Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Report

Published Date: 24 January 2026 | Report Code: hedge-fund-industry-growth-trends-and-forecast-2020-2025

Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of trends and forecasts in the hedge fund industry from 2020 to 2025, highlighting essential insights, market dynamics, and future growth potential through 2033.

| Metric | Value |

|---|---|

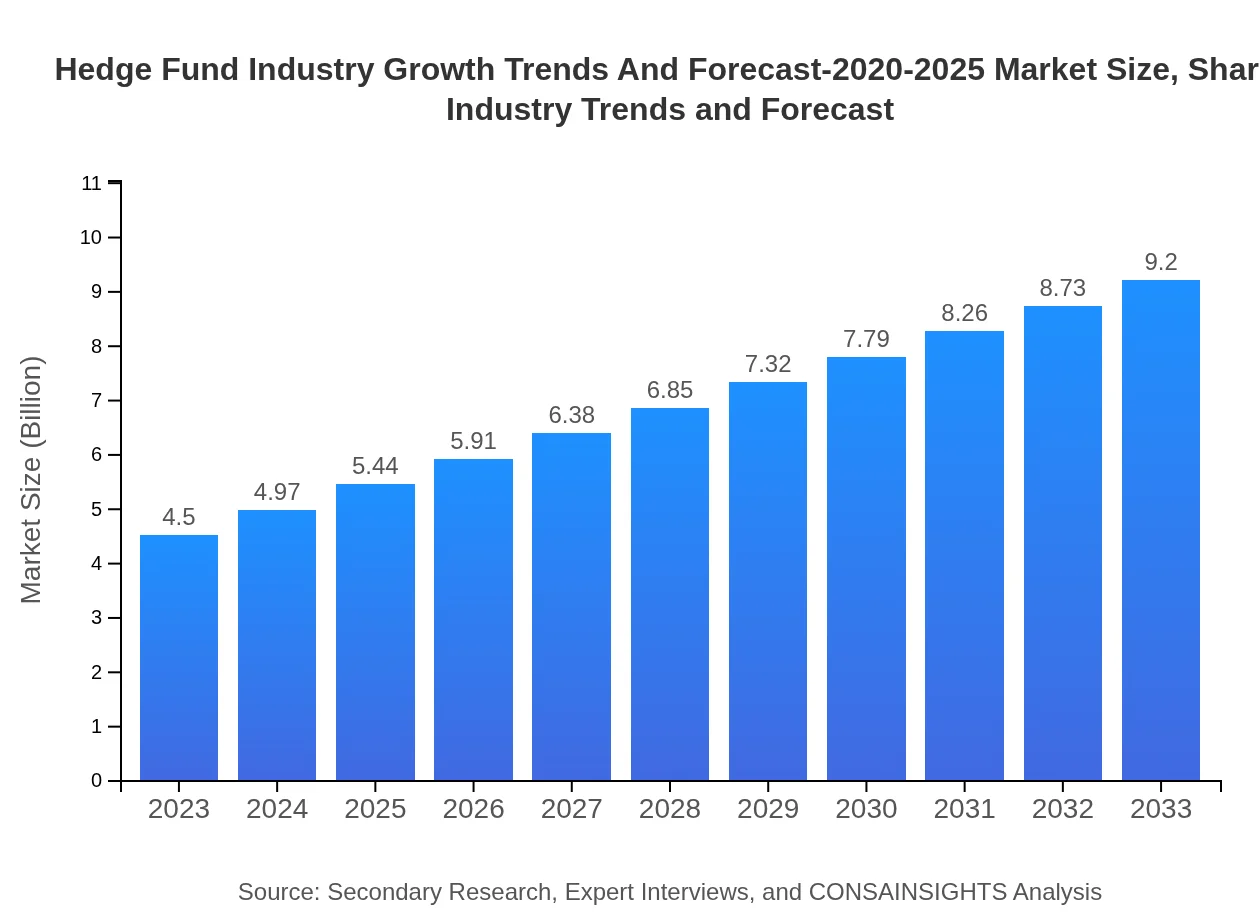

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Trillion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $9.20 Trillion |

| Top Companies | Bridgewater Associates, Renaissance Technologies, Man Group, Two Sigma Investments, AQR Capital Management |

| Last Modified Date | 24 January 2026 |

Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Overview

Customize Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Report market research report

- ✔ Get in-depth analysis of Hedge Fund Industry Growth Trends And Forecast-2020-2025 market size, growth, and forecasts.

- ✔ Understand Hedge Fund Industry Growth Trends And Forecast-2020-2025's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hedge Fund Industry Growth Trends And Forecast-2020-2025

What is the Market Size & CAGR of Hedge Fund Industry Growth Trends And Forecast-2020-2025 market in 2023?

Hedge Fund Industry Growth Trends And Forecast-2020-2025 Industry Analysis

Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Analysis Report by Region

Europe Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Report:

The European hedge fund market is anticipated to expand from $1.26 trillion in 2023 to $2.57 trillion by 2033. Regulatory harmonization and an increase in alternative investment demand are significant factors contributing to robust growth in this region.Asia Pacific Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Report:

In the Asia-Pacific region, the hedge fund market is projected to reach $1.86 trillion by 2033, up from $0.91 trillion in 2023. This growth is attributed to rising affluence, increased financial literacy, and a growing demand for alternative investments among high net worth individuals.North America Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Report:

North America remains the largest hedge fund market, expected to grow from $1.63 trillion in 2023 to $3.34 trillion by 2033. This growth is driven by established institutional investors and a burgeoning interest from family offices and wealthy individuals looking for diversification in their portfolios.South America Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Report:

The South American hedge fund market is gradually developing, with projections estimating it will increase from $0.27 trillion in 2023 to approximately $0.56 trillion by 2033. This segment is buoyed by improving economic conditions and a shift towards more sophisticated investment options.Middle East & Africa Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Report:

The Middle East and Africa are projected to see modest growth, with the market increasing from $0.43 trillion in 2023 to $0.87 trillion by 2033. The increasing sophistication of local investors and the entrance of global hedge fund managers are key driving forces.Tell us your focus area and get a customized research report.

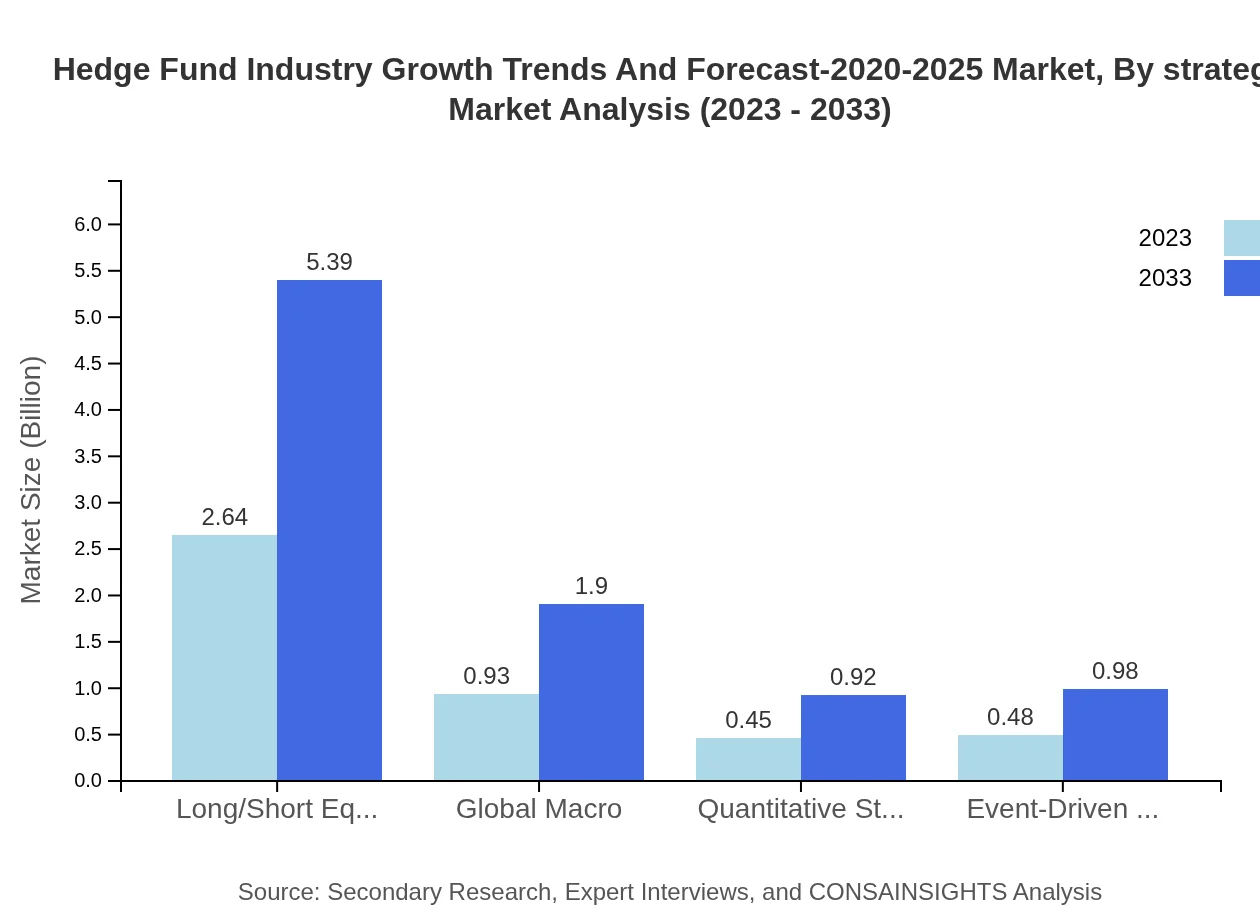

Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Analysis By Strategy

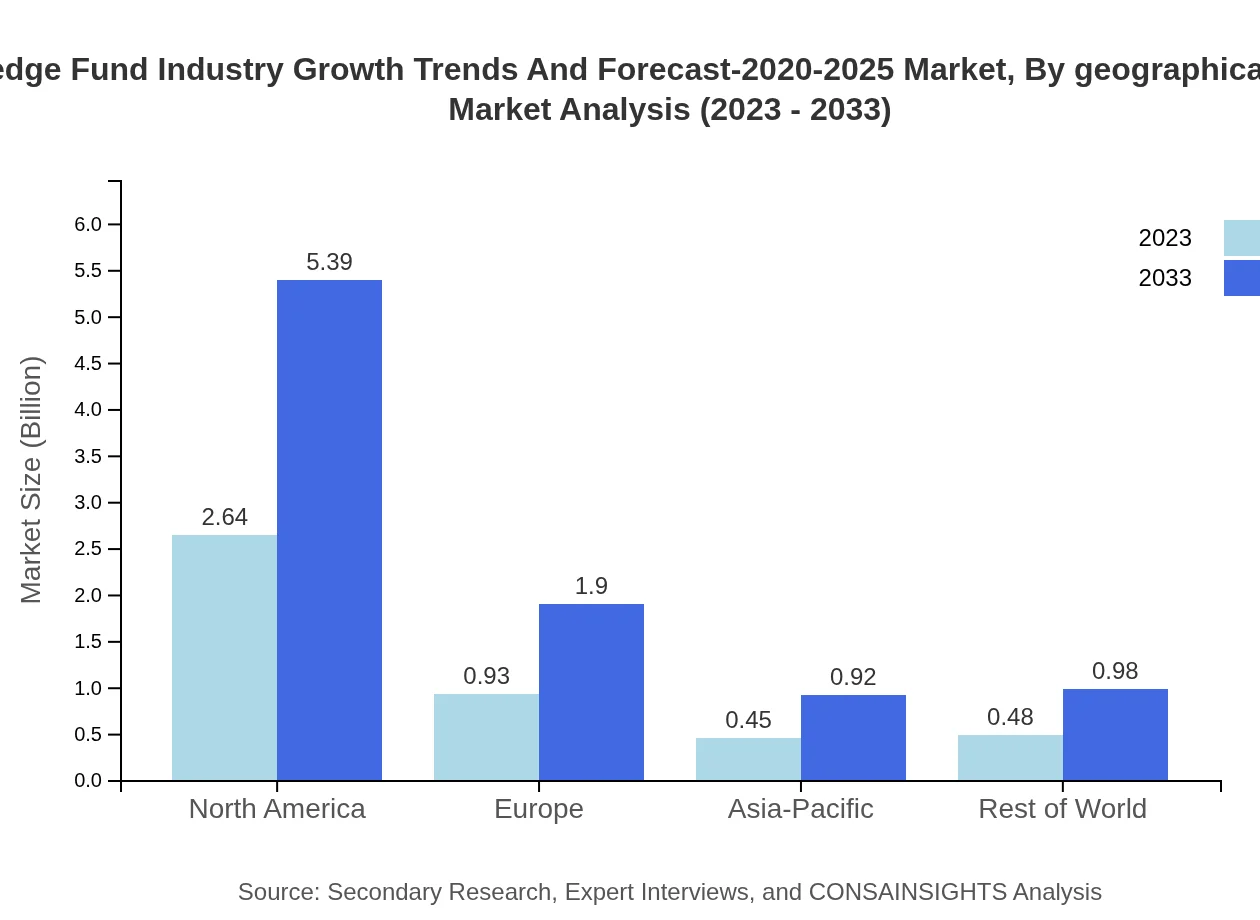

Key strategies and their growth forecasts include: - Long/Short Equity: Projected to grow from $2.64 trillion in 2023 to $5.39 trillion by 2033, commanding 58.64% market share. - Global Macro: Expected to increase from $0.93 trillion to $1.90 trillion, holding 20.65% share. - Quantitative Strategies: Anticipated to grow from $0.45 trillion to $0.92 trillion, with a 10.04% market share. - Event-Driven Strategies: Forecasted to rise from $0.48 trillion to $0.98 trillion, maintaining a 10.67% share.

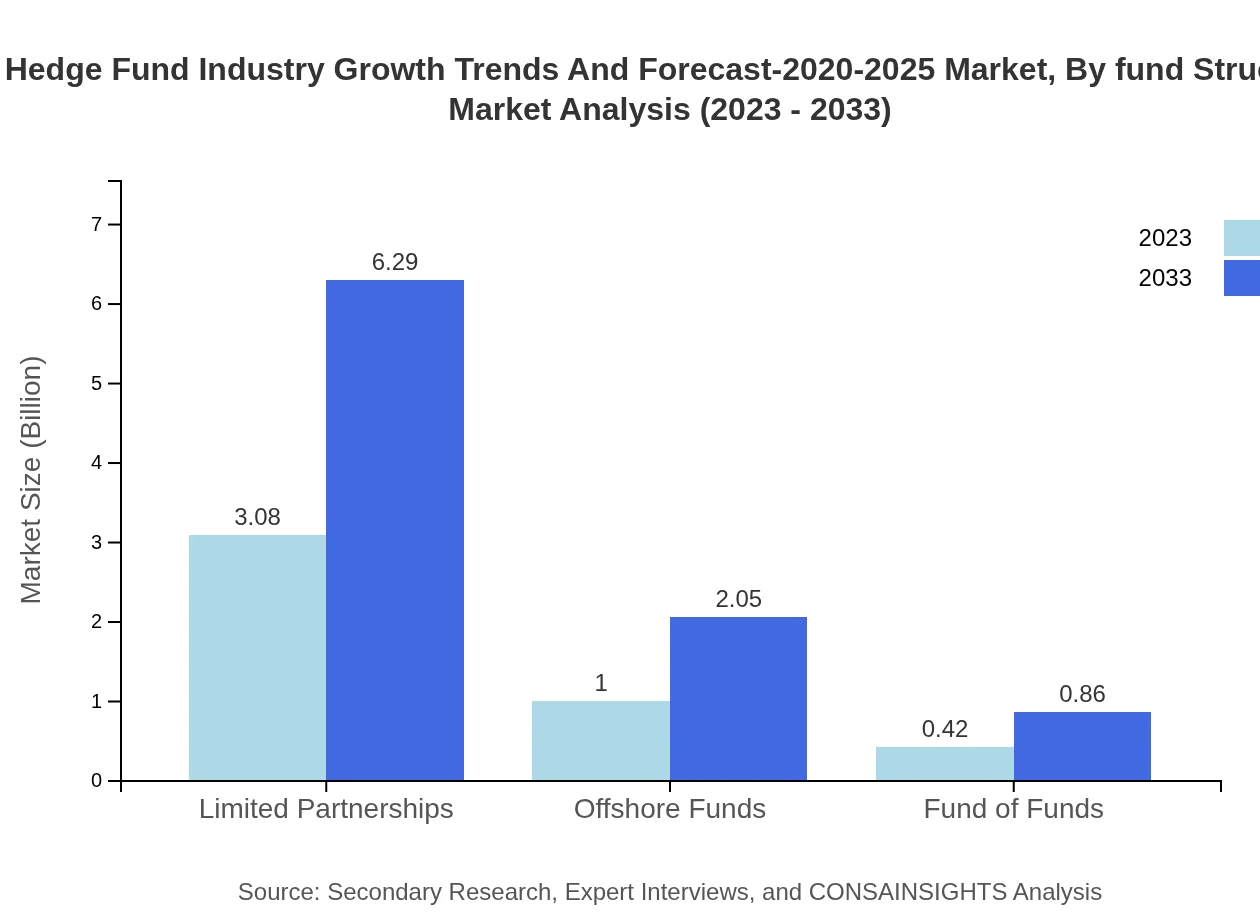

Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Analysis By Fund Structure

The fund structure segment comprises limited partnerships, offshore funds, and fund of funds, with the market expected to expand effectively. Limited partnerships will remain dominant, showing significant growth from $3.08 trillion to $6.29 trillion, retaining a substantial share of 68.34%. Offshore funds and fund of funds are also projected to see growth reflecting increasing global investments.

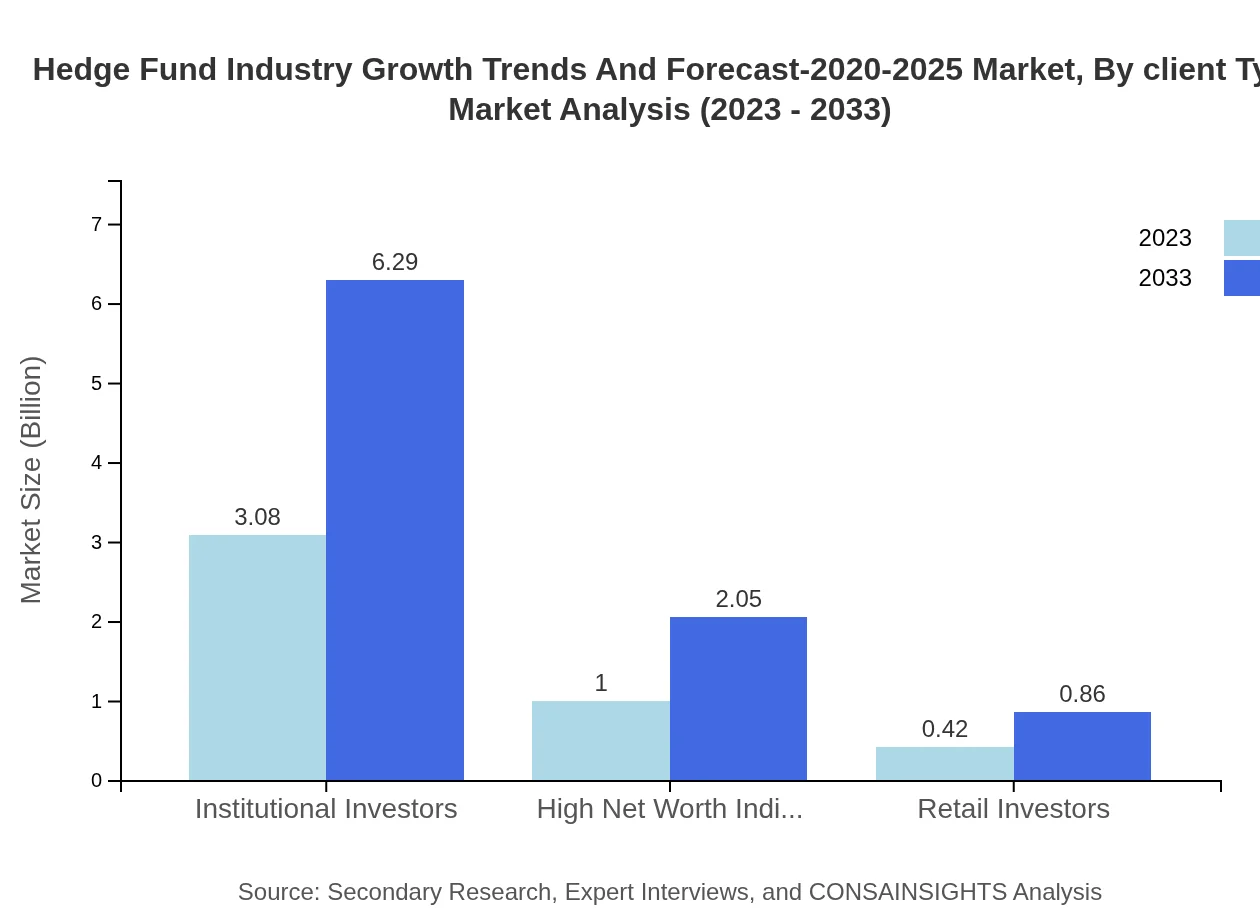

Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Analysis By Client Type

The client type segment shows distinct growth patterns. Institutional investors lead significantly, projected to shift from $3.08 trillion to $6.29 trillion, providing a 68.34% market share. High net worth individuals are also expected to grow substantially, while retail investors are poised for steady growth as their participation in hedge funds increases.

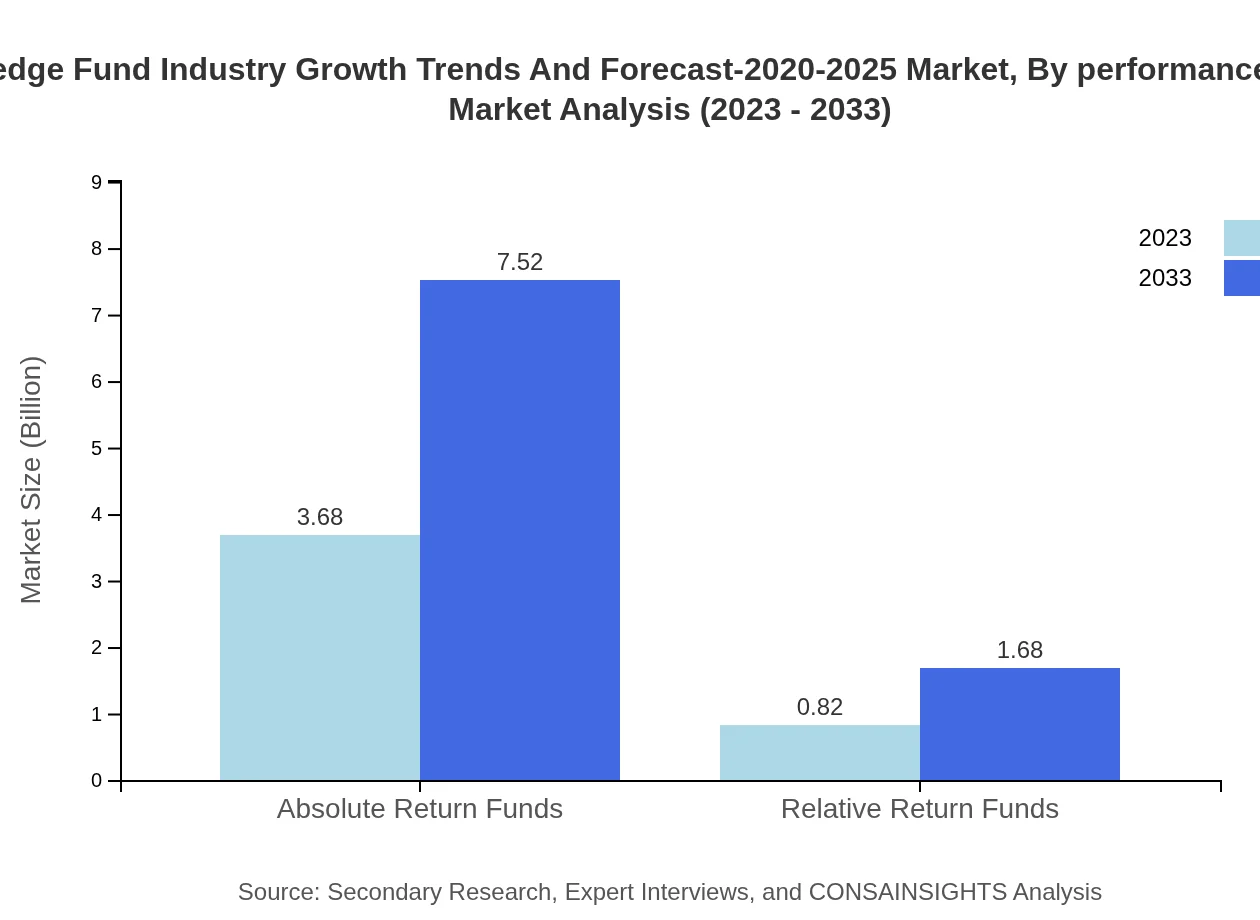

Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Analysis By Performance Metric

The performance metric sector includes absolute return funds, which project growth from $3.68 trillion to $7.52 trillion (81.75% share), and relative return funds, expected to expand from $0.82 trillion to $1.68 trillion (18.25% share). This segmentation reflects a growing demand for performance-based compensation models.

Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Analysis By Geographical Focus

Geographical focus reveals strong demand across various regions. North America leads, followed by Europe and Asia-Pacific, with projections showing robust growth in all geographies due to the diversification approaches and investment strategy deployment across markets.

Hedge Fund Industry Growth Trends And Forecast-2020-2025 Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hedge Fund Industry Growth Trends And Forecast-2020-2025 Industry

Bridgewater Associates:

A leading hedge fund firm known for pioneering the investment strategy approach of pure alpha and risk parity, managing over $140 billion in assets.Renaissance Technologies:

Famous for utilizing quantitative analysis and algorithmic trading strategies, Renaissance manages billions and is recognized for its proprietary technology development.Man Group:

One of the largest publicly traded hedge fund companies, specializing in active investment management and multi-strategy approaches.Two Sigma Investments:

A tech-driven hedge fund with cutting-edge technology and data science approaches to investments, managing substantial capital across various strategies.AQR Capital Management:

A pioneer of quantitative investing, AQR combines traditional and alternative investment strategies and offers a diversified portfolio to its clients.We're grateful to work with incredible clients.

FAQs

What is the market size of hedge Fund Industry Growth Trends And Forecast-2020-2025?

The hedge fund industry is valued at approximately $4.5 trillion in 2023, with a projected CAGR of 7.2% through 2025. This growth reflects the increasing capital allocation towards hedge funds as investors seek alternative investment avenues.

What are the key market players or companies in this hedge fund industry?

Key players in the hedge fund industry include prominent firms such as Bridgewater Associates, Renaissance Technologies, and Man Group. These firms are notable for their innovative strategies and significant market influence.

What are the primary factors driving the growth in the hedge fund industry?

Growth in the hedge fund industry is driven by increased demand for diversification, the pursuit of higher returns, and enhanced risk management strategies. Additionally, rising wealth among high net worth individuals and institutional investors fuels this demand.

Which region is the fastest Growing in the hedge fund industry?

North America is the fastest-growing region, with a market size expected to reach $3.34 trillion by 2033, up from $1.63 trillion in 2023. Following North America, Europe and Asia-Pacific are also seeing robust growth, reflecting increased investment interest.

Does ConsaInsights provide customized market report data for the hedge fund industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the hedge fund industry, ensuring that clients receive relevant insights and analytics based on their strategic interests or investment goals.

What deliverables can I expect from this hedge fund market research project?

From the hedge fund market research project, you can expect comprehensive reports detailing market size, trends, competitive analyses, forecasts, and sector insights. These deliverables will equip you with actionable information for informed investment decisions.

What are the market trends of hedge fund industry?

Current trends in the hedge fund industry include a shift towards quantitative and algorithm-driven strategies, along with increased focus on ESG (Environmental, Social, and Governance) investments. Furthermore, the growth of digital assets is creating new investment opportunities.