Healthcare It Outsourcing Market Report

Published Date: 31 January 2026 | Report Code: healthcare-it-outsourcing

Healthcare It Outsourcing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Healthcare IT Outsourcing market, including market size, growth trends, and regional insights from 2023 to 2033, offering valuable data for stakeholders in the industry.

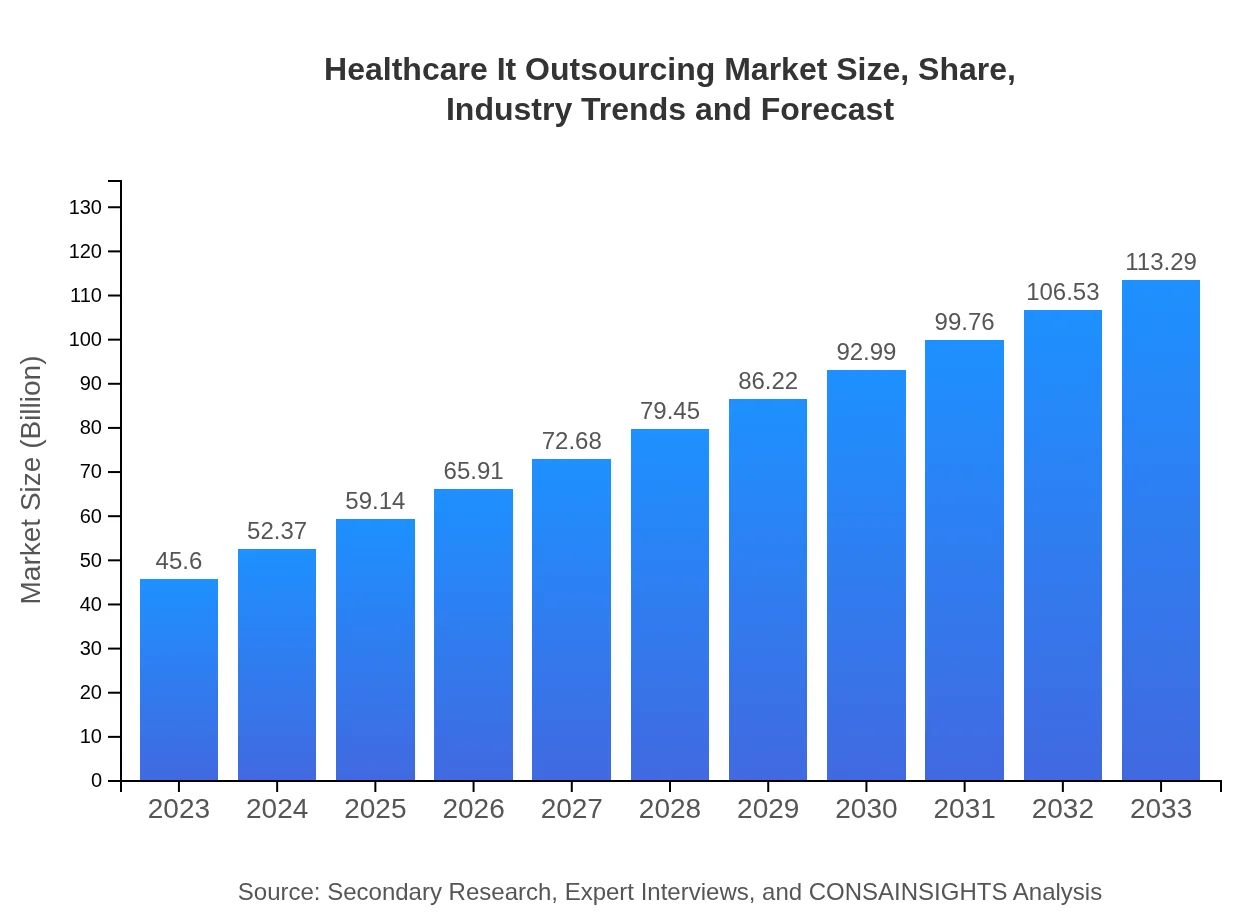

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $113.29 Billion |

| Top Companies | Accenture, IBM, Cognizant, Dell Technologies, TCS |

| Last Modified Date | 31 January 2026 |

Healthcare IT Outsourcing Market Overview

Customize Healthcare It Outsourcing Market Report market research report

- ✔ Get in-depth analysis of Healthcare It Outsourcing market size, growth, and forecasts.

- ✔ Understand Healthcare It Outsourcing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare It Outsourcing

What is the Market Size & CAGR of Healthcare IT Outsourcing market in 2023?

Healthcare IT Outsourcing Industry Analysis

Healthcare IT Outsourcing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare IT Outsourcing Market Analysis Report by Region

Europe Healthcare It Outsourcing Market Report:

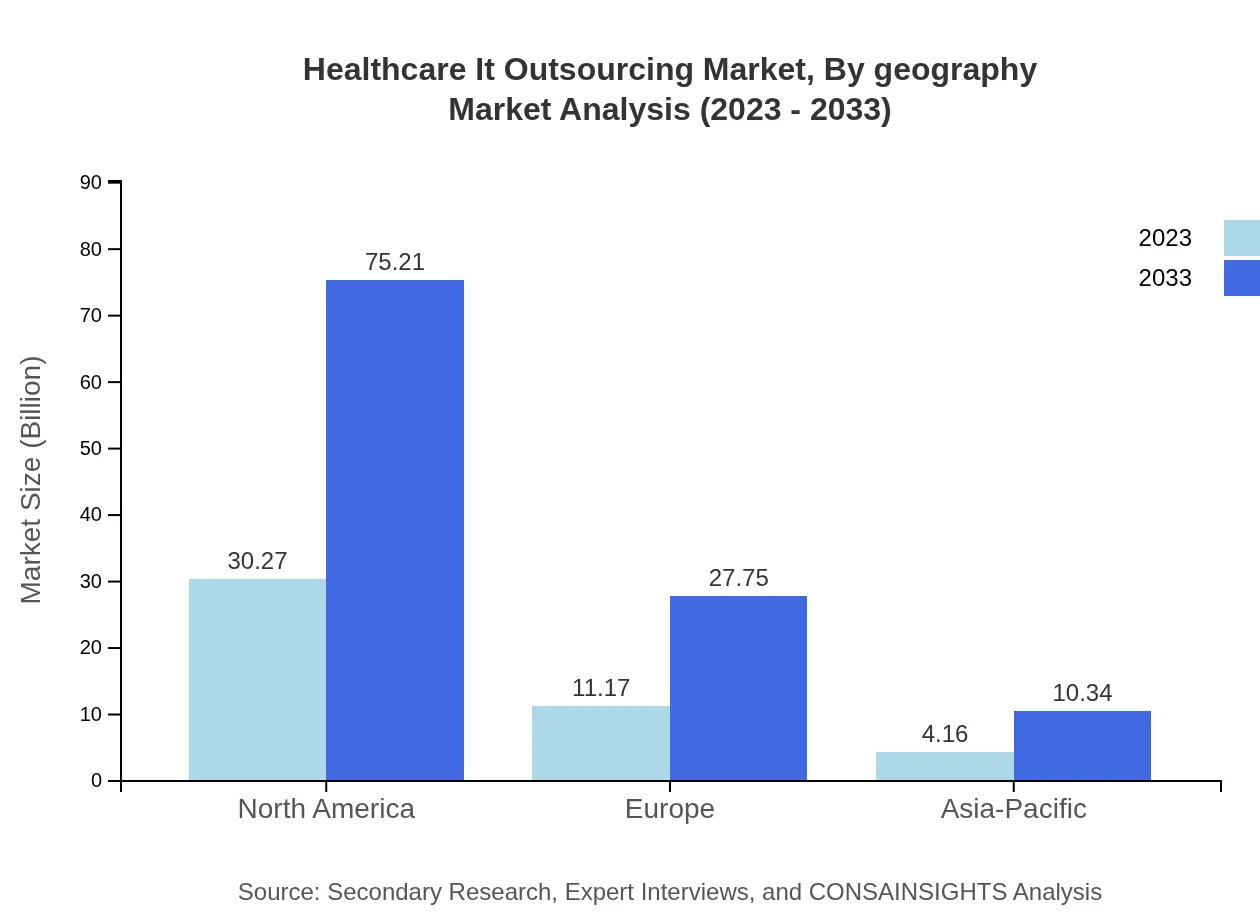

In Europe, the market size will increase from $15.31 billion in 2023 to $38.03 billion by 2033, with a focus on improving patient outcomes and operational efficiency through outsourced IT solutions, including telehealth and electronic health record management.Asia Pacific Healthcare It Outsourcing Market Report:

The Asia-Pacific region is experiencing impressive growth in the Healthcare IT Outsourcing market, projected to increase from $8.41 billion in 2023 to $20.89 billion by 2033. This growth is fueled by rising healthcare expenditures, increasing technology adoption, and expanding healthcare infrastructure in emerging economies.North America Healthcare It Outsourcing Market Report:

North America remains the largest market for Healthcare IT Outsourcing, anticipated to grow from $15.87 billion in 2023 to $39.44 billion by 2033. This growth is due to the high concentration of healthcare stakeholders, advancements in healthcare technology, and a strong emphasis on regulatory compliance.South America Healthcare It Outsourcing Market Report:

In South America, the market size is expected to grow from $4.33 billion in 2023 to $10.76 billion by 2033, driven by improvements in healthcare delivery and the growing adoption of IT solutions to enhance patient care and data management.Middle East & Africa Healthcare It Outsourcing Market Report:

The Middle East and Africa market is projected to grow from $1.68 billion in 2023 to $4.17 billion by 2033, driven by increasing healthcare investments, a growing healthcare sector, and rising demand for innovative technology solutions.Tell us your focus area and get a customized research report.

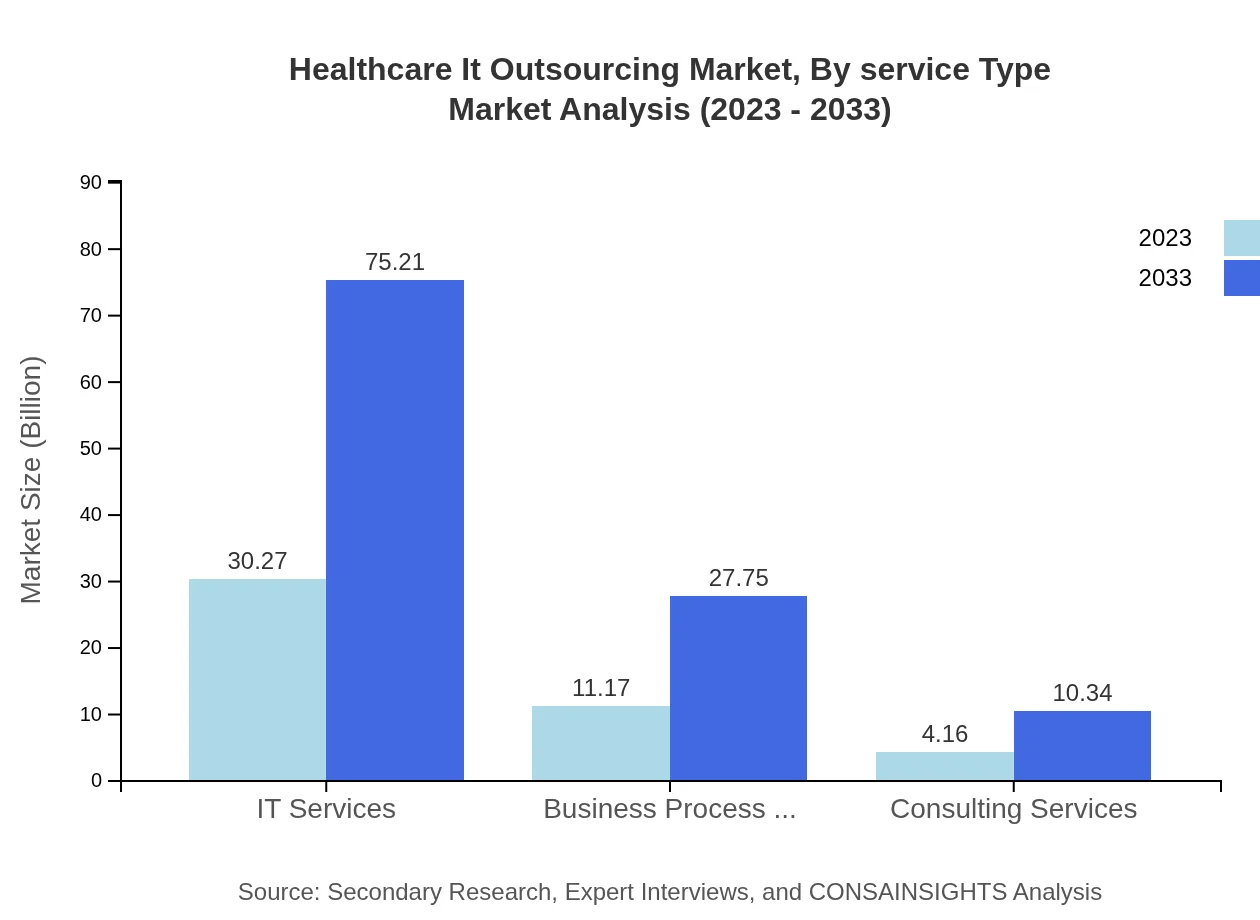

Healthcare It Outsourcing Market Analysis By Service Type

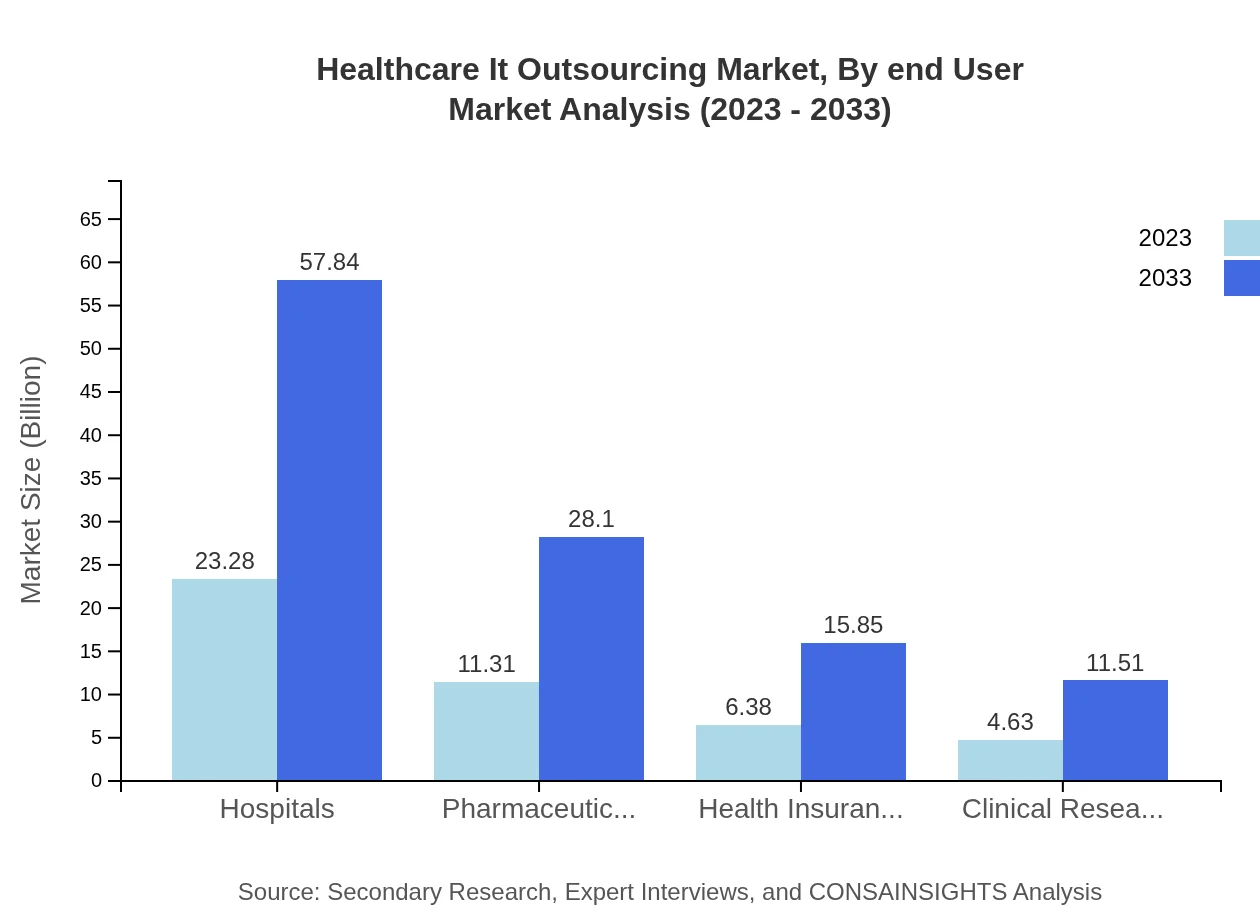

In the Healthcare IT Outsourcing market, hospitals account for the largest share, valued at $23.28 billion in 2023 and expected to reach $57.84 billion by 2033, commanding a share of 51.05%. Pharmaceutical companies follow closely, with a market size of $11.31 billion expected to grow to $28.10 billion (24.8% share) by 2033. Health insurance companies and clinical research organizations also contribute significantly, showcasing diverse areas of service demand within the outsourcing market.

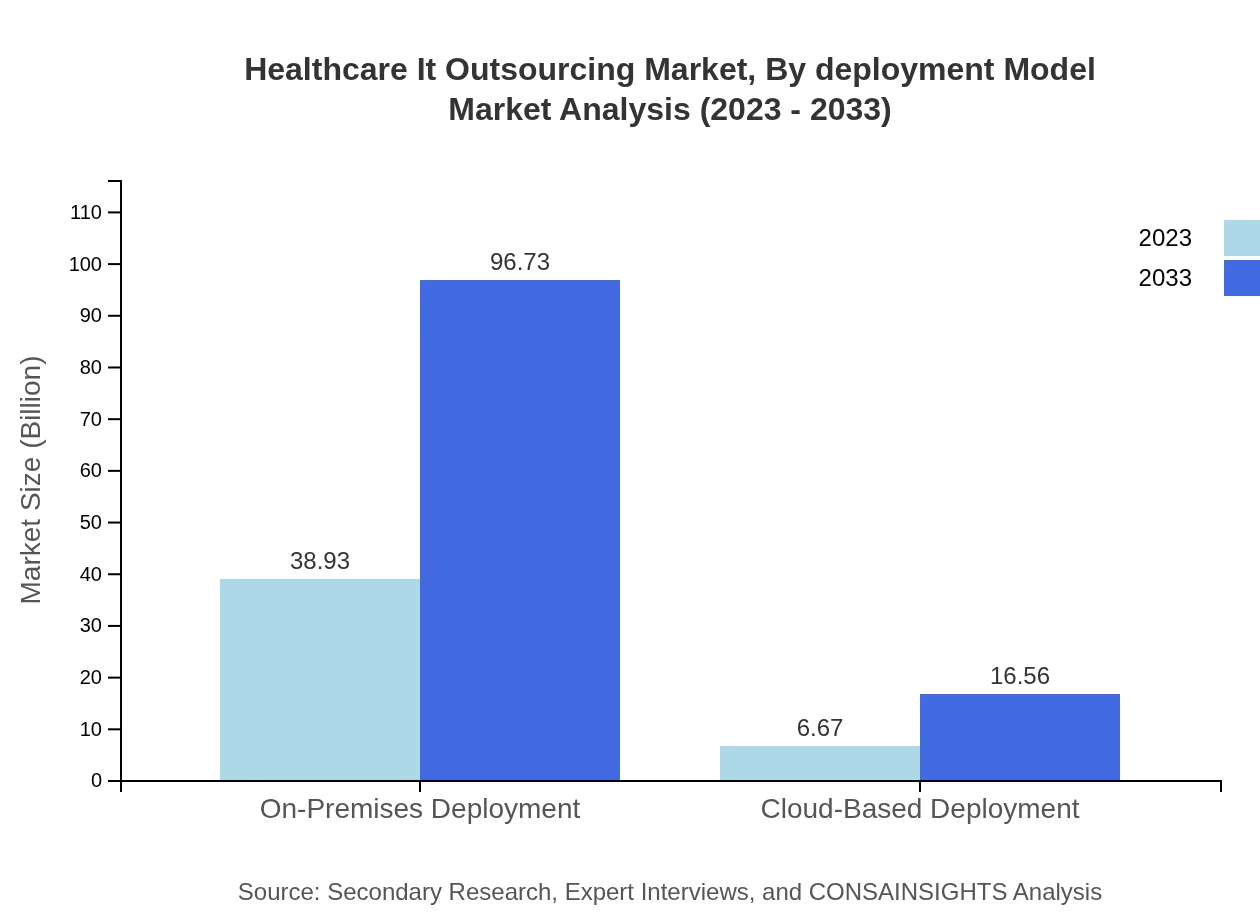

Healthcare It Outsourcing Market Analysis By Deployment Model

Deployment models in the Healthcare IT Outsourcing market are classified into on-premises and cloud-based. On-premises deployment, valued at $38.93 billion in 2023, will grow to $96.73 billion by 2033, maintaining a dominant share of 85.38%. Conversely, cloud-based deployment, starting at $6.67 billion, is set to increase to $16.56 billion (14.62% share) as healthcare organizations increasingly leverage cloud technologies for flexibility and scalability.

Healthcare It Outsourcing Market Analysis By End User

The Healthcare IT Outsourcing market's end-user segment highlights the importance of hospitals, pharmaceutical companies, health insurance providers, and clinical research organizations. Hospitals dominate the segment with the highest revenue contribution, followed by pharmaceutical companies, reflecting the need for various IT solutions tailored to different sectors within healthcare.

Healthcare It Outsourcing Market Analysis By Geography

Geographical analysis illustrates differing growth rates, with North America leading the sector followed by Europe and the Asia-Pacific. The growing demand for advanced healthcare technologies, including telemedicine and electronic health records, propels growth across regions while also reflecting regional differences in healthcare maturity and IT infrastructure.

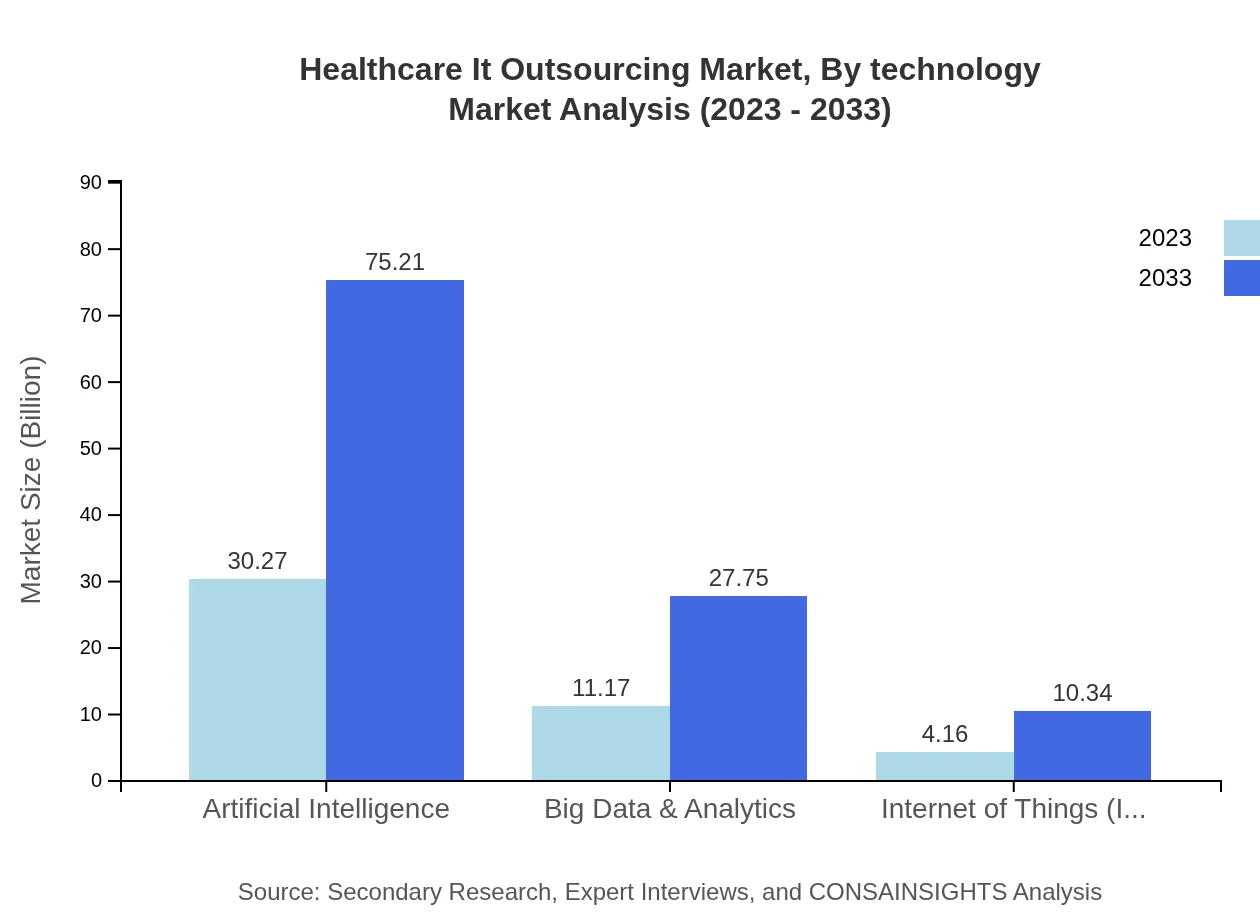

Healthcare It Outsourcing Market Analysis By Technology

In terms of technology, Artificial Intelligence (AI) leads with a market size of $30.27 billion in 2023, anticipated to grow to $75.21 billion by 2033 (66.38% share). Big Data & Analytics and Internet of Things (IoT) technologies also play crucial roles, showcasing significant growth along with their respective market shares and increasing relevance for healthcare organizations.

Healthcare IT Outsourcing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare IT Outsourcing Industry

Accenture:

A leading global professional services company providing a wide range of services and solutions in healthcare technology including IT consulting and BPO offerings.IBM:

Known for its advancements in AI and cognitive solutions, IBM plays a pivotal role in healthcare IT outsourcing through its innovative technology platforms and solutions.Cognizant:

A key player in healthcare outsourcing, Cognizant specializes in data analytics, healthcare consulting, and IT services aimed at enhancing operational efficiencies.Dell Technologies:

Recognized for data management and security in the healthcare outsourcing landscape, providing IT infrastructure services to aid healthcare providers.TCS:

Tata Consultancy Services provides a multitude of IT services and BPO solutions, significantly contributing to the optimization of operational processes in healthcare.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare IT outsourcing?

The global healthcare IT outsourcing market is expected to reach approximately $45.6 billion in 2023, with a projected compound annual growth rate (CAGR) of 9.2% from 2023 to 2033.

What are the key market players or companies in the healthcare IT outsourcing industry?

Key players in the healthcare IT outsourcing industry include major companies such as Cognizant Technology Solutions, Infosys, Wipro, Accenture, and IBM, each contributing innovative solutions and extensive expertise to the market.

What are the primary factors driving the growth in the healthcare IT outsourcing industry?

Growth drivers include the increasing demand for cost-effective healthcare solutions, advancements in technology such as AI and analytics, regulatory changes, and the need for improved operational efficiency in healthcare facilities.

Which region is the fastest Growing in healthcare IT outsourcing?

The North American region is the fastest-growing in the healthcare IT outsourcing market, projected to grow from $15.87 billion in 2023 to $39.44 billion by 2033, highlighting its dominant position in the industry.

Does ConsaInsights provide customized market report data for the healthcare IT outsourcing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the healthcare IT outsourcing industry, enabling stakeholders to obtain relevant information suitable for their strategic decisions.

What deliverables can I expect from this healthcare IT outsourcing market research project?

Deliverables include comprehensive market analysis reports, segment insights, competitive landscape assessment, and future growth forecasts, which collectively provide essential data for informed decision-making.

What are the market trends of healthcare IT outsourcing?

Trends include a rising focus on cybersecurity, increased adoption of cloud-based solutions, and integration of advanced technologies, such as AI and IoT, all reshaping the landscape of healthcare IT outsourcing.