Healthcare Staffing Market Report

Published Date: 31 January 2026 | Report Code: healthcare-staffing

Healthcare Staffing Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Healthcare Staffing market, detailing its size, growth trends, and regional insights from 2023 to 2033. It covers market segmentation, key players, technological advances, and future forecasts, offering valuable insights for stakeholders in the industry.

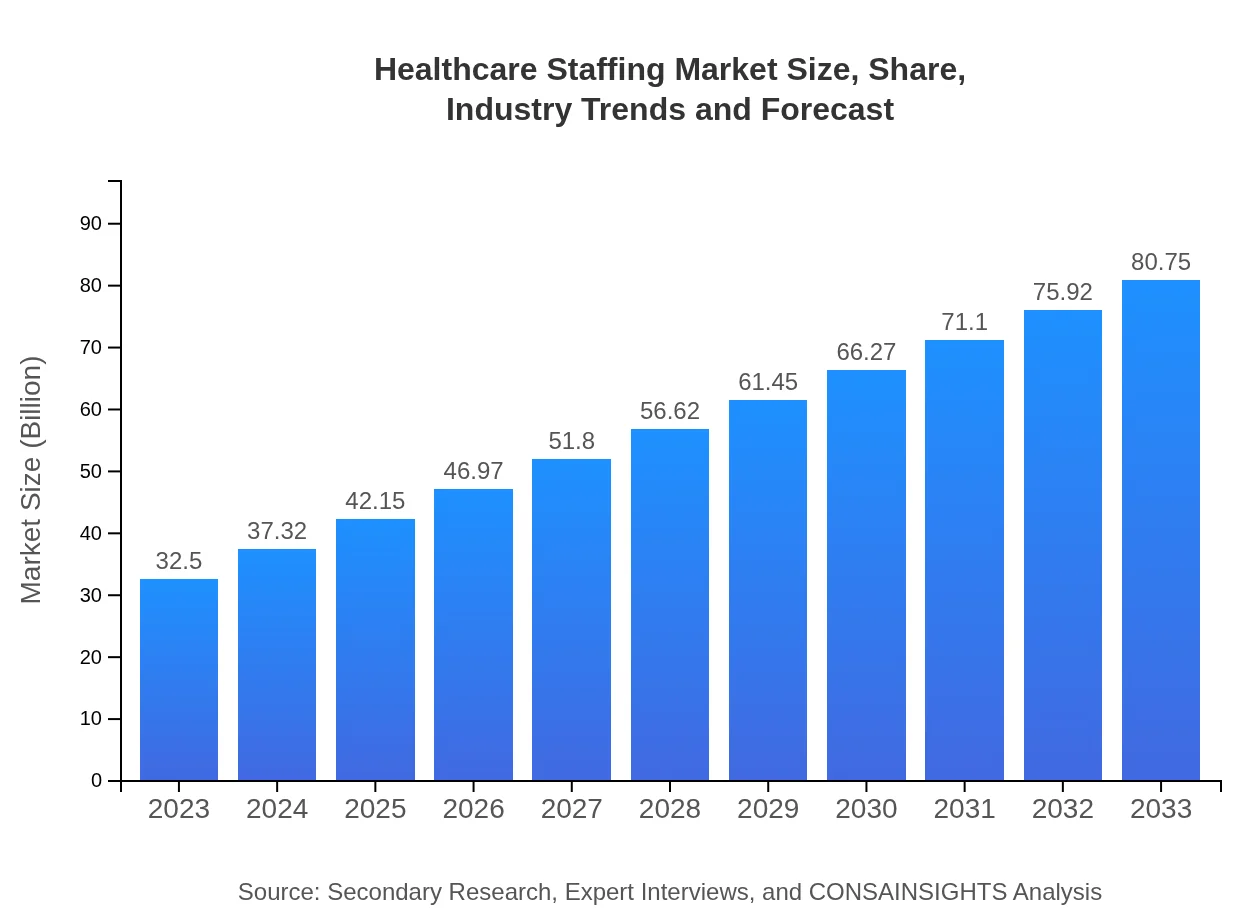

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $32.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $80.75 Billion |

| Top Companies | AMN Healthcare, Cross Country Healthcare, Maxim Healthcare Services, Randstad Healthcare |

| Last Modified Date | 31 January 2026 |

Healthcare Staffing Market Overview

Customize Healthcare Staffing Market Report market research report

- ✔ Get in-depth analysis of Healthcare Staffing market size, growth, and forecasts.

- ✔ Understand Healthcare Staffing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Healthcare Staffing

What is the Market Size & CAGR of Healthcare Staffing market in 2023?

Healthcare Staffing Industry Analysis

Healthcare Staffing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Healthcare Staffing Market Analysis Report by Region

Europe Healthcare Staffing Market Report:

In Europe, the Healthcare Staffing market was valued at $9.36 billion in 2023, set to increase to $23.25 billion by 2033. The region faces unique challenges, including demographic changes and the need to improve patient care accessibility, contributing to the uptick in staffing solutions.Asia Pacific Healthcare Staffing Market Report:

In the Asia Pacific region, the Healthcare Staffing market was valued at $6.28 billion in 2023, expected to grow to $15.59 billion by 2033, driven by an increasing demand for qualified healthcare workers and the rise of medical tourism. Countries like India and China are amassing significant growth due to the expanding healthcare infrastructure.North America Healthcare Staffing Market Report:

The North American Healthcare Staffing market, valued at $11.52 billion in 2023, is projected to soar to $28.63 billion by 2033. Factors such as advanced healthcare technologies, the increasing prevalence of chronic illnesses, and a growing elderly population underlie this significant growth.South America Healthcare Staffing Market Report:

The South American market stands at $2.42 billion in 2023, with expectations to reach $6.01 billion in 2033. This growth is propelled by increasing investments in healthcare and a surge in the geriatric population necessitating more healthcare services.Middle East & Africa Healthcare Staffing Market Report:

In the Middle East and Africa, the market size is estimated at $2.92 billion in 2023, anticipated to reach $7.27 billion by 2033. This growth reflects increased government investments in healthcare infrastructure and an emphasis on public-private partnerships.Tell us your focus area and get a customized research report.

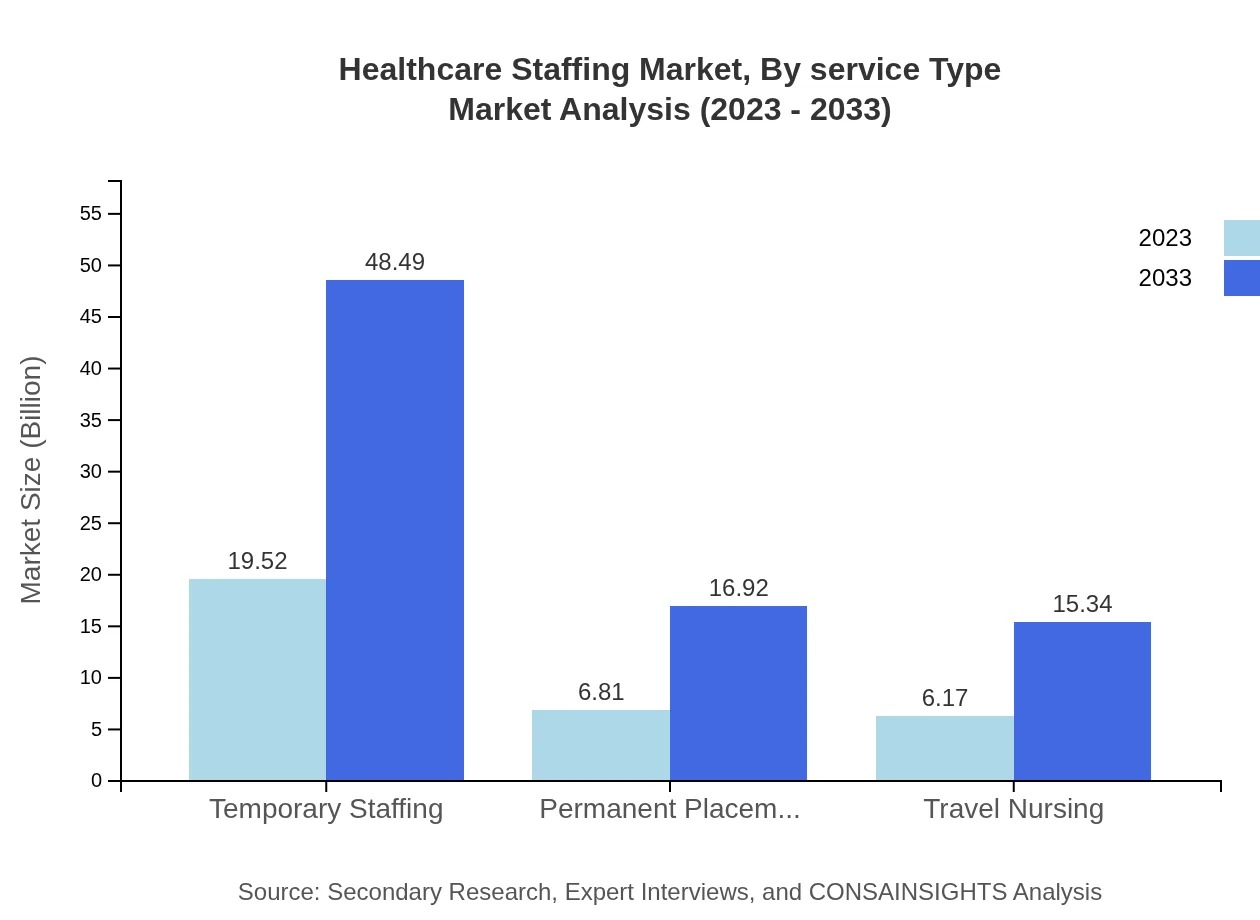

Healthcare Staffing Market Analysis By Service Type

The segmentation by service types reveals that temporary staffing dominates the market, valued at $19.52 billion in 2023, forecasted to grow to $48.49 billion by 2033, accounting for 60.05% of the market share. Permanent placements follow, with a size of $6.81 billion in 2023, expected to increase to $16.92 billion by 2033, equating to 20.95% of the market share. Travel nursing and long-term care staffing are other notable segments.

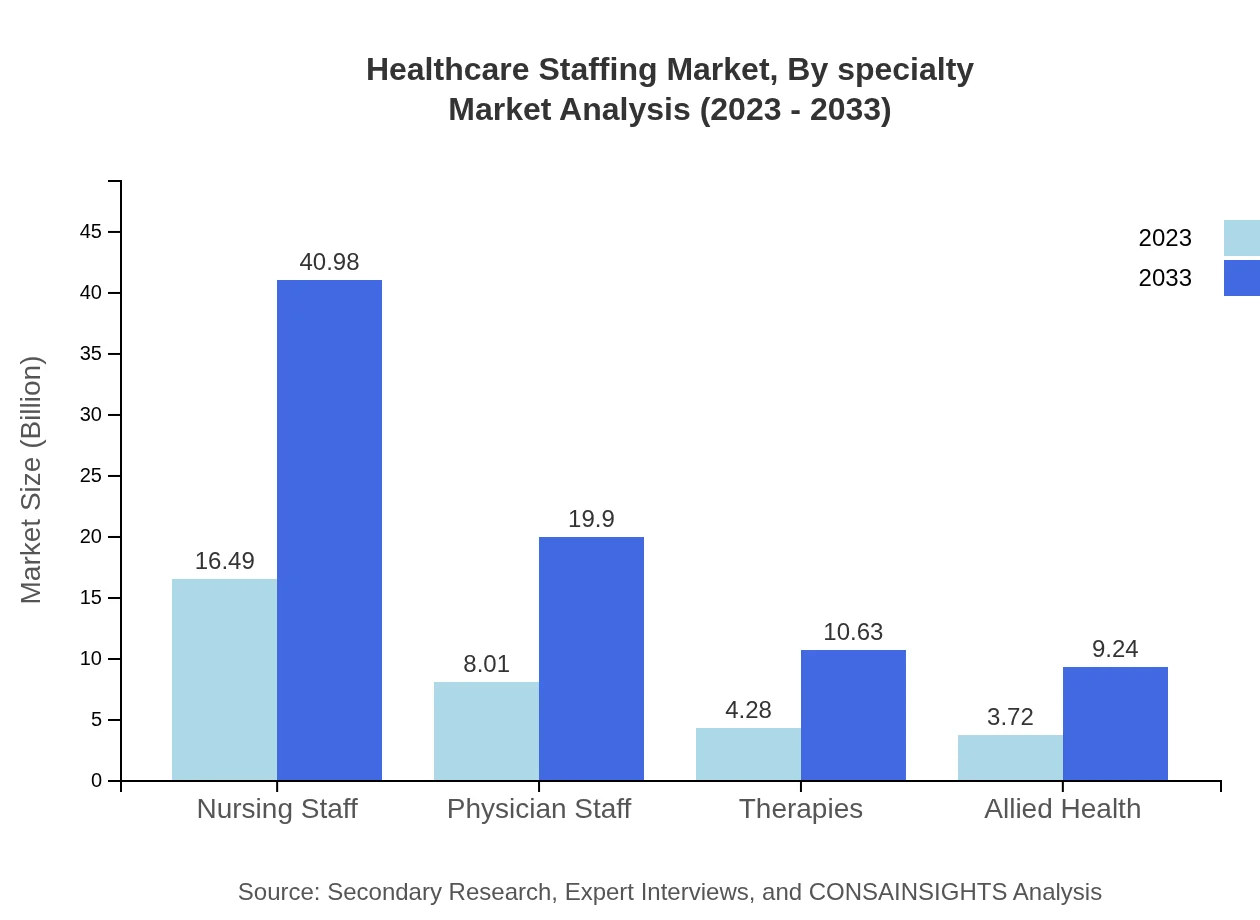

Healthcare Staffing Market Analysis By Specialty

The specialty segment reveals that nursing staff constitutes a significant portion of the market, estimated at $16.49 billion in 2023 and expected to surge to $40.98 billion by 2033. Physician staff is valued at $8.01 billion in 2023, with projections reaching $19.90 billion by 2033, while therapy-related staffing is expected to grow significantly from $4.28 billion in 2023 to $10.63 billion by 2033.

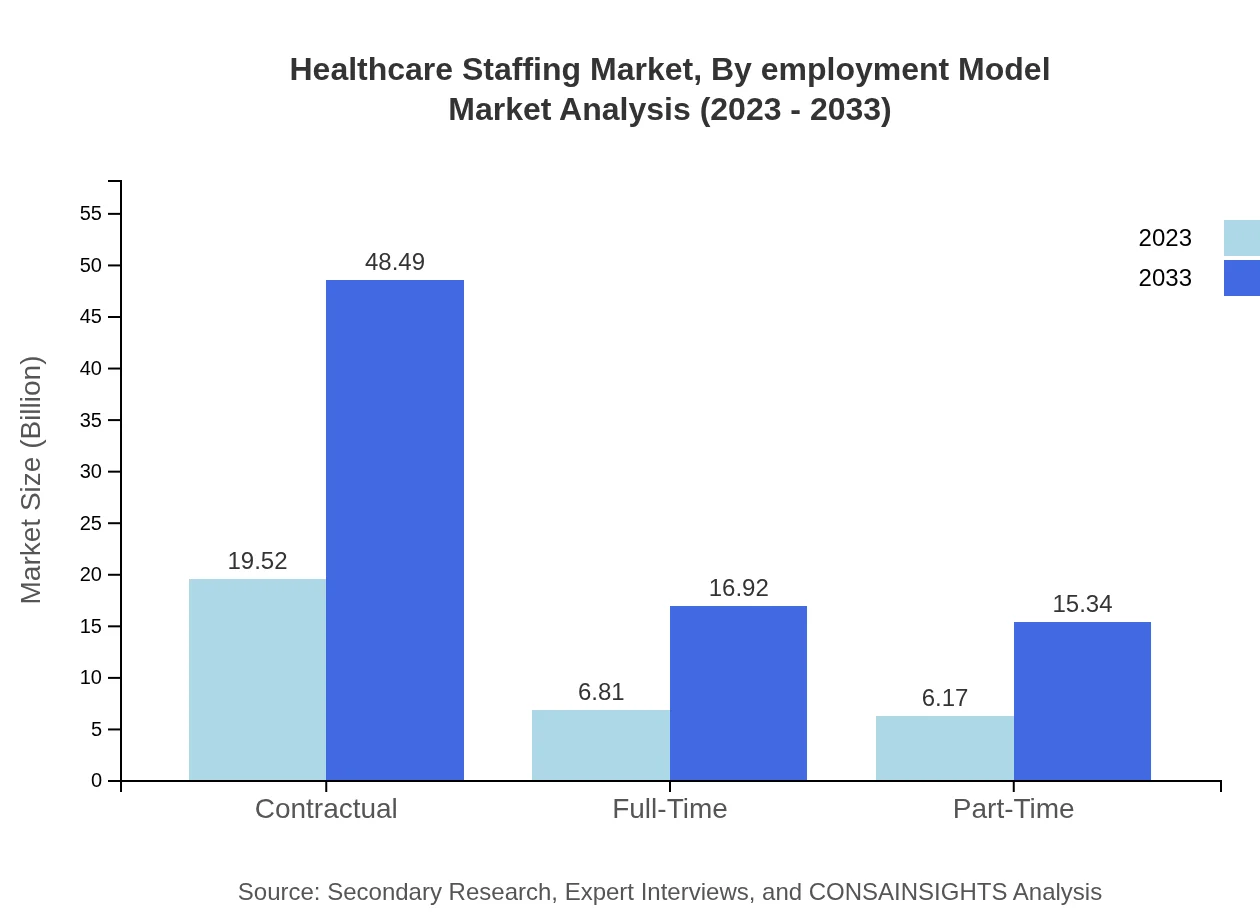

Healthcare Staffing Market Analysis By Employment Model

The employment model segmentation indicates that in-house recruitment and temporary staffing each hold significant shares in Healthcare Staffing. In-house recruitment is projected to grow from $19.52 billion in 2023 to $48.49 billion by 2033. Temporary staffing remains critical, reflecting the need for agility in health systems.

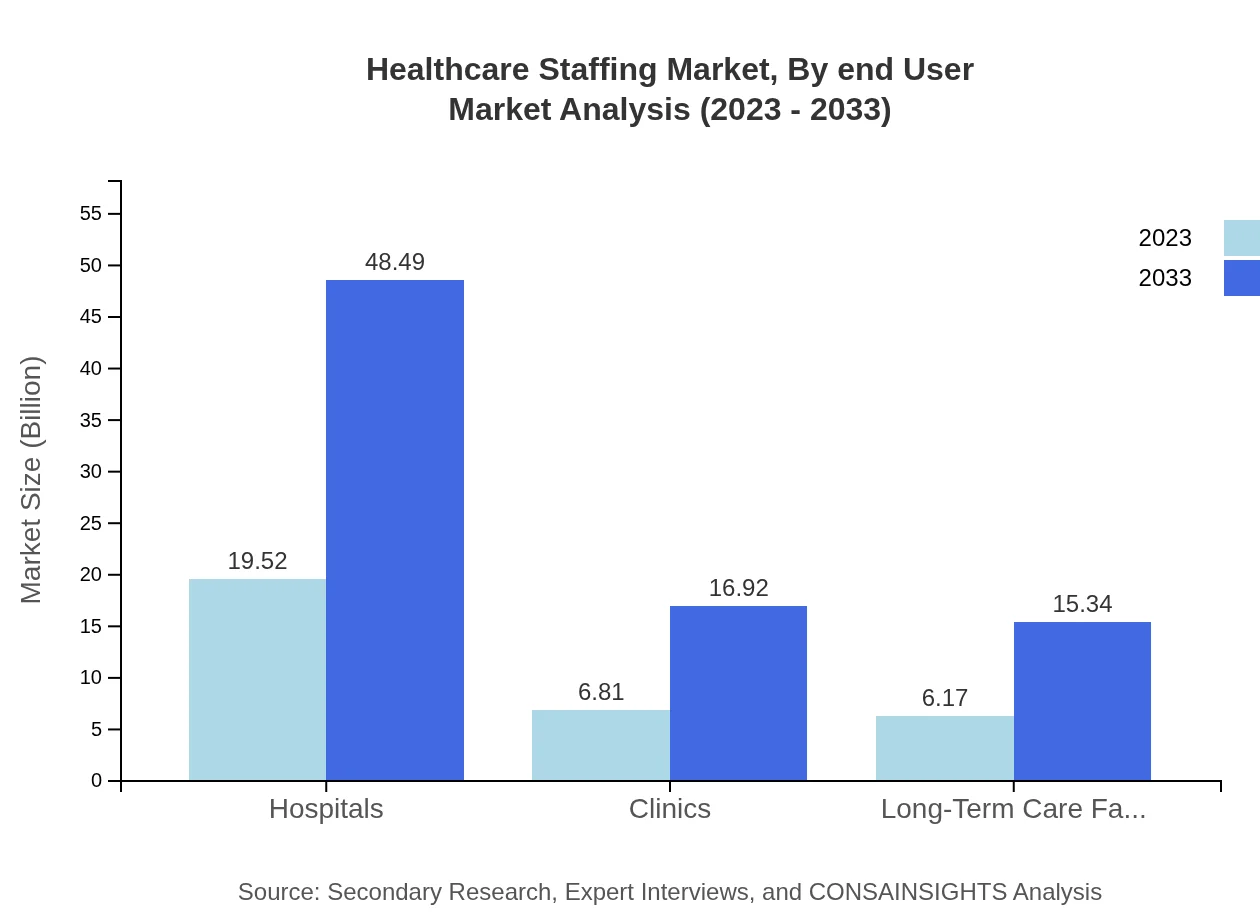

Healthcare Staffing Market Analysis By End User

For end-users, hospitals are the leading segment, forecasted to increase from $19.52 billion in 2023 to $48.49 billion by 2033, representing a steady 60.05% market share. Clinics and long-term care facilities have established market sizes of $6.81 billion and $6.17 billion respectively in 2023, projected to exhibit significant growth through 2033.

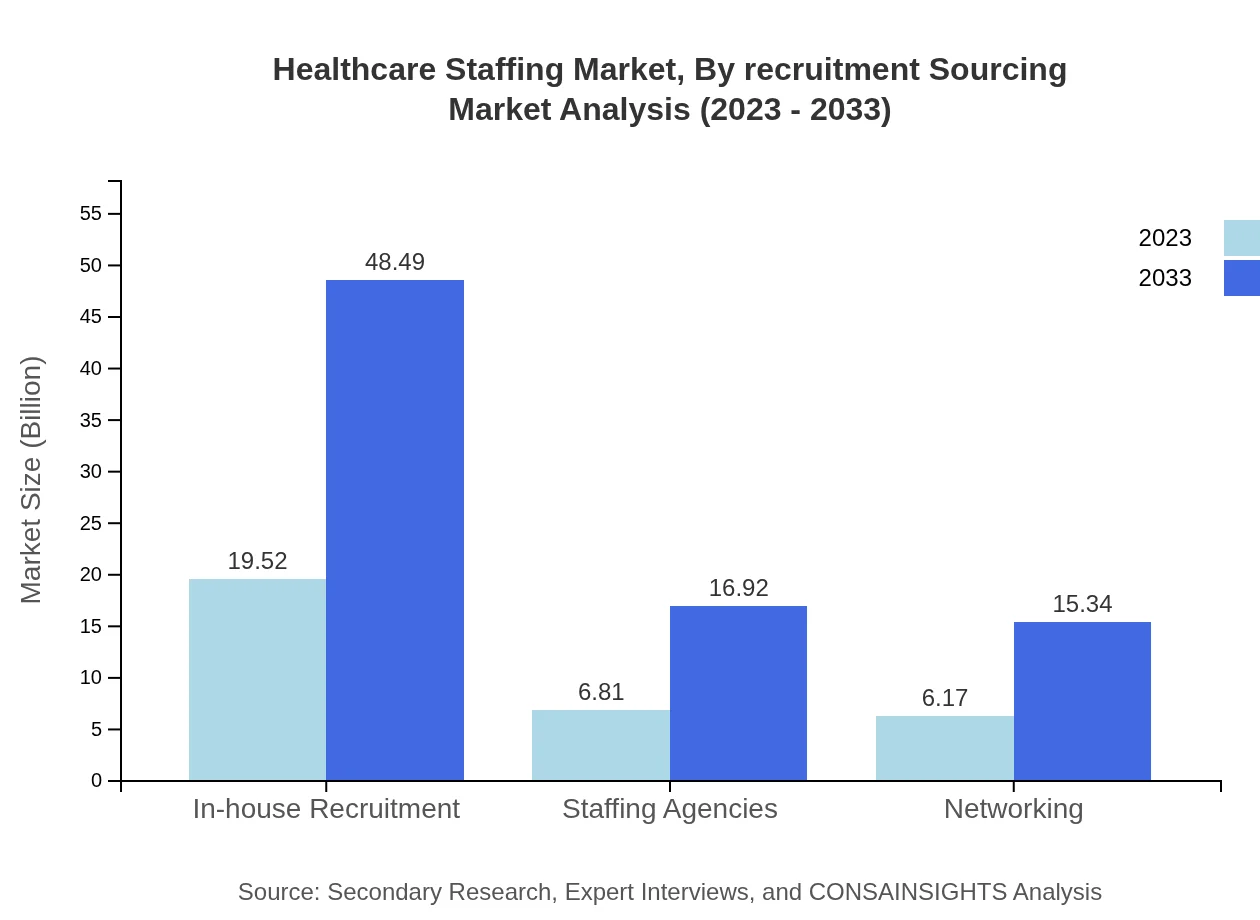

Healthcare Staffing Market Analysis By Recruitment Sourcing

In the recruitment sourcing segment, staffing agencies play a vital role, valued at $6.81 billion in 2023 with a stable share of 20.95%. The emergence of networking and technological recruitment sourcing emerges as key dynamics that will reshape the recruitment space within Healthcare Staffing.

Healthcare Staffing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Healthcare Staffing Industry

AMN Healthcare:

AMN Healthcare is a leading provider of healthcare workforce solutions, offering staffing and workforce management services along with innovative technology solutions to improve healthcare delivery.Cross Country Healthcare:

Cross Country Healthcare provides staffing solutions across various healthcare settings, specializing in travel nursing, locum tenens, and per diem staffing services, ensuring flexibility and quality care.Maxim Healthcare Services:

Maxim Healthcare Services offers a wide range of staffing solutions, including home healthcare and workforce management, emphasizing patient-centric services and innovative practices.Randstad Healthcare:

Randstad Healthcare is renowned for providing tailored staffing solutions and workforce planning services, focusing on improving client satisfaction and operational efficiency in healthcare organizations.We're grateful to work with incredible clients.

FAQs

What is the market size of healthcare staffing?

The global healthcare staffing market is valued at approximately $32.5 billion in 2023, with a projected CAGR of 9.2%, leading to significant growth by 2033.

What are the key market players or companies in this healthcare staffing industry?

Key players in the healthcare staffing industry include established companies like AMN Healthcare, C&A Industries, and Cross Country Healthcare, which dominate the market with their extensive services and innovative staffing solutions.

What are the primary factors driving the growth in the healthcare staffing industry?

Growth in the healthcare staffing industry is driven by an aging population, rising chronic health conditions, increased demand for healthcare services, and a growing focus on efficient staffing solutions.

Which region is the fastest Growing in the healthcare staffing market?

North America is the fastest-growing region in the healthcare staffing market, with a market size projected to grow from $11.52 billion in 2023 to $28.63 billion by 2033.

Does ConsaInsights provide customized market report data for the healthcare staffing industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the healthcare staffing industry, enabling businesses to gain relevant insights.

What deliverables can I expect from this healthcare staffing market research project?

Expect detailed reports, market forecasts, competitor analysis, and insights on trends and growth opportunities within the healthcare staffing market.

What are the market trends of healthcare staffing?

Major trends in the healthcare staffing market include increased demand for travel nursing, a rise in telehealth services, and a shift towards flexible staffing models for healthcare providers.