Helicopter Engines Market Report

Published Date: 03 February 2026 | Report Code: helicopter-engines

Helicopter Engines Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Helicopter Engines market, covering market trends, segmentation, regional insights, and forecasts from 2023 to 2033. It aims to offer valuable insights and data to stakeholders for informed decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

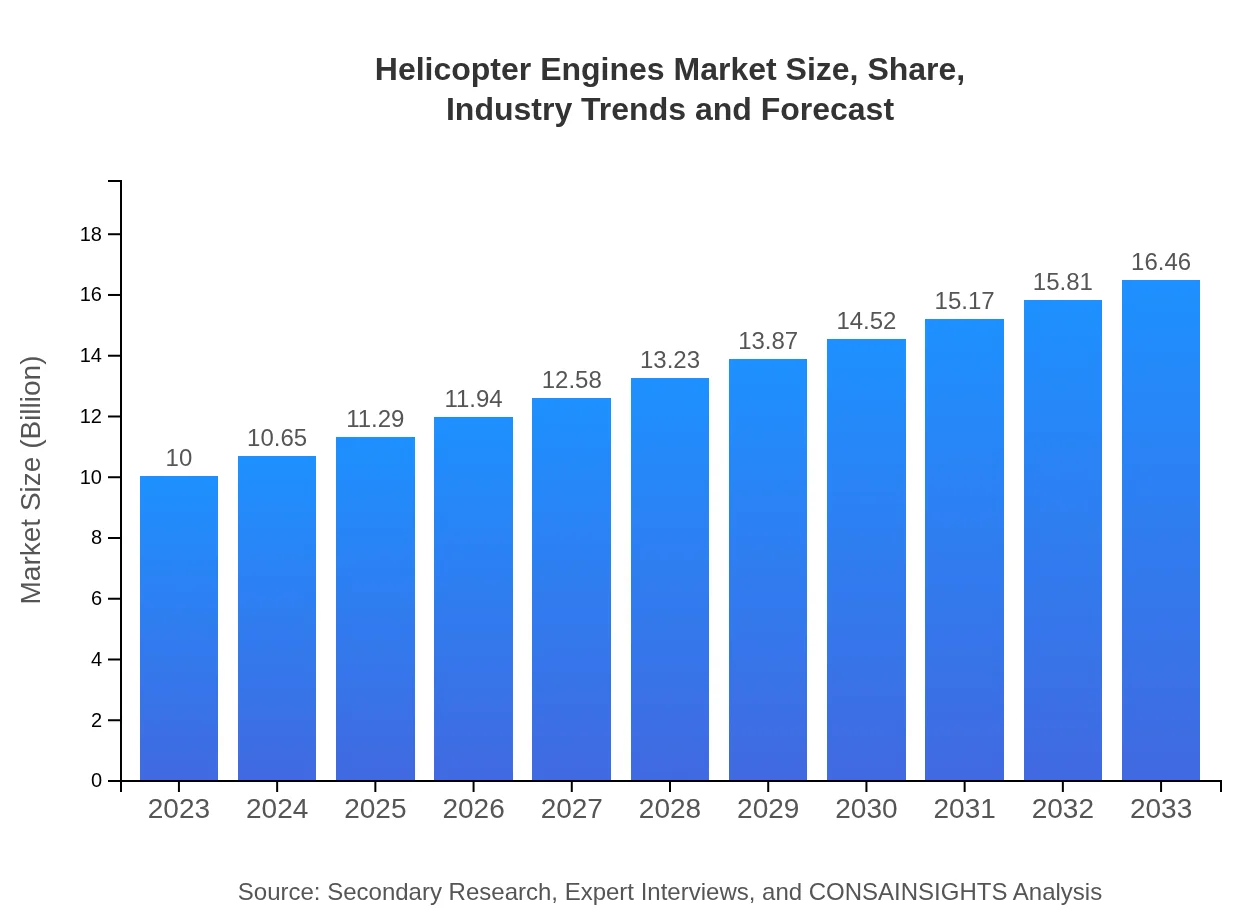

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | General Electric Company, Rolls-Royce Holdings plc, Safran Helicopter Engines, Honeywell International Inc., Pratt & Whitney Canada |

| Last Modified Date | 03 February 2026 |

Helicopter Engines Market Overview

Customize Helicopter Engines Market Report market research report

- ✔ Get in-depth analysis of Helicopter Engines market size, growth, and forecasts.

- ✔ Understand Helicopter Engines's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Helicopter Engines

What is the Market Size & CAGR of Helicopter Engines market in 2023?

Helicopter Engines Industry Analysis

Helicopter Engines Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Helicopter Engines Market Analysis Report by Region

Europe Helicopter Engines Market Report:

Europe's Helicopter Engines market is projected to grow from $3.23 billion in 2023 to $5.31 billion by 2033. This growth is encouraged by increasing helicopter operations for law enforcement and medical purposes, alongside initiatives to enhance aviation safety and efficiency. Collaborations between government and private entities are also promoting technological advancements.Asia Pacific Helicopter Engines Market Report:

In 2023, the Asia Pacific region's Helicopter Engines market is estimated at $1.89 billion, projected to grow to $3.12 billion by 2033. The growth is fueled by increasing helicopter utilization in countries like China and India, where investment in air mobility and infrastructure is rising. Furthermore, defense spending is expected to bolster military helicopter operations in the region.North America Helicopter Engines Market Report:

North America remains the largest market for Helicopter Engines, valued at $3.40 billion in 2023 and expected to grow to $5.60 billion by 2033. The demand for helicopters in both the military and civilian sectors, particularly utilizing advanced technologies, is driving market expansion. The region's prominent OEMs and strong defense budgets contribute significantly to this growth.South America Helicopter Engines Market Report:

The South American market, with a size of $0.72 billion in 2023, is anticipated to reach $1.19 billion by 2033. The region's growth is largely driven by the increasing adoption of helicopters for emergency medical services and the tourism industry. Additionally, political stability in several nations is promoting investment in aviation capabilities.Middle East & Africa Helicopter Engines Market Report:

The Middle East and Africa's market, estimated at $0.75 billion in 2023, is expected to reach $1.24 billion by 2033. Increased helicopter usage in defense, coupled with the need for efficient transportation in remote regions, is aiding market expansion. Investment in tourism and infrastructure projects further emphasizes growth potential in this region.Tell us your focus area and get a customized research report.

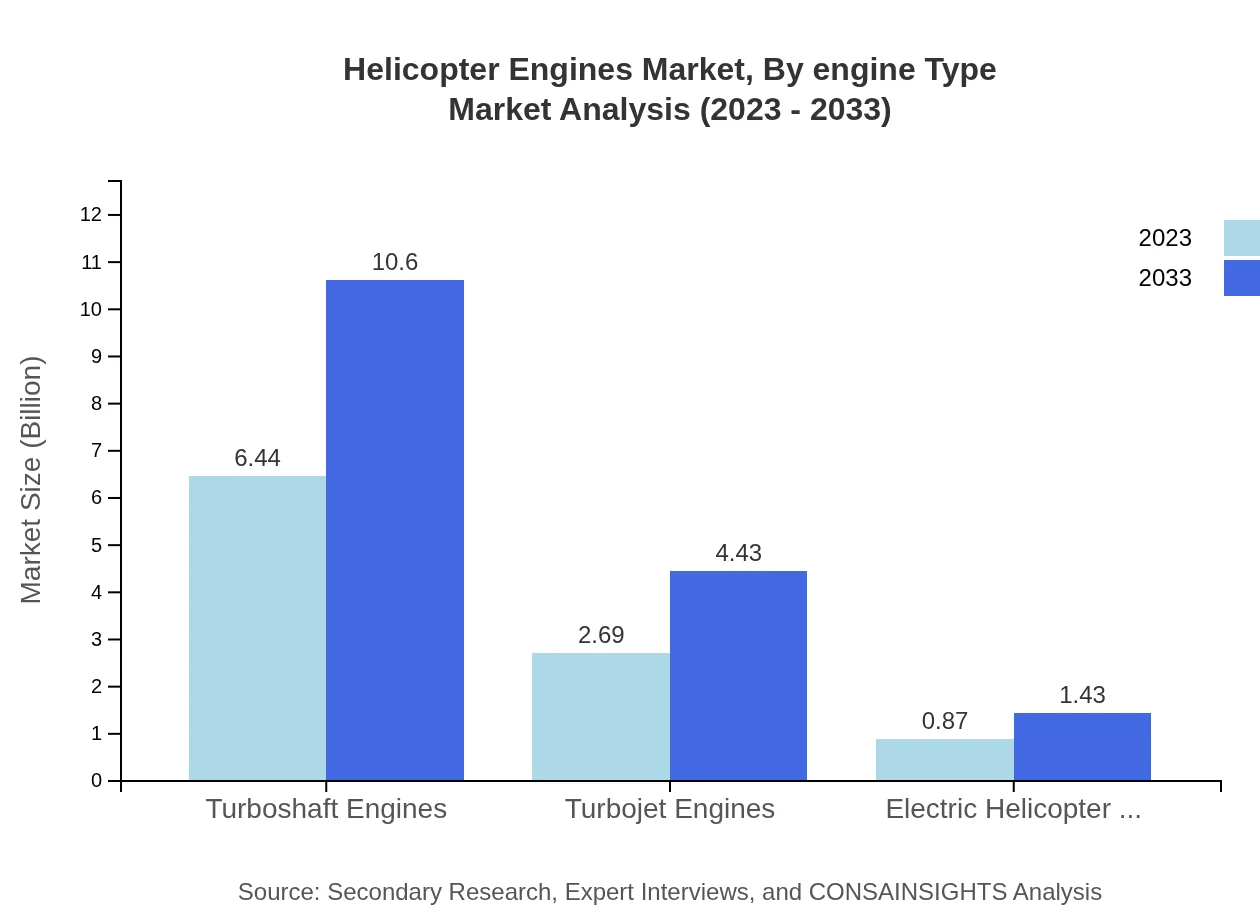

Helicopter Engines Market Analysis By Engine Type

The segment for Engine Type indicates a significant market size for turboshaft engines, valued at $6.44 billion in 2023, growing to $10.60 billion by 2033, dominating the sector primarily in military applications. Turbojet engines are projected to expand from $2.69 billion to $4.43 billion over the same period. Electric helicopter engines, though in earlier stages of adoption, are growing, expected to rise from $0.87 billion to $1.43 billion, reflecting a trend towards sustainable aviation.

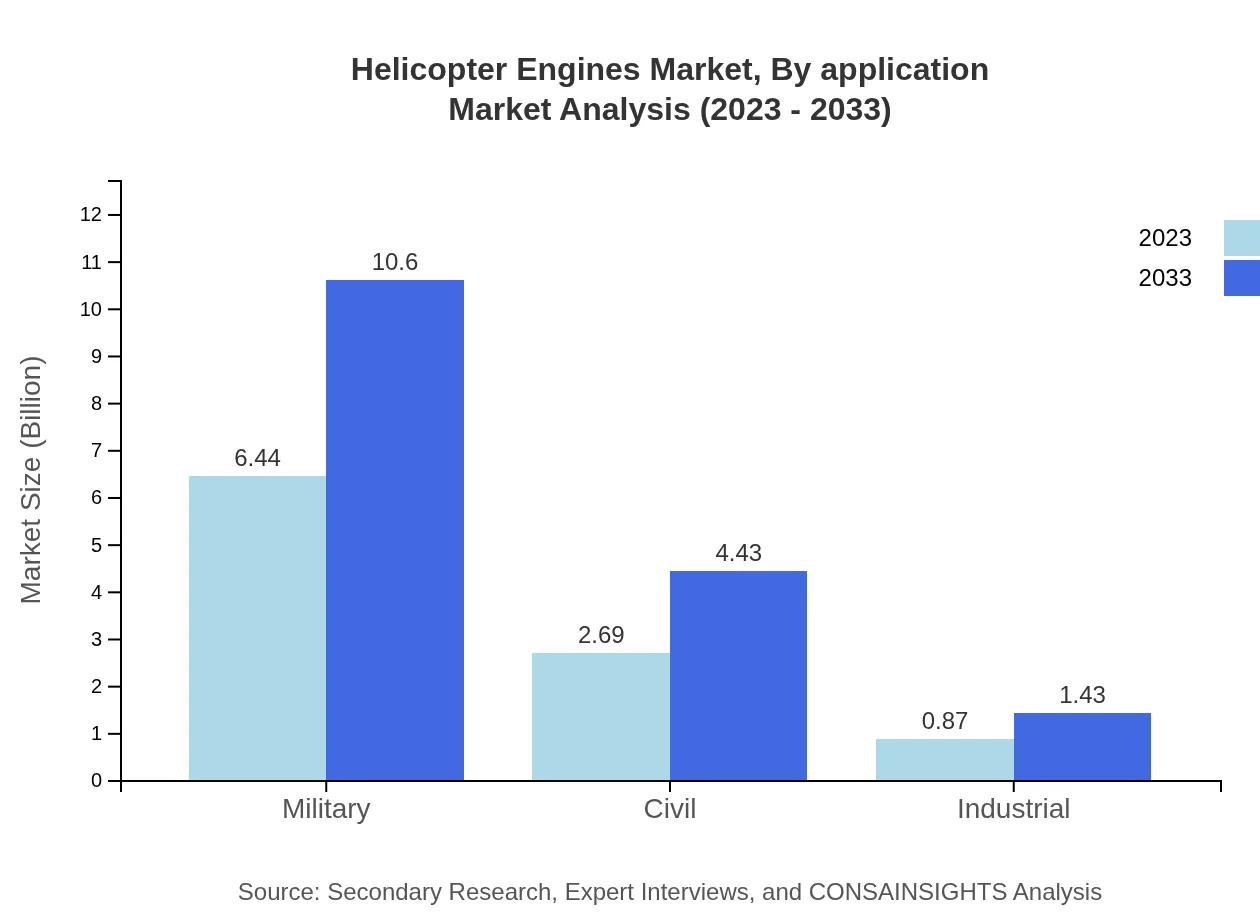

Helicopter Engines Market Analysis By Application

The military application segment continues to lead, with a market value of $6.44 billion in 2023 and expected to grow to $10.60 billion by 2033, representing a share of 64.39%. Civil applications follow, with a smaller share of 26.91%, indicating significant growth from $2.69 billion to $4.43 billion. The industrial segment, while smaller, is also growing, projected from $0.87 billion to $1.43 billion.

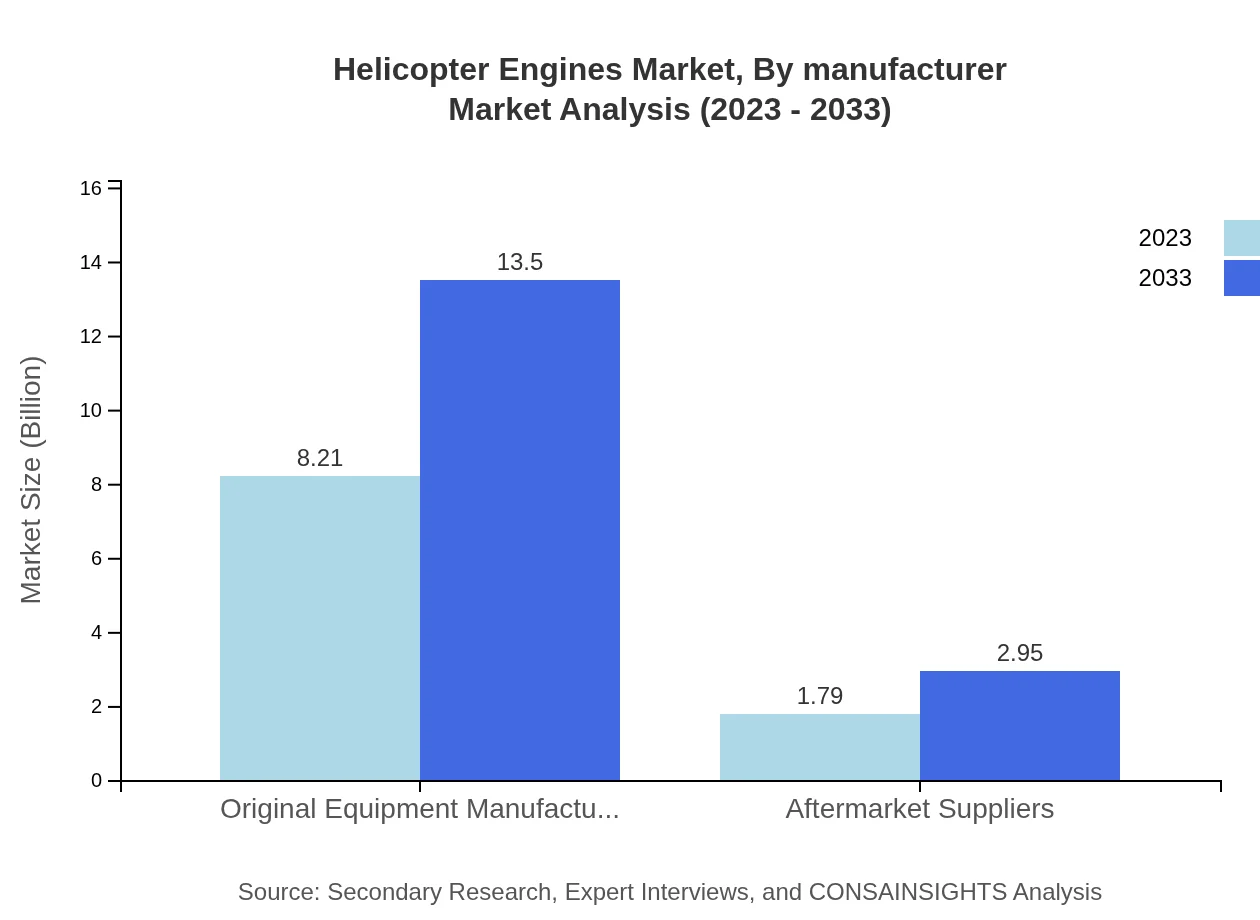

Helicopter Engines Market Analysis By Manufacturer

The OEM segment accounts for a substantial portion of the market at 82.05%, with an expected size increase from $8.21 billion in 2023 to $13.50 billion by 2033. In comparison, the aftermarket suppliers’ segment is smaller, maintaining a steady market share of 17.95%, anticipated to grow from $1.79 billion to $2.95 billion.

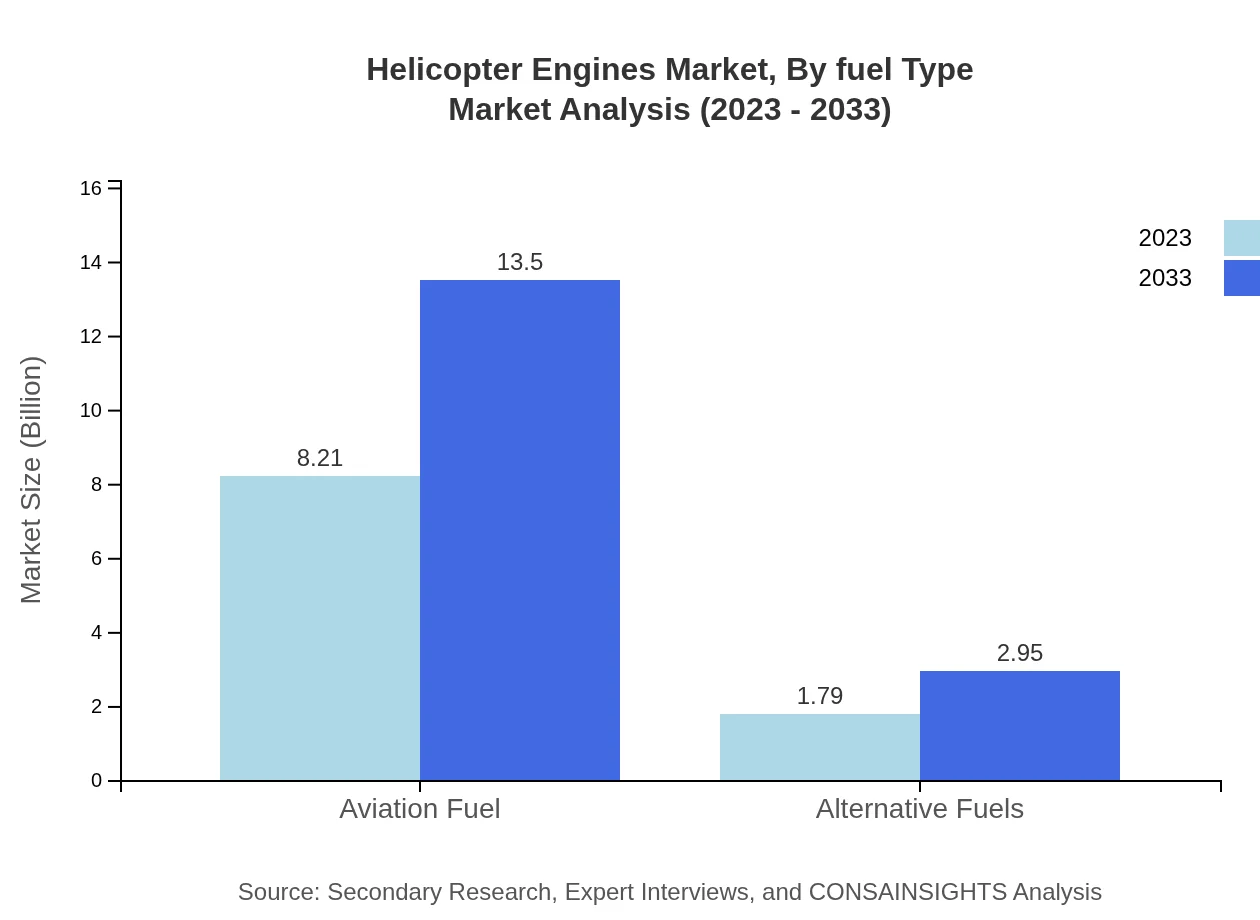

Helicopter Engines Market Analysis By Fuel Type

The Helicopter Engines market predominantly utilizes aviation fuels, with the segment valued at $8.21 billion in 2023, expected to reach $13.50 billion by 2033, maintaining an 82.05% market share. The alternative fuels segment, although currently smaller at $1.79 billion, is projected to grow to $2.95 billion, reflecting a shift towards greener aviation solutions.

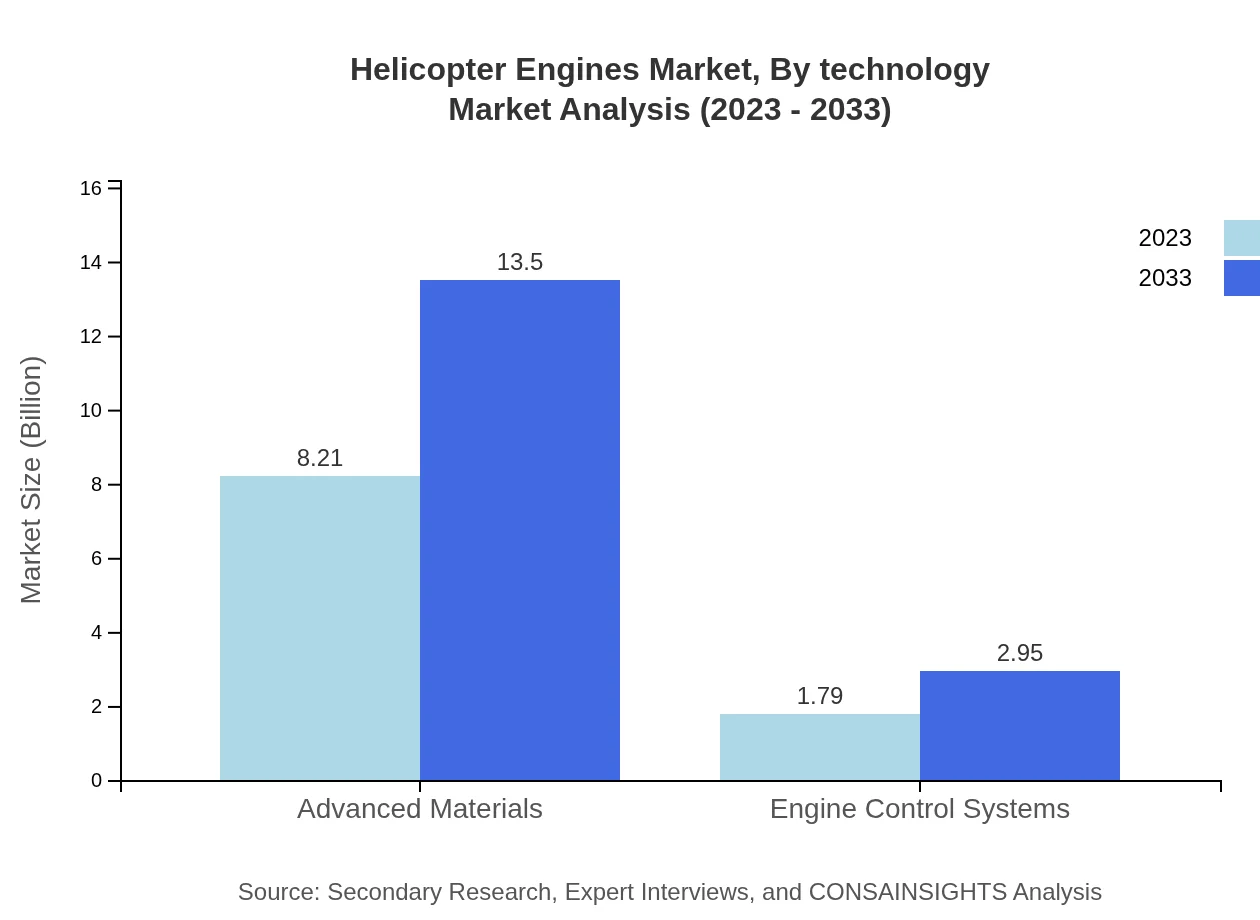

Helicopter Engines Market Analysis By Technology

Emerging technologies are reshaping the Helicopter Engines market. Innovations in engine control systems are crucial, with their share expected to remain at 17.95%, rising from $1.79 billion to $2.95 billion by 2033. Advanced materials continue to dominate, also maintaining an 82.05% share, anticipated to grow from $8.21 billion to $13.50 billion, reflecting ongoing advancements in material science.

Helicopter Engines Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Helicopter Engines Industry

General Electric Company:

A leading company in the aviation sector, GE produces a variety of engines, including those for military and commercial helicopters.Rolls-Royce Holdings plc:

Known for its high-performance jet engines, Rolls-Royce is also a key player in the helicopter engine market, focusing on innovative solutions.Safran Helicopter Engines:

A prominent manufacturer specializing in turboshaft engines, Safran contributes significantly to the civil and military aviation industries.Honeywell International Inc.:

Honeywell is recognized for its advancement in avionics and propulsion systems, providing integrated cockpit solutions alongside helicopter engines.Pratt & Whitney Canada:

A major player in helicopter engine manufacturing, Pratt & Whitney designs and produces engines that are highly regarded for reliability and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of helicopter Engines?

The global helicopter engines market is valued at approximately $10 billion in 2023 and is projected to grow at a CAGR of 5% to reach $16.28 billion by 2033, showing significant expansion in demand and technological advancements.

What are the key market players or companies in the helicopter Engines industry?

Key players in the helicopter engines market include major aerospace companies such as Pratt & Whitney, Rolls-Royce, General Electric, and Safran, among others who dominate the landscape with technological innovations and extensive product portfolios.

What are the primary factors driving the growth in the helicopter Engines industry?

Growth in the helicopter engines sector is primarily driven by increasing military expenditure, advancements in technology, demand for civil helicopter transport, and the rising need for surveillance and emergency services.

Which region is the fastest Growing in the helicopter Engines?

The Asia Pacific region is expected to be the fastest-growing market for helicopter engines, with growth from $1.89 billion in 2023 to $3.12 billion by 2033, as demand for helicopters in both commercial and military applications rises.

Does ConsaInsights provide customized market report data for the helicopter Engines industry?

Yes, ConsaInsights offers tailored market reports for the helicopter engines industry, enabling clients to access specific data and insights to better understand market dynamics and make informed decisions.

What deliverables can I expect from this helicopter Engines market research project?

Deliverables from the helicopter engines market research project include comprehensive market analysis reports, competitive landscape assessments, growth forecasts, and strategic recommendations tailored to specific business needs.

What are the market trends of helicopter Engines?

Current market trends in helicopter engines include a shift towards electric propulsion systems, increasing investment in R&D for alternative fuels, and a growing focus on lightweight materials to enhance fuel efficiency and performance.