Healthcare It Market Report

Published Date: 31 January 2026 | Report Code: healthcare-it

Healthcare It Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Healthcare IT market, including market size, growth forecasts, and regional insights from 2023 to 2033. It highlights key trends, technological advancements, and profiles leading companies within the industry.

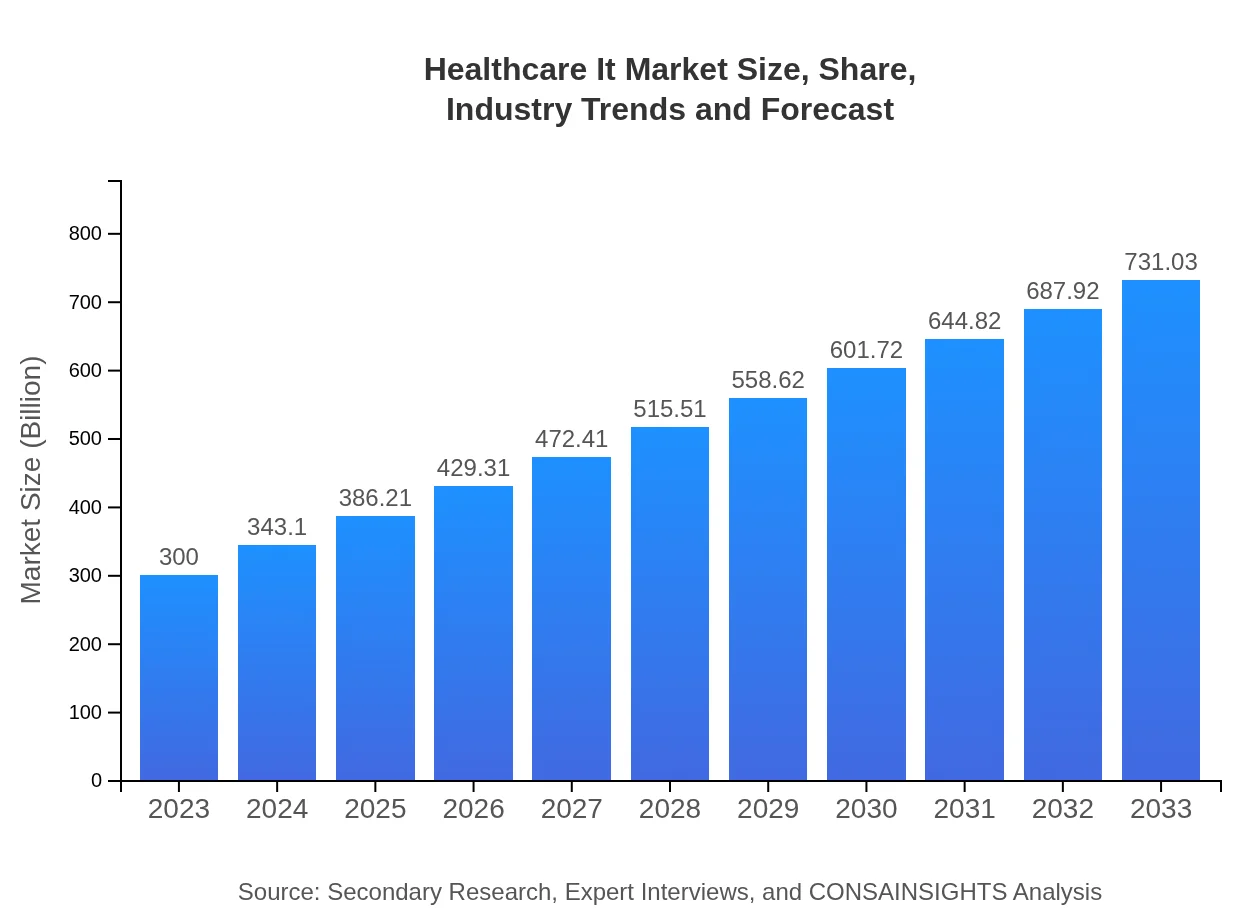

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $300.00 Billion |

| CAGR (2023-2033) | 9% |

| 2033 Market Size | $731.03 Billion |

| Top Companies | Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, McKesson Corporation, IBM Watson Health |

| Last Modified Date | 31 January 2026 |

Healthcare IT Market Overview

Customize Healthcare It Market Report market research report

- ✔ Get in-depth analysis of Healthcare It market size, growth, and forecasts.

- ✔ Understand Healthcare It's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare It

What is the Market Size & CAGR of Healthcare IT market in 2023?

Healthcare IT Industry Analysis

Healthcare IT Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare IT Market Analysis Report by Region

Europe Healthcare It Market Report:

The European Healthcare IT market is anticipated to grow from $91.44 billion in 2023 to $222.82 billion by 2033, driven by increasing investments in health tech and a growing emphasis on interoperability of healthcare systems.Asia Pacific Healthcare It Market Report:

In 2023, the Healthcare IT market in the Asia Pacific region is valued at $51.03 billion, expected to reach $124.35 billion by 2033. Factors contributing to this growth include rising investments in healthcare infrastructure, the adoption of advanced technologies, and increasing government initiatives aimed at enhancing healthcare delivery.North America Healthcare It Market Report:

North America dominates the Healthcare IT market, valued at $112.80 billion in 2023 and expected to reach $274.87 billion by 2033. The region's growth is propelled by high technology adoption rates, substantial healthcare expenditure, and a robust regulatory framework supporting healthcare technology.South America Healthcare It Market Report:

The South American Healthcare IT market is projected to grow from $28.65 billion in 2023 to $69.81 billion by 2033. The growth is driven by a rising focus on healthcare digitization, improving health outcomes, and an increasing population seeking healthcare services.Middle East & Africa Healthcare It Market Report:

In the Middle East and Africa, the Healthcare IT market will expand from $16.08 billion in 2023 to $39.18 billion by 2033. Significant growth factors include government initiatives to improve healthcare infrastructure and rising adoption of telehealth services.Tell us your focus area and get a customized research report.

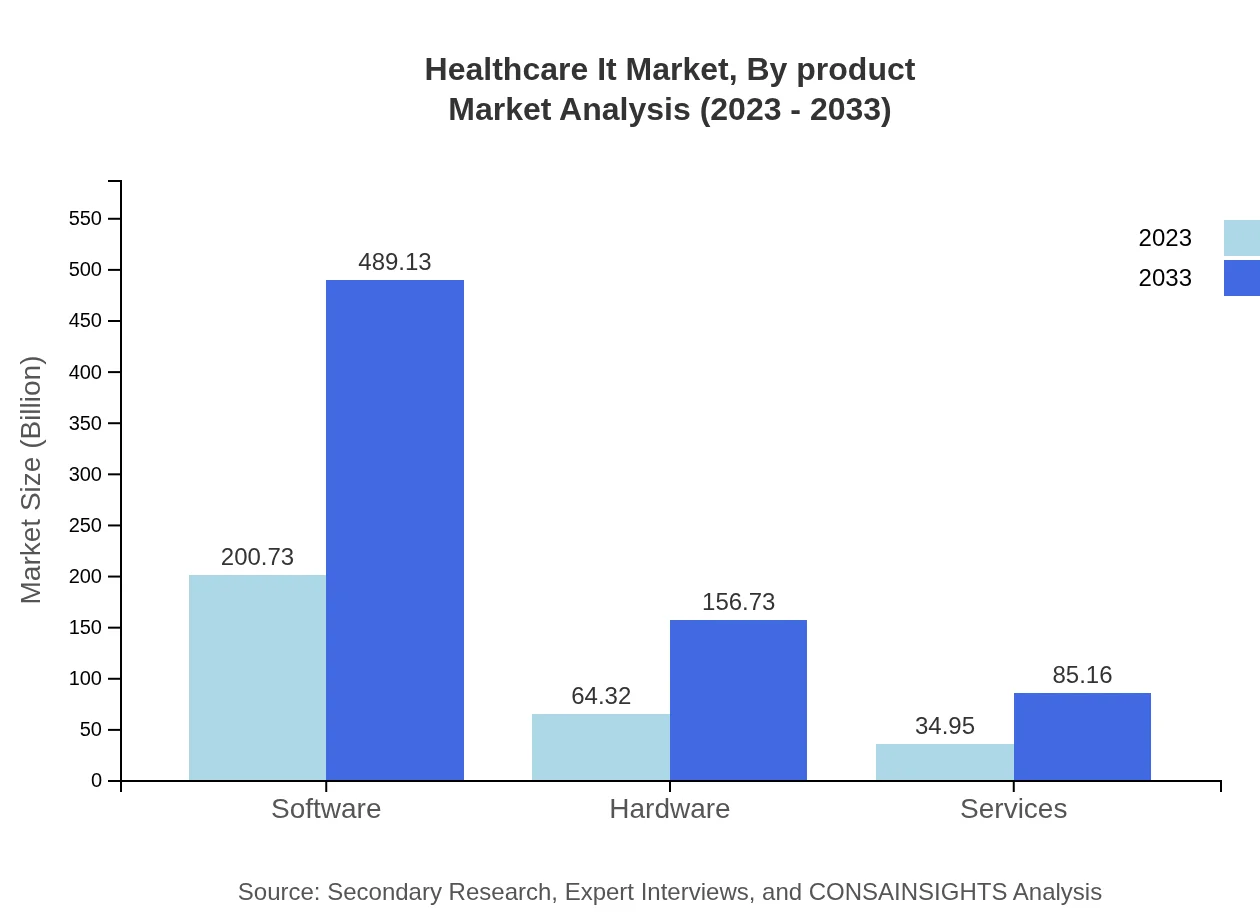

Healthcare It Market Analysis By Product

Product segments in the Healthcare IT market include software, hardware, and services. In 2023, the software segment accounts for $200.73 billion and is projected to reach $489.13 billion by 2033. Hardware follows with a market size of $64.32 billion, expected to grow to $156.73 billion, while services are valued at $34.95 billion and are forecasted to increase to $85.16 billion.

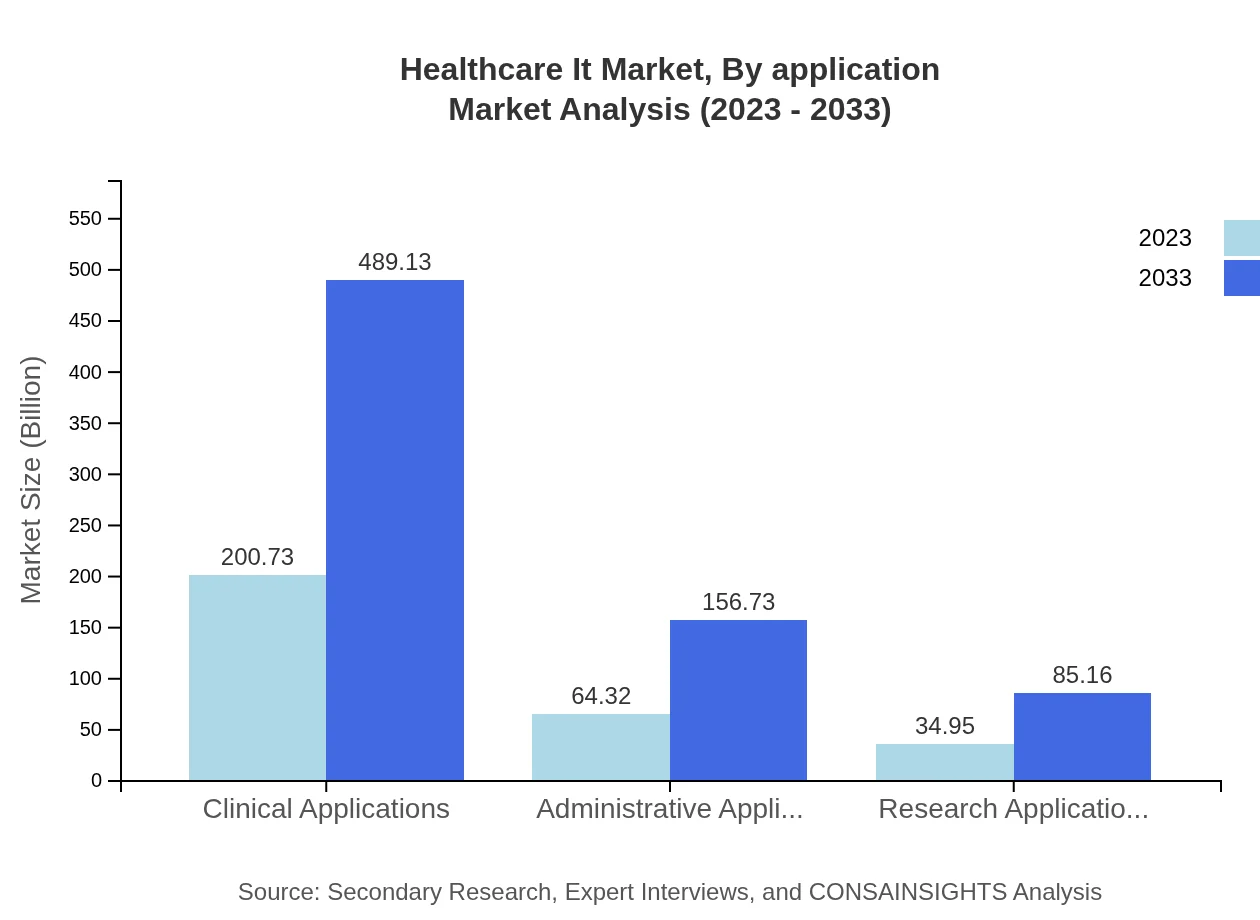

Healthcare It Market Analysis By Application

The market is segmented by applications, including clinical, administrative, and research applications. Clinical applications dominate with a market size of $200.73 billion in 2023, projected to grow to $489.13 billion by 2033. Administrative applications account for $64.32 billion, expected to rise to $156.73 billion. Research applications also see substantial growth from $34.95 billion to $85.16 billion.

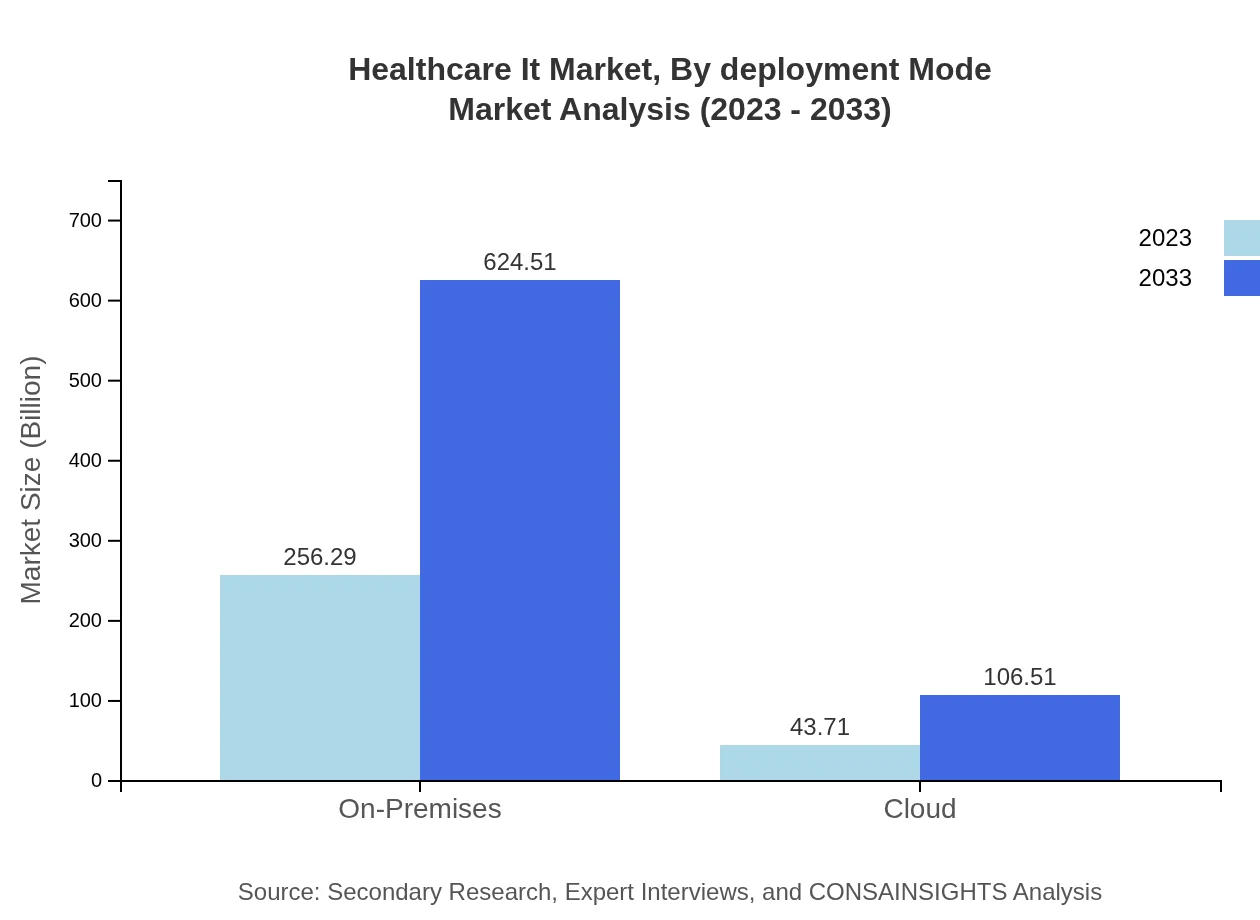

Healthcare It Market Analysis By Deployment Mode

The deployment modes include on-premises and cloud-based solutions. The on-premises segment is valued at $256.29 billion in 2023, forecasted to reach $624.51 billion by 2033. Conversely, the cloud segment starts at $43.71 billion, projected to grow to $106.51 billion, reflecting a trend toward flexibility and scalability in IT solutions.

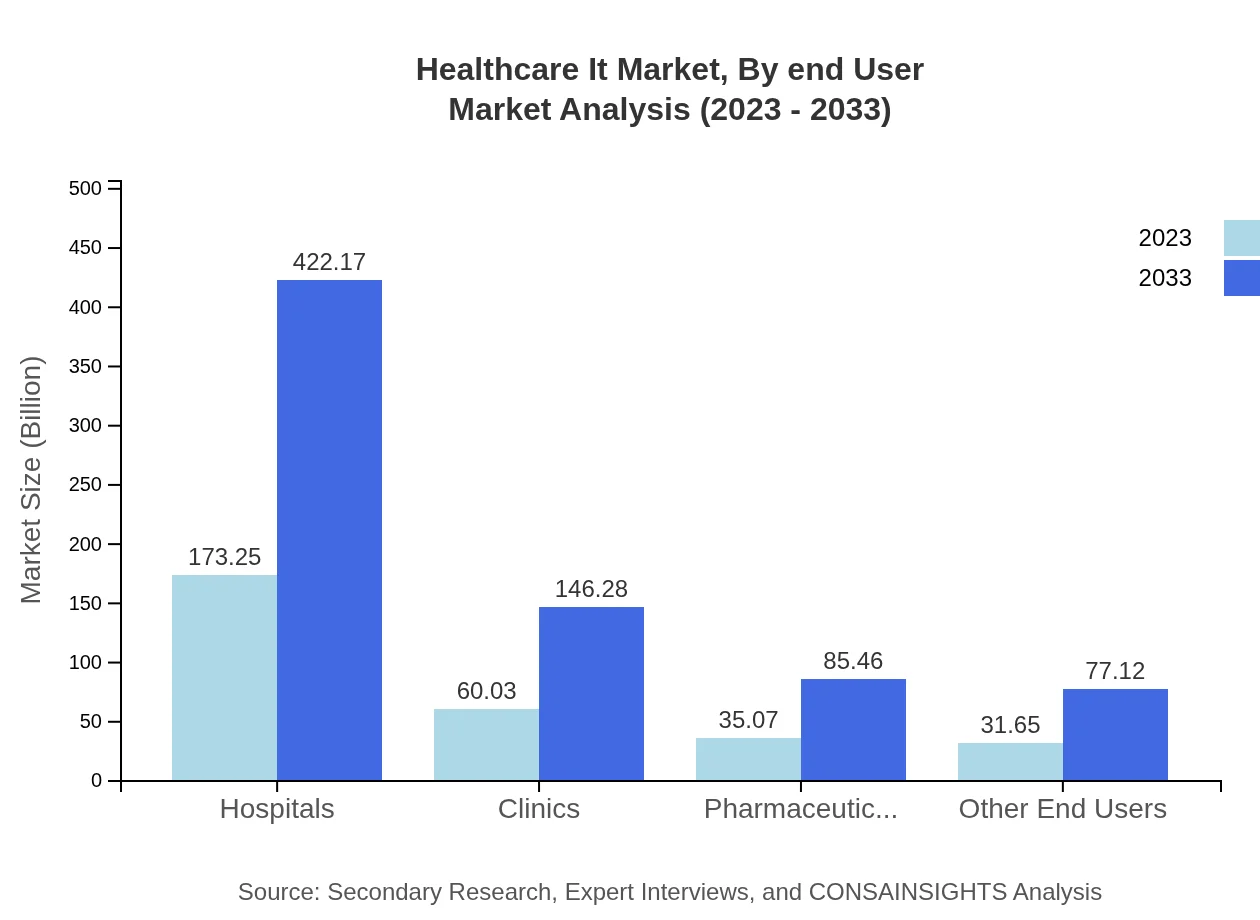

Healthcare It Market Analysis By End User

End-user segmentation includes hospitals, clinics, pharmaceutical companies, and others. Hospitals lead with a market size of $173.25 billion, expected to grow to $422.17 billion. Clinics will rise from $60.03 billion to $146.28 billion, while pharmaceutical companies expand from $35.07 billion to $85.46 billion.

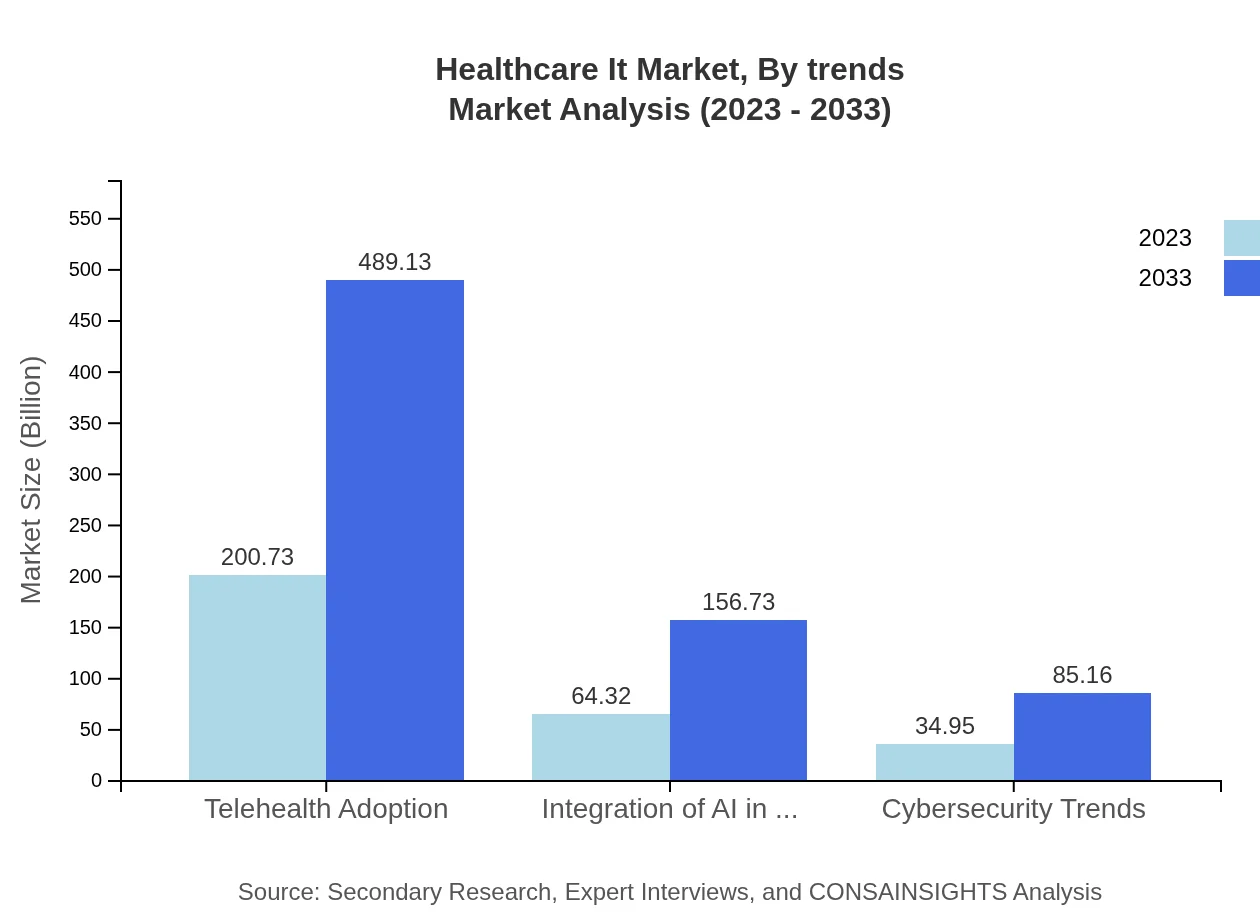

Healthcare It Market Analysis By Trends

Major trends impacting the Healthcare IT market include telehealth adoption, integration of AI, and cybersecurity advancements. Telehealth adoption is anticipated to grow from $200.73 billion in 2023 to $489.13 billion by 2033. AI integration will enhance efficiency, increasing market size from $64.32 billion to $156.73 billion, while cybersecurity trends are projected to grow from $34.95 billion to $85.16 billion.

Healthcare IT Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare IT Industry

Epic Systems Corporation:

Epic is a leading provider of healthcare software, specializing in EHR systems that improve patient care and streamline operations for healthcare providers.Cerner Corporation:

Cerner offers health information technology solutions, aiming to enhance healthcare efficiency through comprehensive electronic health records and data analytics.Allscripts Healthcare Solutions:

Allscripts provides a range of healthcare IT solutions, including EHR and revenue cycle management, focusing on improving the quality of care.McKesson Corporation:

McKesson is a healthcare services and information technology provider, known for its supply chain management and pharmacy management solutions.IBM Watson Health:

IBM Watson Health utilizes advanced analytics and machine learning to provide solutions aimed at improving clinical outcomes and operational efficiencies in healthcare.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare IT?

The global healthcare IT market size is projected to reach approximately $300 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 9%. This growth reflects increasing investments in healthcare technologies and digital solutions.

What are the key market players or companies in the healthcare IT industry?

Key players in the healthcare IT industry include multinational corporations like Cerner Corporation, Epic Systems, McKesson Corporation, Allscripts Healthcare Solutions, and Philips Healthcare. These companies are pivotal in providing various healthcare IT solutions and services driving market growth.

What are the primary factors driving the growth in the healthcare IT industry?

Factors driving the growth include increased adoption of electronic health records (EHRs), a surge in telehealth services, enhanced data security needs, adoption of AI, and rising healthcare costs. These technological advancements improve operational efficiencies in healthcare.

Which region is the fastest Growing in the healthcare IT market?

North America is currently the fastest-growing region in the healthcare IT market, expected to expand from $112.80 billion in 2023 to $274.87 billion by 2033, driven by technological advancements and increasing healthcare investments.

Does ConsaInsights provide customized market report data for the healthcare IT industry?

Yes, ConsaInsights offers tailored market report data to meet the specific needs of stakeholders in the healthcare IT industry. Clients can receive insights that align with their strategic objectives and market focus.

What deliverables can I expect from this healthcare IT market research project?

Deliverables from this healthcare IT market research project include detailed market analysis reports, segmentation insights, competitor benchmarking, growth forecasts, and actionable recommendations tailored to your business needs.

What are the market trends of healthcare IT?

Key trends in the healthcare IT market include a rising focus on telehealth adoption, the integration of AI for improved healthcare outcomes, emphasis on cybersecurity, and a shift towards cloud-based solutions. These trends reflect the industry's evolution in technology adoption.