High Density Interconnect Market Report

Published Date: 22 January 2026 | Report Code: high-density-interconnect

High Density Interconnect Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the High Density Interconnect (HDI) market, including insights on market size, growth potential, segmentation, and technological trends, along with forecasts for the years 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

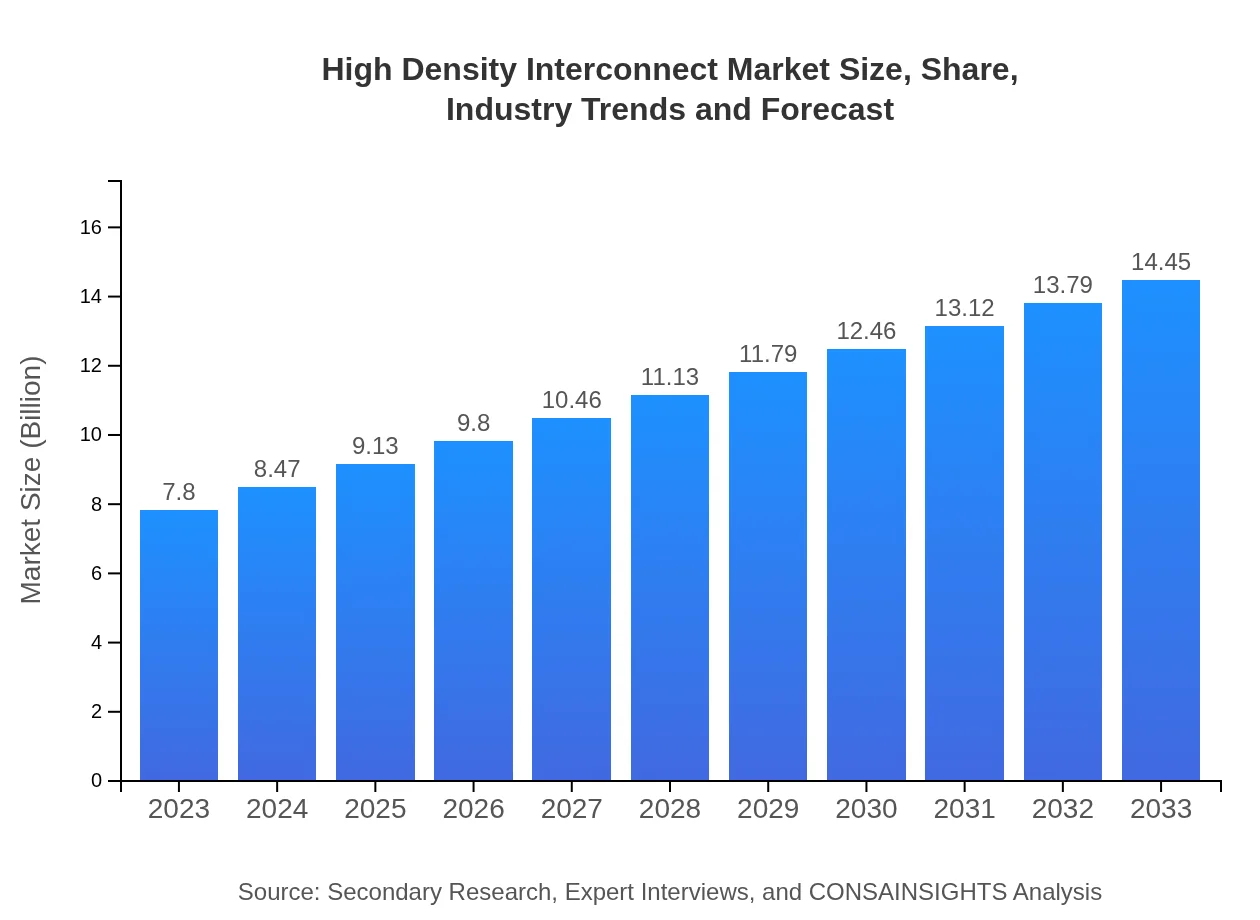

| 2023 Market Size | $7.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $14.45 Billion |

| Top Companies | AMETEK, Inc., Molex LLC, Sumitomo Electric Industries, Ltd., Taiyo Yuden Co., Ltd. |

| Last Modified Date | 22 January 2026 |

High Density Interconnect Market Overview

Customize High Density Interconnect Market Report market research report

- ✔ Get in-depth analysis of High Density Interconnect market size, growth, and forecasts.

- ✔ Understand High Density Interconnect's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Density Interconnect

What is the Market Size & CAGR of High Density Interconnect market in 2023?

High Density Interconnect Industry Analysis

High Density Interconnect Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Density Interconnect Market Analysis Report by Region

Europe High Density Interconnect Market Report:

The European market for High Density Interconnect is anticipated to grow from $2.36 billion in 2023 to $4.37 billion by 2033. This region's growth is influenced by strict regulatory standards and a growing focus on automotive and aerospace industries, where HDI technologies are increasingly utilized.Asia Pacific High Density Interconnect Market Report:

In 2023, the High Density Interconnect market in the Asia Pacific region is valued at $1.43 billion and is projected to grow to $2.64 billion by 2033. This significant growth is driven by the booming electronics manufacturing sector, particularly in countries like China, Japan, and South Korea, which are known for their advanced technology production capabilities.North America High Density Interconnect Market Report:

In North America, the HDI market stands at $2.85 billion in 2023, expected to rise to $5.28 billion by 2033. The region benefits from a strong emphasis on research and development, hosting many of the leading electronic device manufacturers, which drives demand for high-performance interconnect solutions.South America High Density Interconnect Market Report:

The South American HDI market in 2023 is valued at $0.46 billion, with an expected increase to $0.84 billion by 2033. This region's steady growth is linked to rising investments in telecommunications and consumer electronics, highlighting the increasing demand for HDI solutions.Middle East & Africa High Density Interconnect Market Report:

The Middle East and Africa region has a market value of $0.71 billion in 2023, which is forecasted to reach $1.31 billion by 2033. The growth in this region is primarily driven by increasing digitization and modernization of infrastructure, propelling the adoption of cutting-edge electronic solutions.Tell us your focus area and get a customized research report.

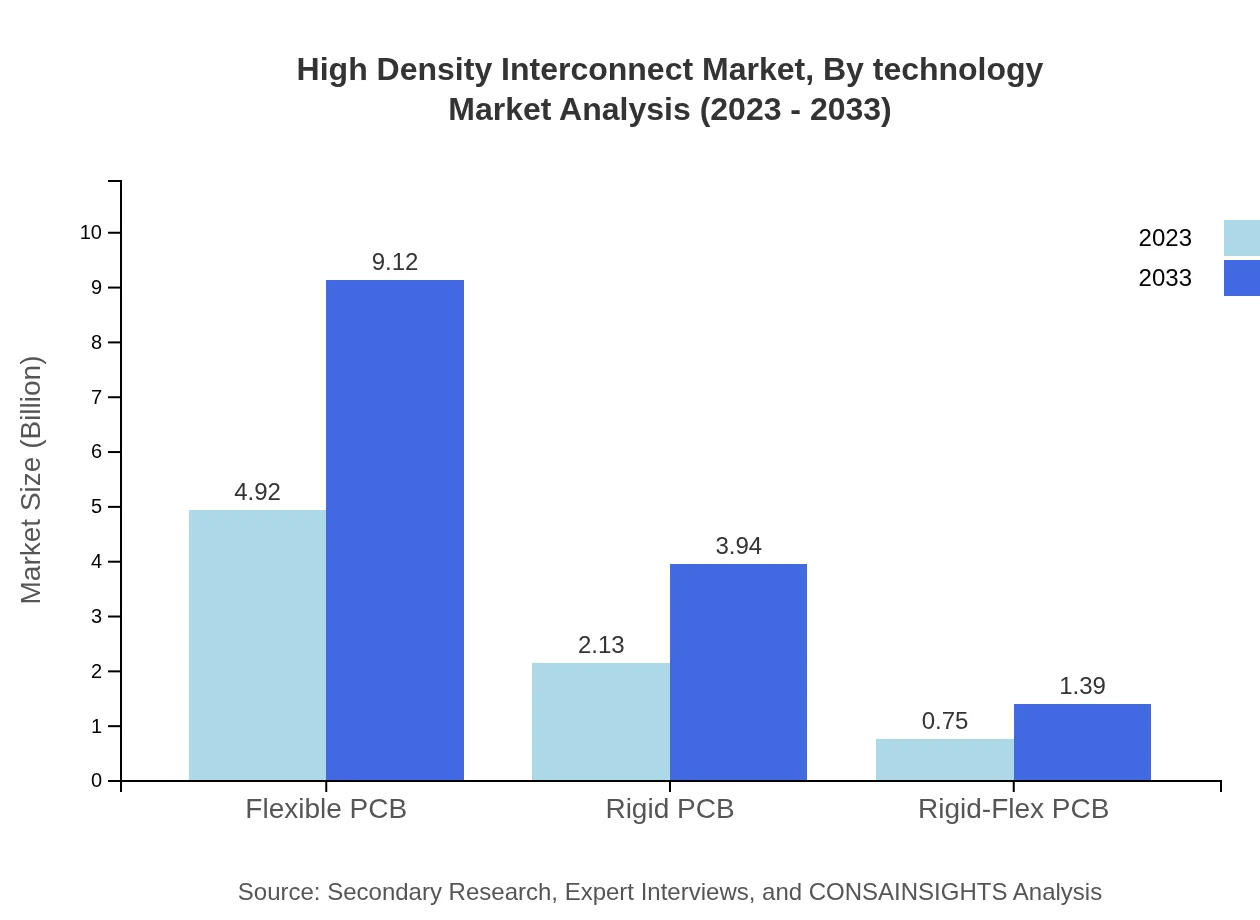

High Density Interconnect Market Analysis By Technology

The HDI market is heavily segmented by technology, including flexible PCBs, rigid PCBs, and rigid-flex PCBs. Flexible PCBs dominate with a market size of $4.92 billion in 2023 and a projection of $9.12 billion by 2033, capturing over 63% of the overall market. Rigid PCBs hold a significant share as well, exhibiting a robust growth trajectory supported by advancements in manufacturing techniques.

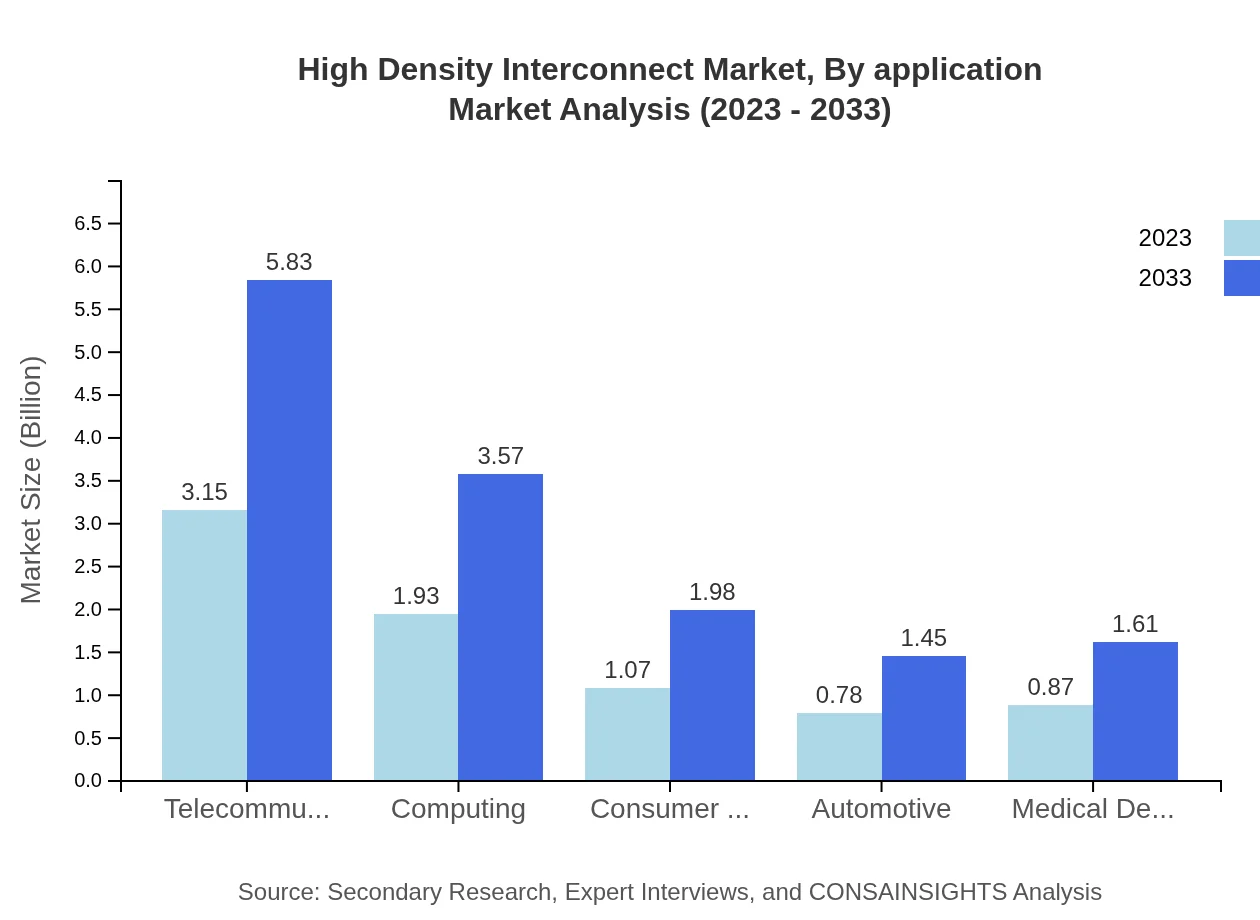

High Density Interconnect Market Analysis By Application

The applications of HDI span various industries including telecommunications, computing, consumer goods, healthcare, and automotive. Telecommunications holds a notable share, representing approximately 40.35%, with a market valued at $3.15 billion in 2023, anticipated to rise to $5.83 billion by 2033. Emerging technologies and the IoT surge are compelling factors contributing to this significant market share.

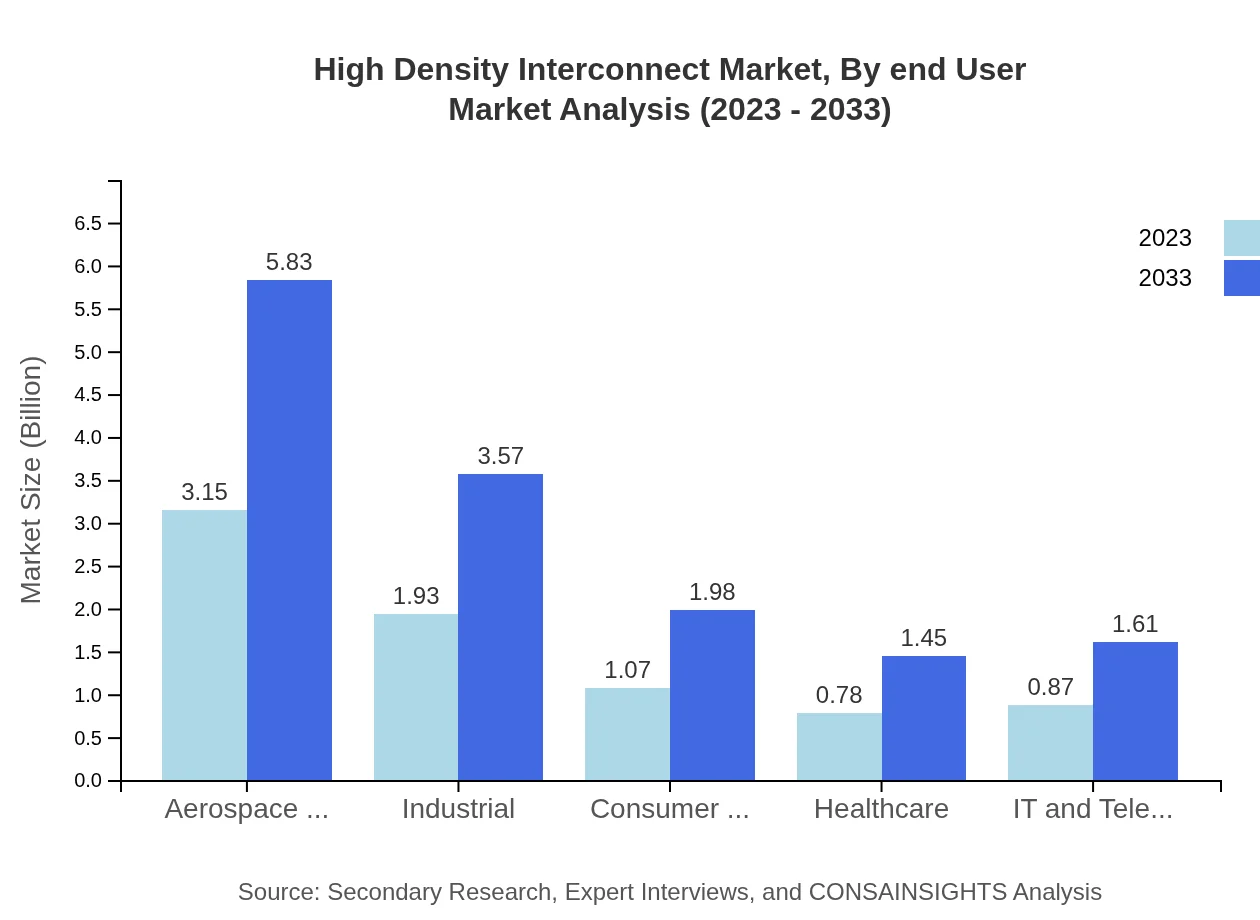

High Density Interconnect Market Analysis By End User

By end-user, the aerospace and defense sectors are substantial players, showcasing a market size of $3.15 billion in 2023, projected to grow to $5.83 billion by 2033. Furthermore, industries like healthcare and automotive, with respective shares of 10.05% and 11.16%, reflect increasing reliance on sophisticated and reliable electronics.

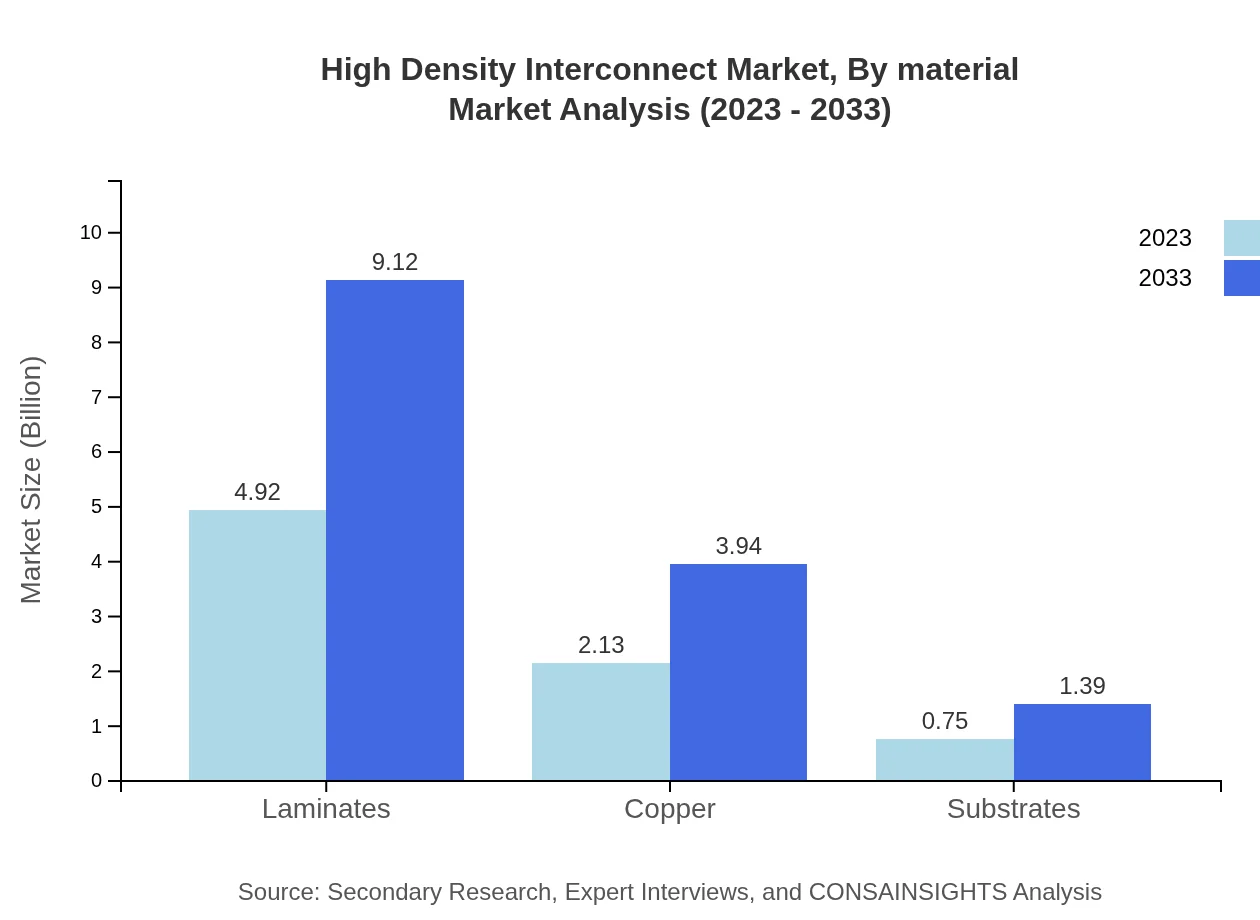

High Density Interconnect Market Analysis By Material

Material usage within HDI manufacturing includes laminates, copper, substrates, and others. Laminates lead the market with a significant size of $4.92 billion in 2023, projected to reach $9.12 billion by 2033, where copper holds 27.26% market share, highlighting vital material usage in PCB development.

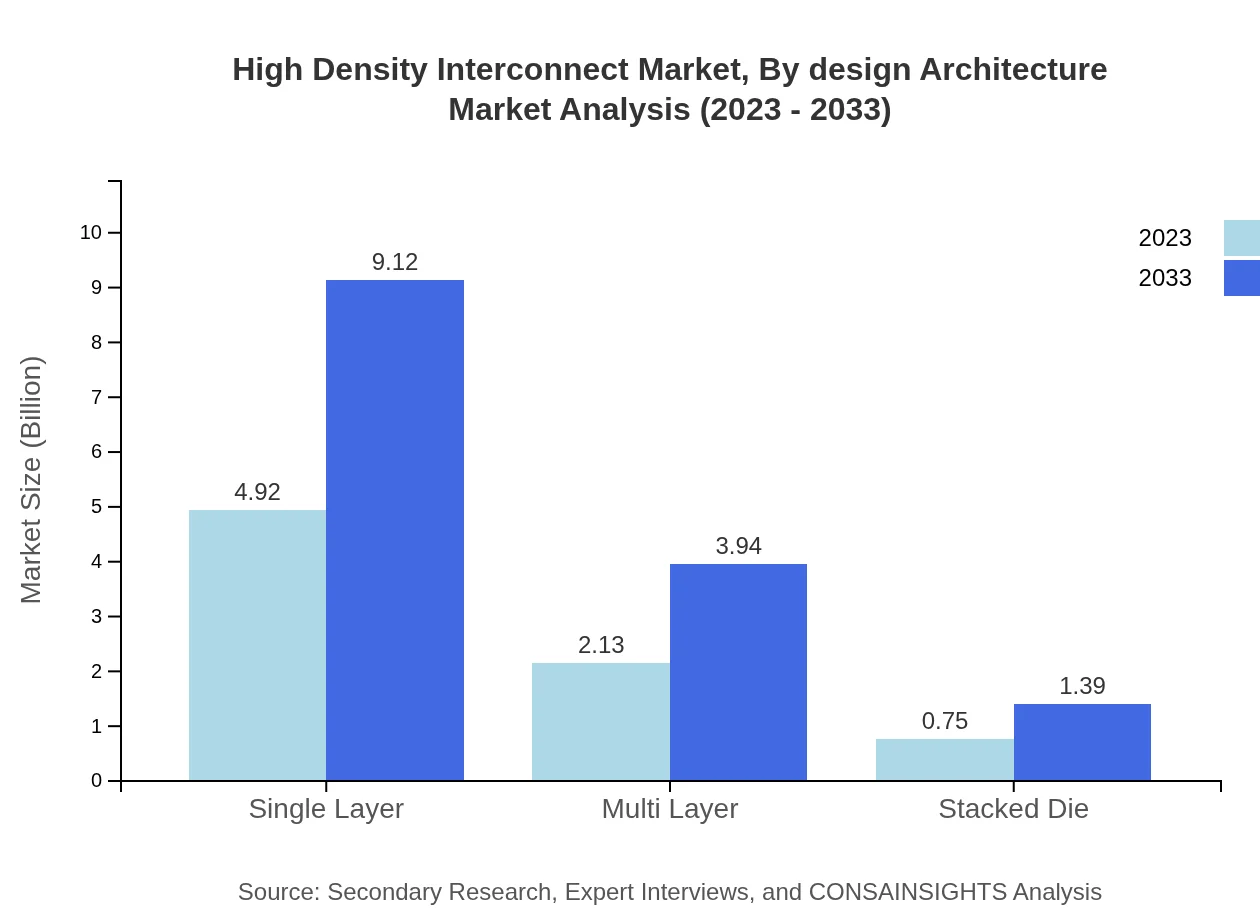

High Density Interconnect Market Analysis By Design Architecture

The design architecture segment, including single-layer, multi-layer, and stacked die configurations, plays a crucial role in performance capability. Single-layer designs command 63.12% of the market share, while multi-layer designs are gaining traction owing to the increased demand for complex circuitry in modern electronic devices.

High Density Interconnect Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Density Interconnect Industry

AMETEK, Inc.:

A leader in electronic instruments and electromechanical devices, AMETEK plays a crucial role in providing advanced HDI solutions.Molex LLC:

Molex is a major participant in the HDI market, specializing in interconnect solutions for automotive, telecommunications, and consumer electronics sectors.Sumitomo Electric Industries, Ltd.:

With a broad portfolio in electrical wire and cable systems, Sumitomo Electric focuses on delivering high-quality HDI products to support various industries.Taiyo Yuden Co., Ltd.:

A Japanese manufacturer, Taiyo Yuden develops premium HDI solutions, particularly recognized for their high-density multilayer boards.We're grateful to work with incredible clients.

FAQs

What is the market size of high Density Interconnect?

The global high-density interconnect market is valued at approximately $7.8 billion in 2023, projected to grow at a CAGR of 6.2% to reach significant milestones by 2033.

What are the key market players or companies in this high Density Interconnect industry?

Key players in the high-density interconnect market include major companies specializing in advanced connectivity solutions, PCB manufacturing, and electronic components. Focused innovation marks this competitive landscape.

What are the primary factors driving the growth in the high Density Interconnect industry?

Growth in the high-density interconnect industry is driven by increasing demand for compact electronic devices, advancements in technology, rising aerospace and defense expenditures, and the expansion of telecommunications infrastructure.

Which region is the fastest Growing in the high Density Interconnect?

Asia-Pacific and North America are expected to exhibit the fastest growth, with the North American market projected to reach $5.28 billion by 2033, while Asia-Pacific will grow to $2.64 billion in the same timeframe.

Does ConsaInsights provide customized market report data for the high Density Interconnect industry?

Yes, ConsaInsights offers tailored market reports to meet specific client needs in the high-density interconnect industry, ensuring relevant data and insights.

What deliverables can I expect from this high Density Interconnect market research project?

Deliverables include comprehensive market analysis, segmentation data, competitive landscape review, regional insights, and strategic recommendations for stakeholders in the high-density interconnect sector.

What are the market trends of high Density Interconnect?

Current trends include the rise of flexible PCBs, increased use in automotive and aerospace sectors, advancements in AI and IoT technologies, and a focus on sustainability and eco-friendly materials.