Hematology Market Report

Published Date: 31 January 2026 | Report Code: hematology

Hematology Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Hematology market, including insights on market dynamics, size, growth forecasts from 2023 to 2033, and regional trends impacting the industry.

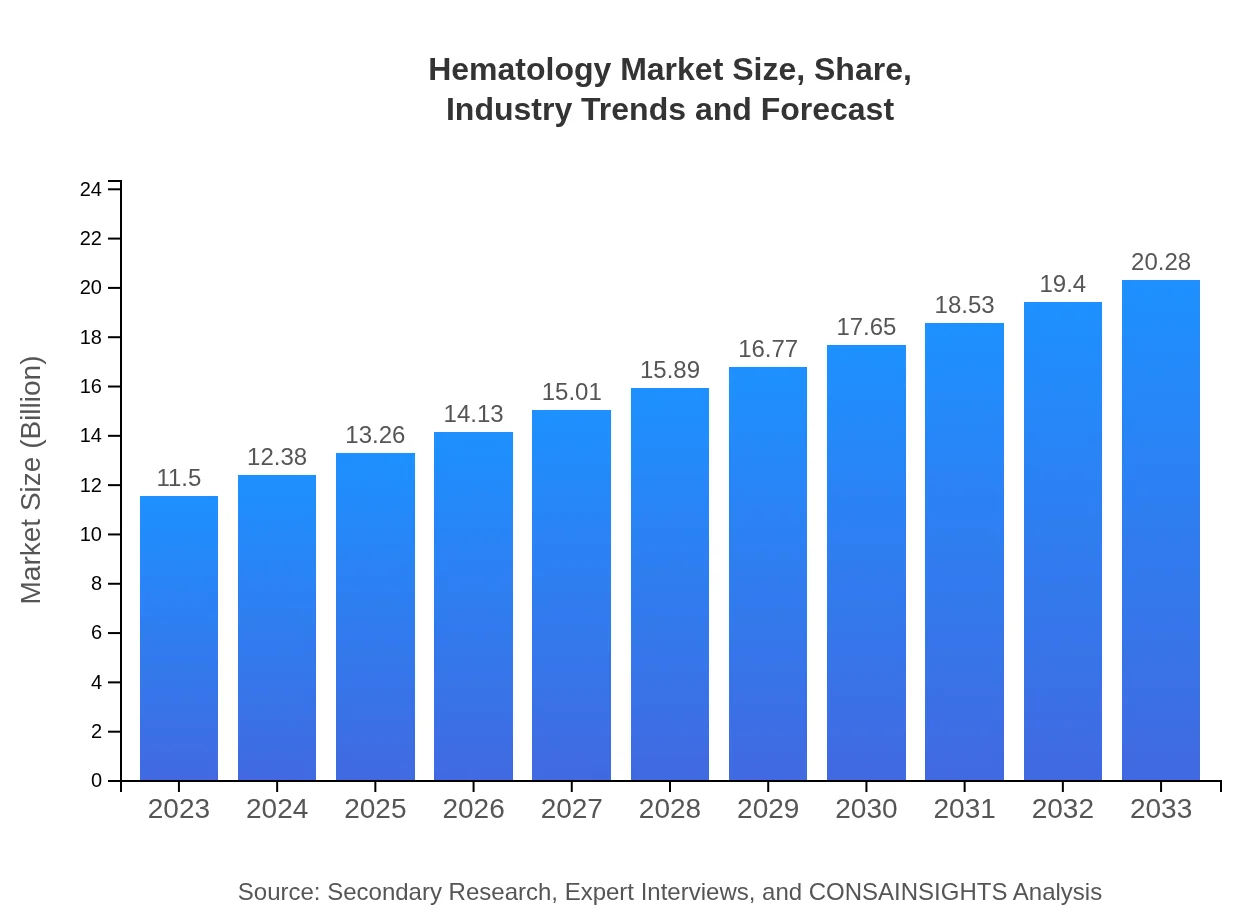

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $11.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $20.28 Billion |

| Top Companies | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Thermo Fisher Scientific |

| Last Modified Date | 31 January 2026 |

Hematology Market Overview

Customize Hematology Market Report market research report

- ✔ Get in-depth analysis of Hematology market size, growth, and forecasts.

- ✔ Understand Hematology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hematology

What is the Market Size & CAGR of Hematology market in 2023?

Hematology Industry Analysis

Hematology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hematology Market Analysis Report by Region

Europe Hematology Market Report:

The Hematology market in Europe is valued at $3.68 billion in 2023 and is projected to grow to $6.48 billion by 2033. European countries are focusing on enhancing their healthcare systems, with increased public health funding and innovations in diagnostics contributing to the market's growth.Asia Pacific Hematology Market Report:

In 2023, the Hematology market in the Asia Pacific region is valued at $2.05 billion and is projected to reach $3.62 billion by 2033. Factors contributing to this growth include an increase in healthcare spending, expanding access to advanced medical technologies, and a rising prevalence of hematological disorders in populous countries like China and India.North America Hematology Market Report:

North America dominates the Hematology market, valued at $4.31 billion in 2023, and expected to grow to $7.61 billion by 2033. Key factors include advanced healthcare systems, high adoption rates of innovative technologies, and significant investment in R&D, alongside a well-established network of hospitals and diagnostic laboratories.South America Hematology Market Report:

The South American Hematology market is relatively small, with a size of -$0.11 billion in 2023 projected to decrease slightly to -$0.19 billion by 2033. This decline is largely due to economic challenges and limited availability of advanced diagnostics in certain areas. However, government initiatives to boost healthcare infrastructure may reverse this trend in the long term.Middle East & Africa Hematology Market Report:

In the Middle East and Africa, the Hematology market is expected to grow from $1.57 billion in 2023 to $2.76 billion by 2033. This growth is influenced by growing awareness of hematological diseases, improvements in healthcare access, and investments in new health technologies.Tell us your focus area and get a customized research report.

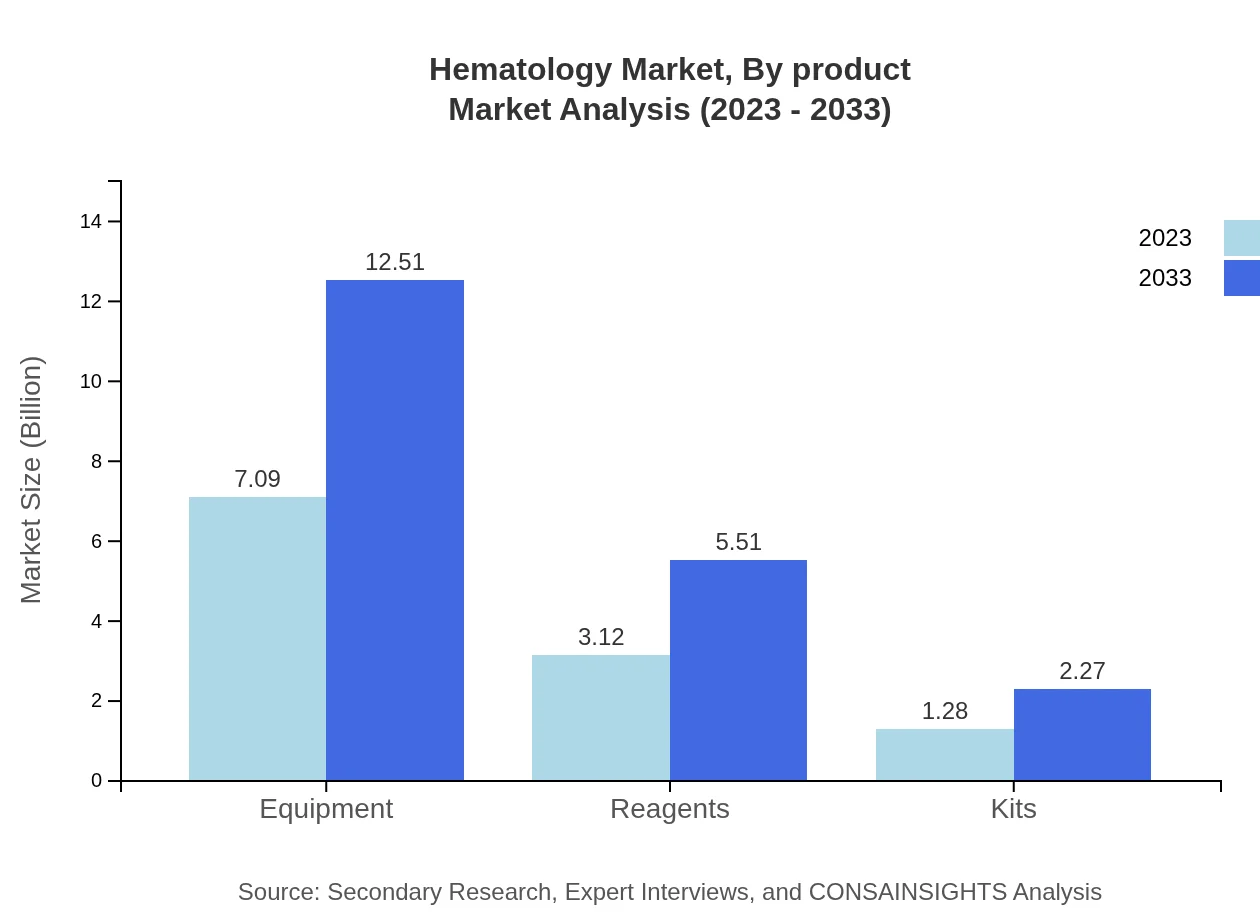

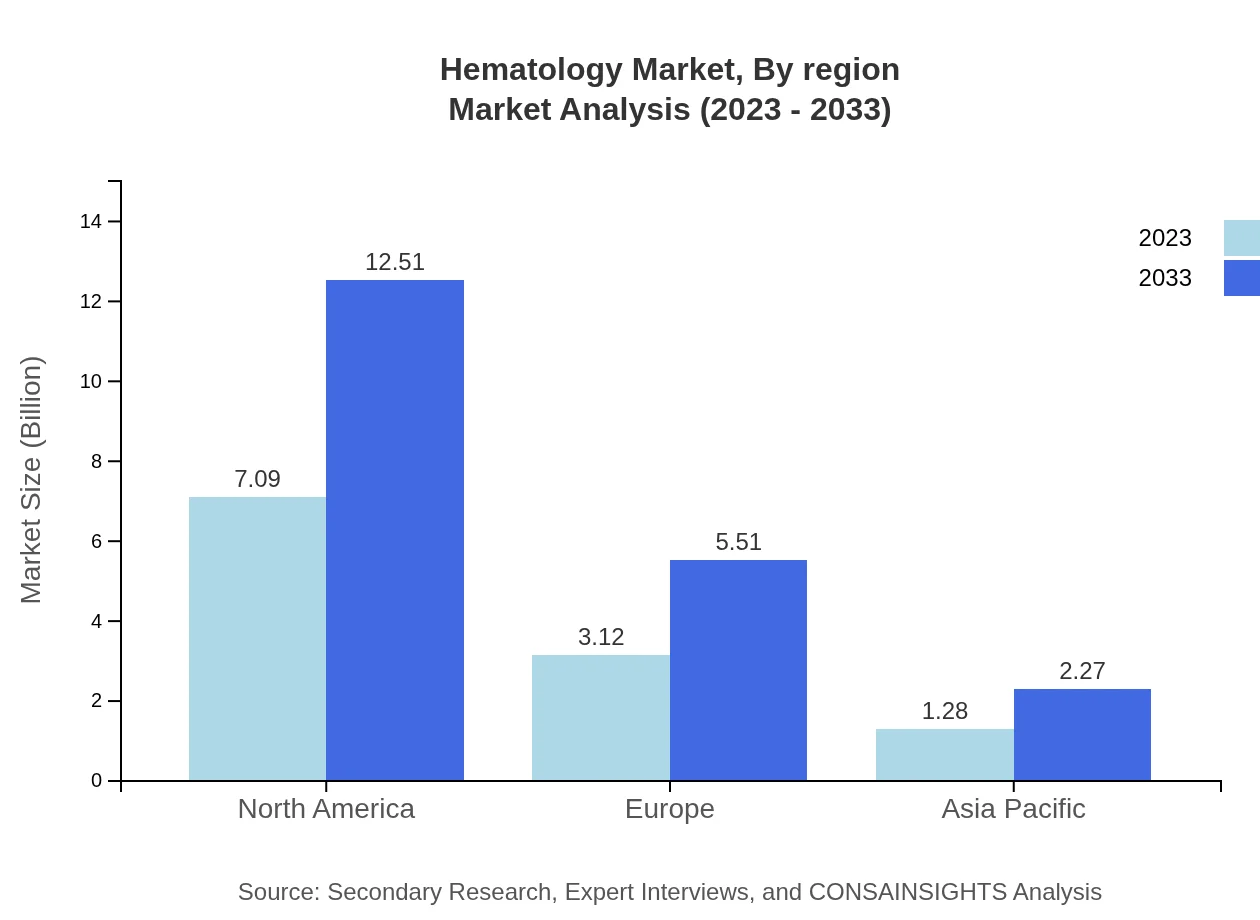

Hematology Market Analysis By Product

The Hematology market segmented by product shows that Equipment leads the way with a size of $7.09 billion in 2023, projected to expand to $12.51 billion by 2033, capturing 61.66% market share. Reagents hold the second position, valued at $3.12 billion in 2023 and expected to grow to $5.51 billion by 2033, accounting for 27.17% of the market. The Kits segment is smaller, valued at $1.28 billion in 2023 and anticipated to grow to $2.27 billion by 2033, with a market share of 11.17%.

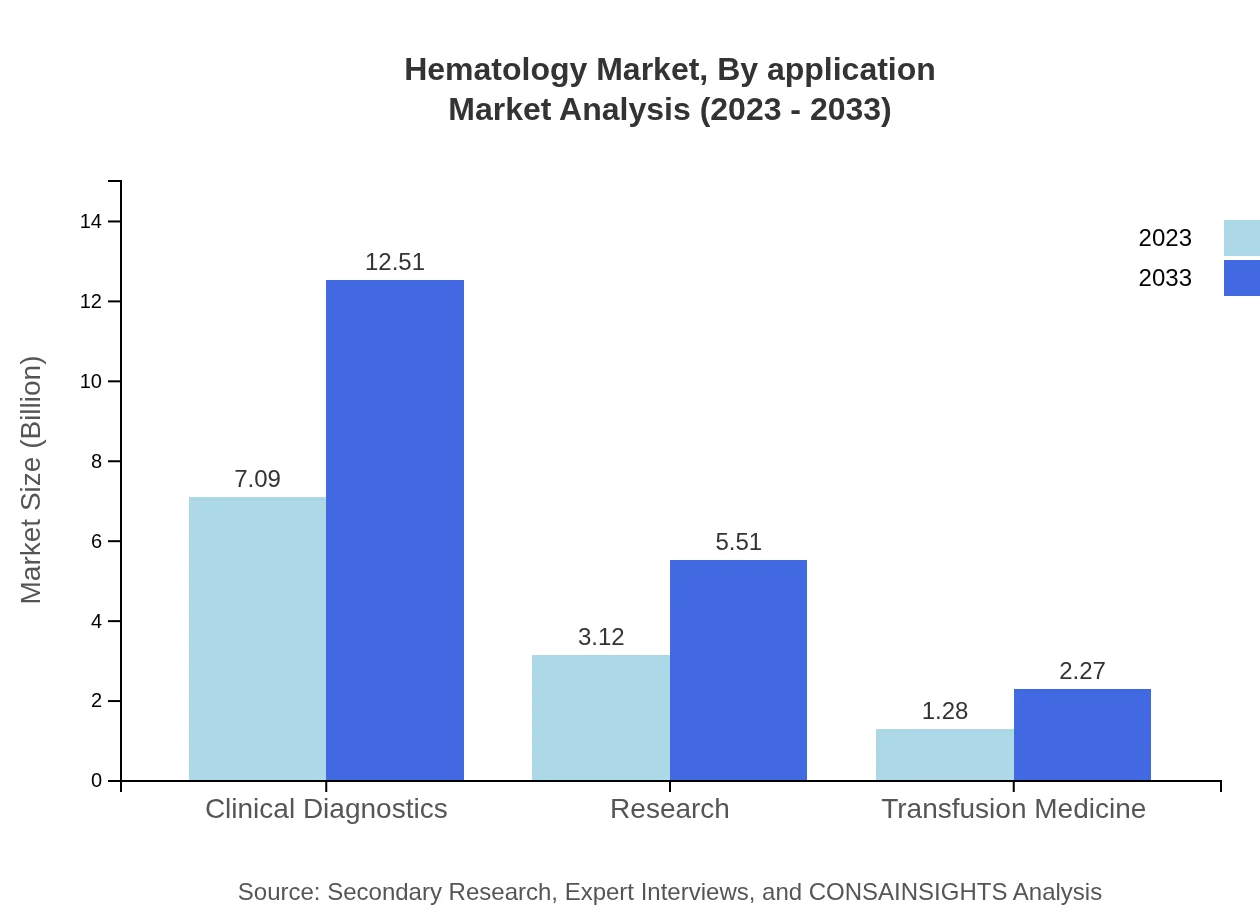

Hematology Market Analysis By Application

By application, the Hematology market is prominently driven by Clinical Diagnostics, which commands a market size of $7.09 billion in 2023, projected to reach $12.51 billion by 2033. It holds a significant share of 61.66%. Following this, Research and Academic Institutions exhibit substantial growth potential, with sizes of $3.12 billion and $1.28 billion respectively in 2023, both growing steadily through 2033.

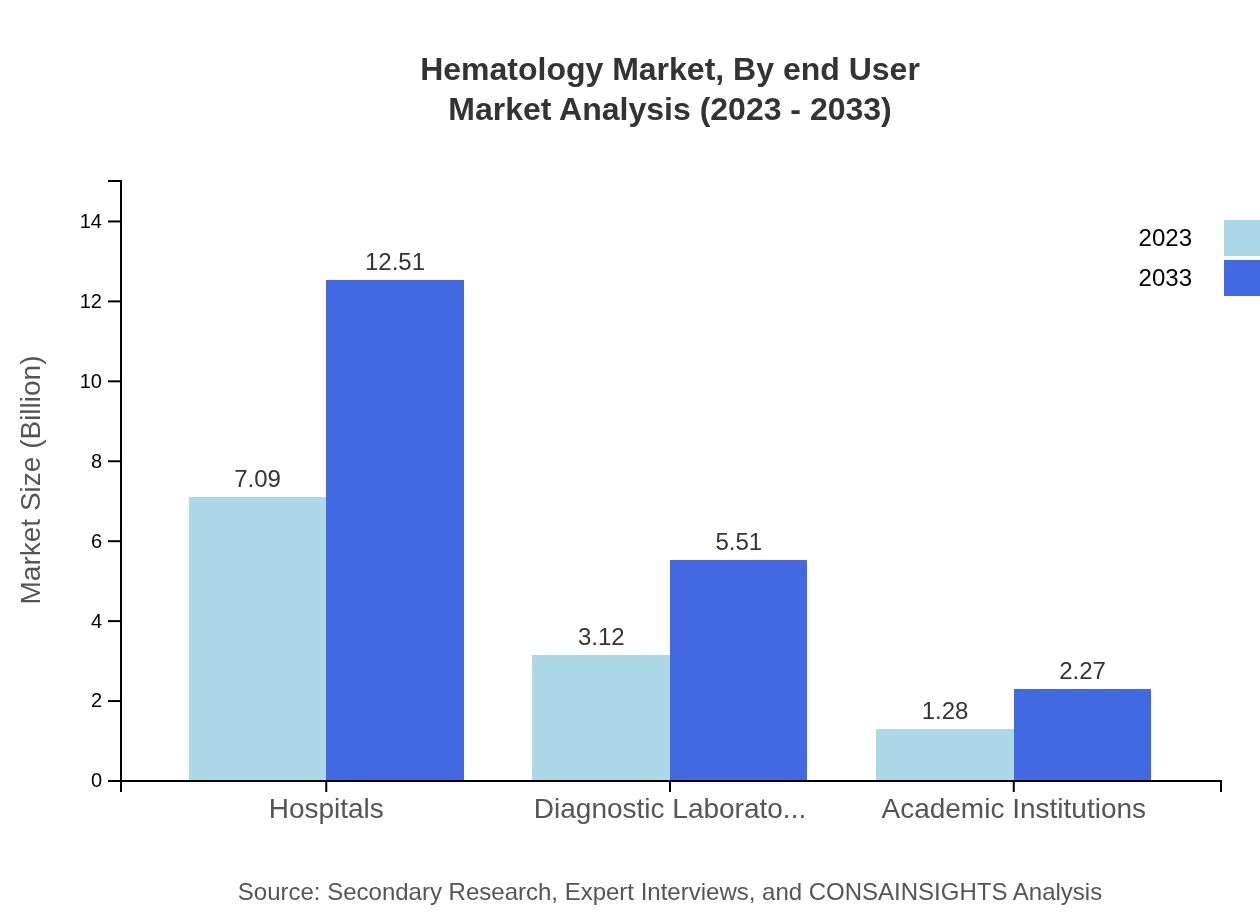

Hematology Market Analysis By End User

Market segments categorized by end-user demonstrate that Hospitals are the largest segment, valued at $7.09 billion in 2023 and growing to $12.51 billion by 2033, holding a 61.66% share. Diagnostic Laboratories and Academic Institutions are also crucial segments, displaying continued growth and collectively contributing to the market's expansion as healthcare sectors evolve.

Hematology Market Analysis By Region

Regionally, North America remains the dominant market, while Europe follows closely, supported by robust healthcare systems. The Asia Pacific shows promising growth due to increasing investments and healthcare access, whereas South America faces unique challenges that may hinder market prosperity. The Middle East and Africa exhibit potential for growth through infrastructure improvements and rising awareness.

Hematology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hematology Industry

Abbott Laboratories:

A leader in the development of innovative diagnostic tests for blood disorders, Abbott focuses on improving the accuracy and speed of diagnostics.Roche Diagnostics:

Roche specializes in blood testing and offers an extensive range of hematology products, contributing significantly to the industry's growth through advanced technology.Siemens Healthineers:

A well-established player in medical technology, Siemens focuses on integrating digital technologies in their hematology products, aiming for enhanced patient outcomes.Thermo Fisher Scientific:

Thermo Fisher leads in providing laboratory equipment and reagents for hematology research, supporting the scientific community with quality and innovation.We're grateful to work with incredible clients.

FAQs

What is the market size of hematology?

The hematology market is currently valued at approximately $11.5 billion and is projected to grow at a CAGR of 5.7% from 2023 to 2033. This growth is driven by advances in diagnostic technologies and increasing prevalence of blood disorders.

What are the key market players or companies in the hematology industry?

Key players in the hematology market include major global firms such as Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, and Beckman Coulter. These companies play crucial roles in developing innovative diagnostic equipment and reagents used for hematological analysis.

What are the primary factors driving the growth in the hematology industry?

Growth in the hematology market is primarily driven by rising incidences of blood-related diseases, advancements in diagnostic technologies, increased healthcare spending, and a growing focus on personalized medicine. These factors together contribute to the market's robust development.

Which region is the fastest Growing in the hematology?

The North America region is the fastest-growing market for hematology, expected to increase from $4.31 billion in 2023 to $7.61 billion by 2033. This growth is attributed to advanced healthcare infrastructure and rising awareness about blood disorders.

Does ConsaInsights provide customized market report data for the hematology industry?

Yes, ConsaInsights provides customized market report data tailored to specific requirements in the hematology industry. Clients can receive insights on trends, forecasts, and competitive landscapes that meet their unique business needs.

What deliverables can I expect from this hematology market research project?

Deliverables from the hematology market research project include comprehensive market analysis reports, regional forecasts, segment insights, and competitor analysis. These tailored reports ensure actionable intelligence for strategic decision-making.

What are the market trends of hematology?

Current trends in hematology include the integration of AI in diagnostics, personalized medicine approaches, and the increasing focus on genetic testing. Additionally, the rise in point-of-care testing is reshaping how hematological conditions are diagnosed and treated.