Healthcare Payer Services Market Report

Published Date: 31 January 2026 | Report Code: healthcare-payer-services

Healthcare Payer Services Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the extensive Healthcare Payer Services market, detailing insights and data for a forecast period from 2023 to 2033, including market size, trends, challenges, and opportunities.

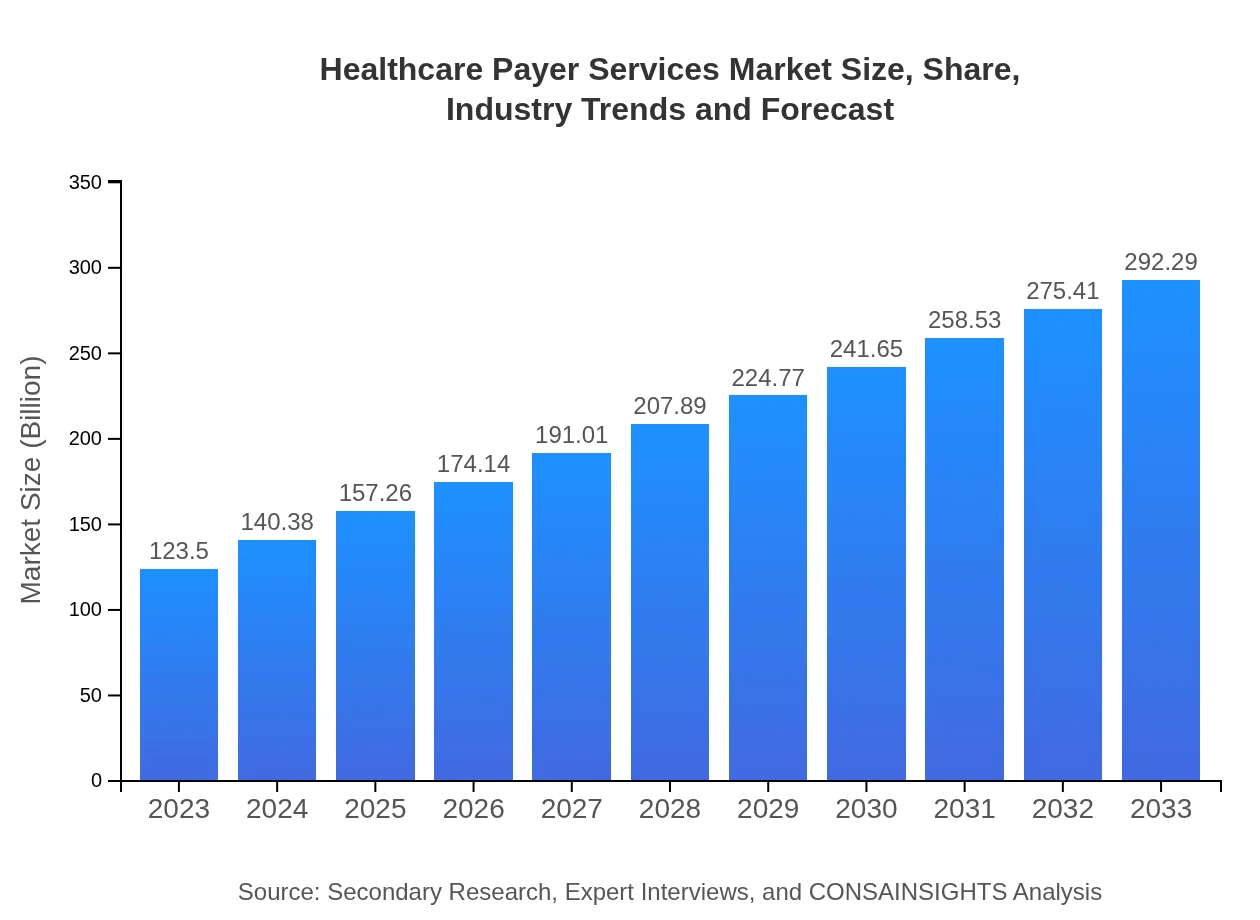

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $123.50 Billion |

| CAGR (2023-2033) | 8.7% |

| 2033 Market Size | $292.29 Billion |

| Top Companies | Anthem Inc., UnitedHealth Group, Aetna Inc., Cigna Corporation |

| Last Modified Date | 31 January 2026 |

Healthcare Payer Services Market Overview

Customize Healthcare Payer Services Market Report market research report

- ✔ Get in-depth analysis of Healthcare Payer Services market size, growth, and forecasts.

- ✔ Understand Healthcare Payer Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Payer Services

What is the Market Size & CAGR of Healthcare Payer Services market in 2023?

Healthcare Payer Services Industry Analysis

Healthcare Payer Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Payer Services Market Analysis Report by Region

Europe Healthcare Payer Services Market Report:

Europe's Healthcare Payer Services market is anticipated to grow from $39.26 billion in 2023 to $92.92 billion by 2033. Increased investment in digital health solutions, coupled with a rising emphasis on patient-centric models of care, are critical drivers of growth. Regulatory frameworks supporting healthcare digitization are also propelling market expansion.Asia Pacific Healthcare Payer Services Market Report:

In the Asia Pacific region, the Healthcare Payer Services market is expected to grow from $21.22 billion in 2023 to $50.21 billion by 2033. This growth is fueled by an increasing population, greater access to healthcare services, and rising disposable incomes. Countries like India and China are witnessing rapid digital adoption in healthcare, propelling payer service demand.North America Healthcare Payer Services Market Report:

North America, primarily led by the U.S., represents the largest market, with a size expected to rise from $45.67 billion in 2023 to $108.09 billion by 2033. The growth is driven by technological advancements, a shift towards value-based care, and increasing healthcare expenditure. Regulatory changes under the Affordable Care Act continue to influence payer practices significantly.South America Healthcare Payer Services Market Report:

The South American market for Healthcare Payer Services is projected to expand from $11.52 billion in 2023 to $27.27 billion by 2033. Economic recovery and healthcare reforms across countries like Brazil and Argentina are contributing to the progressive adoption of innovative payer solutions. Public health initiatives are also crucial to enhancing service accessibility.Middle East & Africa Healthcare Payer Services Market Report:

In the Middle East and Africa, the market is expected to increase from $5.83 billion in 2023 to $13.80 billion by 2033. Growing healthcare needs driven by population growth and urbanization in countries like the UAE and South Africa are catalyzing the uptake of Healthcare Payer Services, boosted by government-led healthcare initiatives.Tell us your focus area and get a customized research report.

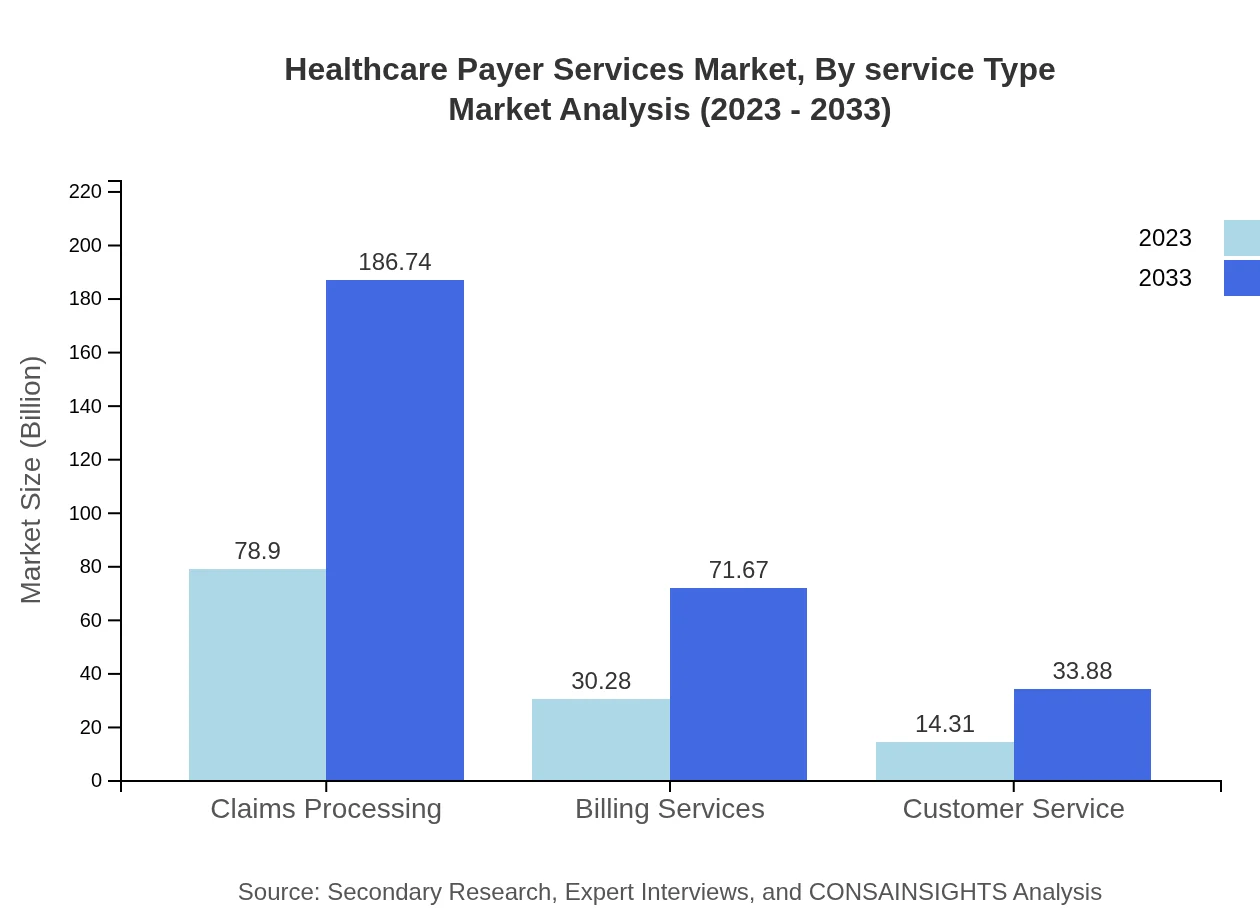

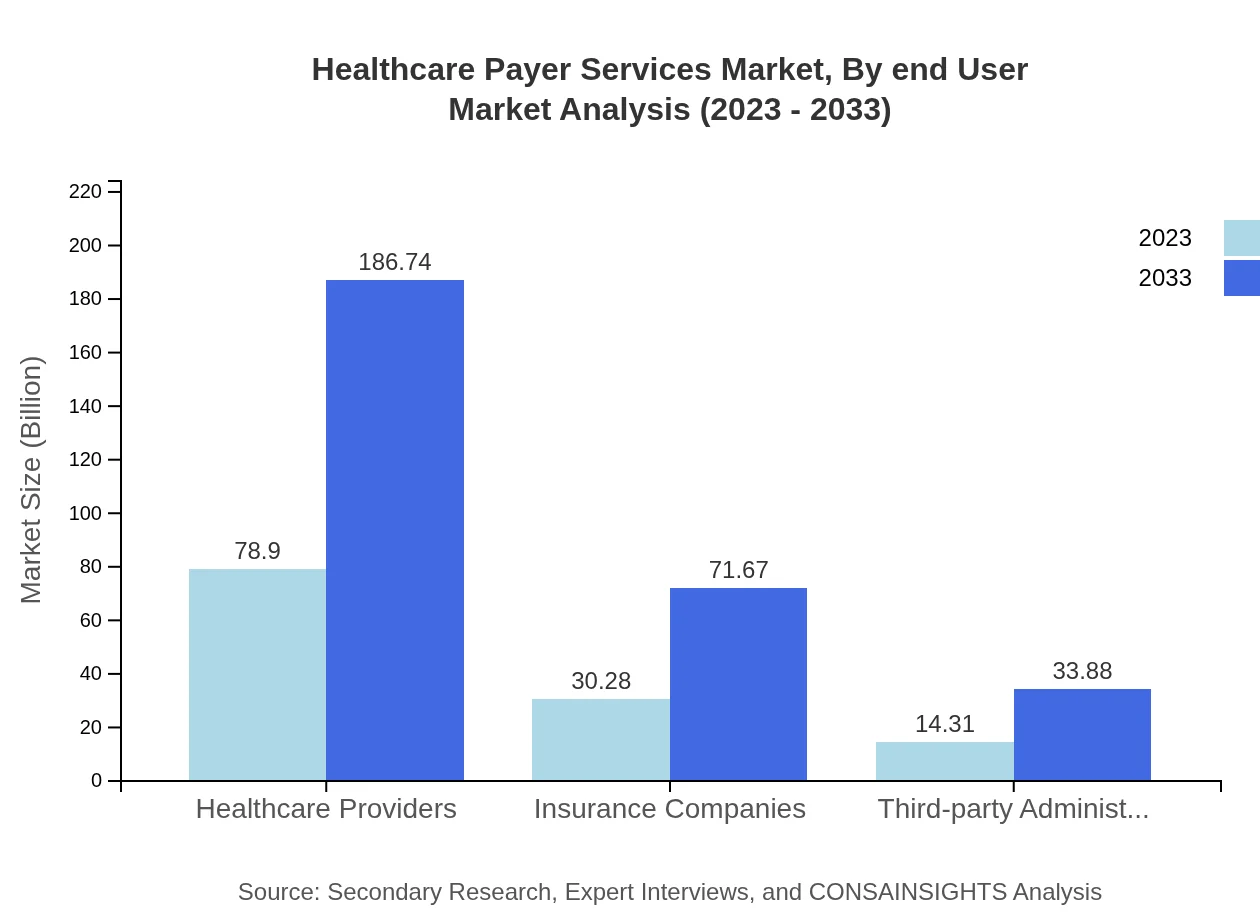

Healthcare Payer Services Market Analysis By Service Type

The sector of Healthcare Providers dominates the market, experiencing growth from $78.90 billion in 2023 to $186.74 billion by 2033, capturing 63.89% of the market share. Insurance Companies account for $30.28 billion and are expected to reach $71.67 billion. Third-party Administrators signify a niche yet crucial segment, growing from $14.31 billion to $33.88 billion. Private Payers show a strong market presence of $106.06 billion, expanding to $251.02 billion by 2033, while Public Payers are expected to grow from $17.44 billion to $41.27 billion.

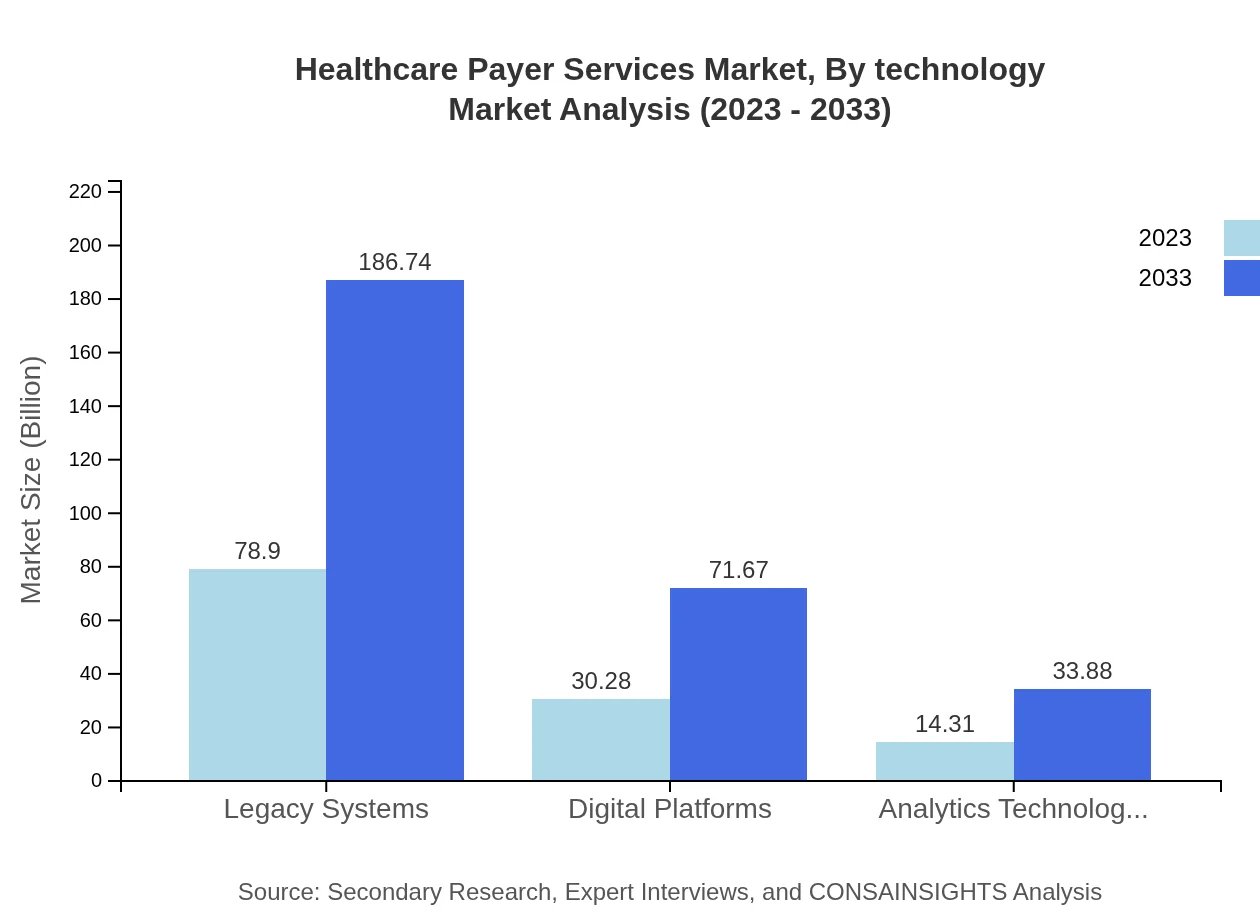

Healthcare Payer Services Market Analysis By Technology

The market reveals a critical reliance on Legacy Systems with $78.90 billion, projected to rise to $186.74 billion by 2033. Digital Platforms and Analytics Technologies are also notable segments, estimated to increase from $30.28 billion to $71.67 billion, and $14.31 billion to $33.88 billion, respectively. As the need for modernized solutions grows, investments into advanced analytics and AI technologies will become essential.

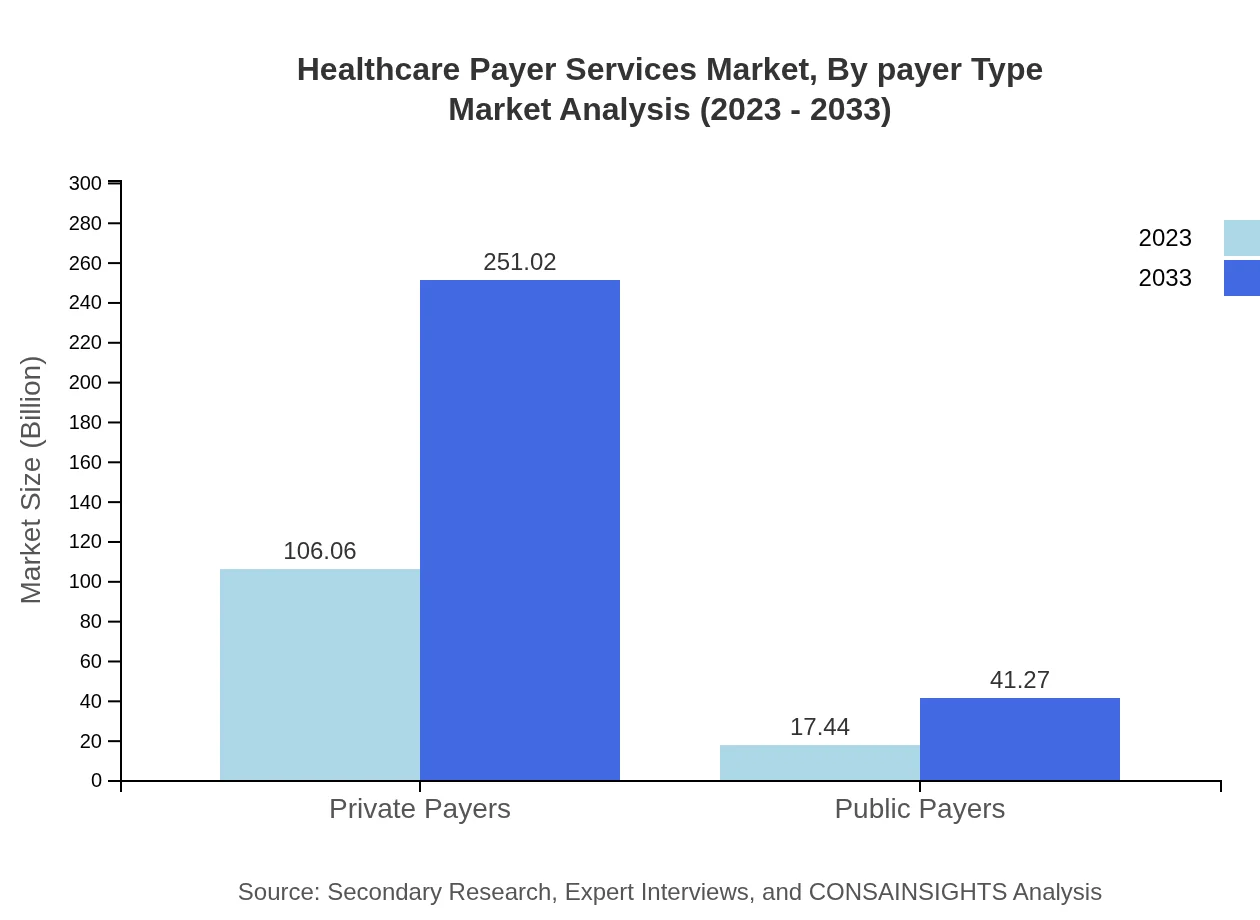

Healthcare Payer Services Market Analysis By Payer Type

Private Payers dominate with significant figures of $106.06 billion projected to grow to $251.02 billion, while Public Payers are anticipated to grow from $17.44 billion to $41.27 billion. The strategic frameworks designed by insurance companies for improved health outcomes reinforce their position as crucial market players amid rising healthcare expenses.

Healthcare Payer Services Market Analysis By End User

The Healthcare Provider segment is significant in terms of end-user consumption, leading expenditures on services. Insurers leverage these services to ensure policy compliance and administrative efficiency, just as government bodies utilize payer services to meet public health mandates. Technological adoption plays a key role in enhancing user experience across all types of end-users.

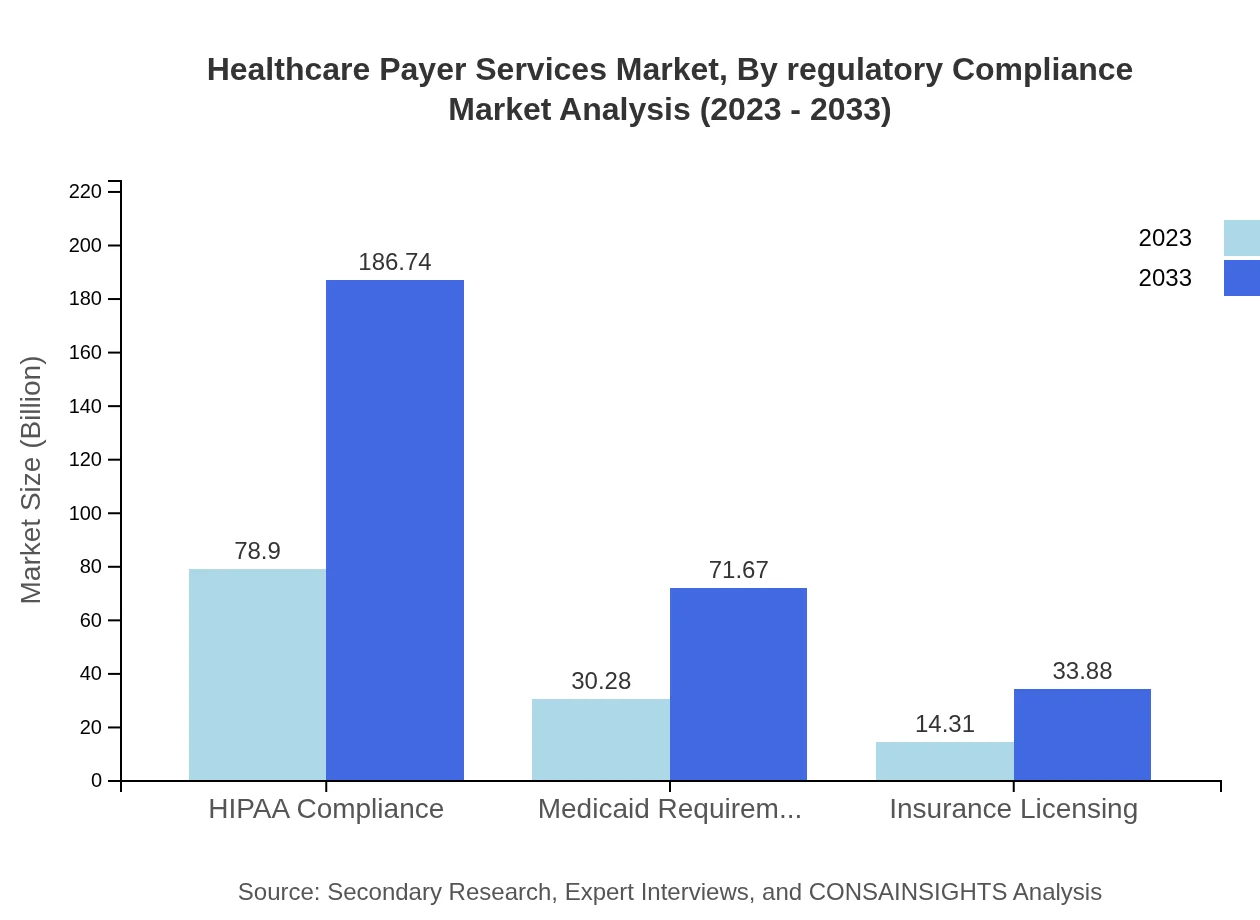

Healthcare Payer Services Market Analysis By Regulatory Compliance

Regulatory compliance, particularly under frameworks like HIPAA, continues to shape service delivery and operational models within the Healthcare Payer Services market. The focus on adherence to regulations assures stakeholders of the data privacy and integrity of healthcare transactions, emphasizing the importance of compliance-driven service strategies in securing consumer trust.

Healthcare Payer Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Payer Services Industry

Anthem Inc.:

Anthem is a leading health insurance company offering a comprehensive suite of healthcare solutions. Their focus on technology integration and value-driven healthcare models positions them as a key player in the payer services market.UnitedHealth Group:

UnitedHealth Group operates in both healthcare coverage and healthcare services. Their innovative approaches to digital health and analytics underscore their leadership and impact on healthcare payer services.Aetna Inc.:

Aetna, part of the CVS Health family, is a prominent provider of health insurance in the U.S. They are known for their emphasis on wellness programs and digital health solutions, significantly enhancing patient engagement.Cigna Corporation:

Cigna specializes in global health services and offers a variety of payer solutions that emphasize access to healthcare and personalized services for their customers, pushing for greater healthcare accessibility.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare Payer Services?

The healthcare payer services market is projected to reach a market size of $123.5 billion in 2023, with a robust Compound Annual Growth Rate (CAGR) of 8.7% expected through 2033.

What are the key market players or companies in this healthcare Payer Services industry?

The key players in the healthcare payer services market include major insurance companies, third-party administrators, healthcare providers, and technology solution providers, all contributing significantly to the industry's growth and innovation.

What are the primary factors driving the growth in the healthcare Payer Services industry?

Growth drivers in this industry include increased healthcare expenditures, technological advancements, rising demand for value-based care models, and regulatory changes requiring improved administrative efficiencies.

Which region is the fastest Growing in the healthcare Payer Services?

The fastest-growing region in healthcare payer services is North America, with the market expected to grow from $45.67 billion in 2023 to $108.09 billion by 2033, reflecting strong demand and investment.

Does ConsaInsights provide customized market report data for the healthcare Payer Services industry?

Yes, ConsaInsights offers customized market report data for the healthcare payer services industry, allowing clients to obtain tailored insights and analyses to meet their specific needs.

What deliverables can I expect from this healthcare Payer Services market research project?

Clients can expect comprehensive market analysis reports, segmentation data, regional insights, trend forecasting, and strategic recommendations tailored to the healthcare payer services landscape.

What are the market trends of healthcare Payer Services?

Trends in the healthcare payer services market include a shift towards digital solutions, increased focus on patient engagement, utilization of analytics for decision-making, and greater integration of healthcare systems across various platforms.