High Bandwidth Memory Market Report

Published Date: 31 January 2026 | Report Code: high-bandwidth-memory

High Bandwidth Memory Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the High Bandwidth Memory market from 2023 to 2033, focusing on market trends, size, segmentation, and regional insights. It covers significant forecasts and insights across the industry.

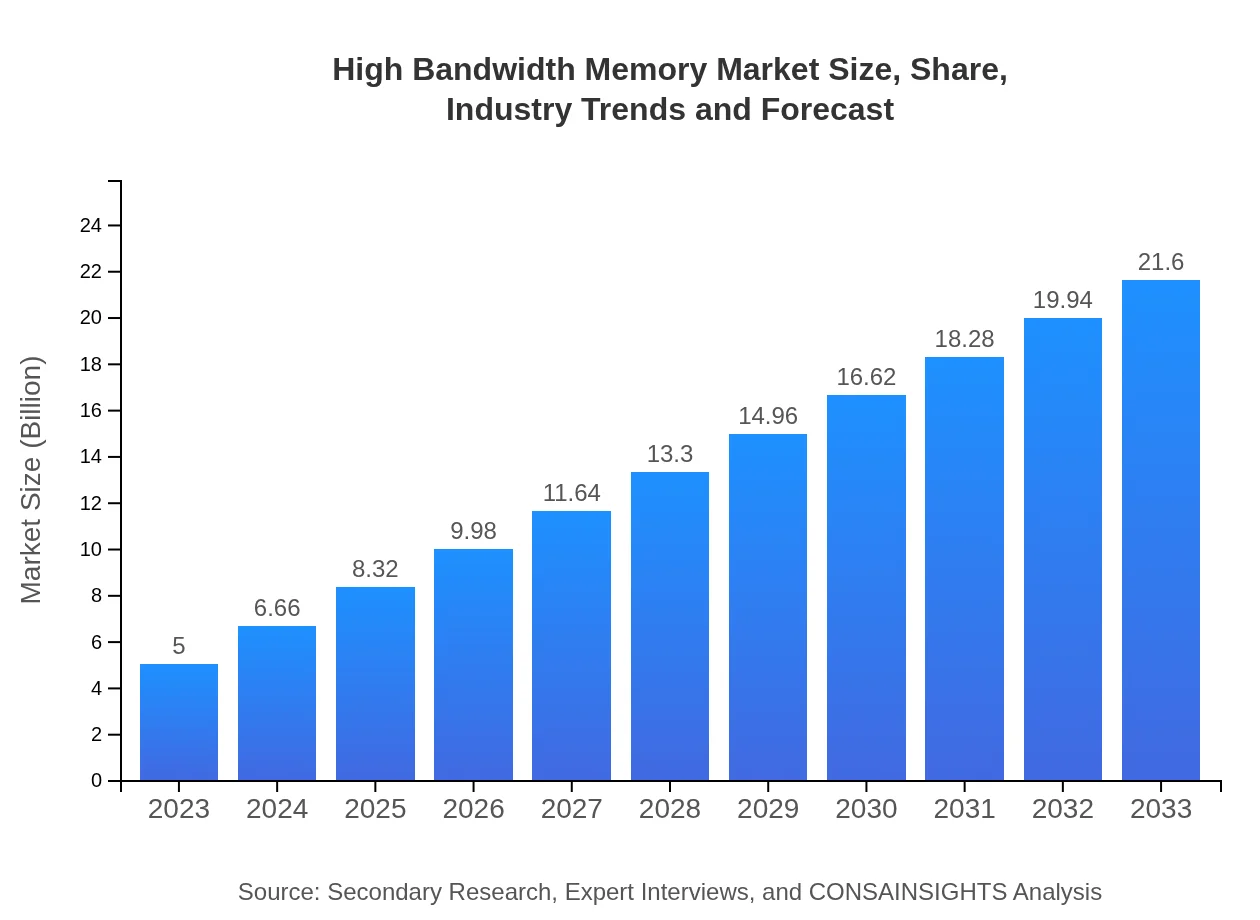

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $21.60 Billion |

| Top Companies | Samsung Electronics, SK Hynix, Micron Technology, NVIDIA, Intel Corporation |

| Last Modified Date | 31 January 2026 |

High Bandwidth Memory Market Overview

Customize High Bandwidth Memory Market Report market research report

- ✔ Get in-depth analysis of High Bandwidth Memory market size, growth, and forecasts.

- ✔ Understand High Bandwidth Memory's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Bandwidth Memory

What is the Market Size & CAGR of High Bandwidth Memory Market in 2023?

High Bandwidth Memory Industry Analysis

High Bandwidth Memory Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Bandwidth Memory Market Analysis Report by Region

Europe High Bandwidth Memory Market Report:

The European market is anticipated to reach $6.57 billion by 2033, growing from $1.52 billion in 2023. The market benefits from strong regulatory support for research and development in semiconductor technologies.Asia Pacific High Bandwidth Memory Market Report:

In the Asia Pacific region, the High Bandwidth Memory market is projected to reach $4.21 billion by 2033, up from $0.98 billion in 2023. The growth is driven by significant investments in technology and the rising demand for memory solutions in gaming and AI applications.North America High Bandwidth Memory Market Report:

North America is set to witness considerable growth, with the market projected to grow from $1.75 billion in 2023 to $7.58 billion by 2033. The increasing presence of data centers and advancements in AI technologies are key factors driving this growth.South America High Bandwidth Memory Market Report:

The South American market for High Bandwidth Memory is expected to grow from $0.11 billion in 2023 to $0.46 billion by 2033. This growth is fostered by increasing adoption of advanced technology in telecommunications and consumer electronics sectors.Middle East & Africa High Bandwidth Memory Market Report:

The Middle East and Africa region is projected to grow from $0.65 billion in 2023 to $2.79 billion by 2033. This growth is supported by a rising interest in smart technologies and enhanced telecommunications infrastructure.Tell us your focus area and get a customized research report.

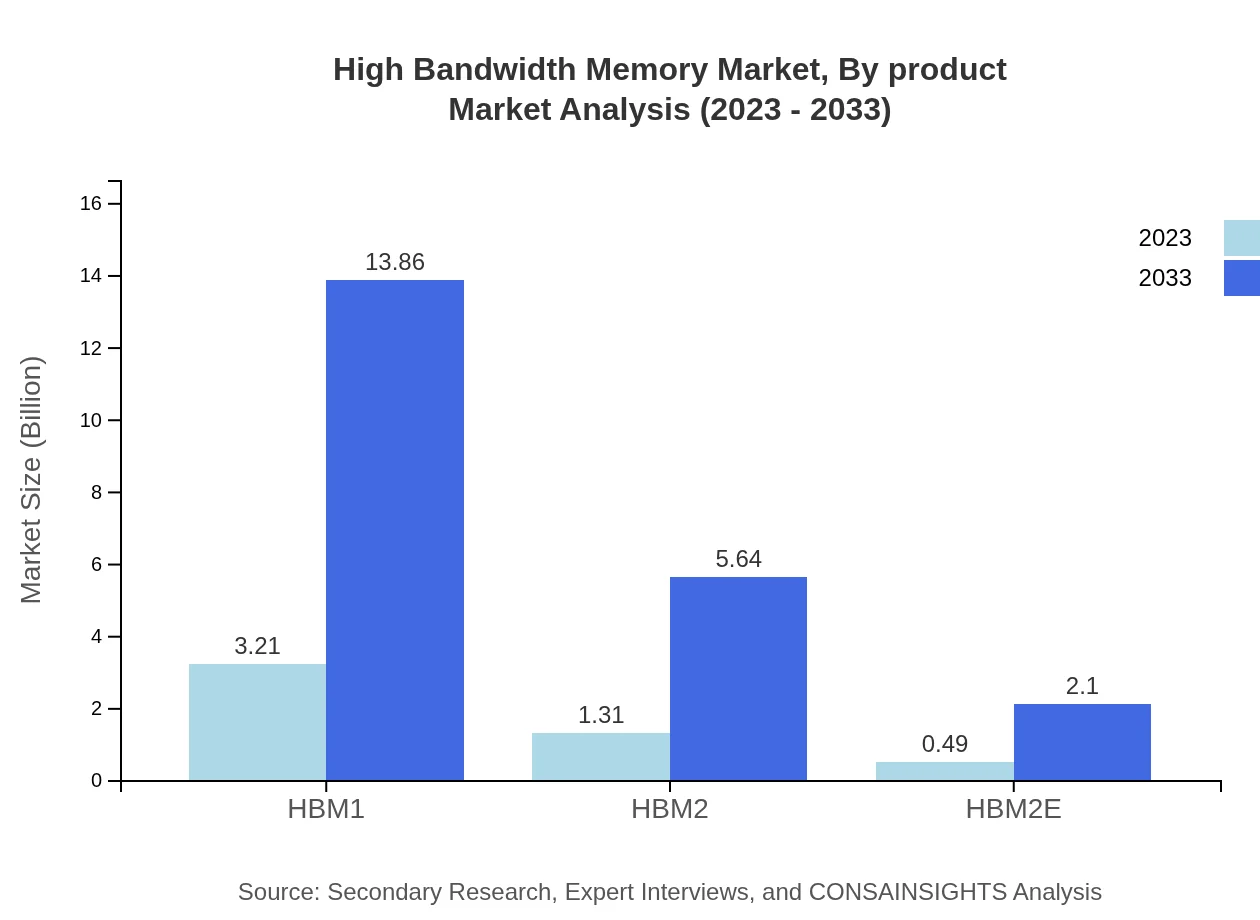

High Bandwidth Memory Market Analysis By Product

The HBM market is largely defined by product types, dominating the scene are HBM1, HBM2, and HBM2E. HBM1 holds a significant market share of 64.16%, while HBM2 constitutes around 26.1%. Projections show HBM1's market size increasing from $3.21 billion in 2023 to $13.86 billion by 2033, demonstrating strong future demand.

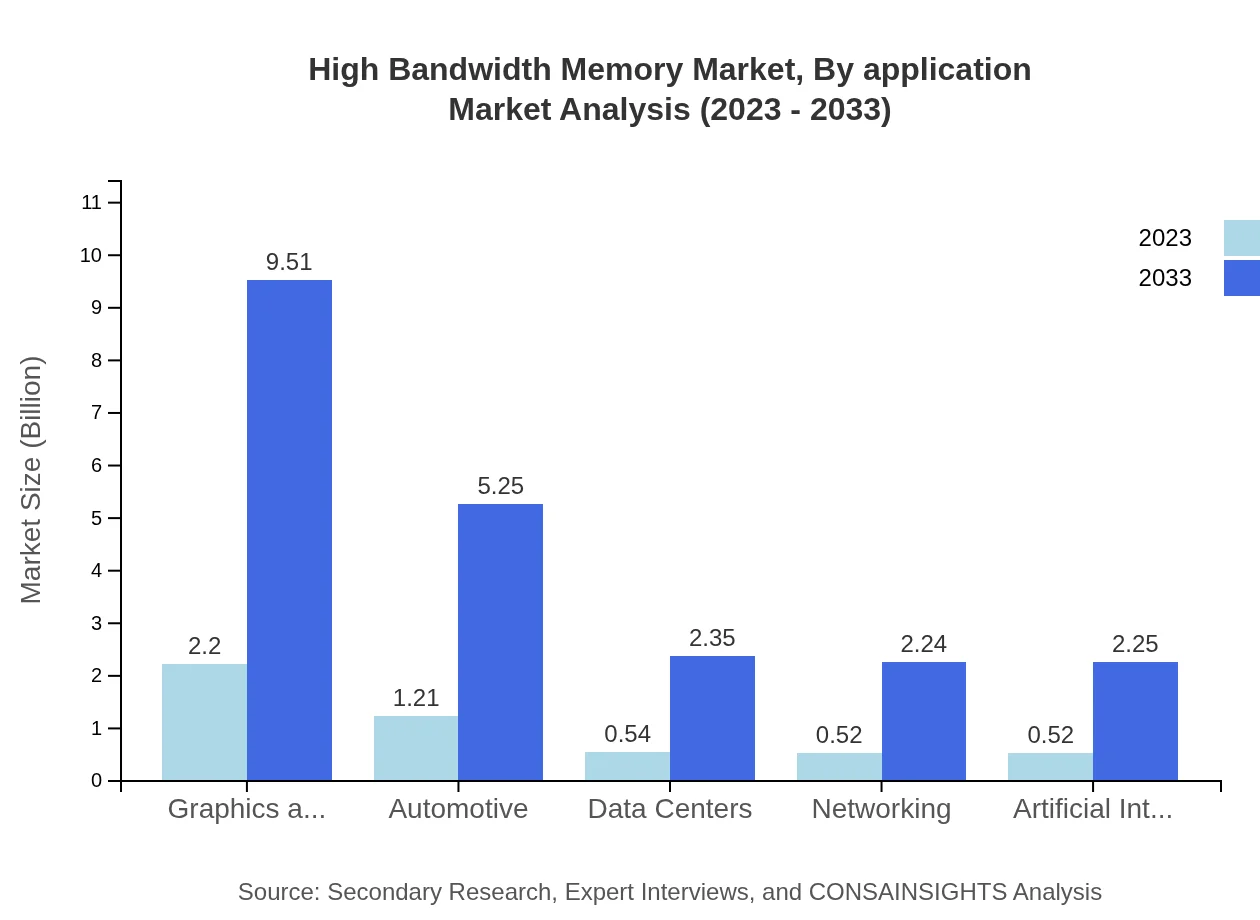

High Bandwidth Memory Market Analysis By Application

Key application segments include IT and Telecom, Consumer Electronics, and Automotive. IT and Telecom dominate with a market size of $2.53 billion in 2023, expected to maintain a 50.57% market share. The gaming and AI applications are projected to drive substantial growth, particularly in graphics and gaming with an anticipated value of $9.51 billion by 2033.

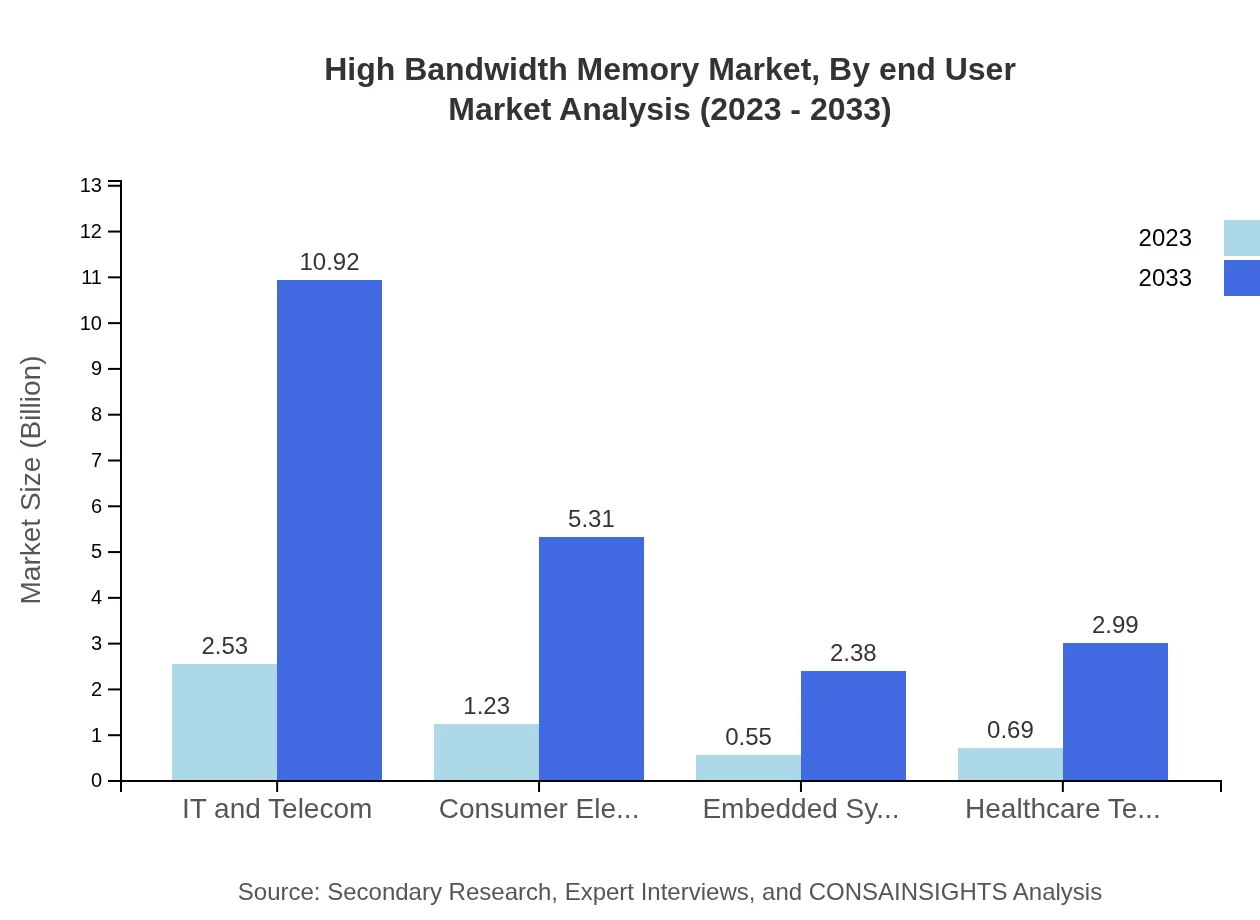

High Bandwidth Memory Market Analysis By End User

In terms of end-users, sectors like data centers and networking are prominent, with the data center segment projected to grow from $0.54 billion in 2023 to $2.35 billion by 2033. Automotive and healthcare technologies are also identified as growing end-user industries, indicating broad applicability of HBM solutions.

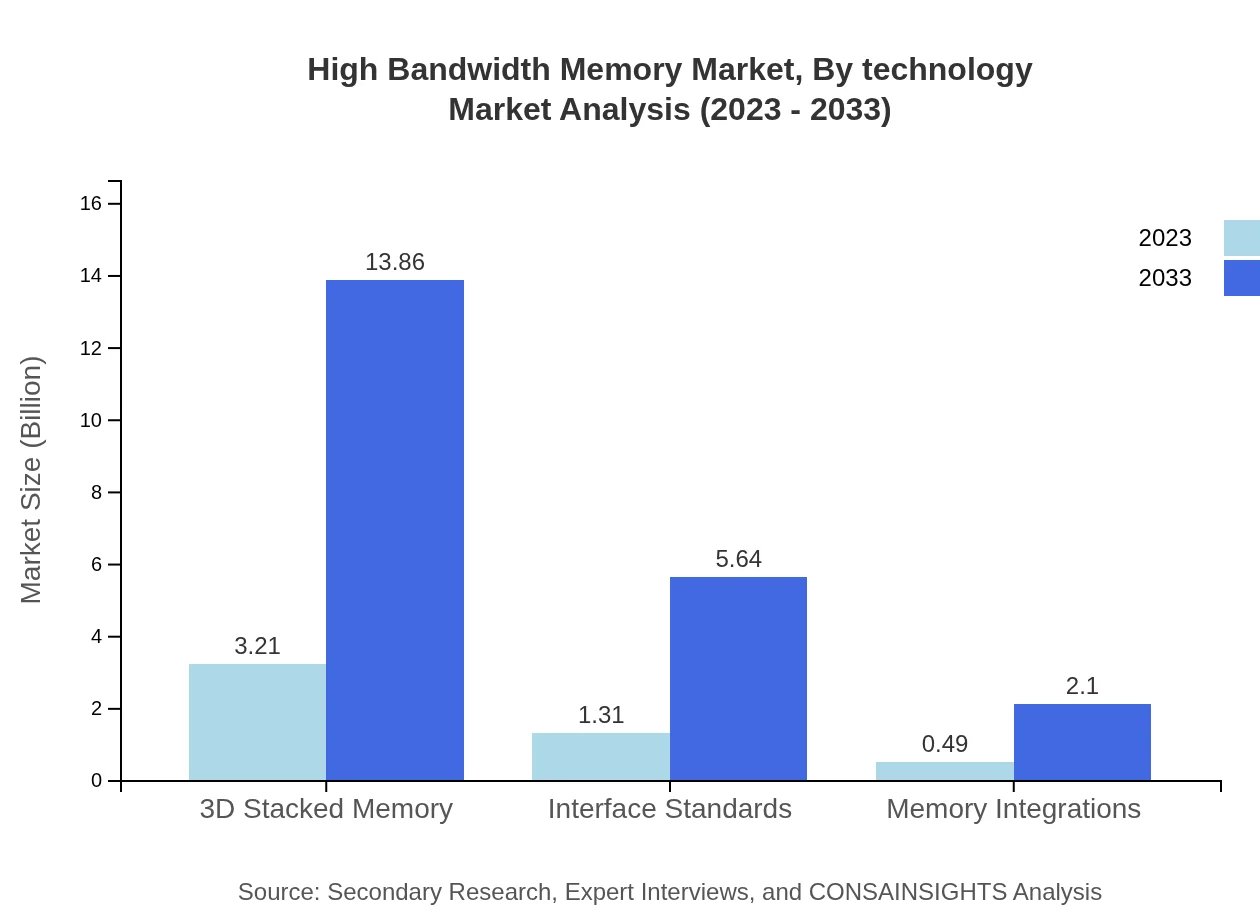

High Bandwidth Memory Market Analysis By Technology

The technology segment analysis shows the prominent use of 3D Stacked Memory technology in HBM application, maintaining a market share of 64.16%. Advancements in Memory Integrations and Interface Standards also reveal a commitment to optimizing performance, demonstrating the importance of technology in the market landscape.

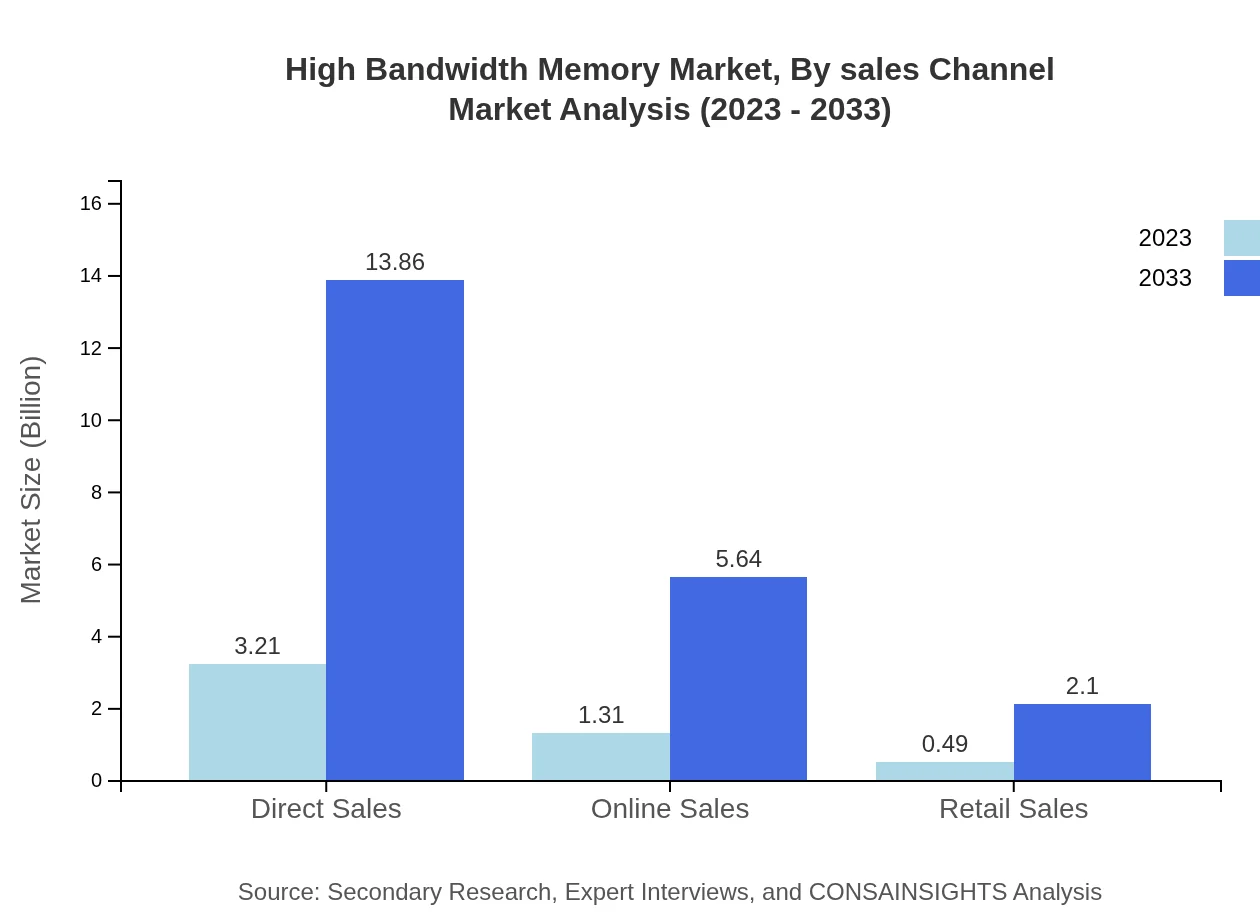

High Bandwidth Memory Market Analysis By Sales Channel

Sales channel analysis reveals that Direct Sales dominate with 64.16% of the market share, followed by Online Sales which constitute 26.1%. This trend signifies the growing emphasis on digital channels for distribution and customer engagement in the HBM market.

High Bandwidth Memory Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Bandwidth Memory Industry

Samsung Electronics:

A leading innovator in semiconductor technologies, Samsung plays a significant role in the HBM market, continuously pushing the boundaries of memory capacity and performance.SK Hynix:

As a key player in HBM manufacturing, SK Hynix offers advanced memory solutions and has made substantial investments in HBM research, positioning itself as a front-runner in high-performance memory.Micron Technology:

Micron is known for its cutting-edge memory technology including HBM solutions, focusing on integrating high bandwidth solutions across data centers and AI frameworks.NVIDIA:

NVIDIA utilizes HBM technologies to enhance its graphics processing units (GPUs), essential for gaming and AI research, contributing significantly to the advancement of HBM applications.Intel Corporation:

Intel's contributions to the HBM sector include integrating memory solutions in their processors, focusing on high bandwidth memory as a key driver for increasing computing efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of high Bandwidth Memory?

The global high-bandwidth memory market is projected to grow significantly, with a current market size estimated at $5 billion and a compound annual growth rate (CAGR) of 15%. This trend reflects increasing demand across various sectors, including IT, telecom, and consumer electronics.

What are the key market players or companies in the high Bandwidth Memory industry?

Key players in the high-bandwidth memory industry include major semiconductor manufacturers such as Samsung, Hynix, and Micron Technology. These companies are instrumental in developing innovative memory technologies that address the needs of high-performance computing and data-intensive applications.

What are the primary factors driving the growth in the high Bandwidth Memory industry?

The growth of the high-bandwidth memory industry is propelled by factors such as rising demand for faster data processing speeds, advancements in AI and machine learning, and the increasing need for high-performance computing systems across sectors like gaming and data centers.

Which region is the fastest Growing in the high Bandwidth Memory market?

The fastest-growing region in the high-bandwidth memory market is North America, anticipated to grow from $1.75 billion in 2023 to $7.58 billion by 2033. Europe and Asia Pacific also show significant growth, reflecting regional advancements in technology.

Does ConsaInsights provide customized market report data for the high Bandwidth Memory industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the high-bandwidth memory industry. This includes insights on market trends, competitive analysis, and forecasts beneficial for strategic decision-making.

What deliverables can I expect from this high Bandwidth Memory market research project?

Expect comprehensive deliverables from the high-bandwidth-memory market research project, including detailed market reports, segment analysis, competitive landscape assessments, and forecasts for regional growth trends over the coming decade.

What are the market trends of high Bandwidth Memory?

Current trends in the high-bandwidth memory market include a shift towards emerging applications in AI, gaming, and automotive industries, coupled with an emphasis on developing next-generation memory technologies such as HBM2E and HBM3 to enhance performance.