Herbicides Market Report

Published Date: 02 February 2026 | Report Code: herbicides

Herbicides Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Herbicides market, focusing on market trends, segmentation, and regional insights, alongside a comprehensive forecast for 2023-2033.

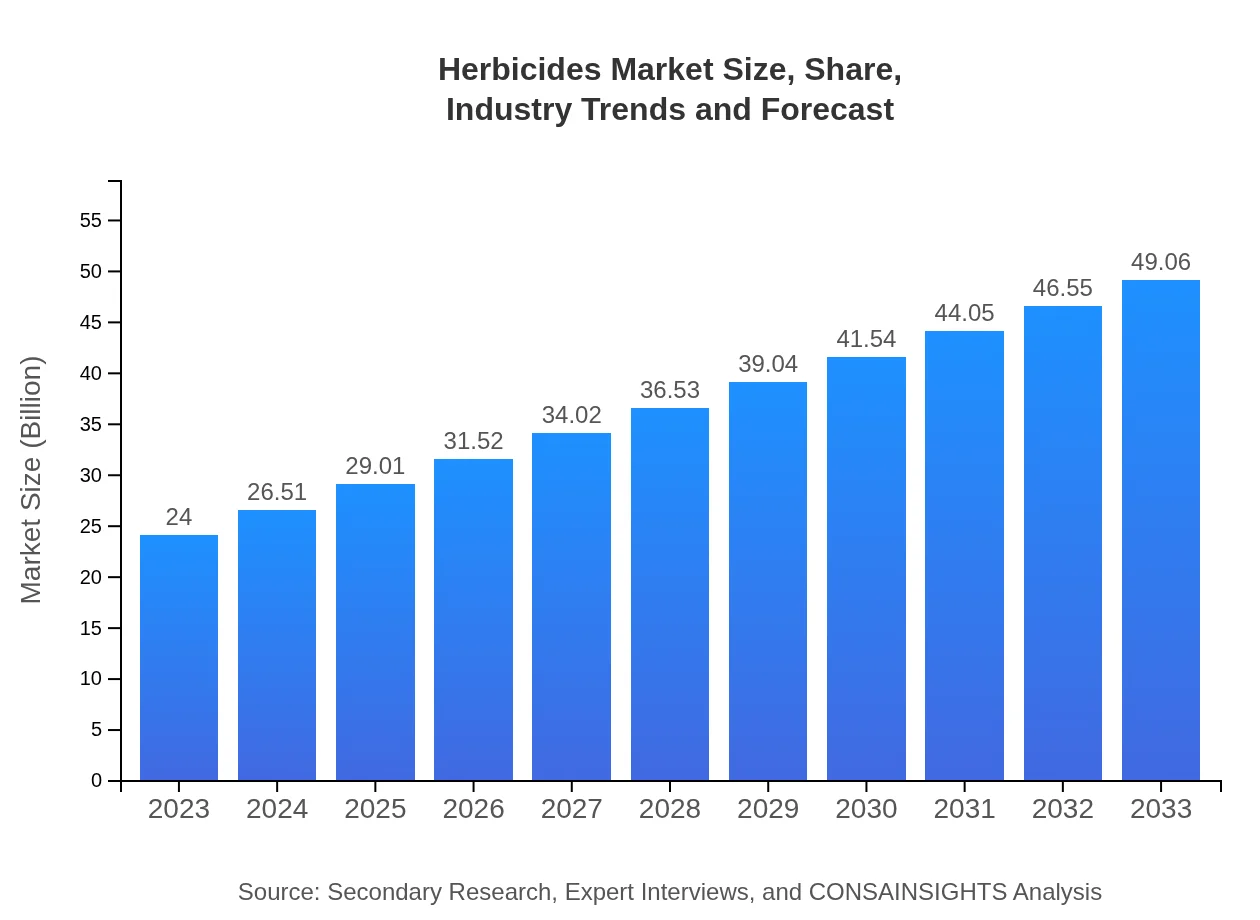

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $24.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $49.06 Billion |

| Top Companies | BASF SE, Syngenta AG, Dow AgroSciences, Monsanto Company |

| Last Modified Date | 02 February 2026 |

Herbicides Market Overview

Customize Herbicides Market Report market research report

- ✔ Get in-depth analysis of Herbicides market size, growth, and forecasts.

- ✔ Understand Herbicides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Herbicides

What is the Market Size & CAGR of Herbicides market in 2023?

Herbicides Industry Analysis

Herbicides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Herbicides Market Analysis Report by Region

Europe Herbicides Market Report:

Europe's herbicide market size is estimated at 8.72 billion USD in 2023 and projected to grow to 17.82 billion USD by 2033, led by countries such as Germany, France, and the UK. A major focus on sustainability and reduced chemical usage presents growth opportunities for biopesticides and eco-friendly herbicides.Asia Pacific Herbicides Market Report:

The Asia-Pacific region represents a significant portion of the herbicides market, with a size of approximately 4.10 billion USD in 2023, projected to grow to 8.39 billion USD by 2033. The demand is driven by a large agricultural sector coupled with the growing need for improved yields. Countries such as China and India are key markets, benefiting from heightened investment in modern agricultural practices.North America Herbicides Market Report:

The North American market was valued at 7.74 billion USD in 2023 and is set to reach around 15.81 billion USD by 2033. The United States remains the largest consumer, facilitated by high mechanization in agriculture and stringent regulations promoting the use of more effective herbicide products.South America Herbicides Market Report:

In South America, the herbicides market is expected to see an increase from 1.42 billion USD in 2023 to 2.90 billion USD by 2033. Brazil and Argentina are the leading consumers, with a rising emphasis on sustainability and organic farming fueling the adoption of advanced herbicides.Middle East & Africa Herbicides Market Report:

In the Middle East and Africa, the market is anticipated to expand from 2.02 billion USD in 2023 to 4.14 billion USD by 2033. The agricultural practices in this region are gradually modernizing, increasing the uptake of advanced herbicide technologies, particularly in South Africa and Egypt.Tell us your focus area and get a customized research report.

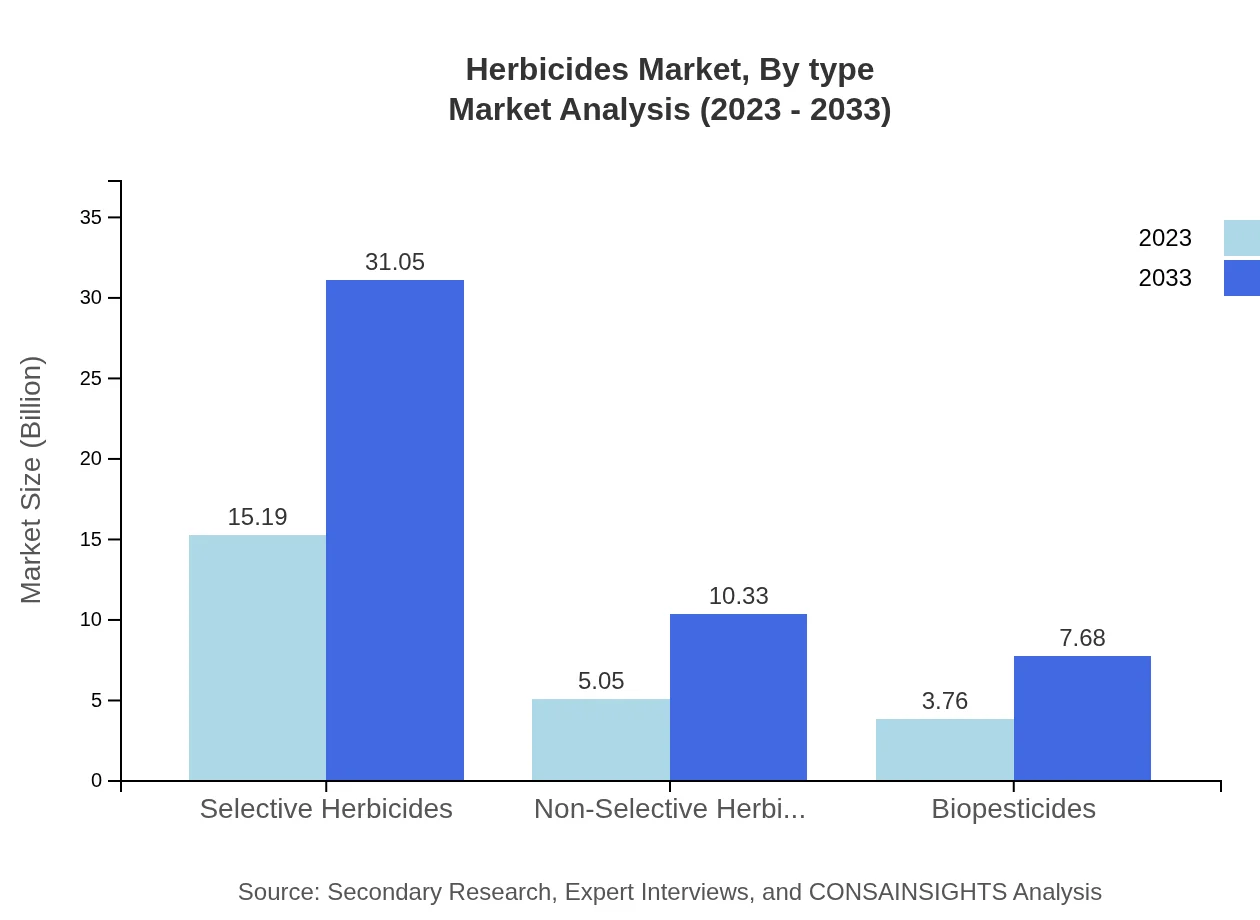

Herbicides Market Analysis By Type

The herbicides market is categorized into selective and non-selective herbicides, along with biopesticides. Selective herbicides dominate the market, valued at 15.19 billion USD in 2023 and expected to double to 31.05 billion USD by 2033, holding a stable market share of 63.29%. Non-selective herbicides and biopesticides follow, contributing significant yet smaller values in the sector.

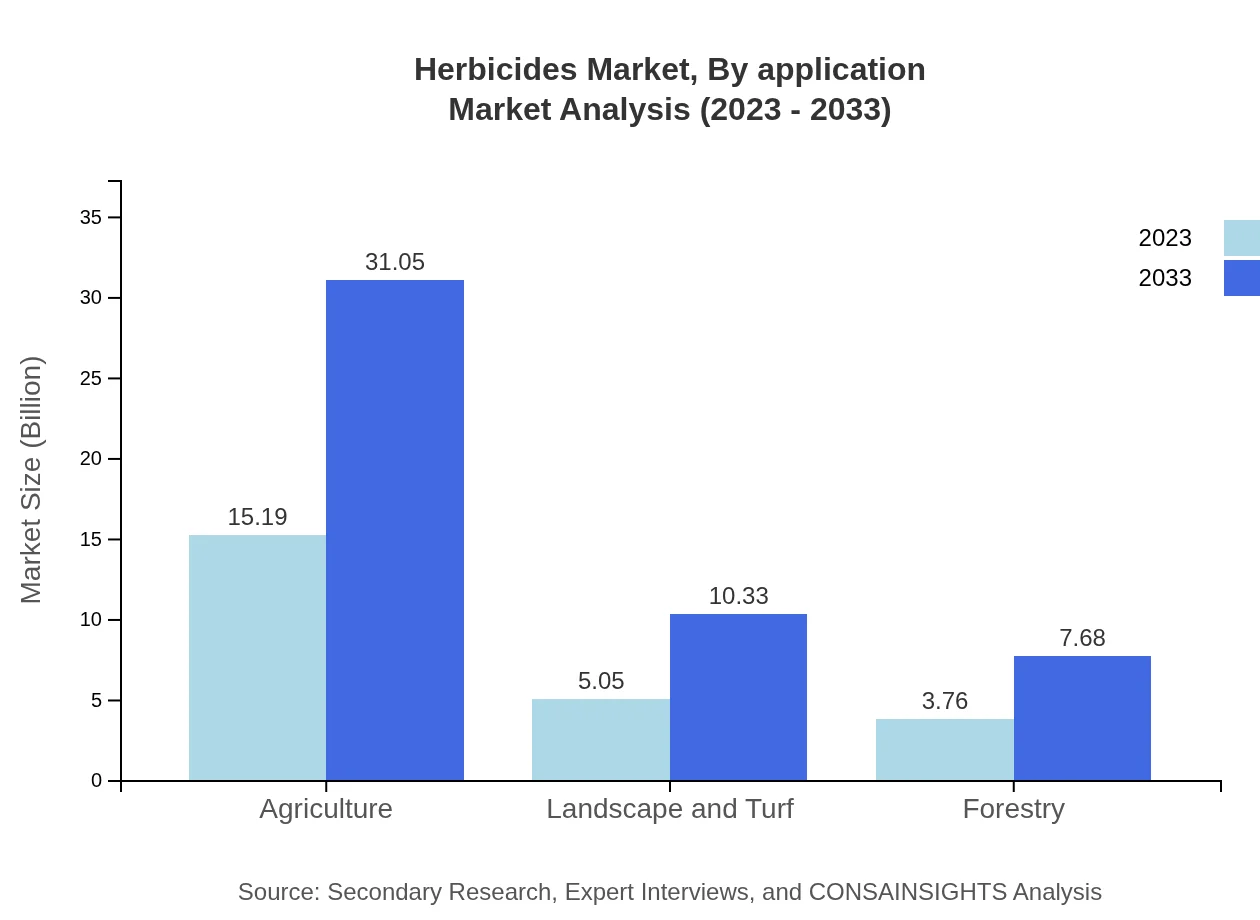

Herbicides Market Analysis By Application

In terms of application, agriculture remains the largest segment, forecasted to maintain a substantial share. Following agriculture, landscape and turf, along with forestry applications, represent important segments as well, reflecting the variety of uses herbicides can be applied for. The agricultural segment's market size rose to 15.19 billion USD in 2023 and will likely see similar growth trajectories.

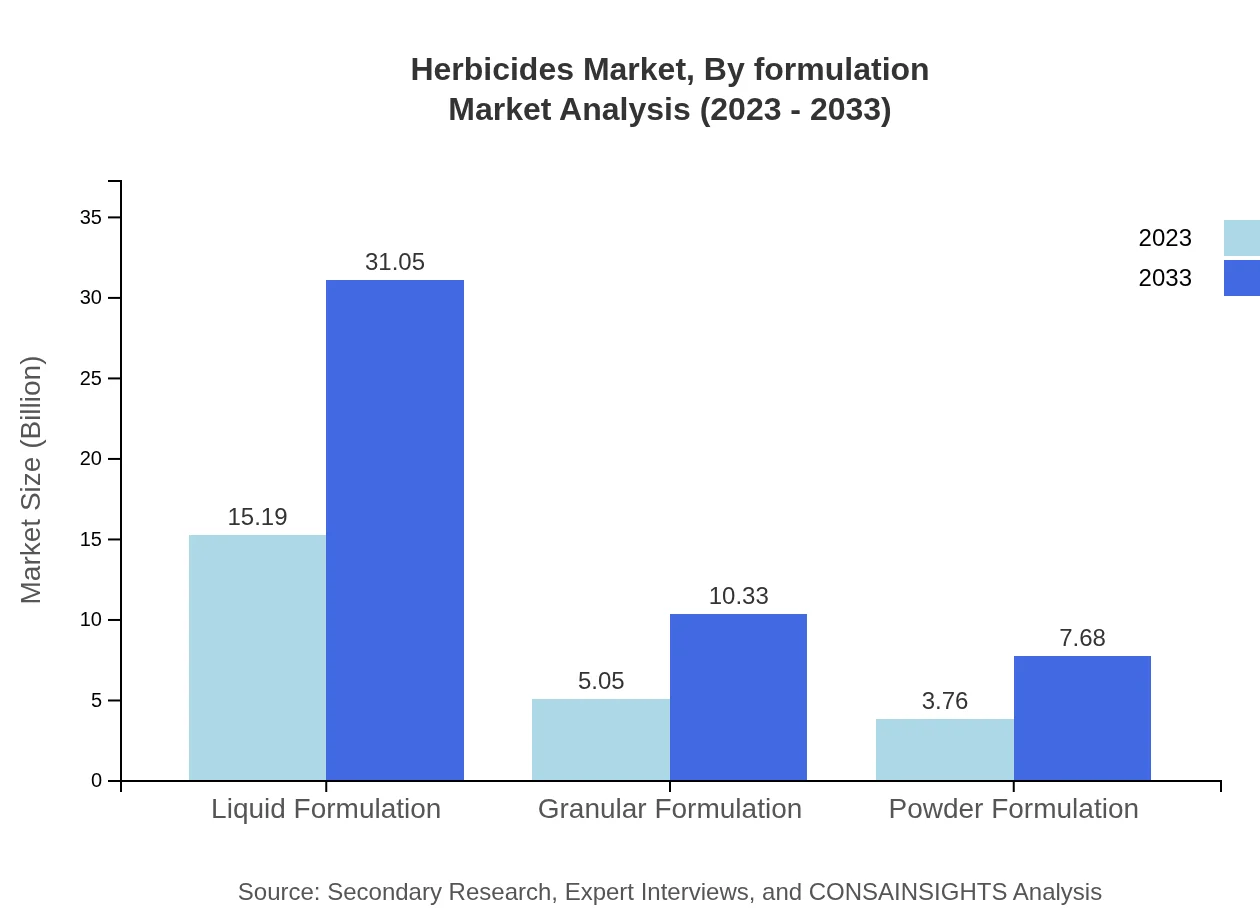

Herbicides Market Analysis By Formulation

The herbicide formulations include liquid, granular, and powder types. Liquid formulations lead the market, commanding a size of 15.19 billion USD in 2023, and are expected to reach 31.05 billion USD by 2033. Granular and powder formulations provide alternative methods for herbicide application, with their respective market sizes being 5.05 billion USD and 3.76 billion USD in 2023, implying consistent growth in demand.

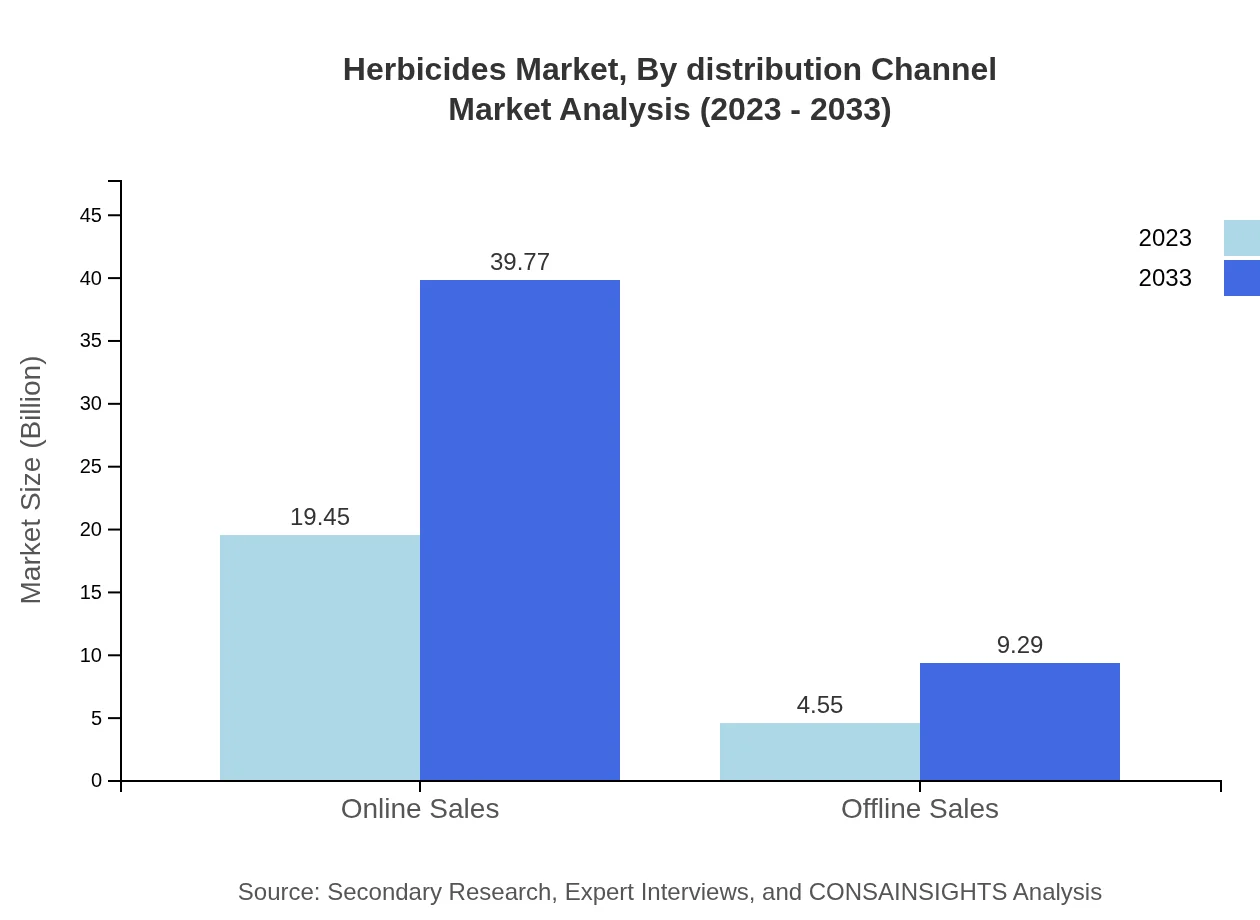

Herbicides Market Analysis By Distribution Channel

Distribution channels for the herbicides market are divided into online and offline sales. Online sales dominate with significant market size—19.45 billion USD in 2023, projected to rise to 39.77 billion USD by 2033—reflecting consumer trends towards convenience. Offline sales are also increasing, but at a lower growth rate compared to online sales.

Herbicides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Herbicides Industry

BASF SE:

A global leader in the chemical industry, BASF develops a wide range of chemical solutions for agriculture, including innovative herbicides that enhance plant growth and protect against weeds.Syngenta AG:

Syngenta is a prominent agriculture company that provides a diverse portfolio of herbicides. Their commitment to research and development drives innovation in crop protection technologies.Dow AgroSciences:

A key player in agricultural solutions, Dow AgroSciences produces herbicides that effectively manage weed species while complying with strict environmental regulations.Monsanto Company:

Monsanto, now part of Bayer, is known for its genetically modified crops and corresponding herbicides like Roundup, which have significantly influenced herbicide usage patterns globally.We're grateful to work with incredible clients.

FAQs

What is the market size of herbicides?

The global herbicides market size was valued at $24 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2023 to 2033.

What are the key market players or companies in the herbicides industry?

Key players in the herbicides market include major agricultural firms like Bayer AG, Syngenta AG, BASF, and DuPont. These companies dominate through innovative product offerings and extensive distribution networks.

What are the primary factors driving the growth in the herbicides industry?

Driving factors include the increasing demand for efficient agriculture, rising global population leading to food security concerns, and advancements in herbicide formulations that enhance efficacy and reduce environmental impact.

Which region is the fastest Growing in the herbicides market?

Asia-Pacific is the fastest-growing region, with the market expected to increase from $4.10 billion in 2023 to $8.39 billion by 2033, reflecting significant agricultural growth and technology adoption.

Does ConsaInsights provide customized market report data for the herbicides industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the herbicides industry, allowing for detailed insights and strategic analysis.

What deliverables can I expect from this herbicides market research project?

Expect comprehensive reports detailing market size, growth trends, competitive landscape, regional analysis, and segment-specific insights tailored to your requirements.

What are the market trends of herbicides?

Current trends include the growing shift towards biopesticides, advancements in herbicide formulations, increasing integration of digital agriculture technologies, and a focus on sustainable farming practices.