Heavy Construction Equipment Market Report

Published Date: 22 January 2026 | Report Code: heavy-construction-equipment

Heavy Construction Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Heavy Construction Equipment market, exploring insights on market size, industry trends, technologies, and regional performance forecasts from 2023 to 2033.

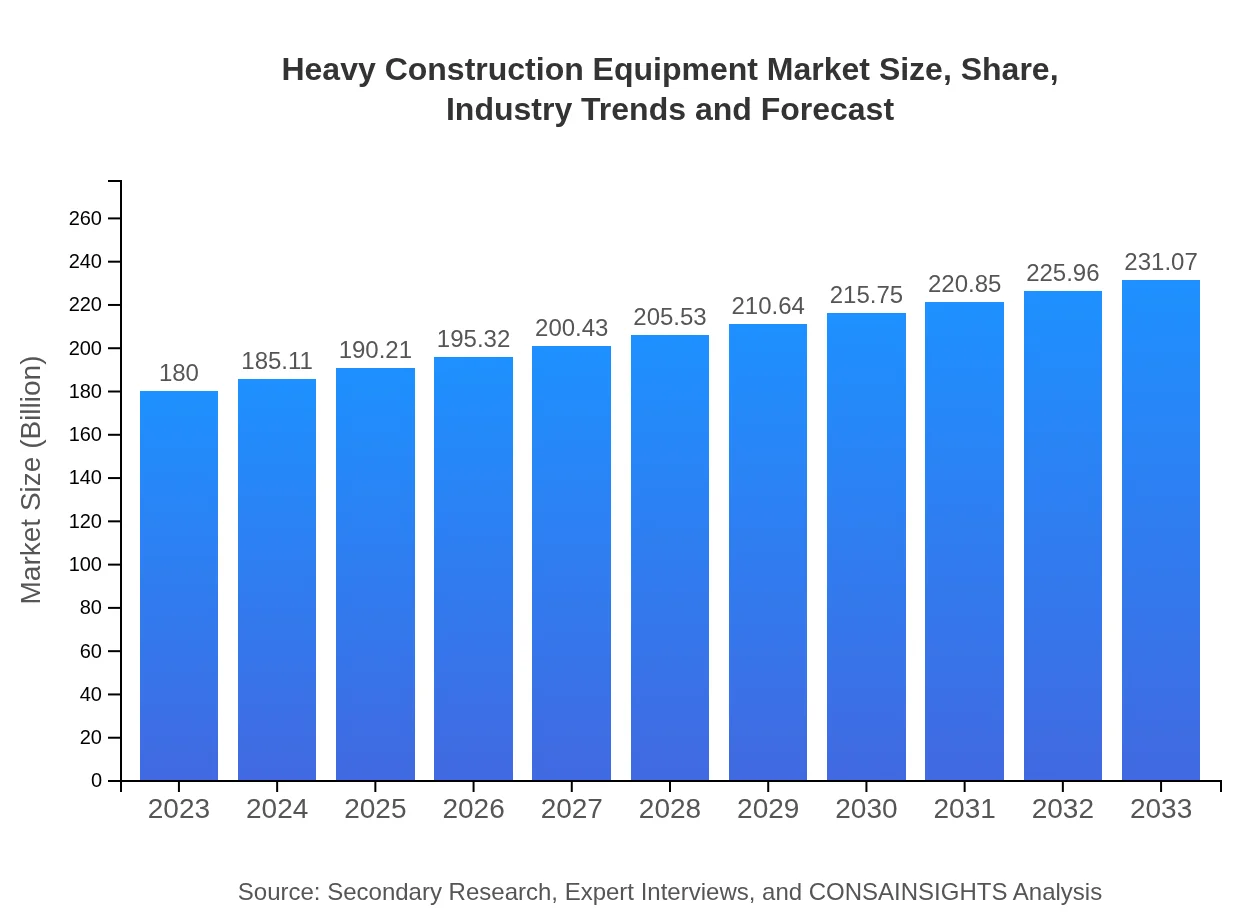

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $180.00 Billion |

| CAGR (2023-2033) | 2.5% |

| 2033 Market Size | $231.07 Billion |

| Top Companies | Caterpillar , Komatsu, Hitachi Construction Machinery, Volvo Construction Equipment |

| Last Modified Date | 22 January 2026 |

Heavy Construction Equipment Market Overview

Customize Heavy Construction Equipment Market Report market research report

- ✔ Get in-depth analysis of Heavy Construction Equipment market size, growth, and forecasts.

- ✔ Understand Heavy Construction Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Heavy Construction Equipment

What is the Market Size & CAGR of Heavy Construction Equipment market in 2023?

Heavy Construction Equipment Industry Analysis

Heavy Construction Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Heavy Construction Equipment Market Analysis Report by Region

Europe Heavy Construction Equipment Market Report:

Europe's market, valued at $44.91 billion in 2023 and forecasted to grow to $57.65 billion by 2033, is influenced by stringent environmental regulations pushing for greener technologies and equipment.Asia Pacific Heavy Construction Equipment Market Report:

The Asia Pacific region, valued at $34.47 billion in 2023 and projected to reach $44.25 billion by 2033, is experiencing rapid growth due to major infrastructure projects in countries like China and India. Increasing urbanization and industrialization in these countries are set to boost demand.North America Heavy Construction Equipment Market Report:

With a market size of $62.44 billion in 2023, North America is projected to reach $80.16 billion by 2033. The United States leads in construction initiatives, particularly in road and bridge maintenance, driven by government investments and policies.South America Heavy Construction Equipment Market Report:

The South American market is expected to grow from $16.94 billion in 2023 to $21.74 billion by 2033. The rise in mining activities and infrastructure projects in Brazil and Chile are significant contributors to this growth.Middle East & Africa Heavy Construction Equipment Market Report:

The Middle East and Africa market is projected to grow from $21.24 billion in 2023 to $27.27 billion by 2033, driven primarily by oil and gas projects alongside major infrastructure developments in the region.Tell us your focus area and get a customized research report.

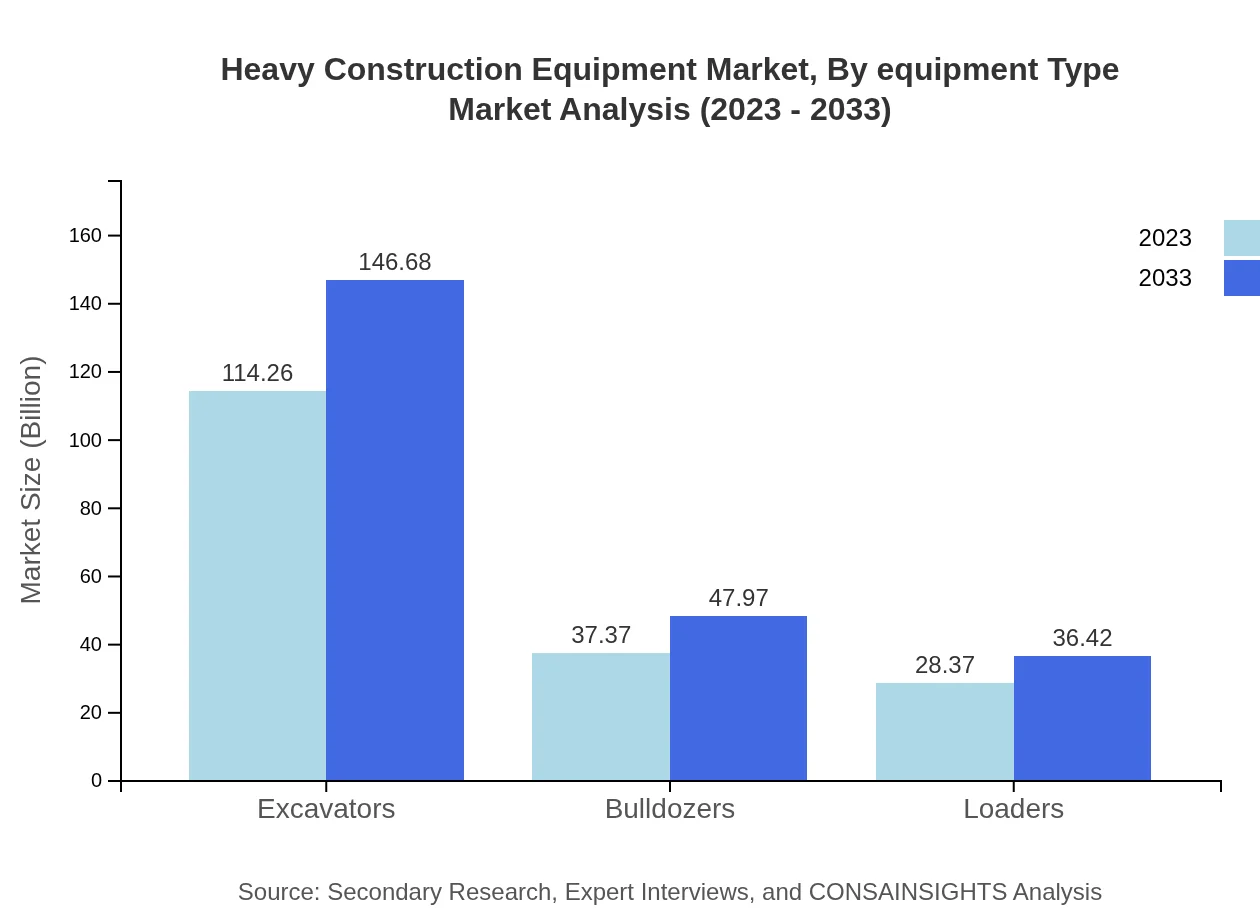

Heavy Construction Equipment Market Analysis By Equipment Type

In 2023, heavy construction equipment segmented by equipment type is led by traditional equipment, which accounts for a substantial market share. Notably, excavators are expected to sustain their position as the dominant machinery type, valued at $114.26 billion in 2023 and projected to grow to $146.68 billion by 2033, largely due to their versatility and efficiency in various applications.

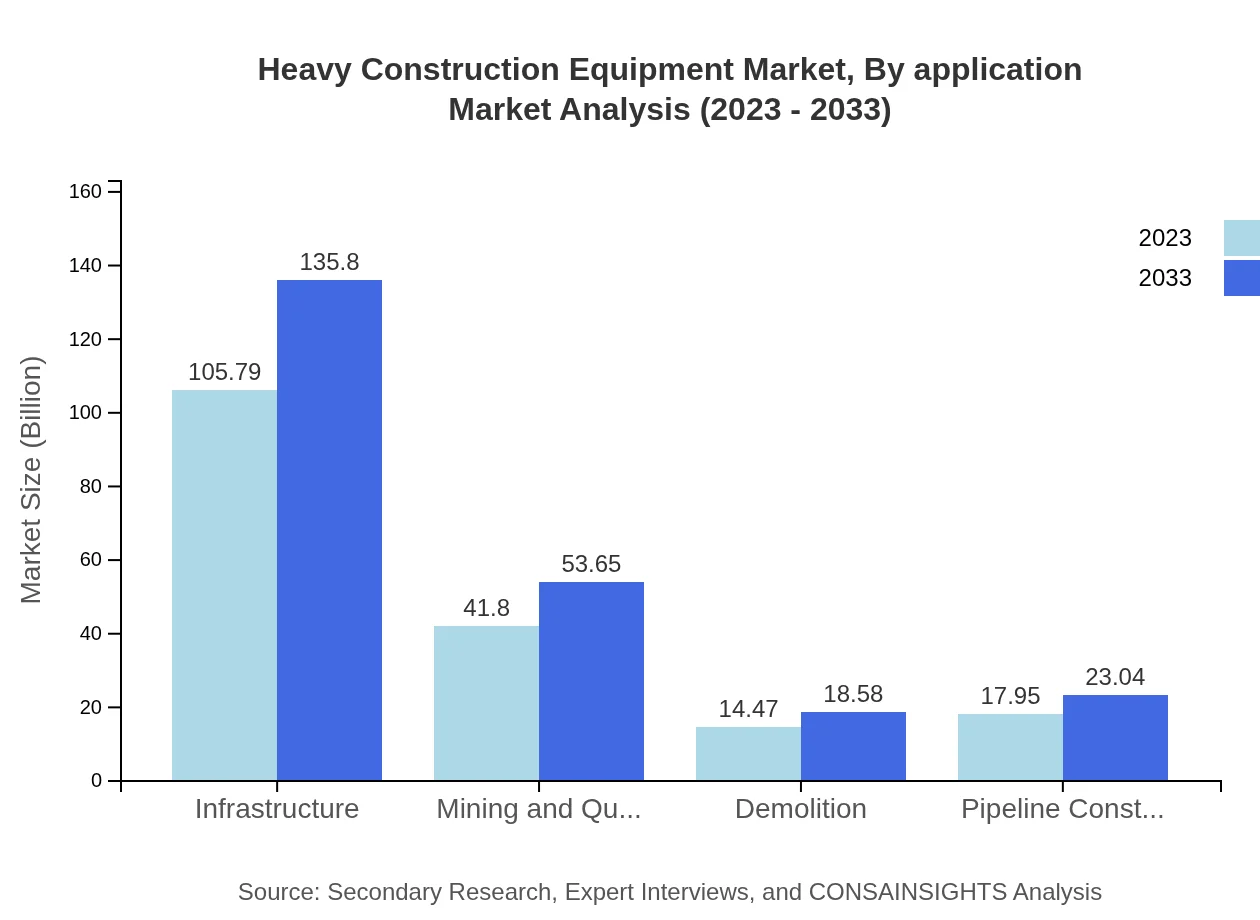

Heavy Construction Equipment Market Analysis By Application

The application segment reveals that infrastructure projects dominate the market, accounting for significant revenue share. In 2023, infrastructure projects constitute around 58.77% of the market, valued at approximately $105.79 billion, projected to continue growing as global demand for robust infrastructure develops.

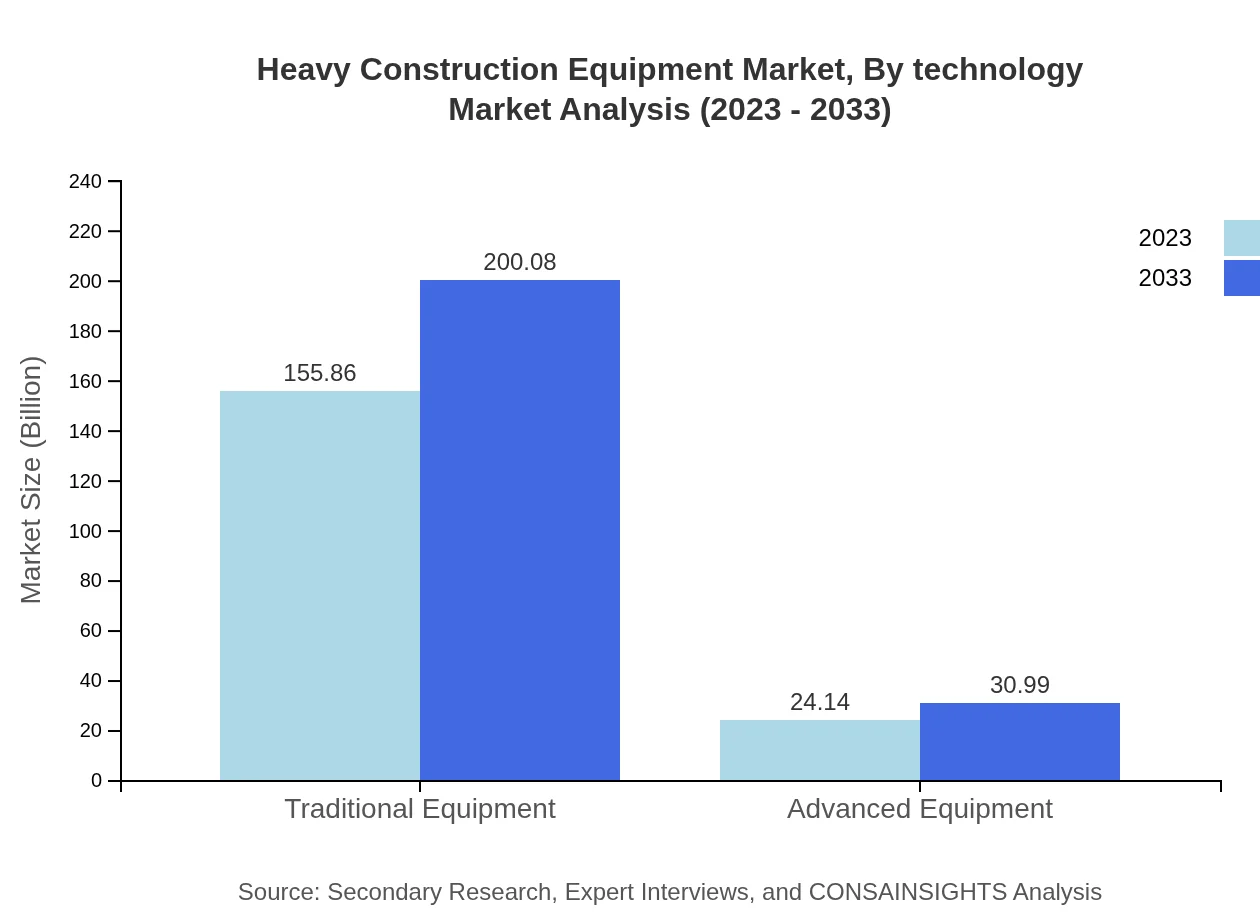

Heavy Construction Equipment Market Analysis By Technology

The technology segment has seen a distinct shift towards hybrid and electric machinery, addressing increasing environmental concerns. By 2033, electric machinery’s market size is forecasted to reach $47.97 billion, corresponding to a rising trend towards sustainable practices in heavy construction.

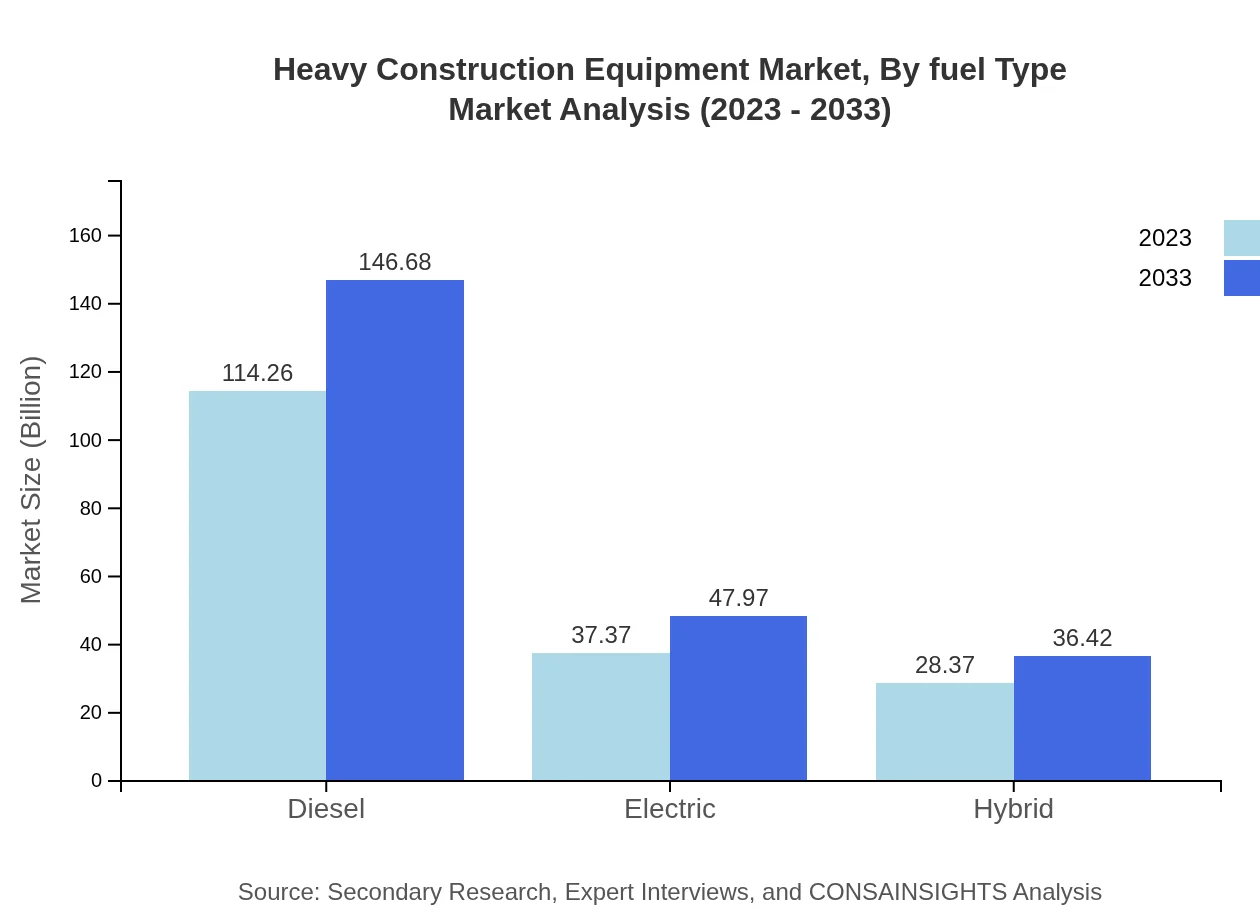

Heavy Construction Equipment Market Analysis By Fuel Type

The diesel segment remains dominant in fuel types, with an expected size of $114.26 billion in 2023 and a rise to $146.68 billion by 2033. However, significant growth is anticipated in electric and hybrid machinery as the industry shifts towards reducing its carbon footprint.

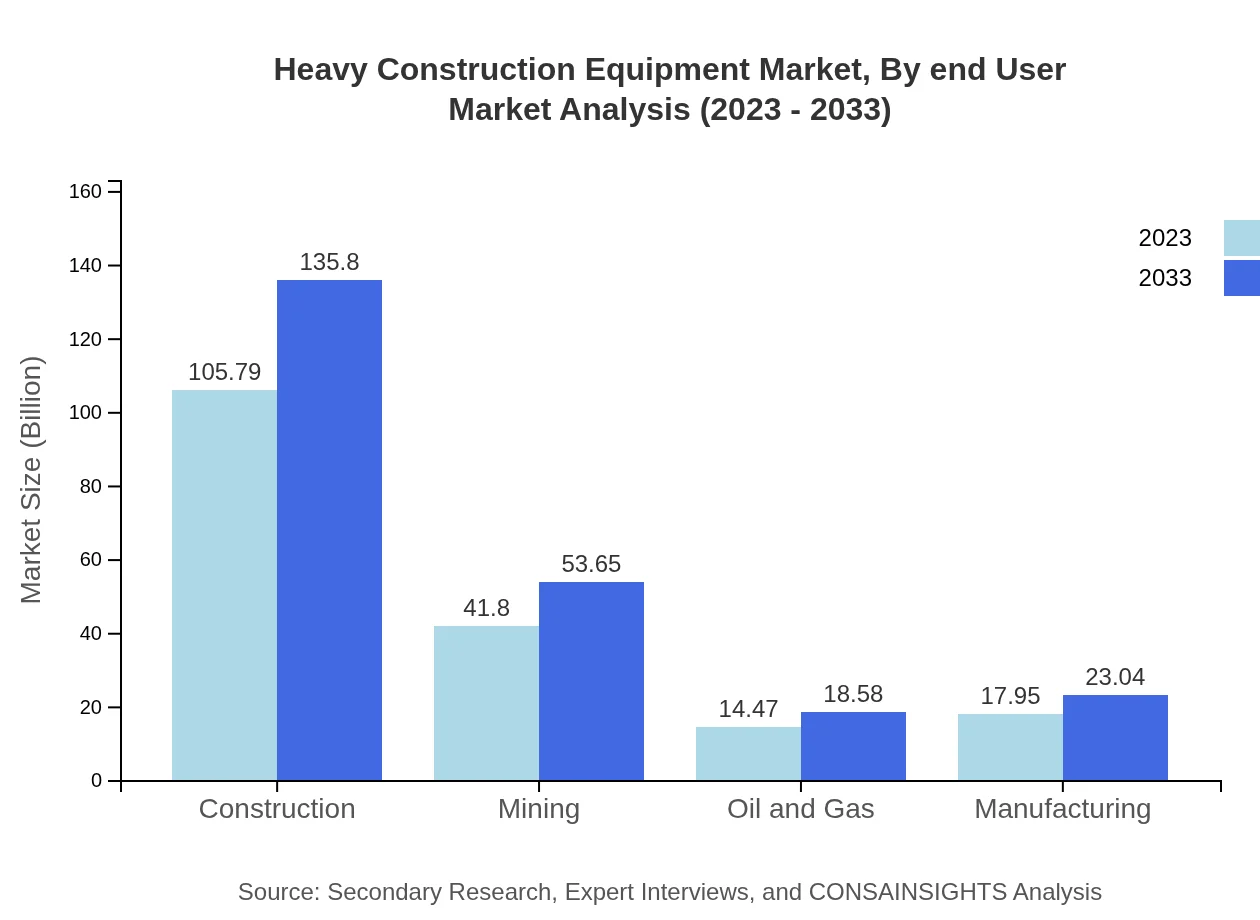

Heavy Construction Equipment Market Analysis By End User

The construction and mining sectors are the largest end-users of heavy machinery. In 2023, they comprise a significant portion of market demand, with increasing investments expected to foster further growth, reaching a combined market size of $105.79 billion by 2033.

Heavy Construction Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Heavy Construction Equipment Industry

Caterpillar :

Caterpillar is a leading manufacturer of construction and mining equipment, renowned for its innovative and efficient machinery designed to enhance productivity.Komatsu:

Komatsu is a Japanese firm offering a vast range of heavy equipment, focusing on sustainability and advanced technologies to meet modern construction needs.Hitachi Construction Machinery:

Hitachi specializes in hydraulic excavators and provides a diverse range of heavy construction equipment with an emphasis on technological advancements.Volvo Construction Equipment:

Volvo Construction Equipment manufactures a wide array of construction machinery, known for its commitment to safety, environmental focus, and innovative design.We're grateful to work with incredible clients.

FAQs

What is the market size of heavy Construction Equipment?

The heavy construction equipment market is projected to reach a size of approximately $180 billion by 2033, with a CAGR of 2.5%. This growth is driven by increased infrastructure development and urbanization across various regions.

What are the key market players or companies in this heavy Construction Equipment industry?

Key players in the heavy construction equipment industry include Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery, and Volvo Construction Equipment, among others. These companies lead in technological advancements and market share.

What are the primary factors driving the growth in the heavy construction equipment industry?

Factors driving growth include increasing infrastructure projects, urbanization, technological advancements in equipment, and demand for efficient construction processes. Moreover, government investments in transportation and energy sectors boost market expansion.

Which region is the fastest Growing in the heavy construction equipment market?

The fastest-growing region in the heavy construction equipment market is projected to be Asia Pacific, with market growth from $34.47 billion in 2023 to $44.25 billion by 2033, reflecting increased construction activities and investments in infrastructure.

Does ConsaInsights provide customized market report data for the heavy construction equipment industry?

Yes, ConsaInsights offers customized market report data tailored to the heavy construction equipment industry. These reports can focus on specific segments or regions based on clients' unique needs.

What deliverables can I expect from this heavy construction equipment market research project?

Deliverables include a comprehensive market analysis report detailing market size, growth forecasts, competitive landscape profiles, segment analysis, and regional insights. Additionally, customized data based on client specifications is available.

What are the market trends of heavy construction equipment?

Market trends indicate a shift towards electric and hybrid machinery, increased automation, and smart equipment integration. Traditional equipment remains dominant, but advanced solutions are gaining traction as environmental concerns rise.