High Availability Server Market Report

Published Date: 31 January 2026 | Report Code: high-availability-server

High Availability Server Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the High Availability Server market from 2023 to 2033, covering market size, segmentation, regional analyses, technology trends, and company insights aimed at guiding stakeholders in making informed decisions.

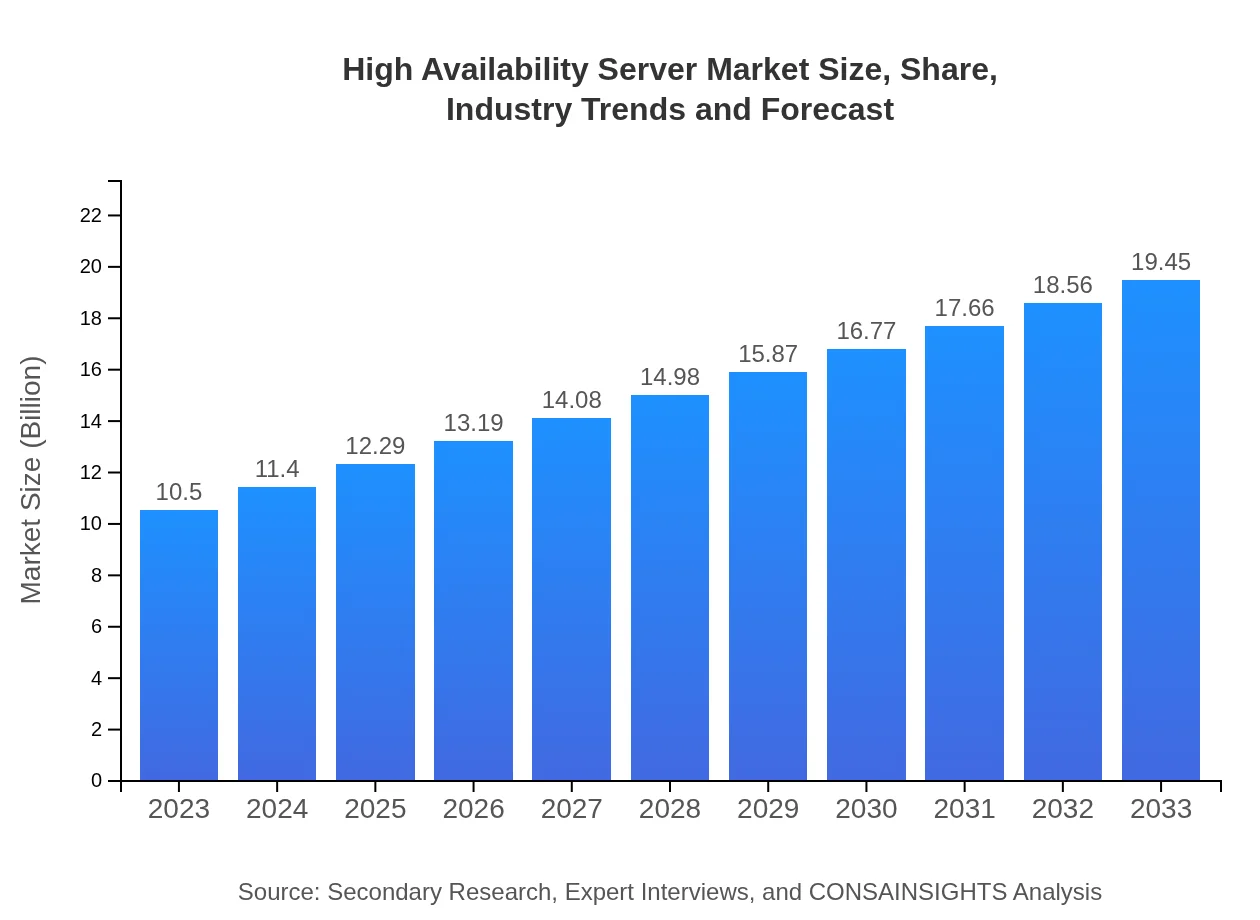

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $19.45 Billion |

| Top Companies | Hewlett Packard Enterprise (HPE), IBM, Dell Technologies, Cisco Systems, Lenovo |

| Last Modified Date | 31 January 2026 |

High Availability Server Market Overview

Customize High Availability Server Market Report market research report

- ✔ Get in-depth analysis of High Availability Server market size, growth, and forecasts.

- ✔ Understand High Availability Server's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Availability Server

What is the Market Size & CAGR of the High Availability Server Market in 2023?

High Availability Server Industry Analysis

High Availability Server Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Availability Server Market Analysis Report by Region

Europe High Availability Server Market Report:

The European market for High Availability Servers, valued at $2.75 billion in 2023, is anticipated to grow to $5.10 billion by 2033. Stringent regulations and heightened demand for data security have made High Availability solutions a priority for enterprises in this region.Asia Pacific High Availability Server Market Report:

The Asia Pacific region holds a strong position in the High Availability Server market, with a market size of $2.09 billion in 2023, expected to reach $3.86 billion by 2033. The growth is driven by rapid digital transformation and the increasing need for business continuity solutions among SMEs and large enterprises.North America High Availability Server Market Report:

North America dominates the High Availability Server market with a valuation of $3.93 billion in 2023, projected to grow to $7.28 billion by 2033. The region's advanced IT infrastructure, high adoption of cloud services, and significant investments in technology are the main drivers of growth.South America High Availability Server Market Report:

In South America, the High Availability Server market is emerging, with a value of $0.58 billion in 2023, projected to double to $1.07 billion by 2033. Investment in IT infrastructure and a growing focus on improving operational efficiencies are key growth factors.Middle East & Africa High Availability Server Market Report:

The Middle East and Africa market is set to grow from $1.16 billion in 2023 to $2.14 billion by 2033. Enhanced internet penetration and a push for technological advancement across various sectors are fueling this growth.Tell us your focus area and get a customized research report.

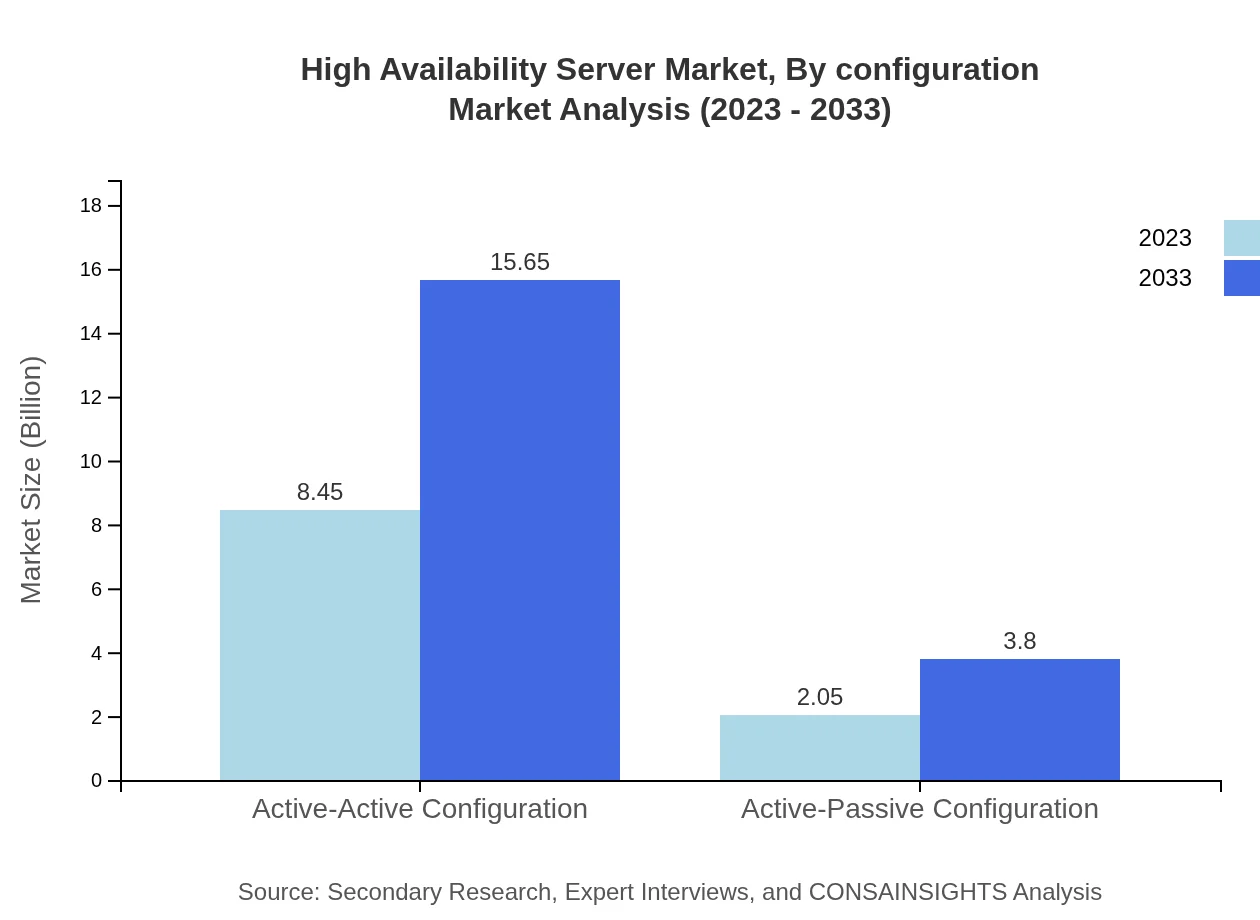

High Availability Server Market Analysis By Configuration

The market for High Availability Servers based on configuration types is increasingly leaning towards Active-Active setups, expected to dominate with a market size reaching $15.65 billion by 2033, driven by their resilience and enhanced uptime capabilities. Active-Passive configurations, while still relevant, are anticipated to grow at a slower rate, yet they are crucial for businesses still transitioning to newer technologies.

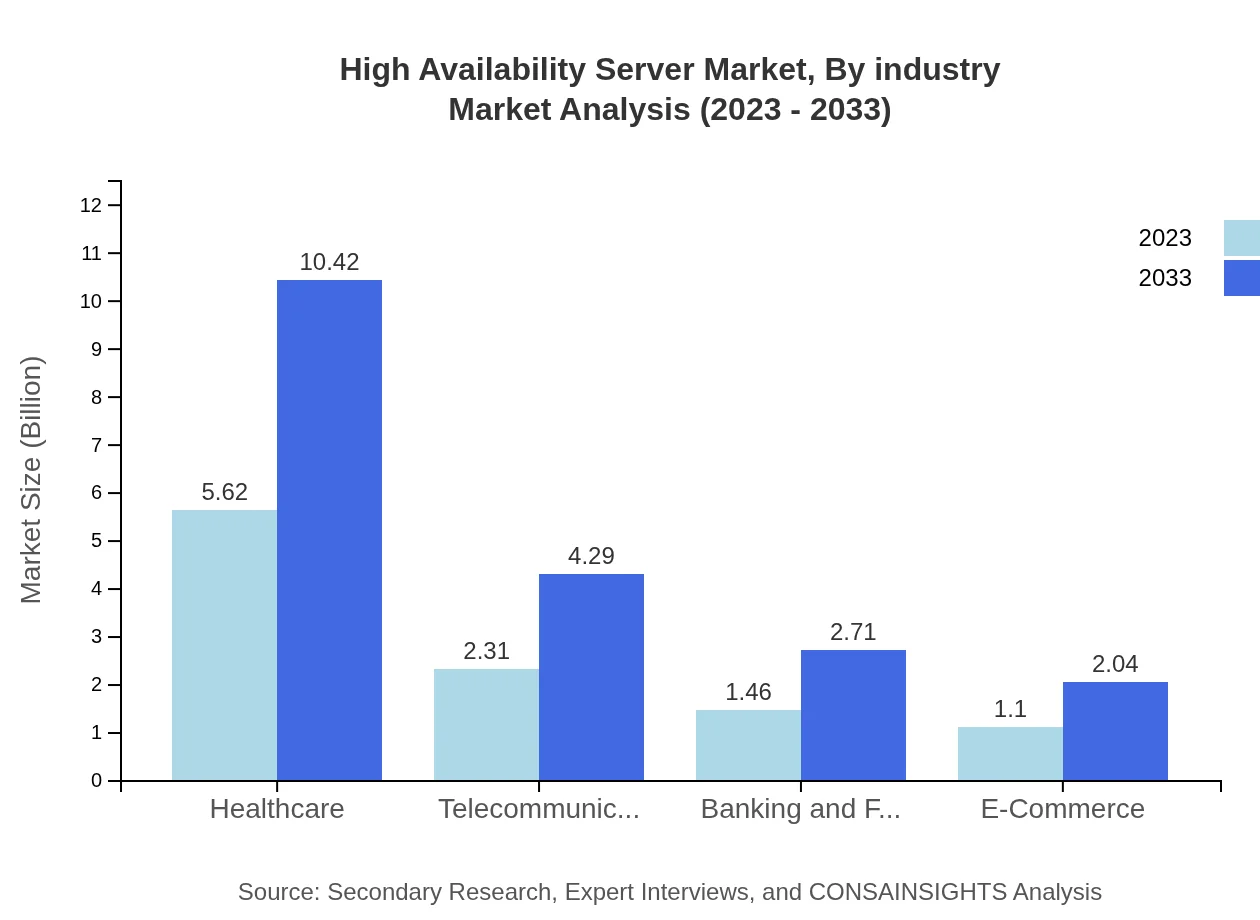

High Availability Server Market Analysis By Industry

The healthcare sector leads the High Availability Server market by industry, with a substantial size increase from $5.62 billion in 2023 to $10.42 billion by 2033. Telecommunications and banking sectors also hold significant shares, projected to reach $2.31 billion and $1.46 billion respectively by 2033, highlighting the critical need for reliable infrastructures.

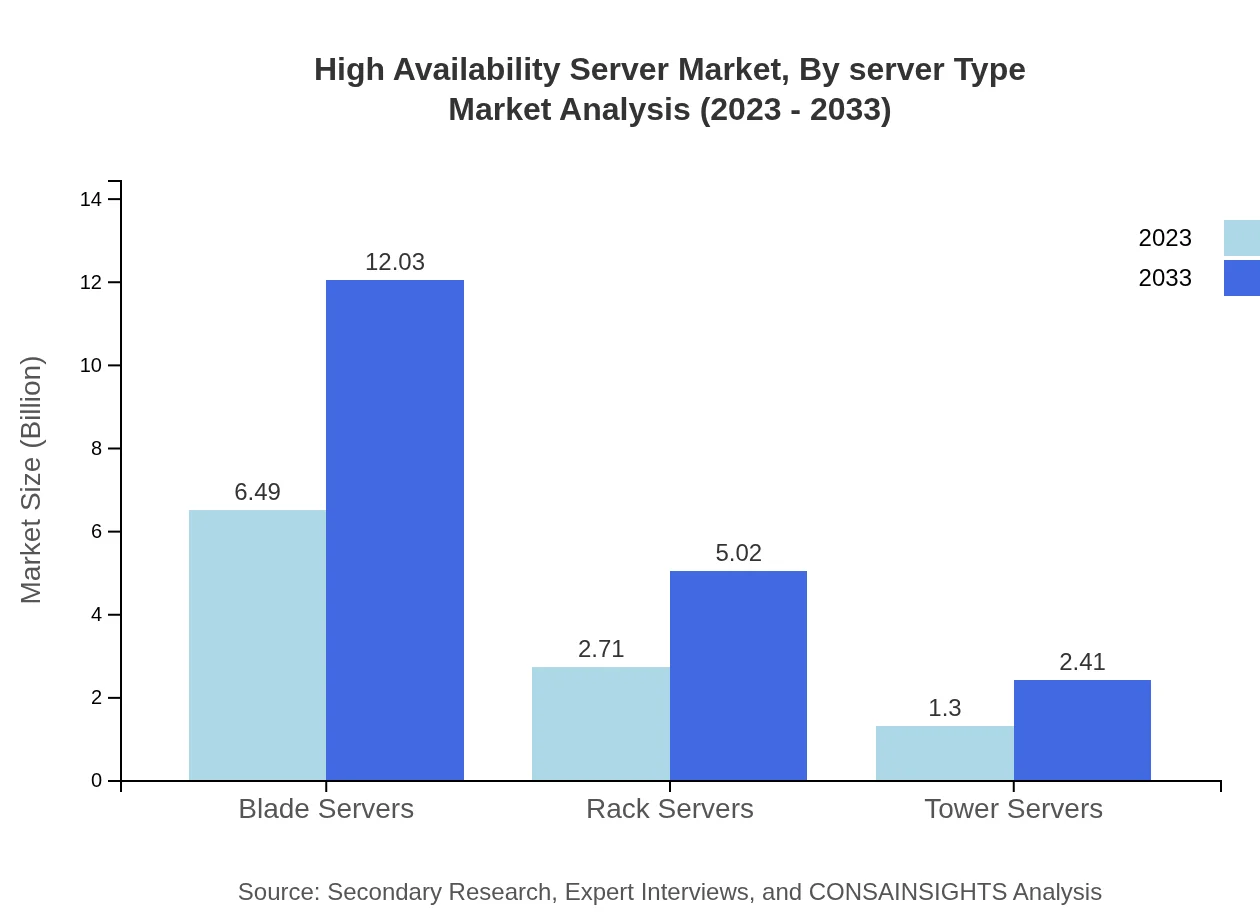

High Availability Server Market Analysis By Server Type

Blade Servers dominate the market, with a market size of $6.49 billion in 2023, expected to grow significantly due to their space savings and energy efficiency. Rack Servers and Tower Servers also show stable growth, but the former experiences a lower market share relative to blades.

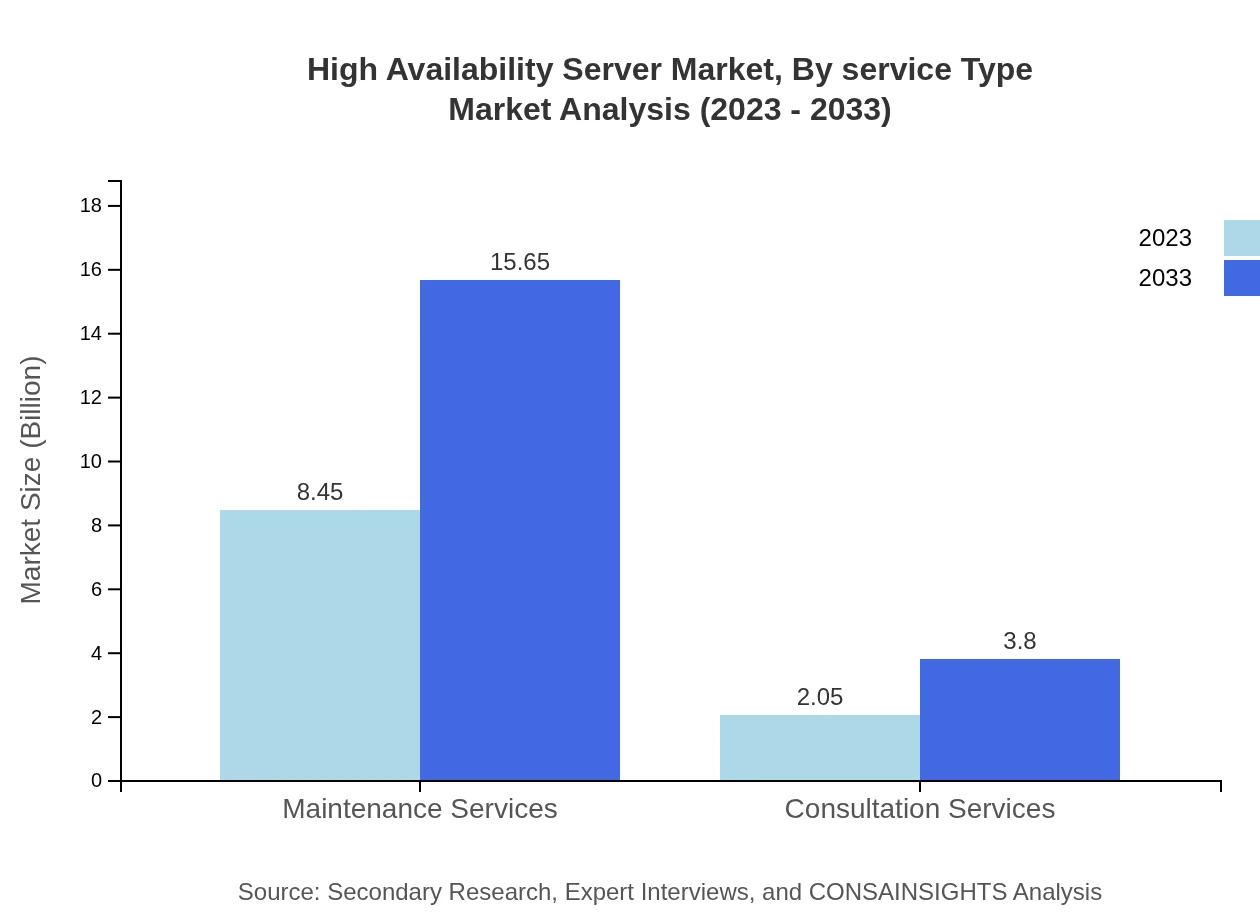

High Availability Server Market Analysis By Service Type

Maintenance Services are pivotal in the support of High Availability Servers, with a projected size increase to $15.65 billion by 2033. Consultation Services are also gaining importance as organizations seek external expertise to optimize their infrastructure resilience.

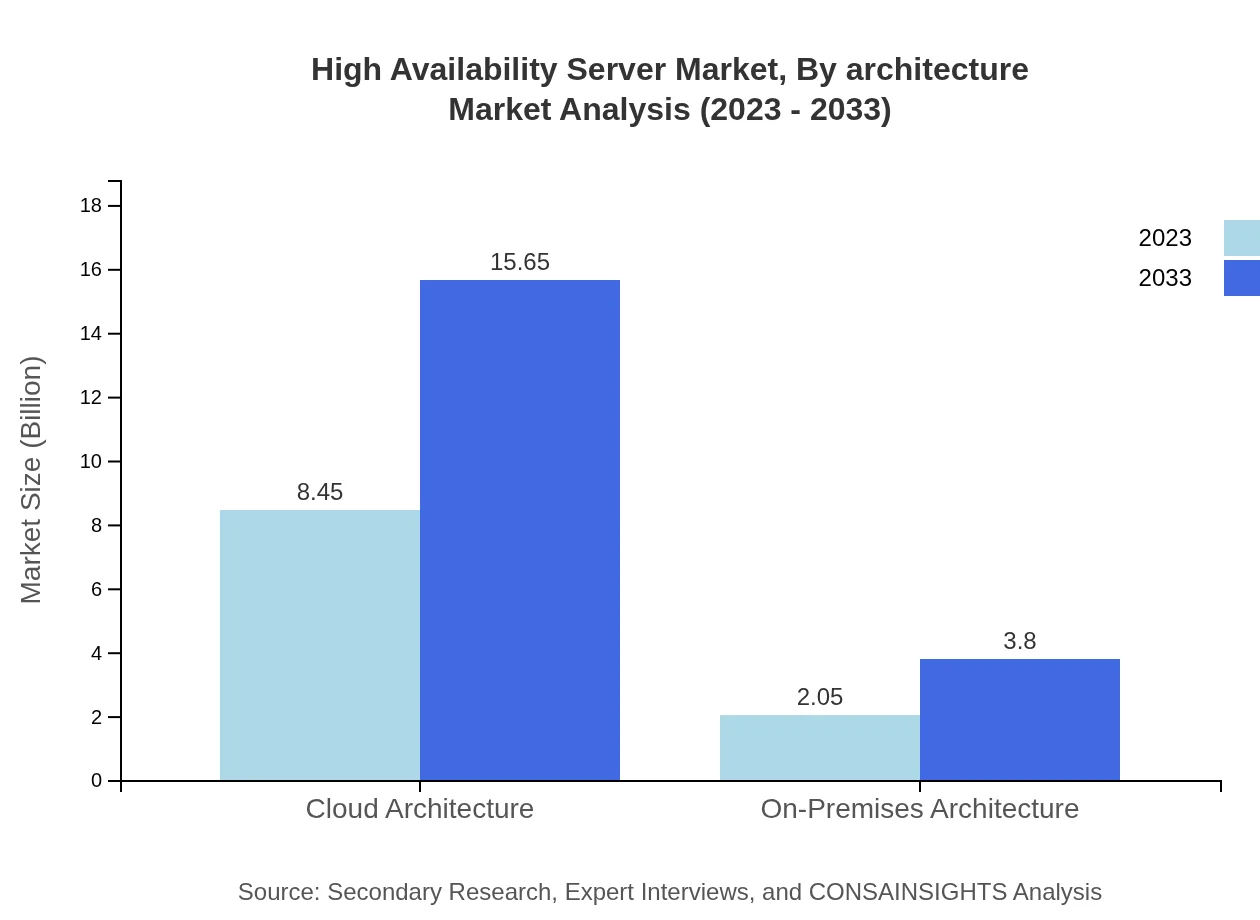

High Availability Server Market Analysis By Architecture

Cloud architecture is leading the High Availability Server market, showing a remarkable growth rate, transitioning from $8.45 billion in 2023 to $15.65 billion by 2033, primarily due to the ongoing shift towards cloud solutions. On-Premises architecture remains significant but shows slower market growth as enterprises increasingly adopt cloud solutions.

High Availability Server Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Availability Server Industry

Hewlett Packard Enterprise (HPE):

Hewlett Packard Enterprise leads in providing High Availability Server solutions with its innovative technology and reliable service support, catering to diverse sectors including healthcare and finance.IBM:

IBM offers a comprehensive portfolio of High Availability Server products, focusing on infrastructure resilience and cloud-based solutions, ensuring clients have round-the-clock service availability.Dell Technologies:

Dell Technologies provides customizable High Availability Server solutions, known for performance efficiency and extensive support services, serving numerous global enterprises.Cisco Systems:

Cisco's High Availability offerings focus on robust networking capabilities, enabling businesses to deploy effective strategies for minimizing downtime and enhancing service availability.Lenovo :

Lenovo provides a range of High Availability Servers that cater to various industries, specializing in performance-driven solutions that ensure business continuity without compromising on efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of high Availability Server?

The high-availability server market is estimated to grow from $10.5 billion in 2023 to $21 billion by 2033, registering a compound annual growth rate (CAGR) of 6.2%. This growth indicates increased reliance on uninterrupted services across industries.

What are the key market players or companies in the high Availability Server industry?

Key players in the high-availability server industry include but are not limited to major companies like Dell Technologies, Hewlett Packard Enterprise, IBM, Cisco Systems, and Oracle. These organizations are pivotal in offering robust solutions and innovation.

What are the primary factors driving the growth in the high Availability Server industry?

The growth of the high-availability server market is driven largely by increased demand for uninterrupted access to applications, the proliferation of digital transformation, and the rise of critical data management requirements, especially in sectors like healthcare and finance.

Which region is the fastest Growing in the high Availability Server industry?

North America is the fastest-growing region for high-availability servers, expected to expand from $3.93 billion in 2023 to $7.28 billion by 2033. This growth is attributed to robust technological infrastructure and widespread adoption of cloud services.

Does ConsaInsights provide customized market report data for the high Availability Server industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the high-availability server industry. Clients can request detailed insights and analyses to suit their unique business requirements.

What deliverables can I expect from this high Availability Server market research project?

Deliverables from the high-availability server market research project typically include comprehensive reports, regional analyses, segment data, market forecasts, and competitive landscape assessments, which all aid in informed decision-making.

What are the market trends of high Availability Server?

Current trends in the high-availability server market include the rise of cloud-based solutions, increasing adoption of hybrid architectures, and demand for maintenance and consultation services, highlighting an evolving infrastructure landscape.