Helicopters Market Report

Published Date: 03 February 2026 | Report Code: helicopters

Helicopters Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Helicopter market, capturing key insights, trends, and forecasts covering the period from 2023 to 2033. It includes detailed data on market size, growth rates, and segmentation across various applications and regions.

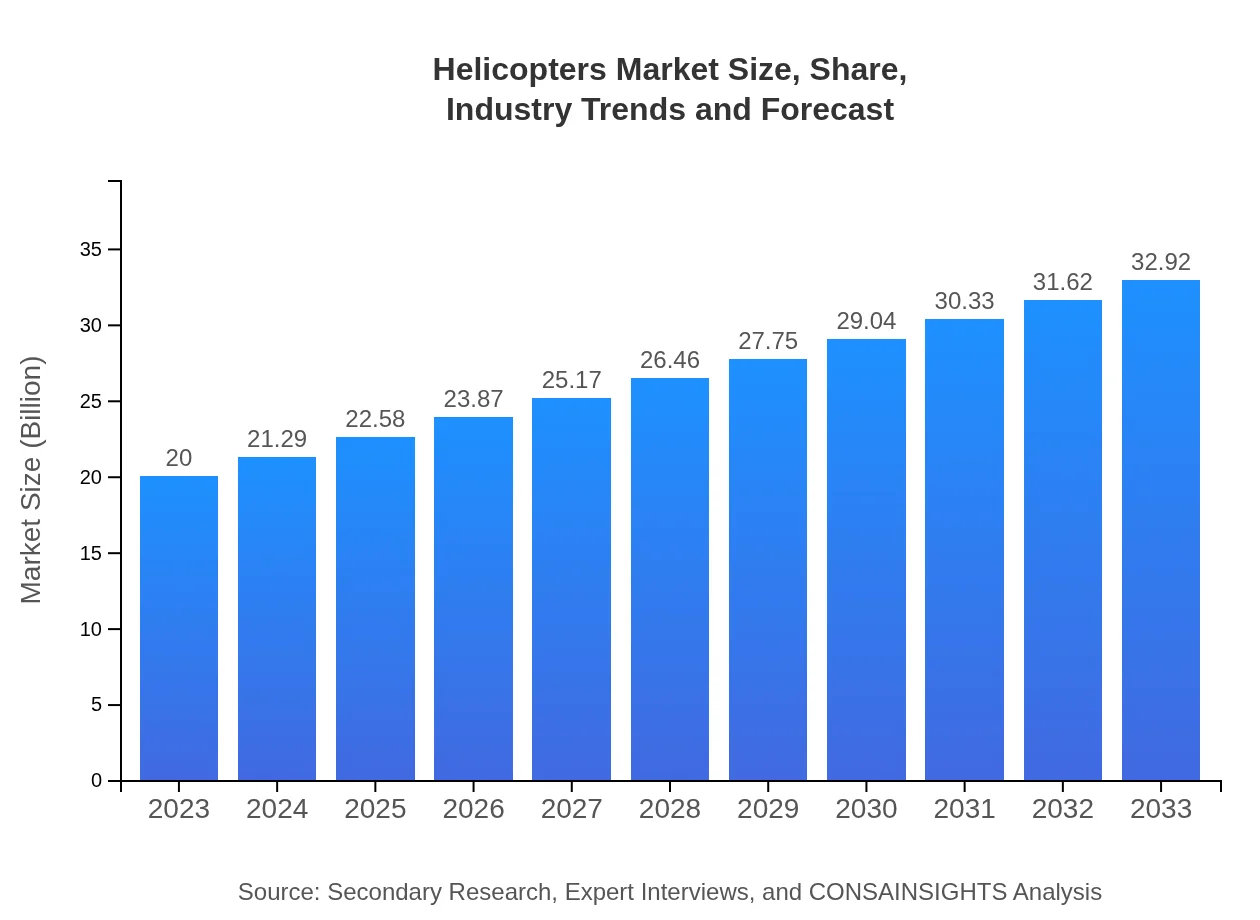

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $32.92 Billion |

| Top Companies | Airbus Helicopters, Leonardo S.p.A, Bell Helicopter, Lockheed Martin |

| Last Modified Date | 03 February 2026 |

Helicopters Market Overview

Customize Helicopters Market Report market research report

- ✔ Get in-depth analysis of Helicopters market size, growth, and forecasts.

- ✔ Understand Helicopters's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Helicopters

What is the Market Size & CAGR of Helicopters market in 2023?

Helicopters Industry Analysis

Helicopters Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Helicopters Market Analysis Report by Region

Europe Helicopters Market Report:

The European helicopter market is also experiencing growth, expected to rise from $6.45 billion in 2023 to $10.61 billion by 2033. The market’s rise is supported by increasing investments in emergency and medical services, alongside the rising emphasis on urban air mobility.Asia Pacific Helicopters Market Report:

In the Asia Pacific, the helicopter market is anticipated to reach $6.18 billion by 2033, growing from $3.75 billion in 2023. The growth is fueled by rising military budgets from countries like India and China, coupled with increasing demand for civil helicopters for purposes such as tourism and corporate transport.North America Helicopters Market Report:

North America remains a dominant player in the helicopter market, with a market size of $11.44 billion projected for 2033, up from $6.95 billion in 2023. The region's growth is led by high demand for both commercial and military helicopters, as well as advancements in technology.South America Helicopters Market Report:

The South American helicopter market is projected to grow from $0.34 billion in 2023 to $0.56 billion in 2033. Economic growth in countries like Brazil and Argentina, along with the need for aerial support in remote areas, is driving the market.Middle East & Africa Helicopters Market Report:

In the Middle East and Africa, the helicopter market is anticipated to grow from $2.51 billion in 2023 to $4.13 billion by 2033. The demand is being driven by military operations, as well as an increase in oil and gas industry activities requiring aerial support.Tell us your focus area and get a customized research report.

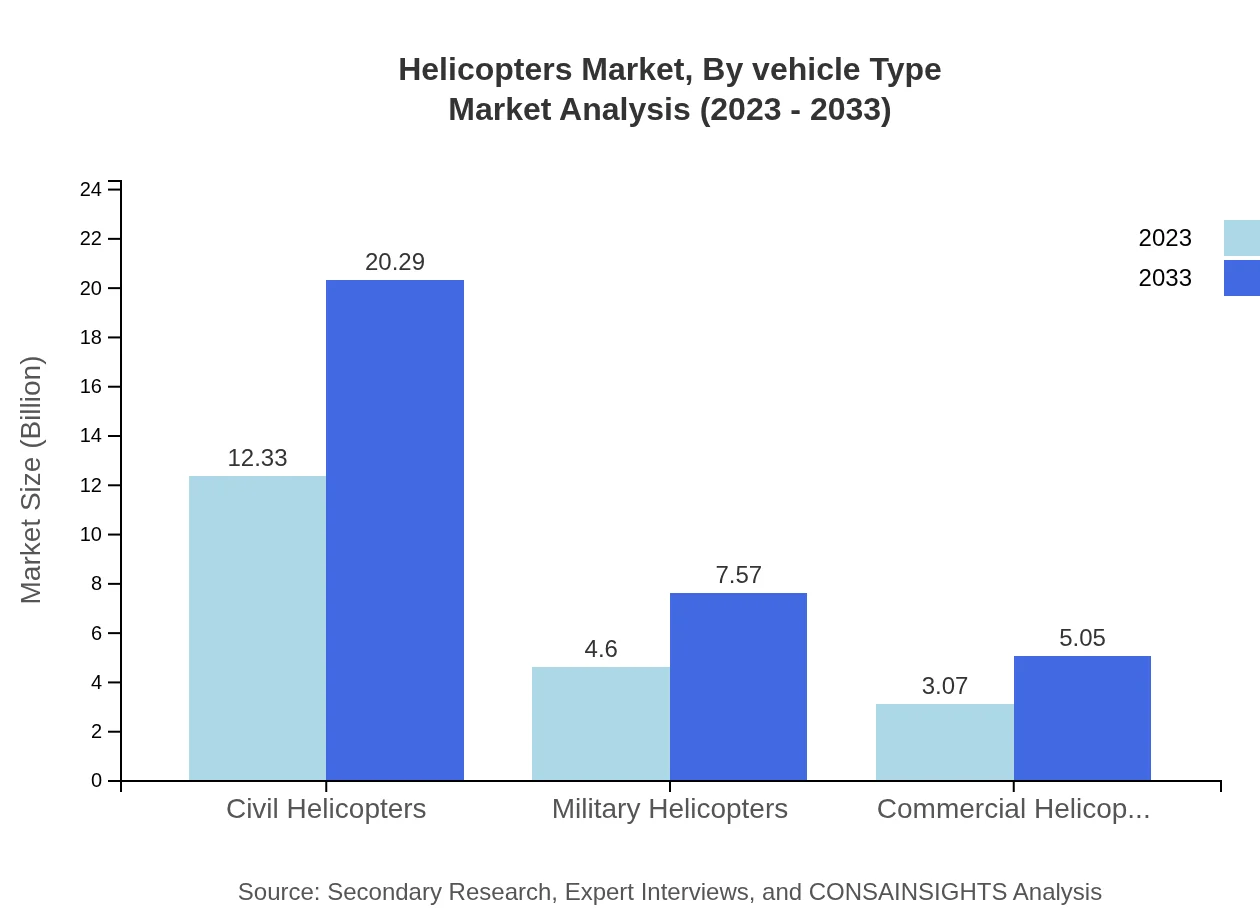

Helicopters Market Analysis By Vehicle Type

The market is segmented into civil and military helicopters. Civil helicopters dominate the market, showcasing significant growth with a projected increase from $12.33 billion in 2023 to $20.29 billion by 2033, while military helicopters are expected to grow from $4.60 billion to $7.57 billion in the same period.

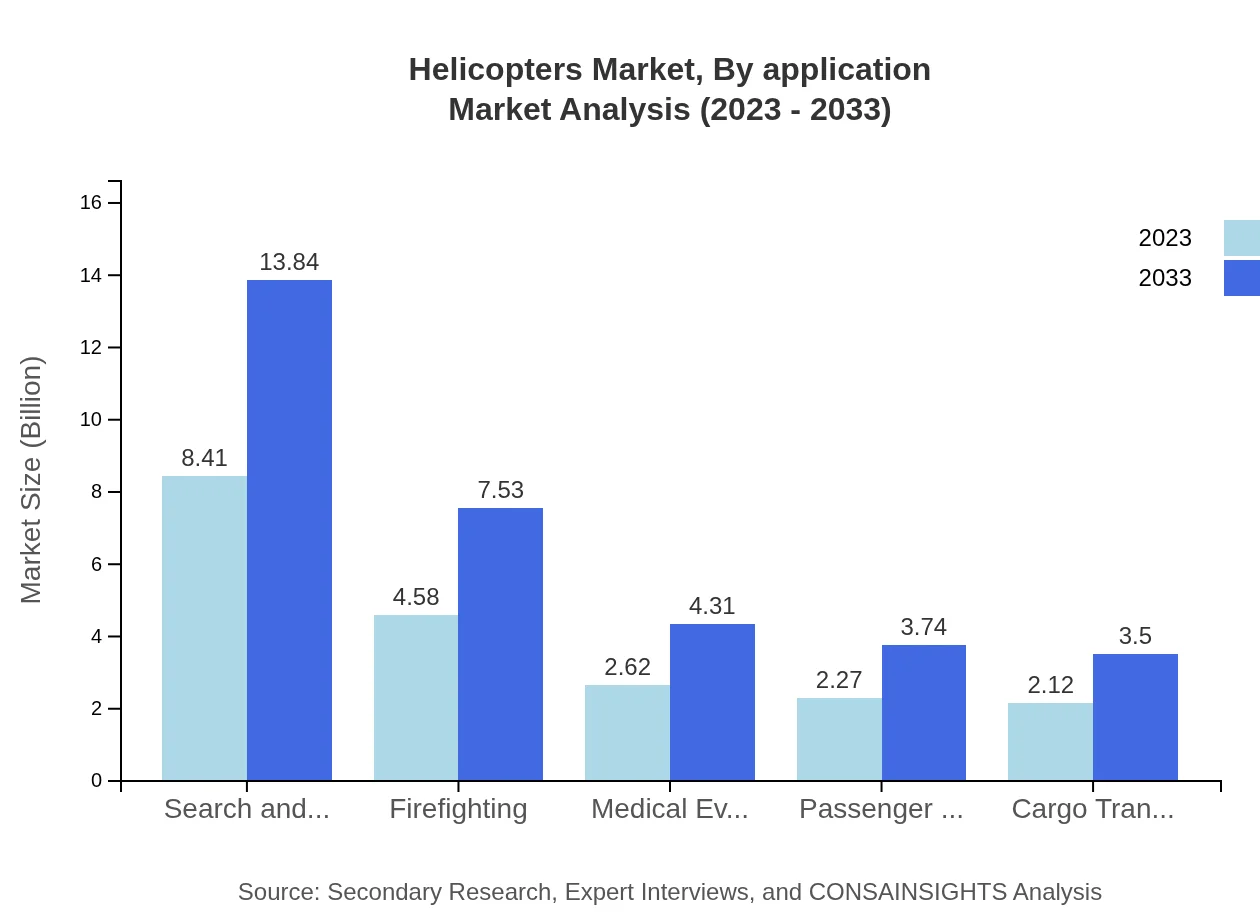

Helicopters Market Analysis By Application

Application segments include search and rescue, medical evacuation, firefighting, and passenger transport. The search and rescue application is particularly prominent, projected to grow from an estimated $8.41 billion in 2023 to $13.84 billion by 2033. Medical evacuation is also growing, from $2.62 billion to $4.31 billion.

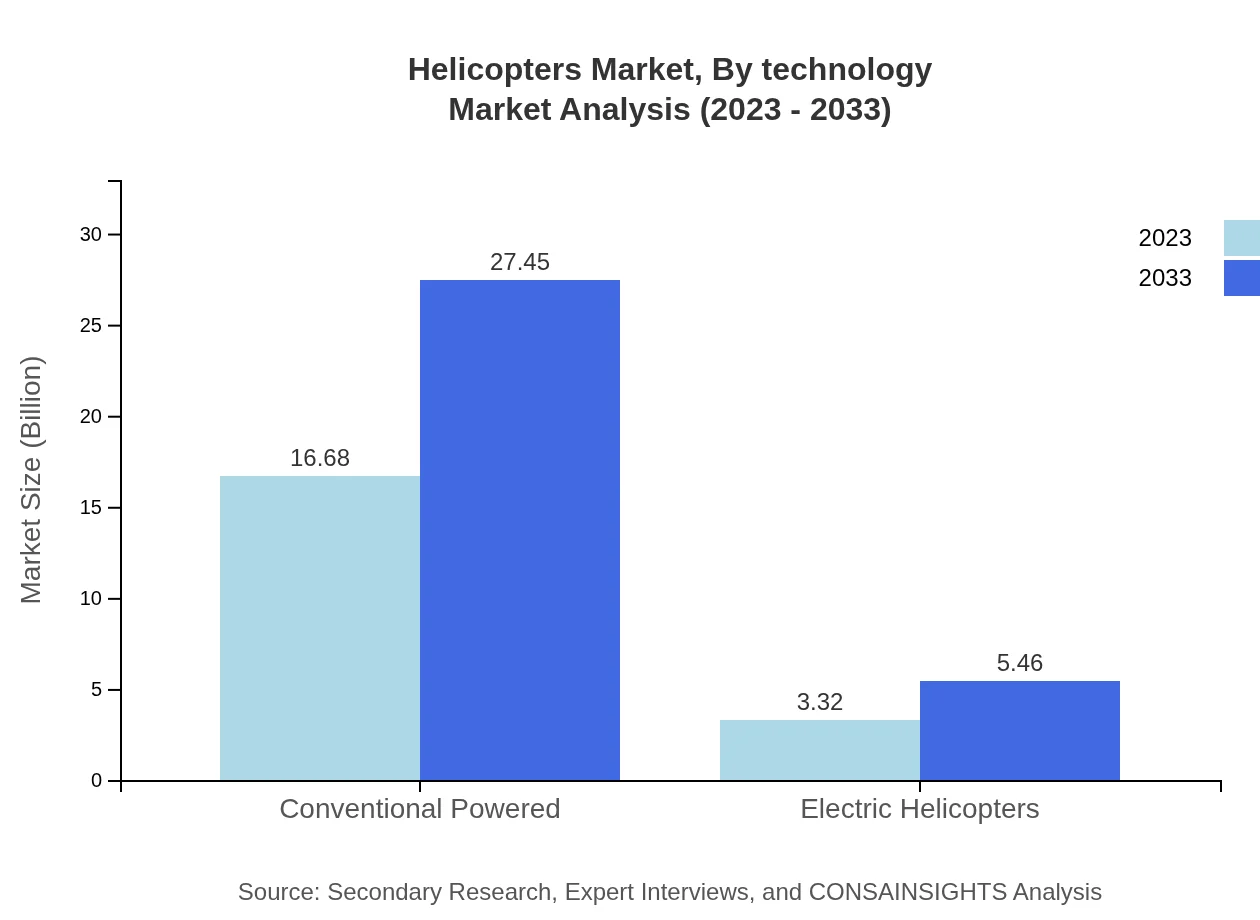

Helicopters Market Analysis By Technology

Technological innovations in helicopters include conventional powered and electric helicopters. Conventional powered helicopters represent the majority share, expanding from $16.68 billion in 2023 to $27.45 billion by 2033, while electric helicopters are projected to grow from $3.32 billion to $5.46 billion.

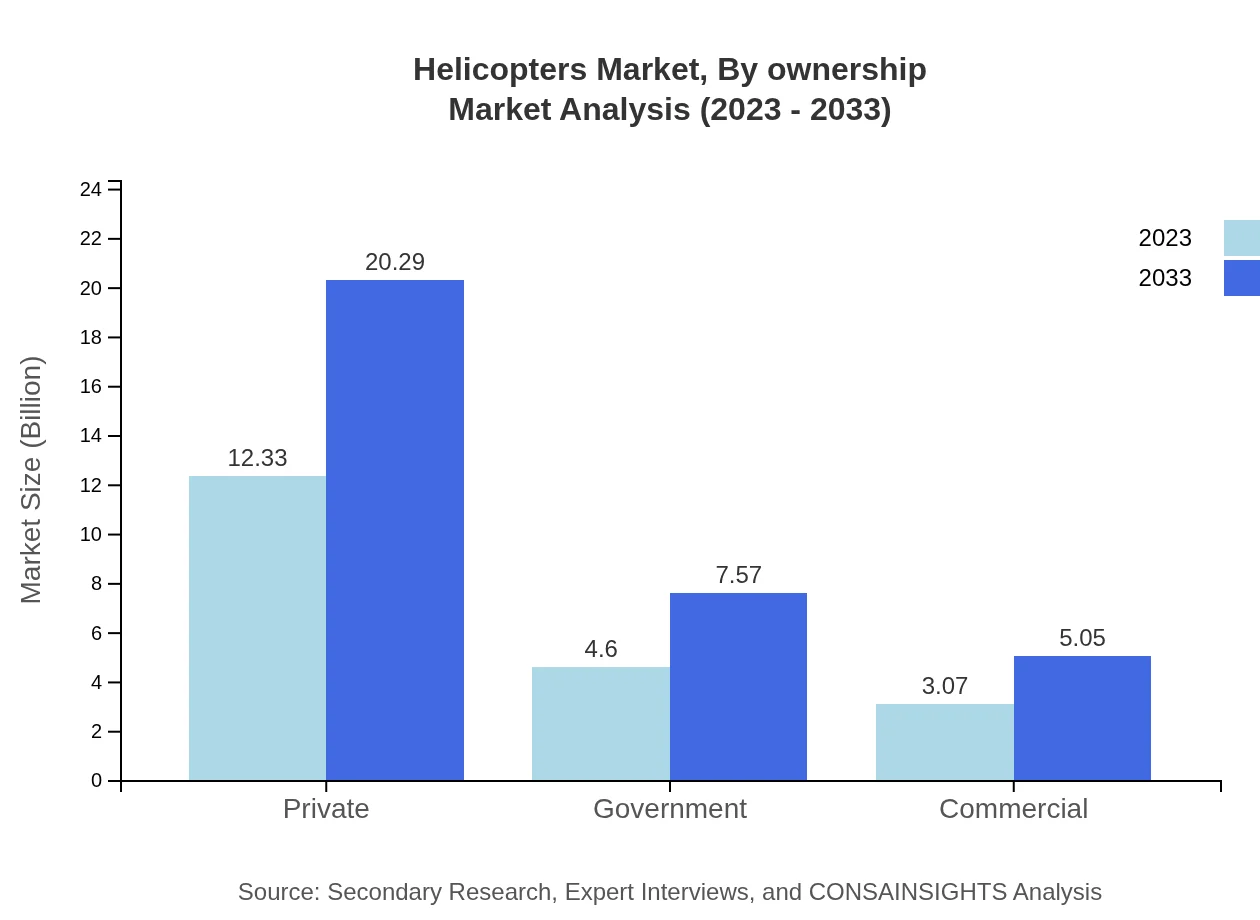

Helicopters Market Analysis By Ownership

Ownership is categorized into private and commercial uses. The private helicopter market is expected to expand from $12.33 billion in 2023 to $20.29 billion by 2033. In contrast, the commercial helicopter segment is anticipated to grow from $3.07 billion to $5.05 billion during the same period.

Helicopters Market Analysis By Maintenance Type

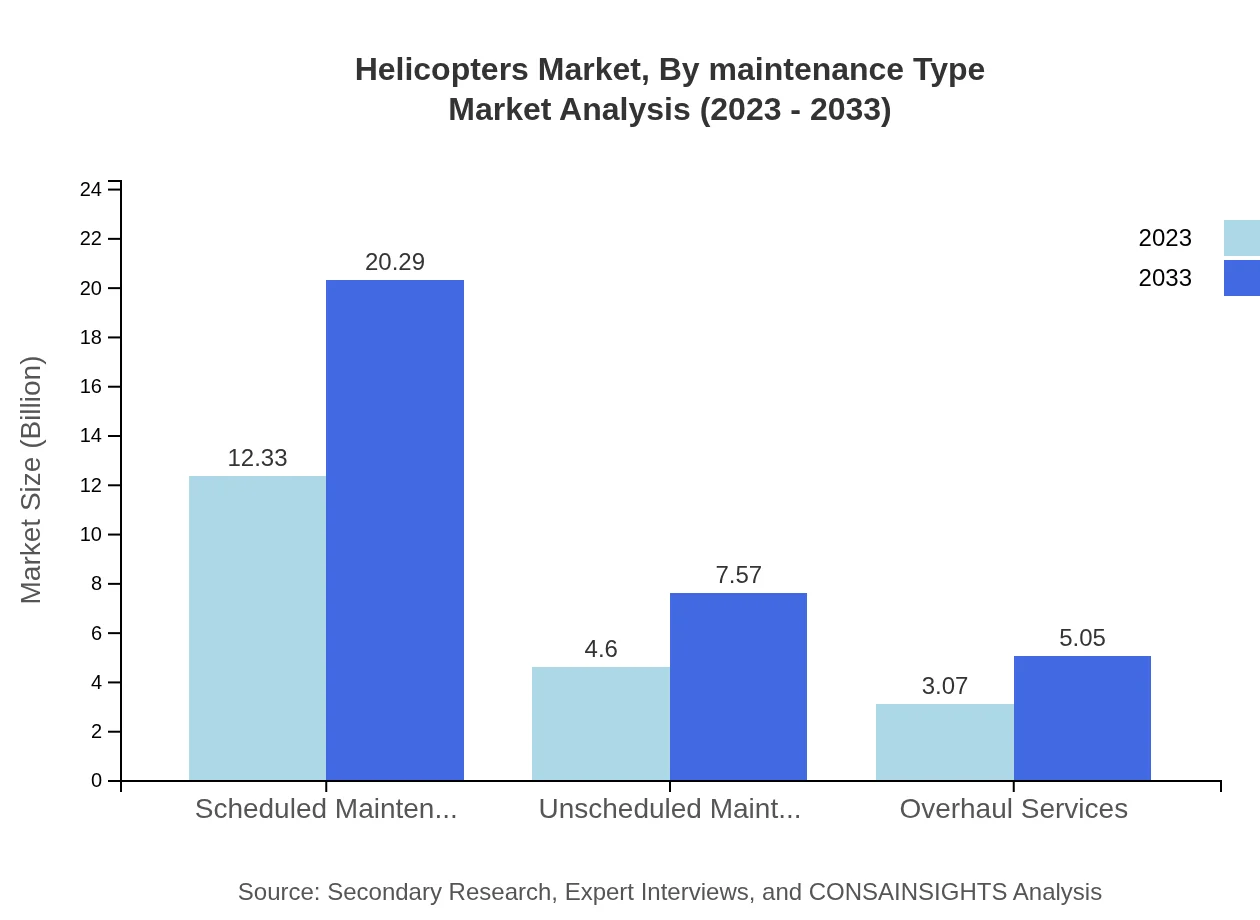

Maintenance segments include scheduled, unscheduled, and overhaul services. Scheduled maintenance is the largest segment, predicted to increase from $12.33 billion to $20.29 billion. Unscheduled maintenance is expected to expand from $4.60 billion to $7.57 billion over the next decade.

Helicopters Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Helicopters Industry

Airbus Helicopters:

A leading global rotorcraft manufacturer known for its innovative product offerings ranging from civil to military helicopters, emphasizing safety and efficiency.Leonardo S.p.A:

An Italian specialist in aerospace, defense, and security, recognized for its advanced helicopters used in military and civilian operations.Bell Helicopter:

A subsidiary of Textron Inc., Bell is a prominent player known for its pioneering designs and production of commercial and military helicopters.Lockheed Martin:

A leading global security and aerospace company that provides advanced technology solutions and offers military helicopters as part of its defense portfolio.We're grateful to work with incredible clients.

FAQs

What is the market size of helicopters?

The global helicopter market is currently valued at approximately $20 billion, with a projected annual growth rate (CAGR) of 5%. The market is expected to further grow as demand from various sectors increases over the coming years.

What are the key market players or companies in the helicopters industry?

Key players in the helicopter market include established manufacturers and companies specializing in aviation such as Bell Helicopter, Airbus Helicopters, and Sikorsky. These leaders drive innovation and market trends within the industry.

What are the primary factors driving the growth in the helicopter industry?

Growth in the helicopter market is driven by increased demand for emergency services, infrastructure projects, and advancements in technologies such as electric helicopters. Economic growth also contributes to fleet modernization.

Which region is the fastest Growing in the helicopter market?

The fastest-growing region in the helicopter market is projected to be Asia Pacific, with the market expected to reach $6.18 billion by 2033, up from $3.75 billion in 2023, reflecting a strong demand for helicopters in this region.

Does ConsaInsights provide customized market report data for the helicopter industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, providing detailed insights and analysis for various sectors within the helicopter industry to help stakeholders make informed decisions.

What deliverables can I expect from this helicopter market research project?

Deliverables from the helicopter market research project include comprehensive reports, detailed segment analysis, competitive landscape evaluations, and projections on market trends, helping stakeholders gain actionable insights.

What are the market trends of helicopters?

Key market trends include the rise of electric helicopters, increasing focus on safety and efficiency, and growth in private and military helicopter segments. Additionally, the importance of sustainability is shaping future developments.