Healthcare It Integration Market Report

Published Date: 31 January 2026 | Report Code: healthcare-it-integration

Healthcare It Integration Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Healthcare IT Integration market, providing insights into market size, growth projections, industry analysis, segmentation, regional dynamics, technology trends, and leading players. The forecast period is from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

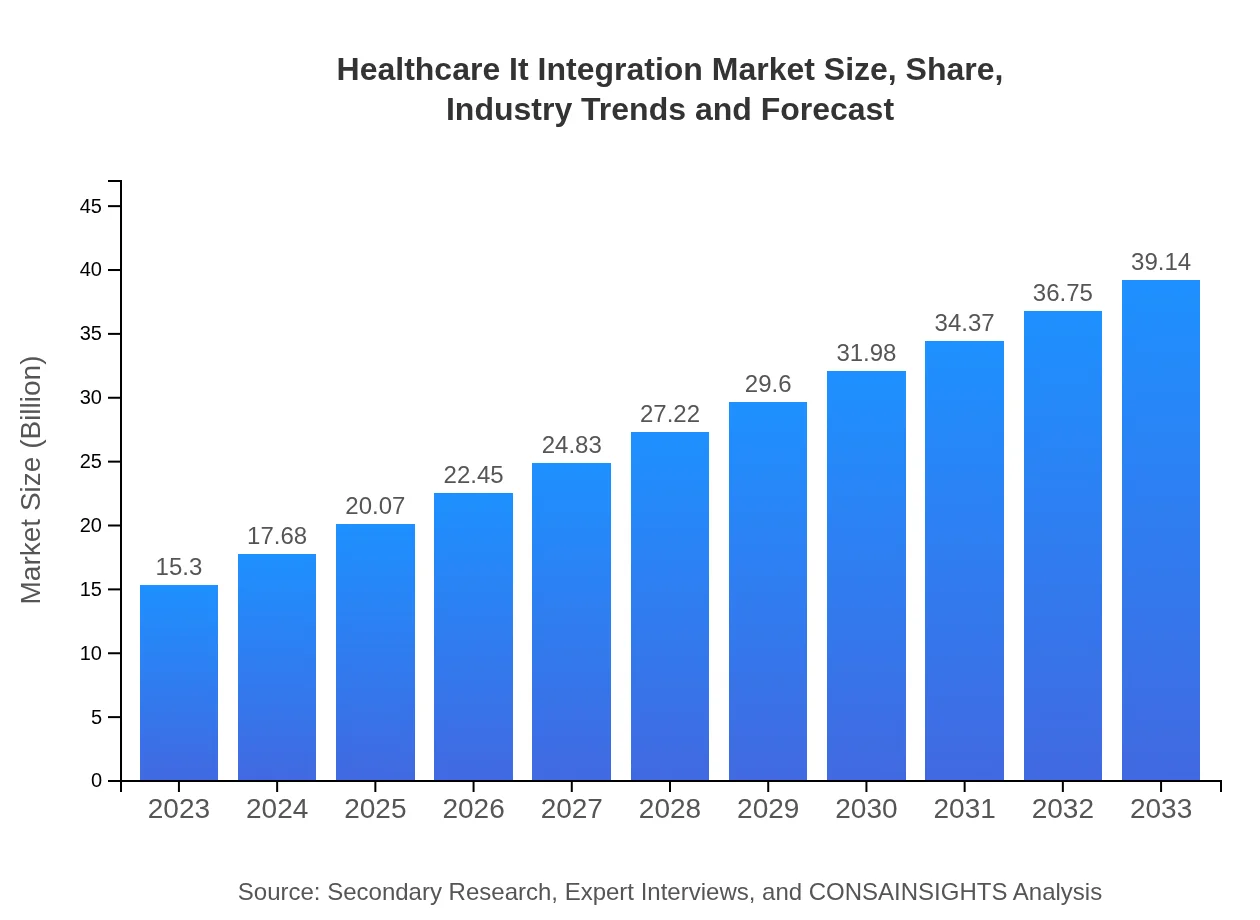

| 2023 Market Size | $15.30 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $39.14 Billion |

| Top Companies | Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions, Inc., Athenahealth, Inc. |

| Last Modified Date | 31 January 2026 |

Healthcare IT Integration Market Overview

Customize Healthcare It Integration Market Report market research report

- ✔ Get in-depth analysis of Healthcare It Integration market size, growth, and forecasts.

- ✔ Understand Healthcare It Integration's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare It Integration

What is the Market Size & CAGR of Healthcare IT Integration market in 2023?

Healthcare IT Integration Industry Analysis

Healthcare IT Integration Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare IT Integration Market Analysis Report by Region

Europe Healthcare It Integration Market Report:

In Europe, the market is valued at $4.48 billion in 2023, projected to grow to $11.45 billion by 2033. Strong regulatory frameworks and increasing adoption of integrated health solutions are key drivers in this region.Asia Pacific Healthcare It Integration Market Report:

In 2023, the Asia Pacific market for Healthcare IT Integration is valued at $2.91 billion, projected to grow to $7.45 billion by 2033, driven by increased investments in healthcare IT infrastructure and growing demand for cloud-based solutions.North America Healthcare It Integration Market Report:

North America holds the largest market share, estimated at $5.03 billion in 2023, expected to rise to $12.87 billion by 2033. This growth is attributed to the established presence of major healthcare IT companies and a focus on enhancing patient care through technology.South America Healthcare It Integration Market Report:

The South American market is currently valued at $1.12 billion in 2023, with growth expected to reach $2.86 billion by 2033. Factors such as improving healthcare access and the digital transformation of health services are catalysts for growth.Middle East & Africa Healthcare It Integration Market Report:

The Middle East and Africa market stands at $1.76 billion in 2023, expected to reach $4.50 billion by 2033. The region is focusing on improving healthcare access and quality, spurring investments in IT solutions.Tell us your focus area and get a customized research report.

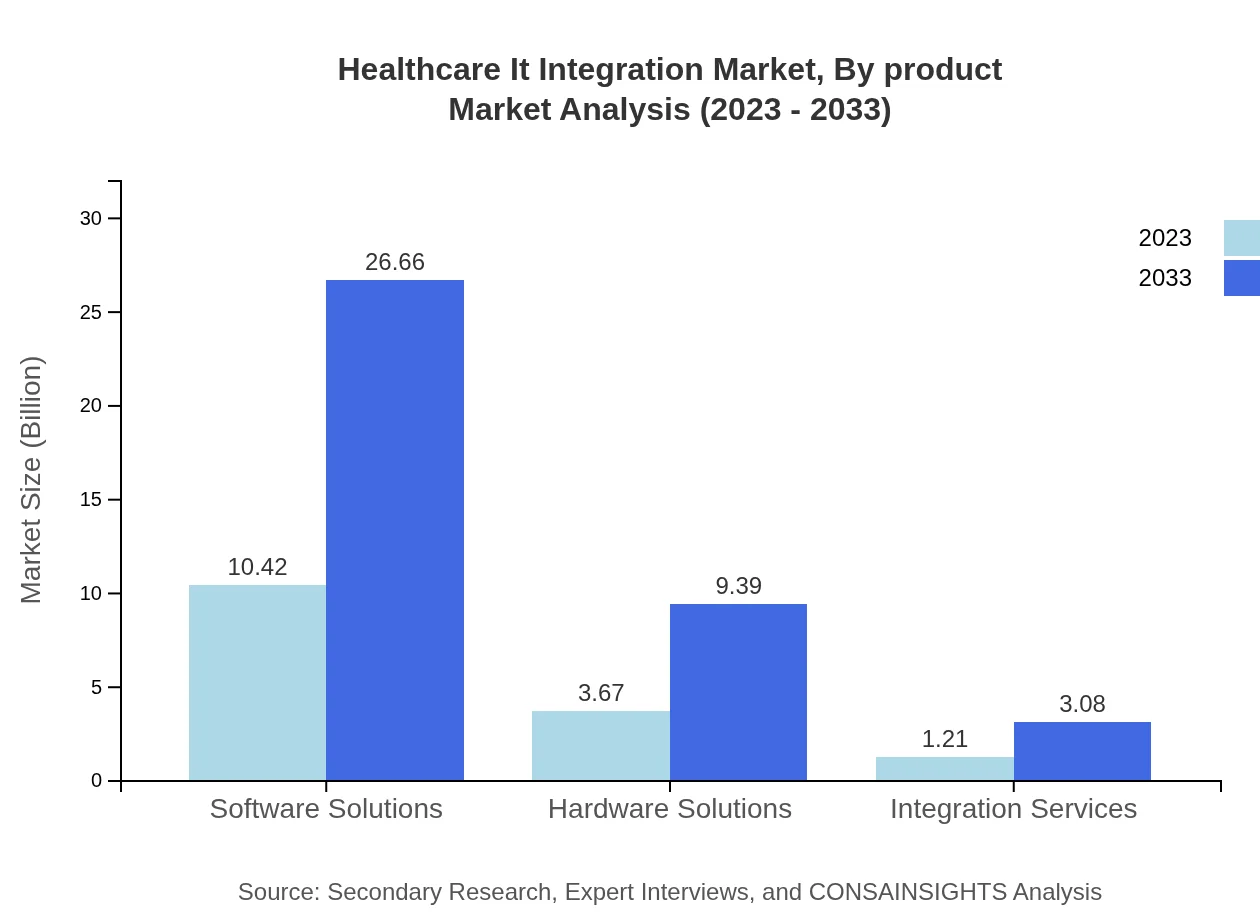

Healthcare It Integration Market Analysis By Product

The Healthcare IT Integration market is primarily divided into software solutions, hardware solutions, and integration services. In 2023, the software solutions segment accounts for $10.42 billion, projected to grow to $26.66 billion by 2033. Hardware solutions currently represent $3.67 billion, with estimates of $9.39 billion in 2033, while integration services are valued at $1.21 billion, expected to reach $3.08 billion over the forecast period.

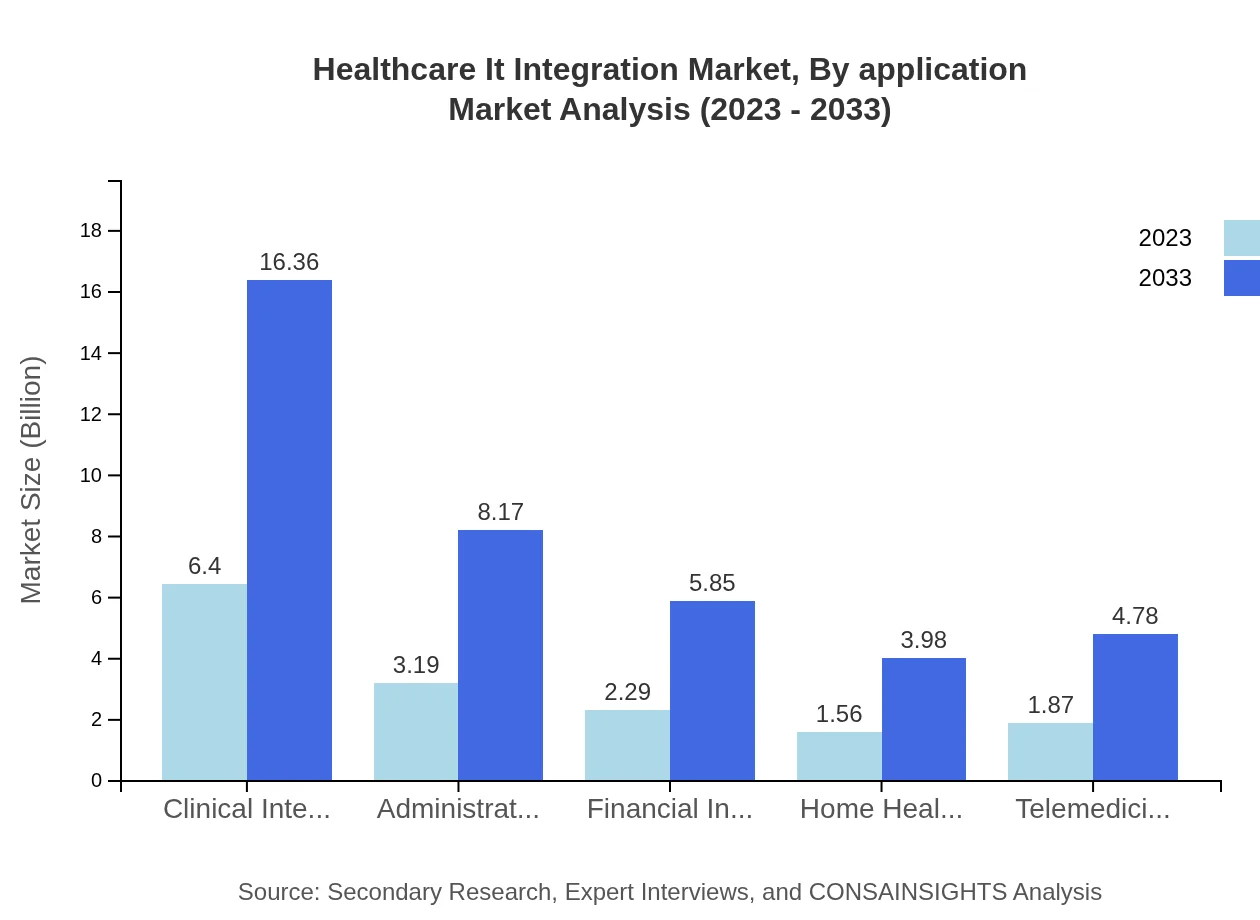

Healthcare It Integration Market Analysis By Application

Applications in the Healthcare IT Integration market include clinical integration, administrative integration, financial integration, and home health integration. Clinical integration dominates with $6.40 billion in 2023, projected to grow to $16.36 billion by 2033. Administrative integration, currently at $3.19 billion, will grow to $8.17 billion, while financial integration is expected to expand from $2.29 billion to $5.85 billion.

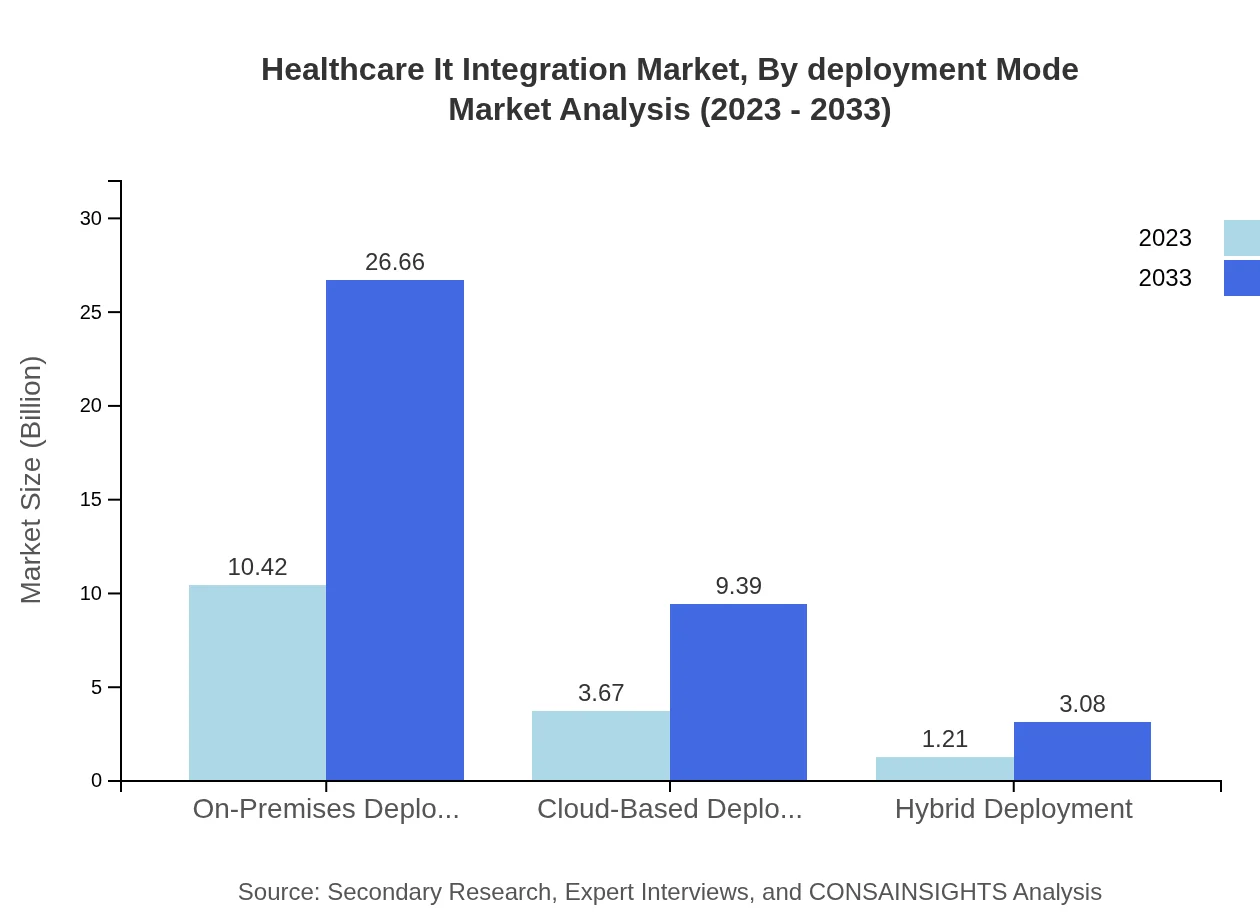

Healthcare It Integration Market Analysis By Deployment Mode

The market's deployment modes include on-premises, cloud-based, and hybrid solutions. The on-premises segment leads with $10.42 billion in 2023 and is projected to grow to $26.66 billion in 2033. Cloud-based solutions are expected to rise from $3.67 billion to $9.39 billion, while hybrid solutions will see growth from $1.21 billion to $3.08 billion.

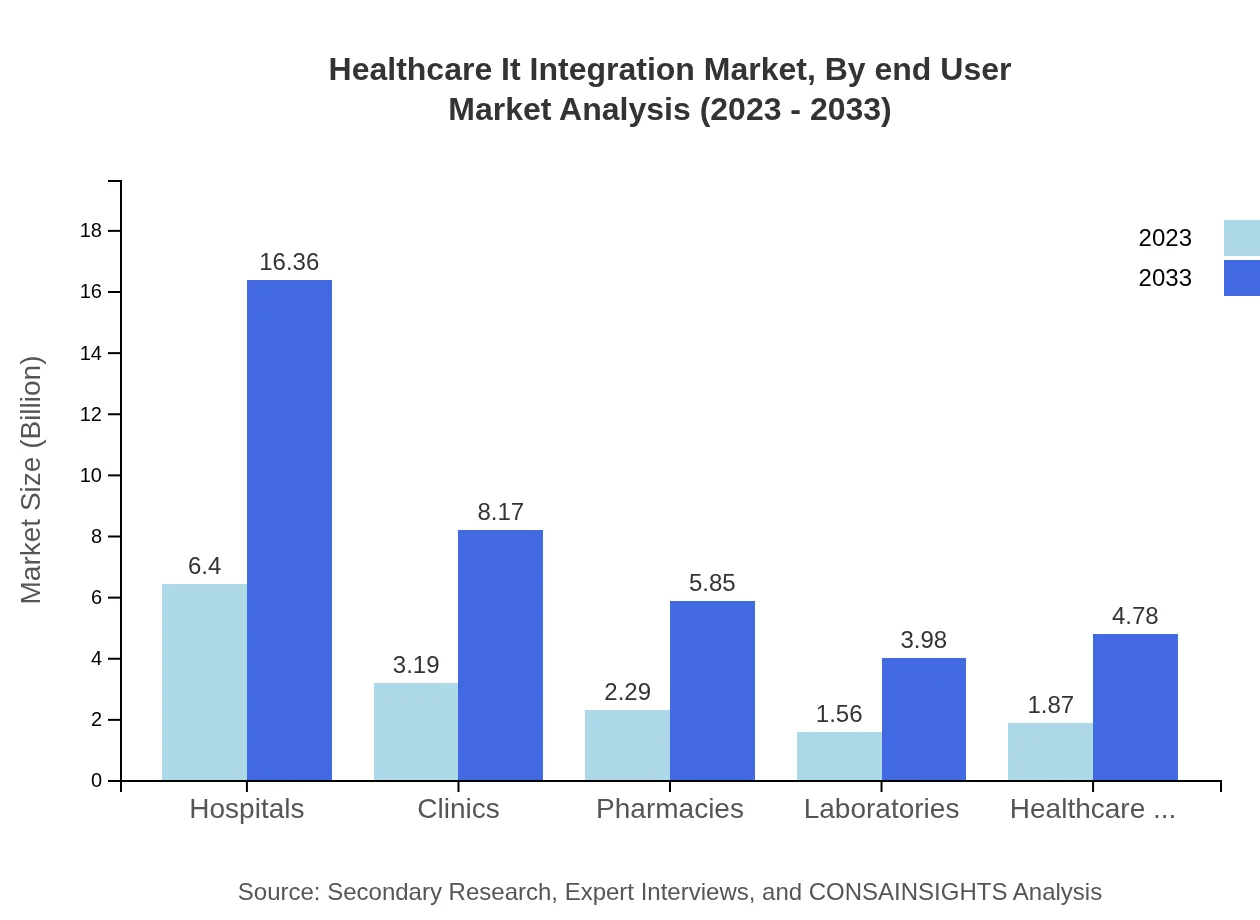

Healthcare It Integration Market Analysis By End User

Key end-users in the Healthcare IT Integration market include hospitals, clinics, pharmacies, and laboratories. Hospitals dominate the market with $6.40 billion in 2023, expected to increase to $16.36 billion by 2033. Clinics and pharmacies are projected to grow from $3.19 billion and $2.29 billion, respectively, to $8.17 billion and $5.85 billion by 2033.

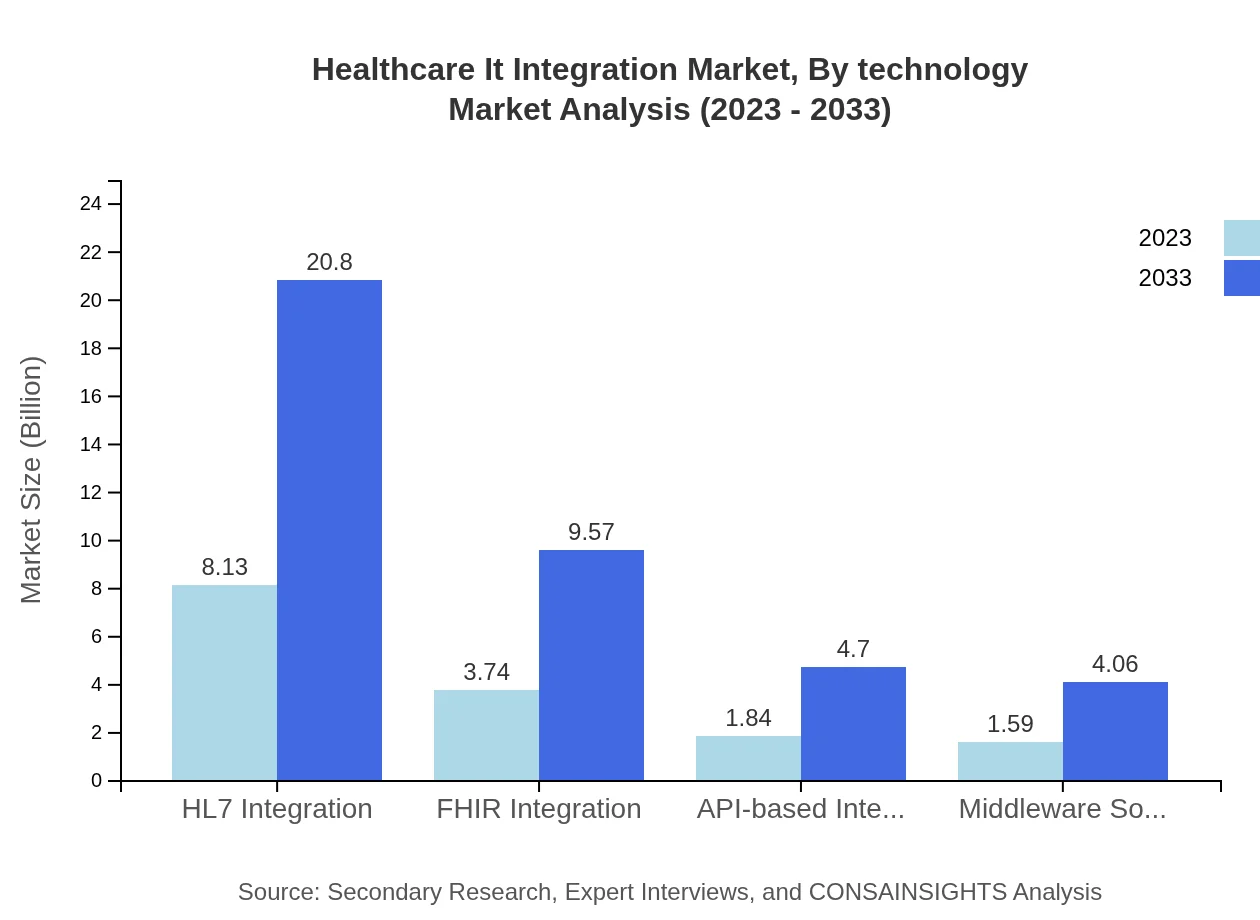

Healthcare It Integration Market Analysis By Technology

Technological advancements driving the integration market include HL7, FHIR, API-based, and middleware solutions. HL7 integration leads with $8.13 billion in 2023 and will grow to $20.80 billion by 2033, while FHIR is expected to increase from $3.74 billion to $9.57 billion. API-based integration currently valued at $1.84 billion is projected to grow to $4.70 billion.

Healthcare IT Integration Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare IT Integration Industry

Cerner Corporation:

A leading provider of health information technology solutions, Cerner offers software and services to improve patient care through integrated data management.Epic Systems Corporation:

Epic is known for its electronic health record software that integrates various healthcare processes, facilitating better patient management and communication.Allscripts Healthcare Solutions, Inc.:

Allscripts provides EHR, practice management, and other integration solutions tailored for healthcare providers to enhance data sharing.Athenahealth, Inc.:

Athenahealth offers cloud-based healthcare solutions, emphasizing interoperability and better care coordination across the healthcare continuum.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare IT integration?

The healthcare IT integration market is valued at approximately $15.3 billion in 2023, with a projected CAGR of 9.5% from 2023 to 2033, indicating substantial growth and expansion in this critical sector.

What are the key market players or companies in this healthcare IT integration industry?

Key players in the healthcare IT integration market include established companies known for their software solutions and integration services, such as Epic Systems, Cerner Corporation, and Allscripts, who drive innovation and market dynamics.

What are the primary factors driving the growth in the healthcare IT integration industry?

The growth of the healthcare IT integration market is primarily driven by the increasing need for effective healthcare processes, rising demand for seamless data sharing, advancements in technology, and increasing regulatory requirements for interoperability.

Which region is the fastest Growing in the healthcare IT integration?

The Asia Pacific region is expected to be the fastest-growing market for healthcare IT integration, projected to grow from $2.91 billion in 2023 to $7.45 billion by 2033, driven by increased healthcare investments and digital transformation.

Does ConsaInsights provide customized market report data for the healthcare IT integration industry?

Yes, ConsaInsights offers customized market report data tailored specifically to the healthcare IT integration industry, allowing clients to obtain insights according to their unique research needs and business objectives.

What deliverables can I expect from this healthcare IT integration market research project?

From the healthcare IT integration market research project, expect comprehensive deliverables such as detailed market analysis, segmentation insights, growth forecasts, competitive landscape assessment, and actionable recommendations for strategic decisions.

What are the market trends of healthcare IT integration?

Key market trends in healthcare IT integration include increasing adoption of cloud-based solutions, the rise of telemedicine integration, enhanced focus on data security, and growing investment in AI and machine learning technologies to improve patient care.