Hemophilia Market Report

Published Date: 31 January 2026 | Report Code: hemophilia

Hemophilia Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Hemophilia market from 2023 to 2033, including current market conditions, segmentation, regional insights, and future forecasts. Detailed data on market size, growth rates, and key industry players are also included.

| Metric | Value |

|---|---|

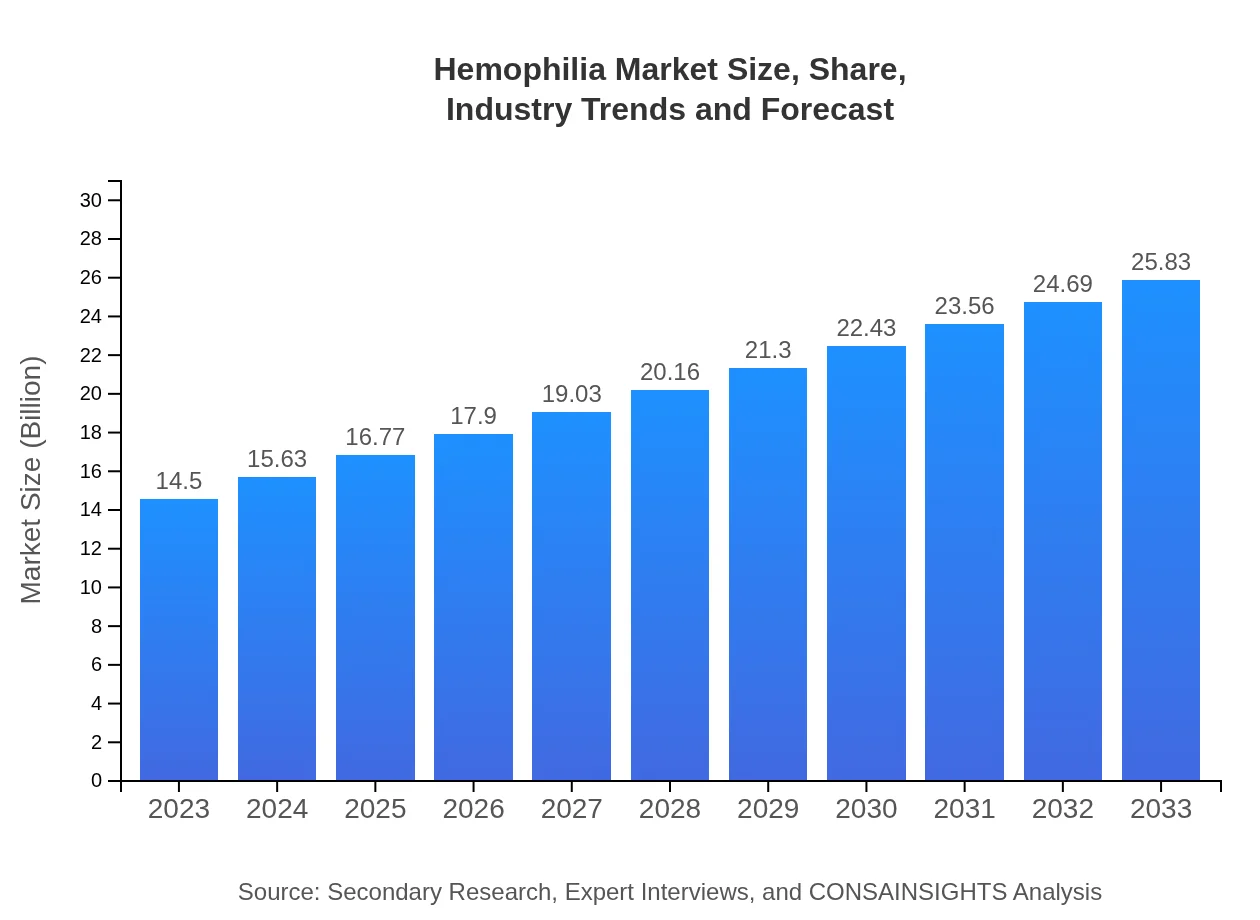

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $25.83 Billion |

| Top Companies | Pfizer Inc., Baxter International Inc., Boehringer Ingelheim, Novo Nordisk, Octapharma |

| Last Modified Date | 31 January 2026 |

Hemophilia Market Overview

Customize Hemophilia Market Report market research report

- ✔ Get in-depth analysis of Hemophilia market size, growth, and forecasts.

- ✔ Understand Hemophilia's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hemophilia

What is the Market Size & CAGR of Hemophilia market in 2023?

Hemophilia Industry Analysis

Hemophilia Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hemophilia Market Analysis Report by Region

Europe Hemophilia Market Report:

In Europe, the hemophilia market is projected to grow from $5.42 billion in 2023 to $9.66 billion by 2033. The region benefits from high healthcare spending and innovation in treatment, though regulatory barriers and pricing pressures pose challenges.Asia Pacific Hemophilia Market Report:

In the Asia Pacific region, the hemophilia market was valued at $2.35 billion in 2023, projected to reach $4.19 billion by 2033. Rising healthcare investments and growing awareness about hemophilia treatment options are driving this market. However, challenges remain, particularly in rural healthcare infrastructure and access to specialized care.North America Hemophilia Market Report:

North America, with a market size of $4.70 billion in 2023, is one of the largest regions for hemophilia treatment, anticipated to grow to $8.38 billion by 2033. Advanced healthcare systems, widespread availability of treatment options, and robust patient advocacy contribute positively to this growth.South America Hemophilia Market Report:

South America showcased a market size of $1.32 billion in 2023, with expectations to grow to $2.35 billion by 2033. The region is experiencing gradual improvements in treatment access and patient care models, but economic constraints limit rapid advancements in hemophilia management.Middle East & Africa Hemophilia Market Report:

The Middle East and Africa's hemophilia market was valued at $0.70 billion in 2023 and is expected to reach $1.25 billion by 2033. Improving healthcare frameworks and awareness initiatives are pivotal for market expansion, as well as the importation of advanced treatment options.Tell us your focus area and get a customized research report.

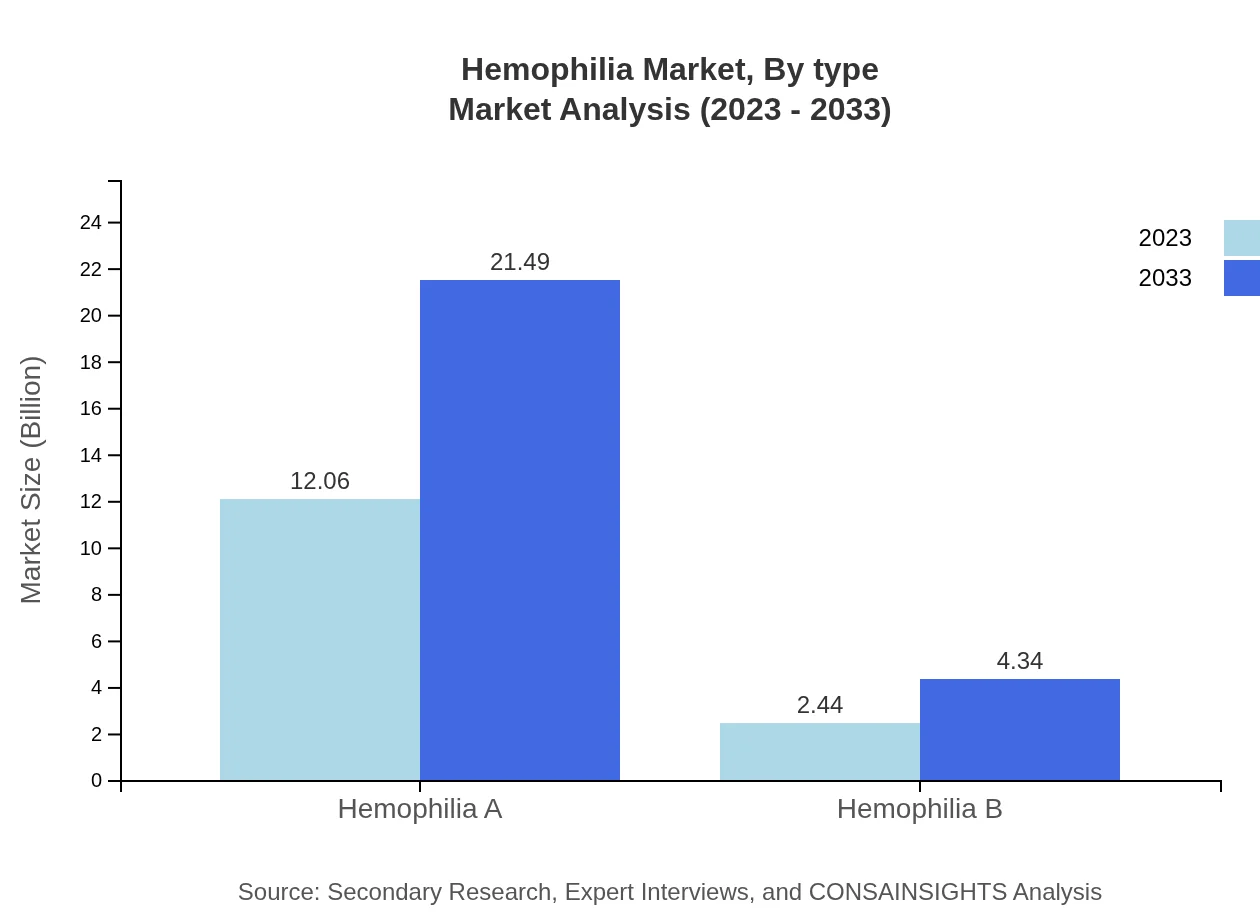

Hemophilia Market Analysis By Type

The market is primarily divided into Hemophilia A and Hemophilia B. Hemophilia A dominates the market with a size of $12.06 billion in 2023, projected to grow to $21.49 billion by 2033, capturing 83.2% of the total market share. Conversely, Hemophilia B holds a smaller segment, starting at $2.44 billion in 2023 and growing to $4.34 billion in 2033, representing 16.8% market share.

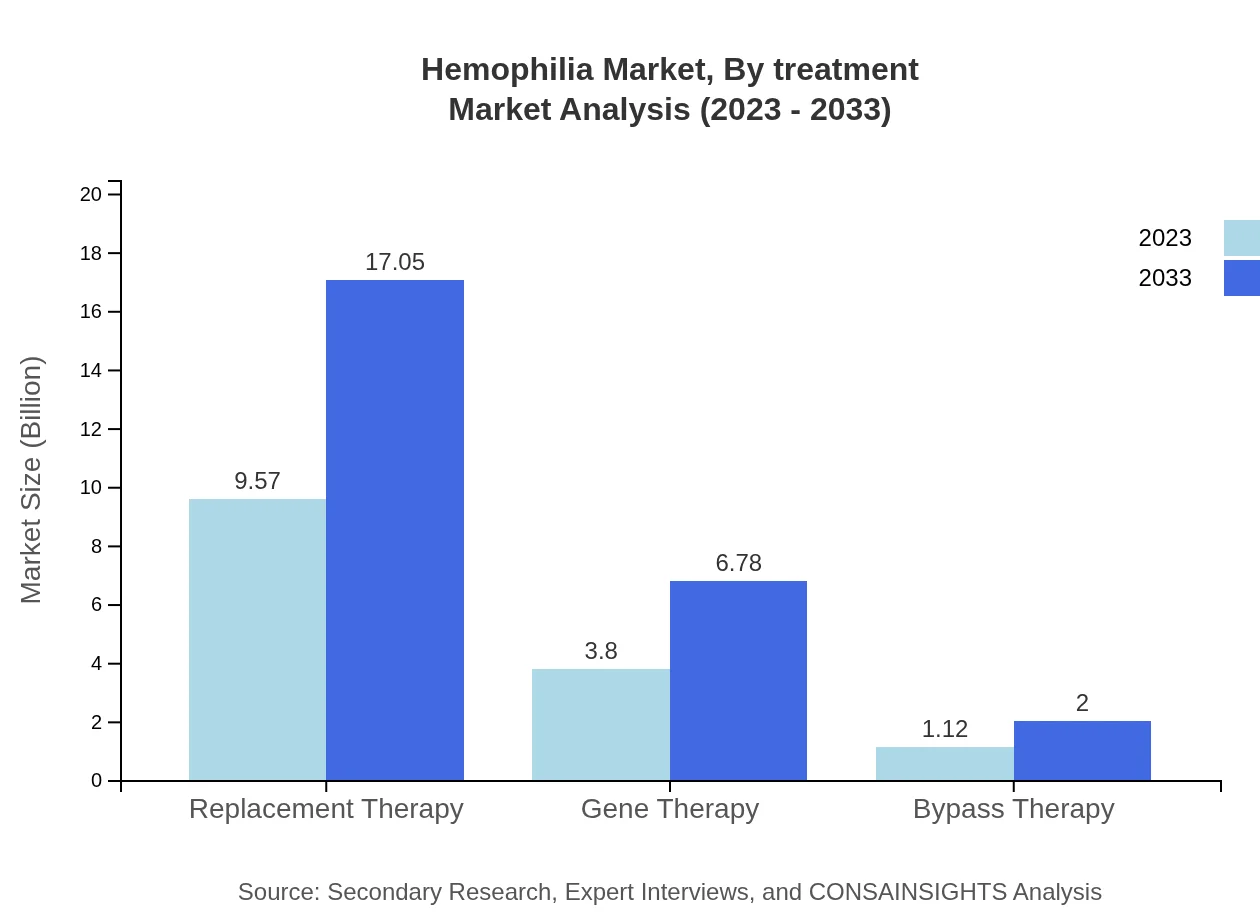

Hemophilia Market Analysis By Treatment

The main treatment categories include Replacement Therapy, Gene Therapy, and Bypass Therapy. Replacement Therapy leads the way, with a market size of $9.57 billion in 2023, reaching $17.05 billion by 2033, accounting for 66.01% of the market. Gene Therapy is also on the rise, from $3.80 billion in 2023 to $6.78 billion in 2033, representing a 26.24% market share.

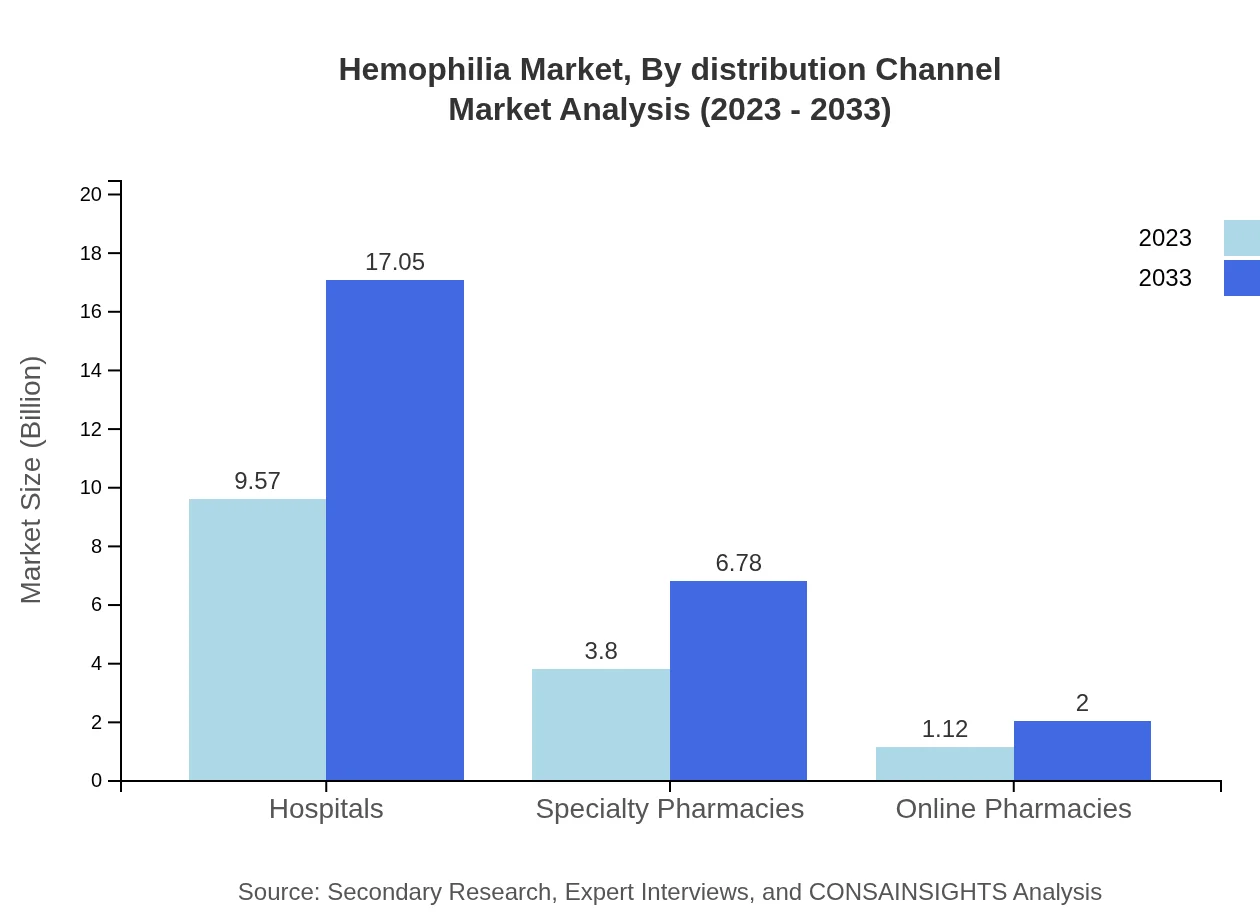

Hemophilia Market Analysis By Distribution Channel

The distribution channels encompass Hospitals, Specialty Pharmacies, Clinics, and Online Pharmacies. Hospitals dominate the market, recording $9.57 billion in 2023, expected to expand to $17.05 billion by 2033. Specialty Pharmacies and Online Pharmacies are also notable channels, contributing insights into evolving healthcare delivery models.

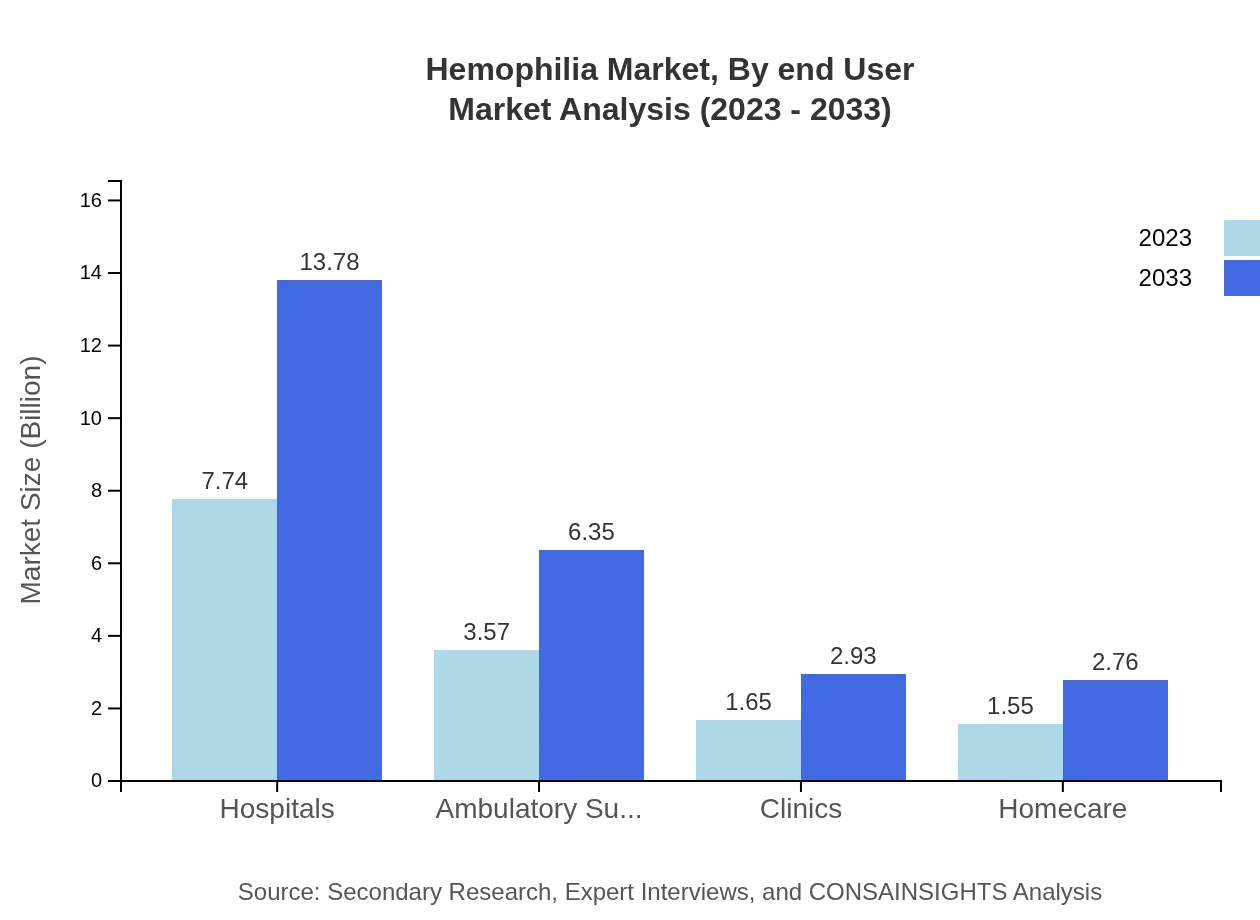

Hemophilia Market Analysis By End User

The key end-user segments include Hospitals and Ambulatory Surgical Centers. Hospitals capture a significant share with a market size of $7.74 billion in 2023, projected to grow to $13.78 billion by 2033. Meanwhile, Ambulatory Surgical Centers account for $3.57 billion in 2023, with estimates of $6.35 billion by 2033.

Hemophilia Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hemophilia Industry

Pfizer Inc.:

Pfizer is a leading biopharmaceutical company known for its extensive range of hemophilia therapies, including innovative factor products and gene therapies.Baxter International Inc.:

Baxter provides a diverse portfolio of hemophilia treatments and is recognized for its advanced therapies and commitment to patient care.Boehringer Ingelheim:

Boehringer Ingelheim is involved in the development of biopharmaceuticals, including innovative treatments for hemophilia A and B.Novo Nordisk:

Novo Nordisk is a global leader in diabetes care that also offers specialized treatments for hemophilia, focusing on quality and safety.Octapharma:

Octapharma is specialized in human protein products, particularly in coagulation factors for hemophilia treatment.We're grateful to work with incredible clients.

FAQs

What is the market size of hemophilia?

The global hemophilia market is currently valued at approximately $14.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.8%, reaching around $23.8 billion by 2033.

What are the key market players or companies in the hemophilia industry?

Key market players in the hemophilia industry include major pharmaceutical companies such as Bayer, Roche, Takeda, and Novo Nordisk, which lead in research, development, and marketing of hemophilia treatments globally.

What are the primary factors driving the growth in the hemophilia industry?

Key growth drivers for the hemophilia market include increasing incidences of hemophilia, advancements in treatment options, rising awareness of novel therapies, and improvements in healthcare infrastructure and access worldwide.

Which region is the fastest Growing in the hemophilia market?

The Asia Pacific region is currently the fastest-growing market for hemophilia treatment, projected to grow from $2.35 billion in 2023 to $4.19 billion in 2033, showcasing increased healthcare investment and rising disease prevalence.

Does ConsaInsights provide customized market report data for the hemophilia industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, allowing clients to access unique insights and detailed market data relevant to the hemophilia industry.

What deliverables can I expect from this hemophilia market research project?

Upon completion of the market research project, clients can expect comprehensive reports that include market analysis, trends, forecasts, competitive landscape, detailed segmentations, and strategic recommendations for informed decision-making.

What are the market trends of hemophilia?

Current trends in the hemophilia market include the increasing adoption of gene therapies, growing preference for homecare treatment options, and ongoing innovation in product development aimed at improving patient outcomes and quality of life.