Held Pulse Oximeter Market Report

Published Date: 31 January 2026 | Report Code: held-pulse-oximeter

Held Pulse Oximeter Market Size, Share, Industry Trends and Forecast to 2033

This report offers comprehensive insights into the Held Pulse Oximeter market, analyzing growth trends, regional dynamics, and emerging technologies between 2023 and 2033, providing key data for stakeholders.

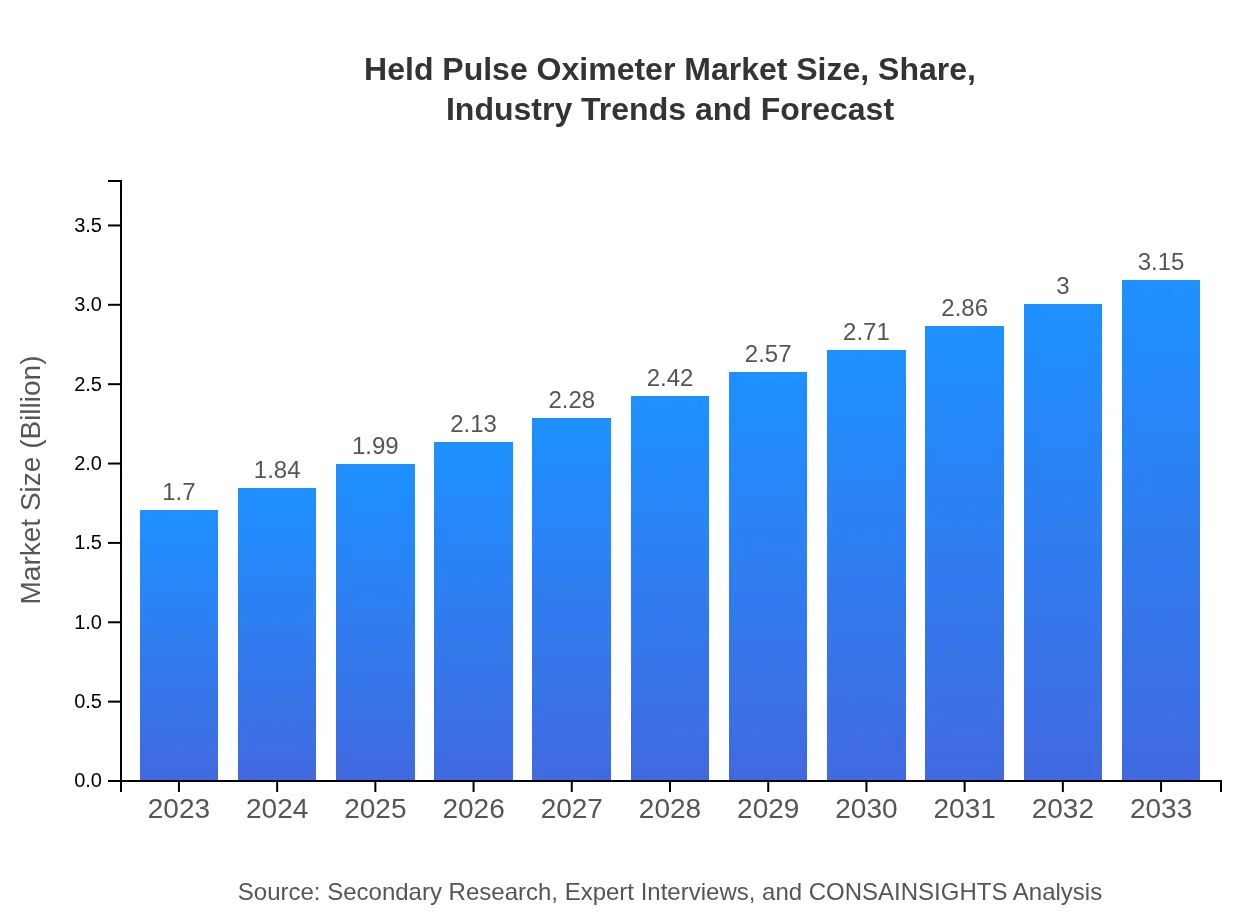

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.70 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.15 Billion |

| Top Companies | Medtronic , Masimo Corporation, Philips Healthcare, Nonin Medical, Inc., Zebra Medical Technologies |

| Last Modified Date | 31 January 2026 |

Held Pulse Oximeter Market Overview

Customize Held Pulse Oximeter Market Report market research report

- ✔ Get in-depth analysis of Held Pulse Oximeter market size, growth, and forecasts.

- ✔ Understand Held Pulse Oximeter's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Held Pulse Oximeter

What is the Market Size & CAGR of Held Pulse Oximeter market in 2023 and 2033?

Held Pulse Oximeter Industry Analysis

Held Pulse Oximeter Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Held Pulse Oximeter Market Analysis Report by Region

Europe Held Pulse Oximeter Market Report:

In Europe, the market is set to grow from 0.48 billion USD in 2023 to 0.90 billion USD in 2033. The adoption of portable health monitoring devices and the focus on preventive healthcare are significant factors contributing to this trend.Asia Pacific Held Pulse Oximeter Market Report:

In the Asia Pacific region, the Held Pulse Oximeter market is expected to grow from 0.33 billion USD in 2023 to 0.61 billion USD in 2033, driven by rising healthcare expenditure and increasing prevalence of respiratory conditions. The region's expanding geriatric population is also a significant contributor to this growth.North America Held Pulse Oximeter Market Report:

North America holds a dominant share in the global market, with the market size anticipated to increase from 0.62 billion USD in 2023 to 1.14 billion USD in 2033. High healthcare awareness, advanced healthcare infrastructure, and innovations in telehealth are primary drivers for this growth.South America Held Pulse Oximeter Market Report:

South America is projected to witness growth from 0.16 billion USD in 2023 to 0.30 billion USD in 2033. Factors such as increasing healthcare access and growing awareness of health monitoring practices are expected to fuel this market.Middle East & Africa Held Pulse Oximeter Market Report:

The Middle East and Africa region is expected to expand from 0.11 billion USD in 2023 to 0.20 billion USD in 2033. Increasing healthcare investments and initiatives to improve healthcare accessibility are pivotal to market growth in this region.Tell us your focus area and get a customized research report.

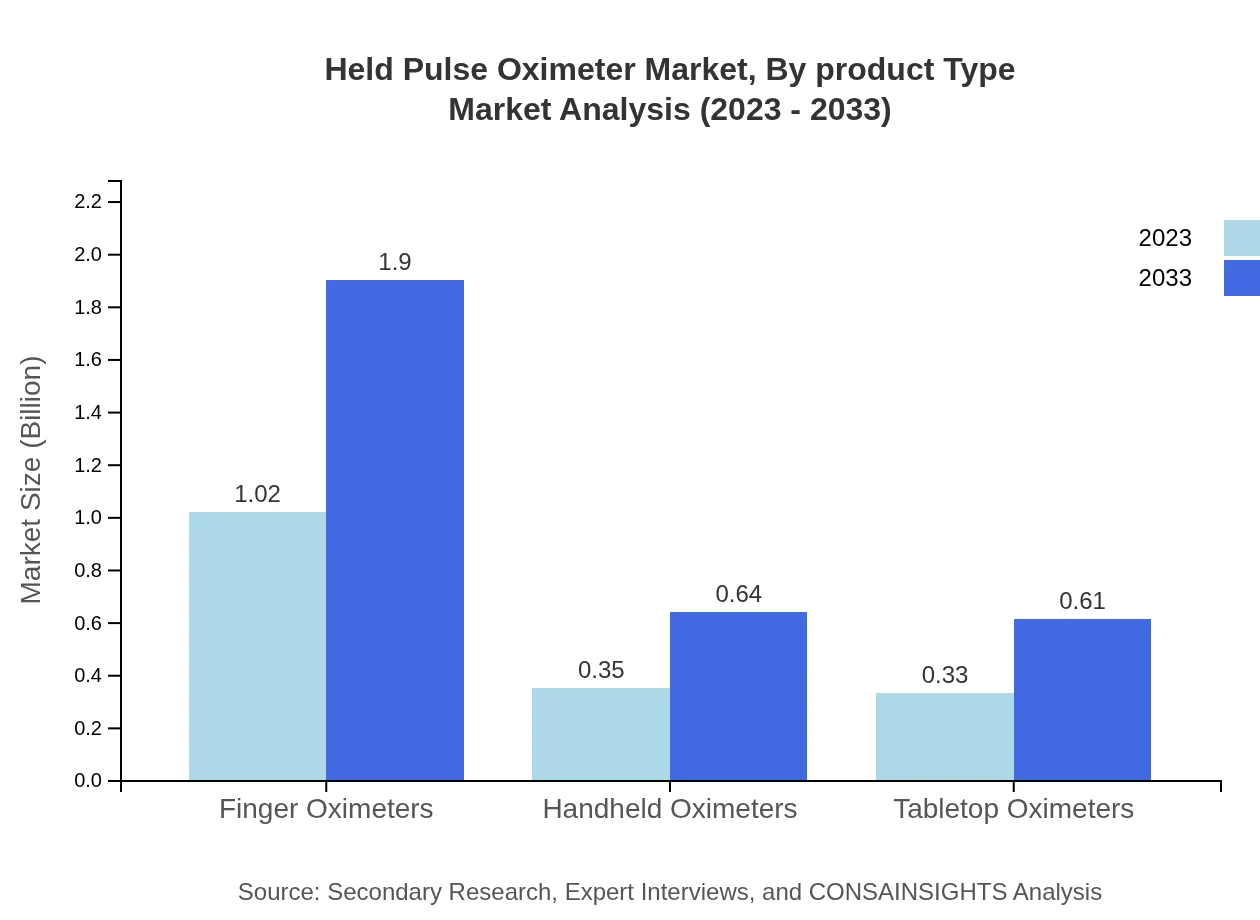

Held Pulse Oximeter Market Analysis By Product Type

The Held Pulse Oximeter market by product type includes finger oximeters, handheld oximeters, and tabletop oximeters. Finger oximeters dominate the market with a size of approximately 1.02 billion USD in 2023 and are projected to reach 1.90 billion USD by 2033, capturing around 60.24% of the market share. Handheld oximeters and tabletop oximeters are also significant, with sizes of 0.35 billion USD and 0.33 billion USD in 2023, respectively.

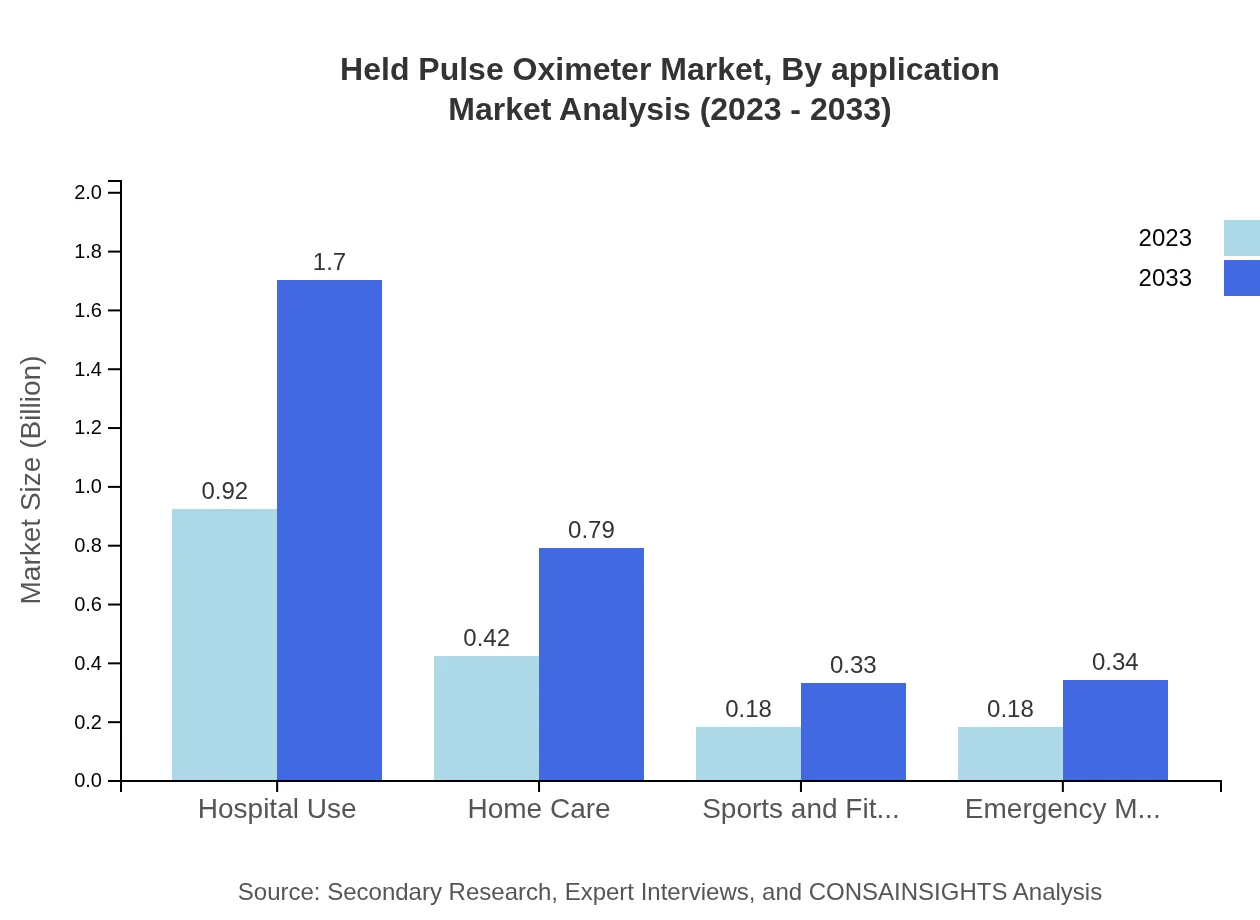

Held Pulse Oximeter Market Analysis By Application

The application segments include hospitals, clinics, home healthcare, fitness centers, and emergency medical services. Hospitals account for the major share, with a size of 0.92 billion USD in 2023, expected to expand to 1.70 billion USD by 2033, retaining a market share of 53.87%. Home healthcare and fitness centers are also growing segments, indicating the rising demand for personal health monitoring solutions.

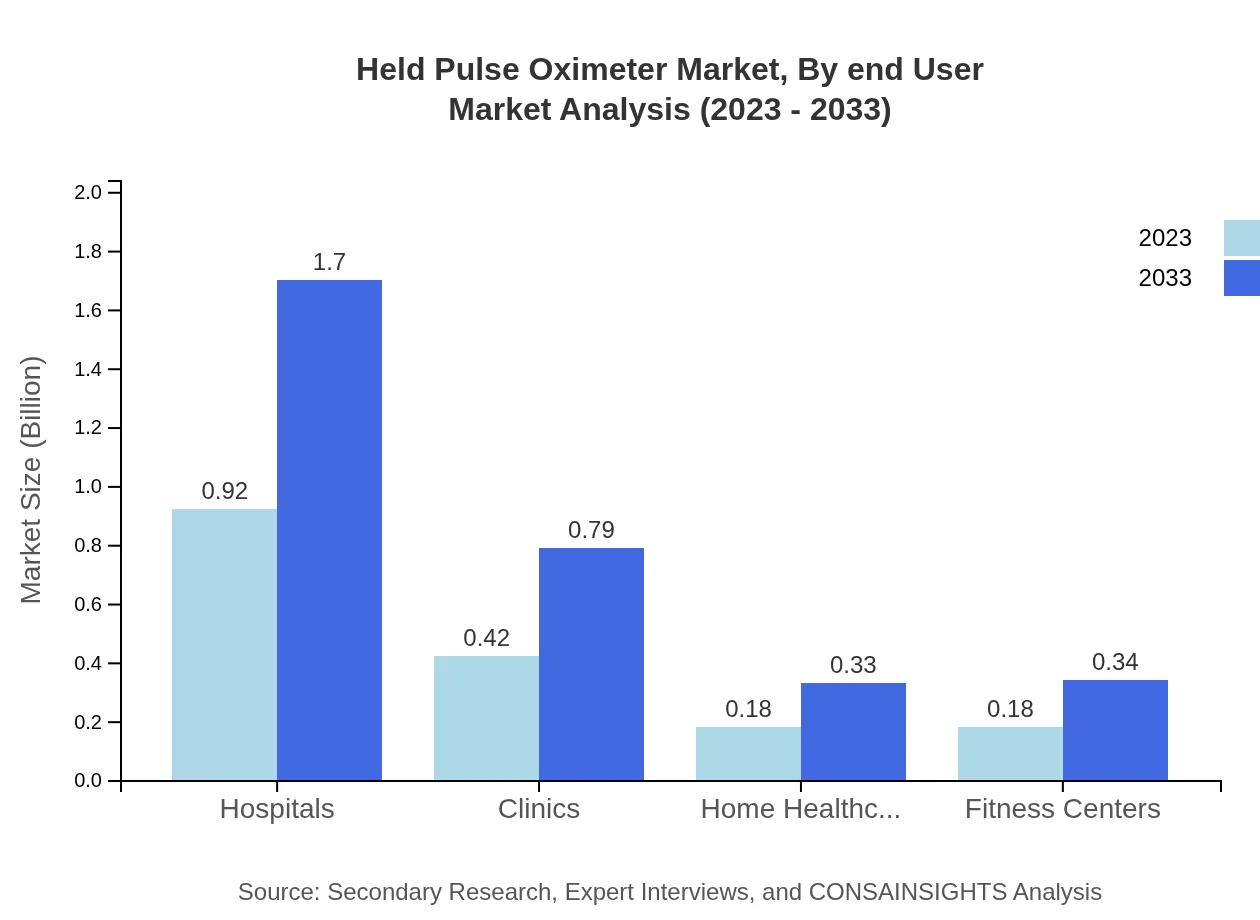

Held Pulse Oximeter Market Analysis By End User

End users primarily consist of healthcare professionals and individual consumers. The demand from healthcare providers is substantial, reflected in the 0.92 billion USD size for hospitals in 2023. Individual consumers leverage these devices for home monitoring and fitness tracking, indicating a strong consumer market segment.

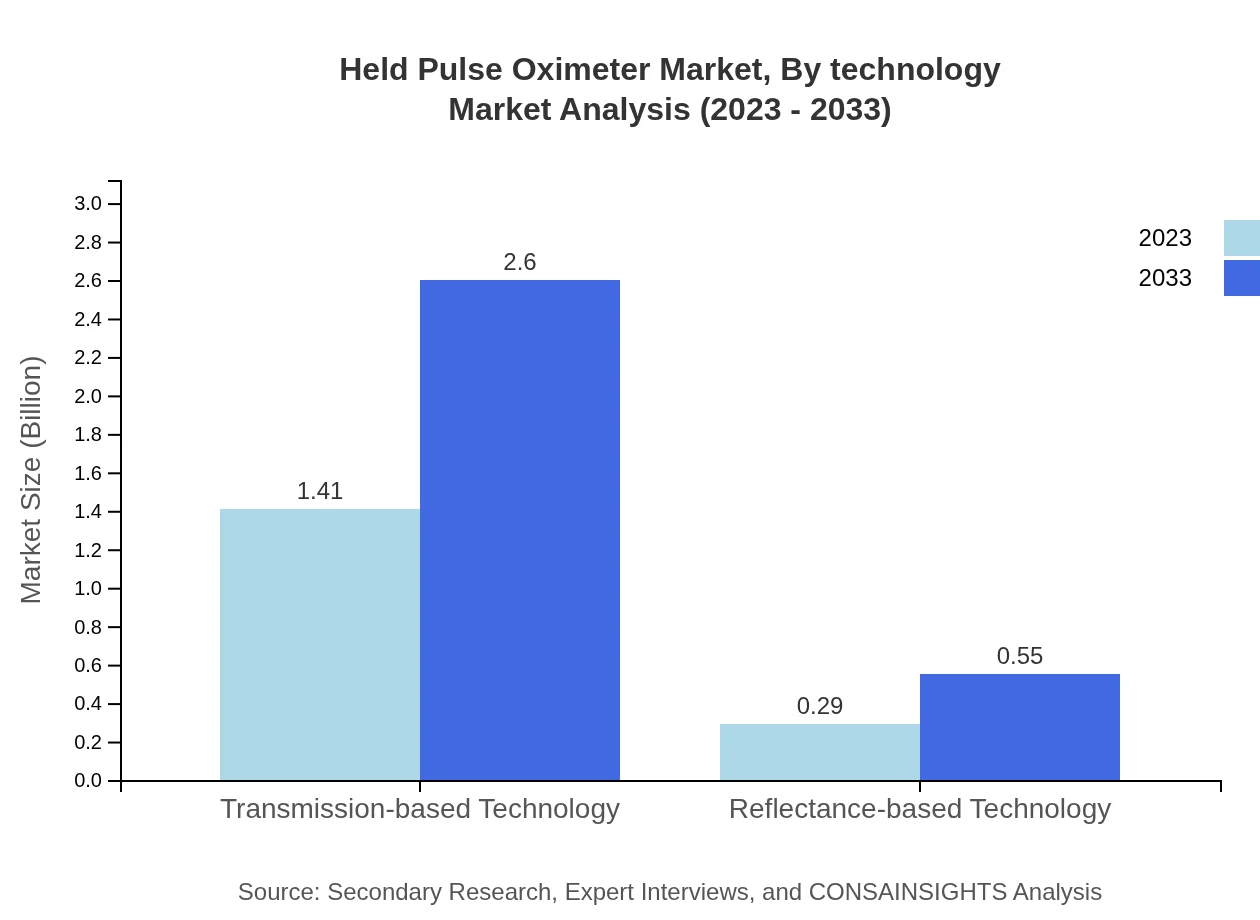

Held Pulse Oximeter Market Analysis By Technology

The technology segmentation features transmission-based and reflectance-based technologies. Transmission-based technology holds a significant market size of 1.41 billion USD in 2023, poised to grow to 2.60 billion USD by 2033, capturing 82.68% of the market share. Reflectance-based technology, while a smaller segment, is critical in specific applications.

Held Pulse Oximeter Market Analysis By Distribution Channel

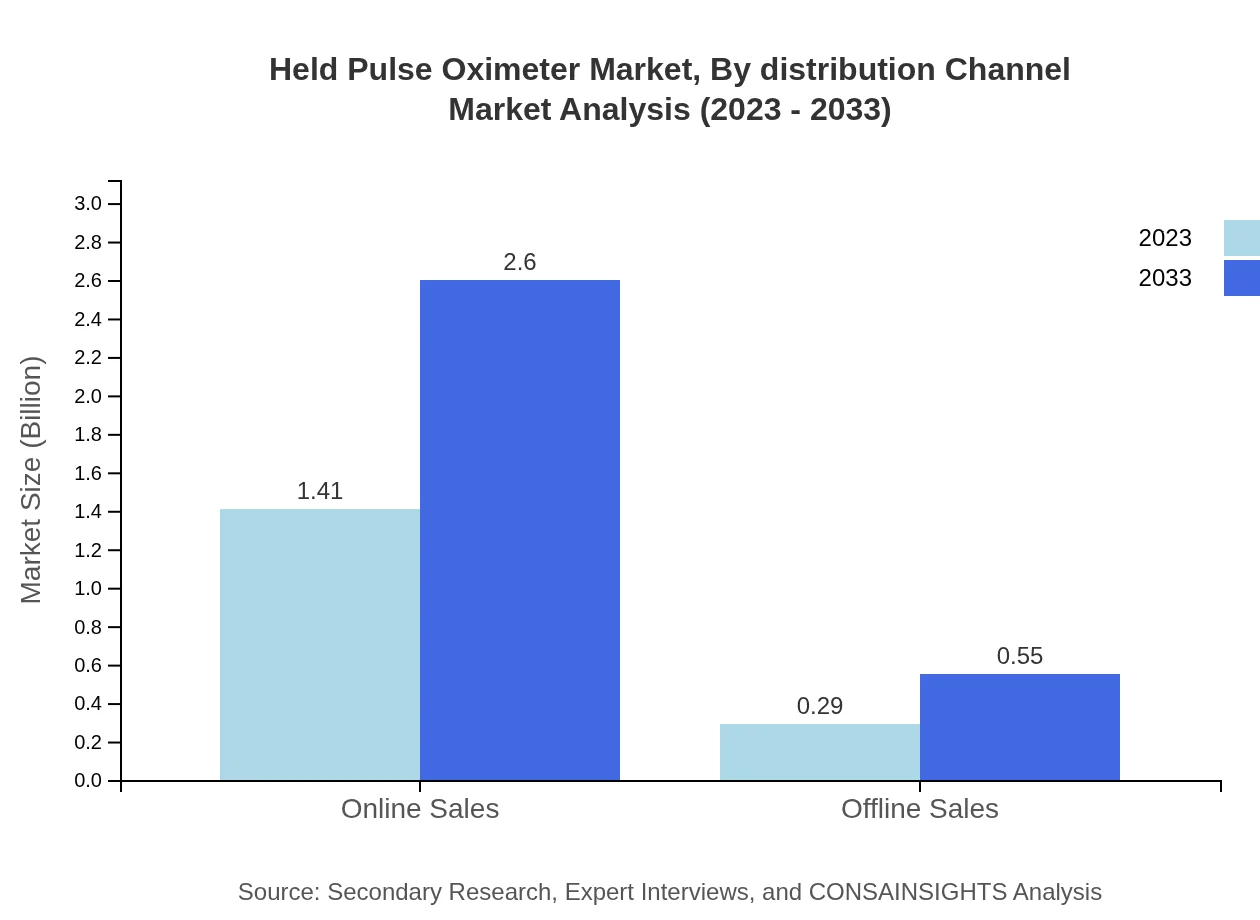

Distribution channels include online and offline sales. Online sales dominate the market with a size of 1.41 billion USD in 2023, anticipated to grow to 2.60 billion USD by 2033, marking 82.68% of the total market share. Offline sales, although significant, account for a smaller portion of the market, indicating a shift in consumer purchasing preferences.

Held Pulse Oximeter Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Held Pulse Oximeter Industry

Medtronic :

A leading global healthcare solutions company, Medtronic specializes in innovative technologies and devices for chronic conditions, including advanced oximetry solutions.Masimo Corporation:

Masimo is renowned for its groundbreaking noninvasive monitoring technologies, providing pulse oximetry solutions that enhance patient care and outcomes.Philips Healthcare:

Philips is a global leader in healthcare technologies, focusing on improving people's health and well-being through innovative solutions, including pulse oximeters.Nonin Medical, Inc.:

Nonin specializes in innovative pulse oximetry technologies, emphasizing accuracy and reliability in diverse application settings.Zebra Medical Technologies:

Zebra Medical Technologies focuses on developing affordable and accessible pulse oximeters, catering to both consumer and clinical markets.We're grateful to work with incredible clients.

FAQs

What is the market size of held Pulse Oximeter?

The held-pulse oximeter market is projected to reach a size of $1.7 billion by 2033, growing at a robust CAGR of 6.2%. This growth highlights the increasing adoption of advanced health monitoring devices in healthcare settings.

What are the key market players or companies in this held Pulse Oximeter industry?

Key players in the held-pulse oximeter market include major medical device manufacturers and innovative startups focused on health technology, driving competition and advancements in design, accuracy, and connectivity features.

What are the primary factors driving the growth in the held Pulse Oximeter industry?

Growth in the held-pulse oximeter industry is primarily driven by rising health awareness, advancements in healthcare technology, and an increase in respiratory diseases. Telehealth services also contribute significantly to the demand for these devices.

Which region is the fastest Growing in the held Pulse Oximeter market?

The North American region is expected to be the fastest-growing market, with growth from $0.62 billion in 2023 to $1.14 billion by 2033. This rise can be attributed to increased health expenditure and technological advancements.

Does ConsaInsights provide customized market report data for the held Pulse Oximeter industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the held-pulse oximeter industry, allowing stakeholders to make informed decisions based on detailed insights and analytics.

What deliverables can I expect from this held Pulse Oximeter market research project?

Deliverables include comprehensive market analyses, forecasts, competitive landscape assessments, and segmented data, covering various applications like hospitals, clinics, and fitness centers.

What are the market trends of held Pulse Oximeter?

Current trends in the held-pulse oximeter market include increased usage in home healthcare, a rise in online sales, and innovations in sensor technology, influencing healthcare accessibility and patient monitoring.