Healthcare Rcm Outsourcing Market Report

Published Date: 31 January 2026 | Report Code: healthcare-rcm-outsourcing

Healthcare Rcm Outsourcing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Healthcare RCM Outsourcing market from 2023 to 2033, including market size, trends, technology advancements, and competitive landscape offering critical insights for stakeholders.

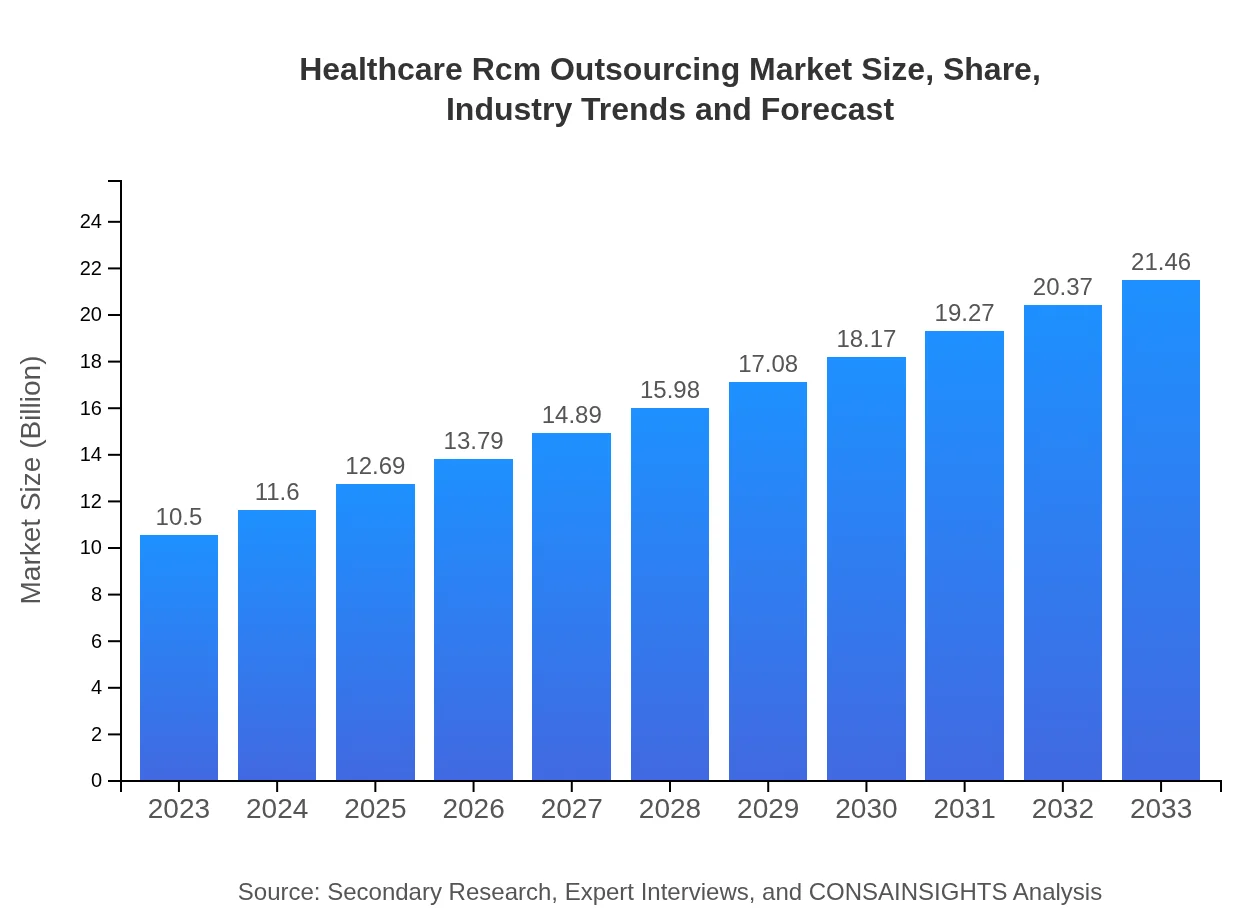

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Cerner Corporation, Optum, Advent Health, TransUnion Healthcare |

| Last Modified Date | 31 January 2026 |

Healthcare Rcm Outsourcing Market Overview

Customize Healthcare Rcm Outsourcing Market Report market research report

- ✔ Get in-depth analysis of Healthcare Rcm Outsourcing market size, growth, and forecasts.

- ✔ Understand Healthcare Rcm Outsourcing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Rcm Outsourcing

What is the Market Size & CAGR of Healthcare Rcm Outsourcing market in 2023?

Healthcare Rcm Outsourcing Industry Analysis

Healthcare Rcm Outsourcing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Rcm Outsourcing Market Analysis Report by Region

Europe Healthcare Rcm Outsourcing Market Report:

The European market for RCM Outsourcing is forecasted to rise from $2.64 billion in 2023 to $5.39 billion by 2033, fueled by increasing healthcare expenditure and a shift towards value-based care models in response to regulatory requirements.Asia Pacific Healthcare Rcm Outsourcing Market Report:

The Asia Pacific RCM Outsourcing market is expected to grow from $2.19 billion in 2023 to $4.47 billion in 2033, driven by increasing healthcare investments and expanding healthcare infrastructure. Rising health awareness and insurance penetration in countries like India and China are pivotal factors spurring growth.North America Healthcare Rcm Outsourcing Market Report:

North America's market is expected to grow significantly from $3.45 billion in 2023 to $7.05 billion by 2033. Factors such as stringent reimbursement regulations, a robust healthcare sector, and the presence of major service providers are propelling market growth in this region.South America Healthcare Rcm Outsourcing Market Report:

In South America, the market is projected to expand from $0.98 billion in 2023 to $2.01 billion by 2033. This growth is primarily attributed to increasing adoption of digital healthcare solutions and a growing emphasis on healthcare cost management to enhance service delivery.Middle East & Africa Healthcare Rcm Outsourcing Market Report:

The Middle East and Africa region will see growth from $1.24 billion in 2023 to $2.53 billion by 2033. Growth drivers include a focus on healthcare reforms, boosting operational efficiency, and the need for improved patient care in developing healthcare systems.Tell us your focus area and get a customized research report.

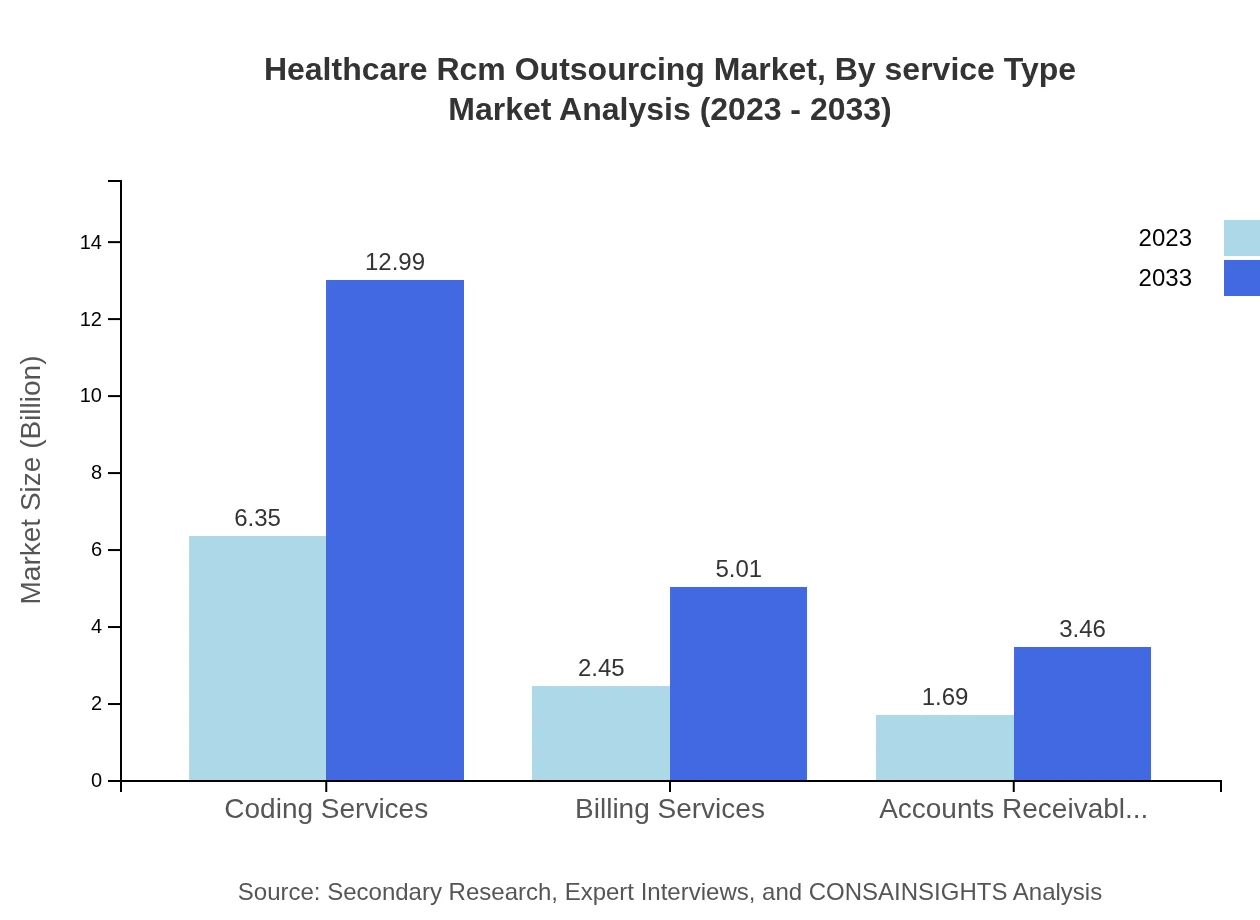

Healthcare Rcm Outsourcing Market Analysis By Service Type

Coding services dominate the market, offering substantial growth prospects. The rise in demand for accurate coding is fueled by regulatory requirements, while billing services and accounts receivable management also exhibit impressive growth, enhancing financial operations across healthcare organizations.

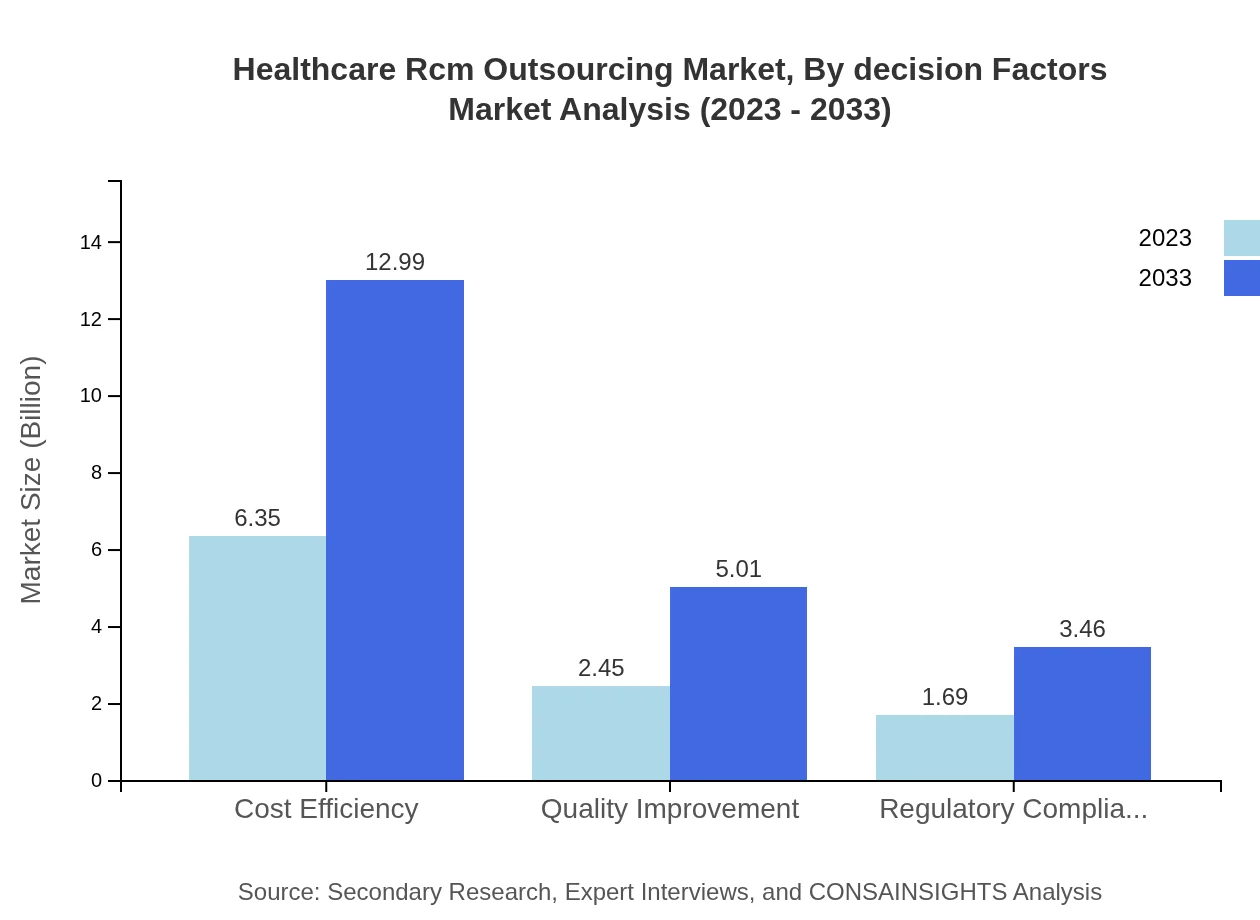

Healthcare Rcm Outsourcing Market Analysis By Decision Factors

Cost efficiency is the leading factor driving organizations towards RCM outsourcing, accounting for a significant share of decisions. Additionally, quality improvement and regulatory compliance emphasize the need for robust operational frameworks that enhance financial sustainability in healthcare.

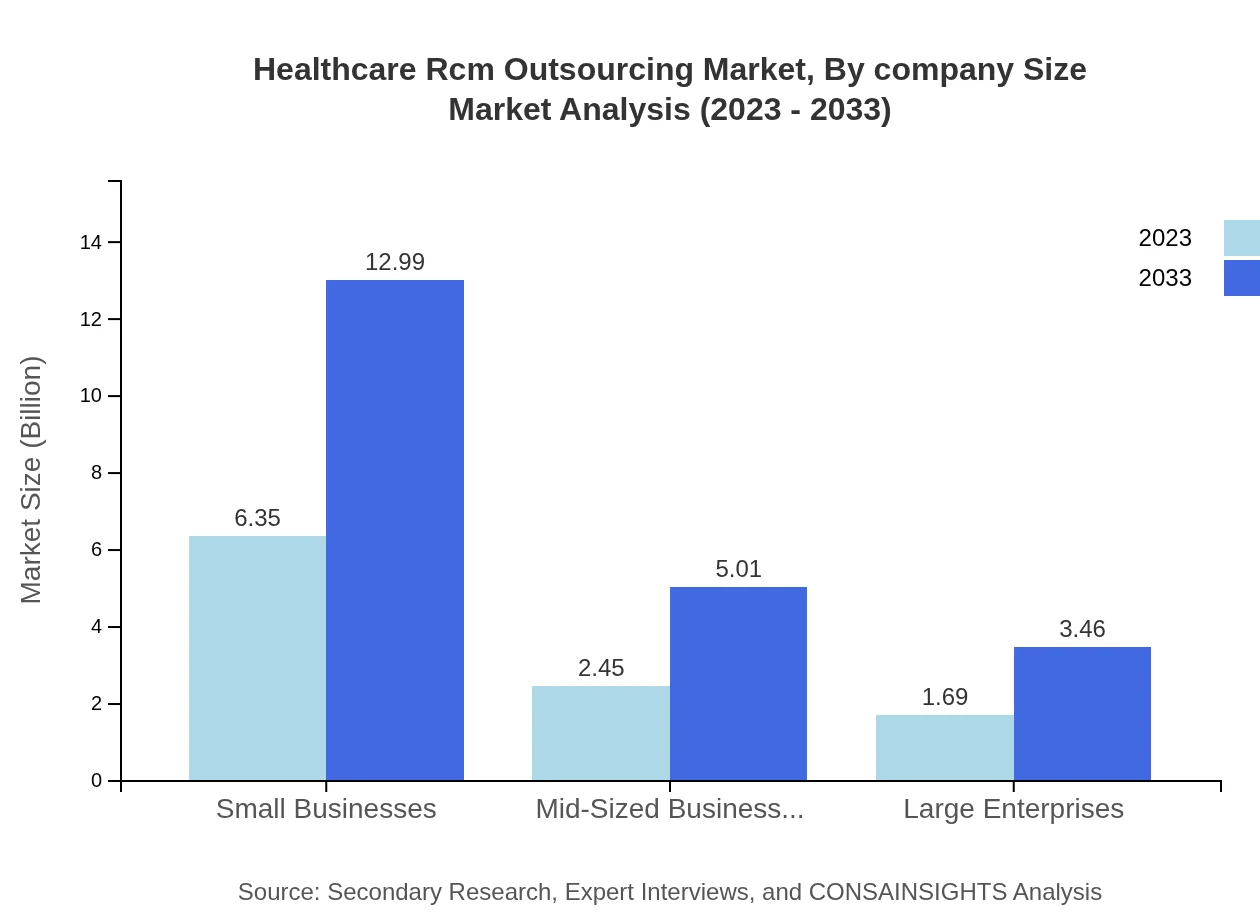

Healthcare Rcm Outsourcing Market Analysis By Company Size

The market showcases considerable participation from small and mid-sized businesses, which represent approximately 60.51% and 23.35% of the market share respectively in 2023. Large enterprises follow with significant investment strategies focusing on comprehensive RCM solutions.

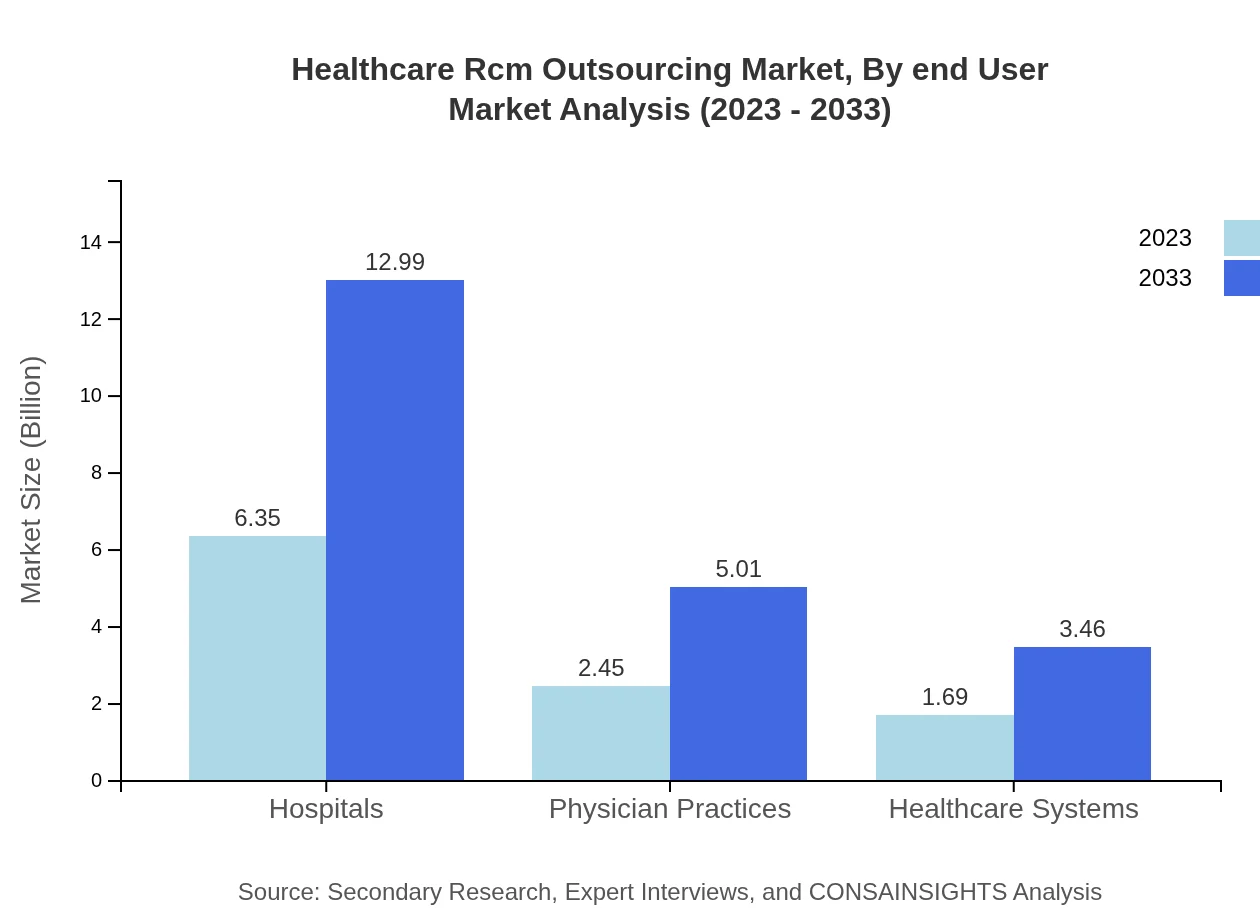

Healthcare Rcm Outsourcing Market Analysis By End User

Hospitals continue to be the foremost end-users in the RCM outsourcing landscape, encapsulating around 60.51% of market share in 2023. Physician practices and healthcare systems contribute substantial portions, driven by the rising need for efficient revenue cycles.

Healthcare Rcm Outsourcing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Rcm Outsourcing Industry

Cerner Corporation:

A leading supplier of healthcare information technology solutions, Cerner offers extensive RCM outsourcing services integrating advanced technologies for streamlined payment processes.Optum:

Optum is known for its innovative health services including premier RCM solutions designed to enhance operational efficiencies and financial outcomes for healthcare providers.Advent Health:

With a focus on patient-centered care, Advent Health provides comprehensive RCM outsourcing services that streamline billing and maximize revenue in healthcare organizations.TransUnion Healthcare:

TransUnion offers advanced data analytics and technology-driven RCM solutions aimed at improving the financial performance of healthcare providers.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare Rcm Outsourcing?

The healthcare RCM outsourcing market is valued at approximately $10.5 billion in 2023 and is projected to grow at a CAGR of 7.2%, reaching significant expansion by 2033.

What are the key market players or companies in this healthcare Rcm Outsourcing industry?

Key market players include industry leaders specializing in revenue cycle management, healthcare IT services, and outsourcing solutions, such as Cognizant Technology Solutions, GeBBS Healthcare Solutions, and Optum, fostering competitive growth.

What are the primary factors driving the growth in the healthcare Rcm Outsourcing industry?

Major growth drivers are the increasing need for cost efficiency, regulatory compliance, and quality improvement in healthcare processes, combined with the rising adoption of electronic health records and analytics tools.

Which region is the fastest Growing in the healthcare Rcm Outsourcing?

North America is currently the fastest-growing region, expected to increase from $3.45 billion in 2023 to $7.05 billion by 2033, reflecting a strong demand for outsourcing in the healthcare sector.

Does ConsaInsights provide customized market report data for the healthcare Rcm Outsourcing industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, allowing clients to receive pertinent and detailed insights into the healthcare RCM outsourcing landscape.

What deliverables can I expect from this healthcare Rcm Outsourcing market research project?

Expect comprehensive reports featuring market trends, regional analyses, competitive landscapes, forecast data, and actionable insights into operational efficiencies and growth opportunities.

What are the market trends of healthcare Rcm Outsourcing?

Trends include increased digitalization, focus on patient experience, evolving reimbursement models, expanded use of artificial intelligence, and a shift towards value-based care in revenue cycle management.