Healthcare Regulatory Affairs Outsourcing Market Report

Published Date: 31 January 2026 | Report Code: healthcare-regulatory-affairs-outsourcing

Healthcare Regulatory Affairs Outsourcing Market Size, Share, Industry Trends and Forecast to 2033

This report expertly outlines the current state and future of the Healthcare Regulatory Affairs Outsourcing market, including detailed insights into market size, trends, and forecasts for the years 2023 to 2033.

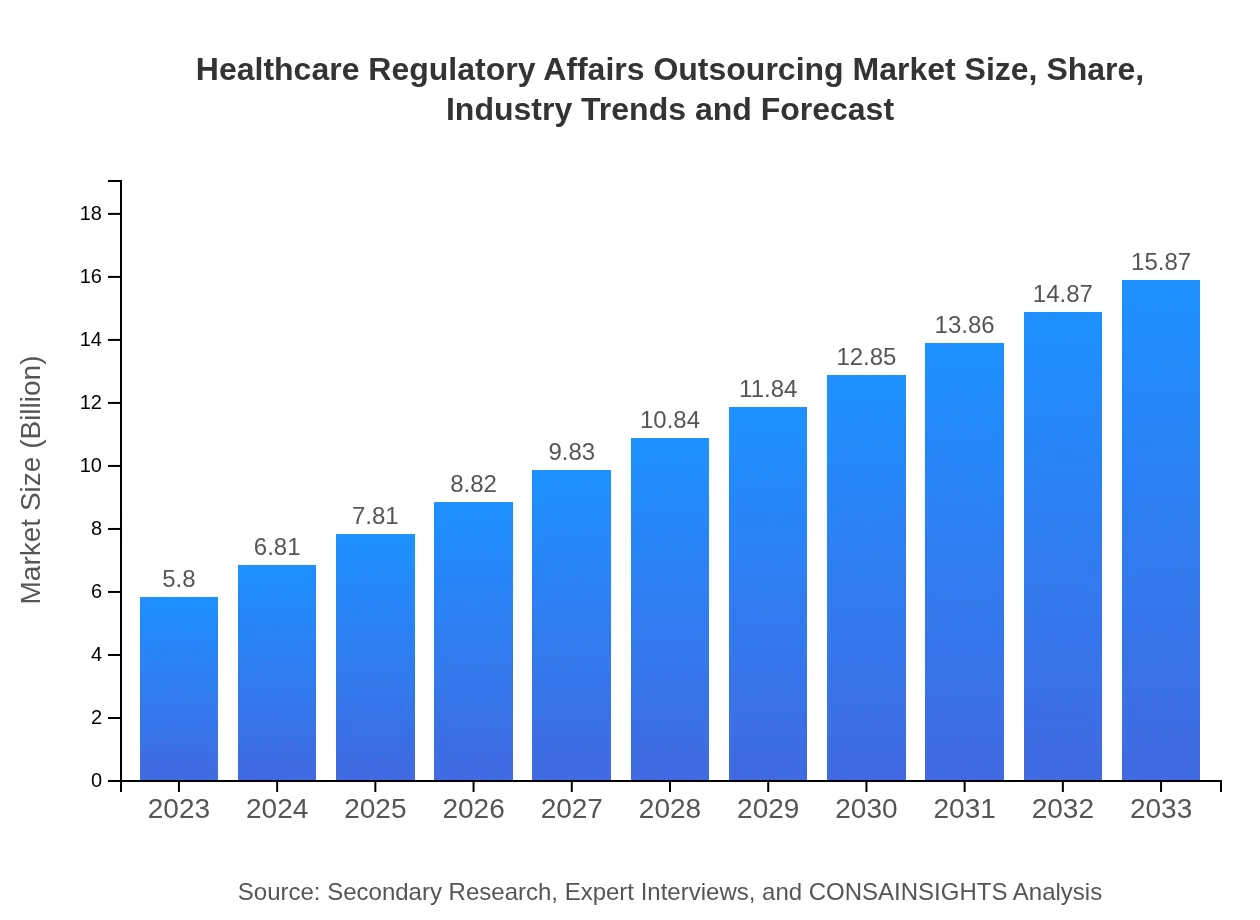

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $15.87 Billion |

| Top Companies | Covance, DrugDev, Medpace, PAREXEL |

| Last Modified Date | 31 January 2026 |

Healthcare Regulatory Affairs Outsourcing Market Overview

Customize Healthcare Regulatory Affairs Outsourcing Market Report market research report

- ✔ Get in-depth analysis of Healthcare Regulatory Affairs Outsourcing market size, growth, and forecasts.

- ✔ Understand Healthcare Regulatory Affairs Outsourcing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Regulatory Affairs Outsourcing

What is the Market Size & CAGR of Healthcare Regulatory Affairs Outsourcing market in 2023?

Healthcare Regulatory Affairs Outsourcing Industry Analysis

Healthcare Regulatory Affairs Outsourcing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Regulatory Affairs Outsourcing Market Analysis Report by Region

Europe Healthcare Regulatory Affairs Outsourcing Market Report:

The European market is anticipated to grow from $1.41 billion in 2023 to $3.85 billion by 2033. The rigorous standards set by the European Medicines Agency drive the demand for outsourcing regulatory affairs to experienced partners that can navigate this complexity.Asia Pacific Healthcare Regulatory Affairs Outsourcing Market Report:

The Asia Pacific region is projected to grow from $1.27 billion in 2023 to $3.47 billion by 2033. This growth is fueled by increased investment in biotechnology and pharmaceuticals, as well as a rise in clinical trials being conducted in countries such as India and China. Local regulatory bodies are also evolving, driving the demand for compliance expertise.North America Healthcare Regulatory Affairs Outsourcing Market Report:

North America remains the dominant region, with the market size expected to soar from $2.16 billion in 2023 to $5.92 billion in 2033. The presence of major pharmaceutical companies, coupled with stringent regulatory environments, supports this robust growth prospect.South America Healthcare Regulatory Affairs Outsourcing Market Report:

In South America, the market is expected to expand from $0.46 billion in 2023 to $1.25 billion by 2033. Enhanced healthcare infrastructures and increasing political support for regulatory reforms are positively influencing the outsourcing dynamics in this region.Middle East & Africa Healthcare Regulatory Affairs Outsourcing Market Report:

The Middle East and Africa market is set to increase from $0.50 billion in 2023 to $1.38 billion by 2033. The region's growing health sector is catalyzing a need for regulatory expertise, particularly as more local products seek entry in international markets.Tell us your focus area and get a customized research report.

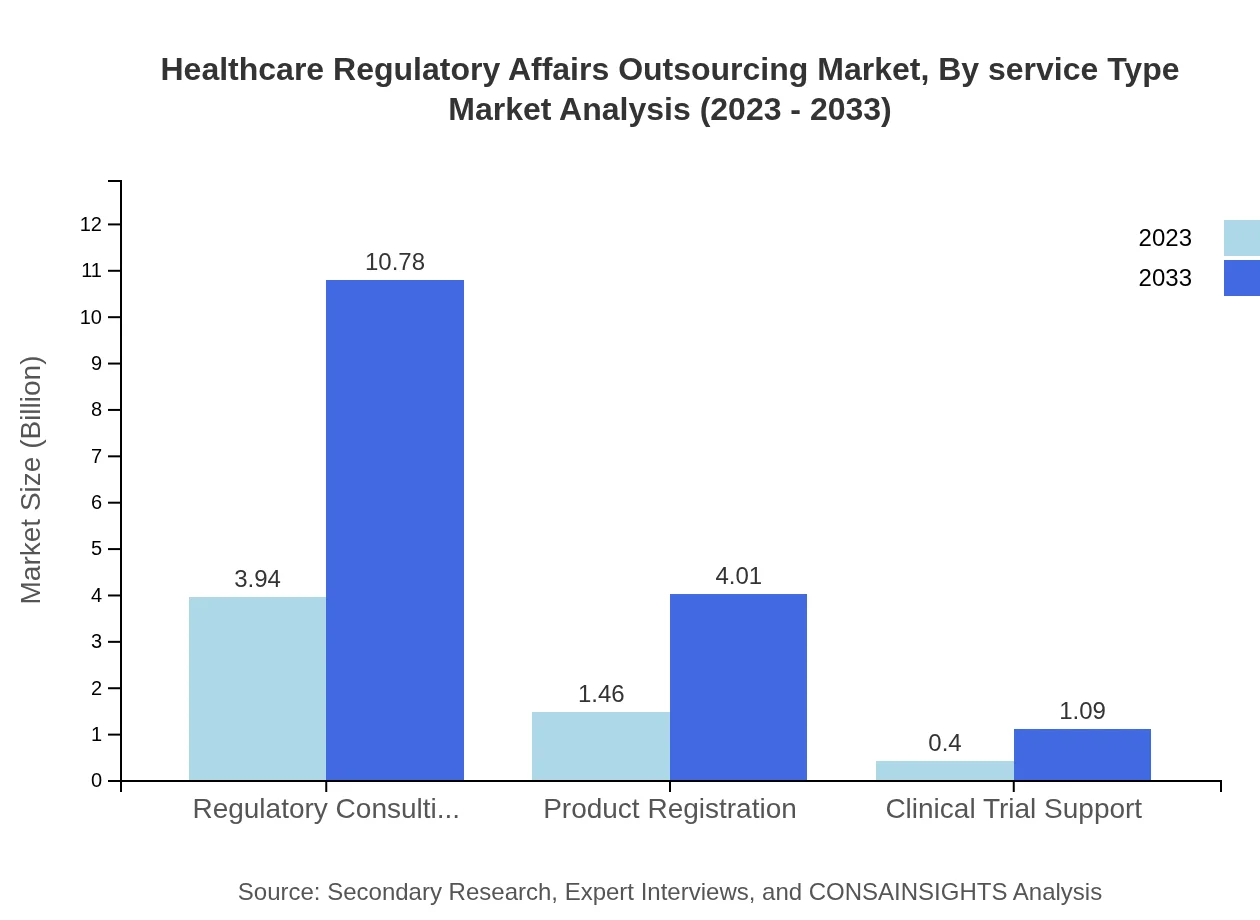

Healthcare Regulatory Affairs Outsourcing Market Analysis By Service Type

The service type segment shows significant differentiation in market performance. Regulatory Consulting, for example, is the largest service segment valued at $3.94 billion in 2023, increasing to $10.78 billion by 2033, representing a share of 67.91%. Product Registration services are also vital, reflecting a steady growth from $1.46 billion in 2023 to $4.01 billion by 2033, maintaining a market share of 25.24%.

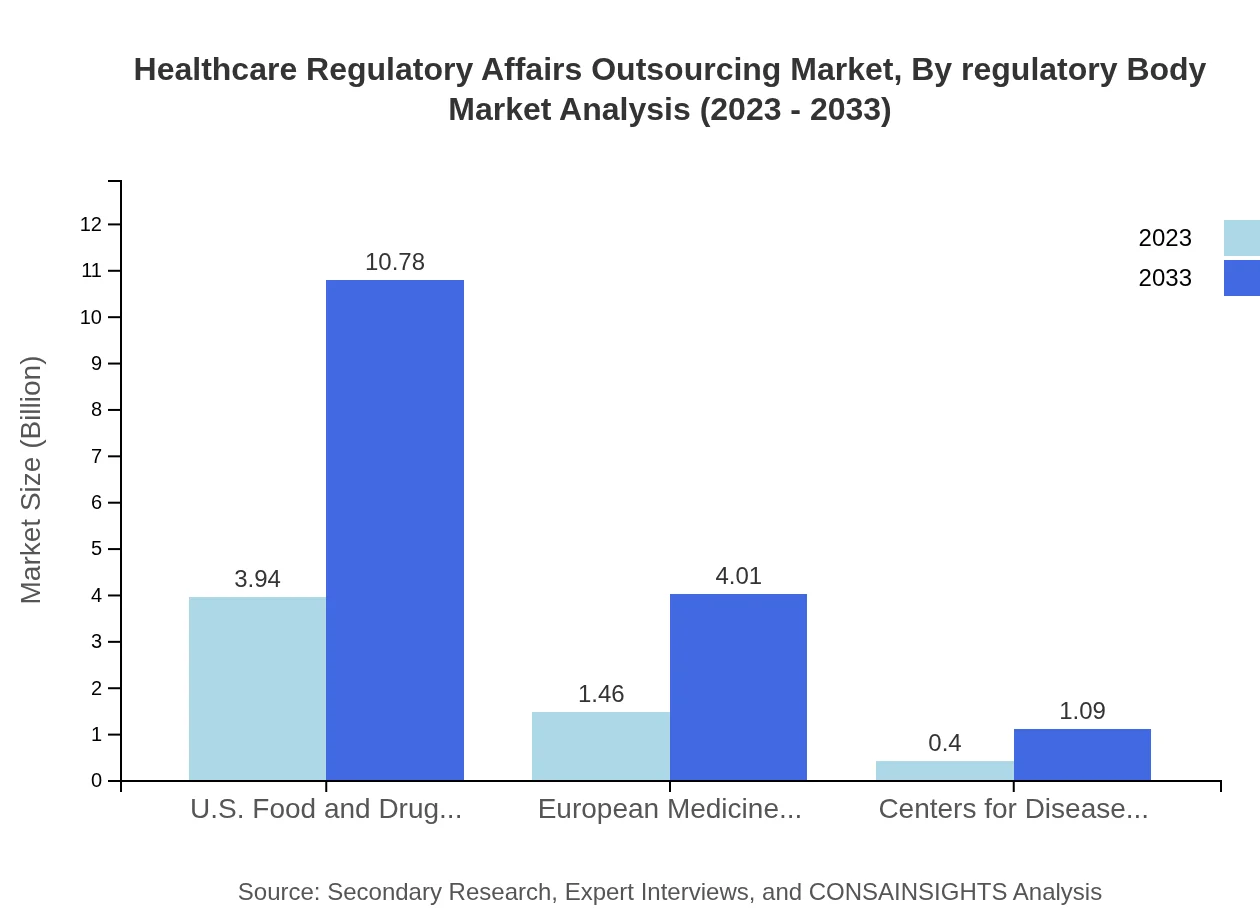

Healthcare Regulatory Affairs Outsourcing Market Analysis By Regulatory Body

Regulatory bodies significantly influence the outsourcing landscape. The U.S. FDA, representing the largest body, accounts for $3.94 billion in 2023, expanding to $10.78 billion by 2033. The European Medicines Agency (EMA) has a share of 25.24%, increasing from $1.46 billion to $4.01 billion, reflecting the EU's stringent regulatory environment.

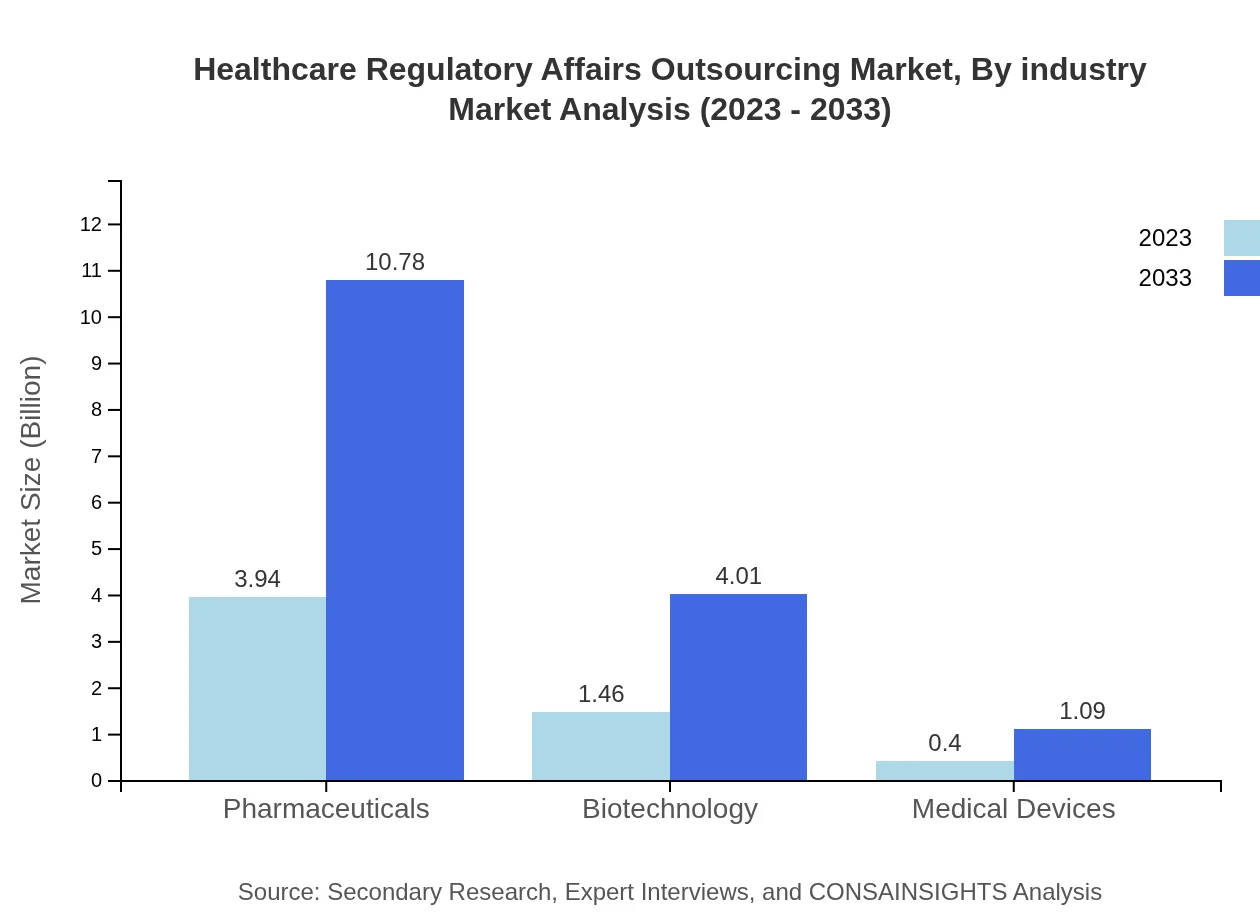

Healthcare Regulatory Affairs Outsourcing Market Analysis By Industry

Pharmaceuticals remain the most significant industry segment for regulatory affairs outsourcing, with a market size of $3.94 billion in 2023 and an expected growth to $10.78 billion by 2033. The biotechnology sector also shows strong potential, moving from $1.46 billion to $4.01 billion within the same period, highlighting the opportunities within emerging biopharma companies.

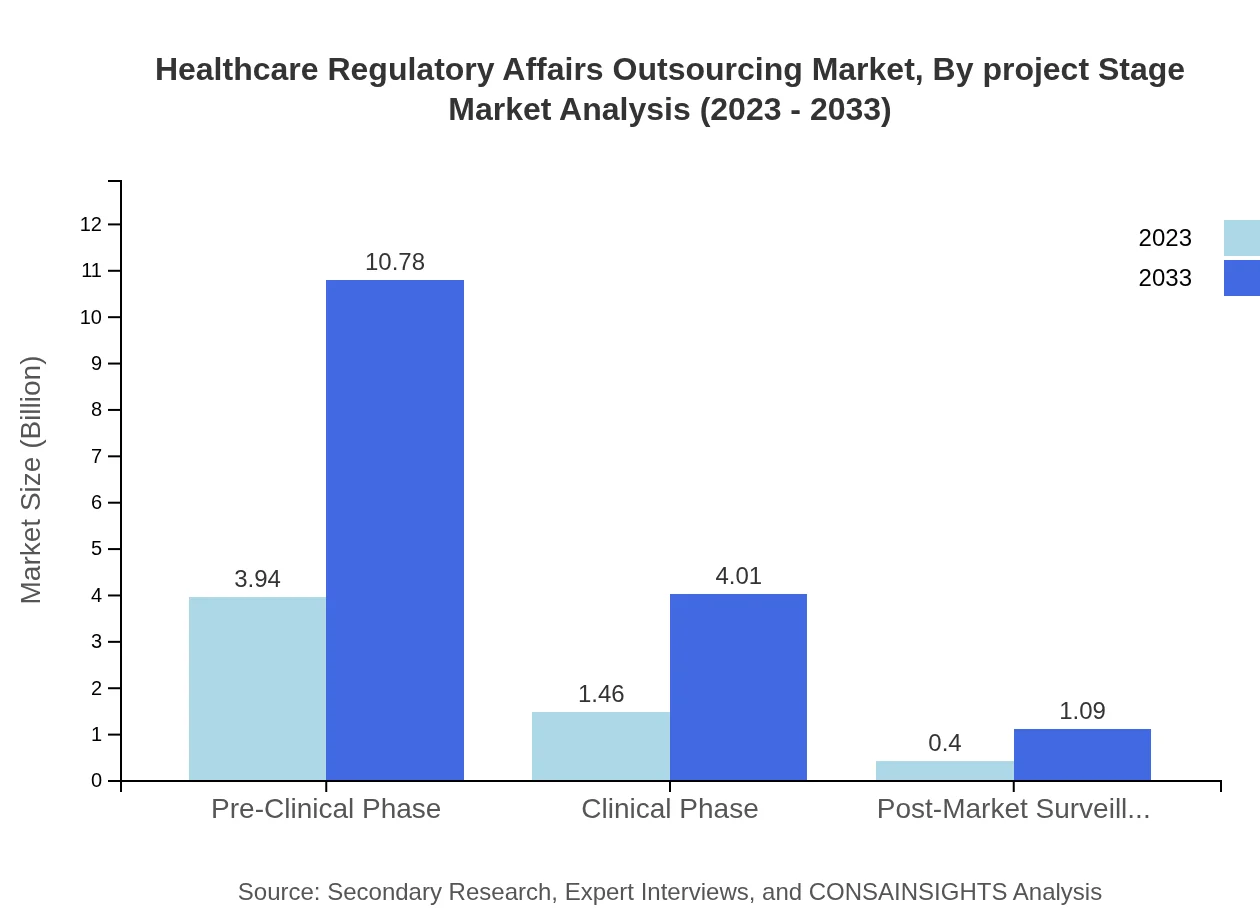

Healthcare Regulatory Affairs Outsourcing Market Analysis By Project Stage

The project stage segment illustrates varied demand across phases. The pre-clinical phase holds the majority with $3.94 billion in 2023, growing to $10.78 billion by 2033, reflecting significant investments in early-stage research. Conversely, post-market surveillance, while crucial, remains lower at $0.40 billion, up to $1.09 billion, highlighting its supportive role in the lifecycle.

Healthcare Regulatory Affairs Outsourcing Market Analysis By Business Model

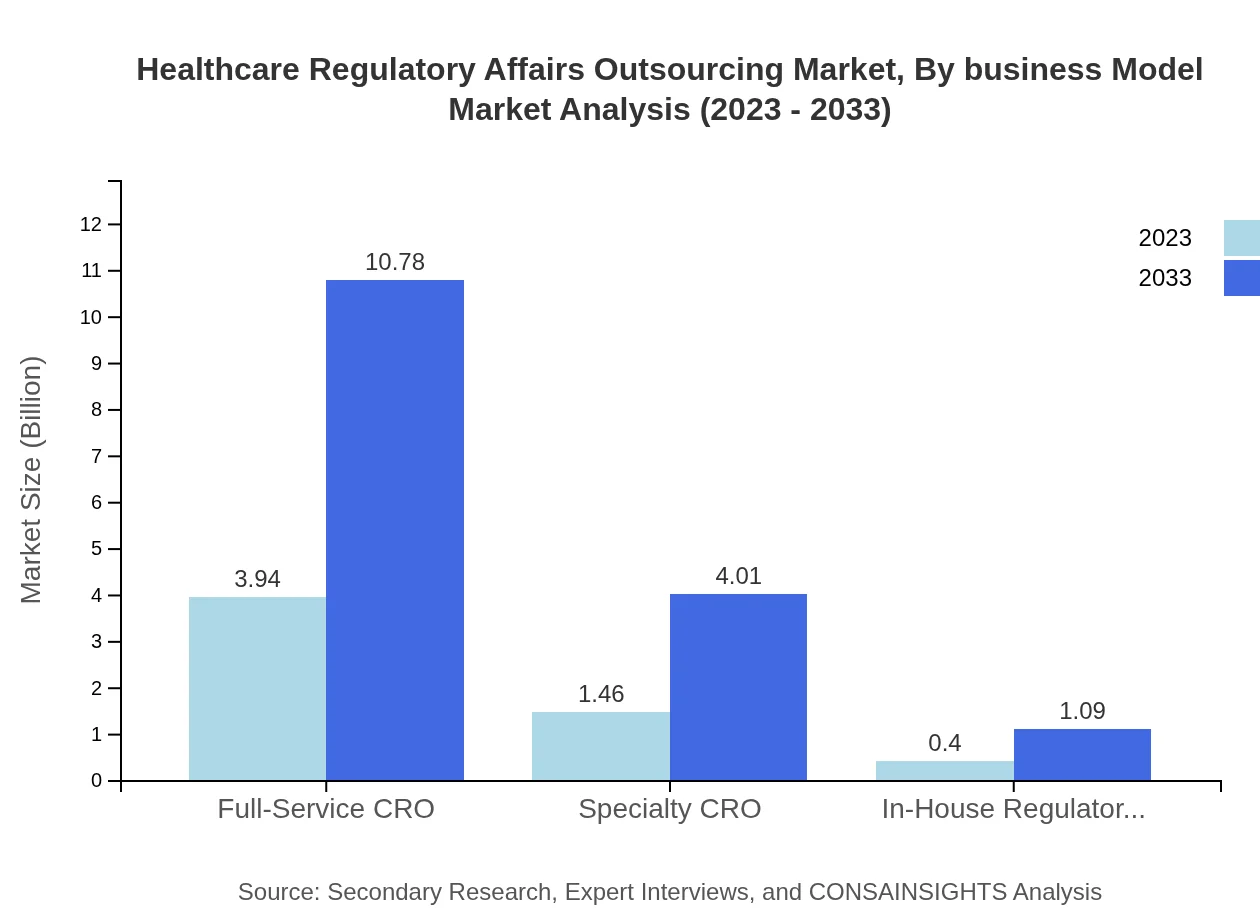

Outsourcing models reveal important insights into client preferences. Full-Service CROs dominate with a market presence of $3.94 billion in 2023 and forecasted growth to $10.78 billion by 2033, capturing 67.91%. Specialty CROs follow, that also show a notable increase from $1.46 billion to $4.01 billion, showcasing a growing appetite for targeted expertise.

Healthcare Regulatory Affairs Outsourcing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Regulatory Affairs Outsourcing Industry

Covance:

Covance, a global leader in drug development services, offers a comprehensive range of regulatory affairs outsourcing services, helping clients navigate complex regulatory requirements effectively.DrugDev:

DrugDev specializes in providing innovative solutions tailored to clinical trial management and regulatory submissions, enabling swift access to global markets.Medpace:

Medpace is a full-service clinical contract research organization that combines regulatory expertise with clinical development services to optimize the drug approval process.PAREXEL:

PAREXEL offers an array of regulatory consulting services aimed at assisting healthcare companies in ensuring compliance with global regulations throughout the product lifecycle.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare Regulatory Affairs Outsourcing?

The global Healthcare Regulatory Affairs Outsourcing market is valued at approximately $5.8 billion in 2023 and is projected to grow at a CAGR of 10.2% to reach significant growth by 2033.

What are the key market players or companies in the healthcare Regulatory Affairs Outsourcing industry?

Key players in the Healthcare Regulatory Affairs Outsourcing industry include large CROs, pharmaceutical companies, and regulatory consultancy firms that provide essential services for compliance and product registration.

What are the primary factors driving the growth in the healthcare Regulatory Affairs Outsourcing industry?

The growth drivers include increased demand for cost-effective regulatory solutions, rising complexities in healthcare regulations, and the need for efficient product development and market approval processes.

Which region is the fastest Growing in healthcare Regulatory Affairs Outsourcing?

The Asia Pacific region is emerging as the fastest-growing segment, with market growth anticipated to rise from $1.27 billion in 2023 to $3.47 billion by 2033, fueled by increasing investments in healthcare.

Does ConsaInsights provide customized market report data for the healthcare Regulatory Affairs Outsourcing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the healthcare regulatory affairs outsourcing industry, ensuring relevant and actionable insights for businesses.

What deliverables can I expect from this healthcare Regulatory Affairs Outsourcing market research project?

Deliverables typically include comprehensive market analysis, growth forecasts, competitive landscape insights, and segmentation data, which assist in strategic planning and decision-making.

What are the market trends of healthcare Regulatory Affairs Outsourcing?

Key trends include a shift towards digitalization of regulatory processes, increased reliance on outsourcing for compliance, and an emphasis on partnership with specialized CROs to streamline operations.