Healthcare Reimbursement Market Report

Published Date: 31 January 2026 | Report Code: healthcare-reimbursement

Healthcare Reimbursement Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the global Healthcare Reimbursement market from 2023 to 2033, emphasizing market trends, segmentation, regional analyses, and forecasts to offer actionable insights for stakeholders in the healthcare industry.

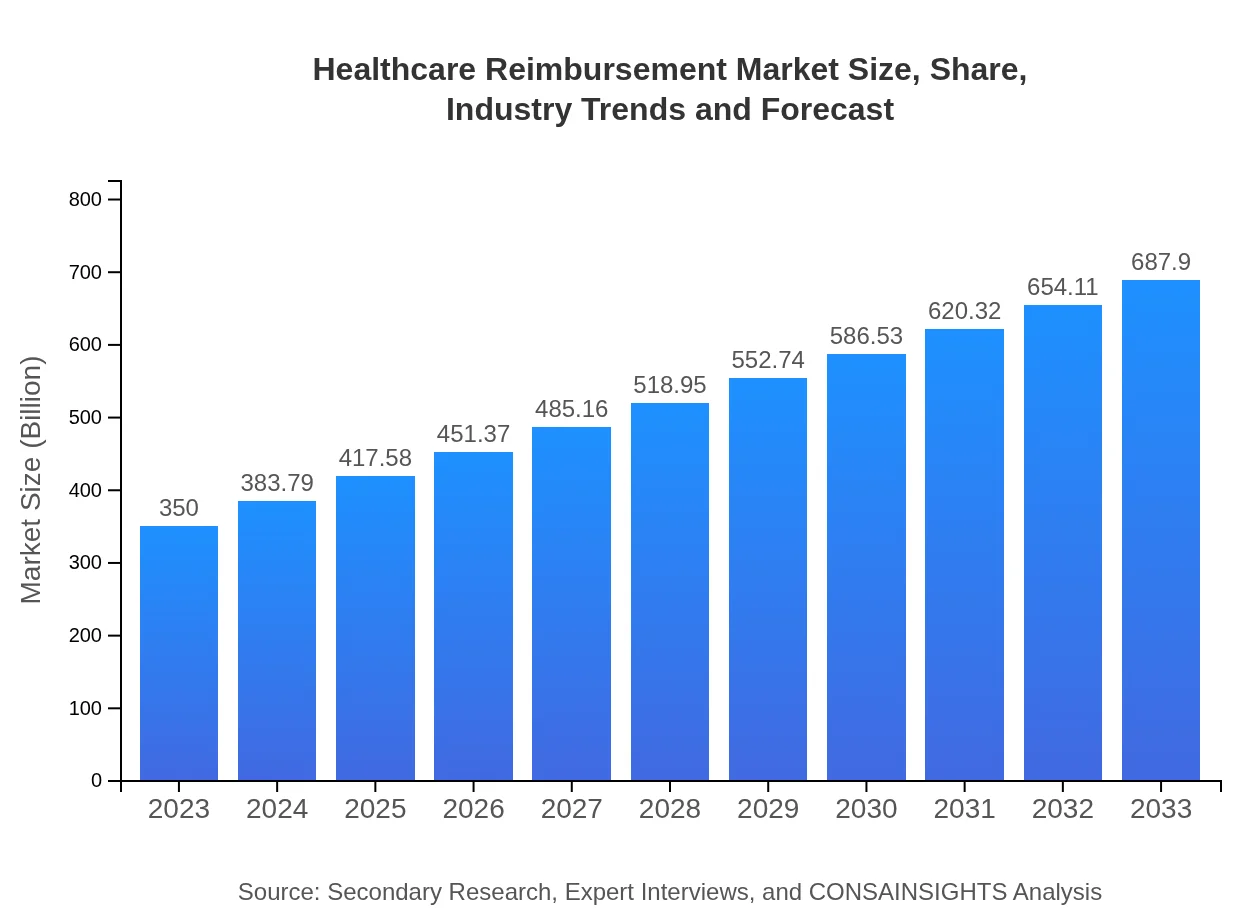

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $350.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $687.90 Billion |

| Top Companies | UnitedHealth Group, Anthem, Inc., Cigna Corporation, Aetna Inc., Kaiser Permanente |

| Last Modified Date | 31 January 2026 |

Healthcare Reimbursement Market Overview

Customize Healthcare Reimbursement Market Report market research report

- ✔ Get in-depth analysis of Healthcare Reimbursement market size, growth, and forecasts.

- ✔ Understand Healthcare Reimbursement's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Reimbursement

What is the Market Size & CAGR of Healthcare Reimbursement market in 2023?

Healthcare Reimbursement Industry Analysis

Healthcare Reimbursement Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Reimbursement Market Analysis Report by Region

Europe Healthcare Reimbursement Market Report:

The European Healthcare Reimbursement market, currently estimated at $90.65 billion, is expected to grow to $178.17 billion by 2033. Rising investments in healthcare technology, along with government initiatives aimed at improving healthcare delivery, are key drivers. However, stringent regulations regarding healthcare practices and reimbursement processes continue to challenge the market.Asia Pacific Healthcare Reimbursement Market Report:

In the Asia Pacific region, the Healthcare Reimbursement market is experiencing rapid growth, projected to rise from $70.45 billion in 2023 to $138.47 billion by 2033. Key factors contributing to this growth include rising healthcare expenditures, an expanding aged population, and advancements in medical technology. However, disparities in healthcare access and reimbursement processes remain challenges that the region must address.North America Healthcare Reimbursement Market Report:

North America holds a substantial share of the Healthcare Reimbursement market, valued at $135.87 billion in 2023 and projected to reach $267.04 billion by 2033. This growth is fueled by a high demand for innovative healthcare solutions, an aging population, and continuous changes in reimbursement policies. The United States, being the largest market, leads in adopting advanced digital technologies to improve reimbursement efficiencies.South America Healthcare Reimbursement Market Report:

The South American Healthcare Reimbursement market, currently valued at $12.21 billion, is expected to grow to $24.01 billion by 2033. The growth is driven by an increasing focus on improving healthcare infrastructure and policy reforms aimed at expanding insurance coverage. Nonetheless, economic instability and regulatory challenges pose significant hurdles to market expansion.Middle East & Africa Healthcare Reimbursement Market Report:

In the Middle East and Africa, the Healthcare Reimbursement market is anticipated to grow from $40.81 billion in 2023 to $80.21 billion by 2033. The rising prevalence of chronic diseases and an increase in health insurance adoption contribute significantly to this growth. However, challenges such as inadequate healthcare infrastructure, political instability, and economic disparities could hinder rapid development.Tell us your focus area and get a customized research report.

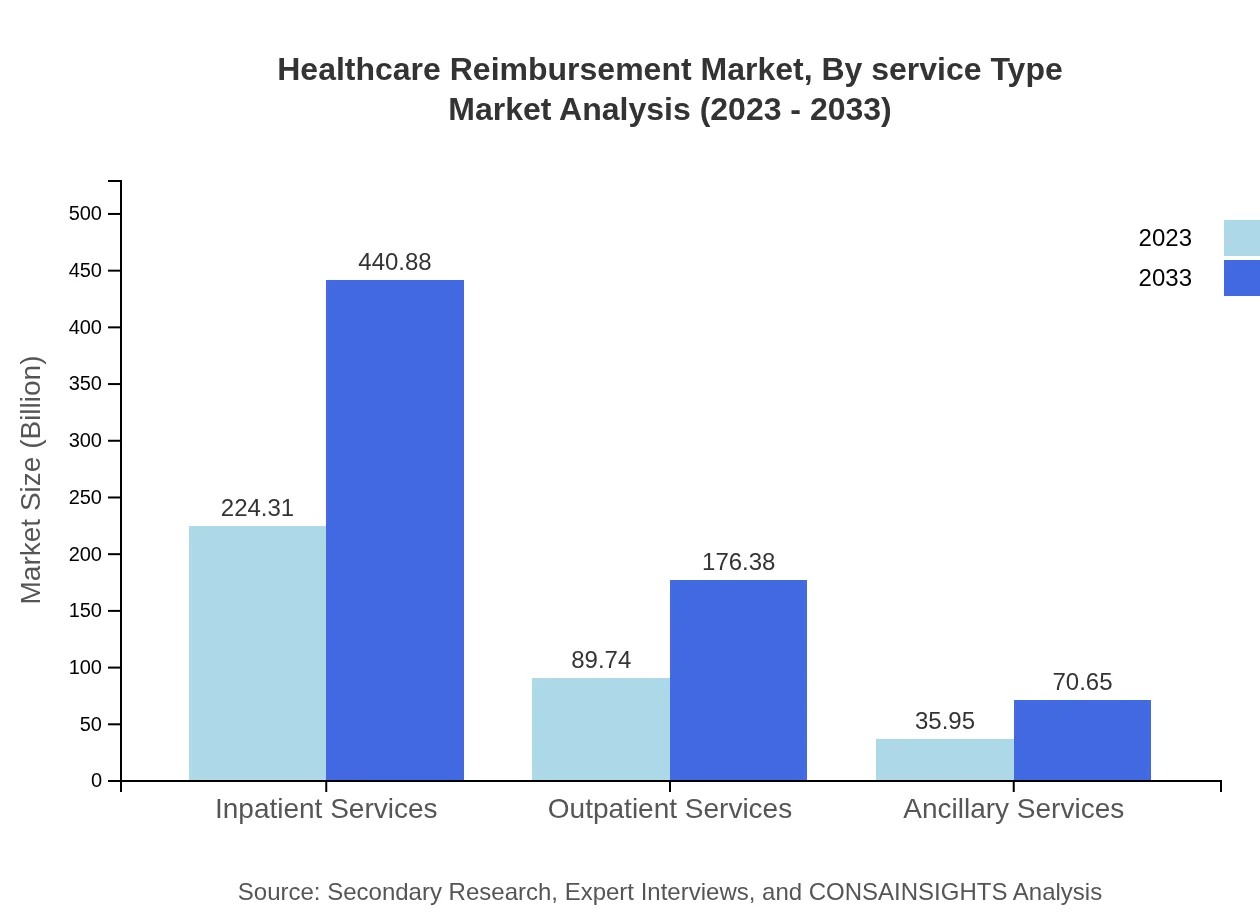

Healthcare Reimbursement Market Analysis By Service Type

By service type, the market is segmented into inpatient services, outpatient services, and ancillary services. Inpatient services dominate the market with a significant share, valued at $224.31 billion in 2023 and projected to rise to $440.88 billion by 2033. Outpatient services follow, with a market size of $89.74 billion in 2023, growing to $176.38 billion by 2033. Finally, ancillary services, though relatively smaller, show promising growth, increasing from $35.95 billion in 2023 to $70.65 billion by 2033.

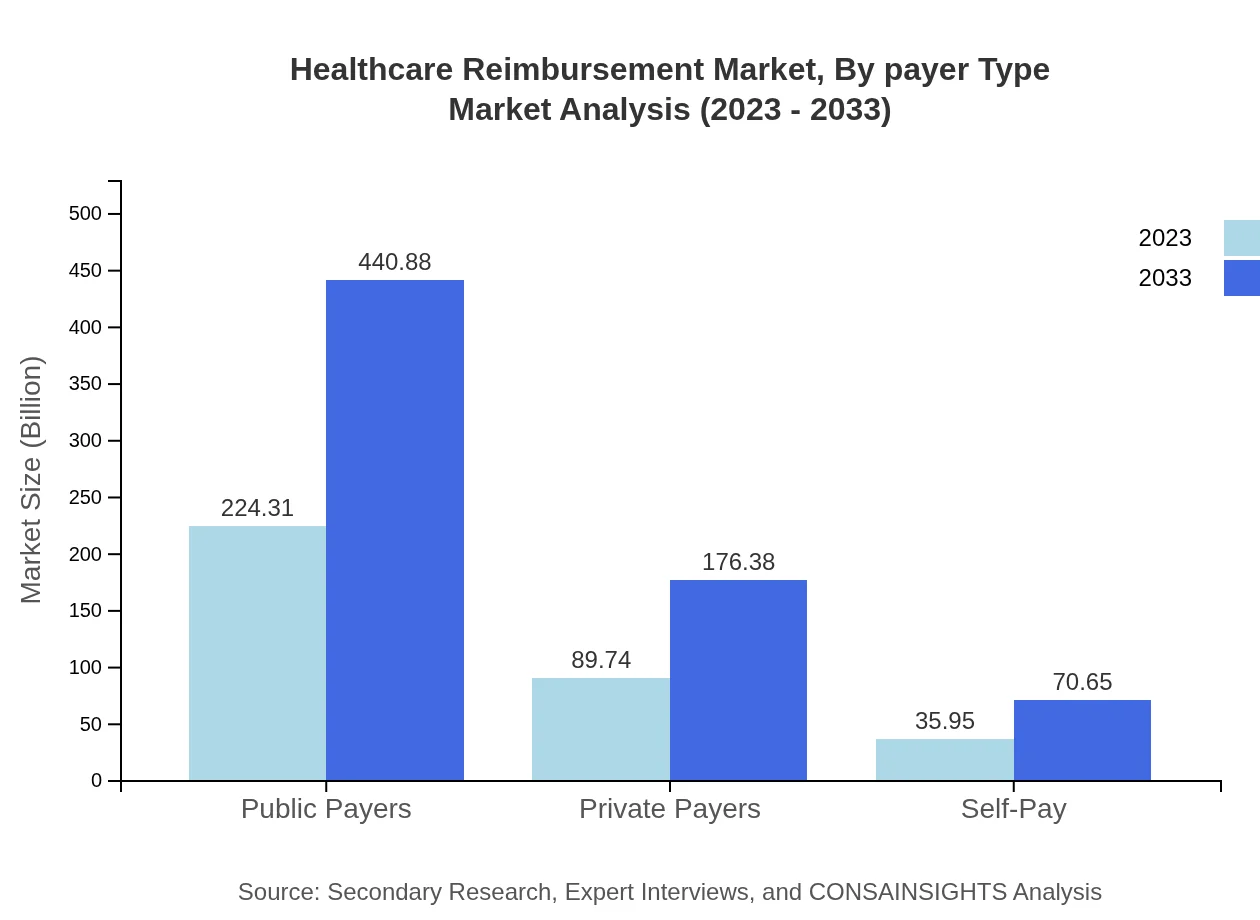

Healthcare Reimbursement Market Analysis By Payer Type

The payer type segmentation includes public payers, private payers, and self-pay. Public payers hold the majority market share, with estimates of $224.31 billion in 2023 and projected growth to $440.88 billion by 2033. Private payers account for $89.74 billion in 2023, expected to rise to $176.38 billion. Self-pay options are smaller but are important as they increase from $35.95 billion to $70.65 billion over the same period.

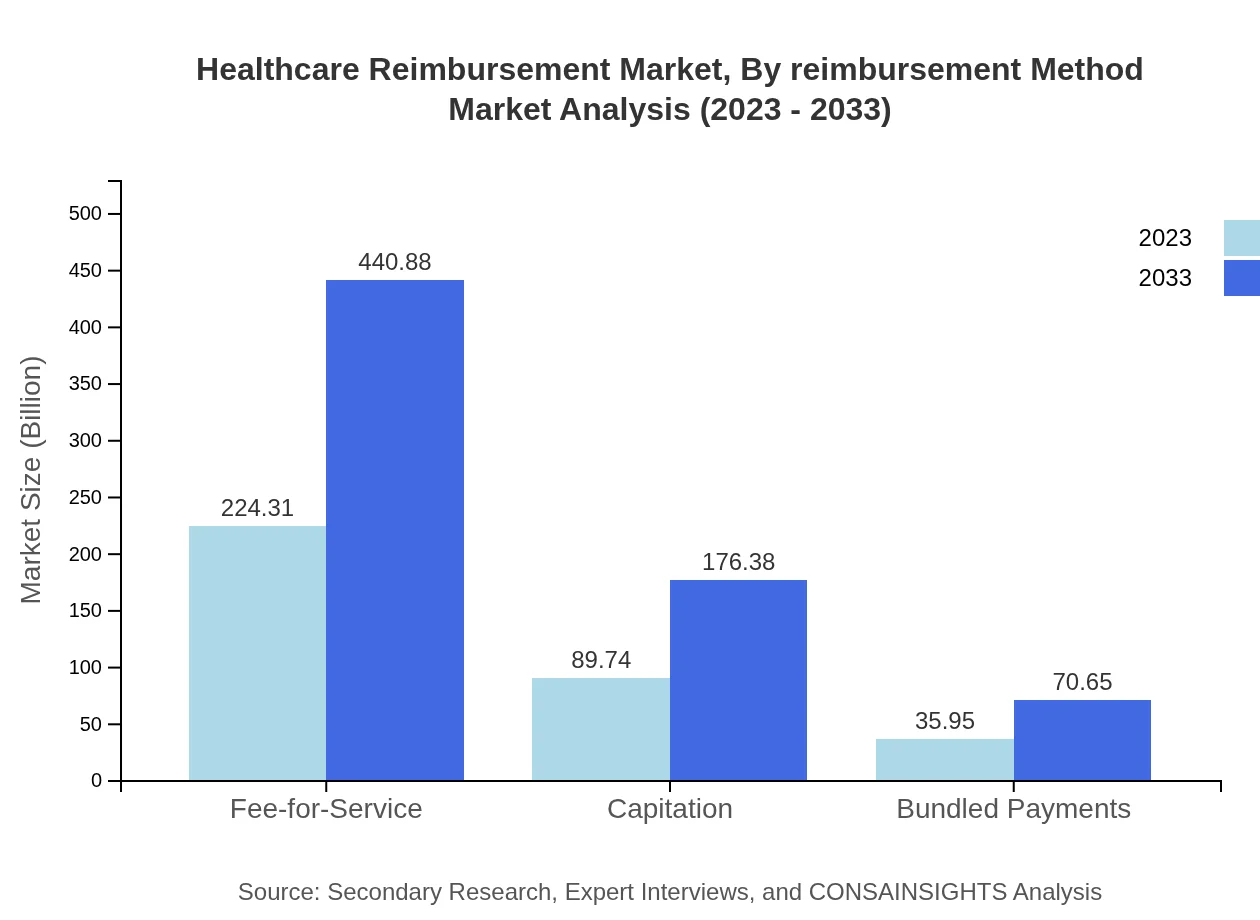

Healthcare Reimbursement Market Analysis By Reimbursement Method

The reimbursement method can be categorized into fee-for-service, capitation, and bundled payments. Fee-for-service remains the largest segment, valued at $224.31 billion in 2023, anticipated to grow to $440.88 billion by 2033. Capitation is a significant model, growing from $89.74 billion to $176.38 billion. Bundled payments, while smaller, are gaining traction and expected to increase from $35.95 billion to $70.65 billion.

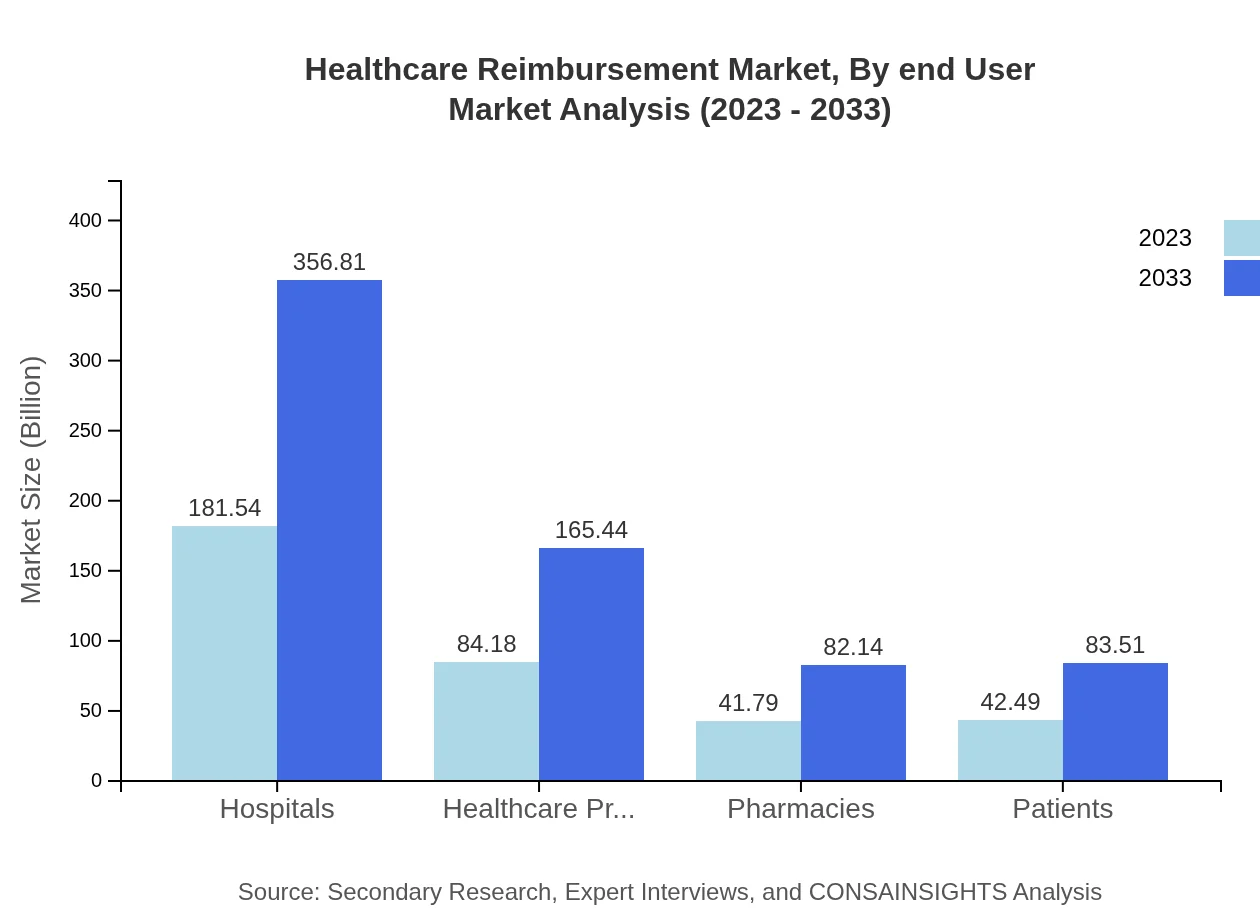

Healthcare Reimbursement Market Analysis By End User

End-users of Healthcare Reimbursement include hospitals, healthcare providers, pharmacies, and patients. Hospitals are the leading segment, with a market share of $181.54 billion in 2023 and projected to expand to $356.81 billion. Healthcare providers account for $84.18 billion, growing to $165.44 billion. Pharmacies and patients are also important stakeholders in the reimbursement landscape, showing growth trends but at a lesser scale.

Healthcare Reimbursement Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Reimbursement Industry

UnitedHealth Group:

A leading health insurer in the United States, UnitedHealth Group provides comprehensive reimbursement solutions and healthcare services, focusing on improving healthcare access and costs.Anthem, Inc.:

Anthem is a large health insurance provider that offers a diverse range of health plans and innovative reimbursement models, emphasizing value-based care.Cigna Corporation:

Cigna is a global health service company that provides a variety of insurance and healthcare services with an emphasis on reimbursement management and efficiency.Aetna Inc.:

Aetna, part of CVS Health, specializes in health insurance and offers reimbursement solutions across multiple healthcare services.Kaiser Permanente:

Kaiser Permanente is a leading integrated health care provider that innovatively designs reimbursement models to enhance patient care and achieving improved outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare Reimbursement?

The healthcare reimbursement market is valued at approximately $350 billion in 2023, with an expected CAGR of 6.8%, projecting significant growth by 2033. This growth is driven by advancements in healthcare delivery and evolving payment models.

What are the key market players or companies in the healthcare Reimbursement industry?

Key players in the healthcare reimbursement space include major insurance providers, healthcare facilities, and technology firms innovating in medical billing and claims management. Their collaboration shapes the reimbursement landscape and ensures efficient payment processes.

What are the primary factors driving the growth in the healthcare Reimbursement industry?

Growth factors in healthcare reimbursement include increasing healthcare expenditures, rising patient populations, regulatory changes fostering value-based care, and technological advancements that streamline billing processes and improve accuracy in claims submissions.

Which region is the fastest Growing in the healthcare Reimbursement market?

The Asia Pacific region is the fastest-growing market, anticipated to expand from $70.45 billion in 2023 to $138.47 billion by 2033. Increased healthcare access and rapid economic development contribute to this remarkable growth.

Does ConsaInsights provide customized market report data for the healthcare Reimbursement industry?

Yes, ConsaInsights offers tailored market report data for the healthcare reimbursement industry. This customization ensures that clients receive insights specific to their strategic needs and business objectives, enhancing decision-making.

What deliverables can I expect from this healthcare Reimbursement market research project?

Clients can expect comprehensive deliverables including detailed market analysis, regional forecasts, competitive landscape assessments, and strategic recommendations tailored to their specific requirements in the healthcare reimbursement sector.

What are the market trends of healthcare Reimbursement?

Current trends include a shift towards value-based reimbursement models, increased use of telehealth, and adoption of blockchain technology for transparent billing practices. These trends indicate a move towards more patient-centered care and efficient reimbursement processes.