Hereceptin Biosimilars Market Report

Published Date: 31 January 2026 | Report Code: hereceptin-biosimilars

Hereceptin Biosimilars Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Hereceptin Biosimilars market, including market size, growth rates, and forecasts from 2023 to 2033. It further explores industry dynamics, regional insights, segmentation, and competitive landscape.

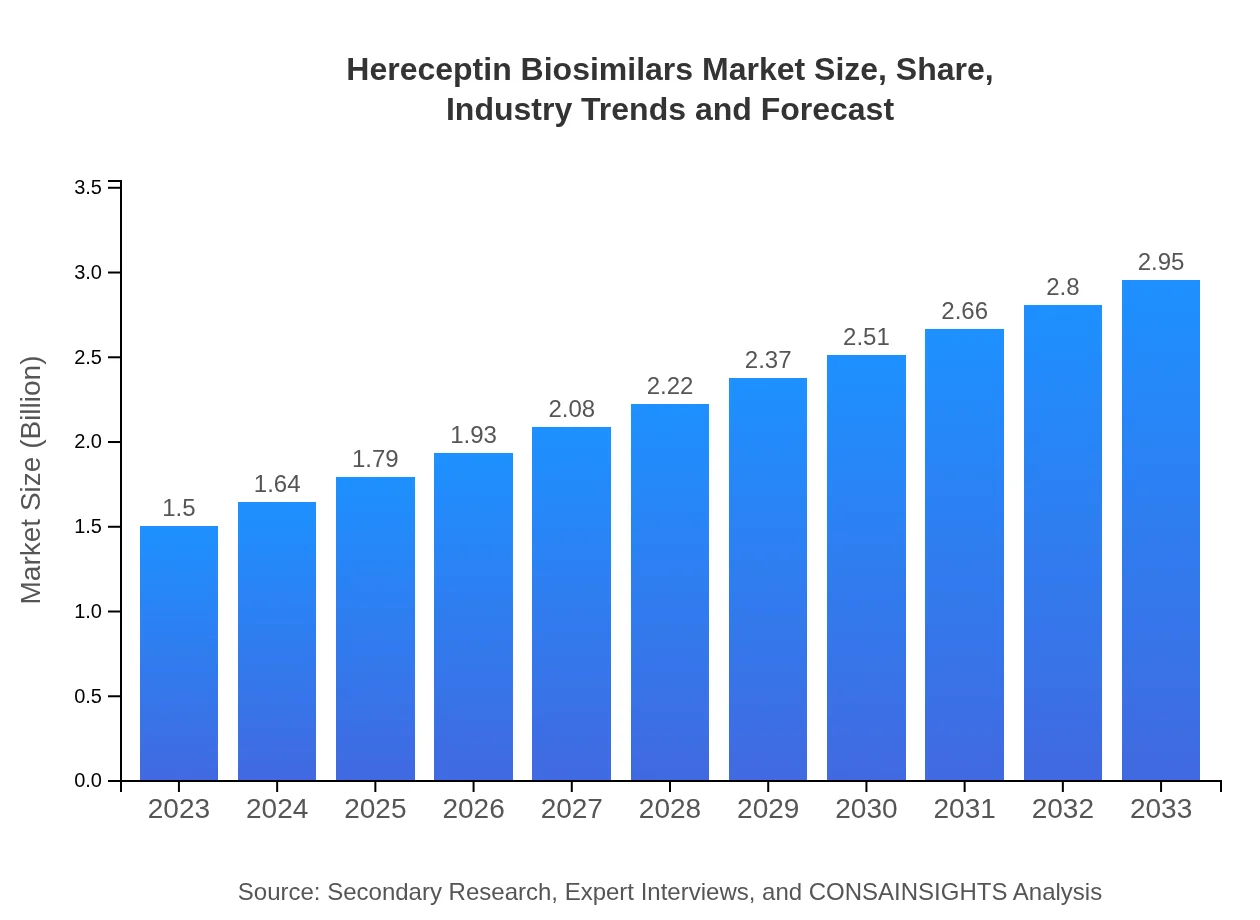

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.95 Billion |

| Top Companies | Roche, Teva Pharmaceuticals, Sandoz, Amgen |

| Last Modified Date | 31 January 2026 |

Hereceptin Biosimilars Market Overview

Customize Hereceptin Biosimilars Market Report market research report

- ✔ Get in-depth analysis of Hereceptin Biosimilars market size, growth, and forecasts.

- ✔ Understand Hereceptin Biosimilars's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hereceptin Biosimilars

What is the Market Size & CAGR of Hereceptin Biosimilars market in 2023?

Hereceptin Biosimilars Industry Analysis

Hereceptin Biosimilars Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hereceptin Biosimilars Market Analysis Report by Region

Europe Hereceptin Biosimilars Market Report:

Europe represents a mature market with increasing penetration of Hereceptin biosimilars, growing from $0.54 billion in 2023 to $1.07 billion by 2033. This growth is driven by solid regulatory support for biosimilars and a higher emphasis on competitive pricing.Asia Pacific Hereceptin Biosimilars Market Report:

The Asia Pacific region shows substantial growth potential in the Hereceptin Biosimilars market, projected to grow from $0.27 billion in 2023 to $0.53 billion by 2033. Factors contributing to this growth include increasing healthcare access, rising cancer awareness, and economic development in countries like China and India.North America Hereceptin Biosimilars Market Report:

North America holds a significant share, with the market size expected to escalate from $0.48 billion in 2023 to $0.95 billion by 2033. This region benefits from advanced healthcare infrastructure, high investment in R&D, and a faster pace in biosimilars adoption.South America Hereceptin Biosimilars Market Report:

In South America, the market is estimated to progress from $0.12 billion in 2023 to $0.23 billion by 2033. The growth is supported by improved healthcare policies and a rising patient population seeking affordable cancer treatments.Middle East & Africa Hereceptin Biosimilars Market Report:

The Middle East and Africa market is foreseen to expand from $0.09 billion in 2023 to $0.17 billion by 2033. Growth factors include expanding healthcare access and increasing investment in biotechnology.Tell us your focus area and get a customized research report.

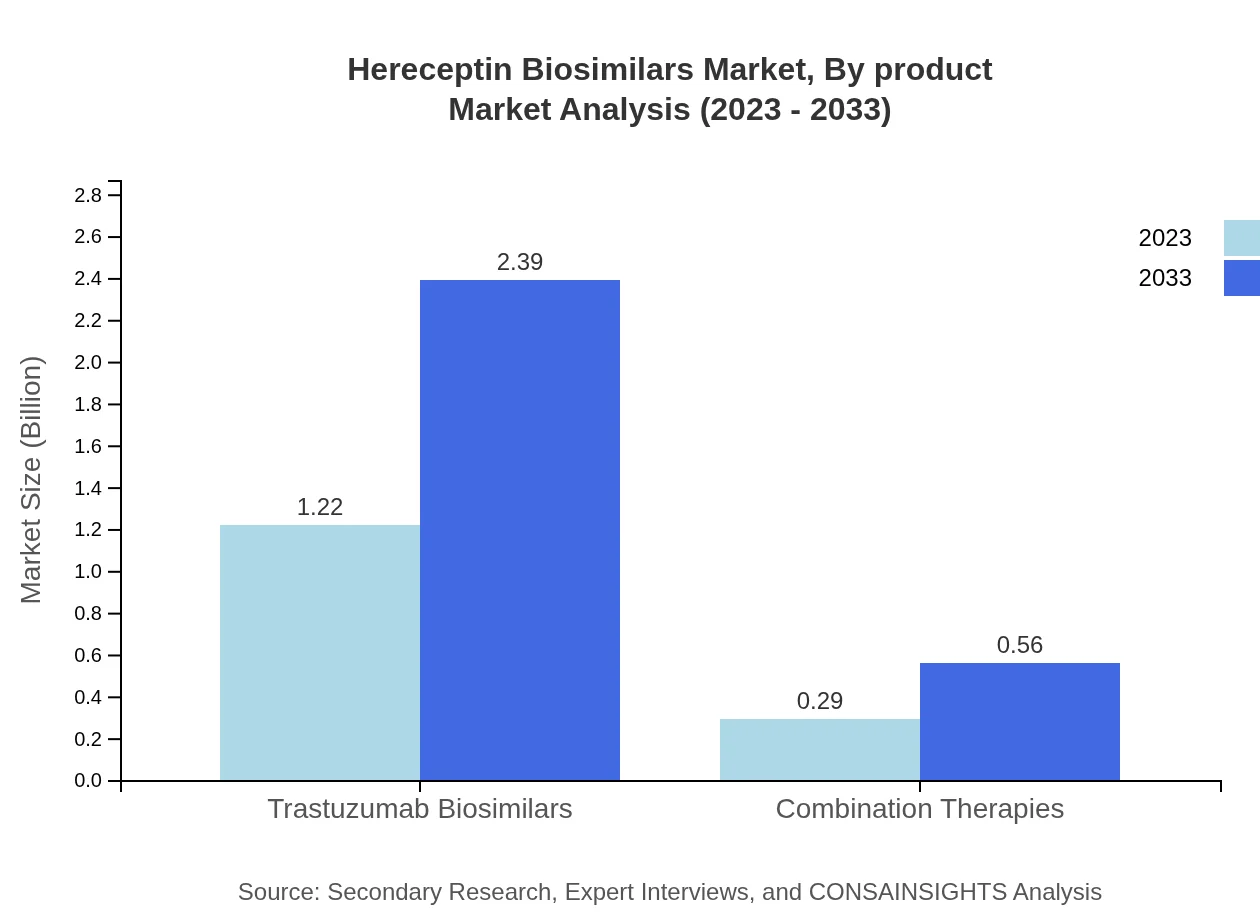

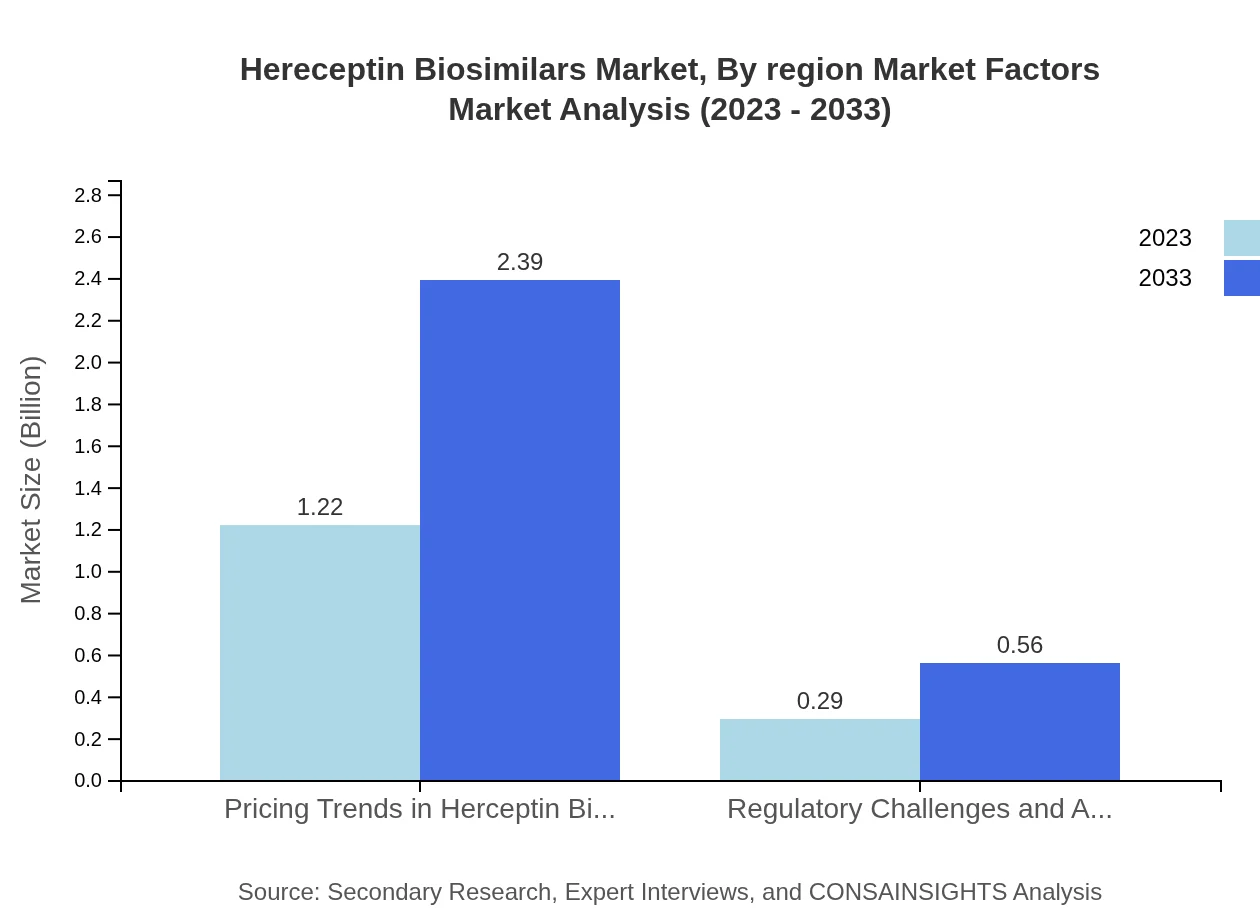

Hereceptin Biosimilars Market Analysis By Product

The Trastuzumab biosimilars segment, representing the largest share, accounts for a market size of $1.22 billion in 2023 and is projected to reach $2.39 billion by 2033. Combination therapies are also gaining traction, with growth from $0.29 billion to $0.56 billion during the same period.

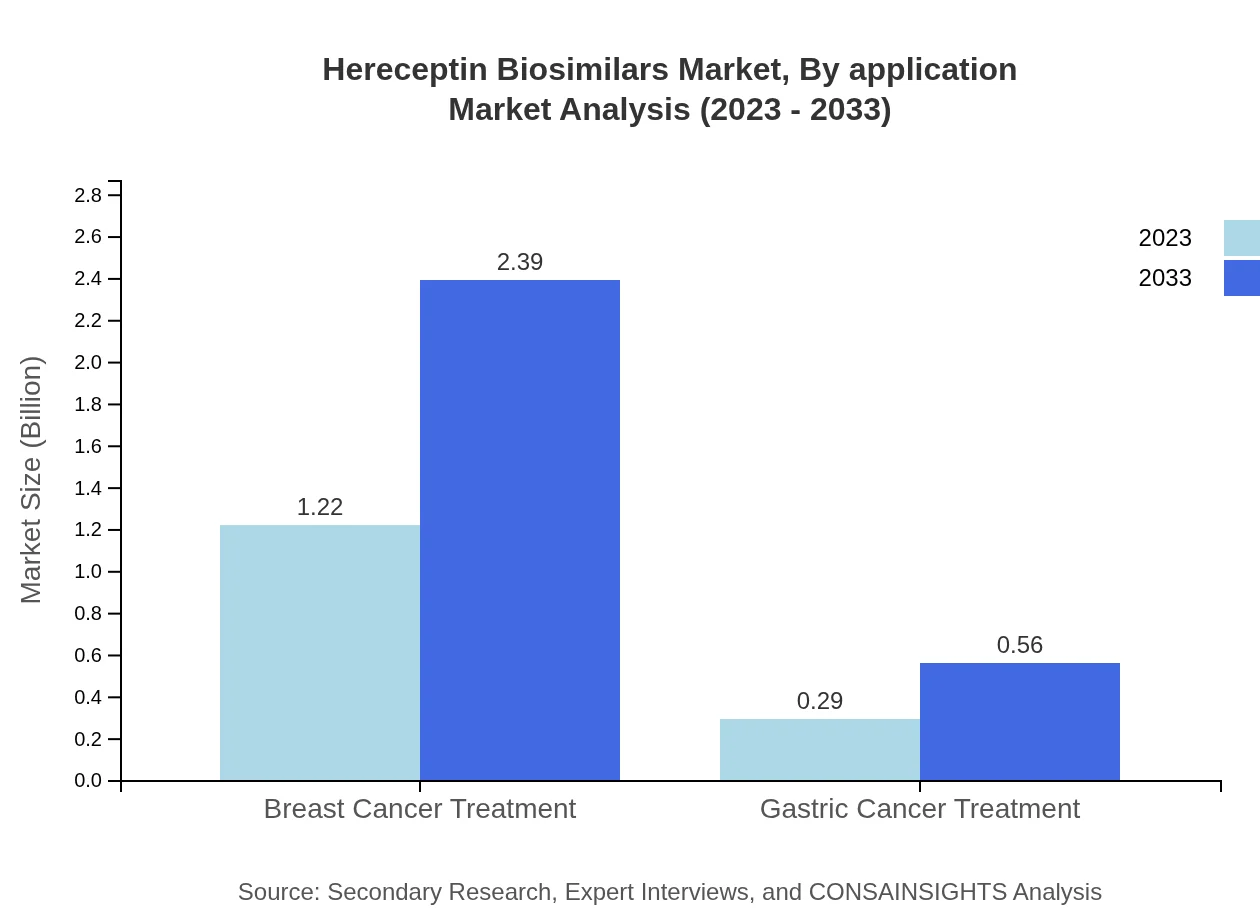

Hereceptin Biosimilars Market Analysis By Application

Breast cancer treatment dominates the market, which is valued at $1.22 billion in 2023 and expected to maintain this leading position through to 2033. Gastric cancer applications represent a smaller, yet growing segment, starting from $0.29 billion and growing to $0.56 billion.

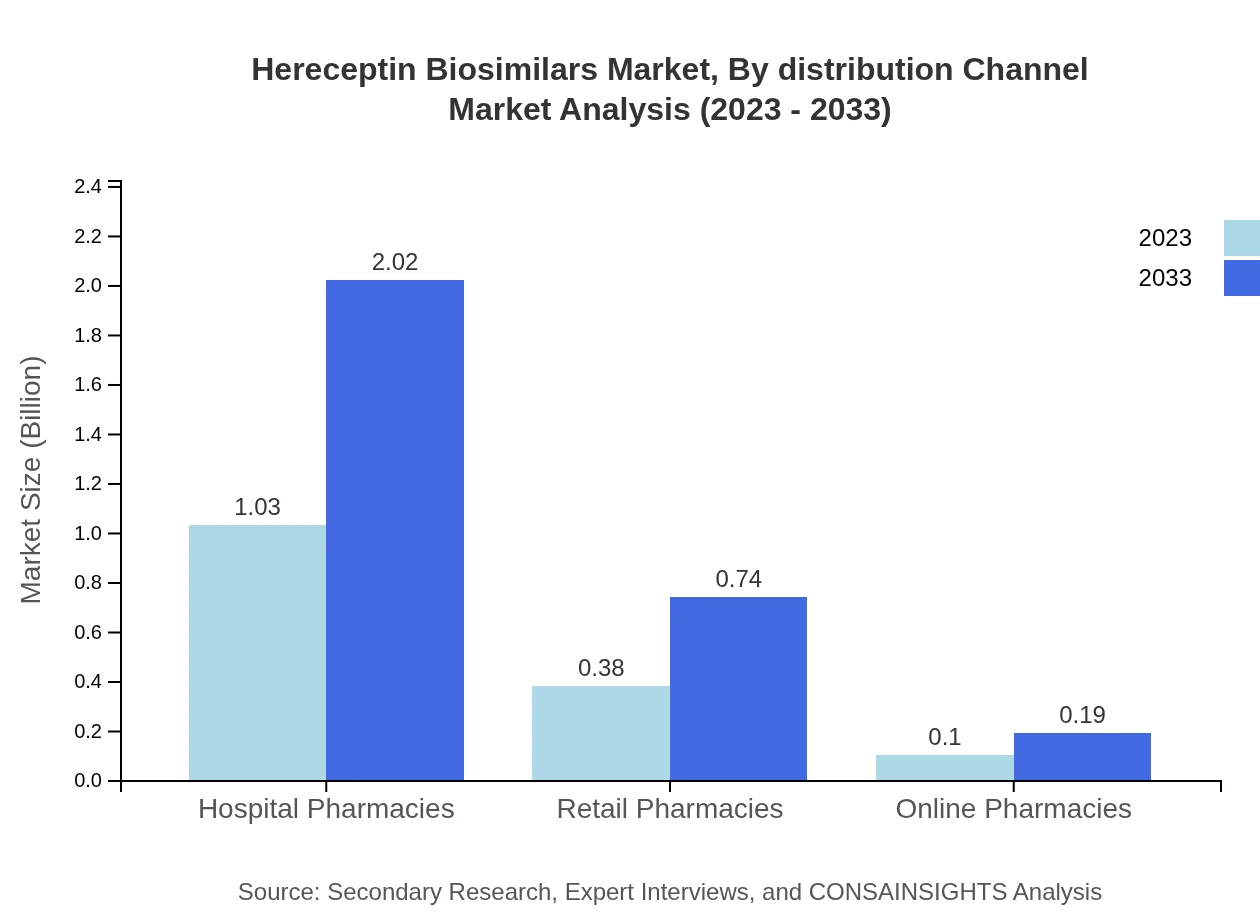

Hereceptin Biosimilars Market Analysis By Distribution Channel

Hospital pharmacies are the largest distribution channel, with market size at $1.03 billion in 2023 and expected to grow to $2.02 billion by 2033. Retail and online pharmacies also play a crucial role, showing substantial growth rates.

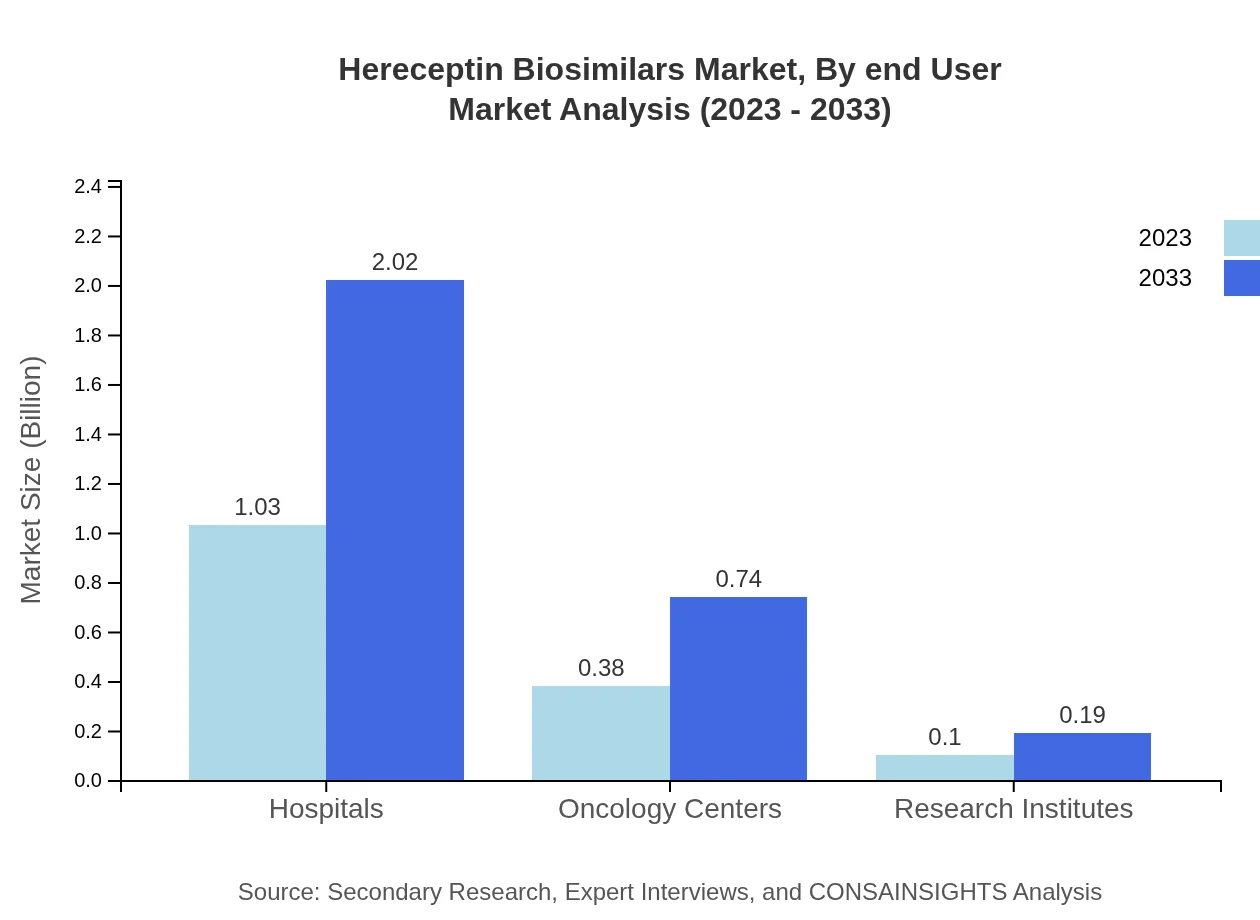

Hereceptin Biosimilars Market Analysis By End User

Hospitals are the predominant end-user segment, accounting for a market size of $1.03 billion in 2023, projected to hit $2.02 billion by 2033. Oncology centers follow closely, emphasizing a structured patient's pathway for complex treatments.

Hereceptin Biosimilars Market Analysis By Region Market Factors

Key market factors influencing the Hereceptin Biosimilars market include regulatory challenges related to approvals, pricing trends reflecting cost-effectiveness, and the ongoing shift towards personalized medicine approaches, which cater to the specific healthcare needs of patients.

Hereceptin Biosimilars Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hereceptin Biosimilars Industry

Roche:

A pioneer in biologics with strong market presence, Roche's products heavily influence the pricing dynamics and innovation trends in the biosimilars market.Teva Pharmaceuticals:

Teva specializes in generics and biosimilars, leveraging its extensive distribution network to promote the uptake of its Hereceptin biosimilar products globally.Sandoz:

Sandoz is a major player focusing on biosimilars development, recognized for its commitment to quality and affordability in cancer treatment options.Amgen:

A leading biotechnology company, Amgen engages in biosimilars development and plays a significant role in shaping industry standards for biosimilars.We're grateful to work with incredible clients.

FAQs

What is the market size of Herceptin Biosimilars?

The Herceptin Biosimilars market is estimated to reach $1.5 billion by 2033, growing from $1.22 billion in 2023, reflecting a compound annual growth rate (CAGR) of 6.8% over the period.

What are the key market players or companies in this Herceptin Biosimilars industry?

Key players in the Herceptin Biosimilars market include major pharmaceutical companies such as Amgen, Mylan, and Teva Pharmaceuticals, which are actively involved in the development and distribution of biosimilars.

What are the primary factors driving the growth in the Herceptin Biosimilars industry?

Drivers of growth include the increasing incidence of breast and gastric cancers, rising healthcare costs prompting the need for affordable therapies, and favorable regulatory scenarios facilitating biosimilar approvals.

Which region is the fastest Growing in the Herceptin Biosimilars?

The Asia Pacific region is the fastest-growing area, with projections showing a market increase from $0.27 billion in 2023 to $0.53 billion by 2033, indicating robust adoption of Herceptin biosimilars.

Does ConsaInsights provide customized market report data for the Herceptin Biosimilars industry?

Yes, ConsaInsights offers tailored market report data that allows clients to request specific insights and analysis based on their unique requirements for the Herceptin Biosimilars sector.

What deliverables can I expect from this Herceptin Biosimilars market research project?

Deliverables from this market research project typically include comprehensive reports, detailed analyses, market forecasts, and actionable insights tailored to the Herceptin Biosimilars landscape.

What are the market trends of Herceptin Biosimilars?

Current trends in the Herceptin Biosimilars market highlight a shift towards combination therapies, increasing investment in research for innovative formulations, and significant demand from hospitals and oncology centers.