Heart Attack Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: heart-attack-diagnostics

Heart Attack Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Heart Attack Diagnostics market, including market size, trends, segment insights, and forecasts for the period from 2023 to 2033. It aims to equip stakeholders with relevant data to inform strategic decisions.

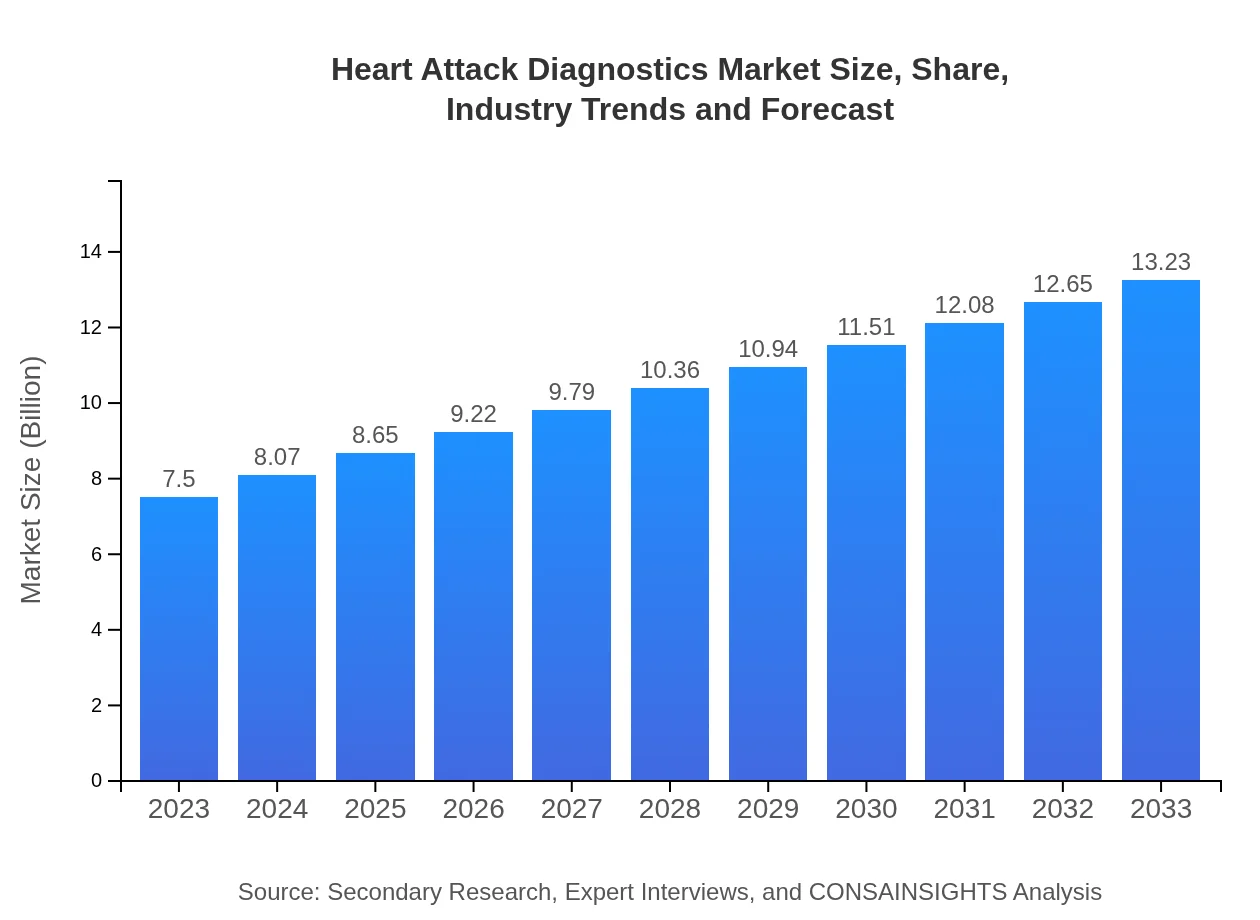

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $13.23 Billion |

| Top Companies | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Philips Healthcare, GE Healthcare |

| Last Modified Date | 31 January 2026 |

Heart Attack Diagnostics Market Overview

Customize Heart Attack Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Heart Attack Diagnostics market size, growth, and forecasts.

- ✔ Understand Heart Attack Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Heart Attack Diagnostics

What is the Market Size & CAGR of Heart Attack Diagnostics market in 2023?

Heart Attack Diagnostics Industry Analysis

Heart Attack Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Heart Attack Diagnostics Market Analysis Report by Region

Europe Heart Attack Diagnostics Market Report:

Europe's Heart Attack Diagnostics market is expected to grow from $2.21 billion in 2023 to $3.89 billion by 2033. Factors such as aging populations and increased healthcare spending are driving the demand for effective heart attack diagnostics.Asia Pacific Heart Attack Diagnostics Market Report:

The Asia Pacific region is projected to see significant growth from $1.55 billion in 2023 to $2.73 billion in 2033. Factors such as urbanization, rising disposable incomes, and increasing health awareness contribute to this growth. The demand for advanced diagnostic technologies in countries like India and China is significantly rising.North America Heart Attack Diagnostics Market Report:

North America currently leads the market with a value of $2.45 billion in 2023, projected to rise to $4.32 billion by 2033. The region's growth is supported by advanced healthcare facilities, high rates of heart diseases, and continuous technological advancements.South America Heart Attack Diagnostics Market Report:

In South America, the market is expected to grow from $0.74 billion in 2023 to $1.31 billion by 2033, driven by improving healthcare infrastructure and growing concern over cardiovascular diseases, reflecting a robust growth potential.Middle East & Africa Heart Attack Diagnostics Market Report:

The Middle East and Africa market is expected to expand from $0.56 billion in 2023 to $0.98 billion by 2033. Efforts to enhance healthcare systems and growing awareness of the importance of early diagnosis are fueling this market growth.Tell us your focus area and get a customized research report.

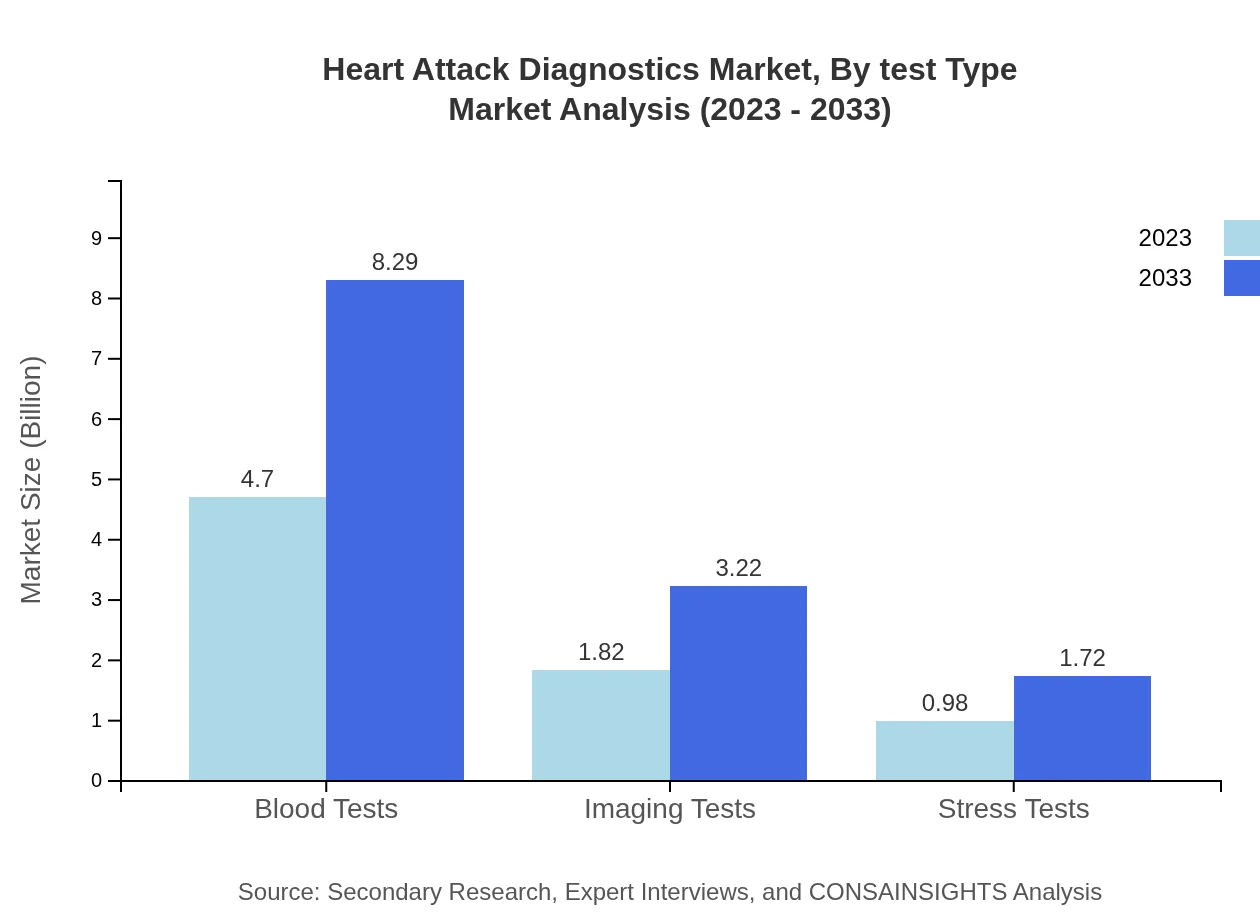

Heart Attack Diagnostics Market Analysis By Test Type

The dominance of traditional diagnostic procedures continues in the Heart Attack Diagnostics market, with Blood Tests and Imaging Tests forming significant portions of this segment. Blood Tests are expected to maintain a market size of $4.70 billion in 2023, growing to $8.29 billion by 2033 due to their fundamental role in early detection. Imaging Tests are projected to expand from $1.82 billion in 2023 to $3.22 billion in 2033 as advancements in imaging technology improve diagnostic accuracy.

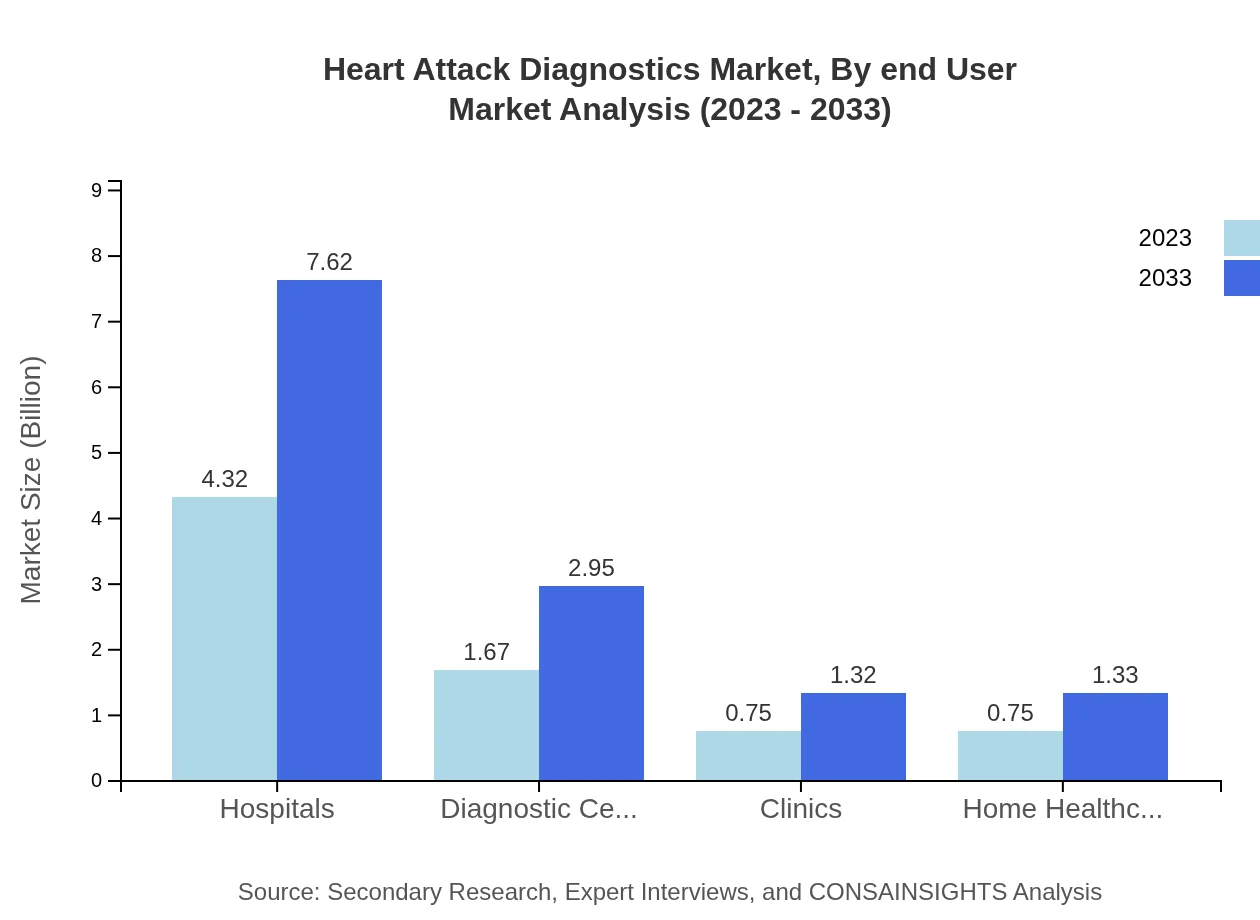

Heart Attack Diagnostics Market Analysis By End User

Hospitals remain the key end-user segment, holding a market share of 57.61% and expected to grow from $4.32 billion in 2023 to $7.62 billion by 2033. Diagnostic Centers are also significant players, increasing from $1.67 billion in 2023 to $2.95 billion by 2033, reflecting the rising preference for specialized testing facilities.

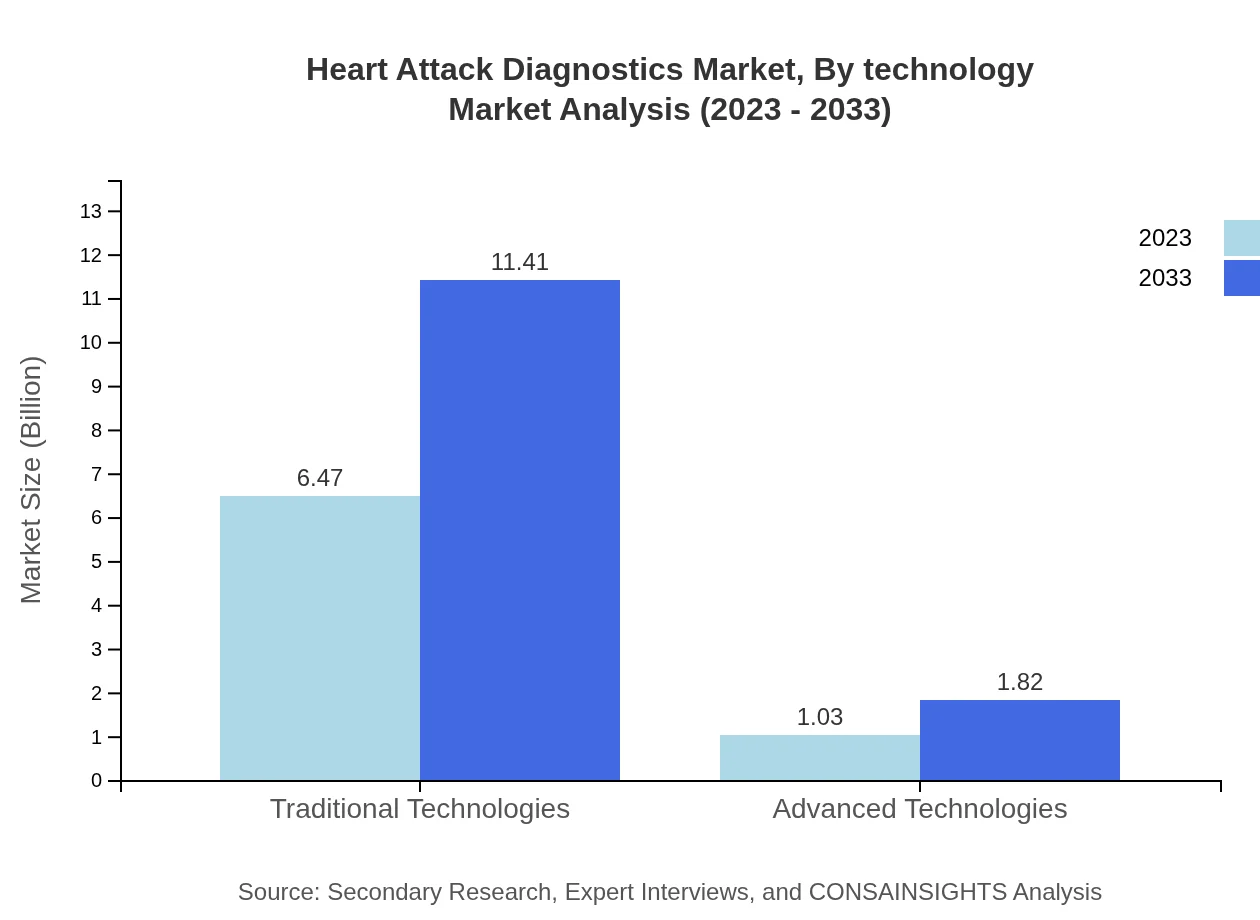

Heart Attack Diagnostics Market Analysis By Technology

Traditional Technologies still dominate the market with a size of $6.47 billion projected for 2023, while Advanced Technologies show promising growth potential, moving from $1.03 billion to $1.82 billion by 2033, driven by innovations in telehealth and remote monitoring capabilities.

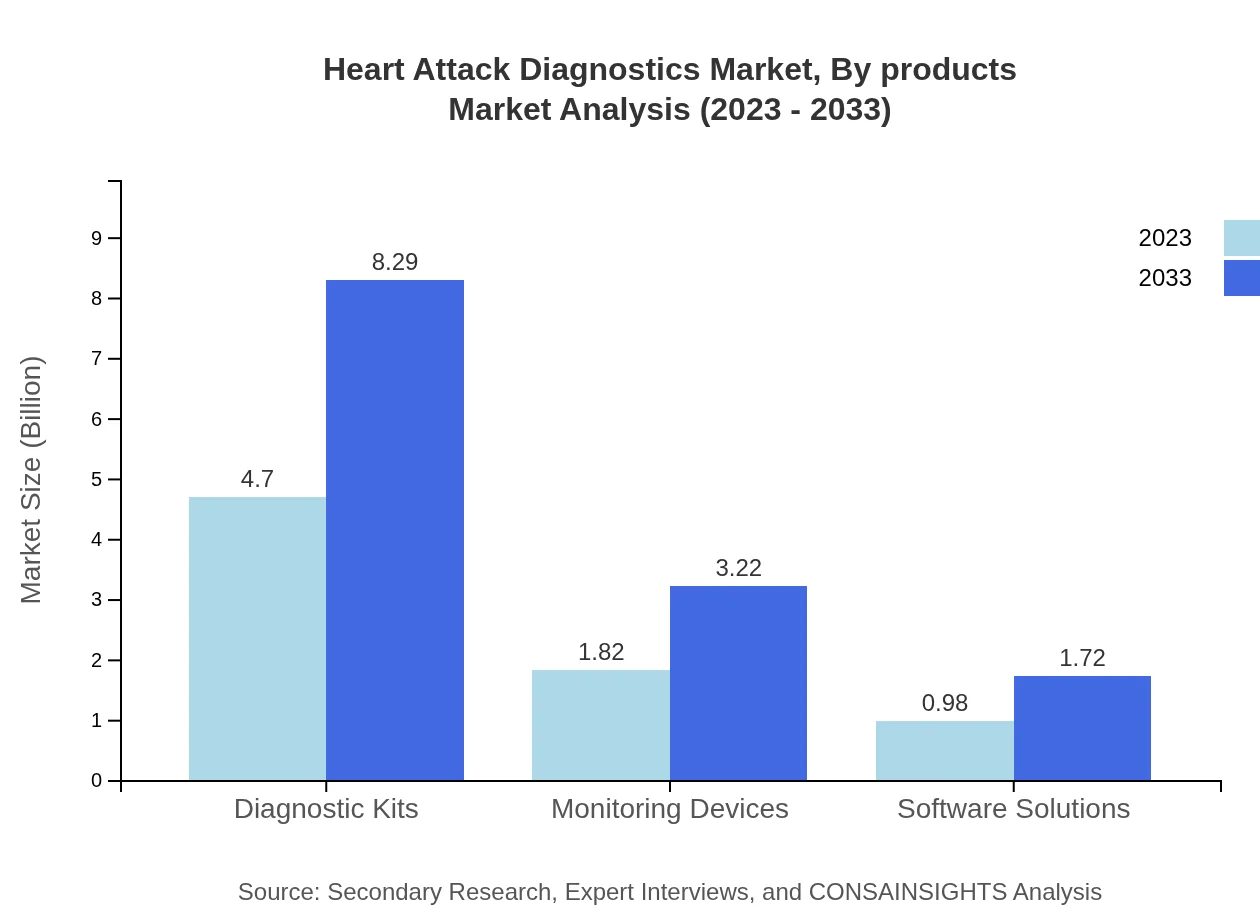

Heart Attack Diagnostics Market Analysis By Products

Diagnostic Kits lead the product segment with a significant market size of $4.70 billion in 2023, poised to reach $8.29 billion by 2033. The growth of monitoring devices and software solutions demonstrates the industry's pivot towards more integrated and technology-driven approaches to heart attack diagnostics.

Heart Attack Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Heart Attack Diagnostics Industry

Abbott Laboratories:

A leader in medical devices and diagnostics, Abbott's innovations in cardiac care significantly drive the Heart Attack Diagnostics market with products that enhance patient diagnostics and monitoring.Roche Diagnostics:

Roche is renowned for its comprehensive diagnostic solutions. Its blood tests for cardiac biomarkers are pivotal in heart attack diagnostics, helping clinicians make timely and informed decisions.Siemens Healthineers:

Siemens Healthineers is at the forefront of imaging technologies for diagnostics. Its advanced imaging solutions are essential in accurately diagnosing heart conditions.Philips Healthcare:

Philips is known for technological innovation in healthcare diagnostics, focusing on solutions that enhance patient care, particularly in cardiovascular health.GE Healthcare:

GE Healthcare's diagnostic products and technologies are crucial in advancing heart attack diagnostics, facilitating rapid assessment and treatment of cardiac events.We're grateful to work with incredible clients.

FAQs

What is the market size of heart Attack Diagnostics?

The global heart-attack diagnostics market is valued at approximately $7.5 billion in 2023. It is projected to grow at a CAGR of 5.7%, reaching significant milestones over the next decade, indicating robust demand for innovative diagnostic solutions.

What are the key market players or companies in this heart Attack Diagnostics industry?

Key players in the heart-attack diagnostics industry include Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, and Thermo Fisher Scientific. These companies are recognized for their extensive product portfolios and contributions to advanced healthcare solutions, shaping market dynamics.

What are the primary factors driving the growth in the heart Attack Diagnostics industry?

Several factors are driving growth in the heart-attack diagnostics market. Increased prevalence of heart diseases, advancements in diagnostic technologies, and a growing focus on preventive healthcare are major contributors. Additionally, better healthcare infrastructure supports market expansion.

Which region is the fastest Growing in the heart Attack Diagnostics?

The fastest-growing region in the heart-attack diagnostics market is North America, with a market size projected to grow from $2.45 billion in 2023 to $4.32 billion by 2033. This growth is driven by high healthcare spending and robust technological advancements in diagnostics.

Does ConsaInsights provide customized market report data for the heart Attack Diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the heart-attack diagnostics industry. This service allows for in-depth insights aligned with unique business objectives and market strategies.

What deliverables can I expect from this heart Attack Diagnostics market research project?

Deliverables from this market research project include comprehensive market analysis reports, segmentation data, competitive landscape assessments, and detailed regional insights. Clients receive actionable recommendations based on the latest market trends and forecasts.

What are the market trends of heart Attack Diagnostics?

Current trends in the heart-attack diagnostics market include the increasing use of advanced technologies such as imaging tests and genetic diagnostics. There is also a growing emphasis on integrating telemedicine and wearable health technology into diagnostic processes.