Helicopter Blades Market Report

Published Date: 03 February 2026 | Report Code: helicopter-blades

Helicopter Blades Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Helicopter Blades market from 2023 to 2033, covering critical insights such as market size, trends, segmentation, and regional dynamics. It serves as a comprehensive guide for stakeholders in the industry.

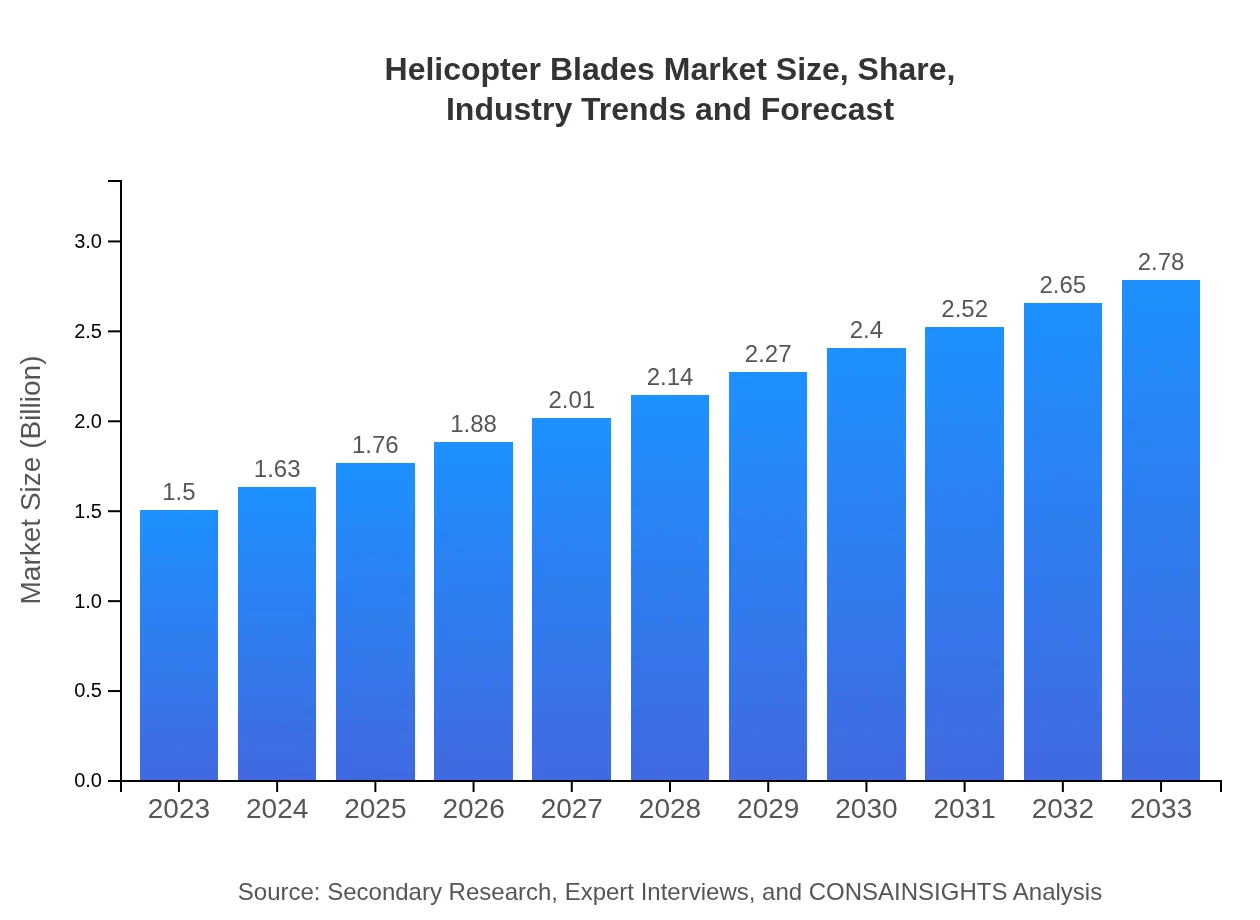

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Bell Helicopter, Airbus Helicopters, Sikorsky Aircraft Corporation, Leonardo S.p.A. |

| Last Modified Date | 03 February 2026 |

Helicopter Blades Market Overview

Customize Helicopter Blades Market Report market research report

- ✔ Get in-depth analysis of Helicopter Blades market size, growth, and forecasts.

- ✔ Understand Helicopter Blades's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Helicopter Blades

What is the Market Size & CAGR of Helicopter Blades market in 2033?

Helicopter Blades Industry Analysis

Helicopter Blades Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Helicopter Blades Market Analysis Report by Region

Europe Helicopter Blades Market Report:

The European helicopter blades market is projected to expand from $0.46 billion in 2023 to $0.85 billion by 2033. The increase is fueled by advancements in helicopter safety technologies and growing interest in urban air mobility initiatives.Asia Pacific Helicopter Blades Market Report:

In the Asia Pacific region, the helicopter blades market is expected to grow from $0.30 billion in 2023 to $0.55 billion in 2033. Key factors driving this growth include increasing investments in military helicopters, rising demand for air ambulances, and expanding civil aviation sectors in countries such as China and India.North America Helicopter Blades Market Report:

North America leads the helicopter blades market with estimates of growing from $0.52 billion in 2023 to $0.97 billion by 2033. The region's growth is attributed to high defense budgets, significant civil aviation growth, and innovations in rotorcraft technology.South America Helicopter Blades Market Report:

The South America market for helicopter blades is forecasted to elevate from $0.15 billion in 2023 to $0.27 billion in 2033. The growth is driven by increased government investments in public safety and the expansion of commercial helicopter services in Brazil.Middle East & Africa Helicopter Blades Market Report:

In the Middle East and Africa, the market is set to grow from $0.08 billion in 2023 to $0.14 billion in 2033, supported by increasing military budgets and the use of helicopters for oil and gas exploration.Tell us your focus area and get a customized research report.

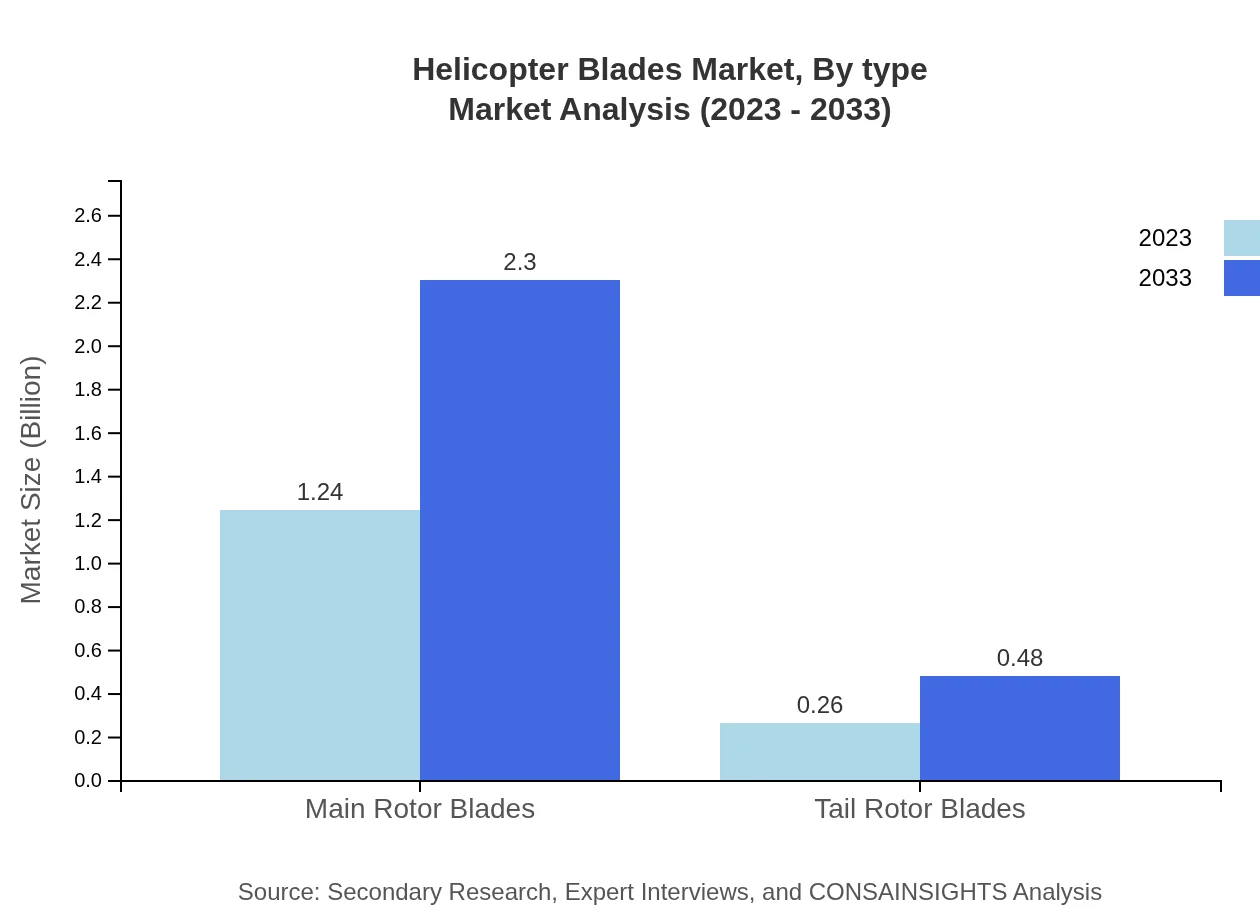

Helicopter Blades Market Analysis By Type

The helicopter blades market, by type, consists primarily of main rotor blades and tail rotor blades. In 2023, the main rotor blades segment holds a market size of $1.24 billion, expected to grow to $2.30 billion by 2033, capturing an 82.68% share. Tail rotor blades show significant growth potential as well, increasing from $0.26 billion in 2023 to $0.48 billion in 2033, accounting for a 17.32% market share.

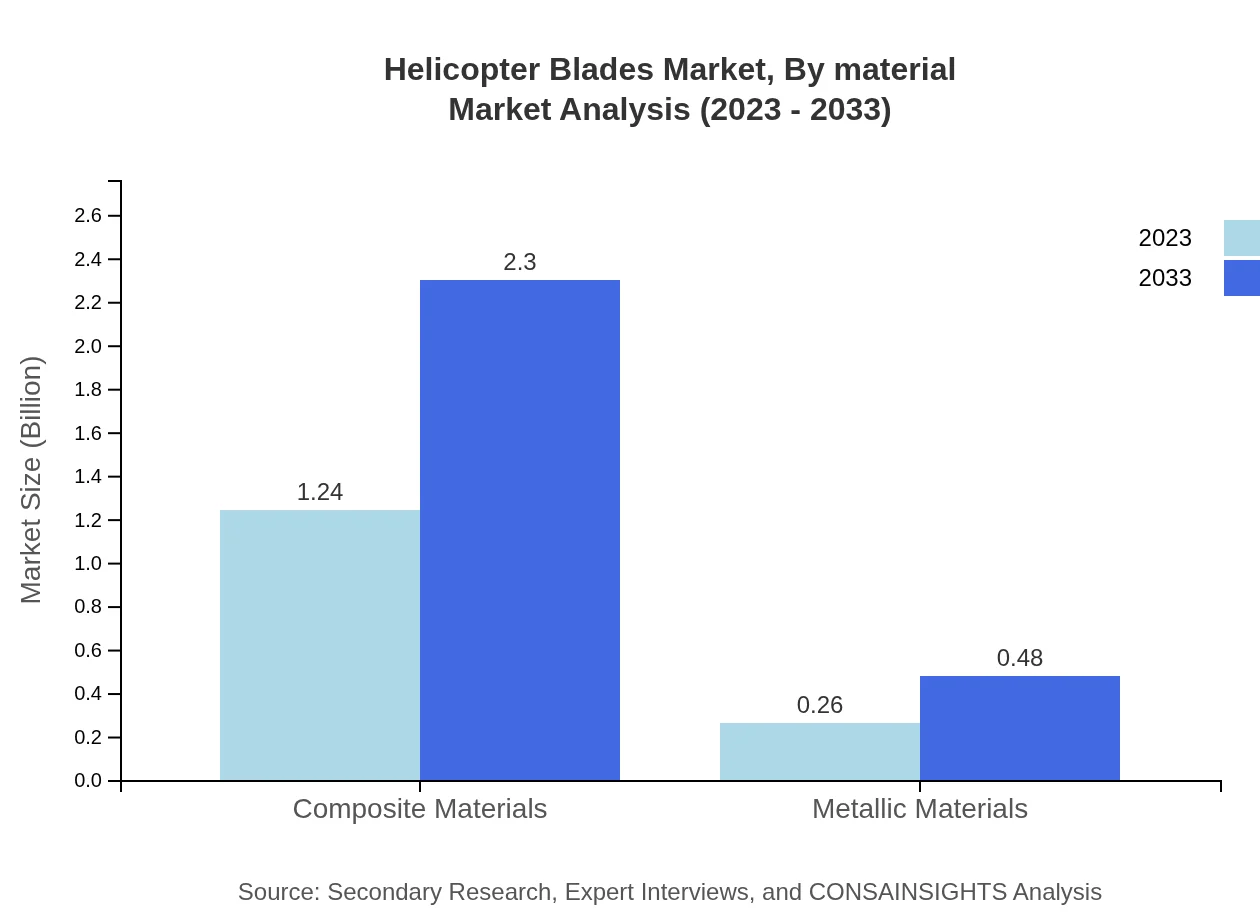

Helicopter Blades Market Analysis By Material

Analyzing by material, the market showcases a dominance of composite materials, valued at $1.24 billion in 2023 and anticipated to reach $2.30 billion by 2033, representing 82.68% of the market share. Conversely, metallic materials exhibit growth from $0.26 billion to $0.48 billion, comprising 17.32% by 2033.

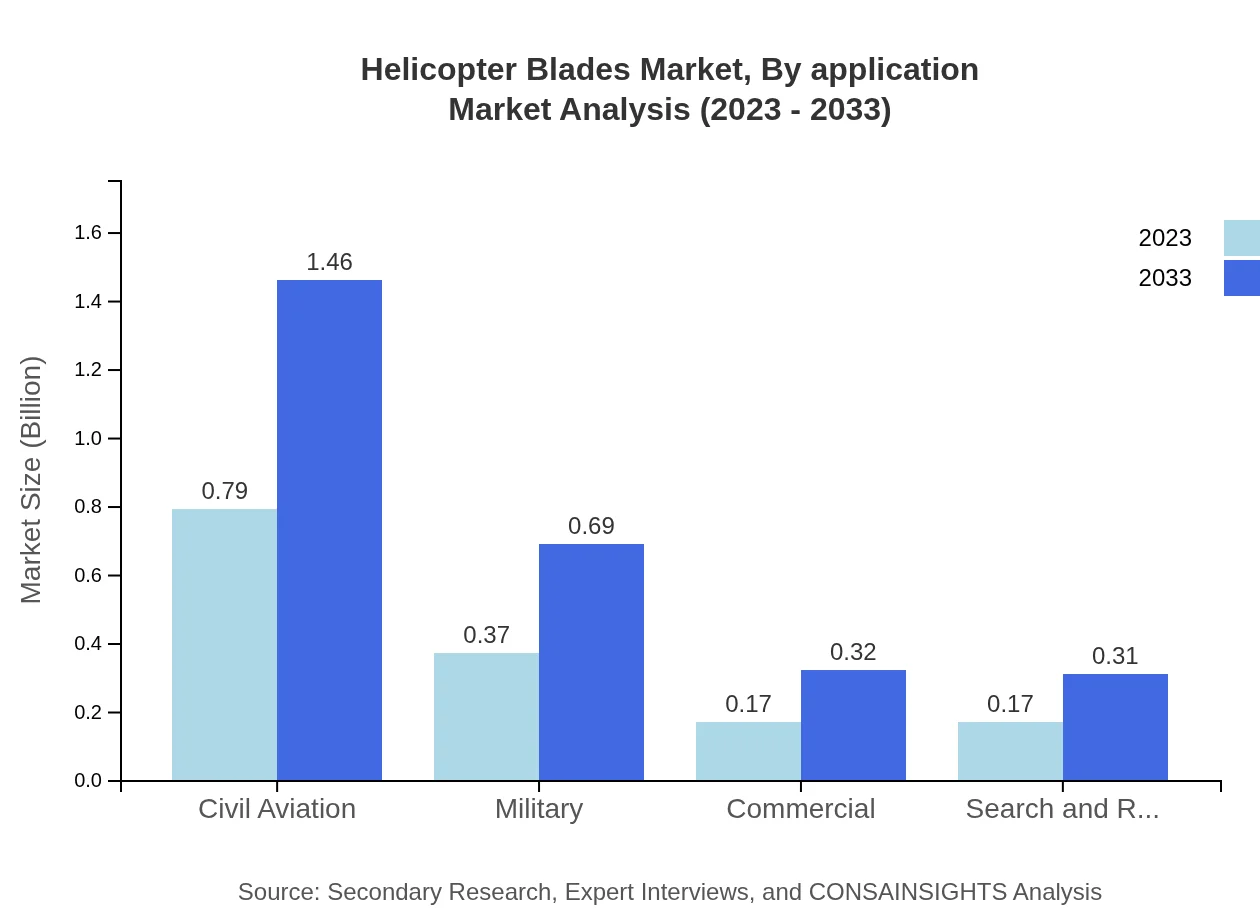

Helicopter Blades Market Analysis By Application

By application, civil aviation leads with a market size of $0.79 billion in 2023, projected to rise to $1.46 billion by 2033 (52.62% share). Military applications follow, expanding from $0.37 billion to $0.69 billion, capturing 24.85% of the share.

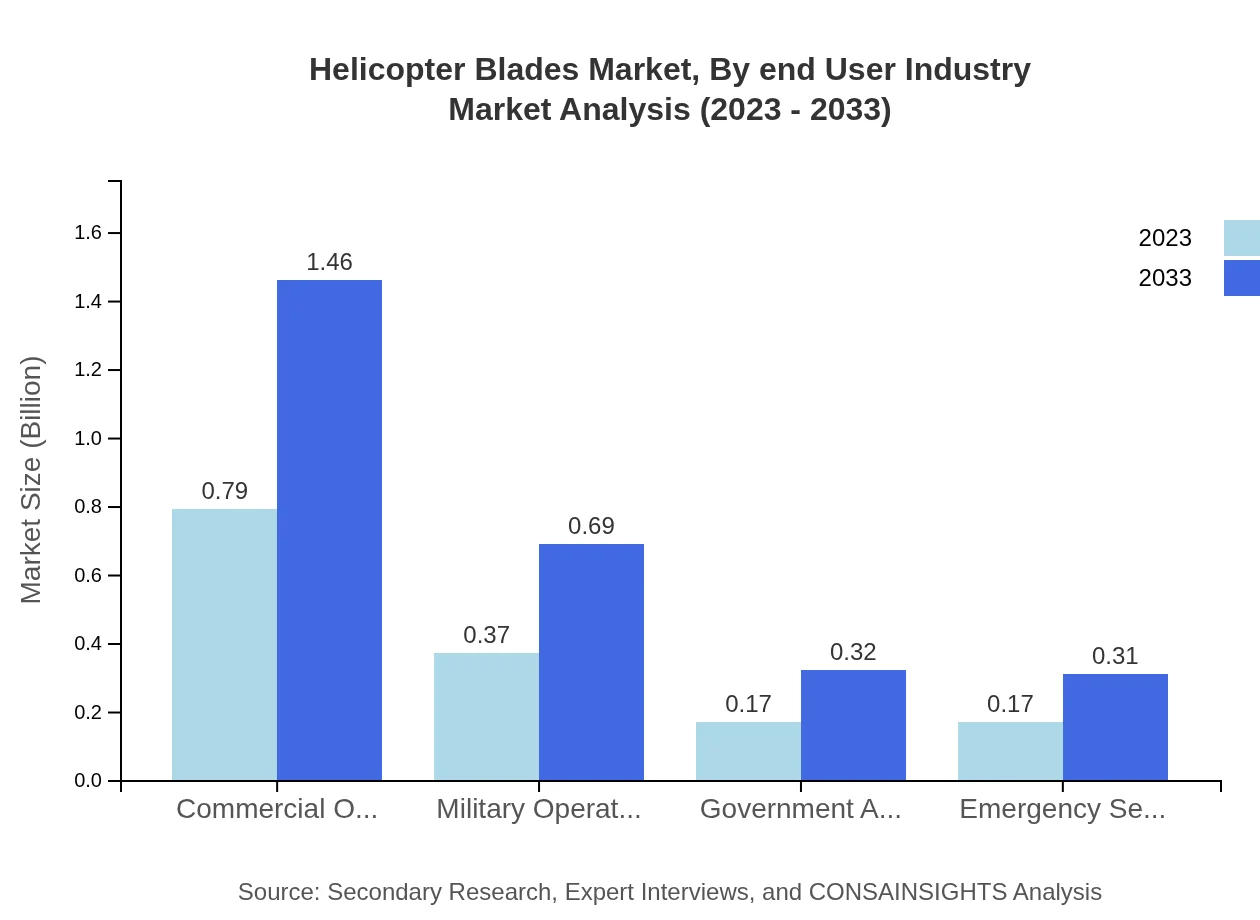

Helicopter Blades Market Analysis By End User Industry

Segmentation by end-user industry highlights commercial operators as the largest segment, growing from $0.79 billion in 2023 to $1.46 billion in 2033 (52.62% share). Military operators also show significant potential for growth, increasing from $0.37 billion to $0.69 billion, accounting for 24.85%.

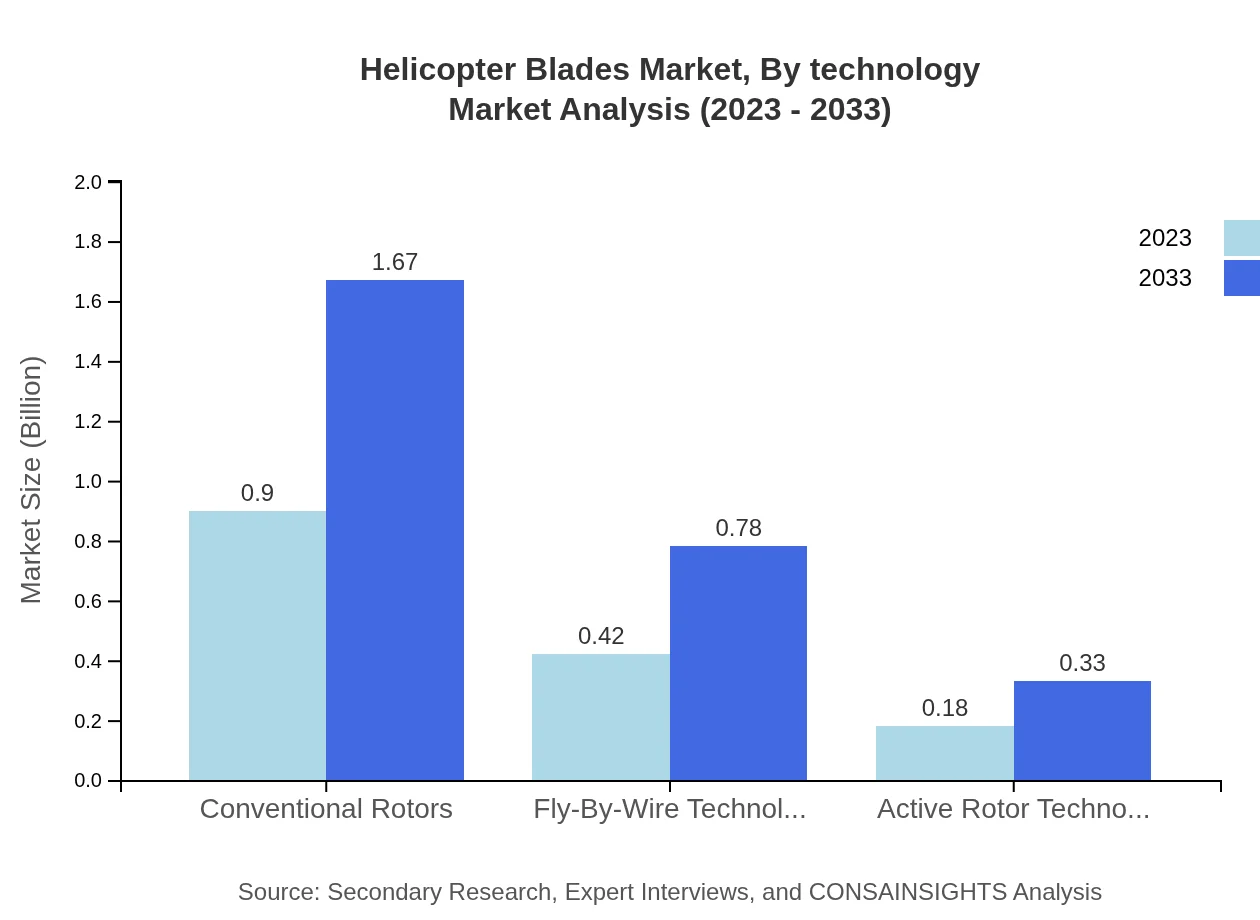

Helicopter Blades Market Analysis By Technology

The market analysis by technology reveals trends towards advanced rotor technologies such as Fly-By-Wire and Active Rotor Technology, with Fly-By-Wire technologies expected to grow from $0.42 billion in 2023 to $0.78 billion in 2033 (28.01% share). Active Rotor Technology is projected to increase from $0.18 billion to $0.33 billion during the same period (11.8% share).

Helicopter Blades Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Helicopter Blades Industry

Bell Helicopter:

A major player in the rotorcraft market, Bell Helicopter is known for its innovative designs and manufacturing capabilities in helicopter blades and systems.Airbus Helicopters:

A subsidiary of Airbus, Airbus Helicopters specializes in designing and manufacturing high-performance helicopters and blades, emphasizing aerospace advancements and safety.Sikorsky Aircraft Corporation:

Part of Lockheed Martin, Sikorsky is a prominent player producing helicopters and associated components, including advanced rotor blade technologies.Leonardo S.p.A.:

This Italian aerospace and defense company focuses on helicopters, offering cutting-edge designs, which include advanced rotor blades for enhanced performance.We're grateful to work with incredible clients.

FAQs

What is the market size of helicopter Blades?

The global helicopter blades market size is projected to reach $1.5 billion by 2033, growing at a CAGR of 6.2%. In 2023, the market was valued at around $1.5 billion, reflecting steady demand and advancements in rotor technologies.

What are the key market players or companies in this helicopter Blades industry?

Key players in the helicopter blades industry include major aerospace manufacturers and defense contractors. Leading companies are investing in advanced materials and innovative technologies to enhance performance and safety, maintaining competitiveness in this growing market.

What are the primary factors driving the growth in the helicopter blades industry?

Growth in the helicopter blades market is driven by increased demand for advanced rotorcraft, military uses, and civil aviation applications. Technological innovation and a rise in air transportation needs further stimulate market expansion, leading to higher investments in R&D.

Which region is the fastest Growing in the helicopter blades market?

The North America region is projected to be the fastest-growing market for helicopter blades, expanding from a size of $0.52 billion in 2023 to $0.97 billion by 2033. Other regions like Europe and Asia Pacific are also seeing significant growth.

Does ConsaInsights provide customized market report data for the helicopter blades industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs in the helicopter blades industry. This includes detailed analysis, insights, and data relevant to market dynamics and emerging trends.

What deliverables can I expect from this helicopter blades market research project?

You can expect comprehensive deliverables including market size analysis, growth forecasts, competitive landscape assessment, and trends identification. Additional insights specific to regional market performance and segmentations will also be provided.

What are the market trends of helicopter blades?

Current trends in the helicopter blades market include the increasing use of composite materials, technological advancements like Fly-By-Wire systems, and a rise in demand for military and rescue operations. This points to a shift towards more efficient and capable rotorcraft.