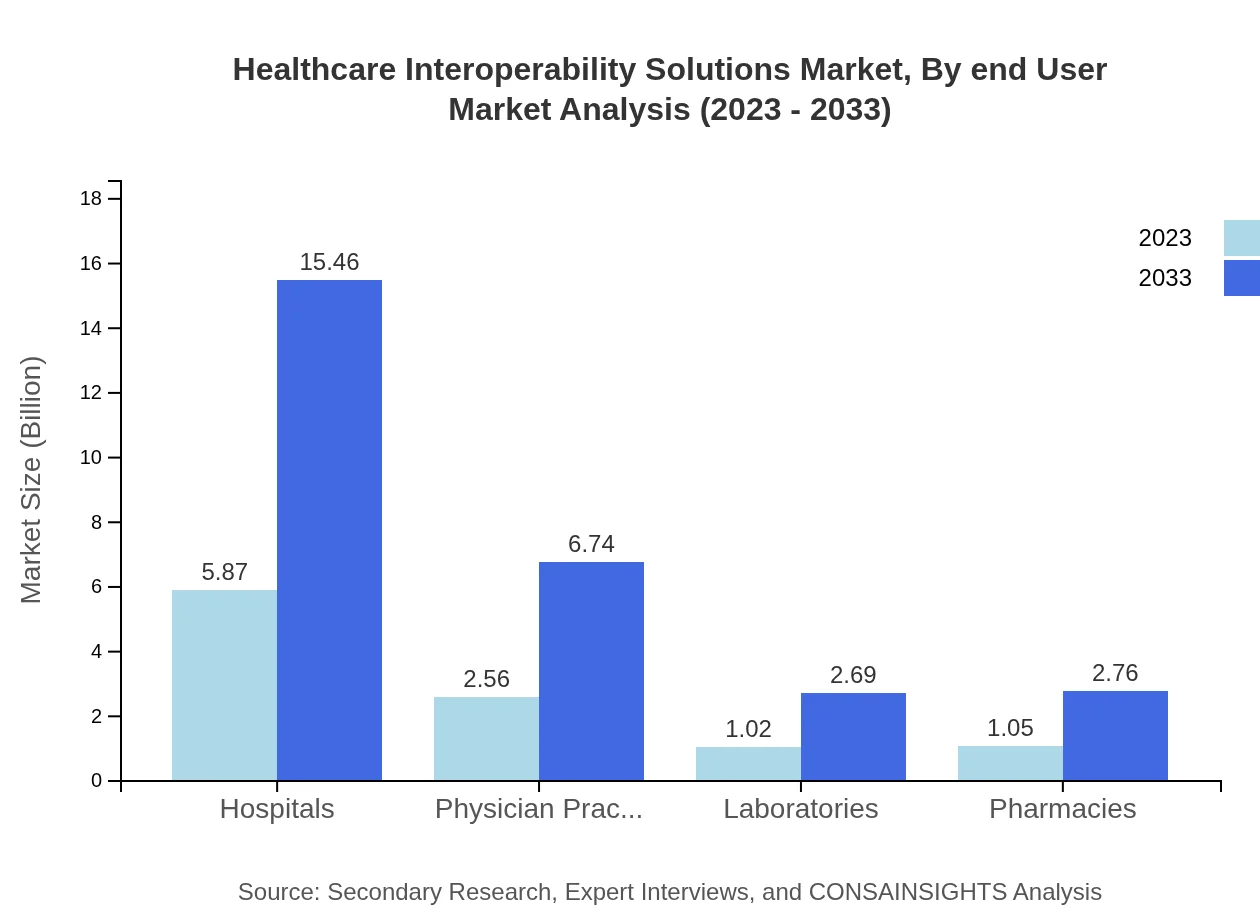

Healthcare Interoperability Solutions Market Analysis By End User

Hospitals are the primary end-users of Healthcare Interoperability Solutions, generating a market size of $5.87 billion in 2023, expected to grow to $15.46 billion by 2033, with a consistent share of 55.93%. Physician practices and laboratories also play important roles as demand for interoperability continues to enhance care delivery.

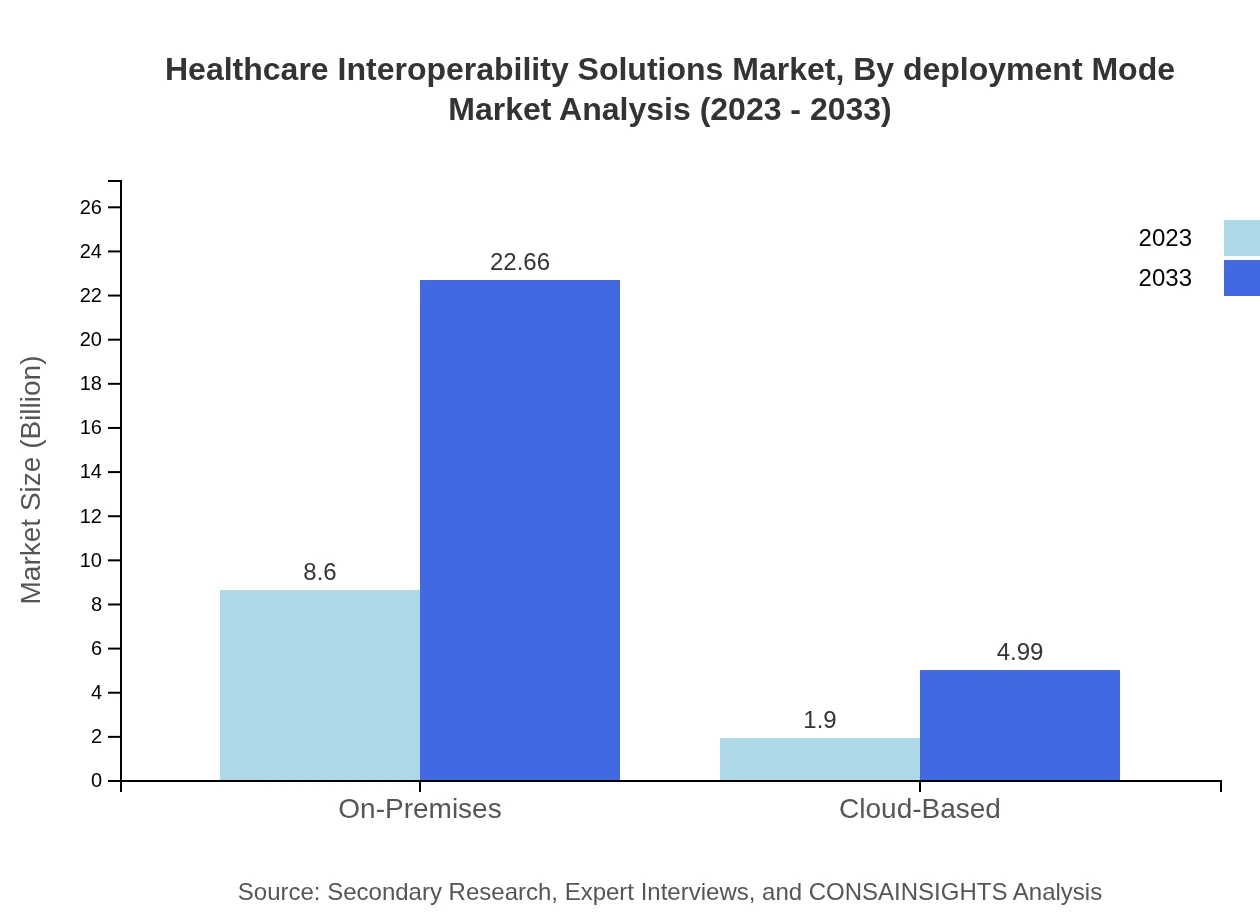

Healthcare Interoperability Solutions Market Analysis By Deployment Mode

In 2023, On-Premises solutions account for a market size of $8.60 billion, poised to grow to $22.66 billion by 2033. Cloud-Based solutions, while smaller at $1.90 billion currently, are forecasted to grow significantly given the increasing preference for flexible, scalable solutions.

Healthcare Interoperability Solutions Market Analysis By Organization Size

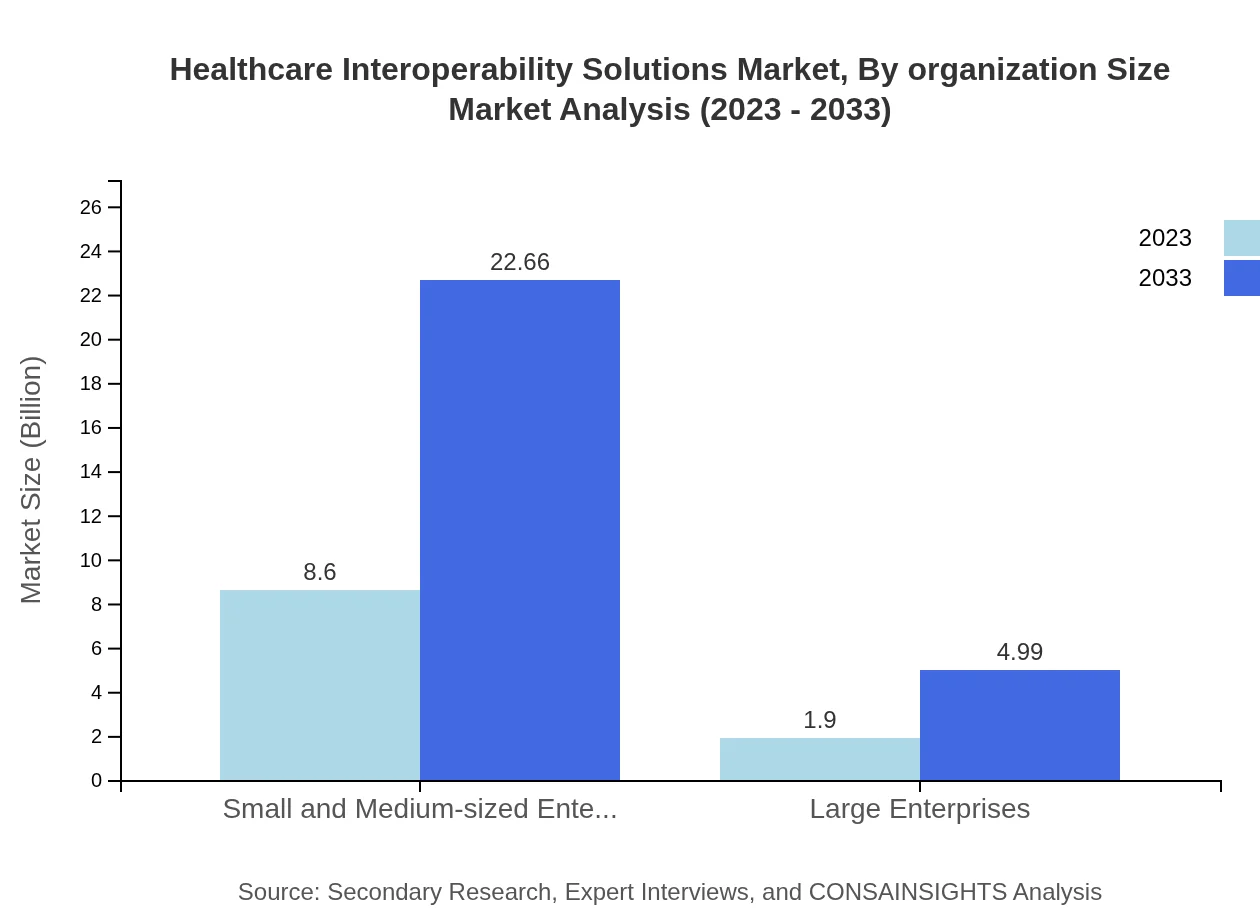

Small and Medium-sized Enterprises (SMEs) hold the majority market share due to their need for cost-effective interoperability solutions, accounting for $8.60 billion in 2023, projected to reach $22.66 billion by 2033. Large Enterprises also contribute notably, valuing $1.90 billion in 2023.

Healthcare Interoperability Solutions Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Interoperability Solutions Industry

Epic Systems Corporation:

A leader in healthcare software with a strong focus on interoperability solutions, Epic enables seamless healthcare data sharing across its EHR platform.Cerner Corporation:

Cerner is known for its robust interoperability tools, facilitating efficient data exchange and enhancing patient care through integrated health solutions.Allscripts Healthcare Solutions:

Allscripts offers comprehensive healthcare IT solutions that emphasize interoperability, particularly in EHR integration and patient engagement.MEDITECH:

A pioneer in health information technology, MEDITECH specializes in delivering interoperable solutions that optimize healthcare workflows and data accessibility.InterSystems:

InterSystems focuses on providing advanced interoperability solutions that improve data sharing across various healthcare settings, enhancing overall patient outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare Interoperability Solutions?

The healthcare interoperability solutions market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 9.8% over the next decade, indicating significant growth potential and increasing demand for integration solutions.

What are the key market players or companies in the healthcare Interoperability Solutions industry?

Key players in the healthcare interoperability solutions market include Allscripts Healthcare Solutions, Cerner Corporation, Epic Systems Corporation, InterSystems, and IBM Healthcare, which are leading innovation and service delivery in interoperability.

What are the primary factors driving the growth in the healthcare Interoperability Solutions industry?

The primary growth drivers include the increasing need for data sharing across healthcare systems, regulatory pressures for interoperability, rising telehealth adoption, and advancements in technology that facilitate better data integration and patient management.

Which region is the fastest Growing in the healthcare Interoperability Solutions?

North America is the fastest-growing region in healthcare interoperability solutions, with a market size projected to grow from $3.61 billion in 2023 to $9.51 billion by 2033, reflecting heightened investment and innovation.

Does ConsaInsights provide customized market report data for the healthcare Interoperability Solutions industry?

Yes, ConsaInsights offers tailored market report data, enabling clients to access specialized insights and analytics that meet their specific requirements in the healthcare interoperability solutions sector.

What deliverables can I expect from this healthcare Interoperability Solutions market research project?

Deliverables typically include an in-depth market analysis report, segmentation insights, competitive landscape data, and growth forecasts, providing comprehensive understanding for strategic decision-making.

What are the market trends of healthcare Interoperability Solutions?

Current market trends include increased investments in cloud-based solutions, integration of AI and machine learning technologies, emphasis on patient engagement platforms, and a shift towards value-based care, all driving interoperability advancements.